fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

It might be a good idea to switch to new S2FX that is stock-to-flow model updated with cross asset that may be even more precise than regular S2F model we used so far. PlanB removed time and included other assets like Gold and Silver in his calculation formulas, you can check his reasons for doing that in his medium post and go visit new s2fx model chart: https://stats.buybitcoinworldwide.com/s2fx/I guess those two models are quite different. But as you correctly say, S2FX removes time from the model, comparing stock to flow across assets, and not across time. From the SLP243:

To be honest, I like both models — they’re both my babies! But if I had to choose, I would choose the S2FX model, because it’s not a time-series model so it’s more robust. It’s always better to have time out of the equation, because we’ll get maybe into that later, but if you correlate to time-series, there is a big risk of correlation being spurious. And that risk is less if you don’t have time series! The other big thing is that we can now interpolate instead of extrapolate! If you have a time-series model — it can be the number of transactions, it can be the time itself, it can be the number of Bitcoins in existence — then you don’t know what the number of transactions in the future are, and to base the prediction on top of that is a risky thing! It’s extrapolation — it’s based on data that you don’t have in your data set! But the S2FX model, we have gold being at a higher stock to flow, and real estate being at a higher stock to flow and higher value, so we can actually interpolate within the data that is used to fit the model, and that is a very, very strong argument for this S2FX model!

In the graph you posted, instead, there still is a time axis, so I'm not entirely sure what it is really plotted on that graph. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

|

|

Whoever mines the block which ends up containing your transaction will get its fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 01, 2021, 10:51:12 PM

Last edit: May 15, 2023, 11:45:12 PM by fillippone Merited by vapourminer (1), JayJuanGee (1) |

|

Excellent post by PlanB  Well, once again he's referring to something he has stated on the last Stephan Livera Podcast: Here the relevant passage: Stephan Livera [08:19]: And so probably it’s a good point also to discuss some of the critiques of some of the modeling. The thing is, it’s kind of shifted over time, right? And I guess we’re talking about both the different models, but with the S2F, one of the interesting developments was this idea of cointegration, which then later it seems that part has now been shown that we can apply the cointegration test. From your perspective, what does that mean? Does it essentially just mean we don’t have the confidence that would have been provided by cointegration, but you believe that the model might still provide some high-level predictive power? Is that how you would summarize it? Or how would you summarize it? PlanB [09:00]: A bit differently! By the way, I got a lot of critique on the models, which I also invited, because I think the models are only getting better if they’re open sourced and discussed! And the point you mention about cointegration was one of the more interesting and very intelligent discussions! I liked that very much! It’s important to know that it only applies to the first model — the time-series original S2F model — and not to the S2FX model. And what it basically does — it’s a measure that gives you some certainty that it is not a spurious regression, not a spurious correlation. Because there’s always a risk that you find correlation [but] that there is no causation or no relationship at all! It’s just a fake, fake correlation — that’s always a risk! And to be clear, that is still a risk! It could be, the relation between stock to flow, scarcity, and value, could be spurious—although every day that seems less likely! It is important to make that point! Now with cointegration it’s actually a test, and that test — if you apply it and it proves cointegration — then the less likely, it’s not certain, but the less likely the relationship, the correlation, is spurious, is false. So there’s a lot of probability that it’s a causal relation and a correlation that you can use for making predictions! But the discussion was quite interesting because it was actually held with a Dutch guy, an Australian guy, a German guy, and me! There were four people working on the same data and the same test. And first we all did the same test and the test clearly showed cointegration! And cointegration means that the series stick together very closely. The story about the drunk and the dog was made. The drunk goes on the street to walk his dog, the dog is on the lease, the drunk goes everywhere, the dog goes everywhere, but the distance between the drunk and the dog can never be longer than the leash! And that’s what you measure — the leash! They always stick together, and actually that’s what you see in the data! If you look at the Bitcoin price, it sticks to the model, it tracks the model really really close! And if you do the test, you also measure there is cointegration. But then the German guy said, Well, one of the assumptions of the test is that both variables are stochastic and not deterministic, so they should be random and not predetermined. And of course, stock to flow is predetermined! So we couldn’t apply the test! So although the test showed cointegration, theoretically and practically we cannot use it! But it clearly shows the moving of the price around the model. The test also shows it, but we cannot use it! Yeah, that was the end of it right there! You could say, Okay, we should use another test, or develop another test, because it clearly sticks to the model—the price. But on the other hand, it’s maybe best to be conservative and say that there is no cointegration and probably the relationship is spurious! So, that was the end of that discussion! On the other hand, if there’s no cointegration, it doesn’t mean there is no correlation. And the cointegration only works on the time-series model — so the original S2F model. By the time the discussion was at its peak, I introduced the other model, the S2FX model, and there of course you see an even higher R2, and even higher correlation, and we cannot apply the cointegration test over there. Yeah, that was a very interesting discussion at the time! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 08, 2021, 11:07:40 PM

