Few articles have been so impactful on Bitcoin environment as the one from PlanB.

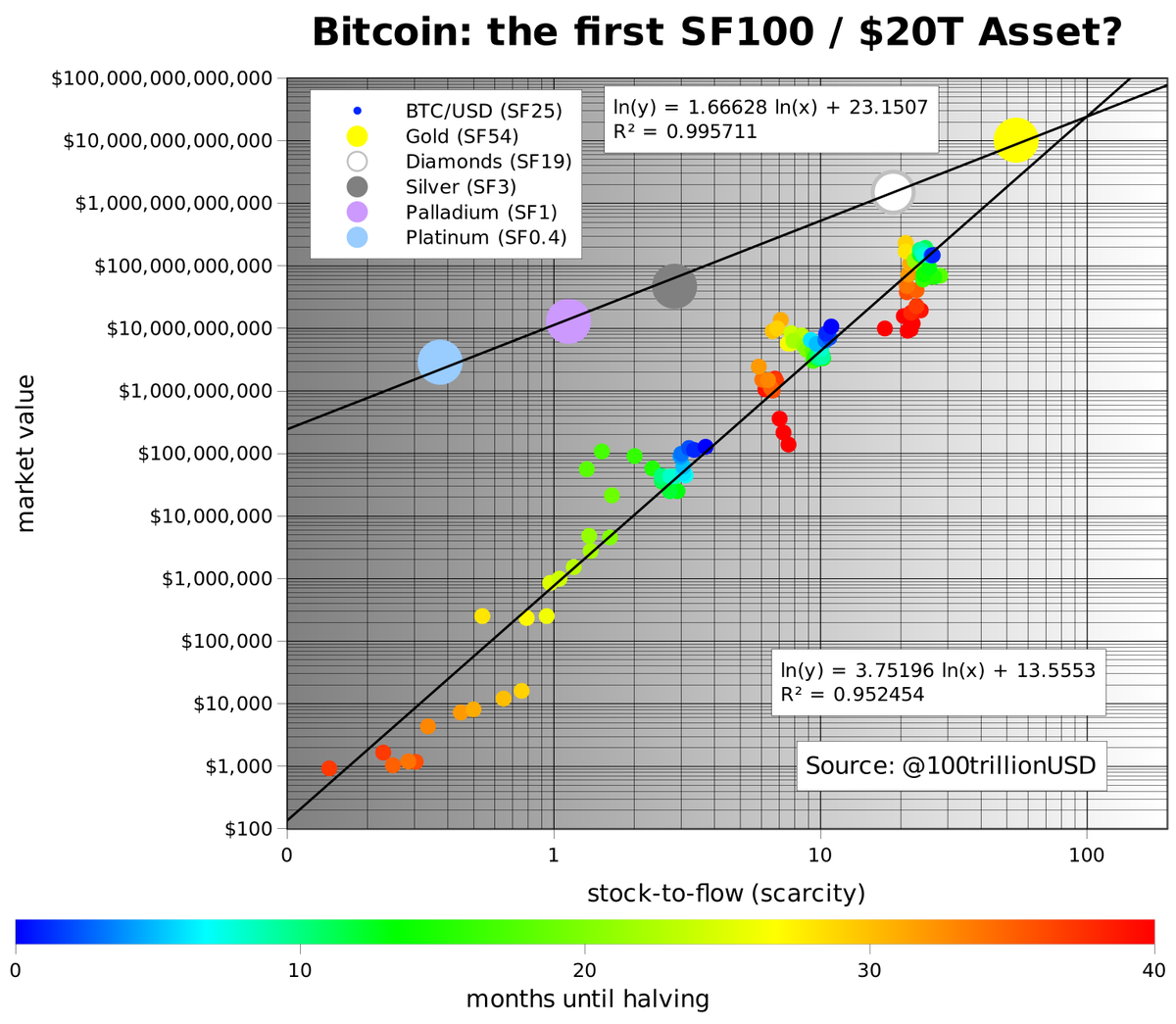

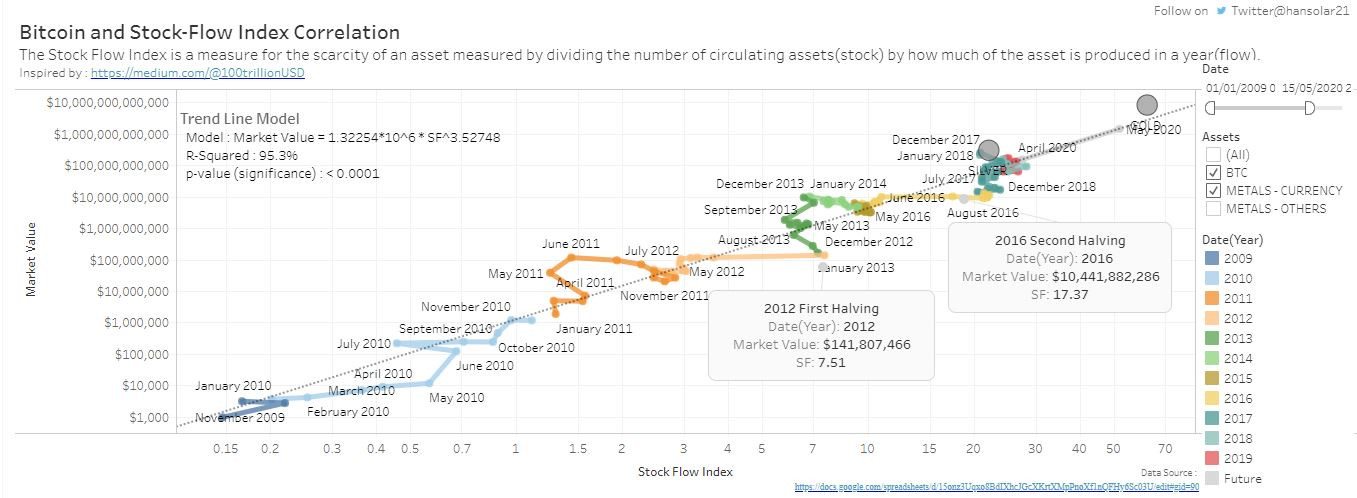

He tried to model Bitcoin valuation using Stock-to-Flow approach.

Stock-to-Flow approach is nothing new to financial world, it has long been used in physical commodities; it also was first applied to Bitcoin by Saifedean Ammous into his book "The Bitcoin Standard", as he used this approach to describe why Bitcoin is a "superior, harder money" when compared to commodities and FIAT money.

PlanB’s article has been published later than Saifedean’s book, but had a major impact: it was specifically oriented to determine Bitcoin Price and had a tremendous effect underlying the importance of halvings for bitcoin.

At the time of publication Bitcoin Price was around USD 3,400.

In this thread I will provide an explanation to some of misconceptions about this article, answering a few often posed questions, studying criticism to this model and some further development.

Link to original article:

Modeling Bitcoin's Value with Scarcity

Introduction

Satoshi Nakamoto published the bitcoin white paper 31/Oct 2008, created the bitcoin genesis block 03/Jan 2009, and released the bitcoin code 08/Jan 2009. So begins a journey that leads to a $70bn bitcoin (BTC) market today.

Bitcoin is the first scarce digital object the world has ever seen. It is scarce like silver & gold, and can be sent over the internet, radio, satellite etc.

