|

UnunoctiumTesticles

|

|

November 09, 2014, 12:41:21 AM

Last edit: November 17, 2014, 04:43:48 AM by UnunoctiumTesticles |

|

Seems everyone is using that statement about Armstrong's computer being self-aware to discredit him. So let me clarify the difference between sentient and self-aware. I have argued that Kurzweil's Singularity can not occur for as long as computers are not integrated into reproduction and evolution because the entropy added by the humans is not contained within the entropy of the self-learning computers. Here is an excerpt: Algorithm ≠ Entropy

Proponents of the technological singularity theory cite the exponential increase in computing hardware power such as Moore's Law and recent software advances such the sophisticated Spaun artificial brain which can pass simple IQ tests and interact with its environment; also IBM's Watson computer which defeated Jeopardy and chess masters, subsequently was recently programmed to do lung cancer diagnosis more accurately than human doctors.

However, the speed of the computing hardware and the sophistication of the software has no relevance because creativity can't be expressed in an algorithm. Every possible model of the brain will lack the fundamental cause of human creativity— every human brain is unique. Thus each of billions of brains is able to contemplate possibilities and scenarios differently enough so that it is more likely at least one brain will contemplate some unique idea that fits each set of possibilities at each point in time.

An algorithm or model can describe what and how to do and even be generalized to respond to unknown future scenarios by observing patterns and deducing rules about its environment, but it can't vary its imperfections nondeterministically, because the input entropy (to the algorithm) is known a priori and is finite. Whereas, for the collection of all human brains, the entropy is unbounded and thus the future can't be predetermined, i.e. isn't deterministic.

Imagine if life was perfect and without chance. Life would be deterministic and could be modeled with an algorithm, then failure couldn't exist, everything would be known in advance, and thus there could be no change that wasn't predictable, i.e. real change wouldn't exist and the universe would be static. Life requires imperfection and unbounded diversity, else life doesn't exist and isn't alive. Equality and perfection are the ambition of the insane who probably don't realize they must destroy life to reach their goal.

Thus the theory that it would be impossible to predict what computers would contemplate is nonsense because the input entropy of the models of the brain will always be finite and deterministic from the time the input entropy is varied.

Pseudo-random number generators are deterministic from the time the seed is changed. Even dynamically capturing entropy from the changing content of the internet would be deterministic from each moment of capture to the next, and the model of capture would be lacking diversity and static (only modified by a human).

Thought Isn't Fungible

To make the computers as creative as the humans would require inputting the entropy from all the human brains. Yet there is no plausible way to extract the future uniqueness of human brains other than to allow them interact with the environment over unbounded time, because the occurrence of creativity is probablistic (by chance) as the dynamic diversity of human minds interact with the changing environment. The term unbounded means there is no way to observe or capture that uniqueness a priori other than through the future of life as it unfolds.

Inmates can be forced to do manual labor because it is possible to observe the performance of the menial tasks. However, it is impossible (or at least very inefficient and imprecise) to determine whether a human is feigning inability or giving best effort at a knowledge task. Manual labor is fungible, i.e. nearly any person with average IQ and dexterous limbs can be substituted to do the task. Whereas, knowledge production such as programming the computer, authoring content or developing marketing plans, requires diversity of thought. Armstrong claims his computer was capable of learning from and be aware of its environment and took evasive action when its security was threatened. This is entirely possible as we know for example that A.I. neural networks can distill patterns from a series of inputs. However what is not possible is for the computer to have feelings about its relatives, nor be able to come up with an innovative idea that wasn't contained within its input entropy. The input entropy of the set of all humans is not only the environmental input since birth, rather it also includes the entire evolutionary history of that particular ancestry path via the DNA. One thing I forget to put in my linked essay is that the known genome is not finite. There resolution of the DNA is not limited to the finite genes, instead there are finer grained elements within the genome which we are either already aware of or will discover. When we think about the interaction of the environment with the collective genome, we need to pay attention to my point about path dependencies and why no two events can ever be exactly identical (although cycles can have general resemblance). So computers will do amazing things that seem almost sentient, but they will never replace humans unless they are able to reproduce biologically with the randomness (entropy) of the infinite encoding in the genome.http://unenumerated.blogspot.com/2011/01/singularity.htmlThe Singularitarian notion of an all-encompassing or "general" intelligence flies in the face of how our modern economy, with its extreme specialization, works. We have been implementing human intelligence in computers little bits and pieces at a time, and this has been going on for centuries. First arithmetic (first with mechanical calculators), then bitwise Boolean logic (from the early parts of the 20th century with vacuum tubes), then accounting formulae and linear algebra (big mainframes of the 1950s and 60s), typesetting (Xerox PARC, Apple, Adobe, etc.), etc. etc. have each gone through their own periods of exponential and even super-exponential growth. But it's these particular operations, not intelligence in general, that exhibits such growth.

...

Another way to look at the limits of this hypothetical general AI is to look at the limits of machine learning. I've worked extensively with evolutionary algorithms and other machine learning techniques. These are very promising but are also extremely limited without accurate and complete simulations of an environment in which to learn. So for example in evolutionary techniques the "fitness function" involves, critically, a simulation of electric circuits (if evolving electric circuits), of some mechanical physics (if evolving simple mechanical devices or discovering mechanical laws), and so on.

These techniques only can learn things about the real world to the extent such simulations accurately simulate the real world, but except for extremely simple situations (e.g. rediscovering the formulae for Kepler's laws based on orbital data, which a modern computer with the appropriate learning algorithm can now do in seconds) the simulations are usually very woefully incomplete, rendering the results usually useless. For example John Koza after about 20 years of working on genetic programming has discovered about that many useful inventions with it, largely involving easily simulable aspects of electronic circults. And "meta GP", genetic programming that is supposed to evolve its own GP-implementing code, is useless because we can't simulate future runs of GP without actually running them. So these evolutionary techniques, and other machine learning techniques, are often interesting and useful, but the severely limited ability of computers to simulate most real-world phenomena means that no runaway is in store, just potentially much more incremental improvements which will be much greater in simulable arenas and much smaller in others, and will slowly improve as the accuracy and completeness of our simulations slowly improves.

Nor does the human mind, as flexible as it is, exhibit much in the way of some universal general intelligence. Many machines and many other creatures are capable of sensory, information-processing, and output feats that the human mind is quite incapable of. So even if we in some sense had a full understanding of the human mind (and it is information theoretically impossible for one human mind to fully understand even one other human mind), or could somehow faithfully "upload" a human mind to a computer (another entirely conjectural operation, which may require infeasible simulations of chemistry), we would still not have "general" intelligence, again if such a thing even exists.

That's not to say that many of the wide variety of techniques that go under the rubric "AI" are not or will not be highly useful, and may even lead to accelerated economic growth as computers help make themselves smarter. But these will turn into S-curves as they approach physical limits and the idea that this growth or these many and varied intelligences are in any nontrivial way "singular" is very wrong.

On a separate topic, I see the national security agencies are now using the ISIS false flag operation (the west funded and armed them, e.g. to overthrow Syria) to justify their abrogation of our basic rights. These fuckers will never stop the encroaching Police state until we make them impotent technologically. Political solutions won't work until after society crashes and burns, because people are complacent until then. Note the rise in the religious war was coming now due to the natural cycle. Nevertheless, our western governments are leveraging this (sowing chaos) to justify abrogating our human rights. The only way to take back what is ours, is to make the governments impotent with technology that empowers the individual. Political solutions will always end up owned by the elite, e.g. the coming IMF globalized monetary unit after 2024.  | http://blog.mpettis.com/2014/11/china-europe-and-optimal-currency-zones/#comment-94248

Suvy, your assay of the problems is clairvoyant, but you won’t get solutions politically in time, at least not on the national scope. Instead we will crash and burn first. Another much more severe global contagion will ensue in 2016.

