|

Obim34

|

|

December 22, 2023, 11:29:55 AM Merited by fillippone (1) |

|

It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior.

Before Bitcoin went into this current DIP, many people bought at the pick $60k and above, it takes only a true Bitcoin investor who is well propounded with the knowledge of Bitcoin to keep holding till now. Many must have sold with disappointment and dissatisfaction of making profit only as investing into the market then.

I also see people that are new into bitcoin who have only little in their bitcoin portfolio, that feels because the price of bitcoin is pumping and for that reason they are over investing aggressively because they want to have enough bitcoin during the bull run as investors that plans to sell in a short-term which is why they are acting that way and if bitcoin price didn't turn out as they expected, they will be disappointed

Buying aggressively in advantage of the current DIP as to hold enough Bitcoin in my wallet before hitting a new All Time High does not necessarily mean am into short term investment. This is taking advantage of the market, having enough funds and accumulating very well is something that will benefit more not necessarily meaning will sell when the price climbs a little. |

|

|

|

|

|

|

If you want to be a moderator, report many posts with accuracy. You will be noticed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Litzki1990

|

|

December 22, 2023, 11:36:43 AM Merited by JayJuanGee (1) |

|

But the thing is that if anyone is DCAing with time to time so this strategy will recover the mistakes which he/s made at the time of FOMO. If anyone invested on the top when Bitcoin was at $69000. And still DCAing so I am sure that he has recovered almost 80% to 90% loss and if he will hold and continue the strategy so he/s will be in profit when Bitcoin will cross ATH again.

Alright I think I get your point here,you mean if anyone trys to DCA when the Bitcoin reaches $69k he/she could recover profits when the next ATH comes . Well I guess if I'm not mistaken Bitcoin is still volatile and predicting it just like that mightnot work as we could be expecting something else by then but Bitcoin is not just any type of coin and not too volatile,there's still a chance for DCA maybe but the future will determine.Thus, you wanna consider DCA then start nowThe price of Bitcoin has been moving forward positively in the last few months and those who have invested in Bitcoin following the DCA method in the last few months are now seeing a clear return on their investment. The market is slowly moving upwards and we are gradually buying bitcoins according to the DCA method considering the market. I have purchased bitcoins in several steps according to my DCA method until the price of bitcoins is 40 thousand dollars and I am thinking of investing in several more steps. I don't think it would be a wrong decision for me if I invest some more money in Bitcoin according to the current market. Assuming now that I invest in Bitcoin the market has gone down a bit but if I compare this period with when I invested when Bitcoin was worth twenty thousand dollars, I will not have a loss but a profit. And this is the positive aspect of investing in DCA method. As a bitcoin investor I believe bitcoin price will touch $50000 soon and then one hundred thousand dollars later. Even if the price of bitcoin reaches fifty thousand dollars I will invest according to DCA method at that time and if the price of bitcoin reaches the highest level then I will invest according to DCA method and this strategy of investing is right for me. As our objective is to hold our investment for a long time, buying bitcoin in stages is a good decision for us and we will continue to do so. If you keep money in the bank, the bank will return you that amount at the end of the specified period, although they will take some additional charges from you, but if you invest in Bitcoin for a long time, that investment can return you several times more money in the future. So invest yourself without depositing unnecessary money in the bank and keep investing consistently and keep your investment for a long time. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

|

jcojci

|

|

December 22, 2023, 03:09:23 PM |

|

That is if the person can continue to hold the bitcoin even though the price is still below the purchase price. Most people will panic and sell their bitcoins quickly, even if they bear the loss. Not many people can continue to hold their bitcoin in a loss condition. By using the DCA method, you can increase the number of bitcoins at many prices so that it will reduce your average buying price. And your purchase price is no longer at $69k but could be even lower so if he can continue investing in bitcoin at the low price, that would benefit him. Not all investors sell their investments at a loss, but those who have a pre-planned investment hold their investments even in bad times. When the Bitcoin market moved above $60,000 and those who bought Bitcoin at that time and who have held onto that investment until now are real patient investors. Patience is a very necessary aspect of a human being. He who has no patience loses everything. I got real proof of how important patience is for a man. [/quote] People who sell their investments at a loss are panicked. They cannot continue to hold their bitcoin when the price decreases. They think that by selling their bitcoin, they have money to buy bitcoin at a lower price. And, indeed, those who can hold their bitcoin until the price exceeds the initial purchase price will be able to see the profits begin to appear. And you are right that patience is needed in holding this bitcoin until it reaches more than the purchase price. |

|

|

|

|

|

Frankolala

|

|

December 22, 2023, 04:53:21 PM |

|

Of course, someone who bought at the top and then did not buy any more BTC will be stuck waiting for the BTC price to get back above the ATH in order to get into profits.

Snip

You bring up a valid point. It's true that if someone bought at the top and didn't continue to buy more BTC, they would indeed have to wait for the price to surpass the ATH in order to see profits. And I have read the example which you have given. I totally agree wthi you. In conclusion if there is anyone, a trader (except those who leveraging) or an investor they need to hold. If there is a trader so he bought BTC on top so he will try average the BTC price. But still if he is in loss so he has to wait for weeks for months or even years to get profit when the value will go above his entry point. In the end, each investor's strategy and goals may differ and it's important to consider multiple factors when assessing the profitability of BTC holdings. Correct, this is why anyone that bought when the price of Bitcoin was very high, needs to continue with DCA regular buying to make sure that he increases his bitcoin portfolio and also to be able to balance the average cost of bitcoin that he is holding, because it is only when you buy regular that you will have the opportunity to get a better profit at the long run, instead of waiting and keeping his bitcoin investment stagnant till after tye price of bitcoin passes his entry point in the next circle, which nobody knows when. DCA approach is very good because it gives room for you to recover with time if you bought on the peak of the market. When i am DCAing, I only just make sure that i am consistent in I and I don't bother to check if I am making profit because I know that as long as I am holding for a long term, I will be profitable at the end after I have reached my bitcoin target. This is because sometimes, the profit in your investment can be tempting, if you are the one that is always checking your profit, so to avoid distraction i don't check. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

MusaPk

|

|

December 22, 2023, 06:25:34 PM Merited by JayJuanGee (1) |

|

"8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. DCA is not only recommended for people who don't have time much time to study but its also adopted by people who have sound knowledge of Bitcoin. Because as you study more about Bitcoin and strategies to invest in Bitcoin you get to know that DCA is quite a good option to go for it. There are other options also but DCA is different in a sense that it benefits everyone the same way and this is something not available in other investing options. What works well for me may or may not work for you. |

|

|

|

|

JoyMarsha

|

|

December 22, 2023, 10:28:27 PM

Last edit: December 22, 2023, 10:44:49 PM by JoyMarsha |

|

It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior.

