Nagle (OP)

Legendary

Offline Offline

Activity: 1204

Merit: 1000

|

|

July 24, 2011, 05:48:52 PM |

|

Realistically, the price seems to have leveled out for now. It's roughly at mining cost; the mining forums indicate that running existing mining hardware is worthwhile, but buying new hardware is not.

Mining cost alone isn't enough to determine the price, but it does seem to have an effect.

Now that we've had a few weeks of reasonable stability, Bitcoin has more potential as a currency.

|

|

|

|

|

|

|

|

|

|

Bitcoin mining is now a specialized and very risky industry, just like gold mining. Amateur miners are unlikely to make much money, and may even lose money. Bitcoin is much more than just mining, though!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Edward50

|

|

July 25, 2011, 05:47:31 PM |

|

Realistically, the price seems to have leveled out for now. It's roughly at mining cost; the mining forums indicate that running existing mining hardware is worthwhile, but buying new hardware is not.

Mining cost alone isn't enough to determine the price, but it does seem to have an effect.

Now that we've had a few weeks of reasonable stability, Bitcoin has more potential as a currency.

I know that the going trend is to state that mining has nothing to do with the price of bitcoins, however, I agree with you that I think mining cost has something to do with the price of bitcoins, probably more then most people think. have you noticed that if you say anything on the forum about price of bitcoins and mining people will get all crazy like "Bitcoin price and mining has nothing to do with the price, you moron". |

Empty your mind, be formless, shapeless — like water. Now you put water in a cup, it becomes the cup; You put water into a bottle it becomes the bottle; You put it in a teapot it becomes the teapot. Now water can flow or it can crash. Be water, my friend.

|

|

|

|

enmaku

|

|

July 25, 2011, 05:53:13 PM |

|

Realistically, the price seems to have leveled out for now. It's roughly at mining cost; the mining forums indicate that running existing mining hardware is worthwhile, but buying new hardware is not.

Mining cost alone isn't enough to determine the price, but it does seem to have an effect.

Now that we've had a few weeks of reasonable stability, Bitcoin has more potential as a currency.

I know that the going trend is to state that mining has nothing to do with the price of bitcoins, however, I agree with you that I think mining cost has something to do with the price of bitcoins, probably more then most people think. have you noticed that if you say anything on the forum about price of bitcoins and mining people will get all crazy like "Bitcoin price and mining has nothing to do with the price, you moron". What you're describing is a "tangled hierarchy" and it is, in fact, the state of every economic system. Mining has an impact on bitcoin price and bitcoin price has an impact on mining. Many things have an impact on price, and many of those things are more substantial than mining activity - likewise price is not the only impact on mining, though price->mining is a stronger effect than mining-> price. Among other things, miners produce some 7200 new coins per day - in times of low market movement the influx of new fiat moneys can be less than the face value of the 7200 new coins, and in such markets price tends to decline. This is just one of the many recognizable effects and it is admittedly a minor one that occurs only under limited circumstances. Anyone who claims that they have the whole of the market "figured out" is either a fool or a liar. There are too many causes and effects and too many unknown ways in which the causes and effects interact, stack, tangle and loop back on themselves. The best we can do is look for indicators of mass market psychology and make educated guesses. Welcome to the wonderful world of economic theory  |

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

July 25, 2011, 08:10:55 PM |

|

have you noticed that if you say anything on the forum about price of bitcoins and mining people will get all crazy like "Bitcoin price and mining has nothing to do with the price, you moron".

When prices are volatile, I tend to stay up late trading until I can buy in low, until then I get hungry and raid the fridge. I have recently noticed an inverse relationship between the quantity of munchies in my apartment and bitcoin volatility and a less extreme inverse correlation with trend direction. I am now on a starvation diet and expect the market to respond. If anyone calls me a moron, I'll consider that a reinforcing signal. |

|

|

|

datguywhowanders

Member

Offline Offline

Activity: 112

Merit: 10

|

|

July 25, 2011, 08:33:29 PM |

|

Moron  |

Donations Welcome: 163id7T8KZ6MevqT86DjrBF2kfCPrQsfZE

|

|

|

bitcoinBull

Legendary

Offline Offline

Activity: 826

Merit: 1001

rippleFanatic

|

|

July 25, 2011, 11:43:27 PM |

|

Realistically, the price seems to have leveled out for now. It's roughly at mining cost; the mining forums indicate that running existing mining hardware is worthwhile, but buying new hardware is not.

