johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 12:08:00 AM

Last edit: September 27, 2013, 10:43:11 AM by johnyj |

|

Joe had $1000, he bought 100 bitcoins at $10. After one year, he sold them for $1100 at $11. He spent $100 and reinvested the rest $1000 back into bitcoin Only 10 bitcoins were actually sold from him the second year, and 9 bitcoins will be sold from him the year after, etc... He will be able to spend $100 year after year, like a 10% interest earned forever So, if everyone sell 10% of their purchased coins per year, and the number of coins per day is decreasing by 16% per year (50% every 4 years), the coin supply will still derease by 6% per year This means, with a good cash out strategy (sell 10% of coins each year), people could keep making profit while maintain the deflation trend of bitcoin, thus price will appreciate continuously, at least 6% per year In above case, Joe only buy once and keep cashing out year after year, so averagely each year there should be 1.04x more people to buy bitcoins (if every one spend only $1000 like Joe), in order to keep the 10% price appreciation (together with a 6% decrease in supply) If the price appreciation speed is higher, say 100% per year, Joe can still keep this 10% cash out strategy, but the second year he will have much higher amount to spend, and that will also require 2x number of new joiner to support the higher bitcoin price What if Joe decided to purchase $1000 worth of coins each year until he retire after 30 years? Same, but price appreciation speed will be much higher during those 30 years because of constant buying support and no sell pressure from him. He would have accumulated so much coins during those 30 years, and when he start to spend 10% of them, he will cause a large increase in coin supply, but his profit will be bigger since he reinvested all the returns back into bitcoin during those years No matter one year or 30 years investment period, after Joe quit, if there is another Joe start to invest in bitcoin, the demand for bitcoin will not reduce, just like a pension fund, Joe's children and grand children will join it one after another, so long term wise this is sustainable With many different investors that holding from 1 year to 30 years, and different start time, the sell pressure will be more evenly distributed, if all of them hold a strategy of cashing out no more than 10% each year, then they will all benefit from the investment So, it is easy to see, even the underlying bitcoin economy does not grow at all, just because bitcoin's deflation nature, it will become a perfect medium for saving and investment If bitcoin's supply can be arbitrarily changed like fiat money, then all of these won't work at all (Edit: added the simulation of daily coin supply for 1, 2 and 4 years investing period)  |

|

|

|

|

|

|

|

|

Even in the event that an attacker gains more than 50% of the network's

computational power, only transactions sent by the attacker could be

reversed or double-spent. The network would not be destroyed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Priceslide

Full Member

Offline Offline

Activity: 220

Merit: 102

Hello

|

|

August 19, 2013, 05:14:48 AM |

|

What if an alt-coin reaches the same adoption level as Bitcoin? Wouldn't that be seen as effectively increasing the total number of available coins, therefore devaluing BTC?

|

reddit.com/r/kinfoundation

|

|

|

frankenmint

Legendary

Offline Offline

Activity: 1456

Merit: 1018

HoneybadgerOfMoney.com Weed4bitcoin.com

|

|

August 19, 2013, 05:31:44 AM |

|

amen brother. Makes things more interesting when you put in the fact that you could buy at the 52 week high price if youre smart about it. As I type this the ticker says 117 and put in my funds at 96 so it would make sense for me to dump it whenever I feel comfortable - safe bet would be now, but I'd like to be much more risky and wait until it gets back to 200 a peice and then Ill cash a little bit out.

Agree with alts. What makes things more interesting though is exchanges. I've found that with maybe 5 bitcoins (which is possible to appreciate very slowly over time) could allow adequate coverage across all alts to the point to where you can play the martingale strategy if desired. I've seen great positive swings in value on my alts despite having used a substantial portion on litecoin market alts. If the price of litecoin skyrockets, then in principle by proxy so do all those litecoin valuation dependent alts as well.

We need an open api that allows any alt to be transacted like a bar code with a built in message to be attached. mtgox and bitinstant (currently going through a website redesign) offer tools like these, but I'd prefer something open source along with the mobile wallet apps that could be used with standalone wallets...this would allow the ecosystem to takeoff!

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 10:19:27 AM |

|

What if an alt-coin reaches the same adoption level as Bitcoin? Wouldn't that be seen as effectively increasing the total number of available coins, therefore devaluing BTC?