I don't think they bought bitcoin at a high price because they were ready. They bought it because they thought bitcoin would keep increasing in price and they got caught up with the price when bitcoin discontinued the price increase. Before the price of bitcoin increased to this extent, some would have sold their bitcoin before now for less money, while others would have decided to hold onto it in the hope that its value would increase above the $60k purchase price. Whatever the event is, it does not prevent them from having the chance to accumulate bitcoin over time at a discounted price. |

| Ladies.de | | | | ███████████████

████▄▄▄▄███████▄▄▄▄▄

▄█████████████████████▄

███████████████████████

███████████████████████

▐█████████████████████▌

░█████████████████████

░█████████████████████

▐█████████████████████▌

░█████████████████████

██▀█████████████████▀

███████████████████

██████████████████ | ▬▬▬▬▬▬▬▬▬▬▬▬ ♥

LadiesStars

▬▬▬▬▬▬▬▬ ♥ | ♥

♥ | | | ♥

♥ | ██████▀█████████

███████▀███████▌

████████▐███████▄

██████████████████▄

█████████▐██████████

████████████████████▌

███████▄████████████

███████████████████

████▄█████████████

█████████████████▌

████████▀░███████

░█████▀█████████

████▀██████████ |

|

|

|

|

ginsan

|

|

December 22, 2023, 10:43:59 PM |

|

"8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. DCA is not only recommended for people who don't have time much time to study but its also adopted by people who have sound knowledge of Bitcoin. Because as you study more about Bitcoin and strategies to invest in Bitcoin you get to know that DCA is quite a good option to go for it. There are other options also but DCA is different in a sense that it benefits everyone the same way and this is something not available in other investing options. What works well for me may or may not work for you. I think everyone who invests in Bitcoin definitely has time to organize their purchases and why DCA is so popular because they invest in the long term with hundreds of purchases throughout their investment journey. Of course DCA is the best and maybe buying at the same time is not too popular if the market situation is bullish. Apart from that, at a special level, continuing to pay attention to the charts is of course not something that everyone can do because they don't have much time due to their busy work, therefore those who focus on DCA will visit the market when their purchases are due and they do it like once every two months or once a month. And it is true as stated by JJG because in point 8 where we can change our formation when the market situation changes suddenly, that is, we make purchases before the time comes in the composition of the list of purchases that we will make. It all depends on the situation because they can act more aggressively when the market turns red and can also accumulate more when the market falls 10%. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 22, 2023, 11:30:10 PM |

|

edited out

You bring up a valid point. It's true that if someone bought at the top and didn't continue to buy more BTC, they would indeed have to wait for the price to surpass the ATH in order to see profits. And I have read the example which you have given. I totally agree wthi you. In conclusion if there is anyone, a trader (except those who leveraging) or an investor they need to hold. Of course, the basic math would be that if you bought at a higher price, then the only way to make sure that you are in profits is to wait to sell at a higher price than you bought. There surely are other ideas about how to manage investment (trading) portfolios, including cutting losses by selling even if the holding is at a loss, and then being able to either use that capital on some other investment, or to find a better (presumptively lower) entry point. Some folks get anxious about tying their capital up until the amount becomes profitable, and surely I personally don't agree with following those kinds of trading approaches, absent some kind of exigent circumstances, and my own approach to bitcoin has always been to guard that I am not selling any BTC at prices lower than I bought them, and so there could be some calculation that any time that any of us make a BTC purchase, then we are willing to ride that purchase amount down to zero, if we are making such purchase under the premise that we are ONLY going to sell it once it becomes profitable, and so surely an averaging of your BTC purchase price could end up becoming a way to rationalize being able to sell at a profit based on a different way of accounting. If there is a trader so he bought BTC on top so he will try average the BTC price. But still if he is in loss so he has to wait for weeks for months or even years to get profit when the value will go above his entry point.

In the end, each investor's strategy and goals may differ and it's important to consider multiple factors when assessing the profitability of BTC holdings.

