JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 09, 2024, 01:22:52 AM |

|

Sure there could be a general field rather than a tax specific field, the field would account for estimated expenses and it would reduce the payout amount in order to attempt to measure net pay as compared to gross pay, yet from my current thinking that kind of extra field seems to have tendencies to overly complicate the tool. What do you think bitmover? Do you want to add an expenses field?

One of the main reasons to use this kind of a tool is to get some kind of idea regarding how much BTC to withdraw and to even show maximum withdrawal amounts based on current BTC price conditions in relation to the 200-week moving average, and surely there could be some cases in which the actual benefits of the coins is reduced due to various transaction fees, taxes or other costs that could be applied right at the time of withdrawal, yet something like taxes might be a matter of how it is categorized within reporting categories that might be somewhat ambiguous and difficult to capture even if we were to put a general expenses field in there, and even if such an "expenses" field might be helpful, I am still leaning towards thinking that such a field adds more clutter, complication and distraction to the idea than it benefits - even though it is not totally irrational to want to include the consideration of those kinds of personalization ideas.

It doesn't need to be a very specific field, something generic could be interesting. The possibility of indicating a fixed value or a percentage. it still would end up in the user input data so then would end up affecting the results of the output, and I would imagine the default would be zero, so the user would need to select either a percentage and/or a fixed amount. Which kind of reminds me of what I consider to be a more important feature that is currently not present which is the user's ability to share his inputs, so that if he provides a link to someone they could optionally see his inputs... Each of these DCA cites allow for the copying and sharing of results based on inputs. https://dcabtc.com/https://dcacryptocalculator.com/bitcoinhttps://costavg.com/It is true that there are several possibilities, in turn the person making the withdrawal may have expenses, expenses that will be deducted from the withdrawal amount. So, having a way for the match to get an idea of this value can help in making a decision.

Fair enough. In fact, you can even change the data, and make the indicated withdrawal times no longer exist.

I am not sure exactly what you mean, here. If we are in the middle of a month and working through our monthly limit, of course, the BTC price relative to the 200-WMA is changing throughout the month, so a lot of times if we are just considering that we do not go over the authorized BTC withdrawal amount for that particular month, then that amount should stay consistent as long at the BTC price is at least 25% or higher than the 200-WMA so we can keep track of our various withdrawals until we reach our monthly limit or we could just do them all on one day for the whole month. On the other hand, if we are going to perform some kind of an withdrawal of advance months, then the number of months that we are authorized to withdraw in advance might have a short period of time that it is possible to accomplish based on if the BTC price moves into a certain range that authorizes additional months to withdraw in advance. There could be discretion regarding how to accomplish the withdrawals and at which price point, and the user would have to keep track of how he is carrying out such record keeping and keeping himself within the parameters of the guidelines of the rules of the tool (if he were to choose to try to follow the rules of the tool..including that if I were to authorize you joker_josue to withdraw from an account that we establish within the confines of the tool, then if you want to stay compliant, you would be restricted to the amounts within the parameters of the rule...and we could plug in our 20.5 example for that... . Bitmover and I have already been discussing some of the difficulties with the tools ability to capture the exact spot price upon hitting refresh or at any specific time of the day, and as a tentative resolution we had agreed to showing BTC's price range for any selected day (and bitmover is still working on adding that) and I am not sure if having that feature will completely resolve the issue of trying to figure out at what price on the upside a person might be triggered to withdraw additional months or perhaps on the downside at what price the withdrawal amount might enter more restrictive territories.... and perhaps some of the calculations might need to be carried out manually for someone who had gotten used to using the tool and understanding how it works in line with familiarity with the formulas that are contained to trigger changes in the monthly withdrawal limit thresholds. Or change accounts for consistent withdrawals over time.

Consistent withdrawal over time would be a different tool. Admittedly as long as the BTC price is more than 25% over the 200-WMA, the monthly withdrawal amount in terms of BTC will be the same in terms of BTC amount, but surely not in terms of dollar value. Also the further the price is above the 200-WMA, the more months in advance become authorized for withdrawal, and I think that it would be prudent to take advantage of those guidelines, especially once the BTC price starts to get into % territories (such as higher than 400% above the 200WMA) that are authorizing 23 months in advance and more...and yeah there could be some accounting difficulty in regards to doing that, but it is still recommended to follow...especially if there are preferences to cash out BTC during the higher prices rather than during lower prices... and even though the tool is giving guidelines and I am recommending to take advantage of those guidelines, each person has discretion if he does not want to follow the guidelines, unless you happen to be someone who is mandated to follow the guidelines, if we go back to the example that I give you a budget and require you to spend within the guidelines. Anyway, it could be another variable for the accounts, which I remembered could be useful.