Unless bitcoin had some major technical problem, alt-coins will remain a small part of the bitcoin market value. When it comes to money, you need only one type, because money's universal equivalent property. Bitcoin's first mover advantage is very clear, people need one type of digital currency that has limited total supply and no central authority, as long as bitcoin works, this demand is fulfilled |

|

|

|

|

xxjs

|

|

August 19, 2013, 10:38:36 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

|

|

|

|

|

|

J603

|

|

August 19, 2013, 02:48:02 PM |

|

Joe had $1000, he bought 100 bitcoins at $10. After one year, he sold them for $1100 at $11. He spent $100 and reinvested the rest $1000 back into bitcoin

Only 10 bitcoins were actually sold from him the second year, and 9 bitcoins will be sold from him the year after, etc... He will be able to spend $100 year after year, like a 10% interest earned forever

So, if everyone sell 10% of their purchased coins per year, and the number of coins per day is decreasing by 16% per year (50% every 4 years), the coin supply will still derease by 6% per year

This means, with a good cash out strategy (sell 10% of coins each year), people could keep making profit while maintain the deflation trend of bitcoin, thus price will appreciate continuously, at least 6% per year

In above case, Joe only buy once and keep cashing out year after year, so averagely each year there should be 1.04x more people to buy bitcoins (if every one spend only $1000 like Joe), in order to keep the 10% price appreciation (together with a 6% decrease in supply)

If the price appreciation speed is higher, say 100% per year, Joe can still keep this 10% cash out strategy, but the second year he will have much higher amount to spend, and that will also require 2x number of new joiner to support the higher bitcoin price

What if Joe decided to purchase $1000 worth of coins each year until he retire after 30 years? Same, but price appreciation speed will be much higher during those 30 years because of constant buying support and no sell pressure from him. He would have accumulated so much coins during those 30 years, and when he start to spend 10% of them, he will cause a large increase in coin supply, but his profit will be bigger since he reinvested all the returns back into bitcoin during those years

No matter one year or 30 years investment period, after Joe quit, if there is another Joe start to invest in bitcoin, the demand for bitcoin will not reduce, just like a pension fund, Joe's children and grand children will join it one after another, so long term wise this is sustainable

With many different investors that holding from 1 year to 30 years, and different start time, the sell pressure will be more evenly distributed, if all of them hold a strategy of cashing out no more than 10% each year, then they will all benefit from the investment

So, it is easy to see, even the underlying bitcoin economy does not grow at all, just because bitcoin's deflation nature, it will become a perfect medium for saving and investment

If bitcoin's supply can be arbitrarily changed like fiat money, then all of these won't work at all

I don't get this logic. Your evidence for bitcoins appreciating forever... is that they appreciate forever? Why did the price of bitcoins increase from 10 to 11 in the first few lines? In order for Joe to make money, someone has to be willing to buy bitcoins for more than what they used to be worth... Who would buy bitcoins at the highest they've ever been? |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 05:05:25 PM |

|

I don't get this logic. Your evidence for bitcoins appreciating forever... is that they appreciate forever? Why did the price of bitcoins increase from 10 to 11 in the first few lines? In order for Joe to make money, someone has to be willing to buy bitcoins for more than what they used to be worth... Who would buy bitcoins at the highest they've ever been?

Thanks for the question. I'm not 100% convinced of my logic, it is just a draft, but with your question, I can go a little bit deep into this topic Price appreciated from 10 to 11, simply because there are not enough coin and there are more participants. Suppose that first year there are 10,000 people, each of them buy 0.36 coins per day at $10, total 3600 coins were bought every day If second year there are 11000 people buying coins with same amount of dollar from each person ($3.6 per day), then there will not be enough coins, since 3600 coins per day is fixed in the protocol. They will get less coin for the same amount of dollar, so the exchange rate will rise Not all the people will buy the coins at the highest price they've ever been, they will select a proper timing based on their judgement. Maybe price first rised to 13 then dropped back to 9 and end up at 11 at year end. Anyway, supply is fixed, if the coin have some history of good performance, and there are more people joining the bitcoin economy, the supply will be insufficient, the average price over a year will rise The key point is: How to make sure that there are sustainable fiat money inflow into bitcoin (so it will not become a ponzi scheme or pyramid scheme), and what is the motivation behind those purchases If you have more question regarding this, I will be very interested to hear |

|

|

|

|

J603

|

|

August 19, 2013, 06:09:14 PM |

|

Thanks for the question. I'm not 100% convinced of my logic, it is just a draft, but with your question, I can go a little bit deep into this topic

Price appreciated from 10 to 11, simply because there are not enough coin and there are more participants. Suppose that first year there are 10,000 people, each of them buy 0.36 coins per day at $10, total 3600 coins were bought every day

If second year there are 11000 people buying coins with same amount of dollar from each person ($3.6 per day), then there will not be enough coins, since 3600 coins per day is fixed in the protocol. They will get less coin for the same amount of dollar, so the exchange rate will rise.

