|

348Judah

|

|

November 06, 2023, 12:53:17 PM |

|

Bitcoin is on the rise now and this is an indication of bull market. And now that bitcoin is $34k to $35k those who want to buy and hodle, this is the best time to invest. Those who indicate interest to invest on bitcoin in my location came to meet me yesterday and I told them the factors involved. I told them both the benefits and the risky. Early is the best.

We should try as much as possible to see that we take advantage of this bear market while the market is fast rising to make our own Investment with bitcoin, we can as well learn to earn from it, this is a preriod whereby some are already being positively emotional about their Investment because they have long time ago Invested while we experience the dip at #15,000 the market is standing in between 34,000 and $35,000 and anything can happen hence that we see the market rising towards $38,000 to $40,000 before the end of the month, if we Invest now, the future ahead awaits our decision today if we are really going to beba partaker of the next bull. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

|

|

|

|

|

|

Once a transaction has 6 confirmations, it is extremely unlikely that an attacker without at least 50% of the network's computation power would be able to reverse it.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

Litzki1990

|

|

November 06, 2023, 02:00:13 PM |

|

I don't believe you are saying this, I am a crypto newbie but will my little research about Bitcoin investment I can tell that long term Bitcoin investment is far more better than shart terms, in Bitcoin investment, within some period there will be

Maybe he can just able to handle dealing with long term hodl that's the reason why he said its the same.

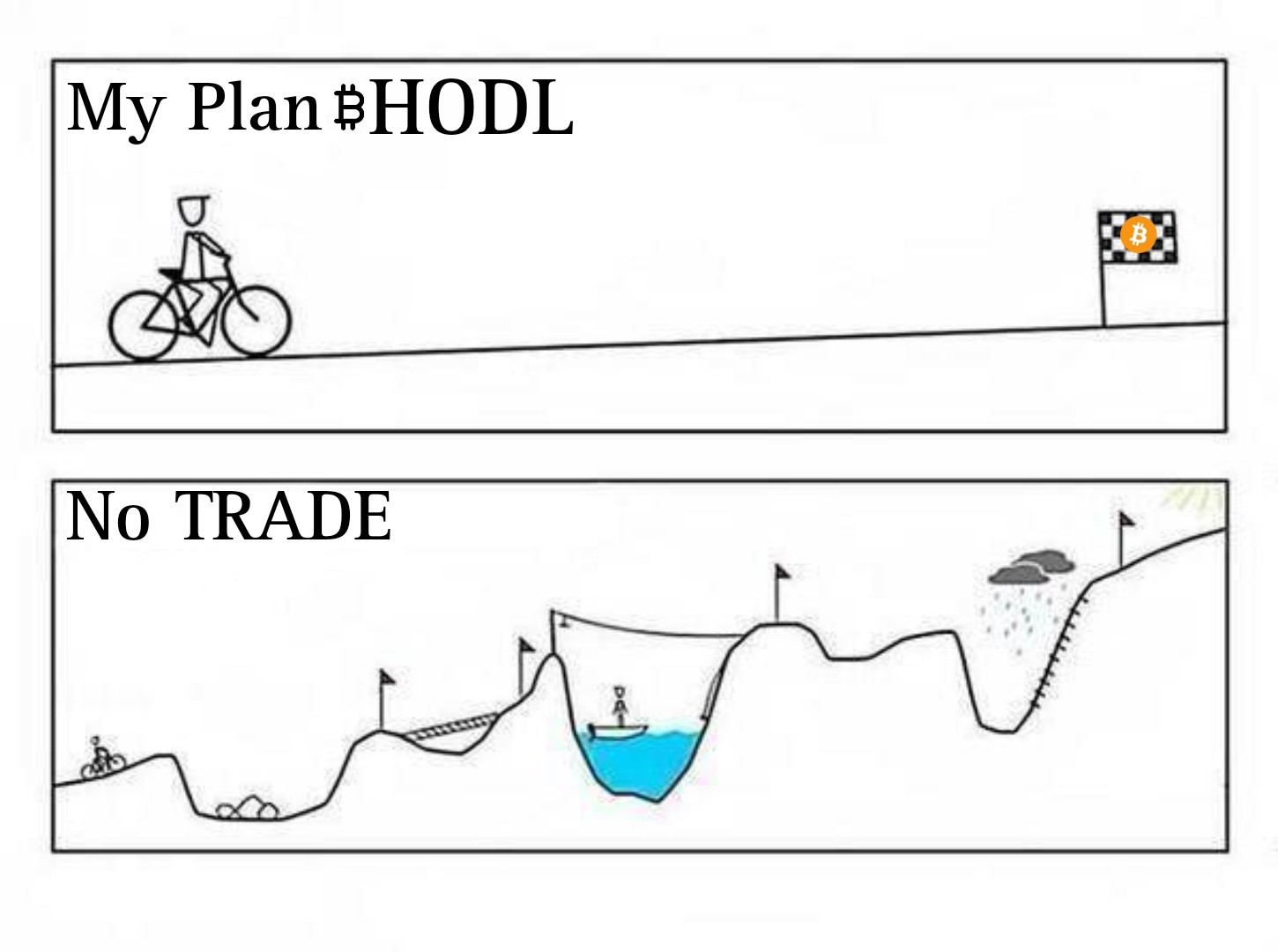

But if we look at the history base on its statistics we can really see that more people became rich for deciding to hodl their bitcoins for long term rather than doing some short trades. And those people who regret for seeing those huge bull run came are those people who doubt about its future so HODL is the best to do by people who want to invest with bitcoin since its proven that it can bring more good profit than taking those small chunks doing this short trades we call.

I know market is unpredictable but good things will surely happen for those people who have huge faith on bitcoin.

We hear many stories of people who have trusted Bitcoin and who have held their Bitcoins for a long time and how Bitcoin has changed their lives. Many people sometimes share success stories of long-term Bitcoin success and it's nice to hear them. I agree with you and I also want to tell you that you should dare to invest in Bitcoin and keep your investment for a long time. After investing in Bitcoin, forget about selling your investment and think about how to grow your investment. If you trust Bitcoin now then I am sure that Bitcoin will give you many good things in future. One thing we should always keep in mind is that 'Hold is Gold'the more we hold the more we create profit potential. We should try as much as possible to see that we take advantage of this bear market while the market is fast rising to make our own Investment with bitcoin, we can as well learn to earn from it, this is a preriod whereby some are already being positively emotional about their Investment because they have long time ago Invested while we experience the dip at #15,000 the market is standing in between 34,000 and $35,000 and anything can happen hence that we see the market rising towards $38,000 to $40,000 before the end of the month, if we Invest now, the future ahead awaits our decision today if we are really going to beba partaker of the next bull.

