Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

June 21, 2022, 06:24:41 AM |

|

At the moment the S2F model is having a few difficulties, and PlanB itself is finding new narratives to keep it alive.

Hopefully, we will be able to cross that S2F line again in the future!

(it's not a gamble, it' s a strategy)

To be honest, considering how smart PlanB is, it doesn't seem to me to be a very wise decision on their part. When the facts dismantle your theory, or model, the sensible thing to do is to write it off as invalid, not to keep remodeling it constantly. Although I understand that he will have invested a lot of time and effort in this issue, and giving up all that time and effort as useless is not easy emotionally. |

|

|

|

|

|

|

|

|

Every time a block is mined, a certain amount of BTC (called the

subsidy) is created out of thin air and given to the miner. The

subsidy halves every four years and will reach 0 in about 130 years.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 21, 2022, 11:31:13 AM

Last edit: May 15, 2023, 12:18:27 PM by fillippone Merited by JayJuanGee (1) |

|

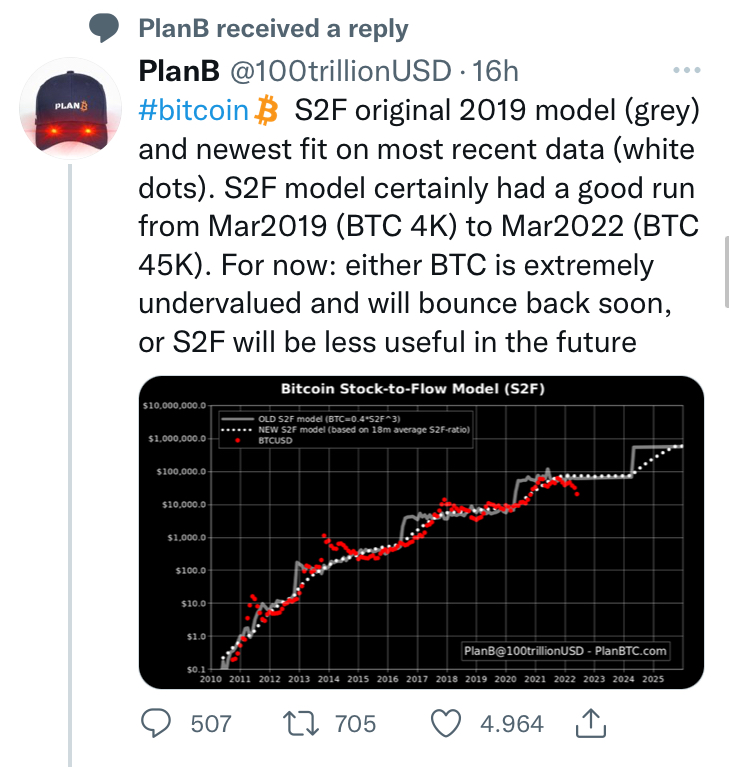

A little bit of debate about Stock to Flow lately. Firstly, PlanB showed a long awaited tweak on his model, plotting the price not against a lagged Stock to Flow, but agains an average stock to flow:  The fit is remarkably good in the past cycles, but of course at the moment it is still high undervalued according to model. Is this an incredible buying opportunity ?is the S2F a broken model that should be forgotten? I hope we will have a go at the model line, but this is only my gut feeling. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

Flexystar

|

|

June 21, 2022, 12:59:14 PM Merited by JayJuanGee (1) |

|

That’s deep and factua analysis on how the “pricing” and “minimum cap” might have been decided by Satoshi. Obviously we never calculated the factor of increased rates per item over the time since from raw materials to logistics, everything will become costly. This would be based on world economic growth, worlds GDP and many more things right?

Definitely we do not need unlimited Satoshi because we don’t want to stabilise the prices like stable coin so surely it’s limited, so prices would hike as the time will pass on.

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 21, 2022, 06:32:53 PM Merited by fillippone (4) |

|

At the moment the S2F model is having a few difficulties, and PlanB itself is finding new narratives to keep it alive.

Hopefully, we will be able to cross that S2F line again in the future!

(it's not a gamble, it' s a strategy)

To be honest, considering how smart PlanB is, it doesn't seem to me to be a very wise decision on their part. When the facts dismantle your theory, or model, the sensible thing to do is to write it off as invalid, not to keep remodeling it constantly. Although I understand that he will have invested a lot of time and effort in this issue, and giving up all that time and effort as useless is not easy emotionally. Even PlanB came out with a concession speech and proclaimed that his interpretation of stock to flow has been invalidated by the facts, the various underlying foundational principles of stock to flow still seem to be correct, even if some of the market dynamics contributed to BTC's price performance towards having peaks that were way lower than expected and then subsequent dips that went quite bit beyond expectations. Perhaps some real world events contribute towards facts that the establish that the projection axis has been shifted downward, but the model still might not be broken. I consider the model to still have a quite a bit of validity in terms of figuring out various ongoing pulls on the BTC price that relate to ongoing adoption that has continued upwards price pressures based on bitcoin's supply issuance, and sure maybe the rainbow chart captures various ongoing upwards pressures in similar kinds of ways.. but the stock to flow model still has some specific cyclical aspects that are built into it that show a bit more directionality within Bitcoin's spot price relationship in connection with changes in the supply. where as the rainbow chart just attempts to explain magnitudes of deviance from the mean..but does not have attempts to show how the halvenings might have some specific influences on some of the BTC price pressures. I am no where really close to wanting to completely negate stock to flow - or to suggest that PlanB is some kind of a god or less than a god now because he is emotional and a bit of a waffler.. hahahahaha.. I can understand some of the frustrations with his changing the model so frequently and then understanding how that might defeat the purpose of suggesting that the model had any predictive power merely because it keeps getting changed. For sure PlanB seems to have had incorporated quite a bit of predictive power to how the 200-week moving average tended to give some guidance regarding how far the BTC price might go up, but if we end up experiencing diminished BTC price peaks, then even the 200-week moving average is not going to be moving up at as fast of a pace as had been anticipated. Even now, within the past week we had the 200-week moving average breached when it was about $22,300 and then movement 21% below the 200-week moving average with a so far price bottom of $17,953 but also seeming to take place at a weird place on the stock to flow cycle anticipations. .. including the breach of the 100-week moving average at $35k from nearly two months ago. At this time, the 200-week moving average is still moving up at slightly less than $30 per day and is at $22,371, and for sure the BTC spot price likely has a dragging down effect on that too.. and the 100-week moving average continues to move up too (at least for now) since it is a bit over $36k, but surely we know that the longer the BTC spot price stays below either of those two averages, there is going to be dragging down effects on them either in decreasing their rate of going up and also even per haps causing them to get closer to being flat.. so it seems to me that traditional assets do like to use those kinds of longer time-frame moving average indicators, yet it also seems that PlanB's incorporation of the halveniungs into his attempts to present what is going on in bitcoin had been (and has been) an attempt to tailorize some of those traditional financial tools into bitcoin.. so for me, even if some of the specifics of the magnitude of the movement ended u being off in a variety of ways, we likely still can be informed by what the model had been showing and how far the BTC price is deviating from some of the parameters of the model.. including whether the pattern might look the same as expected (or not) while at the same time appreciating whether there might be some additional phenomena that might be existing that might need to be plugged into the model or can that additional phenomena (to the extent that it can even be identified) help to create a better model.. or do we give up completely and call planB, his model , and anyone defending either of those (including yours truly) a bunch of loonies. I continue to have difficulties appreciating why so many folks get so worked up about the various ways that plan B is wrong and has been wrong and suggesting that bitcoiners had been mislead by information contained in his model and assertions that PlanB made i connection with the model.. blah blah blah... Oh and by the way, Plan B was not the ONLY one expecting BTC prices to go to $100k and beyond in 2021..and whether the planB ideas had subliminal effects.. I have my doubts.. even though all the time we see people putting too much credence into predictions that are intended to have probability assignments, and we also know that even if a model were to come out with 80% or 90% numbers, the 10% or 20% scenarios could end up playing out, but still would not necessarily take a way the value of having had the model/predictions.. so sometimes people will end up attributing 80% or 90% as if it meant 100% and 10% or 20% probabilities as if they were to mean zero.. hahahaha.. people can be simple (and short-sighted) like that sometimes.. but still does not mean that the model was not valuable and good even if people misunderstood it and even if the author of the model might have gotten some of the probabilities wrong or maybe even if the author seemed to have had exaggerated some of the numbers of the model because he was trying to incorporate some of the parlance of his speaking to be like normal people in their everyday speech patterns. which happens to be.. frequently speaking in absolutes.. that's what many normal people prefer to hear and want to pressure scientist into speaking the same way.. even if there might be probabilities contained therein and also when there might be some qualifiers contained therein, too... .but who wants to hear about the qualifiers? People want the punchline, even if it might end up misleading them into failure refusal to prepare (psychologically and/or financially) for scenarios beyond just the punchline scenario(s). That’s deep and factua analysis on how the “pricing” and “minimum cap” might have been decided by Satoshi. Obviously we never calculated the factor of increased rates per item over the time since from raw materials to logistics, everything will become costly. This would be based on world economic growth, worlds GDP and many more things right?