" As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in colour, not a good conductor of electricity, not particularly strong [..], not useful for any practical or ornamental purpose .. and one special, magical property: can be transported over a communications channel" — Nakamoto

Surely this digital scarcity has value. But how much? In this article I quantify scarcity using Stock-to-flow, and use Stock-to-Flow to model bitcoin’s value.

31 Translations are already available, more will follow (I will add them here).

ArabicArmenianBulgarianChinese Croatian Czech DutchFinnishFrench Frisian GermanGeorgianGreek GujaratiHebrewHindiIndonesian Italian Japanese Korean Norwegian PersianPolish PortugueseRomanian Russian SlovenianSpanishSwedishTurkishVietnameseLive Stock-to-Flow Price:

Bitcoin Stock-to-Flow model live chart

Live Stock-to-Flow dashboard:

Bitcoin SF Analysis by @hansolar21

F.A.Q.

There are a lot of questions about the Stock-to-Flow Model. Many of those have already been answered in the many podcasts (reference after the answer). I will copy here the most recurring ones, I will use PlanB’s words to describe the answer, adding some considerations of mine in case it's required.

Q1.

Stephan Livera: I guess the other factor here to think about is that in practice what happens is markets can swing, or it can overshoot and then undershoot. Can you discuss that a little bit?

A1.