The near-term future of the youth is the internet and an internet monetary system controlled by no one. But Bitcoin has failed to be that unit. After 2032, you will see political solutions but your youthful demographic will get glossy-eyed and hand the power to globalized monetary fiat in return for idealistic slogans of “end war” which we will be very tired of by then because we will see a massive upswing of war from now until 2024 at least. For example, China and Japan are ramping up to fight in order to redirect public angst away from the failed national monetary policies.

In short, the death of the nation-states and the rise of a global community. There will be a split between the first-class Knowledge workers who will go for individual sovereignty with an improved decentalized internet monetary unit and the rest who will side with a socialistic (political) fiat global reset.

|

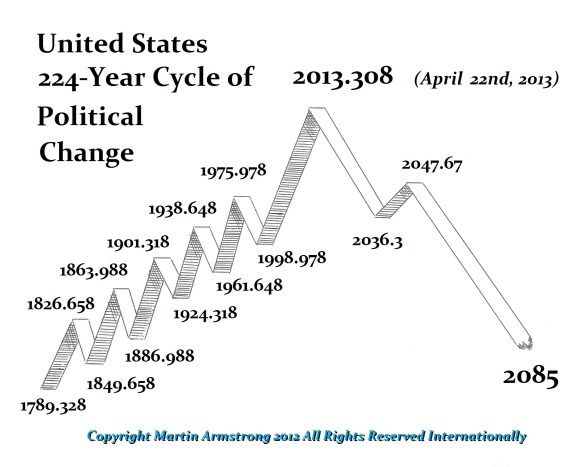

Armstrong correctly explains that the elite are not suppressing the precious metals. I had posted upthread a long explanation that the elite are not powerful enough to control the chaos in nature, rather what they do is to align themselves with creative destruction and experiment to find ways to achieve their goals of more globalized economies-of-scale for their multi-national corporations and political capture. Armstrong is correct about the money center banks being very short-term fraud oriented. The elite who sit above the money center banks (Armstrong doesn't agree) could not further their aims for creative destruction symbiosis by trying to entirely suppress the precious metal prices. Fiat and futures markets on precious metals have sustained because the broad populace doesn't then want to use physical metal, but that is not really a manipulation rather it is what society has chosen. The way the elite plan to obtain their goals for a global fiat is by pumping the world full of debt as they have done and then IMF will rush in with a new monetary system solution after 2024. The chaos from 2016 to 2024 will burn the confidence in the nation-states to the ground. This I argue was by-design of the long-term thinking elite such as Rothschild et al. They have aligned themselves with this natural cycle of chaos and the natural tendency of society towards socialism failure and debt. Armstrong has apparently unlocked the math of the natural cycles. Apparently Pi (a.k.a. π = 3.1459) is the basis, which seems plausible since the circumference (= π2r, where r = radius) and area (= πr2, where r = radius) of a circle, as well all wave equations involve π. |

|

|

|

|

|

|

|

|

|

|

|

TalkImg was created especially for hosting images on bitcointalk.org: try it next time you want to post an image

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

UnunoctiumTesticles

|

|

November 09, 2014, 03:04:06 AM

Last edit: November 09, 2014, 04:36:46 AM by UnunoctiumTesticles |

|

http://blog.mpettis.com/2014/11/china-europe-and-optimal-currency-zones/#comment-94338BACK TO THE FUTURE: IS THE US NOW IN LATE 1928?

In the late 1920’s, after the Fed engaged in QE in 1924 and 1927 (monetizing bankers acceptance notes at the time in absence of Federal debt) to encourage gold to leave the US and return to Europe...

But, by cutting interest rates and doing some QE in 1927, the Fed triggered massive speculation in the US stock market. This was partly on leverage (brokers loans exploded). By August 1928, despite the Fed tightening again between February and July 1928 because the market was getting “frothy”, capital started to flee Europe again to flow back into the US, attracted by the apparently fantastic gains to be made in the US stock market and scared by reparation tensions rising between France and Germany ... The value of total capital in the US exploded relative to the value of production from 4.2x end 1926 to over 6x end 1929...

The situation today is strikingly similar: QE fueled the S&P500 for the past years but has now ended. Still, global capital is rushing back to the US, fleeing Japan and Europe, both struggling under deflation and both trying to debase their currency. Europe is close to recession again...

The US stock market is the receptacle for all this floating capital looking for a home as the bond market provides negative real return, commodities are crashing and there is little real economy investment opportunities because final demand is lacklustre and capacity often already in excess. This is fueling another leg up in the S&P500, similar to the post Fed-tightening ramp up from Q3 1928 ... The value of total capital in the US is now over 5.5x the value of production, the level of December 1928, though the composition is different (more debt, less stock market equity, comparable home equity).

...

– The S&P500 will go up ... at ~2740 by late 2015, which is 2 standard deviations above its long term trend since 1871...

– Then we’ll have a major financial crash as equity are grossly overvalued compared to the sea of debt underneath it and the correction degenerates due to leverage unwinding. It will spill over into an economic recession / depression in 2016-2017.

– By Q3 2018, the S&P500 will be at 265, which is 2 standard deviations below its long term trend, as many companies part of the index won’t survive. Armstrong has pointed out that historically the Fed will tighten because they mistake the macroeconomic deadcat bounce—caused by the influx of international capital flows—as a real economic upturn. Historically the stock market doesn't decline when interest rates rise. As interest rates rise, more capital flows into the dollar because the rest of the world is short the dollar due to the carry trade in dollars from the QE1 - 3 (world has accrued massive dollar loans because QE drove dollar investors abroad to seek yield). Meaning the rest of world will accelerate its implosion, thus more capital will flee. It is inescapable spiral and the real interest rate return on equities is not the driving factor.

1929 was the beginning a Public wave; whereas, 2007 or 2015 are both in the middle of a Private wave. Also we have a confluence of the upswing in the 25.6 year war cycle in 2014, the peak of 224 year political cycle in the USA in 2013 (see Public wave link for chart), the pandemic cycle peaking in 2019 (see Public wave link), and the peak of the 309.6 year civilization wave in 2032 (note it is not a public wave but a civilization change wave).

So not only is the USA not entering a Public confidence in 2007 or 2015, rather the confidence in the Public bonds is collapsing every where (even Germany will be insolvent). The movement is towards Private assets every where and there will be no safe haven sovereign nation. This is why all the cycles are flashing red alert in unison.

The governments will hunt down the wealth with a globalized police state (and squander it of course in collapsing spiral of failure and pestilence). This is extremely dangerous. Asia will rise as the next financial center, but after the chaos and not until 2032.

World War 2 was a walk in the park compared to what is coming for us now. We will be begging for hyperinflation instead of strong military governments raising taxes, capital controls, bail-ins, and hunting us all down.