Last edit: May 15, 2023, 11:44:27 PM by fillippone |

|

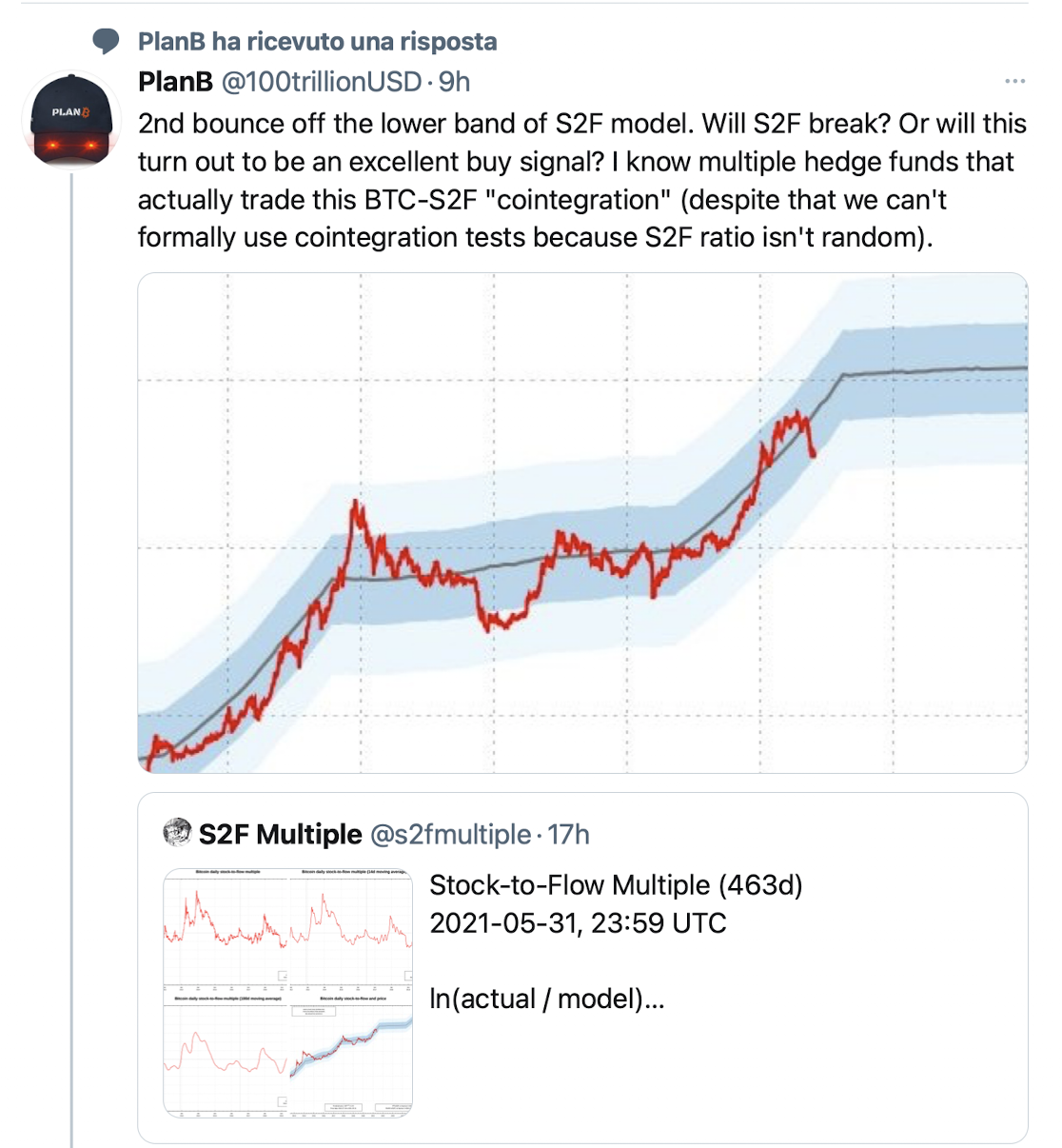

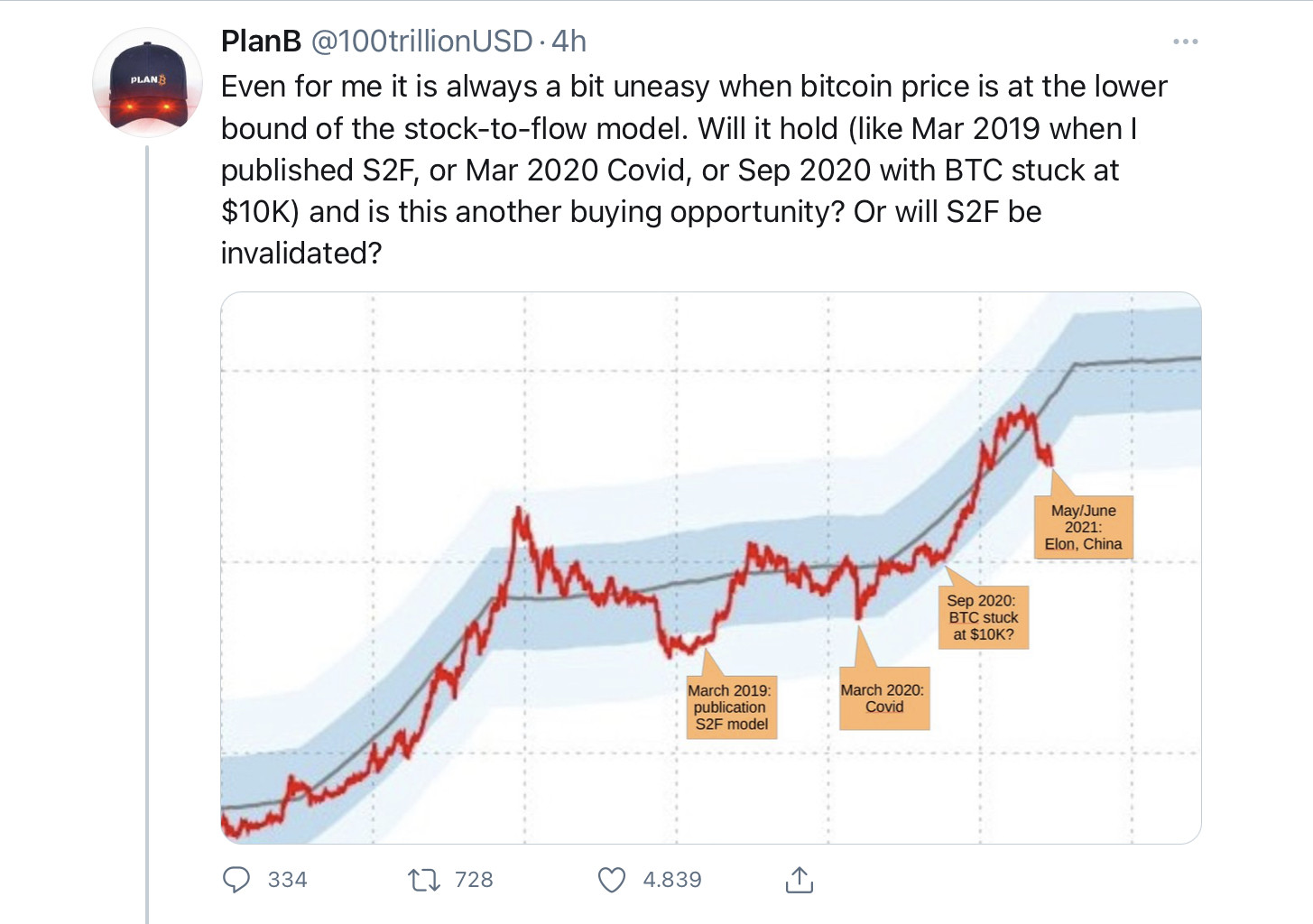

A little update today from PlanB on the same topic:  https://twitter.com/100trillionusd/status/1402213619354456065?s=21 https://twitter.com/100trillionusd/status/1402213619354456065?s=21Here is a link to the original image:  Blue bands are the S2F model bands: the price is expected to stay inside the blue bands for most of the time. The more it stays outside of that zone (i.e. beginning of 2019) the more likely a pullback is expected. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 13, 2021, 10:30:54 AM

Last edit: May 15, 2023, 11:42:14 PM by fillippone Merited by paxmao (3), JayJuanGee (1) |