Those who plan for short-term investment will usually think that the price of Bitcoin will stay between $35,000 and $40,000. For a short-term investor this may be a small expectation but since we have a long term investment plan, we should not expect a Bitcoin price of only $35,000 to $40,000. As long-term investors, our expectations must be high and we must hold our investments for a long time. Whenever we hold our investment for a long period of time, we can achieve more than what we expected to invest. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 06, 2023, 02:31:23 PM |

|

Bitcoin is on the rise now and this is an indication of bull market. And now that bitcoin is $34k to $35k those who want to buy and hodle, this is the best time to invest.

The fact that Bitcoin is on the rise right now is not good news for the market. Investing in the DCA method is never determined on a bull market. Investing in Bitcoin DCA method is calculated by % compounding as per monthly or weekly average. The thing about the BTC price is that none of us can really know which way it is going to go, whether we are talking about short (weeks/months), medium (years, such as less than 5 years) or longer term (5-20 years or more). Surely, the longer the time frame, the more confidence that we can have that the BTC price is ultimately going to go up, but not even the going up in the longer term is guaranteed. Anyone who buys or believes in bitcoin should consider that it's going up in price is good for bitcoin, the bitcoin market and the bitcoin ecosystem.. and sure, it might not be as good for some individuals who want to focus on getting more bitcoin prior to the price's going up, but it is not like individuals can really do anything about what the BTC price is going to do, but they can do things about what they are going to do without really knowing for sure what the BTC prices is going to do. Individuals are always going to be in a bit of a blind spot regarding the future, and frequently it is best to try to establish a plan and practice that prepares for a variety of scenarios. There is no point in investing in Bitcoin because the price is going up because we invest in Bitcoin for the long term. Long-term investment should definitely wait for peak bull market.

If you are long term investing, then there should be real needs to try to time if there is some kind of peak market, especially since bitcoin is designed to go up forever (Laura)... so if you are planning to sell your bitcoin at some future date and some supposed top of the market, then where are you going to put your value? ARe you selling all of it, and if not then how much are you going to sell? Do you have a plan to keep bitcoin in your life (now that is real long term thinking) versus just thinking that you are putting your value into something else, and I am not suggesting that it is a bad thing to diversify wealth into a variety of assets (besides bitcoin), but that still does not necessarily mean selling much if any of your bitcoin in order to accomplish such diversification at later points in your investment and/or as your bitcoin value is growing relative to other investments that you have and/or maintain. But now that the current bull market is going on, it's only going to be short and temporary, and the price of Bitcoin will fall again. You act like you know something FinePoine0, when it is more likely the case that you don't know shit, besides your having a feeling that maybe the BTC price might correct from here, which may or may not end up being correct. Those who indicate interest to invest on bitcoin in my location came to meet me yesterday and I told them the factors involved. I told them both the benefits and the risky. Early is the best.

Investing in Bitcoin with DCA method with 15-20% of your income and waiting for long time will definitely make your portfolio bigger. Well yes... it is true that a 15% to 20% investment into bitcoin is going to amount to your being able to invest a whole year's salary into bitcoin within 5 to 7.5 years, and so then there could be some questions regarding if your investment also grows during the time that you are investing to potentially bring that timeline down to lower times - but for anyone getting to a whole year's income worth of an investment portfolio (bitcoin and/or otherwise) is a significant achievement that should start to help such person to feel empowered by his./her investment, but at the same time, the work is not necessarily done, especially if there remains a realization that to really get to a potential sustainable fuck you status, it is likely that such person will need to get to a point in which his/her investment portfolio is in the ballpark of 20-30 years of his/her annual income and/or annual expense cost needs... and sure there can be some creativity in terms of how to measure such threshold amounts, but being able to invest/save higher amounts will likely bring such person to the higher level questions regarding how to know when they might have enough to actually pull the fuck you lever.. which might be something like quitting a job that is not liked and maybe even it could continue to involve working so not really a complete fuck you status, yet still becoming liberated in terms of the kinds of work that is necessary to be done. So now the market time frame is very short and the possibility of Bitcoin price dumping is high at present. In 2023 I think the maximum bitcoin price will be limited to $30000-$40000 thousand.

You act like you know a lot, but probably you do not know much of anything especially if you are trying to present some kind of supposed vision regarding where you believe the BTC price to be in the coming couple of months, and hopefully, you are not overly banking on your scenario to be true, in the event that your scenario ends up not being true.. sure, it could be possible that your scenario has higher than 60% odds to become true, but I doubt that you are able to reach as definitive as you are making it out to be.. which you should even recognize in yourself that you are full of shit when you present your information in such a way of wanting to show yourself as some kind of a visionary regarding where the BTC price is going to be during certain periods into the short term future. We have to make investment decisions knowing that the prices of various coins may fluctuate due to market volatility.

Yeah, but who gives any shits about various coins? We are talking about bitcoin in this thread. It was a good time to invest in Bitcoin when it was $17000 and it was still a good time to invest in Bitcoin when it was $28000 and now Bitcoin is at $35000 and I think it is still a good time to invest.

Well if you hardly have any BTC, then it is likely that anytime is a good time to invest into bitcoin, and maybe once you get a bit more of a BTC stash, then it might be helpful (potentially) to buy on dips and things like that or to consider where the price is relative to the 200-week moving average, in order to get some kind of a gauge upon how much of a value or a discount BTC prices might be... and sure we can see that in recent times (right around a year and a half), the BTC price looks like it has been a pretty good bargain relative to the 200-week moving average, yet again, how much any of us might be emphasizing the stacking of sats versus trying to get some kind of a bargain will likely depend in part upon how many we have already stacked relative to our other personal factors. As we will invest in long term plan so small change in any coin will not have any adverse effect on our long term investment.

Fuck shitcoins. We are not talking about "any coin" here. We are talking about bitcoin.. so I hardly understand how your supposed philosophizing to be trying to supposedly describe broader "intellectual" principles, when you are not, has much utility in terms of actually trying to stay focused on bitcoin rather than muddying your attempted presentation with vague references to shitcoins. When investing one should always plan long term investment, short term investment never fulfills the desired expectations of an investor.

Fair enough in regards to remaining long-term focused, and so are you including shitcoins in those kinds of long term ideas? Surely I appreciate that goals can be set, and surely we have to consider what we are able to do in the short term, and perhaps continue to work towards longer term goals, so yeah, maybe every year or even more frequently, we are assessing whether our current plans are bringing us in the right direction and if we believe that we are making progress towards our longer term goals that might have a lot of variables to reach the longer term goals, but with the shorter term goals, we know what is in front of us right now and we can work towards that.