Our one hope is the internet and privacy (anonymity) enabling technologies. Political solutions will not come until after the public is tired from the chaos by 2032. See the murals at the Denver airport which are aware of what is coming. http://armstrongeconomics.com/2013/01/29/8797/http://princetoneconomics.blogspot.com/2006/06/economic-confidence-model.html http://armstrongeconomics.com/2013/01/29/8797/http://princetoneconomics.blogspot.com/2006/06/economic-confidence-model.html    http://thechive.com/2012/03/08/something-is-rotten-in-the-denver-airport-25-photos/ http://thechive.com/2012/03/08/something-is-rotten-in-the-denver-airport-25-photos/        http://en.wikipedia.org/wiki/Georgia_Guidestones http://en.wikipedia.org/wiki/Georgia_Guidestones  http://en.wikipedia.org/wiki/Skull_and_Bones http://en.wikipedia.org/wiki/Skull_and_Bones   http://www.businessinsider.com/skull-and-bones-alumni-2011-2?op=1 http://www.businessinsider.com/skull-and-bones-alumni-2011-2?op=1

|

|

|

|

|

Rassah

Legendary

Offline Offline

Activity: 1680

Merit: 1035

|

|

November 09, 2014, 07:00:32 AM |

|

Then we have Bitcoin which I (Anonymint) predicted (in this forum numerous times reiterated) would decline from $1000 to $150, based on the fact that adoption was declining due to take over by Coinbase, Bitpay, etc (losing network effects) and because all Private assets will align and move down for a bottom in 2015.

But, despite the decline in price, adoption has actually been increasing drastically, compared to previous years, and possibly thanks to things like BitPay and Coinbase, which are reinforcing network effects. Many believe that the decline in price is actually precisely due to increased adoption and increased use of bitcoin that used to be hoarded, but is now spent more easily and frequently, with the end result of more of it being dumped on the market. It doesn't seem like it will be hitting $150, either, though we still have two more months to go. So, it looks as if your adoption prediction was wrong, and price prediction is in the right trend, but may still be missed exactly, but with the reason behind the price decline being wrong too. |

|

|

|

|

|

RAJSALLIN

|

|

November 09, 2014, 03:43:21 PM |

|

Then we have Bitcoin which I (Anonymint) predicted (in this forum numerous times reiterated) would decline from $1000 to $150, based on the fact that adoption was declining due to take over by Coinbase, Bitpay, etc (losing network effects) and because all Private assets will align and move down for a bottom in 2015.

But, despite the decline in price, adoption has actually been increasing drastically, compared to previous years, and possibly thanks to things like BitPay and Coinbase, which are reinforcing network effects. Many believe that the decline in price is actually precisely due to increased adoption and increased use of bitcoin that used to be hoarded, but is now spent more easily and frequently, with the end result of more of it being dumped on the market. It doesn't seem like it will be hitting $150, either, though we still have two more months to go. So, it looks as if your adoption prediction was wrong, and price prediction is in the right trend, but may still be missed exactly, but with the reason behind the price decline being wrong too. Bitcoin still has another 11 months to hit a low of $150 if we look at Armstrongs ECM model (publc vs private waves) |

|

|

|

|

|

iCEBREAKER

Legendary

Offline Offline

Activity: 2156

Merit: 1072

Crypto is the separation of Power and State.

|

|

November 12, 2014, 11:02:32 AM |

|

You don't need a computer program capable of quibbling about the (lack of) difference between self-awareness and sentience to know that "Europe is going to crash and burn." I'd rather know who you were watching down there in Mindanao, and who was paying you to watch them.  |

██████████

██████████████████

██████████████████████

██████████████████████████

████████████████████████████

██████████████████████████████

████████████████████████████████

████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

██████████████████████████████████

████████████████████████████████

██████████████

██████████████

████████████████████████████

██████████████████████████

██████████████████████

██████████████████

██████████

Monero

|

| "The difference between bad and well-developed digital cash will determine

whether we have a dictatorship or a real democracy." David Chaum 1996

"Fungibility provides privacy as a side effect." Adam Back 2014

|

| | |

|

|

|

Rassah

Legendary

Offline Offline

Activity: 1680

Merit: 1035

|

|

November 14, 2014, 05:10:32 AM |

|

Bitcoin still has another 11 months to hit a low of $150 if we look at Armstrongs ECM model (publc vs private waves)

AnonyMint (aka UnunoctiumTesticles and many other names) claimed $150 by the end of this year, not Armstrong. I don't even know what Armstrong's position on bitcoin is. I know Anonymint thinks it's a POS, because of some ideas he came up with on how to attack and destroy it. Ideas that bitcoin devs and many others explained would not work, even show a lack of understanding of how bitcoin actually works, but which Anonymint stuck to as the absolute truth no matter what. |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 14, 2014, 05:39:37 AM

Last edit: November 14, 2014, 10:50:31 PM by UnunoctiumTesticles |

|

Bitcoin still has another 11 months to hit a low of $150 if we look at Armstrongs ECM model (publc vs private waves)

AnonyMint (aka UnunoctiumTesticles and many other names) claimed $150 by the end of this year, not Armstrong. I don't even know what Armstrong's position on bitcoin is. You are a fucking liar. Try to quote me in full context. I never claimed $150 by the end of the year, rather I am claiming a low in all Private assets before 2015.75 (i.e. Oct. 2015), which is Armstrong's ECM model. I know Anonymint thinks it's a POS, because of some ideas he came up with on how to attack and destroy it. Ideas that bitcoin devs and many others explained would not work, even show a lack of understanding of how bitcoin actually works, but which Anonymint stuck to as the absolute truth no matter what.

I will not waste my time correcting your (loser ass) lies and imbecile level of reading comprehension. Am I understanding it correctly that according to the ECM the dollar will continue to rally until at least a couple of years after 2015.75? Also in accordance with the coming bull market in equity?

I'm quite fine with lower lows, as that can give some time to accumulate a bit. mil·len·ni·um məˈlenēəm/ noun plural noun: millennia 1. a period of a thousand years, especially when calculated from the traditional date of the birth of Christ. The global ECM turns down every 8.6 years (1 millennia or 1000 days x Pi) so it last peaked in 2007.15, which is when the pin event pricked the sub-prime real estate crisis (early stage of the Sovereign Debt Bubble). We are in a Private Wave cycle (alternates every 51.6 years, i.e. 6 cycles x 8.6) so every peak can be another major step towards moving towards maximum move to Private assets by 2032. So in 2015.75 we can expect the pin to be pricked on the next wave of massive Public (Sovereign nation) bonds contaion. Thus from 2011.45 until 2015.75, we've had a reprieve from the move to Private assets while the pressure cooker has been building on the Sovereign bond collapse coming, e.g. Mario Gaghi ECB head took many actions to buy time and load that pressure cooker to the maximum. The dollar has been strengthening a bit since we turned the corner mid-way though this 8.6 cycle in 2011.45, and should continue to increase as rest of the world is collapsing and capital is flowing back (egressing) from the periphery markets back to the reserve currency market (dollar). As the move to Private assets accelerates anew after 2015.75 when the Sovereign Debt Big Bang pin is pricked, the likely beneficiary is also the dollar based stock market, because the Private companies will be seen as a mainstream Private asset (alternative to collapsing Public bonds). Thus the dollar may strengthen along with other Private assets, such as gold, real estate, collectibles, tangible assets, and crypto-currencies. ------------------------------------------------------ Bitcointalk.org is down, so I will post this there later... Those who want Obama's 'net neutrality' bullshit, will end up with this: http://www.coindesk.com/day-reckoning-dark-markets-hundreds-illicit-domains/ The mining stocks have broken down through support, thus we are probably moving lower: http://armstrongeconomics.com/2014/11/13/setting-the-stage-for-the-collapse-in-metals-gold-stocks/ Bitcoin is rallying similar to how gold and silver did before they again moved down to lower lows. All "private assets" will continue to make lower highs and lower lows until the turn in the ECM on 2015.75. The prior bounce in Bitcoin was to $666. It won't make it that high this time before turning down again to make lower lows and eventually bottom at or below $200. These are sucker's rallies for those who don't understand the trend in place until 2015.75. |

|

|

|

|

conspirosphere.tk

Legendary

Offline Offline

Activity: 2352

Merit: 1064

Bitcoin is antisemitic

|

|

November 14, 2014, 03:52:15 PM |

|

Bitcoin is rallying similar to how gold and silver did before they again moved down to lower lows. All "private assets" will continue to make lower highs and lower lows until the turn in the ECM on 2015.75. The prior bounce in Bitcoin was to $666. It won't make it that high this time before turning down again to make lower lows and eventually bottom at or below $200. These are sucker's rallies for those who don't understand the trend in place until 2015.75.