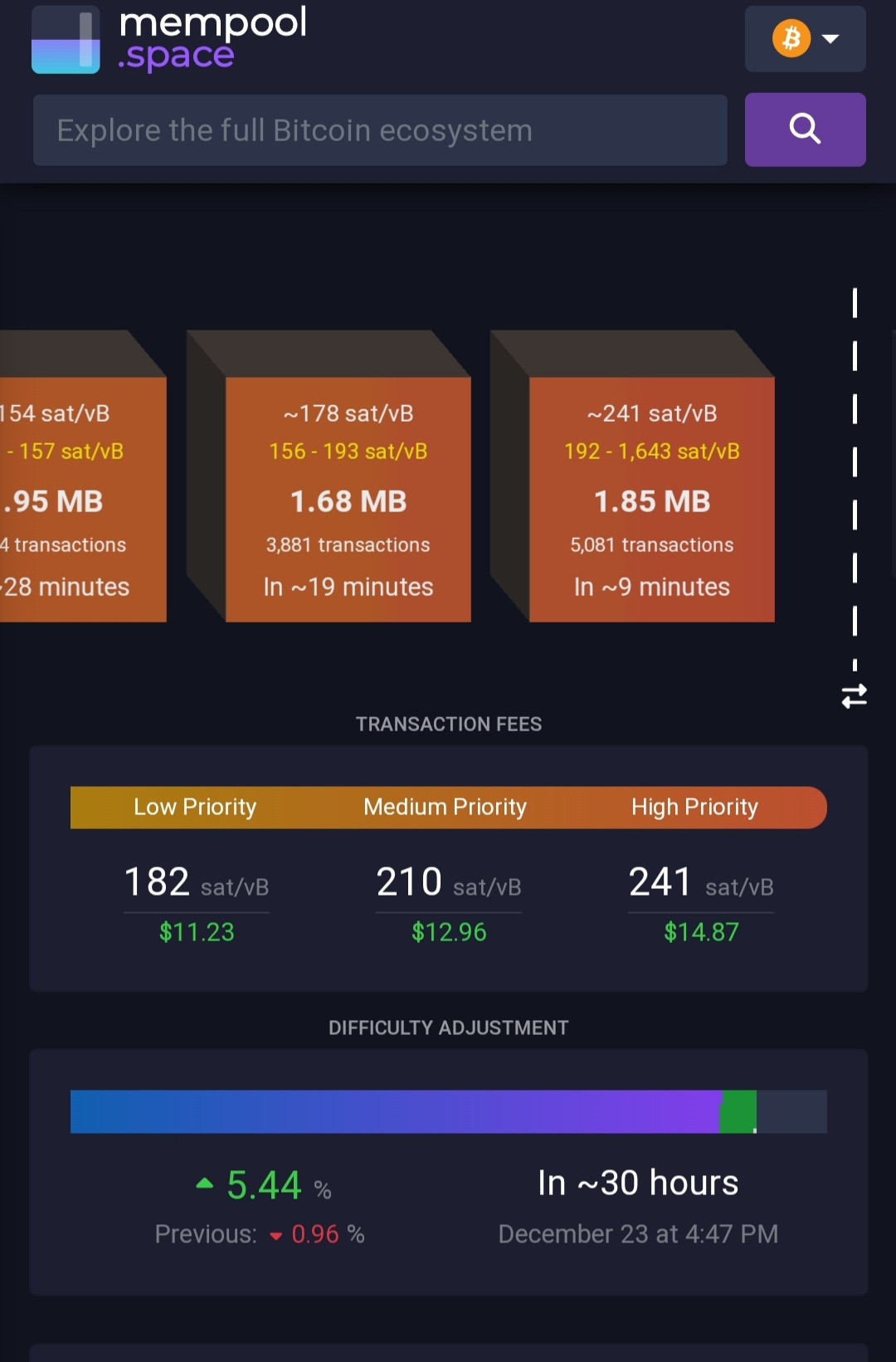

Some times traders do not mind to take losses on certain parts of their investment/trading portfolio holdings in order that they can off-set gains that they made in other portions of their investment/trading portfolio holdings. Sometimes they purposefully choose to take losses to offset gains, and surely some of those kinds of accounting ideas, trading and gambling ideas are also deviating from the topic of this thread.. but sometimes we still may well acknowledge that some of the ideas that various longer term investors will propose will conflict with the ideas of shorter-term investors, and so sometimes we need to make sure that we are considering such comparisons, and not just proclaiming that there is ONLY one way to do things, even though many of us longer term investors likely engage in tactics that are way less complicating than what a trader might do, including when they are maybe employing various kinds of leverage or deploying other financial instruments in order to hedge their BTC long position.. and yes, those kinds of systems exist, even while in this thread, many of us probably recognize and appreciate that some of those tools might not even really be easily available to a lot of normie newbie investors, and the mere fact that you can even deploy such financial instruments does not even necessarily mean that you are going to have better results than the more basic ideas of ongoing, persistent and consistent BTC accumulation over a long period of time....and we have seen a lot of that better performance of the long term BTC accumulator/holder in bitcoin's history, even though a lot of those using financial instruments and trading will brag about various wins (or greater gains) that they are able to make from time to time, but they still likely do not end up outperforming basic accumulation and hodl strategies, especially if we look at longer periods of time, such as 4-10 years or longer. Additional transaction fees have been increasing ever since the price of Bitcoin increased. This transaction fee is currently the biggest hurdle especially for those who are holding Bitcoin with the DCA method of Bitcoin. They incur additional transaction fees to hold bitcoins on a weekly or monthly DCA basis. I myself am under extra stress for Bitcoin transaction fees, because I have to continue investing in the DCA method at high cost. Yet I have not stopped holding bitcoins with the DCA method, continue and will continue to do so in the future no matter how high the transaction fees are. I usually show you a picture of the Bitcoin Mempool.  What you say is not completely true, and it may well be a bit misleading. If you make a lot of small purchases and you process them onchain and hold them in small UTXOs, then the high fees are going to hurt you more because you are likely going to have a bunch of small UTXOs that might not even be spendable because they are so small, and maybe you spent hundreds or even thousands of dollars to accumulate a bunch of small UTXOs. You can use a third party to make your regular BTC buys (as Patrol69 mentioned), and then ONLY transfer them to an onchain wallet (or address that you control) after they reach a certain amount of value that determined by you (as adultcrypto mentioned), and maybe that is after you accumulate $500 or $1k in value in a third party account, then you transfer that value to a private address... rather than transferring every $10 to $100.. which might not be very cost effective to be doing that. You also are not suffering any expenses merely because you are HODLing bitcoin for a long time, but there may be some BTC HODLers who realize that they might have made mistakes if they have a bunch of small UTXOs that they had failed/refused to combine during times in which the transaction fees were much lower, and like you said transaction fees have been pretty high in the last couple of months, and really they have been higher during much of 2023 as compared with prior times. You can see the back up of the mempool over the last year here: https://jochen-hoenicke.de/queue/#BTC,1y,weight You can also change the time period in order to look at further back history or to look more closely at shorter time-periods. [edited out]

You are absolutely right about the transaction fees, but I have a feeling that that is not a problem. There are many people that are applying the DCAing strategy, so anytime they want to accumulate Bitcoin, they can make use of the lighting network or accelerate the transaction so that it will be confirmed in just a matter of minutes (maybe 30 minutes). There may be instances in which the lightning network might be helpful for both large transaction fees but lightning network surely has its own issues in regards to how much BTC can be held in such LN channels, and surely a lot of LN wallets are custodial rather than non-custodial, yet they could still serve as intermediary channels. I am not sure how an accelerator resolves any kind of high fee problem, unless maybe you are referring to some of the free accelerators, which might not necessarily end up resolving issues of transactions getting stuck, and surely there are accelerators that charge extra, so that may well not end up resolving the issue of fees, even though it could help to resolve issues of transactions getting stuck. However, I haven't used any of them, but with the kind of post and discussion at the technical board, I can tell that they are working perfectly. Although I am still planning to buy more coins next week with the help of the DCAing strategy, and if the transaction isn't confirmed quickly, then I will accelerate it.

Again, good luck using accelerators that may or may not lead you to success in getting your transaction to go through, but at least you can try it out and tell us if it is helping you in any kind of meaningful way. Before I came across this post, https://bitcointalk.org/index.php?topic=5034315.0 I was thinking of buying the same amount of Ethereum, then when it's confirmed, I will reconvert it back to BTC just because of the transaction, but now, I will not have to do so, I will just buy the BTC from p2p and accelerate it. I was not following that thread, but it does look like there might be instances in which stuck transactions could be accelerated, yet I am still not sure how that resolves the amount of the transaction fee issue, except maybe if someone had transacted with too small of a fee, and the transaction is not going through then to get the assistance of some accelerator service, and wouldn't you need to pay if you were using such service regularly? But, yeah if you are transacting once every few months and then once in a while those transactions get stuck, there could be some use in terms of getting them unstuck and not necessarily having to pay any extra fee (if the accelerator really is "free.") "8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. edited out] ........ And it is true as stated by JJG because in point 8 where we can change our formation when the market situation changes suddenly, that is, we make purchases before the time comes in the composition of the list of purchases that we will make. It all depends on the situation because they can act more aggressively when the market turns red and can also accumulate more when the market falls 10%. Personally, I don't really think about number 8 as a way to fuck around with trying to time the market - especially, since the more important things about the whole list of the 9 items that are referred to in the list of factors to consider, BTC price (which is contained in the idea of: "4) your view of bitcoin as compared with other investments," And so price is contained within that idea, and we could flesh out the idea, but price ends up ONLY being one of the several factors, and is ultimately a sub-factor of one of the factors. Of course, you can use the idea of tweaking your approach however, you like yet I would suggest that most of the tweaking would come from changes in a persons cashflow/expenses and/or how much BTC that the person accumulates in comparison to other kinds of assets (and so yeah the changes in overall wealth and how it is allocated could justify some needs to change a persons approach in terms of which assets are being bought and/or sold and how the objectives - such as reallocations or changes in allocations are being accomplished). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Onyeeze

|

|

December 22, 2023, 11:41:57 PM |

|

It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior.