A brand new person into bitcoin could realistically set a goal to try to get to 5 BTC in 10 years, so then s/he may need to consider how to get there, and surely s/he might have current cashflows that might allow him to invest $100 per week into bitcoin, but so then after 52weeks, such person would have had invested $5,200 into bitcoin, so that might not seem realistic for getting up to 5 BTC in 10 years, so there will need to be some attempts to increase income and/or decrease expenses, so maybe if there end up being ways to get the investment amount up from $100 per week to $1k per week, then the 5 BTC in 10 years becomes more possible, but it still might take a while to be able to reasonably get to such goal if the $100 per week is already a bit of a struggle.

Each person has to attempt to set goals in reasonable ways that are achievable, which may be part of the reason that you had suggested having shorter term and longer term goals, and the shorter term goal of this particular person might be trying to figure out how to get his/her disposable (discretionary) income to go up from $100 per week to $1k per week, and if it might take 1-2 years to accomplish such shorter term goal, then maybe the goal of reaching 5 BTC in 10 years is seeming more realistic, but if the person stays down at $100 per week, then there may well need to be some other thoughts and/or perhaps changing of the longer term goal to become more realistic.. Yep, you explained it clearly what I am trying to say. I am not known for being such an explained writer so that caused the miscommunication of my ideology about short-term goals in Bitcoin. That is why you are known especially for the way of your writing style and how is it even possible to make such a wall of text for every post and each user too.  Sometimes examples can be helpful to make the point or at least to try to show what the idea might have had been, but it can take some time and space to attempt to flesh out examples, and even the examples might sometimes become confusing in terms of attempting to show (or not) what the original points might have had been. Let's come to the discussion if someone is just starting and they can only afford to invest $100 per week then its okay but if they settle for the same amount throughout the 10 years then its not smart, as you said they need to work in increasing their cash flow without the capital the investments will become less profitable so to be HODLer they also need to keep moving forward which is save more than before and accumulate bitcoin with it and over the years the returns will pay for all the efforts that someone made and invest every week no matter what.

Well, in the short term, people can ONLY do as much as they can do, and so even if they might not be able to increase their amount beyond $100 per week, they might have to soon come to realize that their longer term goal of reaching 5 BTC in 10 years is a bit unrealistic (or difficult to reach), and sure maybe they still might want to stick with such goal in order to try to push themselves towards reaching the goal, but at the same time, at some point, they may well need to come to some kind of a realization that their goal as currently structured is not very likely to reach, and surely I don't mind having some aspirational goals that shoot beyond expectations, but at the same time, sometimes we might have to consider our own psychology can be better satisfied when we are reaching goals (that might be difficult but not impossible) rather than setting goals that we are never (are almost never absent some miracle) going to reach. It is possible that we could end up adjusting the 5 BTC in 10 years down to a lower amount, or maybe to extend it out an additional 5 years to 15 years. You can even see from my fuck you status chart, that 5 BTC in 10 years brings a person exceeding fuck you status, but in 11.5 years, you only need about 3.125 BTC in order to be at fuck you status... Entry-level Fuck you status chart - attempt to prognosticate. BTC_Price Bottom Start $ StartDate Gain/Time(days) FU Status Goal $46.41 6/1/14 182.6 (6 mos) $2,000,000 ...... (Date) | (RL_Price) | (BTC Bottom) | (%gain/time) | (% Rate ∆) | ($ Amount ∆) | (#Coins/FU Status) | 11/30/2030 | | $269,271.34 | 11.64% | 96.00% | $31,356.43 | 7.42745218 | 05/31/2031 | | $300,627.76 | 11.18% | 96.00% | $33,607.54 | 6.65274557 | 11/30/2031 | | $334,235.31 | 10.73% | 96.00% | $35,869.99 | 5.98380823 | 05/30/2032 | | $370,105.30 | 10.3% | 96.00% | $38,130.76 | 5.40386749 | 11/29/2032 | | $408,236.06 | 9.99% | 97.00% | $40,797.47 | 4.89912626 | 05/31/2033 | | $449,033.53 | 9.69% | 97.00% | $43,528.37 | 4.45401037 | 11/29/2033 | | $492,561.90 | 9.4% | 97.00% | $46,315.48 | 4.06040337 | 05/31/2034 | | $538,877.38 | 9.12% | 97.00% | $49,150.40 | 3.71141947 | 11/29/2034 | | $588,027.79 | 8.85% | 97.00% | $52,024.35 | 3.40119980 | 05/31/2035 | | $640,052.14 | 8.58% | 97.00% | $54,928.27 | 3.12474543 | ........ | | | | | | | 05/31/2038 | | $1,013,573 | 7.15% | 97.00% | $72,455.00 | 1.97321752 | ........... | | | | | | | 11/29/2043 | | $1,960,433 | 5.27% | 98.00% | $103,375.00 | 1.02018279 | ................. | | | | | | | 11/28/2048 | | $3,139,783 | 4.31% | 98.00% | $135,277 | 0.63698674 | ................. | | | | | | | 05/29/2056 | | $5,639,679 | 3.67% | 99.00% | $206,870 | 0.35463011 |

and yeah of course, the chart might not play out exactly like it projects, so there would be needs to look at charts like that and to align them with how realistic your goals might be... and even from the current chart projections, it may ONLY be necessary to have 1 BTC in 20 years in order to be at entry-level fuck you status... So frequently there can be realizations that it is good to have aggressive goals, but if the goals might not be reachable, being able to reach some of the intermediate goals can also lead to a lot of satisfaction. and I am not even sure if I would consider 10 years as a reasonable long term goal if we are talking about finances and we are talking about someone who might be new to bitcoin, but if someone is already investing for many years, which you suggested to be your situation @jrrsparkles, and I look at your forum registration and it is around the same as mine... and I had a bit more than 20 years investing prior to my registering with the forum and getting started with bitcoin. So surely timelines are going to vary based on age and also there could be considerations of other investments and various other learnings from past strategies - and surely how many BTC that we might hold could make some difference if we are saying that we want our first 5 BTC within 10 years or if we might feel that we want to add 5 BTC to our existing investment portfolio in 10 years, to the extent that it would be necessary to add 5 BTC to a portfolio in the next 10 years for someone who might already have several BTC in his/her investment portfolio.