I am not sure what you mean here. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

|

February 09, 2024, 01:49:27 AM Merited by JayJuanGee (1) |

|

Sure there could be a general field rather than a tax specific field, the field would account for estimated expenses and it would reduce the payout amount in order to attempt to measure net pay as compared to gross pay, yet from my current thinking that kind of extra field seems to have tendencies to overly complicate the tool. What do you think bitmover? Do you want to add an expenses field?

I think that it will make the tool more complicated and won't add any valuable information. Each country has different taxes, expenses depend on each exchange, bank etc. It is very personal. It could be another slider, but I don't think it will add valuable information |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Kakmakr

Legendary

Offline Offline

Activity: 3430

Merit: 1957

Leading Crypto Sports Betting & Casino Platform

|

Ok, just to clarify why I asked if you could possibly add those other strategies. People always discuss possible outcomes with different scenarios or different strategies. I discussed your strategy on one of the local "investment" WhatsApp groups and people were curious to say the least. They wanted to see what the outcome would be, if they re-invested the yield from your strategy. (They do understand that your strategy are not an investment strategy, but they still wanted to compare the "what if" outcome) Example 1 : What would happen, if I re-invested that yield, compared to withdrawing it and just using it for something else. Example 2 : What would have happened, if I simply deposited it into a fixed deposit at a Bank. (Fixed interest rate, with an option to make additional deposits) It's just fun to play around with the different strategies and I can see that you took that to the next level.   |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

joker_josue

Legendary

Offline Offline

Activity: 1638

Merit: 4543

**In BTC since 2013**

|

|

February 09, 2024, 07:57:01 AM |

|

Thanks for the feedback JJG. Sorry for my English. And just to clarify... In fact, you can even change the data, and make the indicated withdrawal times no longer exist.

I am not sure exactly what you mean, here. If we are in the middle of a month and working through our monthly limit, of course, the BTC price relative to the 200-WMA is changing throughout the month, so a lot of times if we are just considering that we do not go over the authorized BTC withdrawal amount for that particular month, then that amount should stay consistent as long at the BTC price is at least 25% or higher than the 200-WMA so we can keep track of our various withdrawals until we reach our monthly limit or we could just do them all on one day for the whole month. What I wanted to say is that the value placed in this field could influence the entire field. Based on your explanation, I realized that maybe not so much, due to the way the tool is built. Anyway, it could be another variable for the accounts, which I remembered could be useful.

I am not sure what you mean here. It was just a conclusion, saying that it was an idea I had and found it interesting.  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

|

February 09, 2024, 10:02:00 AM Merited by JayJuanGee (1) |

|

Example 1 : What would happen, if I re-invested that yield, compared to withdrawing it and just using it for something else.