Maybe, but check out the current premium on gold that you can hold (and silver too). Your forecast could well be right, but trading in this environment is crazy (for who's not a cabal insider), so imho better sit tight and be right holding to quality, PM and BTC included. |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 14, 2014, 11:05:21 PM

Last edit: November 14, 2014, 11:42:30 PM by UnunoctiumTesticles |

|

Bitcoin is rallying similar to how gold and silver did before they again moved down to lower lows. All "private assets" will continue to make lower highs and lower lows until the turn in the ECM on 2015.75. The prior bounce in Bitcoin was to $666. It won't make it that high this time before turning down again to make lower lows and eventually bottom at or below $200. These are sucker's rallies for those who don't understand the trend in place until 2015.75.

Maybe, but check out the current premium on gold that you can hold (and silver too). Your forecast could well be right, but trading in this environment is crazy (for who's not a cabal insider), so imho better sit tight and be right holding to quality, PM and BTC included. Sorry but I have to tell you that you are delusional. There is no cabal that has the entire game rigged where analysis no longer works. Read Armstrong so you stop losing your shirt and learn how the trends of international capital flows work. He apparently read my recent summaries of his writing and realized that he doesn't summarize his model well for novices, because he wrote this today: http://armstrongeconomics.com/2014/11/14/the-future-explained-what-is-unfolding-the-connections-in-the-global-economy/Also see what I wrote before about the elite don't control everything:

Armstrong correctly explains that the elite are not suppressing the precious metals. I had posted upthread a long explanation that the elite are not powerful enough to control the chaos in nature, rather what they do is to align themselves with creative destruction and experiment to find ways to achieve their goals of more globalized economies-of-scale for their multi-national corporations and political capture. Armstrong is correct about the money center banks being very short-term fraud oriented. The elite who sit above the money center banks (Armstrong doesn't agree) could not further their aims for creative destruction symbiosis by trying to entirely suppress the precious metal prices. Fiat and futures markets on precious metals have sustained because the broad populace doesn't then want to use physical metal, but that is not really a manipulation rather it is what society has chosen. The way the elite plan to obtain their goals for a global fiat is by pumping the world full of debt as they have done and then IMF will rush in with a new monetary system solution after 2024. The chaos from 2016 to 2024 will burn the confidence in the nation-states to the ground. This I argue was by-design of the long-term thinking elite such as Rothschild et al. They have aligned themselves with this natural cycle of chaos and the natural tendency of society towards socialism failure and debt. Armstrong has apparently unlocked the math of the natural cycles. Apparently Pi is the basis. There is no great premium on bullion if you know where to buy. I was buying 1000oz bars near to spot when silver was $9 and minting generic 1oz rounds (which were in short supply at that time): http://www.fidelitrade.com/home/products-pricesThe following company can help you facilitate delivery from Fidelitrade (even if you are not located in the USA): http://www.fsdepository.com/Vault/Be very careful with gold dealers and never send them too large of a trade: http://www.coinweek.com/bullion-report/tulving-company-collapse/http://web.archive.org/web/20140106153016/http://tulving.com/You should be accumulating some bullion but it should not be more than about 10% of your net worth. As Armstrong says, even bullion won't help you if we go into a severe Mad Max scenario then ONLY food becomes money. Unless you are short-term trader (buying the dips and selling the rallies), the bulk of your money between now and 2015.75 (assuming you don't have another investment) should be invested in the DJIA or S&P500 (perhaps waiting for a near-term correction first), because other private assets are trending to lower highs and lower lows until then. For those who are too heavily invested in bullion or Bitcoin, sell the rallies to lighten up and move the proceeds into the USA stock market until 2015.75. As for crypto-currency, sell Bitcoin into rallies and buy it again on extreme dips, wash and repeat until 2015.75. Also keep your eye out for a crypto-currency that changes every thing and challenges Bitcoin in terms of being actually widely mined and widely used by regular folks. If you see such a crypto-currency buy it regardless of the trend to 2015.75, because this would be a counter-trend phenomenon if it happens. |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 15, 2014, 05:14:53 AM

Last edit: November 15, 2014, 05:26:21 AM by UnunoctiumTesticles |

|

Check out that link from Jim Sinclair back on January 2012 when gold was still skyhigh and Armstrong was predicting $1100 or $1050 before 2015.75. Careful with your subjective bias when the record clearly shows that Armstrong predicts everything every time without fail. 30 years of record is enough to show you that your bias is irrational. https://en.wikipedia.org/wiki/Cognitive_dissonancehttp://www.simplypsychology.org/cognitive-dissonance.htmlhttp://psychcentral.com/blog/archives/2008/10/19/fighting-cognitive-dissonance-the-lies-we-tell-ourselves/birdbrain, it will be proven by 2016 that everything I wrote above about the coming deflation is correct. Now stay on ignore (I encourage other readers to click the ignore next to your name on the left to show you that you speak only noise) with your other dimwitted commentators who have nothing intelligent to say. All of what I wrote is just a re-summary of Martin Armstrong's Pi model of international capital flows. It has enabled him to make the following correct predictions years in advance of the predictions coming true. He spent $100 million developing the research and having his computer find all the correlations. That is when he discovered that human nature and thus international capital flows also move in waves, just like everything else in the The Universe (my blog) does. That doesn't mean we can predict what any individual human will do, only that we can predict the macro waves. Martin Armstrong helped me to make a public prediction that gold would decline from $1550 to under $1200. I was also the person who exactly predicted the 2011 price moves of silver back in Oct 2010. So shut your birdmouth. It is also allowing me to predict that the DJIA will go to 39,000 before 2015.75 and that gold will probably go up to 1424 - 1550, then crash back down to 1050 or below. Gold will not make new highs under after 2015.75. Now you just wait and see if I am correct again or not. I made one mistake betting too early on China's collapse last year, because I wasn't reading Armstrong (who makes it very clear China won't collapse until 2016). P.S. I am sending a link to this rebuttal out publicly.  ================================= Note I was starting to lean towards Armstrong's cycles when I INDEPENDENTLY discovered his 78 year cycle in Feb. 2013. The key was looking at long-term charts for strange patterns that stand out like a bloody nose. This caused me to integrate his 3 x 26 = 78 year model into my understanding of technological unemployment (follow the sub-links at the above linked pages to get to a table of historical dates evidence of the 78 year cycles). Note since parroting that prediction of 39,000 by 2015.75, I have since refined my understanding of Armstrong, and I have explained in the post recently that Armstrong sees the possibility of the DJIA stock market (inverting from its correlation with Public assets) aligning with all Private assets and thus the high being extended beyond 2015.75. |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 15, 2014, 06:10:01 AM |

|

Megadeath coming... http://armstrongeconomics.com/2014/11/14/time-to-hide-under-the-covers/The Chinese have been able to compromise the US defense systems. Meanwhile, in the Black Sea, Russia sent a Su-24 jet which then simulated a missile attack against the USS Donald Cook. It carried a new device that rendered the ship literally deaf, dumb, and blind. The Russian aircraft repeated the same maneuver 12 times before flying away.  Obama better wake up. This is not some video game. The world is on the brink of war and governments need this war because they are dead in the water economically. The government in Ukraine has told its people it cannot reform now, it is in war. So be patient. We will see this same excuse migrate to Europe and the USA. Government NEED such a diversion. It also does not hurt to kill off those anticipating being taken care of by the state.