I don't think they bought bitcoin at a high price because they were ready. They bought it because they thought bitcoin would keep increasing in price and they got caught up with the price when bitcoin discontinued the price increase. Before the price of bitcoin increased to this extent, some would have sold their bitcoin before now for less money, while others would have decided to hold onto it in the hope that its value would increase above the $60k purchase price. Whatever the event is, it does not prevent them from having the chance to accumulate bitcoin over time at a discounted price. What you said is the truth why people buy bitcoin at high price, the reason why people by bitcoin whenever they feel like is that they have in mind that the price of bitcoin at that time will continue to rise and it is not going fail and that is why they continued to buy, so that is the reason why we said that is good to verify about bitcoin before we can purchase bitcoin because if we continue the way we feel in cryptocurrency without have more knowledge of bitcoin before we invest largely we shall continue to experience lose. In bitcoin investment before you buy at any cost of price you have to check the features of bitcoin if the time you buy more of bitcoin what you are supposed to do is to make sure that you have calculated the future of bitcoin, you don't have to buy at high prices and within same period you bought and the price depreciate, I think what we need is a thorough investigation and research to know if the price will increase before you buy at high prices, research methods makes us not lose for bitcoin investment |

|

|

|

|

Fara Chan

|

|

December 22, 2023, 11:53:26 PM |

|

Before Bitcoin went into this current DIP, many people bought at the pick $60k and above, it takes only a true Bitcoin investor who is well propounded with the knowledge of Bitcoin to keep holding till now. Many must have sold with disappointment and dissatisfaction of making profit only as investing into the market then.

Currently the price of Bitcoin is still not that high so you or anyone may still be too early to say that many people will buy at $60K and above, because everyone can still get Bitcoin below $45K. So it is not really feasible to judge whether a true investor will really stick with their current investment or not, because every investor must have a mature target and plan for what they buy and also for what they will invest in any way. Buying aggressively in advantage of the current DIP as to hold enough Bitcoin in my wallet before hitting a new All Time High does not necessarily mean am into short term investment. This is taking advantage of the market, having enough funds and accumulating very well is something that will benefit more not necessarily meaning will sell when the price climbs a little.

I don't think it's an aggressive purchase if you only aim to collect Bitcoin when the price is still in the Dip category, because everyone who buys Bitcoin with funds they have prepared for investment purposes within a certain period of time definitely has a very good goal. So no one will be able to judge whether you will invest in the short term or long term, because the one who will determine that is yourself or the owner of the asset itself. |

| | | | | | | ███▄▀██▄▄

░░▄████▄▀████ ▄▄▄

░░████▄▄▄▄░░█▀▀

███ ██████▄▄▀█▌

░▄░░███▀████

░▐█░░███░██▄▄

░░▄▀░████▄▄▄▀█

░█░▄███▀████ ▐█

▀▄▄███▀▄██▄

░░▄██▌░░██▀

░▐█▀████ ▀██

░░█▌██████ ▀▀██▄

░░▀███ | | ▄▄██▀▄███

▄▄▄████▀▄████▄░░

▀▀█░░▄▄▄▄████░░

▐█▀▄▄█████████

████▀███░░▄░

▄▄██░███░░█▌░

█▀▄▄▄████░▀▄░░

█▌████▀███▄░█░

▄██▄▀███▄▄▀

▀██░░▐██▄░░

██▀████▀█▌░

▄██▀▀██████▐█░░

███▀░░ | | | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 23, 2023, 12:08:33 AM |

|

It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior.

I don't think they bought bitcoin at a high price because they were ready. They bought it because they thought bitcoin would keep increasing in price and they got caught up with the price when bitcoin discontinued the price increase. Before the price of bitcoin increased to this extent, some would have sold their bitcoin before now for less money, while others would have decided to hold onto it in the hope that its value would increase above the $60k purchase price. Whatever the event is, it does not prevent them from having the chance to accumulate bitcoin over time at a discounted price. What you said is the truth why people buy bitcoin at high price, the reason why people by bitcoin whenever they feel like is that they have in mind that the price of bitcoin at that time will continue to rise and it is not going fail and that is why they continued to buy, so that is the reason why we said that is good to verify about bitcoin before we can purchase bitcoin because if we continue the way we feel in cryptocurrency without have more knowledge of bitcoin before we invest largely we shall continue to experience lose. In bitcoin investment before you buy at any cost of price you have to check the features of bitcoin if the time you buy more of bitcoin what you are supposed to do is to make sure that you have calculated the future of bitcoin, you don't have to buy at high prices and within same period you bought and the price depreciate, I think what we need is a thorough investigation and research to know if the price will increase before you buy at high prices, research methods makes us not lose for bitcoin investment Ok. sure. If a person bought BTC in the $60ks, then he is expecting that there is a good chance that the BTC price will go up from there, but of course, since there is no guarantee about price, it is best not to expect ONLY one price direction, which is always the case. The BTC price could go up or it could go down, and the fact that the BTC price had already gone up in the ballpark of 16x during that period, there is already ability to see that it had already gone up, but that also did not mean that the BTC price would end up going down, even though after the fact, we are able to look at the price and see what it ended up doing. So any time that we enter into bitcoin we should be attempting to engage in similar kinds of assessments and preparations that the BTC price could go up or it could go down or it could go sideways, and what are we going to do in each of those scenarios. We could start out with a DCA approach and a lump sum investment (that is a kind of front loading of the investment), so let's say for example that a person decided to front load his investment and to buy $12k worth of bitcoin at $60k, but then to DCA into bitcoin over the next 1-2 years another $14k to $28k, which surely might have ended up being $1k per month or $250k per week. So he would have 0.2 BTC from the initial purchase in around early November 2021, and then over the next two years starting from the beginning of November at $250 per week, he would have bought right around 1.1205 BTC (average of right around $25k per BTC), and so the total would be $40k ($12k + $28k) invested, and a total BTC stash of 1.3205 BTC (average cost of about $30,300 and valued currently right around $58k), so even if he ended up messing up by front loading his BTC investment, his subsequent ongoing buying of BTC ended up bringing down his average costs per BTC quite a bit over the last nearly 26 months. Of course, we don't know which way the BTC price is going to go, and we don't even necessarily know how our ongoing buying of BTC, whether DCA or maybe some other tactics might end up working out, but we can still attempt to prepare for any of the potential BTC directions, even if we might front-load our investment a bit in order to prepare for UPpity, but then when the BTC price ends up moving against our expectations, we still just continue to buy and to build up our BTC position in light of our budgetary considerations. The example still can work if we are dealing with differing amounts, but in this particular example, I try to describe what someone with $12k in cash might do and who has right around a $1k per month budget for ongoing buying of BTC. Of course, the person could lump sum in and then play around with buying on dips, but if the person is still feeling like he is trying to establish his position, and even might be limited in terms of his cashflow being $1k per month, then he may well not have other money for buying on dips, even though he would not necessarily have had to spend the whole $12k at once as a lump sum investment and he also would not have had to buy $250 per week or $1k per month right away, he could save some of that for buying on dips, but if the price had already ended up dipping, then the whole next couple of years, ended up being a kind of buying on dip, even though he is employing a kind of DCA approach and he had not really expected the BTC price to go against his initial purchase in such a great way, in terms of sinking all the way down to the $15ks... but his $250 per week bought more during those times in which the BTC price was at those lower price levels in the cycle. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Lidger