The problem with this is that only bitcoin's rate of supply is fixed. Technically, there can be "infinite" bitcoins if we use more decimal places. All 7 billion of the people on this Earth can share one btc if we really want to. Of course, this would mean that the price of 1 BTC will increase. However, only early adopters will benefit and that's assuming that they hoard and never sell all their bitcoins and then purchase more later. Not all the people will buy the coins at the highest price they've ever been, they will select a proper timing based on their judgement. Maybe price first rised to 13 then dropped back to 9 and end up at 11 at year end. Anyway, supply is fixed, if the coin have some history of good performance, and there are more people joining the bitcoin economy, the supply will be insufficient, the average price over a year will rise Again, there can't be an "insufficient" supply. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 19, 2013, 11:22:21 PM

Last edit: August 22, 2013, 01:50:12 AM by johnyj |

|

The problem with this is that only bitcoin's rate of supply is fixed. Technically, there can be "infinite" bitcoins if we use more decimal places. All 7 billion of the people on this Earth can share one btc if we really want to.

Of course, this would mean that the price of 1 BTC will increase. However, only early adopters will benefit and that's assuming that they hoard and never sell all their bitcoins and then purchase more later.

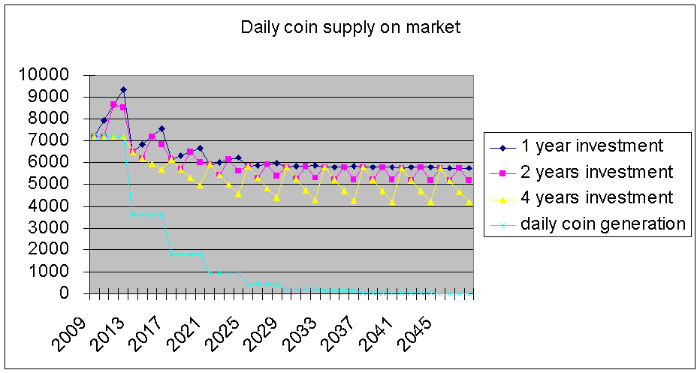

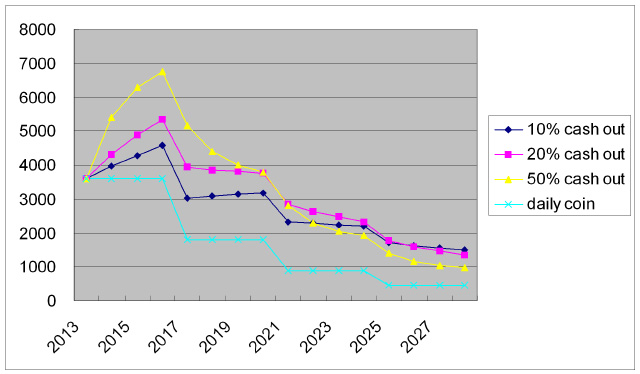

If 3600 people purchase 3600 coins, each of them will receive 1 coin in average, if 7200 people purchase 3600 coins, each of them will get only 0.5 coin. If the amount of fiat money spent per person is the same, per coin cost will double Regarding the sustainability, my first post just tried to show: It does not matter if you are an early adopter or not, as long as there are another people similar to you purchase bitcoin the year after you, you only need to purchase once and then you are able to cash out 10% each year forever Imagine this: There are 10000 people purchased bitcoin in 2013, from 2014 they start to cash out and never buy any coin again. In order to maintain a price increase of 10% per year, you only need 11000 people to purchase bitcoin in 2014 (same amount of investment from each of them). And those 11000 people will also do the same, they never buy any coin after 2014, cash out 10% per year. And 2015 you need 12100 people to purchase bitcoin in order to maintain the price appreciation speed, and so on... Of course the real situation is a bit complex, because you will have those extra coin supply coming from those early buyers (they cash out 10% of their coins each year), that will make the coin supply increase at the beginning. But due to the coin supply will cut by half every 4 years, long term wise daily coin supply would still shrink I took some numbers and did a deeper analysis, Y axis showing the daily coin supply (Edit: this chart is wrong, see the later chart below)  You can see that 10% cash out strategy will not change bitcoin's deflative nature. The interesting thing is, even a 50% cash out strategy still won't change the long term projection, although the coin supply will increase more during the first 4 years, but after 11 years, its daily coin supply will drop below the level of the 10% cash out strategy This chart also indicated: It is always at the beginning of the decade you will face a big sell pressure from the early adopters. If they never reinvest, their sell pressure on the market will get less and less each year Now with this chart, the long term sustainability is even clearer Another question is: If every year more people need to buy the coins and they only buy coin once, for how long the earth population is enough to support the scenario My first thought: Every year there are many people joining the work force, and those people will have some extra money to purchase bitcoin. As long as those people put more money into bitcoin than previous year (due to rising income or rising population), and bitcoin supply is constantly shrinking (even include the cash out from early adopters), the price appreciation can be guaranteed forever. This is the same mechanism of a pension fund With a guaranteed income from bitcoin value increase, people will have the confidence to spend, and no matter what kind of cash out strategy they have, it will not hurt the long term appreciation trend of bitcoin. This means, a deflative currency still encourage people to spend because of their guaranteed future income! Isn't it amazing for such a genius design from Satoshi?  |