|

|

|

|

|

|

UnunoctiumTesticles

|

|

November 15, 2014, 11:50:07 PM

Last edit: November 16, 2014, 01:40:17 AM by UnunoctiumTesticles |

|

Again I repeat, the deadcat bounce in Private assets was anticipated by Armstrong’s model: http://armstrongeconomics.com/2014/11/15/the-precious-metals-the-bounce/ Thus, as I advised before, you should sell the rallies until the turning point on 2015.75 (Oct. 2015).

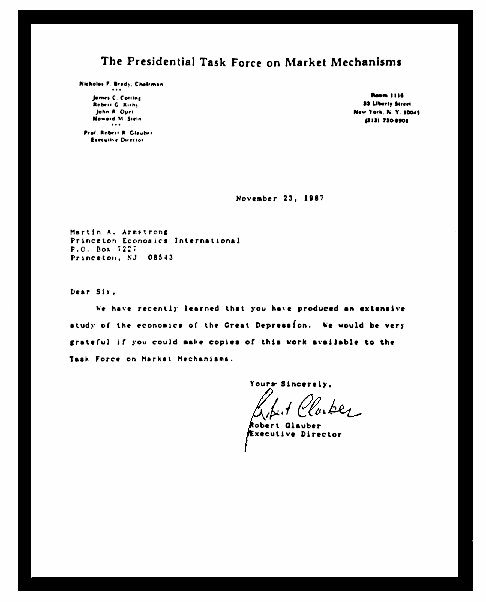

Armstrong has pointed out that the powers-that-be which put him in Supermax prison illegally for 7 years on a bogus contempt-of-court charge:    Have used it as an example to other USA politicians as a warning to not try to stand up to the corruption that is dragging the world towards the coming abyss. http://armstrongeconomics.com/2014/11/15/judge-rakoff-blasts-the-injustice-of-america/I agreed to allow a documentary film the FORECASTER to be made following me around since 2011 that is more of a movie when you see it for two reasons. To expose the legal system to the world and to expose the truth behind the shenanigans behind the curtain the rigging of the financial markets. I was not interested in a poor me film since I have moved on. I do not need the sympathy thank you. It has contributed to the expansion of my knowledge. Yet I respect that if government could do this to me, who was very high-profile internationally, they could do it to anyone. They plastered pictures of me with Margaret Thatcher in the press as a warning to other US politicians to stay back.

Are you sure you want to be the USA as this coming police state horrifies? Compare to most humane prisons in Nordic Europe that have to be shut down because they are working so well at reforming criminals.   |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 16, 2014, 09:38:58 AM |

|

Cross-posting... You are probably right. Or at least it will be much easier for the government to seize domains in the future. From what I have read in news reports, the legal justification that the onion sites were seized were dubious at best

It is already trivial for them to seize domains. It requires little more than them simply ordering the registrar to hand it over. Clearly, this is legally wrong and unconstitutional, since domains are a form of intangible property, but in actual practice, they're doing it on an almost daily basis. (Seizing .onion pseudo-domains requires actually compromising the system, though.) This has literally next to nothing to do with net neutrality, though. Blocking a domain does not block a P2P application such as Bitcoin. It has everything to do with this proposed plan to regulate the internet as a utility, because as you admitted that in order to actually enforce it they need to be able to identify at the protocol layer, which means they can then technically block stuff like Bitcoin and more specifically they can technically put actual content filters on the internet to block certain speech. The reason they are attempting to implement this now, is because they want to be able to control what the public can see as they ramp up the GLOBAL POLICE STATE to Orwellian ideals (think Obama's czars). Ministry of Peace

The Ministry of Peace supports Oceania's perpetual war.

Ministry of Plenty

The Ministry of Plenty rations and controls food, goods, and domestic production; every fiscal quarter, the Miniplenty publishes false claims of having raised the standard of living, when it has, in fact, reduced rations, availability, and production. The Minitrue substantiates the Miniplenty claims by revising historical records to report numbers supporting the current, "increased rations".

Ministry of Truth

The Ministry of Truth controls information: news, entertainment, education, and the arts. Winston Smith works in the Minitrue RecDep (Records Department), "rectifying" historical records to concord with Big Brother's current pronouncements, thus everything the Party says is true.

Ministry of Love

The Ministry of Love identifies, monitors, arrests, and converts real and imagined dissidents. In Winston's experience, the dissident is beaten and tortured, then, when near-broken, is sent to Room 101 to face "the worst thing in the world" — until love for Big Brother and the Party replaces dissension. You aren't the sharpest tool in the shed. |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 16, 2014, 05:36:12 PM |

|

http://armstrongeconomics.com/2014/11/15/g20-targets-the-week-of-the-cycle-of-war/Of course, that G5 manipulation created total havoc in the world economy. Its goal was rather stupid. They assumed that is they could lower the value of the dollar, they would create export jobs. I went public about this and warned they would increase volatility that would culminate in a market crash as capital fled the USA. That happened precisely to the day of the ECM on October 19th, 1987.   In 1997, the memories grew short. Here we had the Asian Currency Crisis and at that time it was Robert Rubin trying to talk the dollar down once again for trade. I had to write once more to warn them what they were doing was insane.    | This time, Timothy Geithner had to respond saying of course they would not do that sort of thing. Indeed, they seemed to back off and listened for once. I was then summoned by Beijing. I flew to meet with the central bank of China to assist in the Asian Currency crisis. They stated bluntly that they believe in our analysis and that we were correct in showing that capital was starting to shift away from Asia because the birth of the Euro was coming on board in 1998. China has publicly announced that they are now using the analysis we pioneered – Capital Flow Analysis. |

|

|

|

|

|

|

UnunoctiumTesticles

|

|

November 17, 2014, 03:26:29 AM

Last edit: November 18, 2014, 07:22:14 AM by UnunoctiumTesticles |

|

To all those fools who doubt whether repeating cycles can predict the future, I hereby predict the sun will rise tomorrow at dawn and set at dusk. Why should the cycles of nature on earth be non-repeating? Of course no two events are ever exactly the same. Thus the sun is never exactly the same state as it was in the past. Yet the general (similar) shape of the cycle repeats. Armstrong's computer found those repeating patterns and has successfully predicted them into the future since the early 1980s at least. You doubt his computer's predictions at your peril. Comparing Armstrong's Socrates to IBM's Watson: http://armstrongeconomics.com/2014/11/16/socrates-v-watson/

so you all are telling me to buy maxcoin now? hah.