Member

Offline Offline

Activity: 60

Merit: 48

|

|

December 23, 2023, 02:58:57 AM |

|

"8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. DCA is not only recommended for people who don't have time much time to study but its also adopted by people who have sound knowledge of Bitcoin. Because as you study more about Bitcoin and strategies to invest in Bitcoin you get to know that DCA is quite a good option to go for it. There are other options also but DCA is different in a sense that it benefits everyone the same way and this is something not available in other investing options. What works well for me may or may not work for you. DCA method is a sound investment method not only for those who do not have enough time to study about Bitcoin but also for all investors. You are an investor and you certainly never want to be limited to the investments you made in the beginning. That is, if I say the matter clearly, then the matter is that once you invest in Bitcoin, you don't stop investing, but you invest in the future when the time gives you an opportunity. And this is called DCA method of investing. I don't know how you think about investing but investing is a bit different for me. It is difficult for me to manage a large amount of money at once so I started my investment with a relatively small amount. After starting investing with less money I have been making my investments regularly so I am not stressed. We have to invest in such a way that we don't have to sell the investment later. I have enough money to invest and I invested with all my money, after some time it appeared that I needed a lot of money and I immediately sold my investment. Isn't it really long term investment? Even if we invest a relatively small amount of money, we must maintain that investment for a long period of time. Bitcoin price is changing every moment whether it is positive change or negative change. If I continue to invest continuously in the midst of change, but considering the profit and loss, at the end of a period my capital amount will be much more and if I keep that large amount of capital for a long time, I will definitely get a lot of good from my investment. |

|

|

|

|

|

Publictalk792

|

|

December 23, 2023, 04:26:04 AM |

|

Of course, the basic math would be that if you bought at a higher price, then the only way to make sure that you are in profits is to wait to sell at a higher price than you bought.

There surely are other ideas about how to manage investment (trading) portfolios, including cutting losses by selling even if the holding is at a loss, and then being able to either use that capital on some other investment, or to find a better (presumptively lower) entry point.

Some folks get anxious about tying their capital up until the amount becomes profitable, and surely I personally don't agree with following those kinds of trading approaches, absent some kind of exigent circumstances, and my own approach to bitcoin has always been to guard that I am not selling any BTC at prices lower than I bought them, and so there could be some calculation that any time that any of us make a BTC purchase, then we are willing to ride that purchase amount down to zero, if we are making such purchase under the premise that we are ONLY going to sell it once it becomes profitable, and so surely an averaging of your BTC purchase price could end up becoming a way to rationalize being able to sell at a profit based on a different way of accounting.

It is true that some investors can choose to cut their losses and can sell at a loss in order to reallocate their capital or find a better entry point. This approach can be influenced by individual risk tolerance and market conditions. On other hand your personal approach to Bitcoin where you aim to not sell any BTC at prices lower than what you buy them for is also a valid strategy. By holding on your purchase until they become profitable you are effectively safeguarding your investment and aiming for a positive return. Additionally... averaging your BTC purchase price can be a way to rationalize selling at a profit based on a different accounting method. This approach takes into consideration the overall average cost of your BTC holdings and can provide a clearer picture of your profitability. Everyone has its own strategy like you have. Some have bought in bear market and not DCAing they are holding tight. Some are those who are DCAing and dont think what the price is. Some are those who bought on high price and still waiting for that value and not DCAing. Means everyone has its own mind.

Some times traders do not mind to take losses on certain parts of their investment/trading portfolio holdings in order that they can off-set gains that they made in other portions of their investment/trading portfolio holdings. Sometimes they purposefully choose to take losses to offset gains, and surely some of those kinds of accounting ideas, trading and gambling ideas are also deviating from the topic of this thread.. but sometimes we still may well acknowledge that some of the ideas that various longer term investors will propose will conflict with the ideas of shorter-term investors, and so sometimes we need to make sure that we are considering such comparisons, and not just proclaiming that there is ONLY one way to do things, even though many of us longer term investors likely engage in tactics that are way less complicating than what a trader might do, including when they are maybe employing various kinds of leverage or deploying other financial instruments in order to hedge their BTC long position.. and yes, those kinds of systems exist, even while in this thread, many of us probably recognize and appreciate that some of those tools might not even really be easily available to a lot of normie newbie investors, and the mere fact that you can even deploy such financial instruments does not even necessarily mean that you are going to have better results than the more basic ideas of ongoing, persistent and consistent BTC accumulation over a long period of time....and we have seen a lot of that better performance of the long term BTC accumulator/holder in bitcoin's history, even though a lot of those using financial instruments and trading will brag about various wins (or greater gains) that they are able to make from time to time, but they still likely do not end up outperforming basic accumulation and hodl strategies, especially if we look at longer periods of time, such as 4-10 years or longer.

It is also true that long term investors may have conflicting ideas with short term traders. Each approach has its own merits and considerations. Long term investors often focus on consistent accumulation and holding of BTC over extended periods while traders may employ leverage and other financial instruments to hedge their positions and can seek short term gains. Traders can get temporary happiness if their trade is in profit and also they can get sadness to if they will be in loss. But an investor dont care about it and he hold tight and don't involve his emotions in his investment. While these financial instruments and trading strategies (which a trader is using) may not be easily accessible to all investors(or they have access but they don't use) it is worth noting that the historical performance of long term BTC accumulation and holding has often out performed more complex trading strategies over long timeframes. While traders may boast about their occasional wins the consistent accumulation and holding strategy has proven to be effective. And sometimes traders close the trade in loss because they think that they will get profit from other trades. And mostly traders lose many things here. When they lose 2 to 4 time they just become emotional and in emotions a man can make bad decisions which can led them to loss. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