|

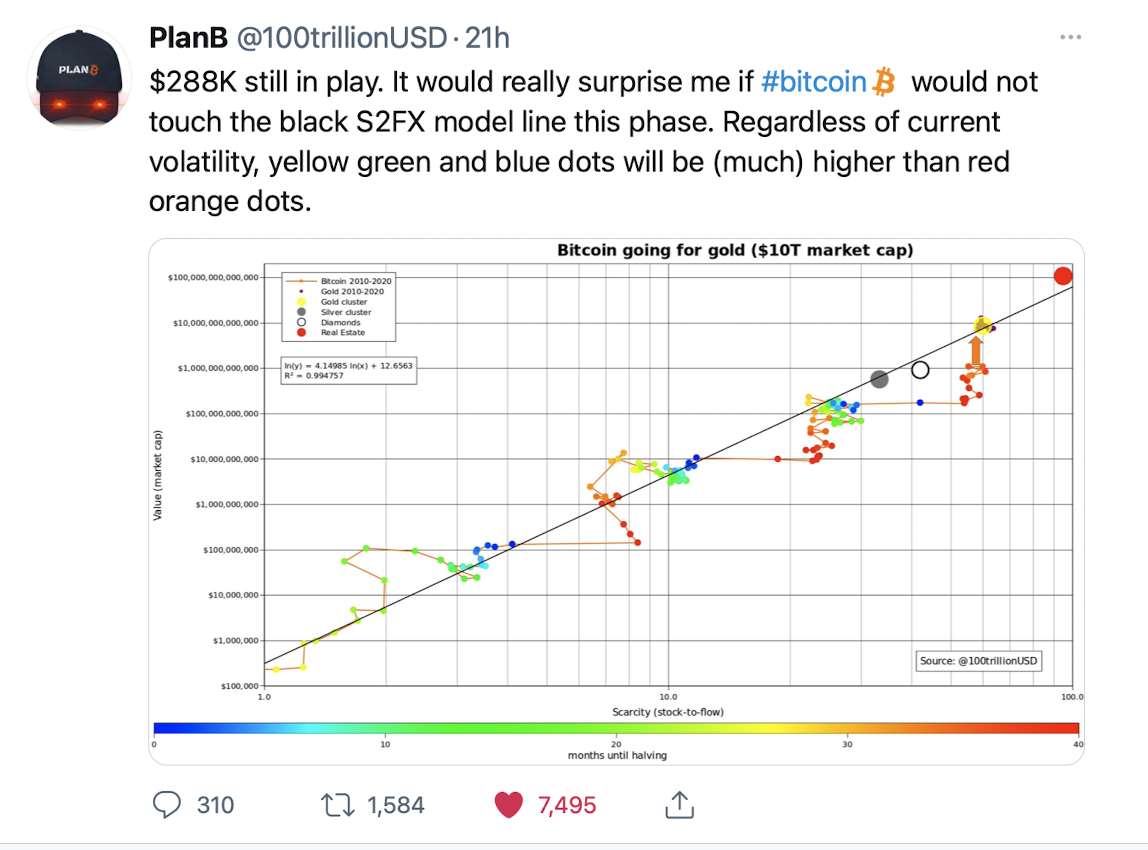

All is still good with Stock to Flow. The drunk man walks with his sill walking his dog on a leash:  https://twitter.com/100trillionusd/status/1403701397774811138?s=21Link to image https://twitter.com/100trillionusd/status/1403701397774811138?s=21Link to image288K still in play. Hopefully. I am personally getting a little bit nervous with price fiddling with 50% of the model value for so long. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 13, 2021, 05:42:53 PM Merited by fillippone (3) |

|

I do understand that if you observe that the BTC price is deviating a certain magnitude from a price prediction model, such as 50% below such model, and the deviation endures for a certain period of time, whether that is 3 months, 6 months, a year or longer, then likely the model need to be adjusted to take that long standing and relatively large deviation into account. At the same time, I personally doubt that we should be giving too many shits about how far or how long that the BTC price might be deviating from such line (or expectations that are shown in the model), and any good model will just attempt to take that into account and to adjust accordingly. Sure, one thing would be to conclude that the model is broken, and another thing would be to attempt to take into account of new facts (to the extent that they are sufficiently material and sustainable) to tweak the model. I give very little weight to any model having high degrees of certainty to future performance of something like BTC price dynamics which includes a variety of factors (including somewhat game theory plays of human behavior) that go beyond merely assessing historically how those various factors have affected BTC price... even while at the same time the stock to flow model does seem to contain a lot of extractability powers to show likely future performance by already had happened past happenings. Of course, one question remains regarding how much deviation and for how long would be necessary in order to justify a BIG ASS tweakening of the model.. and even the worse case scenario of conceding that the whole model is broken. Of course, Plan B does like to frequently and regularly plot new data points into the model in order that we are able to see how far we might be deviating from where the model says we should be and we should also be able to figure out long such deviation has been taken place - including attempting to assess whether such ongoing deviatening rises to a material and substantive level that justifies tweakening or completely reassessing the model in terms of maybe a shift in the line might become appropriate, at a certain point, and sure maybe there is some math that can be applied in terms of if the model is deviating for x quantity for y amount of time then a tweakening or rethinkening is justified. Any of us who attempt to appreciate the model can surely proclaim that it is the worst model out there, except for all the other models, and surely, I like to reduntantly describe the necessity to give weight to the four year fractal (which of course is already in the model), and considerations of how well is exponential s-curve adoption based on metcalfe principles and networking effects coming along - which is not contained in the model, but who cares, we can still assess the model in terms of thinking about those kinds of additional considerations.. and perhaps even saying that the model should be adjusted up or down because demand is higher or lower than we had thought--- blah blah blah... demand is not in the model, but still does not break the model to tweak it a bit, if necessary.. we do not seem to be close to being there.. but maybe I don't know... how long do you think that our staying 40-50% of the model or even going down from here and reaching higher levels of deviation would justify some kind of "oh sheeeiiittt, maybe we need a tweakening?" Sure, the answer could get addressed, if the BTC price were to recover back into the upper $40ks and even into the lower $50ks, and we could proclaim, hey even though the price is still below where the model says it should be, at least we are not 40% to 50% where the model says we should be, so then the urgency of the need for a tweakening becomes less compelling to carry out. Of course, I prefer UP to DOWN, so it would kind of suck to end up either having $64,895 serve as the high for this cycle resulting in a long period of down below what the model says that lasts for a year or longer, right where the model says we should be going UP, then we either go sideways or end up experiencing further correction that lasts well into the period where the model shows that we should be UP higher or going UP. I personally still proclaim that it is a BIG so fucking what. Don't get so goddamned attached to models predicting future performance and just try to plug those new facts into the model and see if some variation of it still works or could work.. in order to both account for facts.. and to give some kind of expectation of "where this thing might go." I know that I am rambling a bit, but I still think that we are going to need a pretty decently sized deviation from the model to take away our hopes and dreams of UPpity.... while at the same time, each of us better be taking these kinds of models with a large enough grain of salt in terms of both our financial and psychological expectations. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 20, 2021, 10:51:40 PM

Last edit: May 15, 2023, 11:39:24 PM by fillippone |

|

Apparently, I am not the only one getting nervous with Stock to Flow: PlanB is trying to spread some hopium, while market price still struggles to grow back above 50% of model value.  https://twitter.com/100trillionusd/status/1406577006230245376?s=21 https://twitter.com/100trillionusd/status/1406577006230245376?s=21I don't know the fundamental reasons but he's going to publish an article later this year. Those prices look weird to me: where they come from? he also predicted a small dip in August, due to worsening of "fundamental conditions". I'd like to know more. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

arallmuus

Legendary

Offline Offline

Activity: 2534

Merit: 1403

|

|

June 20, 2021, 11:49:00 PM |

|

Those prices look weird to me: where they come from? he also predicted a small dip in August, due to worsening of "fundamental conditions".