Definitely we do not need unlimited Satoshi because we don’t want to stabilise the prices like stable coin so surely it’s limited, so prices would hike as the time will pass on.

Of course, there are links in terms of both BTC value and BTC price towards how various things in the real world might also be limited, and surely some things in the real world are more scarce than other things, and some things in the real world are more desired than other things, too. Bitcoin has established a price over the years that could be undervalued or overvalued in terms of what some satoshis might buy you in the future or even today depending on where and how you might try to use it. It is not even that the current value or the future value will be agreed upon, so some folks might be battling to attempt to establish current BTC prices or even to attempt to profit if they see a difference between value and price that they believe that they can get advantage from that or if they might find some usage of bitcoin in the present or even in the future.. There are going to be differences of opinion about both value and price, too.. There are also some examples of some use cases for bitcoin that might be somewhat price neutral so for example, maybe if someone wants to send $100 to El Salvador, they might find some value in using bitcoin/or lightning network to send that value because they believe that it saves them fees over other options that they have available, but they might not care too much about the current BTC price if they are going to convert from dollars to BTC on the sending side and then back from BTC to dollars on the receiving side. Still has a connection to the real world but maybe not as dependent on bitcoin's scarcity in regards to figuring out value. Even miners might have some of their incentives to mine based on bitcoin's scarcity, even though some of them might just want to mine bitcoin because it is profitable in their jurisdiction based on energy costs and other considerations, and the input of energy and other resources into bitcoin does also connect with the real world scarcity (or price) of energy and the availability of equipment to set up such an operation that also does not get set up on its own.. so scarcity of time and labor is actually another real world scarce input that can cause calculations regarding whether the current BTC price or expected future price (or future value) might motivate to continue to engage in mining or to conclude that the activity is not profitable enough or a way that such person wants to spend his/her own time, energies, and the various cost of inputs. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

June 21, 2022, 06:55:41 PM Merited by fillippone (3) |

|

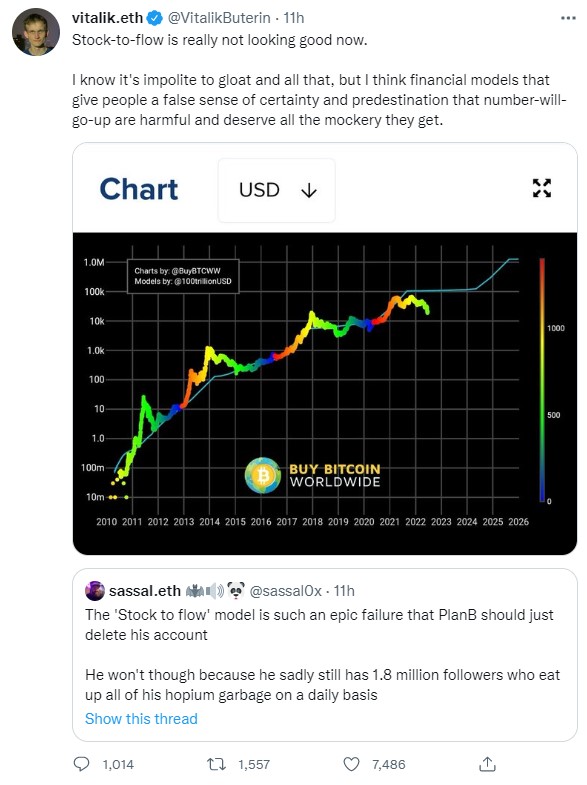

Today I watched @VitalikButerin attacks Stock-to-Flow Model aggressively, I'll quote the tweet: Stock-to-flow is really not looking good now.

I know it's impolite to gloat and all that, but I think financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get. What is the point at which we can say that this model has become "broken" and unreliable in the future? I remember reading somewhere that if the price does not reach 100k by the end of the world, the model will be broken. For NOW, with everything that is happening in the world, it is almost impossible to return to a level closer 70k-100k, so do we have to wait for the end of the year or what? |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 21, 2022, 08:17:39 PM

Last edit: May 15, 2023, 12:18:17 PM by fillippone |

|

Today the Stock to Flow appeared again in the TwitterSphere:  I would say that @PlanB was quite vocal in supporting his model, and even when it was working flawlessly, I never heard him supporting unsensible investment plans. He mentioned many times the reasons why his model(S) could be wrong, and most of the time he was intellectually honest in promoting them. Obviously, PlanB was quite quick to react:  I tend to agree with this last one. I might be a PlanB zealot, but I think he never was trying to lure investors into the business for his own direct financial benefit. The accusation of having many followers is logically inconsistent, I won't even bother to comment. EDIT: I didn't realise Husires just posted the exact same tweet in the above post. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

tadamichi

Full Member

Offline Offline

Activity: 168

Merit: 417

武士道

|

|

June 21, 2022, 09:24:18 PM |

|

What is the point at which we can say that this model has become "broken" and unreliable in the future?

I think we should never expect a model to predict the exact future, but it can be nice to visualize things, start discussion or get ideas and orientation across. Math cant predict politics, manipulation or human decision making, so to me its ridiculous to bash a model, because it suggest that people expected it to be able to do these things in the first place. From my point of view Bitcoin is undervalued rn, so did it really fail? |

9BDB B925 329A C034

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 22, 2022, 06:36:59 AM Merited by fillippone (3) |

|

Today I watched @VitalikButerin attacks Stock-to-Flow Model aggressively, I'll quote the tweet: Stock-to-flow is really not looking good now.