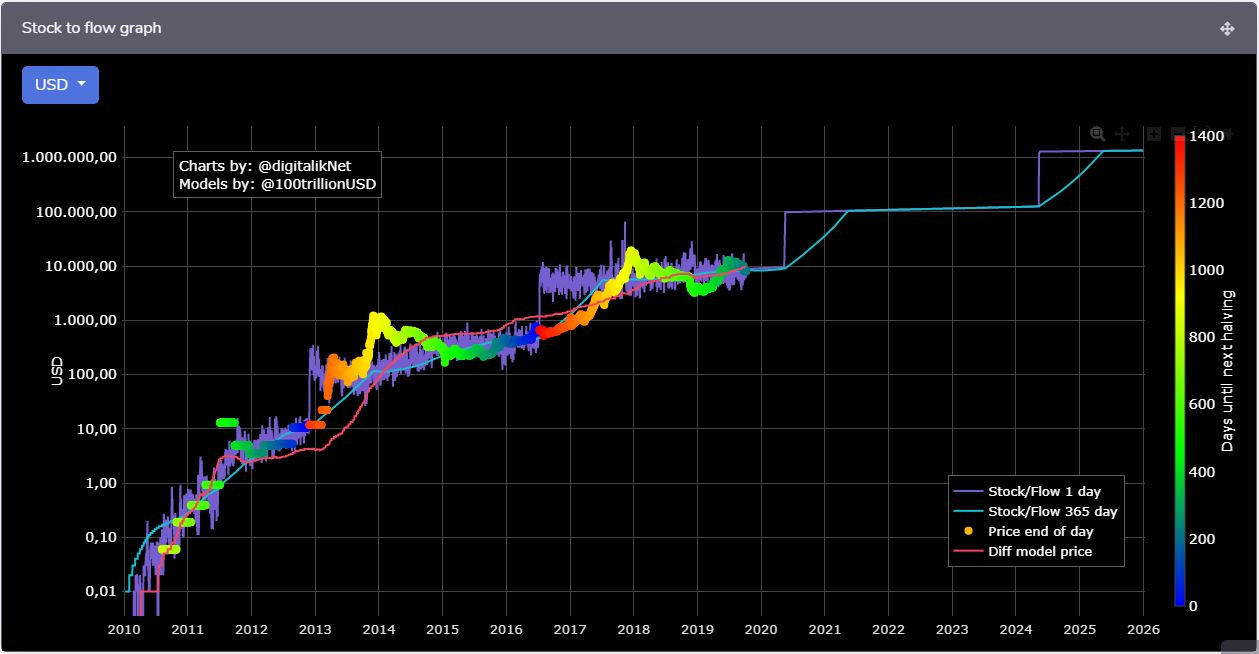

PlanB: Absolutely. Maybe when we talk later about the model itself, you’ll see it doesn’t have an accuracy of 100%, of course, because it’s a model; so all those FOMO actions and bull markets and bear fear, it’s all not in there, and you see that in the chart as well. So, the model price is very simple, based on Stock-to-Flow; but the actual market, of course, where fear and greed are playing out, so it overshoots and undershoots. Usually, what you see… “usually,” I mean the last two times… is that the market overshoots 3-10x the model value, but undershoots 50% maximum, so that’s one of the reasons why I thought, “Okay, if we’re at a model value today of a little above $6000, 50% of that $3000 should be the bottom of current bear market. But, yeah, that’s how I see it.

SLP67

Q2.

“Oh, is the halving priced in?” and I think this does speak on where you stand on other debates; for example, the efficient market hypothesis. So, as an Austrian, and even Saifedean himself I think has made a similar comment on this saying, “Look, knowledge is not given to everyone equally, and so we should not anticipate that what might be called the strong form of the EMH, or even perhaps the weak form of the EMH, is not a good way to think about things,” but then there are others from the Chicago School and other schools of thought that may believe in that more. Where do you side on that?

A2.

PlanB: That’s a very interesting point. Actually, that’s one of my first charts, the halving chart with the color overlay; it shows the Bitcoin price with the months until the next halving; and you can clearly see from that chart that the halving is not priced in, or at least was not priced in the last two times. So, my best guess would be it is not priced in now, next halving May 2020, but the efficient market hypothesis. It’s kind of weird. It should be priced in, of course. In fact, I’m a big believer of the efficient market hypothesis, or at least it should be used as a first starting point for most people that don’t have inside information, or specialized knowledge, or a big trading room available. The efficient market price is the best price there is, they can rely on that, and that’s especially true if markets are really big and liquid and efficient, and I think that’s true for the Bitcoin, in a sense. It’s like an $80 billion market.

SLP67

Q3.

Stephan Livera:[...]“Oh, can you apply the Stock-to-Flow analysis or modeling to Altcoins?” [...]"

A3.