Traditional investments differ a bit here and 10 years is not that long for someone who is an investor but the people who are coming into the bitcoin especially due to the buzz about its return even consider 4 years to be very long term and that is what becomes the issue of the millennials so we also have to suggest some conservative ideology to make them to be an investor and if they start to feel the benefits of being HODLer then they eventually will continue further on their own. I think that you are explaining part of the reason why can formulate both aspirational goals and more realistic and reachable goals, so yeah, it can be difficult to get someone in their 20s (or even early 20s) to start to think about what their investments are going to look like when they are in their 50s or 60s, and sometimes ppeople in their early 20s have trouble getting into worrying about their finances, and they might not be reachable until in their late 20s or early 30s.. but still there are all kinds of people, and surely people do make some kinds of tentative plans and even start to have kids in their early 20s and sometimes before even reaching their 20s, so we know having kids has likely a variety of impacts (including financial) of 20 years and/or longer. We should try as much as possible to see that we take advantage of this bear market while the market is fast rising to make our own Investment with bitcoin, we can as well learn to earn from it, this is a preriod whereby some are already being positively emotional about their Investment because they have long time ago Invested while we experience the dip at #15,000 the market is standing in between 34,000 and $35,000 and anything can happen hence that we see the market rising towards $38,000 to $40,000 before the end of the month, if we Invest now, the future ahead awaits our decision today if we are really going to beba partaker of the next bull.

Those who plan for short-term investment will usually think that the price of Bitcoin will stay between $35,000 and $40,000. For a short-term investor this may be a small expectation but since we have a long term investment plan, we should not expect a Bitcoin price of only $35,000 to $40,000. As long-term investors, our expectations must be high and we must hold our investments for a long time. Whenever we hold our investment for a long period of time, we can achieve more than what we expected to invest. What you say here Litzki1990 does not sound right. Sure the odds of BTC going up in the long term seem to be greater than being able to attempt to predict what BTC will do in the short-term, but we still need to be careful in terms of expecting that we have to have returns that are at some kind of a guaranteed price point that is sufficiently high to remove us from our current doldrums and/or mediocrity, and so in some sense, even though you seem to be focused on the longer term, your language still sounds like a kind of gamblers way of framing BTC price/performance expectation matters. Of course there should be thoughts (and preparations) for upward and downward scenarios, even in the longer term, but even there are likely ways of thinking about worse case scenarios, medium case scenarios, normal (base case) scenarios, somewhat optimistic scenarios and best case scenarios, and so it seems to me that optimistic and best case scenarios should not be presented as if they were normal and/or base case scenarios, even if some variation of the better case scenarios might end up playing out. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Asiska02

|

|

November 06, 2023, 02:44:21 PM |

|

Perhaps if you are using DCA strategy I see no reason why we should focus on buying dip, I no that accumulating during dip is also one of the best time but with DCA strategy we don't need to wait for a dip to come before we could start investing on Bitcoin.

As stated above by @Agbamoni, it is wise as an investor that us DCAing to also keep reserve of funds that he can use to buy at the dip, such incase bitcoin price dips, and he will still continue with his DCA strategy. This will enable you get to your bitcoin target faster than when you are only DCAing. This is because nobody can time the market but you can be prepared for the market by reserving such funds for the dip. Exactly but if you are the type that have already set up some certain percentage of your income to always invest in bitcoin weekly or monthly, without having another source of income asides this money that comes in a week or month time, it will be very hard for you to achieve that. The much possibility of your achievement in such case is to use more than the percentage you’ve set aside for it to invest in bitcoin. If the repercussions of such actions is controllable and can be bared within that period, it will be a great idea to accumulate more bitcoin at dip while keep focusing on continuing the DCA method. If that is even possible and the repercussions will not be able to sustain one for some other weeks or months, you can hold on to DCAing after you’ve already accumulated more bitcoin at a lower price, then continue back when you’re balanced again. Both ways are good but you just have to chose the one that will best work for you. I guess you're contradicting what Mate2337 is trying to say. He's trying to convey that there is no perfect or best time to buy Bitcoin, especially when you're using a DCA approach. When you're DCAing, you can buy Bitcoin at any price because there's still a belief that the price of Bitcoin will be higher than the current price, as long as you're holding it for the long term. There was a time when Bitcoin was at 23k, and everyone was hesitant to buy; now it's at 35k, which would have resulted in a profit of 12k if you had bought it then.

You see, the bitcoin market is one of the most unpredictable market trend to foresee or decide by mere looking or analysis, I don’t blame those that couldn’t still buy at a lower price than it was before since they are hoping it would come lower than it was at that time. One thing is to be understood in this market, some opportunities comes but once and you just have to take it when it comes, if you don’t act that time, you might lose that opportunity forever and will regret such actions. In such an unpredictable market, you must first make up your mind to flow with the trend of the market and not wait for the market to hit your prediction price before you can join in. Many ‘Had I know’ but they remain irreversible at this time now. I believe if you’ve understood the market very well and made up your mind or maybe made a mistake of not buying early in the past, you won’t be repeating same mistake this time around again. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|

Moreno233

|

|

November 06, 2023, 03:01:42 PM |

|

In Trading Bitcoin, technical and psychology careful study is needed in other to continue with your money. Trading Bitcoin has to do with buying and selling which is short-term ,volatile and maximize profit, traders wants to make more profit through different ways with or without using the platform on the market and they tend to profit and loss more than investors.

I have attempted Bitcoin trading before and it ended in tears. I learnt a good strategy that was profitable at first but few times it went bad (don't know if I messed some steps or so), I lost everything. Trading is not for the weak or those not technically and psychologically prepared to face the challenges that are numerous. I almost gave up on Bitcoin but when I realized I could much gains by simply buying and holding, a lot of things changed for me. They again came the question of when to buy that the price will not be too high so that one can start seeing the portfolio in profits and not in deep red. It took me some brainstorming and taking some strong decisions to understand that the seasons where price is generally low like last year till a greater part of this year, any point could be a good one to buy. So, a greater part of my problem was solved. Hold and accumulation of Bitcoin by always DCA makes you stylishly rich because when you invest for along period the reward is enormous, as you keep DCA a higher method (strategy) with finance to invest at all time maybe daily, weekly, monthly, quarterly, yearly or for a longer period of 10 years or more by buying and accumulating Bitcoin in your portfolio.

The DCA method - that I have come to learn out of curiosity- have proven to be a golden tool for me because it makes the investment process effortless and consistent. Some of the capitals I lost to trading would have been put to better use if I had adopted the DCA method earlier than I started. Any new investor that want to start investing in Bitcoin should consider the DCA method because it does not require so much technicalities. The method is straightforward, just that it requires some form of courage to be able to follow it completely without adjusting it haphazardly. As soon as the financial flow is known, one can start the process immediately. |

|

|

|

|

Roseline492

|

|

November 06, 2023, 03:41:45 PM |

|

I don't have as much knowledge about investing as a professional investor but if I have knowledge I can invest in Bitcoin and if I have the patience to hold that investment for a long time I have gained patience and knowledge about investing. I am just waiting to invest maybe soon I will fulfill my investment dream by investing in Bitcoin. The amount of money I want to invest in Bitcoin may not be much but this is the beginning of my investment.