I'd like to know more.

Im quite confused of what he meant with " weakness" in June and July but well some people ( tradingview ) are saying that we are going down in July probably below 30k. On top of that , he seems pretty confident with that tweet. He used the word 'my worst case scenario' instead of best case scenario so that show that he is confident with the price will not go anything lower than $47k on August , thats sick though. So what would happen if somehow this S2F model breaks and we are not heading to anything higher than lets say, 50k this year or probably next year? Alot people seems to trust this S2F model alot though |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 22, 2021, 06:25:58 AM

Last edit: May 15, 2023, 11:37:40 PM by fillippone Merited by JayJuanGee (1) |

|

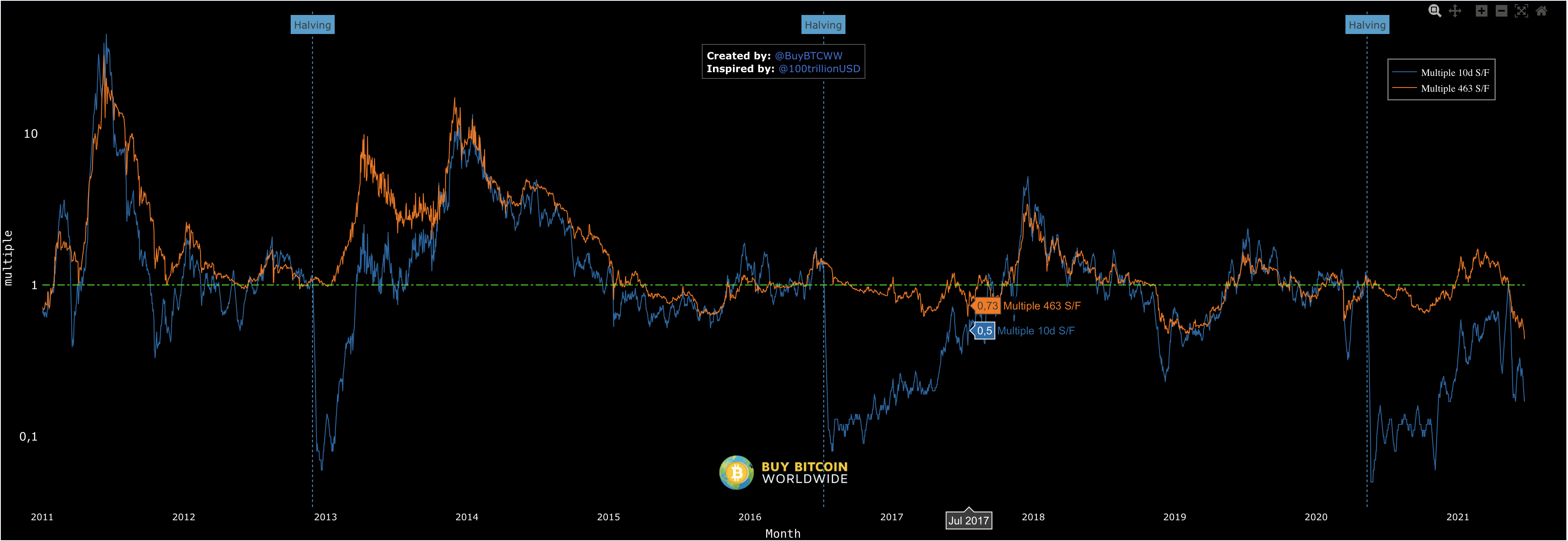

It's official: according to digitalik.net data, stock to flow multiple has never been so low:  What is stock to flow multiple?

This chart is showing Bitcoin stock to flow model price compared to actual close price for a given day. Stock to flow is a value calculated when total number of Bitcoins in circulation is divided by number of Bitcoins generated in a day and then divided by 12. It shows how many years is needed in order to produce all Bitcoins currently in circulation. The higher the number the higher scarcity. If the scarcity is higher then the price goes up. Why is this important? Because every 210.000 blocks there is an event called "halving" which means that reward for mining Bitcoin is cut by half which means monthly production is also cut by half. That makes stock to flow ratio (scracity) higher so in theory price should go up.

On the chart above, X axis is showing days and Y multiple value of current price against model price. Different colors represent number of days until next halving (see color bar on right side).

As you can see, we are at the minimum value ever of 0.46. This means that for the first time in history model price is more than twice the market price. Is market really starting to deviate from the model? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1372

Merit: 2011

|

Is market really starting to deviate from the model?

If I'm reading the chart correctly, the answer would be no. As of today, there is a divergence between what the model predicts and the price on the downside, but in the past there was on the upside and the price returned to the median. Another thing is whether we doubt that the model is correct or not, but as a model that explains quite reliably the behavior of the price as a function of supply, I do not think that the price today falsifies it. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 23, 2021, 01:12:37 PM