Mining cost alone isn't enough to determine the price, but it does seem to have an effect.

Now that we've had a few weeks of reasonable stability, Bitcoin has more potential as a currency.

I know that the going trend is to state that mining has nothing to do with the price of bitcoins, however, I agree with you that I think mining cost has something to do with the price of bitcoins, probably more then most people think. have you noticed that if you say anything on the forum about price of bitcoins and mining people will get all crazy like "Bitcoin price and mining has nothing to do with the price, you moron". What you're describing is a "tangled hierarchy" and it is, in fact, the state of every economic system. Mining has an impact on bitcoin price and bitcoin price has an impact on mining. Many things have an impact on price, and many of those things are more substantial than mining activity - likewise price is not the only impact on mining, though price->mining is a stronger effect than mining-> price. Among other things, miners produce some 7200 new coins per day - in times of low market movement the influx of new fiat moneys can be less than the face value of the 7200 new coins, and in such markets price tends to decline. This is just one of the many recognizable effects and it is admittedly a minor one that occurs only under limited circumstances. Anyone who claims that they have the whole of the market "figured out" is either a fool or a liar. There are too many causes and effects and too many unknown ways in which the causes and effects interact, stack, tangle and loop back on themselves. The best we can do is look for indicators of mass market psychology and make educated guesses. Welcome to the wonderful world of economic theory  Well-said. It was so often repeated that price drives difficulty, "not the other way around". I've always argued that the relationship is "two-way causality". Note that since the crash from $30, difficulty hasn't dropped. To the contrary, difficulty is still growing slowly but steadily, and seems on target to rise to between 1.8 and 1.9 million for the next re-adjustment. By saying two-way causality I mean that price drives difficulty, AND the other way around: difficulty drives price. To be precise, the evidence shows (see charts in my sig) that difficulty sets a bottom for the price. I don't think its coincidence that the price to difficulty ratio has only gone as low as about 0.75 (using a weighted average price), twice for the two bear markets of bitcoin's history. The first time was after price topped at $1.10 and fell from there, through March and early April. And the second time is now, which is where it has been since the crash from $30. If the the price to difficulty ratio continues hovering between 0.75 and 1 (until the coming rally  ), I think it makes for a pretty reliable economic indicator of the mass-market psychology of bitcoin. |

College of Bucking Bulls Knowledge

|

|

|

|

grod

|

|

July 26, 2011, 03:18:49 AM |

|

I think you'll have to adjust that ratio for Moore's law. I know we haven't had much in the way of cheaper computing hardware in the past year or so -- but sooner or later GPU companies will release faster products at the same or lower price points. They have to, not only to compete with each other but also with themselves.

My out of the butt estimates would be a 30% average annual computing power per dollar increase even over the past 4 years of GPU stagnation. The same $200 which bought me an 8800GT early in 2007 bought me about 4x the GPU power in the form of 2x5830s 4 years later.

edit: actually, I think it may have been late 2007 or early 2008 for the 8800GT. Which means closer to 3 years than 4 for that power/dollar increase, in fact.

|

|

|

|

|

Nagle (OP)

Legendary

Offline Offline

Activity: 1204

Merit: 1000

|

|

July 27, 2011, 07:15:07 PM

Last edit: July 28, 2011, 07:23:04 PM by Nagle |

|

Mt. Gox, last 5 weeks. Mt. Gox, last 5 weeks. (Again, starting after the Mt. Gox screwup.) After three weeks of slide and turmoil, we've now had two weeks of modest stability, at $13.50 +- 0.50. |

|

|

|

|

Nagle (OP)

Legendary

Offline Offline

Activity: 1204

Merit: 1000

|

|

July 31, 2011, 06:49:52 AM |

|

After three weeks of slide and turmoil, we've now had two weeks of modest stability, at $13.50 +- 0.50.