I know it's impolite to gloat and all that, but I think financial models that give people a false sense of certainty and predestination that number-will-go-up are harmful and deserve all the mockery they get. What is the point at which we can say that this model has become "broken" and unreliable in the future? I remember reading somewhere that if the price does not reach 100k by the end of the world, the model will be broken. For NOW, with everything that is happening in the world, it is almost impossible to return to a level closer 70k-100k, so do we have to wait for the end of the year or what? I doubt that it is even close to impossible to get a 3x to 8x BTC price rise from here within the next 3 to 30 months. I will agree that currently downward momentum is in place as a current ongoing and existing BTC price dynamic that is in our faces, and upward momentum does not just automatically resume happening without a bit of battling to regain some of the grounds.. but in bitcoin, sometimes UPpity can also escalate quickly.. just like DOWNity sometimes does the same thing.. Bitcoin prices do not always go down merely because a lot of supposedly smart people are proclaiming down to be inevitable... AT the moment, many of us are still likely struggling with some felt shock about how much down we have experienced in the past 6-8 weeks and especially in the past week.. so it is difficult to have any kind of confidence that any kind of BTC price reversal is actually likely or in our current cards at any time soon.. but at the same time, we do know that in bitcoin's history we sometimes do end up witnessing surprises at various points along the way... even when it seems that the majority of folks is writing off UP as if it were close to zero odds, then the opposite ends up happening. So I personally consider it imprudent to write off certain extreme upside BTC price scenarios that could still end up happening sooner than you anticipate... at the same time, no guarantees, so it remains a great idea to continue to prepare for BTC price actions in both directions rather than putting all your eggs into preparing ONLY for one direction that might not end up playing out as you had been speculating to be the most likely price direction scenario |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

June 22, 2022, 09:36:16 AM Merited by fillippone (3) |

|

What is the point at which we can say that this model has become "broken" and unreliable in the future?

I think we should never expect a model to predict the exact future, but it can be nice to visualize things, start discussion or get ideas and orientation across. Math cant predict politics, manipulation or human decision making If we are above 50k, then we can say that the model is working as the assumption of reaching 100k would have been logical if we continued in the region of 40k to 70k, but what is happening now (if we consider it the bottom) then the maximum ATH during the next four years will be About 150k which is far away from the model. I doubt that it is even close to impossible to get a 3x to 8x BTC price rise from here within the next 3 to 30 months.

The model was working fine until last November, but even before the Ukrainian crisis it was difficult to reach the levels of 100k, we hope that all these events are due to political factors and abnormal conditions and that we will return again soon. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 22, 2022, 04:42:25 PM |

|

What is the point at which we can say that this model has become "broken" and unreliable in the future?

I think we should never expect a model to predict the exact future, but it can be nice to visualize things, start discussion or get ideas and orientation across. Math cant predict politics, manipulation or human decision making If we are above 50k, then we can say that the model is working as the assumption of reaching 100k would have been logical if we continued in the region of 40k to 70k, but what is happening now (if we consider it the bottom) then the maximum ATH during the next four years will be About 150k which is far away from the model. I doubt that it is even close to impossible to get a 3x to 8x BTC price rise from here within the next 3 to 30 months.

The model was working fine until last November, but even before the Ukrainian crisis it was difficult to reach the levels of 100k, we hope that all these events are due to political factors and abnormal conditions and that we will return again soon. From my perspective, you seem to want to focus on various ways that bitcoin supposedly failed to reach expectations that involve bitcoin price limitations as if bitcoin falls into some kind of mature asset category or that it is an asset that is similar to other asset classes and controlled my macro/monetary policies like stocks tend to have that kind of correlation, and I am not completely opposed to appreciating that we can see those kinds of ideas of limits in bitcoin's recent historical performance and that in the short term those dynamics might continue... but I also consider that we need to be careful in terms of making these kinds of under appreciation of bitcoin. In other words, bitcoin continues to be in both a new category of a paradigm shifting technology that melds the ability to communicate through the internet and attach value to that transmission (or storage if you don't want to send it to anyone), and holy shit that is powerful while at the same time ONLY less than the 1% of the world's monetary value and/or participation is within this rock the world system.. the upside remains explosive potential, even if it might not happen and we cannot exactly tell when, either. You can look at various points in bitcoin's history and it is swimming along fairly smoothly with other various assets and then it does a shift upwards at various points too.. and then it then becomes correlated with other assets, but instead it is on another curve that is 3x higher or 10x higher than whatever prices that it had been previously... I get a sense we are going to continue to see those kinds of upwards shifts up in bitcoin.. without really knowing when they are going to happen but when they do, we can no longer get bitcoin at the earlier prices... it is like being in the s-curve adoption, but not really seeing or being able to appreciate that we are within that. Don't get me wrong.. on a personal financial preparation level I do not want to presume too much.. so I attempt to prepare for either up or down BTC prices.. and even maintain fairly conservative projections of ongoing BTC price expectations.. while at the same time accounting for those explosive upside possibilities that might only be 0.5% to 5% scenarios.. but they remain part of the expected value formulation that might not change preparations in any kind of meaningful way - except just to avoid selling too much too soon. The various upside scenario considerations do not suddenly go from let's say 25% to zero merely because we had some corrections that went down further than we thought to be possible.. but there still might be a need to tweak the projected numbers downward from 25% to 10% or some other reasonable adjustment that attempts to account what is really going on rather than just getting caught up in a few short term factors that might not be as long-term powerful as they are being proclaimed to be. Each of us has to figure out our own calculations and whether we want to give any odds at all to certain kinds of upside or downside scenarios.. and personally, I believe that it is quite unrealistic to be ruling out some of the various upside scenarios merely because 1) negative things have recently happened in the world, 2) momentum is not looking good, 3) there are threats that more negative things are going to continue to happen. . blah blah blah , even if some of the better upside scenarios need to be downgraded from their previous modestly high expectations ** to lower values.. but those previously modestly high expectations still likely do not need to be downgraded to zero.. **you can characterize your previous assessments as "high expectations" or "overly high expectations" if believe that you had made errors in that direction but I am not going to attribute possible errors of others because I feel that I have a tendency to come to my own assessments that are not overly-influenced merely based on market sentiment or what other people think blah blah blah. I continue to consider myself as arriving at my own assessments of expectations and engaging in my own reasonable assessments of what I believe is likely to happen (or not).. even if sometimes there can be some contagion that gets into my numbers, too. feels right to you.. Of course, you have the right to Monday quarter-back your own ways of assessing probabilities and/or the ways that others assign probabilities (including making of models), and sure each of us are going to have some of our own inclinations, and from this linked post, you can see some of my own ways of making btc price projections and how I assign prediction values... and for sure I have some influence from both stock to flow and the ideas of exponential s-curve adoption based on network effects and Metcalfe principles. Whether you agree with my ways of assigning BTC price prediction values, you can see that I had not updated my upside projections since December 16, 2021, and I ONLY scribbled out my downside projections on May 19, 2022.. and sure it seems that my BTC prices projections in both directions need updating to account for more recent happenings, I give less than two shits if anyone else considers my BTC price prediction assignment of probabilities have good predictive value or that I am changing in my assessment too often in order to account for changes in what has happened since my last update... At the time that I write out my predictive assignment of values, I am trying to best assess my own sense at that particular snapshot time, and those probability assignment charts should give some ideas about how I think about making my own formulations of more and less likely scenarios. .including attempting to account for extremes, even if the extremes are assigned low probabilities.. so for example, even in December 16, 2021, I had considered supra $1.5 million to have 0.5% odds with 99% odds that the peak for the cycle playing out before the 2nd quarter of 2023. Since about mid-May 2022, when the BTC price fell below the 100-week moving average, I concluded that we had fallen out of the bull market so the timeline for the upside were mostly negated as of mid-May 2020. So in that regard, my projections serve as snapshots of then thinking but still provides some ideas of methodology and how much value to place on various extremes.. including but not limited to placing zero probabilities towards extremes. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

tadamichi

Full Member

Offline Offline

Activity: 168

Merit: 417

武士道

|

|

June 22, 2022, 04:56:54 PM

Last edit: June 22, 2022, 05:17:12 PM by tadamichi Merited by d5000 (3), JayJuanGee (1) |

|

What is the point at which we can say that this model has become "broken" and unreliable in the future?