Last edit: May 15, 2023, 11:37:24 PM by fillippone Merited by JayJuanGee (1) |

|

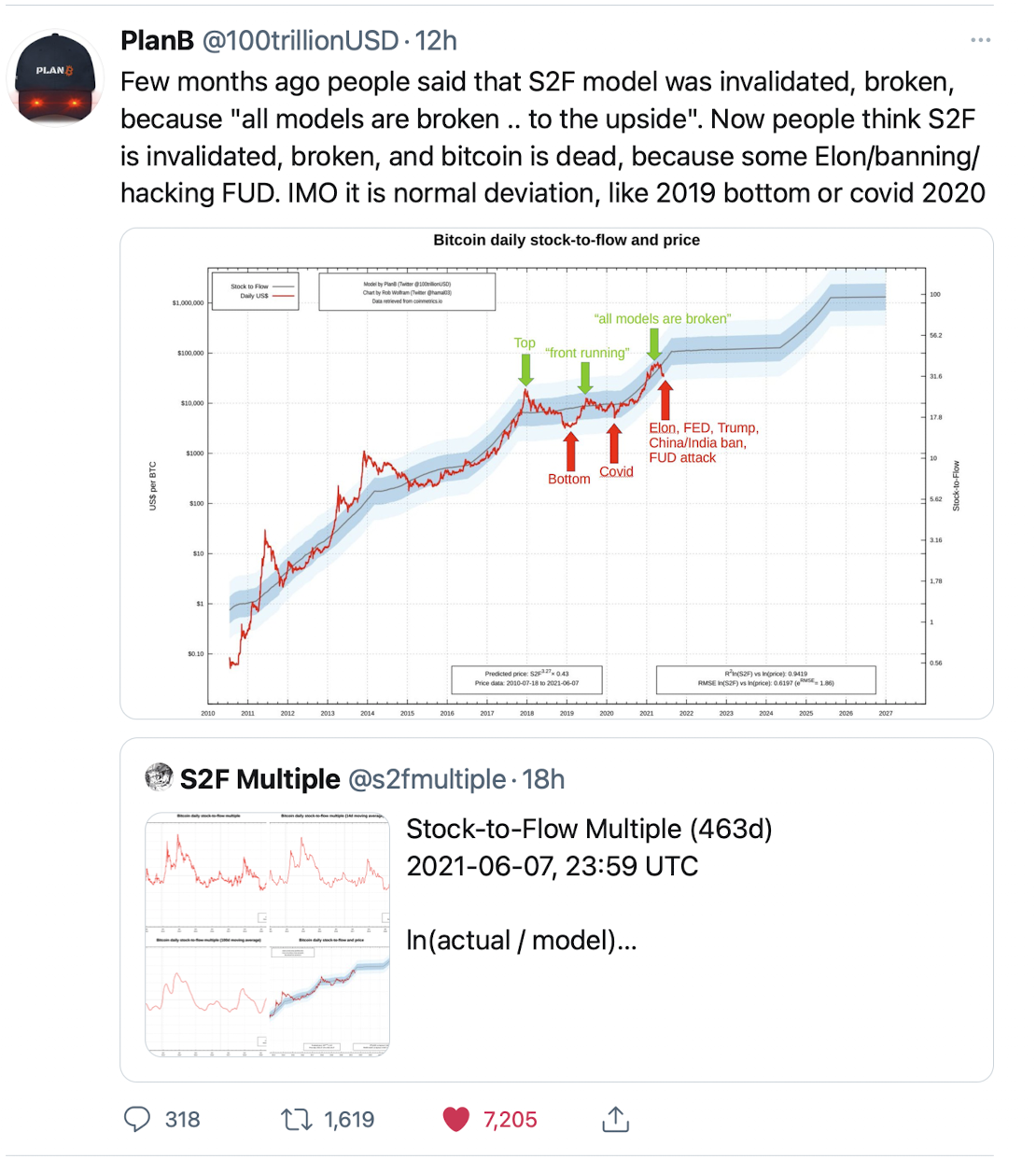

Is market really starting to deviate from the model?

If I'm reading the chart correctly, the answer would be no. As of today, there is a divergence between what the model predicts and the price on the downside, but in the past there was on the upside and the price returned to the median. Another thing is whether we doubt that the model is correct or not, but as a model that explains quite reliably the behavior of the price as a function of supply, I do not think that the price today falsifies it. As PlanB himself states, this situation, albeit new, is still within the boundaries of the functioning of the model:  https://twitter.com/100trillionusd/status/1407620265475989506?s=21 https://twitter.com/100trillionusd/status/1407620265475989506?s=21As someone in the comments recalled, the 1SD band means that 33% of the value should lay outside the darker band. So no major issue unless we don’t cross the model line before the first months of the next year. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 23, 2021, 05:23:21 PM |

|

Is market really starting to deviate from the model?

If I'm reading the chart correctly, the answer would be no. As of today, there is a divergence between what the model predicts and the price on the downside, but in the past there was on the upside and the price returned to the median. Another thing is whether we doubt that the model is correct or not, but as a model that explains quite reliably the behavior of the price as a function of supply, I do not think that the price today falsifies it. As PlanB himself states, this situation, albeit new, is still within the boundaries of the functioning of the model:  https://twitter.com/100trillionusd/status/1407620265475989506?s=21 https://twitter.com/100trillionusd/status/1407620265475989506?s=21As someone in the comments recalled, the 1SD band means that 33% of the value should lay outside the darker band. So no major issue unless we don’t cross the model line before the first months of the next year. I did a quickie glance at the comments from the tweet too, and sure if the dark blue is 1 standard deviation and then maybe the lighter blue is 2 standard deviations, I am thinking that the commenter is probably suggesting that there can be "up to" a certain amount of going outside the 1 standard deviation bond (which he stated as 33%) in order for the model to still be valid. It seems a bit off to be proclaiming that there has to be deviation of 33%.. that is almost ridiculous if you think about the matter. Surely when I do a quickie eyeballing of the chart, probably we are lucky to have even up to 10% of the price points to be outside of 1 standard deviation, and actually that seems like so far the model remains solid as fuck.. In other words, the less deviation the better, but some deviation is expected "up to a point" that is far from even close to being reached. Even if we were approaching 33% of the data outside of 1 standard deviation, that might start to cause some justifications that there may be ways to tweak the model a wee bit to make it more in line with the data rather than proclaiming that the model is actually broken.. I am not even sure what kind of tweak might be reasonable without accusations of trying to conform the data to the theory.. but whatever, punchline still seems to remain that the amount of deviation that we have experienced to date is actually surprisingly low and perhaps even a deviation level for ants. hahahahaha |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