That's a very nice plan buddy, perhaps while you wait to get ready for Bitcoin investment you could utilize the opportunity by learning the basis and the concept of Bitcoin, and also knowing the investment risk and ways to avert it by managing the risk, however you are in the right place because all the knowledge and strategy of accumulating Bitcoin is always discuss here, so it will help to enhance your knowledge about Bitcoin before you will even start investing. Perhaps I would like to correct an impression you said "the amount of money you have may not be enough", it doesn't work that way in times of investing on Bitcoin because Bitcoin is not like stock investment that only allows huge amount to invest but on the contrary Bitcoin allows you to invest as little as you could afford. However that's why DCA strategy came to our discussion because it will help and guide you to regularly accumulate Bitcoin with small money you have, and within years you will be surprise to see the amount of Bitcoin you most have accumulated on your portfolio. |

|

|

|

Out of mind

Full Member

Offline Offline

Activity: 448

Merit: 218

I like to treat everyone as a friend 🔹

|

|

November 06, 2023, 03:44:58 PM Merited by fillippone (1) |

|

Bitcoin is on the rise now and this is an indication of bull market. And now that bitcoin is $34k to $35k those who want to buy and hodle, this is the best time to invest. Those who indicate interest to invest on bitcoin in my location came to meet me yesterday and I told them the factors involved. I told them both the benefits and the risky. Early is the best.

We should try as much as possible to see that we take advantage of this bear market while the market is fast rising to make our own Investment with bitcoin, we can as well learn to earn from it, this is a preriod whereby some are already being positively emotional about their Investment because they have long time ago Invested while we experience the dip at #15,000 the market is standing in between 34,000 and $35,000 and anything can happen hence that we see the market rising towards $38,000 to $40,000 before the end of the month, if we Invest now, the future ahead awaits our decision today if we are really going to beba partaker of the next bull. It is best if we make due diligence investment decisions when the Bitcoin market is bearish. If we have such a plan to buy from the low market and sell in the high market to earn money, then we must learn the market trends and strategies. And if it is not long, term plan then we should invest and hold so that we can earn from it in the future. Those who have already invested for the future must think positive for the purpose of profiting for the future as currently the Bitcoin market is at $35000. And those who invested during the time of $15k must-have got good amount of profit and able to earn now. Currently, as the market position is moving towards a good position and the climate of complete change is seen in the market, we can definitely say that Bitcoin will touch $40k dollars by the end of the year. So if we invest from the current market then we have a plan to earn in the next bull season so that we control our emotions and be patient. |

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

November 06, 2023, 04:54:56 PM Merited by JayJuanGee (1) |

|

That is the point of the problem, sometimes we are not unwilling to allocate our income every monht in a large percentage amount, but with the economic situation that still has to divide on other things that ultimately make us as minimal as possible to allocate it. That is not something wrong either, because there should be no compulsion that makes us ignore other needs, because if we do that it is something that is not wise either.

The most important thing when we do this is consistency, for me it doesn't matter when the percentage is more flexible, especially when our financial situation is up and down.

30% is a fairly large allocation because for me it is a very aggressive step in investing. I disagree with you. 30% is a good amount to start investing in Bitcoin. Its not large at all its accurately a good start in investing and should not be considered as aggressive investing. For instance elf you earn 100$ a month and you use 50% for upkeep and sorting of that month expenses. 20% can be kept for savings or emergency fund and you can invest the 30%. If the economic situation is favorable there persons who would prefer to invest up to 40%. But i would not advice this bold step to family owners because need for other things may arise within the month that could take up some money. Bitcoins price is on the range of $34k it will take a long time to get 1 Bitcoin if you invest less than 30% when your earnings is low. But if you make good money like a $1000 a month even investing 10% a month can give you a good amount of Bitcoin at the end of the year. One thing for sure is that within this period of accumulation the price of Bitcoin might go increase or dip and it will affect the amount of Bitcoin you can buy with that 30%. It is said than done. I see 30% as something too big for newbies to start with, 10% is very cool and if the person has little income, he can start with 5%. what matters is the investors regular buying without skipping any week or month and before you know it in 10yrs time, you will be surprise to see the quantity of bitcoin that you have accumulated. Take note that there are some kind of emergency that one will be faced with, that might take up to 50% of your monthly income sometimes. I have so many needs that arise and emergencies from here and there, if you accumulate aggressively, it will become a problem in your bitcoin journey because, you might go back and sell from your bitcoin investment portfolio when you are short of funds, and this might chatter your bitcoin target goal. It is good to use the money that you can use for regular DCA, no matter the challenges that you are facing and whatever emergency that comes your way, you can still continue with your DCA strategy because you have a bitcoin target. That is why I see 10% as the best option because you will have enough reserve funds to handle any expenses that comes your way. And if it happens that your reserve funds is piling up and you still have more cashm you can keep it and use to to buy at the dip or better still use it to add to your DCA funds. If you use 30%, there will be no way that you will be able to have excess reserve funds for other purposes. I am talking from experience, there was a time that I decided to invest above my regular 10% DCA and I increase it to 20%, for the first three weeks, I was fine but later, I observe that the cash left after buying bitcoin for the week, is not always enough for me to use to take care of other needs and there must be an emergency that will occurs and I will have to take care of it. I got angry on the 6th week towards myself because, the cash on me couldn't take care of my family needs and other emergency. I got broke three days after I got paid because the moment I get paid, I just buy bitcoin instantly with the budgeted amount. This made me to think of selling some fraction from my bitcoi. But because I know where I went wrong and immediately, I asked my colleague at work to lend me some money to take care of major responsibility for that month. The moment I get paid, immefiately I went back to my normal 10% budget, and I was able to clear my sebt and could still balance other expenses. Since then I have never come up with the thought of goin above 10% with my present income. It is better to use 10% because this will not have effect on your income when you use it for DCA. Remember, slow and steady win the race. This is great advice and thanks for sharing from your personal experiences. It really shows a healthy perspective, and your ability to be pivot/be flexible. I think that’s key to any investment. When people talk about investing they even go a level deeper and ratio out the split of investments from that 10% of your income. My deduction from income ranges between 5-25%. Sometimes have richer months and sometimes more expensive so the amount has variance. Recommend ya use excel or google sheets to work it all out for you. I also don’t do the allocation all at once and spread out the “investing” over a month. Sometimes things come up and I don’t like to be over extended, but certainly by month end they are done. Then out of the amount I split my investments like this. %56 BTC %5 add to emergency fund %17 dca stock %12 cash savings %10 into my business If you see someone say they are high allocated into something this is probably what they mean. Every year I re-asess this ratio normally near year end. I do feel like I have over allocated into btc this year but maybe that worked out, we shall see. Keep calm, hodl and dca on  Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger. Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity. Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson. Stay calm, learn shit, and dca on. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 06, 2023, 05:28:09 PM |

|

Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger.

Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity.

Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson.