I think we should never expect a model to predict the exact future, but it can be nice to visualize things, start discussion or get ideas and orientation across. Math cant predict politics, manipulation or human decision making If we are above 50k, then we can say that the model is working as the assumption of reaching 100k would have been logical if we continued in the region of 40k to 70k, but what is happening now (if we consider it the bottom) then the maximum ATH during the next four years will be About 150k which is far away from the model. Idk man, i just checked out the model. The basic assumption is: The hypothesis in this study is that scarcity, as measured by SF, directly drives value. A look at the table above confirms that market values tend to be higher when SF is higher.

I think we can agree that there is some correlation between SF and value, because a high SF indicates scarcity. But thinking it directly drives the value is just foolish, it ignores so many other economic principles or other dynamic factors. Scarcity alone was never the determining factor, just check out the gold chart. This whole model tries to predict price just with the supply side, but we know the demand side can be dynamic af and unpredictable. Gold and silver, which are totally different markets, are in line with the bitcoin model values for SF.

Gold has the highest SF 62, it takes 62 years of production to get current gold stock. Silver is second with SF 22. This high SF makes them monetary goods.

1. It’s not even possible to accurately determine the total supply(stock) or yearly flow of gold and silver. 2. The SF of gold and silver are constantly fluctuating, taking a mean doesn’t prove an accurate model. 3. SF cant even predict the price of gold or silver. Despite this can still see how it’s generally correct about gold gaining value over time, but still inaccurate when we want it to be precise. I would advise against basing price expectations/ predictions on some oversimplified model in the first place. It’s like trying to predict the weather in 30 years by dividing the total rainfall/ yearly rainfall, wrapped in some power law that uses oversimplified assumptions again. See how it won’t work. It fails at trying to predict the price, but i still think it’s valuable by visualising some supply side dynamics. Even if it’s right for some time, it just wouldn’t matter, because it’s trying to solve something impossible. So let’s just note that it just shows us something we can expect about the supply side in the next years, if we make the separation here, we can actually still work with this information. Also golds SF is probably way higher than calculated in the model , and Bitcoins a lil lower(lost coins). Still not everyone is running into gold, because there’s more factors than just this. Fundamental analysis is way more efficient. Both are money, Bitcoins monetary properties are way superior to golds. Even if gold wouldn’t be mined anymore in this decade, i still expect Bitcoin to rise more, for this reason alone. The highest saleable good becomes money, fiat beats gold(more people hold wealth in fiat than in gold, even if it’s dumb), and bitcoin will beat fiat, and rise for this reason alone, not just because SF. |

9BDB B925 329A C034

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 22, 2022, 10:10:55 PM Merited by JayJuanGee (1) |

|

What is the point at which we can say that this model has become "broken" and unreliable in the future?

I think we should never expect a model to predict the exact future, but it can be nice to visualize things, start discussion or get ideas and orientation across. Math cant predict politics, manipulation or human decision making If we are above 50k, then we can say that the model is working as the assumption of reaching 100k would have been logical if we continued in the region of 40k to 70k, but what is happening now (if we consider it the bottom) then the maximum ATH during the next four years will be About 150k which is far away from the model. Idk man, i just checked out the model. The basic assumption is: The hypothesis in this study is that scarcity, as measured by SF, directly drives value. A look at the table above confirms that market values tend to be higher when SF is higher.

I think we can agree that there is some correlation between SF and value, because a high SF indicates scarcity. But thinking it directly drives the value is just foolish, it ignores so many other economic principles or other dynamic factors. Scarcity alone was never the determining factor, just check out the gold chart. This whole model tries to predict price just with the supply side, but we know the demand side can be dynamic af and unpredictable. Gold and silver, which are totally different markets, are in line with the bitcoin model values for SF.

Gold has the highest SF 62, it takes 62 years of production to get current gold stock. Silver is second with SF 22. This high SF makes them monetary goods.

1. It’s not even possible to accurately determine the total supply(stock) or yearly flow of gold and silver. 2. The SF of gold and silver are constantly fluctuating, taking a mean doesn’t prove an accurate model. 3. SF cant even predict the price of gold or silver. Despite this can still see how it’s generally correct about gold gaining value over time, but still inaccurate when we want it to be precise. I would advise against basing price expectations/ predictions on some oversimplified model in the first place. It’s like trying to predict the weather in 30 years by dividing the total rainfall/ yearly rainfall, wrapped in some power law that uses oversimplified assumptions again. See how it won’t work. It fails at trying to predict the price, but i still think it’s valuable by visualising some supply side dynamics. Even if it’s right for some time, it just wouldn’t matter, because it’s trying to solve something impossible. So let’s just note that it just shows us something we can expect about the supply side in the next years, if we make the separation here, we can actually still work with this information. Also golds SF is probably way higher than calculated in the model, and Bitcoins a lil lower(lost coins). Still not everyone is running into gold, because there’s more factors than just this. Fundamental analysis is way more efficient. Both are money, Bitcoins monetary properties are way superior to golds. Even if gold wouldn’t be mined anymore in this decade, I still expect Bitcoin to rise more, for this reason alone. The highest saleable good becomes money, fiat beats gold(more people hold wealth in fiat than in gold, even if it’s dumb), and bitcoin will beat fiat, and rise for this reason alone, not just because SF. I guess you have to patiently re-read all this thread, as I think every one specific statement you declared in this post has been already extensively analysed, discussed and debunked. S2F is not a guarantee of future price paths, this has been a clear statement everyone had in their own mind during this years. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

tadamichi

Full Member

Offline Offline

Activity: 168

Merit: 417

武士道

|

|

June 23, 2022, 12:46:36 AM Merited by fillippone (1) |

|

I guess you have to patiently re-read all this thread, as I think every one specific statement you declared in this post has been already extensively analysed, discussed and debunked.

S2F is not a guarantee of future price paths, this has been a clear statement everyone had in their own mind during this years.