August 03, 2021, 08:24:08 AM Merited by fillippone (1) |

|

It looks like we're back on track again and the S2F model keeps marching on: July closing price @$41,490 means that the S2F bounced from the lows, like clockwork. Also realized cap (average price at which all 18.77M BTC were last transacted) is rising again (calculated over all UTXO's). Last but not least, the few sellers at the moment sell at a profit. More, of course, at https://twitter.com/100trillionUSD |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

September 14, 2021, 02:07:34 PM

Last edit: May 15, 2023, 11:04:07 PM by fillippone Merited by JayJuanGee (1) |

|

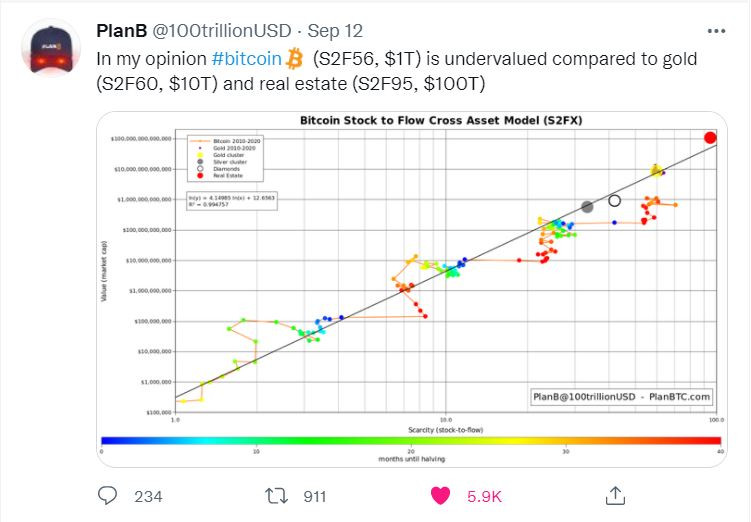

While Stock to Flow is "suffering", Stock to Flow Cross Asset Model is still in play:  Bear in mind this model is inherently different from Stock to Flow: this model compares the ratio Stock to Flow ratios across several asset classes with each asset class market valuation, without taking time into consideration. Essentially, SXF takes a picture of the relative price of each Stock to Flow ratio: turns out you can buy Bitcoins, with his 56 Stock to Flow, cheaper than Gold, which has a similar S2F ratio of 60, but an order of magnitude bigger market valuation. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

ndalliard

|

yesterday i watched an interview with pomp and planb (i watched it, mainly cause according to pomp his youtube channel was shortly deleted because of the video, although this is just speculation and the two hours were a waste of time imo)my critique would be: how can you predict the future price of something without taking demand into account? that is the second side of price. supply and demandOne of the most important tweet bt @100trillionUSD answering the most debated question: Why isn't demand factored in the Stock to Flow model? Some say S2F(X) model must be wrong because #BTC BTC price is determined solely by scarcity (supply) and demand does not play a role.

However Nobel prize winning Capital Asset Pricing Model (CAPM) determines asset returns solely based on risk (volatility, dd) .. no demand, no supply this is a rather stupid explanation. just because a nobel prize winner makes the same mistake doesn't prove it is the right thing to do i more or less read everything in here, but maybe i missed something. i am also no mathematician or someone with a statistical background. i am open to change my mind. the model might be right some more years, cause i think the demand for bitcoin will rise in the future. but the demand is still an unkown in the equation and doesn't "show the future". any thoughts? |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 12, 2021, 11:22:37 AM Merited by JayJuanGee (1) |

|

my critique would be: how can you predict the future price of something without taking demand into account? that is the second side of price. supply and demand

Well, I had a thought on this point and I think there is at least a couple of points to mention: - The reference to CAPM, and in another interview to the Black&Scholes model, it is not meant to refer to their respective inventors winning the Nobel Prize, rather referring to the fact a class of models that don’t take demand in account does exist, and works, or worked, pretty well for a few decades. So, the lack of demand in the factors of the S2F model is not per se and indicator that the model is flawed

- S2F models, without taking on consideration the demand, has an explanatory power of the 95% of the variance of bit pin price. Hence, modelling demand into this, a really cumbersome task, would improve the model of only 5%, at a great complexity cost. Are you sure this is going to dramatically change the global picture? Take into account S2F has never been a trading model, only a “final state” model, providing long term predictions.