|

|

|

CoinChex

Newbie

Offline Offline

Activity: 38

Merit: 0

|

|

August 20, 2013, 12:56:26 AM |

|

Dude you need a disclosure at the bottom of this -

*Past performance is not indicative of future results. Nothing is guaranteed. The opinion of the author is his own and does not directly reflect the opinions of the bitcoin economy.

|

|

|

|

|

foggyb

Legendary

Offline Offline

Activity: 1666

Merit: 1006

|

|

August 20, 2013, 01:07:11 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

There are ALREADY altcoins out there that offer improvements on bitcoin. Everyone must be dumping their bitcoins for these better coins, right? Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup. The 3rd reason that I believe a 'better' altcoin won't usurp bitcoin is this: bitcoin protocol can be upgraded. Its not static. |

I just registered for the $PLOTS presale! Thank you @plotsfinance for allowing me to purchase tokens at the discounted valuation of only $0.015 per token, a special offer for anyone who participated in the airdrop. Tier II round is for the public at $0.025 per token. Allocation is very limited and you need to register first using the official Part III link found on their twitter. Register using my referral code CPB5 to receive 2,500 points.

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 01:10:50 AM |

|

Dude you need a disclosure at the bottom of this -

*Past performance is not indicative of future results. Nothing is guaranteed. The opinion of the author is his own and does not directly reflect the opinions of the bitcoin economy.

Ha, this statement applies perfectly to fiat money, which no one knows how much more FED will print. For a fixed total supply money like bitcoin, such kind of statement is not needed. People get used to an uncertain future because once a while FED will come out and destroy all the people's projection with their OMO I'm not selling any financial products or services, just some research and a conservative hypothesis, not related to real world historical performance of bitcoin in anyway |

|

|

|

Cluster2k

Legendary

Offline Offline

Activity: 1692

Merit: 1018

|

|

August 20, 2013, 04:54:15 AM |

|

Bitcoin will only appreciate in value "forever" if people who want to own bitcoins are willing to pay ever higher prices for them. There is also always scope for something better, faster and easier to use to come along which can send bitcoin's value plummeting. Enjoy the ride and don't forget to cash out to cover all costs.

|

|

|

|

|

|

xxjs

|

|

August 20, 2013, 07:11:10 AM |

|

A better coin is possible, better privacy and microtransactions, otherwise just as good as bitcoin. An altcoin that good could take good slice of the market, but I have not seen such altcoin yet, and hopefully I shall be able to see it coming in time before the mob sees it.

There are ALREADY altcoins out there that offer improvements on bitcoin. Everyone must be dumping their bitcoins for these better coins, right? Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup. The 3rd reason that I believe a 'better' altcoin won't usurp bitcoin is this: bitcoin protocol can be upgraded. Its not static. They have to be better all things considered, and not just a little bit better, because of the reputation that bitcoin now builds up. But a better coin is thinkable. It could also be an improvement of bitcoin itself. |

|

|

|

|

|

xxjs

|

|

August 20, 2013, 07:34:10 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Speculation tends to speed up the change and make us achieve the top of the S earlier.

Dramatic things can happen: War, general destruction of capital and productivity: higher prices (lower bitcoin value). A deadly epidemic disease, fewer users: higher prices(lower bitcoin value). Bitcoin goes out of fashion because all states of the world gradually transforms to totalitarianism: higher prices (lower bitcoin value).

|

|

|

|

|

|

shields

|

|

August 20, 2013, 08:58:16 AM |

|

Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup.