Sorry man i should’ve checked before, i didnt follow this before, but i took the time read to everything now. And it kinda cleared up the things i had in my mind, thanks for the thread. Let’s see what the future holds. |

9BDB B925 329A C034

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 09, 2022, 11:59:52 AM

Last edit: May 15, 2023, 11:55:19 AM by fillippone Merited by JayJuanGee (2) |

|

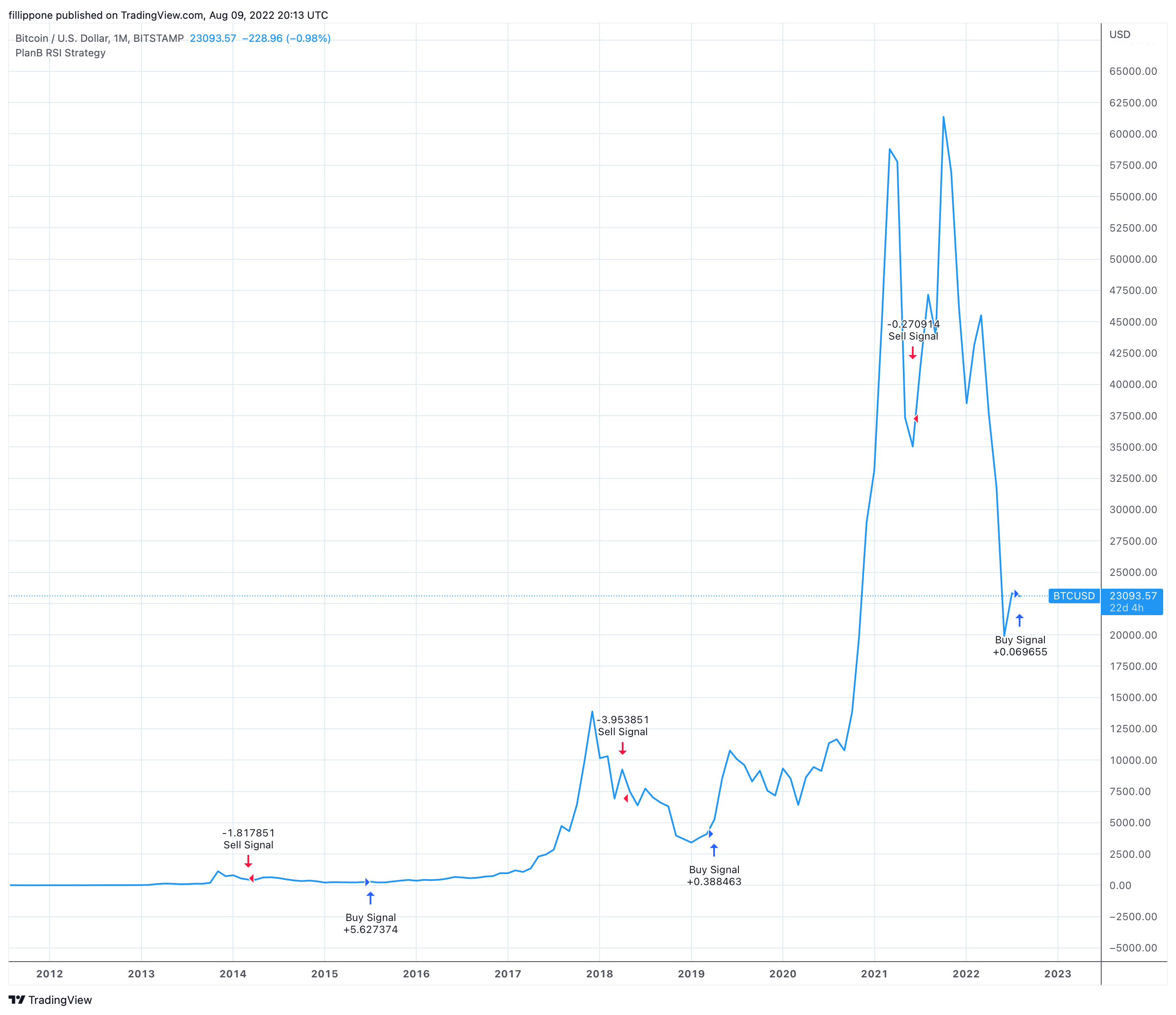

PlanB published another article about investing:  Quant Investing 101 Quant Investing 101I implemented his algorithm on my Tradingview, but as I am away from my laptop, I cannot make it available to everyone. I will do it asap. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 09, 2022, 08:19:47 PM

Last edit: May 15, 2023, 11:54:55 AM by fillippone Merited by JayJuanGee (1) |

|

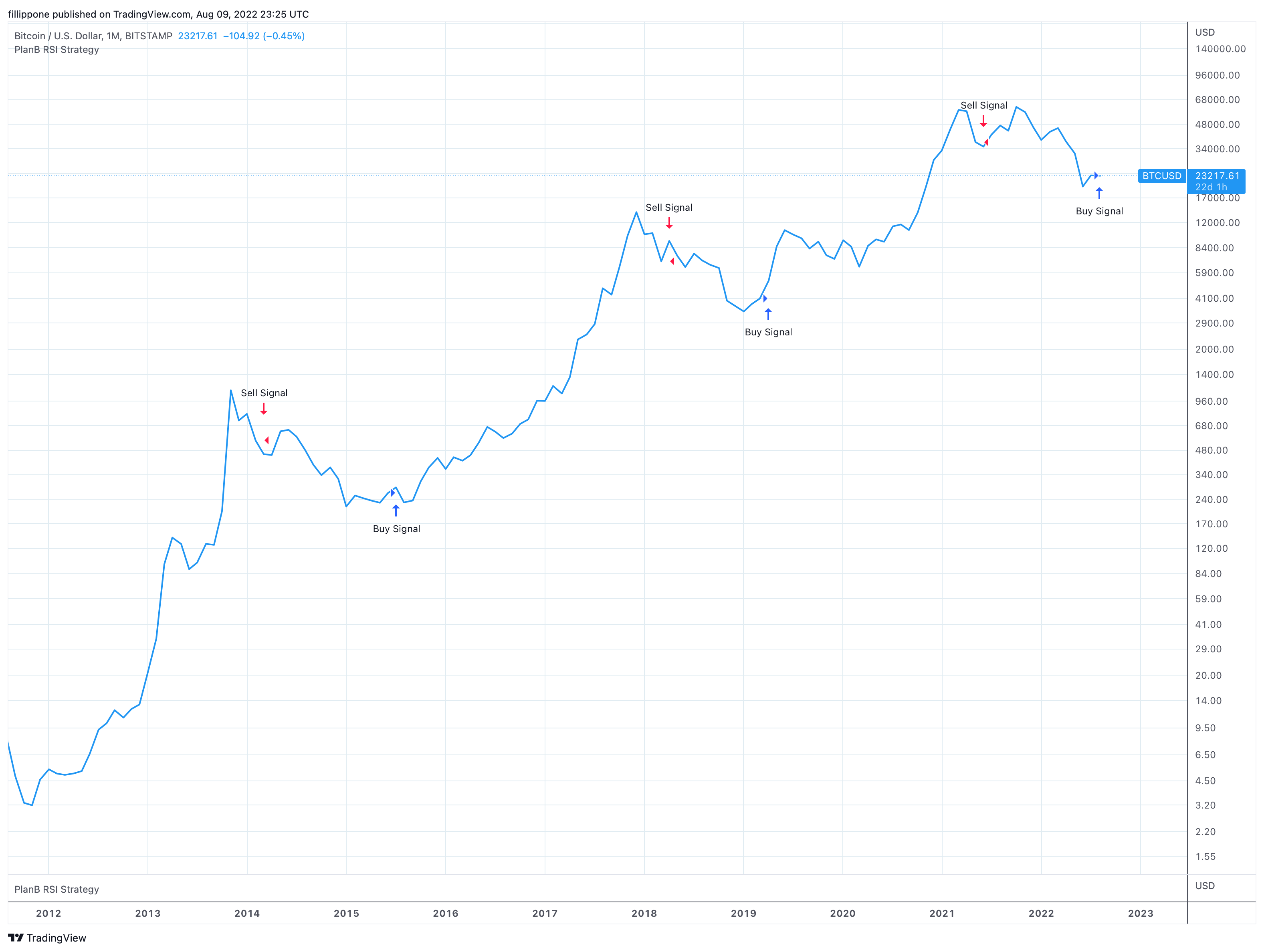

Here is the indicator:  Search "PlanB RSI Strategy". As I said, this is my first try with PINE Editor, so the code might be shaky. Suggestions are more than welcome. EDIT: Log Graph, as suggested by PlanB himself (my life is now complete!)  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Rikafip