Hope this clarifies a little bit. This is anyway my comprehension of the matter: happy to discuss if further. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

ndalliard

|

- The reference to CAPM, and in another interview to the Black&Scholes model, it is not meant to refer to their respective inventors winning the Nobel Prize, rather referring to the fact a class of models that don’t take demand in account does exist, and works, or worked, pretty well for a few decades. So, the lack of demand in the factors of the S2F model is not per se and indicator that the model is flawed

i fail to see how "a model exists that doesn't take into account demand" proves that the model predicts the future, ignoring one side of the equation it wants to predict (price is nothing else than supply and demand). more generalized: how do ~10 years of data and ~3 cycles from the past predict the future? especially if we don't know the demand, which of course is impossible, because no one knows the future... - S2F models, without taking on consideration the demand, has an explanatory power of the 95% of the variance of bit pin price. Hence, modelling demand into this, a really cumbersome task, would improve the model of only 5%, at a great complexity cost. Are you sure this is going to dramatically change the global picture? Take into account S2F has never been a trading model, only a “final state” model, providing long term predictions.

it doesn't provide longterm price prediction cause it won't hold in some years (planb himself said that) |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 12, 2021, 02:11:08 PM |

|

i fail to see how "a model exists that doesn't take into account demand" proves that the model predicts the future, ignoring one side of the equation it wants to predict

According to this model, demand is not in the equation. For you it is part of the equation, not for the model. For the model price is not the result of demand and supply, but ultimately only a function of S2F, or supply.

it doesn't provide longterm price prediction cause it won't hold in some years (planb himself said that)

The model can be wrong for sustained amount of dollars, for sustained amount of times, but price will eventually hover around the model price in the long run, like a “dog on a leash” or “ drunk man walk”. This is why you shouldn’t trade in this model, as it can stay wrong for bigger amounts of dollars or longer periods than you can remain solvent. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

ndalliard

|

|

October 12, 2021, 02:24:11 PM |

|

According to this model, demand is not in the equation.

For you it is part of the equation, not for the model. For the model price is not the result of demand and supply, but ultimately only a function of S2F, or supply.

price is determined by supply and demand, isn't that a fact like 1 + 1 = 2 ? the model is wrong if it claims to predict the future price without looking at demand The model can be wrong for sustained amount of dollars, for sustained amount of times, but price will eventually hover around the model price in the long run, like a “dog on a leash” or “ drunk man walk”.

sorry i don't get it: why will the price eventually hover around the model price? |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 12, 2021, 02:32:36 PM |

|

price is determined by supply and demand, isn't that a fact like 1 + 1 = 2 ? [

The price of an option on a stock has nothing to do with supply and demand. It relies on non-arbitrage condition that determine the unique price. Not saying this model relies on non-arbitrage hypothesis, but no, price is equal to match of supply and demand is not 1+1.

sorry i don't get it: why will the price eventually hover around the model price?

Model cannot micro-estimate or precisely track the bit on. Price, but if you want it to be right, in the long run price has to recover to model price. That’s it. Not too scientific. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 12, 2021, 03:12:54 PM |

|

According to this model, demand is not in the equation.

For you it is part of the equation, not for the model. For the model price is not the result of demand and supply, but ultimately only a function of S2F, or supply.

price is determined by supply and demand, isn't that a fact like 1 + 1 = 2 ? the model is wrong if it claims to predict the future price without looking at demand Ultimately, I believe that this aspect is correct that price is a product of supply and demand.. so they do somehow both need to be accounted for, even if there might not be a need to talk about both - even while presuming both to be within what is determining the price... so I doubt that you can presume S2F to be wrong merely because it does not specifically talk about demand but merely presumes demand in some kind of way... and just focuses on supply.

price is determined by supply and demand, isn't that a fact like 1 + 1 = 2 ? [

The price of an option on a stock has nothing to do with supply and demand. It relies on non-arbitrage condition that determine the unique price. Not saying this model relies on non-arbitrage hypothesis, but no, price is equal to match of supply and demand is not 1+1.

sorry i don't get it: why will the price eventually hover around the model price?

Model cannot micro-estimate or precisely track the bit on. Price, but if you want it to be right, in the long run price has to recover to model price. That’s it. Not too scientific. I have proclaimed on many occasions that the S2F model either presumes demand as a kind of constant or presumes that demand is just going to go up with whatever the conditions and pressures of the market that are contained in looking at supply pressures. Maybe my way of conceptualizing and phrasing is not correct either?... and personally, I have also considered the S2F model to be a valid way of attempting to give odds to what is likely to happen in bitcoin in terms of ongoing price dynamics - even if actual facts might end up causing the curve of the S2F model to have to end up getting shifted down or up based on what ends up actually happening (or as the data flows in)... How do you account for demand in the future anyhow beyond just attempting to treat it as some variation of a constant? I bet that the S2F ends up beating the pants off of any model that attempts to account for demand in any kind of way that takes much of anything away from the supply emphasis aspect that is already contained in the model.... Another vague concept that seems to attempt to explain demand and underly what is pushing underlies bitcoin price dynamics is the exponential s-curve adoption based on Metcalfe principles and networking effects.. which surely those kinds of ideas account for a kind of ongoing onward trajectory of demand that is going up with ongoing adoption and the ideas do not seem incompatible with S2F in terms of being able to use (or even presume) such ideas to consider what is happening with demand as an ongoing upwardly trajectory in a way that complements s2F's attempts to tell us where we are likely going based on where we have been and where we are at. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|