PlanB: Right, yeah. That’s the most frequently asked question that I got, can you make a Stock-to-Flow model for Litecoin or B Cash or Ethereum. So let’s dive a little a little bit deeper there. The thing with a Stock-to-Flow analysis indeed is it’s based on unforgeable costliness. So maybe go one step back for our first-time listeners. Stock-to-flow is stock or the reserves or something like Bitcoin 17 million, almost 18 million in stock, and that’s divided by flow, so stock-to-flow, and flow is the protection. And that’s about 0.7 million bitcoins per year at the moment. And if you divide those two, you get the number 25, and 25 is the stock-to-flow number for Bitcoin.

PlanB: And it’s not just a number, I mean I called it scarcity, a quantitative measure of scarcity in the article, but really the key of stock-to-flow is the inability of production to inflate the stock. If the stock is large enough and the production is kept or restricted somehow then the production and the producers are enabled to inflate the stock. And we know what kind of problems you get when certain individuals or companies, or governments can inflate stock. Look at Zimbabwe for example where Mugabe can print, and did print as many Zimbabwe dollars as he wanted, and with disastrous effects for the economy. And the same with Maduro in Venezuela. And you could say the same from the dollar, and the Euro at the moment as well with quantitative easing. They’re printing… I’m not allowed to say printing, but creating electronic dollars, and Euros, and Yens to bail out banks, and whole economies.

PlanB: So the inability of production to inflate the stock that’s what stock-to-flow really is about to prevent things that we see in fiat currencies in Zimbabwe and Venezuela, and currently in quantitative easing. So if we apply that to crypto, if you like, then the thing like decentralization becomes very important. If one person, one company or a country can decide to change the monetary policy, it’s not decentralized. The producer, this person or government, or company can, it will be able to make more coins and inflate the stock.

PlanB: For example, take Ripple. The CEO of Ripple can premine another hundred billion ripples if he wanted that. And if you look at Ethereum as well, there was no cap on the supply of Ethereum, and now they changed that. So they’re changing the money supply. It’s not what it was or what it will be, the money supply, but the fact that they can change it is… Well, that’s the thing I would be worried about as an investor. And that’s totally different in Bitcoin. Bitcoin, you have this truly peer-to-peer network with many nodes, and you can verify the money supply yourself. You’re not dependent on a third-party like a bank or company, or a data center to tell you how much the money supply is.

PlanB: You cannot change the money supply or change that magic 21 million coins number, and if you do you’re basically hard-forking away from Bitcoin. And, yeah, I guess nobody will follow you. A bit like Bitcoin Cash with the big blocks. Yeah, but you can do it, but don’t expect people to follow you. Maybe a last thing to mention is that that on the theoretical side of stock-to-flow on Altcoins, money has to be hard to produce, expensive like gold. So there’s lots of gold in the oceans, and I even read this article about the asteroid, the golden asteroid recently.

PlanB: It would be very expensive to mine that gold in the ocean or asteroids, and that prevents it from happening, I guess. And the same for Bitcoin. It has a hash-based proof-of-work with a very high hash rate. So it costs a lot of electricity to mine bitcoins, and that’s totally different for a lot of Altcoins of course. So for example, Ripple again has no proof-of-work or Bitcoin Cash has almost no hash rate, so no security. Again, that would make me a little bit nervous as an investor, and people who’d like to know more about this, it was Nick Szabo who invented the term, and described the unforgeable costliness in great lengths. So make sure you read that all.

PlanB: On top of this theoretical argument of unforgeable costliness, I decided a bit against my will, but because there was so much demand to model Altcoin’s with stock-to-flow. Just to see if practically it would be possible to do it. And that’s in fact one of the strains of research I’m working on right now with a team of quants. And I can tell you a little bit already what the result is, and I tweeted a little bit about that as well. They all have very low R-squares, so the models don’t really fit very well. For example, Litecoin which is very interesting because the halving is very soon. Litecoin has an R-squared of 32%. That’s versus Bitcoin 95%. 32 is really low. It basically says there is no relationship there. The same with Ethereum around 50% R-squared. Coins like DCR, Decred. I don’t know how you pronounce it properly, but 0% R-squared.

PlanB: So the theoretical argument of unforgeable costliness already makes you expect that it is not possible, but if you actually do the work and make the stock-to-flow models the outcomes are not very good. [...]

SLP86

A few SF graph for altcoins: clearly there's a lack of correlation (and cointegration) between SF and value:

Q4.