Legendary

Offline Offline

Activity: 1736

Merit: 5961

|

I don't know if you guys noticed but a couple of days ago PlanB started his own YouTube channel. So far he only has few interviews made by other YouTubers but he said that he is currently working on his first video. Anyway, here is the link https://www.youtube.com/@PlanB_Bitcoin |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 25, 2023, 11:56:10 PM

Last edit: May 15, 2023, 10:45:45 AM by fillippone Merited by JayJuanGee (1), Rikafip (1) |

|

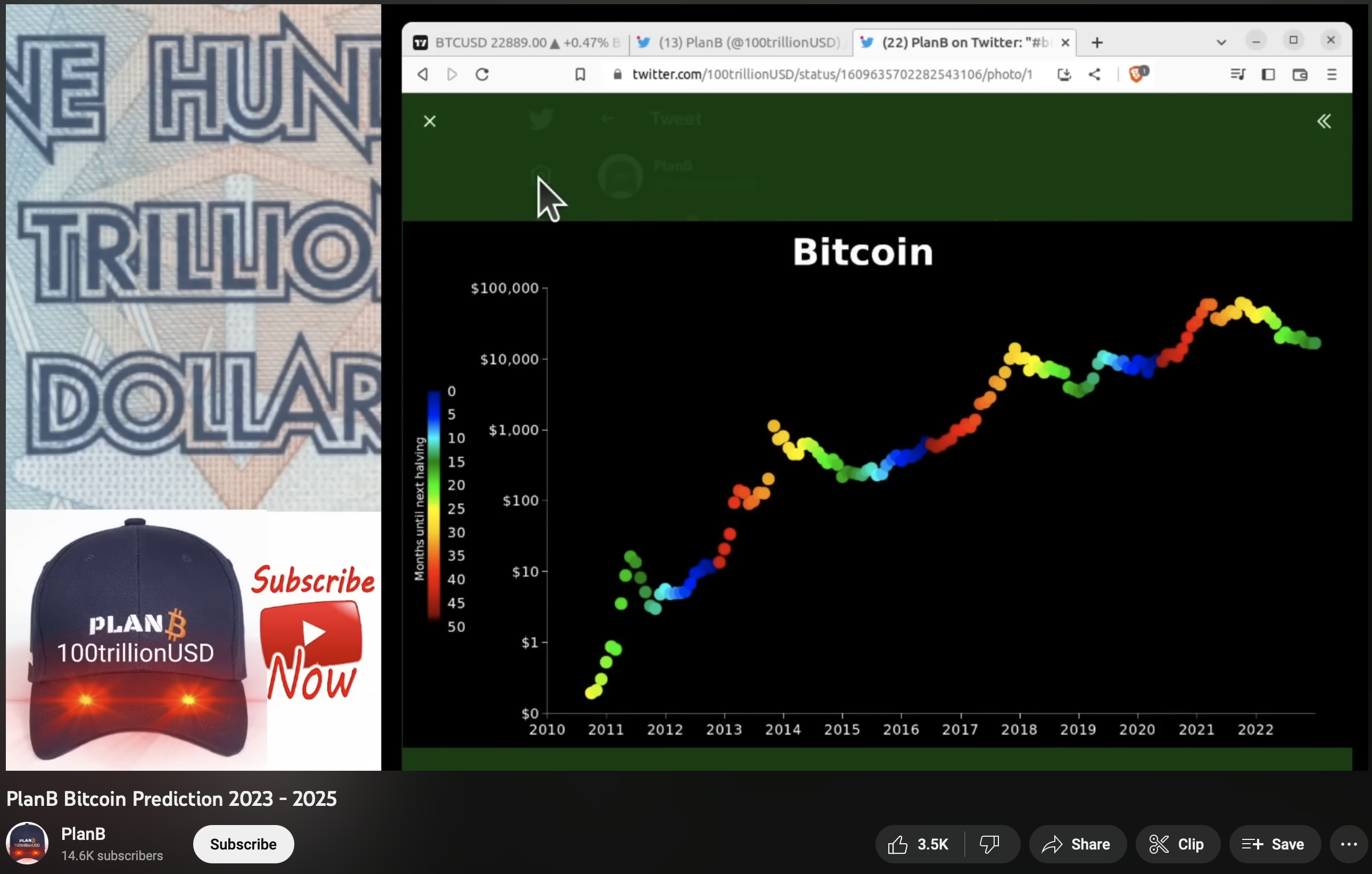

Great, thank you @Rikafip. PlanB published an interesting video:  A little bit amatoriali as production, he's still has to perfection as a YouTuber, but this is a new and good way to explain his tweets that for some reason are obscure to most readers. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 25, 2023, 08:33:22 AM