You are joking. Is that Max Keiser's scamcoin? In terms of crypto-currency, my opinion is I would look for something that is widely used as a currency by n00bs and where they don't use centralized websites which bastardize the whole thing (e.g. Coinbase, Bitpay, etc). Something with that quality might actually be able to snowball into what we wanted Bitcoin to be (i.e. fully decentralized, virally spreading popularity, hopefully anonymous, mineable by all, fast transaction times for micropayments, etc). |

|

|

|

|

C0ins_R_U5

Newbie

Offline Offline

Activity: 50

Merit: 0

|

|

November 17, 2014, 03:31:00 AM |

|

so you all are telling me to buy maxcoin now? hah. ok, very cool insight from some of you on assets and what the future may hold for gold.. interesting.

|

|

|

|

|

|

devphp

|

|

November 17, 2014, 12:02:22 PM |

|

|

|

|

|

|

|

UnunoctiumTesticles

|

|

November 18, 2014, 02:17:27 AM

Last edit: November 18, 2014, 02:40:08 AM by UnunoctiumTesticles |

|

The repeating throughout all history megadeath that results from peaking socialism is well underway... The idea of net neutrality has been adopted positively by a good number of EU countries already. The EU parliament have already come out in support of it. Hell, even Brazil has taken a good stance on it (not saying Brazil is a bad country or anything, they are just corrupt as hell). If this is JUST making news then it's really a sad day.

Armstrong commented on that today. http://armstrongeconomics.com/2014/11/17/governments-are-conspiring-against-people-worldwide/Governments Are Conspiring Against People – WorldwidePosted on November 17, 2014 by Martin Armstrong | A good example of government all ganging up against the people to cling to power is how they all follow each other. These G20 meetings are now serious events because they are all about how to control the people and sustain their power. This is demonstrated by coordination efforts from taxes to now controlling the internet.

I warned that Obama calling the FCC will result in licensing to censor the internet. That’s right, they may even shut this site down in the near future unless I write what they tell me. Sorry, it will be beach-time for me then as far away as I can get.

Illustrating that what Obama has just done is a worldwide conspiracy, we have to look always around the globe to see these movements and shenanigans. The Swiss initiative to start regulating the internet has been unveiled. This is a worldwide effort and those government who have not said anything yet are just hiding behind the curtain. The Swiss will begin with “quality ranking” from TV to internet news sites! Yep – the news on the internet cannot conflict with the newspapers – hello Pravda (means truth). This is a pretend private initiative but their first president is the former member of the state government of Zürich.. It is always government officials who end up in such positions for they are there to rig the game. |

Here is a Google translation of the link above:Stifter Association Media Quality Switzerland

The Donors' Association Media Quality Switzerland "wants to build a foundation that rated neutral and fair by building and operating an independent evaluation of the quality of the media institution and created a rating of media Switzerland. Information pertaining to around 50 most far-reaching national press titles, news sites and information formats of electronic media (radio / TV), with respect scientifically analyzed according to a predefined grid on relevant aspects of quality, compared and evaluated.

The rating is therefore an overview of the major titles and sending vessels in the country as well as its quality. There should be a guide and an outside reference for all individuals and institutions that have to do with media. And it is particularly aimed at the media professionals themselves.

Personalities from the media, politics and business as the founder of the Donors' Association

The founding members are four personalities from the media, politics and business. There are Sylvia Egli von Matt, previously Director of the Swiss School of Journalism maz, Andreas Durisch, Managing Partner Dynamics Group AG, Bruno Gehrig, President of the Swiss International Airlines and former Zurich Government Markus Notter. This was recently elected to the Constituent Assembly as the first president. "The quality of the media in our democracy is of fundamental importance. The media quality is reflected directly in the quality of public discourse. Our goal is to bring in 2015 for the first time the necessary data and to present the results of this novel in this form quality ratings of the Swiss information media in the spring of 2016.

Scientific approach

The quality of the media is collected through scientific methods. The analysis and assessment will be at three levels:

The quality of the organizational structures and quality assurance of the media houses.

The reporting quality of the editorial content of the media

The quality perception among key stakeholders and the general population.

Three university institutes involved:

The rating is following institutions created (scientists)

Institute of Applied Media Studies at the ZHAW Winterthur, fög - public research institute and Society / University of Zurich, Department of Communication and Media Research at the University of Fribourg.

First Media Rating in spring 2016

In a next step, the founder club wants to achieve bis50 30 members by the end of the year. In parallel, the Foundation established in Switzerland media quality and the necessary endowment of around 2 million francs to be boosted by paying to fund the project for the time being three years.

The aim is to raise in 2015 for the first time the necessary data and to present the results in the first and only full quality rating by the Swiss information media in spring 2016.

(Also, on the very slim chance he posted anything worth reading, let me know. It's possible I was too fast with my ignore button, but based on the quality of the first post of his I read, I kinda doubt it.)

Haha, don't worry. You didn't miss anything. More socialist this, socialist that. Never mind that net neutrality has been how the internet has worked ever since it came into being. No, now that the FCC might change the classification to keep net neutrality in the wake of the court case that invalidated the original rule, all of a sudden NOW it's 'fucking socialism.' Hilarious how far up your ass you have to have your head to ignore the facts. Probably Ted Cruz posting under his internet screen name. The following applies to you as well. Hi guys, fucking communist dumbass here.

It is going to be hilarious to watch you and your fellow comrades here become skeletons of your former selves in the coming Gulags. You are actually wishing and fighting for that outcome for yourself. I suppose you missed the relevant logic upthread, so I will quote it again for readers that are interested in the truth. ... You are apparently too retarded to understand that "net neutrality" existed as a natural result of the free market and Obama is preaching that we need government to sustain or implement (regulate) the concept, which is a fucking lie and how they will actually destroy the concept. Those who are bitching about not having net access in their communities are either wanting some subsidy from the government to drive service to their uneconomic rural location or their community is already suffering from lack of competition due to over regulation and regulatory capture by the vested interests. The free market did not fail to provide "net neutrality". Adding more government regulation only makes it worse! You pontificate about shit which you don't know about, because ... well let the progenitor of the term "open source" explain it to you: Those who can’t build, talkThose who can’t build, talk

Posted on 2011-07-28 by Eric Raymond

One of the side-effects of using Google+ is that I’m getting exposed to a kind of writing I usually avoid – ponderous divagations on how the Internet should be and the meaning of it all written by people who’ve never gotten their hands dirty actually making it work. No, I’m not talking about users – I don’t mind listening to those. I’m talking about punditry about the Internet, especially the kind full of grand prescriptive visions. The more I see of this, the more it irritates the crap out of me. But I’m not in the habit of writing in public about merely personal complaints; there’s a broader cultural problem here that needs to be aired. Eric like myself was actually active in building the internet: |