We're now up to 3 weeks at $13.50 +- 0.50. Stability continues. You could now price something in Bitcoins and not change the price very often. |

|

|

|

|

Nagle (OP)

Legendary

Offline Offline

Activity: 1204

Merit: 1000

|

|

August 02, 2011, 04:03:07 PM |

|

Market depth, Mt. Gox. Market depth, Mt. Gox.There are far more sellers than buyers this week. The sell side keeps building up, but little new cash is coming in on the buy side. Remember, it takes $100,000 a day in new cash to keep up with mining. If the supply of suckers investors dries up, Bitcoin must drop. |

|

|

|

|

Piper67

Legendary

Offline Offline

Activity: 1106

Merit: 1001

|

|

August 02, 2011, 04:41:52 PM |

|

Market depth, Mt. Gox. Market depth, Mt. Gox.There are far more sellers than buyers this week. The sell side keeps building up, but little new cash is coming in on the buy side. Remember, it takes $100,000 a day in new cash to keep up with mining. If the supply of suckers investors dries up, Bitcoin must drop. Yes, except the ones that really matter are dark pools, and we don't get to see them, and one of them at 10,000 BTC is enough to drive up the market price by 1.45 USD, as happened over the weekend. Aside from that, you're spot on.  |

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

August 02, 2011, 06:02:06 PM |

|

In the past

two months: average price: $22 +/- $10 (~45%)

one month: average price: $15 +/- $2.5 (~17%)

I think a merchant would be wise to sell with a 25% volatility hedge premium.

|

|

|

|

|

neofutur

|

|

August 02, 2011, 10:00:36 PM |

|

Yes, except the ones that really matter are dark pools, and we don't get to see them, and one of them at 10,000 BTC is enough to drive up the market price by 1.45 USD, as happened over the weekend. Aside from that, you're spot on.  Yes, except there are no more darkpools on mtgox for weeks |

|

|

|

|

|

bitclown

|

|

August 02, 2011, 10:09:48 PM |

|

None of the recent big buys was announced in advance. They're simply waiting for enough bears to swim into the net before buying. Big orders are fake, actual buys comes out of nowhere. So don't read too much into the order book even if there's no dark pool (that we know of) at Empty Gox.

|

|

|

|

|

Nagle (OP)

Legendary

Offline Offline

Activity: 1204

Merit: 1000

|

|

August 03, 2011, 05:07:23 PM |

|

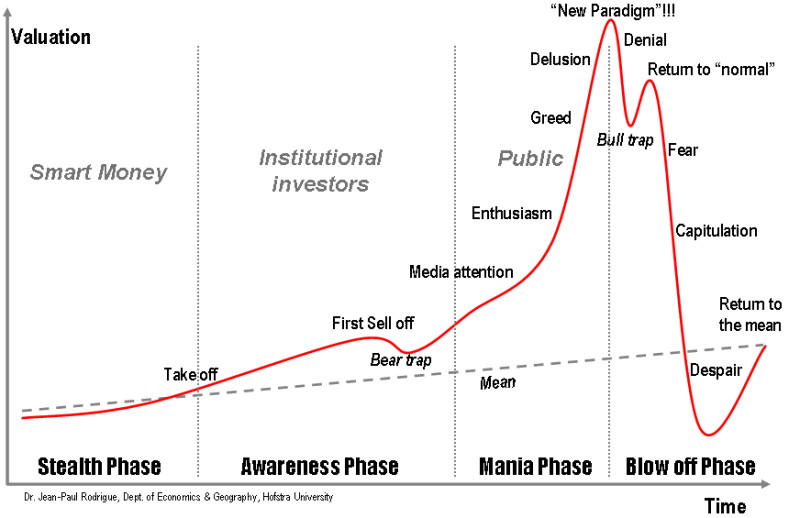

Classic financial bubble pattern. Classic financial bubble pattern. Bitcoin, last 6 months. Bitcoin, last 6 months.Any questions? |

|

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

August 03, 2011, 05:11:30 PM |

|

Have we hit Despair yet?

|

|

|

|

|

|

Crazy

|

|

August 03, 2011, 05:21:03 PM |

|

Have we hit Despair yet?

No |

Elon Krusky

|

|

|

|

Hunterbunter

|

|

August 03, 2011, 05:35:25 PM |

|

Have we hit Despair yet?

Despair doesn't usually feel like confusion. You'll know when it hits by that sinking feeling in your gut that any BTC you have are worthless (or you've lost all your money), or you think that putting money in is pointless, as it's 'all over'. That's despair  . |

|

|

|

|

SgtSpike

Legendary

Offline Offline

Activity: 1400

Merit: 1005

|

|

August 03, 2011, 05:46:57 PM |

|

I'm buying back during this selloff... guess I'm not in too much dispair yet!

|

|

|

|

|

|

ryepdx

|

|

August 03, 2011, 06:10:29 PM |

|

Come on, despair! I want your lovely, lovely low prices!

|

|

|

|

|

|