Last edit: May 15, 2023, 10:26:32 AM by fillippone Merited by JayJuanGee (1) |

|

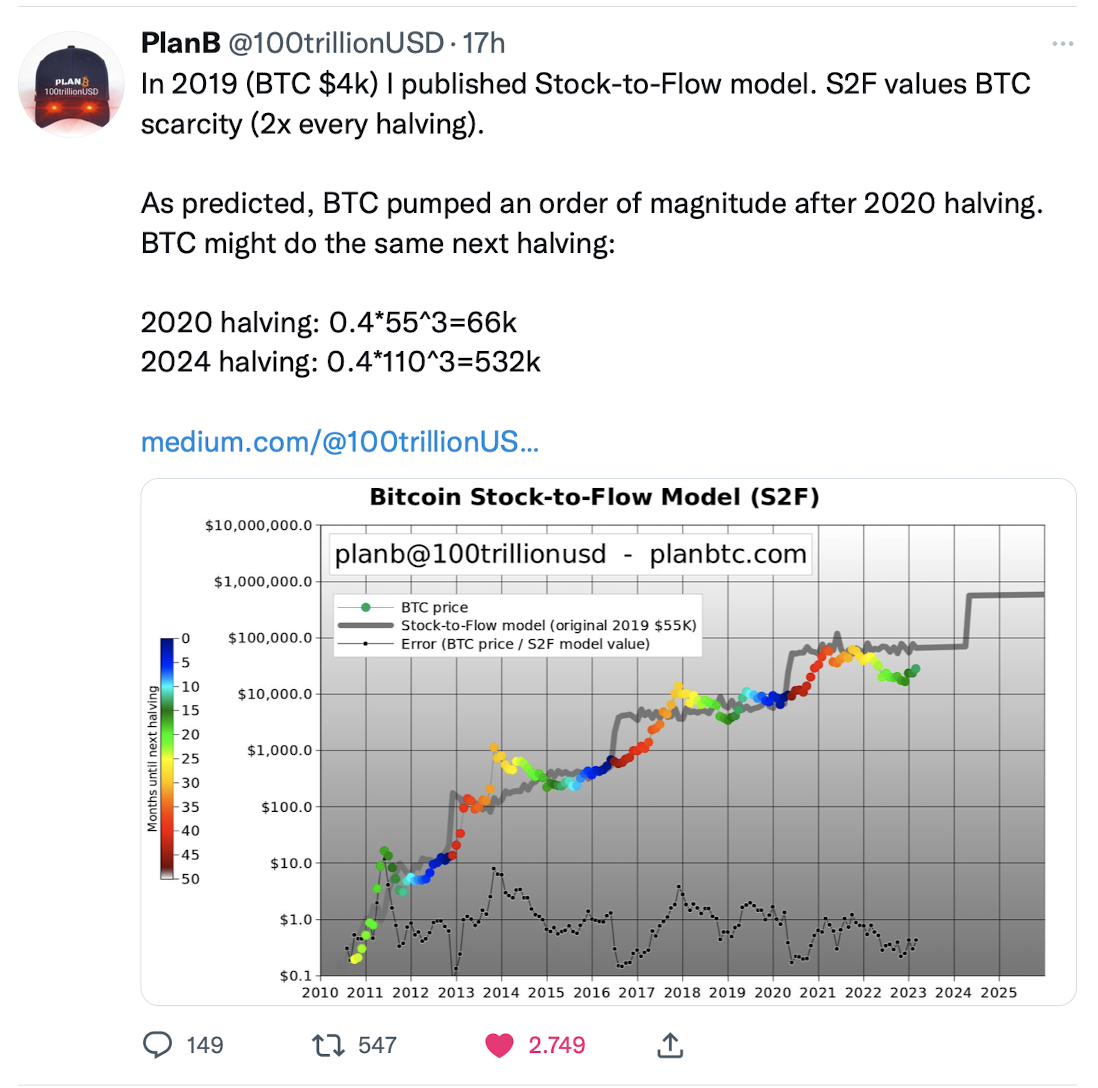

Finally, with the latest bullishness, PlanB is tweeting about Stock to Flow again:  Basically, PlanB is expecting Bitcoin to grow an order of magnitude (10x) following the doubling of the S/F ratio from 55 to 110. Of course, this is something like back fitting, but It's only a reference, not an absolute trading point! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 09, 2023, 01:09:27 PM