|

|

|

|

|

UnunoctiumTesticles

|

|

November 18, 2014, 05:36:24 AM |

|

http://esr.ibiblio.org/?p=6529&cpage=1#comment-1290942Eric, sorry for the off-topic comment, but I don't know if I can reach you by email. I've been anticipating and wondering if you are going to dip your toe into the debate about the rising trend (ah, the serendipity of that link ending in "911") to regulate the internet using for example "net neutrality" as the justification. I don't comment often on your blog any more, but I do read. I am interested to read your logic as always. I suppose I [am] thinking the forces of decentralization will win in the end, but what hell do we have to go through first to get there? I see my recent writings on this subject made all the same points that Eric made in 2008 as follows. Eric S. Raymond's (the progenitor of the term "open source" in the infamous essay "The Cathedral and the Bazaar") past writings about "net neutrality": Net neutrality: what’s a libertarian to do?Posted on 2008-11-13 by Eric Raymond One of my commenters asked, rather plaintively: You mentioned net neutrality. I’ve read about this, and the opposition to it. I’ve read about this, and the opposition to it. As far as I can tell, net neutrality is more supported by liberals/democrats, while the opposition is made up more of conservatives/republicans. But for the life of me I can’t figure out which is the the more libertarian position. Your confusion is entirely reasonable. I’ve hung out with network-neutrality activists and tried to give them what I thought was useful advice. Their political fixations didn’t permit them to hear me. Here’s a summary of the issues and one libertarian’s take on them. Here’s where it starts: the wire-line telcos want to use their control of the copper and fiber that runs to your house to double-dip, not only charging consumers for bandwidth but also hitting up large content providers (Google, Amazon, etc.) for quality-of-service fees. There’s another question that gets folded into the debate, too: under what circumstances the telcos can legitimately traffic-shape, e.g. by blocking or slowing the protocols used for p2p filesharing. It is not clear that the regulatory regime under which the telcos operate allows them to do either thing. They haven’t tried to implement double-dipping yet, and they’re traffic-shaping by stealth and lying about it when they get caught. What they want is a political green light to do both. Let it be clear from the outset that the telcos are putting their case for being allowed to do these things with breathtaking hypocrisy. They honk about how awful it is that regulation keeps them from setting their own terms, blithely ignoring the fact that their last-mile monopoly is entirely a creature of regulation. In effect, Theodore Vail and the old Bell System bribed the Feds to steal the last mile out from under the public’s nose between 1878 and 1920; the wireline telcos have been squatting on that unnatural monopoly ever since as if they actually had some legitimate property right to it. But the telcos’ crimes aren’t merely historical. They have repeatedly bargained for the right to exclude competitors from their networks on the grounds that if the regulators would let them do that, they’d be able to generate enough capital to deploy broadband everywhere. That promise has been repeatedly, egregiously broken. Instead, they’ve creamed off that monopoly rent as profit or used it to cross-subsidize competition in businesses with higher rates of return. (Oh, and of course, to bribe legislators and buy regulators.) Mistake #1 for libertarians to avoid is falling for the telcos’ “we’re pro-free market” bullshit. They’re anything but; what they really want is a politically sheltered monopoly in which they have captured the regulators and created business conditions that fetter everyone but them.OK, so if the telcos are such villainous scum, the pro-network-neutrality activists must be the heroes of this story, right? Unfortunately, no. Your typical network-neutrality activist is a good-government left-liberal who is instinctively hostile to market-based approaches. These people think, rather, that if they can somehow come up with the right regulatory formula, they can jawbone the government into making the telcos play nice. They’re ideologically incapable of questioning the assumption that bandwidth is a scarce “public good” that has to be regulated. They don’t get it that complicated regulations favor the incumbent who can afford to darken the sky with lawyers, and they really don’t get it about outright regulatory capture, a game at which the telcos are past masters. I’ve spent endless hours trying to point out to these people that their assumptions are fundamentally wrong, and that the only way to break the telco monopoly is to break the scarcity assumptions it’s based on. That the telecoms regulatorium, far from being what holds the telcos in check, is actually their instrument of control. And that the only battle that actually matters is the one to carve out enough unlicensed spectrum so we can use technologies like ad-hoc networking with UWB to end-run the whole mess until it collapses under its own weight. They don’t get it. They refuse to get it. I’ve been on a mailing list for something called the “Open Infrastructure Alliance” that consisted of three network engineers and a couple dozen “organizers”; the engineers (even the non-libertarian engineers) all patiently trying to explain why the political attack is a non-starter, and the organizers endlessly rehashing political strategies anyway. Because, well, that’s all they know how to do.In short, the “network neutrality” crowd is mainly composed of well-meaning fools blinded by their own statism, and consequently serving mainly as useful idiots for the telcos’ program of ever-more labyrinthine and manipulable regulation. If I were a telco executive, I’d be on my knees every night thanking my god(s) for this “opposition”. Mistake #2 for any libertarian to avoid is backing these clowns. So, what are libertarians to do? We can start by remembering a simple truth: The only substantive threat to the telco monopoly is bandwidth that has been removed from the reach of both the telcos and their political catspaws in the regulatorium. Keep your eye on that ball; the telcos know it’s the important one and will try to distract you from it, while the “network neutrality” crowd doesn’t know it and wastes most of its energy self-defeatingly wrestling with the telcos over how to re-slice the existing pie. Go active whenever there’s a political debate about “unlicensed spectrum”. More of it is good. Oppose any efforts to make UWB (or any other technology that doesn’t cause destructive interference) require a license anywhere on the spectrum. If you are capable, contribute to the development of mesh networking, especially wireless mesh networking.

Oh, and buy an Android phone. As I noted in my immediately previous post, Google is our ally in this.UPDATE: I’ve summarized the history of the Bell System’s theft of the last mile here.

Why Android mattersPosted on 2008-11-12 by Eric Raymond ... I’m going to start with the relatively far future, like five or even possibly ten years out, because I’m pretty sure my projections for it are very similar to Sergei and Larry’s and that they are what is actually driving Google’s corporate strategy. Cellphone descendants are going to eat the PC... ... Now. You are Google. You make your money by selling ads on the most successful search engine in the world. One of your strategic imperatives is therefore this: you cannot allow anyone to operate a technological or regulatory chokepoint between you and people doing searches, otherwise they’ll stunt your earnings growth and siphon off your revenues. That’s why you ran a politico-financial hack on the Federal auction of radio spectrum to ensure a certain minimum level of openness. And that’s why you are [Google is], very quietly, the single most determined and effective advocate of network neutrality. [note Eric is referring to free market driven "net neutrality" not the political lie "net neutrality" which is actually the way to end "net neutrality"]Now, combine these two visions and you’ll understand why Google is doing Android. Their goal is to create the business conditions that will maximize their ad revenue not just two years out but ten years out. Those business conditions are, basically, an Internet that is as friction-free, cheap, and difficult to lock down as the underlying technology can make it. Under this strategy, Android wins in multiple ways. In the longer term, it gives Google a strong shot at defining the next generation of dominant computing platforms in such a way that nothing but customer demand will be able to control those platforms. In the shorter term, it outflanks the Baby Bells. As web traffic shifts to Googlephones (and things like them), telco efforts to double-dip carriage charges by extracting quality-of-service fees from Google and other content providers will become both technologically more difficult and politically impossible. By depriving them of the ability to lock in customers to gated and proprietary services, Android will hammer both the wire-line and wireless telcos into being nothing but low-margin bit-haulage providers, exactly where Google wants them. (A leading indicator will be the collapse of the blatant absurdity that is the ring-tones market, doomed when anyone can hook MP3s of their choosing to phone events.) As bad as this sounds for the telcos, Microsoft gets outflanked and screwed far worse... ... One of the coolest things about this chain of dominoes is that Google itself doesn’t have to win or end up with control of anything for the future to play out as described. It’s not even necessary that Android itself be the eventual dominant cellphone platform. All they have to do is force the competitive conditions so that whatever does end up dominating is as open as Android is. Given that one of the largest handset makers is already being forced to open source their stack for other reasons (Nokia figured out that they can’t afford to hire enough developers to do all their device ports in-house) this outcome seems certain. For the open-source community, it’s all good. The things Google needs to do with Android for selfish business-strategic reasons are exactly what we want, too. This isn’t an accident, because we’re both pulling in the direction of reducing the effects of market friction, transaction costs, and asymmetries of power and information. If Google didn’t exist, the open-source community would need to invent it.