Stay calm, learn shit, and dca on.

For sure, preparing for UP can sometimes be easier said than done, and when then time comes, it becomes quite concrete, and sure the BTC price might dip again.. but then again, it might not. And, you described a $5k rise, and sure you may largely be correct, because maybe it went up $5k more than what anyone expected, but the fact of the matter is that it went up right around $9k in the last 2-3 weeks from the upper $26ks into the upper $35ks, and sure so far we have had some dipping back down to the lower $34ks, and yeah we could get some more dip, but we might not. If we failed to prepare, we can ONLY go by what happens to be our current situation and to attempt to rethink if there is anything that we should do to adjust, or to just keep with what we had done and just attempt to learn from the matter. Sometimes attempting to correct a mistake after it already happened might exacerbate the mistake rather than learning from it so that you are ahead of similar kinds of potential mistakes. I use this example frequently, but sometimes a mistake can take several months to recover from it.. and maybe even years, so my example is that in October/November 2015, when BTC prices went up from the upper $200s to $500, I did the opposite to what I was supposed to do which was that I continued to buy up to $500, instead of selling or just HODLing.. Of course, I had already considered that I had gotten into stages of overaccumulation so I was supposed to sell small amounts as the BTC price rose, but instead I bought..so even though I scrambled to put some money together after the BTC price dropped back down to $300 and then got stuck in the lower $400s for more than 6 months, there was a bit of locking out and even perception of mistake until the BTC price went back above $500, which was the end of May 2016... so I am not really trying to bring up the idea of selling, but instead the idea that making mistakes can sometimes screw up otherwise good plans for a decent amount of time if we had a plan in place to be in front of price movements and instead we jump straight into the wrong kind of conduct that was not part of our plan and then we later realize that we screwed up. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Ruttoshi

Sr. Member

Offline Offline

Activity: 322

Merit: 272

Baba God Noni

|

|

November 06, 2023, 05:46:06 PM |

|

This is great advice and thanks for sharing from your personal experiences. It really shows a healthy perspective, and your ability to be pivot/be flexible. I think that’s key to any investment. When people talk about investing they even go a level deeper and ratio out the split of investments from that 10% of your income. My deduction from income ranges between 5-25%. Sometimes have richer months and sometimes more expensive so the amount has variance. Recommend ya use excel or google sheets to work it all out for you. I also don’t do the allocation all at once and spread out the “investing” over a month. Sometimes things come up and I don’t like to be over extended, but certainly by month end they are done. Then out of the amount I split my investments like this. %56 BTC %5 add to emergency fund %17 dca stock %12 cash savings %10 into my business If you see someone say they are high allocated into something this is probably what they mean. Every year I re-asess this ratio normally near year end. I do feel like I have over allocated into btc this year but maybe that worked out, we shall see. Keep calm, hodl and dca on  Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger. Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity. Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson. Stay calm, learn shit, and dca on. I am happy that you have learnt something new again in your bitcoin journey, because it is only you that can come up with the right amount that you can use on your regular DCA and get prepared because bitcoin price can pump and dump in a twinkle of an eye, and that is why newbies are advice to hodli for long and increase their bitcoin portfolio with regular DCA. Bitcoin investment has great potentials and outperform other assets in the market currently due to its volatile nature and the only way to benefit from it is to invest and increase your bitcoin for a very long term. The size of your bitcoin and the time duration is what your profit depends on and that is why as time passes by, it is advisable to look for a means to increase your income so that you can also increase the amount that you are using to DCA so that you can reach your bitcoin target earlier, than if you are only accumulating with a particular amount regularly over a long period of time. Since nobody knows if your bitcoin investment will be the one to turn your life around in future. Take your bitcoin journey very precious and threat with caution so that you don't regret your decisions of relenting to buy with a particular amount when you can afford to invest and it wouldn't affect your income. Regular DCA is very effective and has very low risk for a long term hodler who has the passion to accumulate bitcoin, because he believes in bitcoin as an asset that is worth to increase in value with timeline. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

summonerrk

|

|

November 06, 2023, 08:09:11 PM Merited by JayJuanGee (1) |

|

I doubt that the line is as thin as you are making it out to be. Sounds like you are a trader, even though it seems that your goal is to accumulate bitcoin, but if you are fucking around with your whole stash that would be pretty messed up. We likely need a few more details regarding what are you doing once a month with these buys and sells and whether you are religious about it with a system and if you might have a main holding stash or if you are just loosey goosey about the whole thing. then seems like you are a trader.... but if you are ONLY playing around with less then 5% of your stash, then it might be a bit more ambiguous regarding what you are.. .. but you ahve to figure out how much you are holding. and it has to be more than 50% or probably even more than 90% before you are going to start to fall into the HODLer category rather than a trader category.

The punchline is that more details are needed, and each of us might categorize these matters differently, even though I doubt that the line is as fine as you are seeming to suggest it to be merely because you are wanting to trade but still call yourself a HODLer. My main goal is to increase my BTC count by maintaining 50% bitcoins 50% usdt. And depending on the price on the market, my pending orders change the state of the deposit - this can lead to a share of 95% of Bitcoin, and vice versa - 95% of USDT. Ultimately, the strategy still strives to make it 50/50. I understand that in this way, in a full market, I will not get all the cream from the price of Bitcoin, just as if it falls, it will not hurt me like those who are 100 percent in Bitcoin. How did I come to these views on accumulation? Since 2017 I have been a Bitcoin holder, I have waited and waited. And when the price became 65k, I didn’t even transfer part of the money to USDT. I believed that the rocket would fly further. But the rocket flew down. And I realized that it’s pointless to just hold it, market fluctuations can be used to increase the share of BTC, and at the same time not shake with fear over the schedule. I do not claim that the strategy I described above is correct. But I came to this, and these are my views. I gave you guys, my arguments. I'm a trader who doesn't trade much. I am a holder who sometimes buys and sells because the funds have to work. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

Churchillvv

Full Member

Offline Offline

Activity: 392

Merit: 166

Eloncoin.org - Mars, here we come!

|

|

November 06, 2023, 08:14:45 PM |

|

Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger.

Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity.

Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson.

Stay calm, learn shit, and dca on.