Great example, nothing will ever top VHS right? it has first mover advantage, meaning no superior video formats will ever replace it. |

If you liked this post -> 1KRYhandiYsjecZw7mtdLnoeuKUYoGRkH4

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 10:47:56 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

The value maybe never started at 0, since there is a cost, no matter how small it is. Running CPU mining on a computer still need some hardware investment and electricity and maintenance 2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Yes, an exponential increase in the user base will cause the price to rise quickly, but due to there are always new baby born each day, the new users that start to purchase bitcoin will stay relatively stable after a full saturation of existing potential users In such a situation, the price appreciation will purely depend on the population growth and productivity growth. Suppose that population growth is 0, e.g. every day same amount of new people start to purchase bitcoin, then productivity growth will decide the growth of the bitcoin value. Since there will never be liuquidity problem with bitcoin, the productivity growth will always be at their optimum speed |

|

|

|

|

xxjs

|

|

August 20, 2013, 11:31:14 AM |

|

1. Value of bitcoin started at 0, and after some time had a value. If you want to apply a function for that transition, it can not be exponential, because the exponential function will all ways be 0. Something easy: additional, or maybe magical.

The value maybe never started at 0, since there is a cost, no matter how small it is. Running CPU mining on a computer still need some hardware investment and electricity and maintenance Don't agree with this one, we don't support valuation base on cost around here, only subjective valuation from the market. 2. In the beginning, the value will be exponential, for two reasons: each new user spawns new users, and, the coins are more usable for indirect trade as there will be more traders with bitcoins.

3. As all humans in the world get on (or all that wants to use bitcoins), the number of new users will flatten. 2 and 3 represents an S-curve.

4. When the adoption is completed, we have only left growth in productivity, natural expansion of the user base because the world population increases, and lost coins. All these means lower prices measured in bitcoins (price deflation, higher bitcoin value).

Yes, an exponential increase in the user base will cause the price to rise quickly, but due to there are always new baby born each day, the new users that start to purchase bitcoin will stay relatively stable after a full saturation of existing potential users In such a situation, the price appreciation will purely depend on the population growth and productivity growth. Suppose that population growth is 0, e.g. every day same amount of new people start to purchase bitcoin, then productivity growth will decide the growth of the bitcoin value. Since there will never be liuquidity problem with bitcoin, the productivity growth will always be at their optimum speed Mostly agree. You forgot the lost coins. The consequence of all this is, yes, bitcoins will appreciate forever, but hopefully eventually rather slowly so it does not disturb the day to day trade. |

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 20, 2013, 11:37:21 AM |

|

Some argue that while no current altcoin offers any significant improvement over bitcoin, "someday" it will happen....Well, take a look at betamax versus vhs. Betamax was unquestionably the superior format. But they lost the format war because they came 2nd. I predict the same fate for any new altcoin startup.

Great example, nothing will ever top VHS right? it has first mover advantage, meaning no superior video formats will ever replace it. Consumer products and money are very different Money must be able to carry value through decades, people put their value and trust in money, highest credibility and popularity is the key Most of the credibility of bitcoin come from its limited total supply. Alt-coins are inflation in the crypto currency world, this is against the idea of deflative currency, and dilute the wealth in crypto currency world. Even they are technically superior, they are politically wrong I have mined several different coins but most of them disappeared after 1 year, finally I realized that people here don't want their wealth to be stolen by inflation, be it a central bank or an alt-coin |

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

August 21, 2013, 10:01:37 PM

Last edit: August 22, 2013, 01:42:12 AM by johnyj |

|

The motivation behind alt-coin is very clear: Many people missed the chance to be an early adopter of bitcoin, they saw the huge benefit of being an early adopter of bitcoin (much less difficulty and much more coins), and want to become an early adopter of an alt-coin But this is the same as time travel trading. When thousands of geeks were mining bitcoin with their CPUs and GPUs, the price of bitcoin were very low, they never knew that one bitcoin will worth $100 today, just like today's miner never know if one bitcoin will worth $10,000 some time in the future And, just as my analysis revealed, the early adopter's sell pressure will only be temporary during the first several years, it becomes less and less each year, for all the people joined after the first reward halving, they won't be affected too much I made the chart again from 2009 (Edit: corrected an error in previous calculation, those cashed out coins would be bought together with newly mined coins and they will increase the daily coin supply until each reward halving)  For 10% cash out strategy, the coin supply will be shrinking slowly. The 20% cash out strategy would keep the coin supply constant, and 50% cash out each year will cause the daily coin supply to increase very fast. A price appreciation can be projected if cash out less than 20% per year Looking back at 2011-2012, the coin supply actually increased a lot (over 10000 coin per day) due to the cash out pressure from early adopters, maybe that is the reason the last price crash is much more severe than this time (it crashed from 30 to 3) This chart is just a hypothesis, we all know that there are many coins never moved since they were mined, the actual cash out speed could be less than 5% per year |

|

|

|

|