Oh. Wait. We did invent them. Where do you suppose Sergei and Larry came from? Why do you suppose they’ve been running Summer of Code and hiring a noticeable fraction of the most capable open-source developers on the planet? Well, here’s a flare-lit clue: before those two guys [Sergei and Larry Page] were famous, they sent me fan mail once.That’s why I think those two know exactly what they’re doing. And that, if it’s true that their business strategy requires them to be open source’s ally, I think I can be allowed a guess that they chose their business strategy so that would be true. “Don’t be evil”; they’re not angels, but they’re trying. And, from where I sit? All I can say is this: Bwahahaha. The sinister master plan for world domination – it is working!

Telecoms regulation considered harmfulPosted on 2006-02-27 by Eric Raymond Doc Searls asked me to put the argument for total telecoms deregulation into a nutshell, then blog it so he could point at it. Here it is. Telecoms regulation, to the extent it was ever justified, was justified on the basis of preventing or remedying market failures — such as, in particular, lack of market incentives to provide universal coverage. The market failures in telecoms all derive from the high fixed-capital costs of conventional wirelines. These have two major effects: (1) incentives to provide service in rural areas are weak, because the amount of time required to amortize large fixed costs makes for poor discounted ROI; and (2) in higher-density areas, the last mile of wire is a natural monopoly/oligopoly.

New technologies are directly attacking this problem. Wi-Fi, wireless mesh networks, IP over powerlines, and cheap fenceline cable dramatically lower the fixed capital costs of last-mile service. The main things holding these technologies back are regulatory barriers (including, notably, not enough spectrum allocated to WiFi and UWB).

The right answer: deregulate everything, free the new technologies to go head-to-head against the wired last mile, and let the market sort it all out.

Un-ending the InternetPosted on 2006-02-07 by Eric Raymond Recently, The Nation ran an article, The End of the Internet, that viewed with alarm some efforts by telephone companies to hack their governing regulations so they can price-discriminate. Their plans include tiered pricing so a consumer’s monthly rate could be tied to the amount of bandwidth actually used. They also want to be able to offer preferred fast access to on-line services that pay for the privilege — and the flip side of that could be shutting down services like peer-to-peer networking that big media companies dislike. One of my regular visitors. David McCabe, asked me what a libertarian would do about this. A fair question, representative of a large class of problems about what you do to constrain monopolies already in place without resorting to more regulation. Here’s the answer I gave him: Deregulate and let the telcos have their tiered pricing — as long as

we also deregulate enough radio spectrum that the telcos

(evil monopolist scum that they are) will promptly be hammered flat by

wireless mesh networks. David replied “Beautiful. Blog it.” Hence this screed… The fundamental problem with the telecoms regime we have is that the Baby Bells inherited from Mama Bell a monopoly lock on the last mile (the cables running to end-users’ homes and businesses). More backbone capacity would be easy and is in no way a natural monopoly, especially given the huge overbuild of optical-fiber trunk lines during the Internet boom of the 1990s. But the ‘last mile’, as long as it’s wire lines, truly is a natural monopoly or oligopoly — nobody wants more than one set of telephone poles per street, and their capacity to carry wires is limited. That system doesn’t scale up. To a left-wing rag like The Nation, the answer is to huff and puff about more regulation. But more regulation would do nothing to attack the telcos’ real power position, which is the physical constraints on the last mile. The truly pro-freedom anwer is to enable the free market to take that power position away from them. Wireless mesh networking — flocks of cheap WiFi nodes that automatically discover neighboring nodes and act as routers — is the technology that can do that. With the right software, networks of these can be self-configuring and self-repairing. It’s pure libertarianism cast in silicon, a perfectly decentralist bottom-up solution that could replace wirelines and the politico-economic choke-point they imply. The main thing holding wireless mesh networking back is the small size of the bandwidth now allotted to it for spread-spectrum frequency hopping. With enough volume, competition would drive the price of these creatures to $20 or less per unit — low enough for individuals and community organizations to spot them everywhere there’s an electrical grid. Increments of capacity would be cheap, too; with the right software, your WiFi card could aggregate the bandwidth for as many nodes as there happen to be in radio range. (And that software? Open source, of course. Mesh networking relies on open source and open standards. Some of the node designs out there are open hardware, too. The mesh network would be transparent, top to bottom.) Today, many people already leave their WiFi access points open for their neighbors to use, even though DSL or cable costs real money, because the incremental cost of being nice is negligible. At the equilibrium price level of mesh networking, wireless free Internet access would be ubiquitous everywhere except deep wilderness areas. But the wireline backbone wouldn’t vanish, because mesh networking solves the bandwidth problem at the expense of piling on latency (cumulative routing and retransmission delays). Large communications users would still find it useful to be hooked up to long-haul fiber networks in order to hold down the amount of latency added by multiple hops over the mesh. The whole system would self-equilibrate, seeking the most efficient mix of free and pay networking. As usual, the best solution to the problems of regulation and imperfect markets is not more politics and regulation, but less of it — letting the free market work. Not that I expect The Nation to figure this out soon, or ever; like all leftists, they will almost certainly remain useful idiots for anyone, tyrant or telco monopolist, who knows that political ‘solutions’ to market problems always favor the powerful and politically connected over the little people they are ostensibly designed to help.

Why I won’t be signing the “Declaration of Internet Freedom” as it isPosted on 2012-07-03 by Eric Raymond There’s been some buzz in the last few days about the Declaration of Internet Freedom penned by some prominent libertarians. I wish I could sign on to this document. Actually, considering who appears on the list of signatories, I consider the fact that the composers didn’t involve me in drafting it to be a surprising mistake that I can only ascribe to a collective fit of absent-mindedness. But, because neither I nor anyone else from the hacker tribe was involved, it has one very serious flaw.

Humility, yes, Rule of Law yes, Free Expression, yes, Innovation, Competition, Privacy…most of this document is good stuff, with exactly the sort of lucidity and bedrock concern for individual freedom that I expect from libertarians.

But it all goes pear-shaped on one sentence: “Open systems and networks aren’t always better for consumers.” This is a dreadful failure of vision and reasoning, one that is less forgivable here because libertarians – who understand why asymmetries of power and information are in general bad things – have very particular reasons to know better than this.

In the long run, open systems and networks are always better for consumers. Because, whatever other flaws they may have, they have one overriding virtue – they don’t create an asymmetrical power relationship in which the consumer is ever more controlled by the network provider. Statists, who accept and even love asymmetrical power relationships as long as the right sort of people are doing the oppressing, have some excuse within their terms of reference for failing to grasp the nasty second, third, and nth-order consequences of closed-system lock-in. Libertarians have no such excuse.In the context of this Declaration, this defect is particularly sad because the composers could have avoided it without damage to any one of the other pro-market positions they wanted set forth. I actually agree that, as proposed in their next sentence, closed systems such as iOS should be free to compete against open systems such as Android; as the Declaration says, “let technologies evolve and intervene, if at all, only when an abuse of market power clearly harms consumers”. The proper libertarian stance in these contests is to tell government to butt out and then vote with your dollars for openness. I am disappointed in the Declaration’s failure to get this crucial issue right. I hope there is still the option to amend it; and if not, that my objection and correction will reach as many people as the Declaration itself, and the two together will convey important lessons about what we must do to preserve and extend liberty.

|

|

|

|

|

|

Poll

Poll