Gallar

|

|

December 23, 2023, 04:32:54 AM Merited by JayJuanGee (1) |

|

"8 ) your abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time," https://bitcointalk.org/index.php?topic=5376945.msg58719590#msg58719590I personally think that number 8 can deal with a lot of things in terms of how much time anyone has to be able to spend on bitcoin and learning, and if you do not have a lot of time, then you need to attempt to maintain a less aggressive and maybe even a more passive strategy, and DCA works pretty well for someone who does not have a lot of time to study into bitcoin or even to study into various kinds of strategies to monitor if the BTC price is going to go up or down. DCA is not only recommended for people who don't have time much time to study but its also adopted by people who have sound knowledge of Bitcoin. Because as you study more about Bitcoin and strategies to invest in Bitcoin you get to know that DCA is quite a good option to go for it. There are other options also but DCA is different in a sense that it benefits everyone the same way and this is something not available in other investing options. What works well for me may or may not work for you. DCA method is a sound investment method not only for those who do not have enough time to study about Bitcoin but also for all investors. You are an investor and you certainly never want to be limited to the investments you made in the beginning. That is, if I say the matter clearly, then the matter is that once you invest in Bitcoin, you don't stop investing, but you invest in the future when the time gives you an opportunity. And this is called DCA method of investing. I don't know how you think about investing but investing is a bit different for me. It is difficult for me to manage a large amount of money at once so I started my investment with a relatively small amount. After starting investing with less money I have been making my investments regularly so I am not stressed. We have to invest in such a way that we don't have to sell the investment later. I have enough money to invest and I invested with all my money, after some time it appeared that I needed a lot of money and I immediately sold my investment. Isn't it really long term investment? Even if we invest a relatively small amount of money, we must maintain that investment for a long period of time. Bitcoin price is changing every moment whether it is positive change or negative change. If I continue to invest continuously in the midst of change, but considering the profit and loss, at the end of a period my capital amount will be much more and if I keep that large amount of capital for a long time, I will definitely get a lot of good from my investment. Investing in bitcoin using DCA is indeed a good thing for all levels of bitcoin investors. Because by using the DCA method, those who have large, medium and small funds can model it well. Whether it's once a week, or once every two weeks, or once a month. So whatever income Bitcoin investors have every month, it can be accumulated well. Apart from that, investing money in bitcoin using the DCA technique is also profitable with minimal risk of loss. So you don't need to worry, when you experience a decline in the bitcoin market price. Because if, for example, the money you invested in Bitcoin in the first month decreases due to the drop in Bitcoin prices, don't worry, because in the second month you will most likely be able to cover the entire amount. reducing the amount with the money you invested in the second month. Therefore, the DCA technique is both highly compatible and complex when used to invest in bitcoin. Everyone definitely has different abilities regarding the amount of money they want to invest. So if you are a typical bitcoin investor who prefers to invest small amounts, then there is nothing wrong with that. Because the most important thing is that you are consistent with the DCA that is being carried out. And regarding whether the bitcoin investment you are making is long term or not, it depends on how long you hold the bitcoin. If for example there is more than one bitcoin cycle (4-5 years), then the investment can be said to be a long-term investment. Investment assets definitely experience changes in market prices and this also applies to bitcoin. Therefore there will always be a decrease or increase. So your point about holding bitcoin longer is a very good thing if implemented. And to anticipate price declines and increases, DCA is here to be the solution. And a little advice from me, when you do DCA, you should send your bitcoins to your wallet at least every two accumulation periods. Because currently bitcoin transaction costs are quite high. So to minimize this, it's a good idea to collect bitcoins on the exchange first, and if you have collected a large amount of bitcoins, then send them to your wallet. Moreover, you like to do DCA on bitcoin with small amounts. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

|

MusaPk

|

|

December 23, 2023, 08:19:54 AM

Last edit: December 23, 2023, 08:31:44 AM by MusaPk |

|

I think everyone who invests in Bitcoin definitely has time to organize their purchases and why DCA is so popular because they invest in the long term with hundreds of purchases throughout their investment journey. Of course DCA is the best and maybe buying at the same time is not too popular if the market situation is bullish. Apart from that, at a special level, continuing to pay attention to the charts is of course not something that everyone can do because they don't have much time due to their busy work, therefore those who focus on DCA will visit the market when their purchases are due and they do it like once every two months or once a month.

And it is true as stated by JJG because in point 8 where we can change our formation when the market situation changes suddenly, that is, we make purchases before the time comes in the composition of the list of purchases that we will make. It all depends on the situation because they can act more aggressively when the market turns red and can also accumulate more when the market falls 10%.

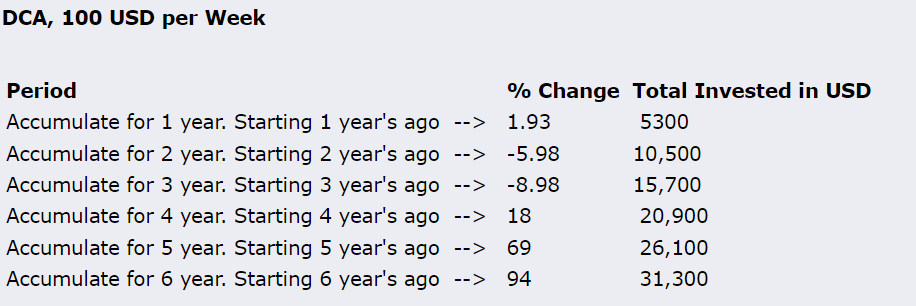

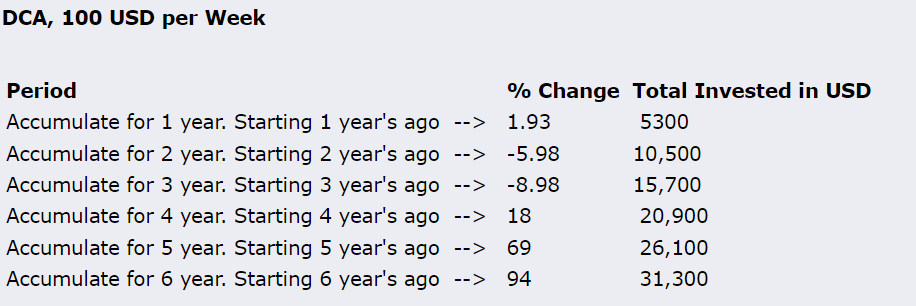

Techniques like technical, fundamental and sentiment analysis aid anyone who is investing but they do require time and expertise which everyone dont have. If I talk about myself I dont have expertise to in TA, FA and SA, thats why I follow DCA. I was doing a small research that how much effective DCA will be on https://dcabtc.com/ and comes up with following data. If you doing DCA 100 dollar per week then here are results:  What I conclude from above table is that even DCA may not be effective over a small period of time but over a longer duration like 4 years or more. |

|

|

|

|

Litzki1990

|

|

December 23, 2023, 12:05:21 PM Merited by JayJuanGee (1) |

|

It means that those people who bought above $60k price bought because they were ready to invest in bitcoin as that was the right time for them. They also have the mindset to hodli for long and they didn't buy because they are after short term profit. This is the reason why they are still hodli their investment till now and some of them are even increasing their bitcoin portfolio because they understand the that the long term goal is superior.