Stephan Livera: Yeah, it’s fascinating stuff. And this table that you’ve got, so you think, so just for the listeners, it’s showing the year, the halving, and the model predicted price. So as you said 50,000, 400,000, and then 3.2 million for the 2028 halving. Now, to the extent that stock-to-flow modeling works, so again caveat, this is not economic law, it’s some sort of modeling, but to the extent that the modeling works. Do you have any reflections on how many cycles we could anticipate this working for?

A4.

PlanB: Yeah, that’s also a discussion on Twitter, lots of questions about exactly this infinite value if you wish. If you follow the table, we could go all the way to 2140 when the flow is zero, when there’s no more new bitcoins, only fees. And the theoretical value how to Stock-to-Flow model would be infinite. So how can that be? And basically I think this is a very theoretical argument. And I’m a very practical guy. So if I look at the next three halvings alone. So we’re now at, say, 100, $200 billion market. Every halving this market goes 10X. So after 2020, we go to one trillion, after ‘24 we go to 10 trillion. And after ’28, so the third halving we go to a 100 trillion US dollars, hence my name, my Twitter handle.

PlanB: I think that we don’t have to wait until 2140 before the model breaks or before something breaks. I think we’ll be there sooner than we think. I think we’ll be there well, maybe 24. Somewhere between 24 and 2028 because 10 to $100 trillion Bitcoin market that’s enormous if you compare it to the US dollar for example. It has a monetary base of three trillion, and I think an M2 of about 12 or 14 trillion. So then that means that somewhere between 2024 and 2028, bitcoin is bigger than the US dollar. It basically means the US dollar will die, and we’ll be measuring things in Bitcoin.

Stephan Livera: Very bullish.

SLP86

Here the image detailing what they were referring to:

Twitter link

Twitter linkWhen Satoshi picked the 21 millions as the total cap to BTC supply made some assumptions on the total money supply, and figured out that if this limit was equalled by Bitcoin, then a satoshi, the minimum unit of bitcoin, a would have been worth a singe cent, the minimum practical unit of account. This backwardly then implied a single bitcoin would have been worth one million. (

Hal Finney was involved into this choice)

For Bitcoin to appreciate beyond this limit of course we need the dollar to lose value: beyond a certain level it is not bitcoin appreciating, it's dollar losing value in real term. When bitcoin will be at 3,200,000 USD maybe a liter of milk will be at 50 USD: we will be measuring the prices with a shorter and shorter meter.

Stock-to-Flow model independent review:

- Quantifying Uncertainty In The Bitcoin Stock-to-Flow Model

The linear regression of the log of the values seems reasonable but the uncertainty (variability / error) large enough, especially when brought back to a linear scale, that it makes it difficult to make useful specific predictions. Then again, that alone is useful information.

- Falsifying Stock-to-Flow As a Model of Bitcoin Value

This article explores if there is a stock-to-flow relationship to Bitcoin value. The proposed log-log model is tested for statistical validity against the least squares assumptions, for stationarity in each variable and for potential spurious relationships. A Vector Error Correction Model (VECM) is built and tested against the original stock-to-flow model. Whilst some of these models out-compete the original model in terms of Akaike Information Criteria, all of them fail to reject the hypothesis that stock-to-flow is an important non-spurious predictor for the value of Bitcoin.

Podcasts where PlanB discusses his article:

Stock-to-Flow appearances in other contexts:

- State-Backed German Bank Says Bitcoin Will Leap to $90,000 in 2020

The German bank BayernLB has published a report on Bitcoin (BTC) versus gold, in which it predicts a big leap for the cryptocurrency in 2020.

Bitcoin outshining gold?

On Oct. 1 the Munich-based, state-owned bank published its latest research report that seems to suggest that the forthcoming Bitcoin halving effect is yet to be factored into its current price of about $8,300.

The financial institution explained that gold had to earn its high stock-to-flow ratio “the hard way over the course of millennia.” Bitcoin on the other hand will most likely succeed to obtain a similar stock-to-flow ratio to that of gold in the coming year, the report predicts.

Direct link to research paper:

Is Bitcoin outshining gold?

This post is eligible for my project:

I am a strong believer in the utility of local boards.

I am lucky enough to be able to express myself in at least a couple of languages, but I know this is not the case for everyone.

A lot of users post only in the local boards because of a variety of reasons either language or cultural barriers, lack of interest or whatever other reason.

I personally know a lot of very good users (from the italian sections mainly, for obvious reason) who doesn't post in the international sections.

I think all those users they are missing a lot of good contents posted on the international (english) section or on other boards.

If you think you can help here, just visit the thread!