If i observed very well I guess you have a potion of BTC now. right? You've bought already but you didn't buy when you desired to hit up your targets. So how about someone like that doesn't have yet or is not yet in a state of making an income to invest in Bitcoin. Your regrets sounds like you don't have self esteem, or you don't believe in yourself, or should say your compare yourself to others success which is awful. I don't have even the minimum of Bitcoin not just me others too but they don't panic as you. The uppity of Bitcoin price is sudden but most times you encouraged people to be prepared of anything why then do you have to negate yourself. much is to come since you've learnt your lesson you can still hit up your targets or to be specific you can still make your profit from the bull market. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 06, 2023, 09:44:54 PM |

|

I doubt that the line is as thin as you are making it out to be. Sounds like you are a trader, even though it seems that your goal is to accumulate bitcoin, but if you are fucking around with your whole stash that would be pretty messed up. We likely need a few more details regarding what are you doing once a month with these buys and sells and whether you are religious about it with a system and if you might have a main holding stash or if you are just loosey goosey about the whole thing. then seems like you are a trader.... but if you are ONLY playing around with less then 5% of your stash, then it might be a bit more ambiguous regarding what you are.. .. but you ahve to figure out how much you are holding. and it has to be more than 50% or probably even more than 90% before you are going to start to fall into the HODLer category rather than a trader category.

The punchline is that more details are needed, and each of us might categorize these matters differently, even though I doubt that the line is as fine as you are seeming to suggest it to be merely because you are wanting to trade but still call yourself a HODLer. My main goal is to increase my BTC count by maintaining 50% bitcoins 50% usdt. And depending on the price on the market, my pending orders change the state of the deposit - this can lead to a share of 95% of Bitcoin, and vice versa - 95% of USDT. Ultimately, the strategy still strives to make it 50/50. I understand that in this way, in a full market, I will not get all the cream from the price of Bitcoin, just as if it falls, it will not hurt me like those who are 100 percent in Bitcoin. How did I come to these views on accumulation? Since 2017 I have been a Bitcoin holder, I have waited and waited. And when the price became 65k, I didn’t even transfer part of the money to USDT. I believed that the rocket would fly further. But the rocket flew down. And I realized that it’s pointless to just hold it, market fluctuations can be used to increase the share of BTC, and at the same time not shake with fear over the schedule. I do not claim that the strategy I described above is correct. But I came to this, and these are my views. I gave you guys, my arguments. I'm a trader who doesn't trade much. I am a holder who sometimes buys and sells because the funds have to work. It is good to have thought through your strategy and make sure that it fits for your situation, and surely here we are not getting so much into trading strategies, but sometimes it is important to figure out a kind of psychological balance that works, and since you say that you are striving to accumulate BTC, then you may well be continuing to add funds to your accounts as well? It is more difficult to build your account merely by trading back and forth between BTC and USDT... so I don't really mind the idea of it, and even something like 70/30 BTC/USDT might seem more practical to me, but surely a variety of your individual factors are going to matter.. including how long that you have been stacking sats... so if you have been stacking sats for a long time (gosh even if we go by your forum registration of more than 7 years ago), then it would make less sense to have your funds so skewed in favor of USDT, and I remember some times in the past (in around late 2017) that my funds had gotten into the ballpark of 90% BTC and 10% cash, and I was feeling like I had way too much cash, but that was when the BTC price was going up, so I was shaving off some BTC along the way up, so I could see that there might be times that a person will shave off BTC on the way up, and then get towards higher levels of cash as contrasted with BTC, but I still have some troubles understanding the justification to try to maintain 50% cash (or USDT), so I suppose just on the face of it, it seems to be me that you might not be very strongly convicted in terms of believing in the power of BTC... because we know that the dollar (and thus also USDT) is in a situation in which it is inevitably losing a lot of purchasing power on a regular basis.. sure they try to say that it is in the single digits, but it also depends on what you are trying to buy, so it seems to me that in the coming years bitcoin is poised to do quite a bit better than the dollar and the rate that the dollar is losing purchasing power.. but surely at the same time, there can be a lot of up and down along the way to see how it plays out and also various periods of time in which bitcoin may end up doing surprise exponential UPward price moves that never end up really recovering (or dipping back down), and then you could end up regretting that you had chosen such a seemingly relatively whimpy bitcoin allocation. Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger.

Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity.

Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson.

Stay calm, learn shit, and dca on.

If i observed very well I guess you have a potion of BTC now. right? You've bought already but you didn't buy when you desired to hit up your targets. So how about someone like that doesn't have yet or is not yet in a state of making an income to invest in Bitcoin. Your regrets sounds like you don't have self esteem, or you don't believe in yourself, or should say your compare yourself to others success which is awful. I don't have even the minimum of Bitcoin not just me others too but they don't panic as you. The uppity of Bitcoin price is sudden but most times you encouraged people to be prepared of anything why then do you have to negate yourself. much is to come since you've learnt your lesson you can still hit up your targets or to be specific you can still make your profit from the bull market. It seems to me that you Churchillvv are missing some understandings in regards to the power of bitcoin, and sure you can approach your own bitcoin investment however you like, whether you perceive urgency to get as many sats as you are able to get in terms of your own budget and not being too whimpy while at the same time not over doing it. For anyone who is serious in his/her efforts to stack sats, it can be quite challenging to achieve these kinds of balances between aggressiveness, not over doing it, and also not being too whimpy in terms of trying to time the market when dips do not end up happening. I am not even completely opposed to your ideas, Churchillvv.. because since bitcoin seems to be quite a bit skewed towards being an asymmetric bet to the upside and likely amongst the best of investments(if not the best) in the midst of one of the largest wealth transfers to ever take place, you can still profit from merely being in bitcoin and not being aggressive about it, and even being a bit whimpy... but at the same time, there are people who seem to recognize the power of bitcoin, and would like to increase their bitcoin exposure reasonably within their means, rather than 5, 10 or even 15 years later regretting that they had approached bitcoin too whimpily. There are a lot of people in the world, maybe even something close to approaching 99% who still do not have any bitcoin, and even the ones who have it might not appreciate the extent to which they are low coiners (and/or under allocated) in terms of if they were to actually understand what bitcoin is. Each of us can make our own choices in regards to how aggressive that we are in terms of bitcoin accumulation, and it has frequently been my point that even the whimpy ones are likely going to end up advantaging greatly from bitcoin so long as they error on the side of mostly accumulating and holding their bitcoin rather than selling it... but hey you can do whatever you like when it comes to how you choose to manage your own BTC stash. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

November 06, 2023, 11:28:54 PM |

|

Since I last posted I have learned something about my self, some people might draw parallels or may have already learnt this about themselves. I was angry that the price went up, and it was the first time I was angry at BTC price even throughout the bear of going/dropping down. I realised too late I hadn't fully prepared for Uppity. I thought I had, I thought I would be happy with double digit value returns. I could handle other asset returns across other investments so why couldn't I project that confidence and experience to BTC. Well what caught me completely off guard was the suddenness. In most if not all other asset classes value add is gradual. You know you build wealth slowly, but like 5K$ increase in BTC price threw me into a loop. I was more angry I hadn't invested more at lower levels than the fact i had just got more returns from one asset in a day than any other asset I have ever owned. The magnitude of that was drowned out by my anger.