I don't think they bought bitcoin at a high price because they were ready. They bought it because they thought bitcoin would keep increasing in price and they got caught up with the price when bitcoin discontinued the price increase. Before the price of bitcoin increased to this extent, some would have sold their bitcoin before now for less money, while others would have decided to hold onto it in the hope that its value would increase above the $60k purchase price. Whatever the event is, it does not prevent them from having the chance to accumulate bitcoin over time at a discounted price. Bitcoin is now at a high price to catch up and knowing that Bitcoin is at a high price anyone who invests in Bitcoin now is not a fool but may be investing in DCA strategy. I don't believe in the idea that you always have to buy bitcoin at low prices. Yes, I don't agree that buying bitcoins at a low price is more profitable if the price goes up later, but many investors can't wait for the price of bitcoins to go down. Investing is difficult for people who only plan to invest and wait for the price of Bitcoin to fall. Our plan is to buy bitcoins at a relatively high price there for a long period of time so it won't affect our investment too badly. In case of long term investment we don't need to see much profit and loss because if we see excess market then it is difficult for us to hold the investment. There are many investors who planned to invest in Bitcoin price from $20K to $25K but at that time they thought that this may be the peak of the Bitcoin market and from this position they waited for the market to go down but the market did not go down due to which they not invested. Again this year when bitcoin reached 30000 dollars it was the highest price of bitcoin touched this year but at that time those who invested managed to come up to $45K with their investment but those who did not invest are still waiting for the market to go down. Since the plan is for a long time, investing without thinking so much, we should only keep the investment for a long time. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 23, 2023, 03:11:22 PM |

|

[edited out]

Everyone has its own strategy like you have. Some have bought in bear market and not DCAing they are holding tight. Some are those who are DCAing and dont think what the price is. Some are those who bought on high price and still waiting for that value and not DCAing. Means everyone has its own mind.The mere fact that these various strategies exist or that people think about these matters in different ways does not even mean that the strategies (or the ways of thinking) are equally as good or even equally thought through or that they are particularly tailored to the circumstances to the person. Sometimes we might even tell someone that their strategy is dumb, even though it is a validly existing strategy that is based on their determination of how to manage their BTC accumulation, maintenance and/or accumulation - and maybe they are engaged in trading, and we can also proclaim that their strategy is valid, but it is dumb, especially when it comes to bitcoin, but such a strategy might be more valid when it comes to shitcoins in which most of the time it is likely better to establish entry and exit strategies rather than planning to hold such crap in the long term - and yeah, hopefully we are not treating our bitcoin holdings like that and hopefully we have assessed where we are at in our bitcoin journey in order to determine what strategy or combination of strategies is going to contribute towards our making progress towards reaching our goals, whether that be BTC accumulation, maintenance, liquidation or some combination of those that might emphasize one or the other at various points in time. Some times traders do not mind to take losses on certain parts of their investment/trading portfolio holdings in order that they can off-set gains that they made in other portions of their investment/trading portfolio holdings. Sometimes they purposefully choose to take losses to offset gains, and surely some of those kinds of accounting ideas, trading and gambling ideas are also deviating from the topic of this thread.. but sometimes we still may well acknowledge that some of the ideas that various longer term investors will propose will conflict with the ideas of shorter-term investors, and so sometimes we need to make sure that we are considering such comparisons, and not just proclaiming that there is ONLY one way to do things, even though many of us longer term investors likely engage in tactics that are way less complicating than what a trader might do, including when they are maybe employing various kinds of leverage or deploying other financial instruments in order to hedge their BTC long position.. and yes, those kinds of systems exist, even while in this thread, many of us probably recognize and appreciate that some of those tools might not even really be easily available to a lot of normie newbie investors, and the mere fact that you can even deploy such financial instruments does not even necessarily mean that you are going to have better results than the more basic ideas of ongoing, persistent and consistent BTC accumulation over a long period of time....and we have seen a lot of that better performance of the long term BTC accumulator/holder in bitcoin's history, even though a lot of those using financial instruments and trading will brag about various wins (or greater gains) that they are able to make from time to time, but they still likely do not end up outperforming basic accumulation and hodl strategies, especially if we look at longer periods of time, such as 4-10 years or longer.

It is also true that long term investors may have conflicting ideas with short term traders. Each approach has its own merits and considerations. It sounds like you are subscribing to some relativistic way of thinking, which likely is not true. The various kinds of strategies can exist, but it does not necessarily meant that the strategies have been thought through or even have much if any merit, even though they might be trying to reach some kind of goal of getting rich quick, so they employ a certain kind of strategy with the belief that they have chosen the best strategy to meet their objectives, when the fact of the matter may well be that they have hardly any clue about how to achieve their objective or that the strategy that they have chosen is not going to work for their unrealistic goal that involves gambling, but they mistakenly believe that they are investing. Long term investors often focus on consistent accumulation and holding of BTC over extended periods while traders may employ leverage and other financial instruments to hedge their positions and can seek short term gains.

Traders can get temporary happiness if their trade is in profit and also they can get sadness to if they will be in loss. But an investor dont care about it and he hold tight and don't involve his emotions in his investment.

A long term investor might consider trading - or selling in order to try to buy back cheaper, as employing too much risk and also putting himself outside of the right kind of ongoing and persistent accumulation mindset, so sure there could be some traders who out perform the longer term investor, but an overwhelming majority of times, the traders do not outperform the long term investor who is just accumulating bitcoin over time... and the longer the time, the more likely that the trader is going to underperform the longer term BTC investor... and sure, these are not absolutes nor are they guaranteed to continue to occur, even though so far they have been true in bitcoin's history..and there seems to be no reason to conclude that bitcoin's long-term investment thesis is getting weaker rather than stronger. While these financial instruments and trading strategies (which a trader is using) may not be easily accessible to all investors(or they have access but they don't use) it is worth noting that the historical performance of long term BTC accumulation and holding has often out performed more complex trading strategies over long timeframes. While traders may boast about their occasional wins the consistent accumulation and holding strategy has proven to be effective.

And sometimes traders close the trade in loss because they think that they will get profit from other trades. And mostly traders lose many things here. When they lose 2 to 4 time they just become emotional and in emotions a man can make bad decisions which can led them to loss.

There can be some traders who win on a vast majority of their trades, but in bitcoin, historically there have sometimes been such violent upward moves in the BTC price that never end up returning, so if a person is not long into bitcoin at the time, or if a person had shorted without a sufficiently strong stoploss, it may well end up that the person ends up losing out upon years worth of gains all because they failed/refused to have a long position in bitcoin at a time that ends up being crucial to the profitability of their BTC holdings. And a little advice from me, when you do DCA, you should send your bitcoins to your wallet at least every two accumulation periods. Because currently bitcoin transaction costs are quite high. So to minimize this, it's a good idea to collect bitcoins on the exchange first, and if you have collected a large amount of bitcoins, then send them to your wallet. Moreover, you like to do DCA on bitcoin with small amounts.