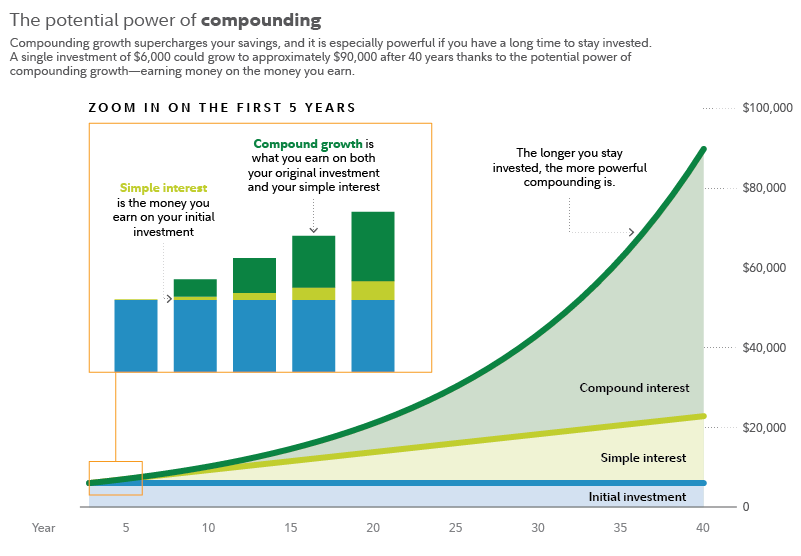

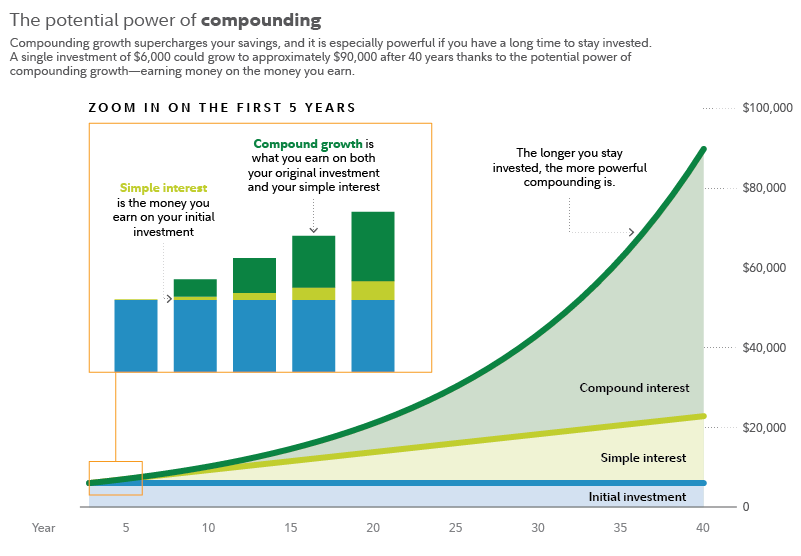

I didnt get it. If you reinvest what you just withdrawal at the same time, it is the same as never withdrawal. You would have a flat line with your btc stash, instead of a decreasing btc stash. If you had 0.5btc, and never sell, you will have 0.5btc forever  JJG has another strategy to sell and buy again using 200WMA, which will be a next tool. Example 2 : What would have happened, if I simply deposited it into a fixed deposit at a Bank. (Fixed interest rate, with an option to make additional deposits)

Now you will have an some exponential growth due to compound interest. There are many tools for compound interest in the web. But time is the most important variable here. You need long time.  https://www.fidelity.com/learning-center/trading-investing/compound-interest https://www.fidelity.com/learning-center/trading-investing/compound-interest |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 10, 2024, 03:16:59 AM

Last edit: February 13, 2024, 12:05:47 PM by JayJuanGee |

|

I am not sure exactly what you mean, here. If we are in the middle of a month and working through our monthly limit, of course, the BTC price relative to the 200-WMA is changing throughout the month, so a lot of times if we are just considering that we do not go over the authorized BTC withdrawal amount for that particular month, then that amount should stay consistent as long at the BTC price is at least 25% or higher than the 200-WMA so we can keep track of our various withdrawals until we reach our monthly limit or we could just do them all on one day for the whole month.

What I wanted to say is that the value placed in this field could influence the entire field. Based on your explanation, I realized that maybe not so much, due to the way the tool is built. I think that sometimes it can take a real long time for some of the most basic of ideas to become widespread, understood and put into practice. I think that the tool can still be considered as a BIG deal to the extent that it can help any of us to better appreciate how BTC may well have a sustainable withdrawal rate that is much higher than other assets, and I think that it remains pretty bold for me to be arguing that bitcoin may well have a sustainable withdrawal rate of 6% to 10% as long as you follow the rules of the tool. There are a lot of people who want to start to apply the tool , but they are either not yet at a stage in their BTC accumulation that this kind of sustainable withdrawal makes sense or they are not to point in which they can set aside a certain quantity of BTC (such as my 21 BTC example) and just start applying the sustainable withdrawal to a budget, which also is likely to be very powerful to use this tool for such a purpose.\ JJG has another strategy to sell and buy again using 200WMA, which will be a next tool.

Even though I have been spending quite bit of time thinking about the 200-week moving average in the last 5 years or so, the foundation for our next tool (that we are still having troubles imagining how to design it in a way that is better than the google/excel spreadsheet), that one is based more on just raking profits on the way up and then speculating about buying back upon certain dips and assigning probabilities to the likelihood of such dips would be hit. Example 2 : What would have happened, if I simply deposited it into a fixed deposit at a Bank. (Fixed interest rate, with an option to make additional deposits)