Well why I am writing this, what happened, what did I learn. Pretty simple I didn't fully understand, when people said be prepared for uppity, what that meant. I also put too much of my investment money looking at a bargain. I should have put it 100% into dca vs split of DCA and BTFD. I fooled myself into thinking my system was flawless because i didn't prepare for uppity properly. I went back through all my BFTD buys and then compared this to increasing DCA during the same time period. DCA would have out won with this 5k$ uppity.

Shifting my strategy I'm not going put as much emphasis on BFTD vs DCA for a while, there is more severe uppity to come but I have learnt my lesson.

Stay calm, learn shit, and dca on.

For sure, preparing for UP can sometimes be easier said than done, and when then time comes, it becomes quite concrete, and sure the BTC price might dip again.. but then again, it might not. And, you described a $5k rise, and sure you may largely be correct, because maybe it went up $5k more than what anyone expected, but the fact of the matter is that it went up right around $9k in the last 2-3 weeks from the upper $26ks into the upper $35ks, and sure so far we have had some dipping back down to the lower $34ks, and yeah we could get some more dip, but we might not. If we failed to prepare, we can ONLY go by what happens to be our current situation and to attempt to rethink if there is anything that we should do to adjust, or to just keep with what we had done and just attempt to learn from the matter. Sometimes attempting to correct a mistake after it already happened might exacerbate the mistake rather than learning from it so that you are ahead of similar kinds of potential mistakes. I use this example frequently, but sometimes a mistake can take several months to recover from it.. and maybe even years, so my example is that in October/November 2015, when BTC prices went up from the upper $200s to $500, I did the opposite to what I was supposed to do which was that I continued to buy up to $500, instead of selling or just HODLing.. Of course, I had already considered that I had gotten into stages of overaccumulation so I was supposed to sell small amounts as the BTC price rose, but instead I bought..so even though I scrambled to put some money together after the BTC price dropped back down to $300 and then got stuck in the lower $400s for more than 6 months, there was a bit of locking out and even perception of mistake until the BTC price went back above $500, which was the end of May 2016... so I am not really trying to bring up the idea of selling, but instead the idea that making mistakes can sometimes screw up otherwise good plans for a decent amount of time if we had a plan in place to be in front of price movements and instead we jump straight into the wrong kind of conduct that was not part of our plan and then we later realize that we screwed up. Thanks JJG, if I boil it down to one thing I think got a bit too caught up in bftd to lower my avg buy-in price when I should have been more consumed with pure accumulation through dca. Avg price is just not that important when I really thought about it because it will even out as you dca to your target. Just right it’s probably at its lowest price for a while and will continue to climb through this cycle. It’s a valuable lesson to be fair and the only good thing I suppose is I was still accumulating just not as much as should have been. I ended up pulling all the lower buys, and used to buy in end of October with last dca buy. I think I’m more likely to review btfd again after I make it my goal amount which i estimate to happen near the end of next year. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10209

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 07, 2023, 01:10:46 AM |

|

[edited out]

Thanks JJG, if I boil it down to one thing I think got a bit too caught up in bftd to lower my avg buy-in price when I should have been more consumed with pure accumulation through dca. Avg price is just not that important when I really thought about it because it will even out as you dca to your target. Just right it’s probably at its lowest price for a while and will continue to climb through this cycle. It’s a valuable lesson to be fair and the only good thing I suppose is I was still accumulating just not as much as should have been. I ended up pulling all the lower buys, and used to buy in end of October with last dca buy. I think I’m more likely to review btfd again after I make it my goal amount which i estimate to happen near the end of next year. For sure any of us can make mistakes of attempting to be overly strategic in regards to buying dips, and I am pretty sure i have been arguing these points until I am blue in the face, and sometimes when we are focusing on buying the dip, we may well end up with a lower cost basis (possibly and possibly not like you suggested) but then we also might end up with fewer coins too.. There is a certain amount of value to continuing to accumulate BTC, and yeah sometimes if the price dips then we are kicking ourselves for mostly running out of fiat to buy more, but we cannot really know that we would have been able to buy more BTC merely because we ended up hanging onto a lot of fiat rather than just regularly and ongoingly buying BTC. And yeah, maybe buying on dip does become more of a luxury (and/or advantage) of the guy who already reached his/her BTC accumulation target or is well on the road to getting there. Let's say for example, you are aiming to get 1 years salary into bitcoin in 5 years or less, so you already realize that you have to try to invest at least 20% of your salary into bitcoin to just get to that point, and sure maybe you might feel that 20% is pushing it, and maybe you figure that you might be able to get some cheaper bitcoin by waiting for dips, but maybe in the end, it might not really matter, so maybe you should just be using the whole of that 20% to buy BTC every week (or whatever is your purchasing frequency) and if you happen to come across more cash because you got a bonus or because you were able to cut some of your expenses, then maybe you might want to hold that extra cash on the side for buying more on dips.. but then maybe overall you are feeling that you need to get to one year's salary invested into bitcoin before you might be able to relax a bit in your BTC accumulation methods, and sometimes these are kinds of artificial and somewhat arbitrary goals, but they might also be indicators that you might start to feel that you are in a position to be more flexible with your style of investing. There can be a bit of anal-retentive behaviors involved in figuring out these kinds of passages of thresholds. I believe that I got to higher levels of being able to relax about my bitcoin holdings at 3 different stages. The first was getting above 10% of my investment portfolio into it. The second was when my BTC portfolio was in profits, and the third was when my BTC holdings started to equal the value of all of my other investments (which was when it got to 50% of the value of my total investment portfolio due to the lopsidedness in BTC's price performance in comparison to my other assets). As I am listing these, they sound so arbitrary, and so it seems to me that individuals are going to cross these kinds of thresholds at differing points, and the crossing of the thresholds might thereafter cause them to go through a review of their whole approach and perhaps make some adjustments to their style based on crossing over these kinds of thresholds. By the way, getting to fuck you status could be another one of those crossed thresholds (and frequently entry level fuck you status is going to be in the ballpark of 20x to 30x annual salary/cost of living expenses), and surely I would expect that most bitcoiners are likely to have other investments, besides bitcoin and cash by the time they get to entry-level fuck you status, but there still could be some bitcoiners who do not have a lot of different kinds of assets, and surely there might be challenges to have fewer assets, but there are likely ways to accomplish that.. and at the same time, sometimes the BTC holdings might feel like it is the only thing that a person has when it is outperforming and dwarfing all other assets in your investment portfolio.. .so there could become some questions about selling off some of the BTC, merely to not have so much value in one asset.. and there could be some assurance that might come from just having some stock index funds, some property or maybe some other kinds of investments that hold somewhat steady, even if some of them might have expenses associated with owning them. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Bitcoin_people

|

|

November 07, 2023, 02:37:33 AM |

|