Yep. BTC accumulators should be trying to figure out the size of their UTXOs, so that they are able to have options in the future, especially if there are periods in which the transaction fees might unexpectantly go higher for a certain period of time, and there could even be instances in which they stay high for long periods of time. If someone is ONLY accumulating $10 per week, then maybe they have to wait several months, even 6-12 months (or even longer) before they send their accumulated BTC holdings to private BTC addresses, and personally I am not trying to encourage holding BTC on exchanges, but it may well be more practical to make sure that a person does not have his BTC in UTXO sizes that become either unspendable or just way too expensive to spend, and even someone with $200 worth of BTC in a UTXO might not want to spend 1/4 or $50 on transaction fees to send it, but if the person has $5k in a UTXO, then spending $50 to send it might be considered reasonable (or acceptable). I know that some folks had already explained and/or theorized that poor people are disproportionately affected by periods in which the BTC transaction fees are really high and also that BTC transactions seem to be unwarranted for smaller sized transactions, and these also could be purposeful attacks on bitcoin in order to dissuade poor people from getting involved in bitcoin, and that truly could end up working to the disadvantage of poor people who do not figure out ways to accumulate bitcoin without incurring high transaction fees, and so what kinds of transaction options that are available is going to vary from location to location, and not everyone is going to have access to lower fee kinds of options in order to accumulate BTC, which likely does not stop BTC's price from going up, but it does end up scaring (or dissuading) some poorer people from getting involved in bitcoin, even though it would be to their advantage to consistently and persistently accumulate BTC during these times rather than waiting. I think everyone who invests in Bitcoin definitely has time to organize their purchases and why DCA is so popular because they invest in the long term with hundreds of purchases throughout their investment journey. Of course DCA is the best and maybe buying at the same time is not too popular if the market situation is bullish. Apart from that, at a special level, continuing to pay attention to the charts is of course not something that everyone can do because they don't have much time due to their busy work, therefore those who focus on DCA will visit the market when their purchases are due and they do it like once every two months or once a month.

And it is true as stated by JJG because in point 8 where we can change our formation when the market situation changes suddenly, that is, we make purchases before the time comes in the composition of the list of purchases that we will make. It all depends on the situation because they can act more aggressively when the market turns red and can also accumulate more when the market falls 10%.

Techniques like technical, fundamental and sentiment analysis aid anyone who is investing but they do require time and expertise which everyone dont have. If I talk about myself I dont have expertise to in TA, FA and SA, thats why I follow DCA. The idea of the importance of SA is stupid, especially when it comes to long term investment, and sure we are talking about buying on dips too.. so sure, sometimes we might want to consider what is a sufficient dip to buy and how much BTC to buy at each dipping point, which is difficult to determine, and still I doubt that SA is going to be very helpful, even though sure people do use that kind of nonsense, which sometimes means going with the sentiment and other times going against it.. but still seems like a BIG waste of time to playing with those kinds of nonsensical measures to guide what to do or what not to do... which then leads you to the conclusion of DCA'ing, which does seem to be the right outcome, but still SA that is a dumb thing to try to use or even to think about as a meaningful guide for action... but it does sound like one of tools of traders and shitcoiners. I was doing a small research that how much effective DCA will be on https://dcabtc.com/ and comes up with following data. If you doing DCA 100 dollar per week then here are results:  What I conclude from above table is that even DCA may not be effective over a small period of time but over a longer duration like 4 years or more. Your numbers are wrong and with that dcabtc.com website you need to manually calculate your level of profits, so let me show you with the 3 year period. So yes, you are correct that $100 per week would result in right around $15,700 invested over three years, and that would also result in about 0.5518 BTC (which today has a market value of about $24,280 (which is an average cost per BTC of about $28,452 ($15,700/0.5518) and a profit amount of about 55% ($24,280/$15,700)). Your table shows losses of nearly 9%.. which surely is not correct, and perhaps some error of the site because the amount accumulated would end up being 0.5518 over 3 years which is truly profitable by 55% and not a 9% loss. You can recalculate for each of the time periods and come up with differing results, but the trend is generally that every period is currently up, and the longer that you have been in then probably the greater your actual profits, even though the percentages might vary along the way, and I don't necessarily feel like going through each of those calculations myself to show the correct results, but I do use that DCAbtc.com website on a regular basis, and I have found that I have to perform some of the calculations manually in order to get the correct results. There are some other DCA calculating websites out there too.. such as https://dcacryptocalculator.com/bitcoin and https://costavg.com/[edited out]

Bitcoin is now at a high price to catch up and knowing that Bitcoin is at a high price anyone who invests in Bitcoin now is not a fool but may be investing in DCA strategy. I don't believe in the idea that you always have to buy bitcoin at low prices. Yes, I don't agree that buying bitcoins at a low price is more profitable if the price goes up later, but many investors can't wait for the price of bitcoins to go down. Investing is difficult for people who only plan to invest and wait for the price of Bitcoin to fall. It is always better to buy BTC at lower prices rather than higher prices, but part of the problem is the inability to know that the BTC price is going to get any lower than it is now or at any other time in the future. Sure, you can have theories and speculation that the BTC price is going to dip at some point in the future, but if you are wrong and the price never dips, then you are preparing for BTC prices to go down and at the same time, you may well be insufficiently and inadequately prepared for the BTC prices to go up. So frequently it is not going to be worth the potential cost of waiting unless you have already accumulated a sufficient and adequate amount of BTC to be prepared for UP. ONLY you can determine if you have enough BTC to be prepared for UP or not, and you may end up being wrong about that, which may be why some people did not accumulate in the last year and a half while BTC prices were way lower than they are currently, and then now they are feeling regrets because they could have had accumulated more bitcoin at much lower prices. At the same time, we cannot go back in time, and we can only figure out and follow through with our BTC accumulation strategy based on current conditions and our knowledge about such current conditions, and part of our knowledge should include the fact that we do not know with any level of certainty if the BTC price is going to go up or down from here, especially in the shorter-term, but we may have some ideas that in the longer term, BTC prices are likely going to be higher than they are today... There are no guarantees that the BTC prices of the future will be higher than they are today, but if we are going to prepare for the future, it would be good that we are prepared for the possibility that BTC prices are higher in the future than they are today and we act upon that possibility. If we choose NOT to act upon such possibility, then that is our choice, and maybe we will regret it, and maybe we won't. Our plan is to buy bitcoins at a relatively high price there for a long period of time so it won't affect our investment too badly. In case of long term investment we don't need to see much profit and loss because if we see excess market then it is difficult for us to hold the investment.

There are many investors who planned to invest in Bitcoin price from $20K to $25K but at that time they thought that this may be the peak of the Bitcoin market and from this position they waited for the market to go down but the market did not go down due to which they not invested.