Last edit: May 15, 2023, 08:09:32 AM by fillippone Merited by JayJuanGee (1) |

|

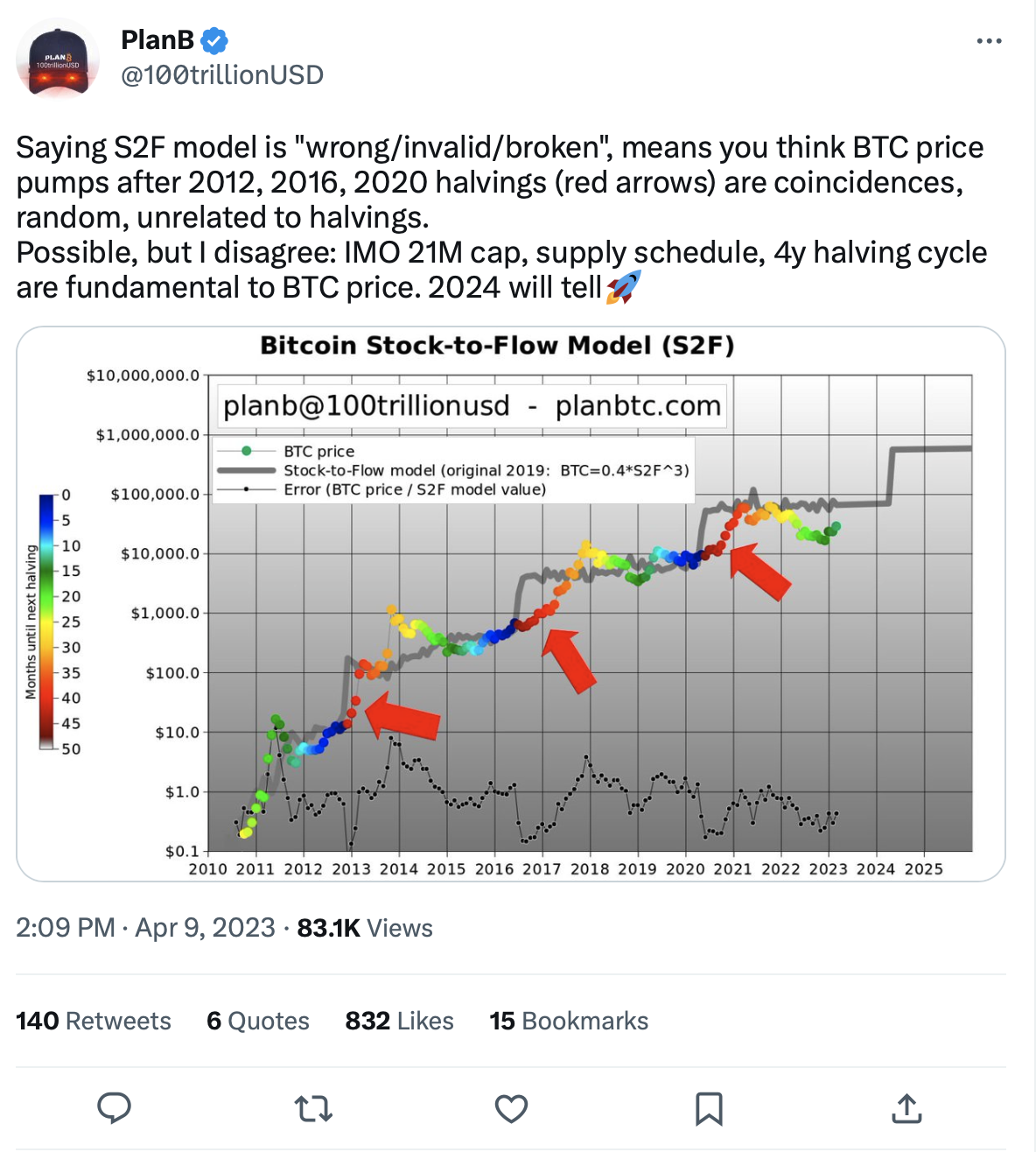

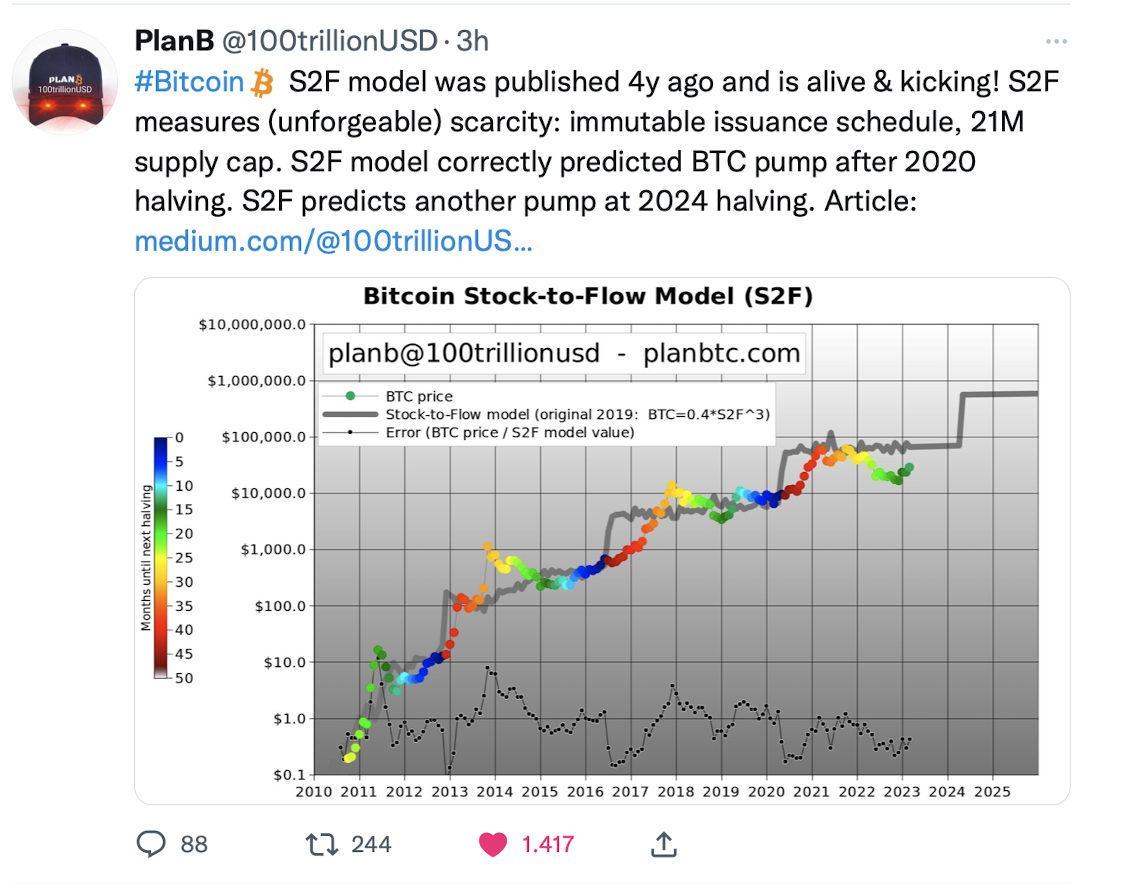

PlanB is not considering Stock to Flow Broken yet, and he has been tweeting about it lately.  and also:  I guess in the case of a pump, we will hear more from him. Being totally honest I guess he is also trying to relaunch his Twitter account after being shadow banned for a long time. So he's tweeting like mad. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15393

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 04, 2023, 12:21:56 PM

Last edit: May 15, 2023, 10:05:45 AM by fillippone Merited by JayJuanGee (1) |

|

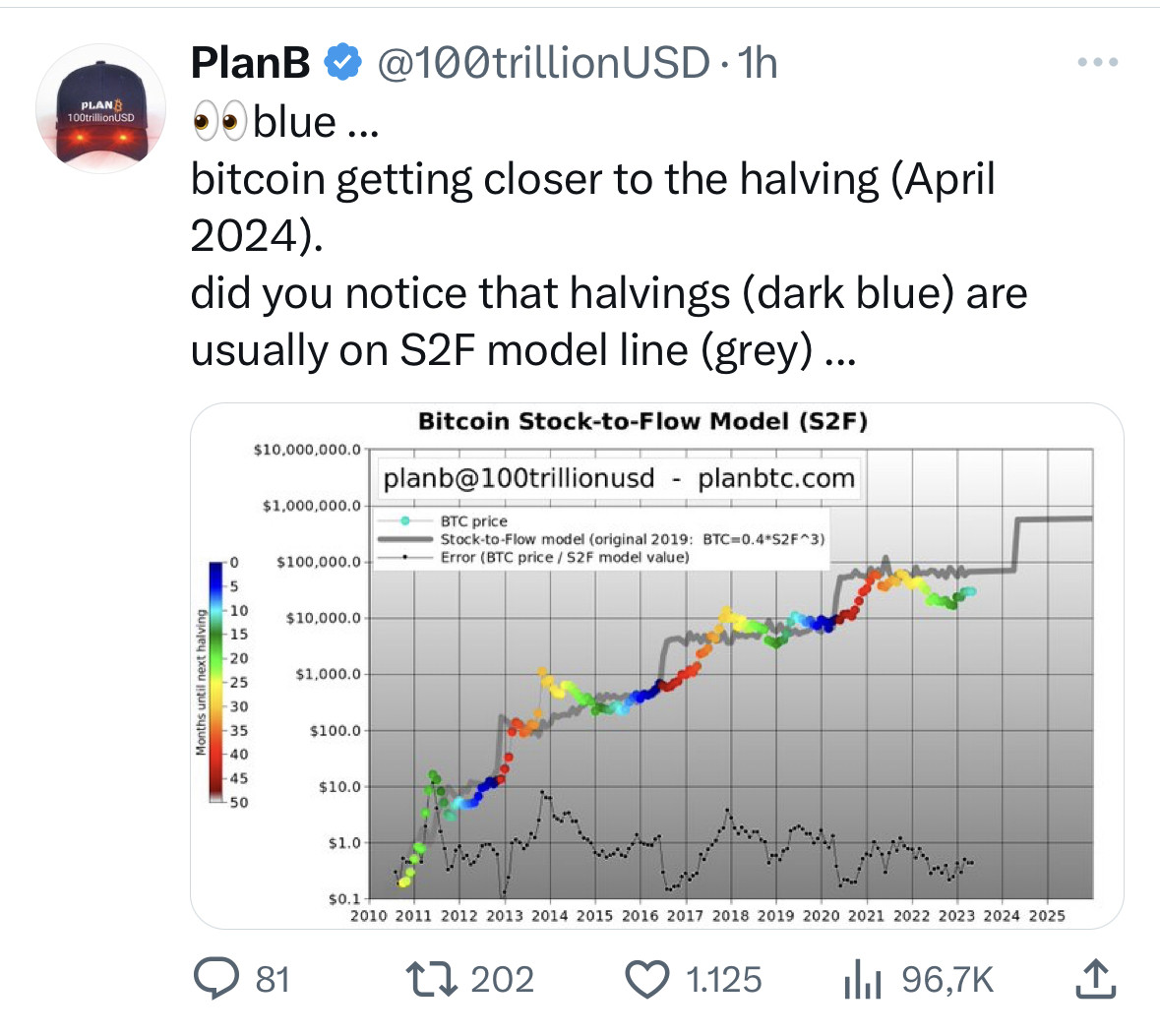

Rejoice! Stock to flow is not broken, and at the time of halving, we will see it again!  Of course, a lot of bullishness in the air, and I thing a value of one on the ratio of market price/model price is long overdue. I see too many risks being taken away from the table and a compelling macroeconomic environment for the orange coin to prosper. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|