Now you will have an some exponential growth due to compound interest. There are many tools for compound interest in the web. But time is the most important variable here. You need long time.  https://www.fidelity.com/learning-center/trading-investing/compound-interest https://www.fidelity.com/learning-center/trading-investing/compound-interestEven though you can get the idea of compounding from various dollar-based interest/dividend bearing accounts, I consider it to be misleading to rely upon interest and/or dividends in order to understand the concept of compounding (even though there is nothing wrong with the chart in terms of nominal terms), but if we are thinking about the matter in real terms rather than nominal terms, we still have to consider bitcoin's value appreciation in relation to the dollar. So bitcoin does not have any dividend or interest, yet there is no need to put bitcoin into an account held by a third-party in order to get interest and/or dividends because historically bitcoin's dollar value has gone up greater than an overwhelming number of dollar-based investments, so the amount of bitcoin's value going up compounds upon itself without having to get interest upon it. Sure, there is no guarantee that bitcoin will continue to go up in value in ways that outpace the devaluation (and debasement of the dollar), but the odds seem quite high that bitcoin will continue to appreciate in value way greater than the dollar debases (even if you include interests (or even compounding interest) that you might earn on holding your value in such depreciating asset/currency like the dollar). For example, even just looking at where bitcoin was in 2015, we can see that there have been about 9 doubling of bitcoin's value events (in terms of it's dollar value) and yeah some retracements but still we are currently still around 8 doublings since 2015 (that is ONLY a little more than 8 years). 1) $250 (2015) 2) $500 (2015-2016) 3) $1,000 (2016-2017) 4) $2,000 (2017) 5) $4,000 (2017-2020) 6) $8,000 (2017-2020) 7) $16,000 (2017-2022) 8 ) $32,000 (2021-2023?) 9) $64,000 (2021-?) 10) $128,000 (?) Historically, those value appreciations in bitcoin have been way greater than the debasement of the dollar even if someone were to have had paid you 10% interest on the dollars that they were holding for you, it still would have had been better for you to keep your value in bitcoin even if no dividends or interest had been paid by keeping your value in bitcoin and stored by yourself in isolation. Even if there are no guarantees of future results bitcoin is sound money and thus Bitcoin is designed to pump forever.. and maybe another way of saying it, is that bitcoin is the most pristine of assets and/or the soundest of monies.. so good luck holding your value somewhere else and expecting your money to appreciate and/or hold its value as well as if you were to keep your value in bitcoin, even if you are not getting any dividends and/or interest in nominal senses, you are getting appreciation of the asset in real terms - again not guaranteed but pretty damned highly likely to have better value retention in bitcoin, especially if you account for the ongoing, persistent and consistent irresponsible behavior of the dollar and all other fiat-based systems. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

|

February 10, 2024, 11:15:50 AM Merited by JayJuanGee (1) |

|

Historically, those value appreciations in bitcoin have been way greater than the debasement of the dollar even if someone were to have had paid you 10% interest on the dollars that they were holding for you, it still would have had been better for you to keep your value in bitcoin even if no dividends or interest had been paid by keeping your value in bitcoin and stored by yourself in isolation.

I think bonds are not very good in developed countries. Brazil has one of the highest interest rates in the world. Always has. http://www.worldgovernmentbonds.com/Brazil has about 11% is this website but we can get easily 14% free of taxes with AAA corp bonds. Long term this is amazing and you 2x every 6 years. This is very powerful and any portfolio 100% bonds will look like the chart above from my last post. However, we were a shitful country, I sent think nobody from a developed country should risk their dollars here. I have treasuries and Corp bonds from the US as well, but much less.. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 10, 2024, 03:37:55 PM |

|

Historically, those value appreciations in bitcoin have been way greater than the debasement of the dollar even if someone were to have had paid you 10% interest on the dollars that they were holding for you, it still would have had been better for you to keep your value in bitcoin even if no dividends or interest had been paid by keeping your value in bitcoin and stored by yourself in isolation.

I think bonds are not very good in developed countries. Brazil has one of the highest interest rates in the world. Always has. http://www.worldgovernmentbonds.com/Brazil has about 11% is this website but we can get easily 14% free of taxes with AAA corp bonds. Long term this is amazing and you 2x every 6 years. This is very powerful and any portfolio 100% bonds will look like the chart above from my last post. However, we were a shitful country, I sent think nobody from a developed country should risk their dollars here. I have treasuries and Corp bonds from the US as well, but much less.. Of course, you still have to consider how much you are allocating to those kinds of shitty products, even if they might perform better than bonds in the developed world, you are still likely earning your interest in a pretty shitty currency that is subject to a lot of risk in terms of its real value as opposed to its nominal value... so yeah, how much to fuck around in any investments other than bitcoin could be a long and indepth discussion that probably takes us away from how we might be thinking about the value of our own bitcoin holdings and how to deal with that.. including that this tool focuses on bitcoin, but at the same time, since it is taking advantage of changes (volatility) of the dollar and likely ongoing debasement of the dollar, we can attempt to create sustainable withdrawal practices around that.. . In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

|

February 10, 2024, 08:37:15 PM Merited by JayJuanGee (1) |

|

Of course, you still have to consider how much you are allocating to those kinds of shitty products, even if they might perform better than bonds in the developed world, you are still likely earning your interest in a pretty shitty currency that is subject to a lot of risk in terms of its real value as opposed to its nominal value... so yeah, how much to fuck around in any investments other than bitcoin could be a long and indepth discussion that probably takes us away from how we might be thinking about the value of our own bitcoin holdings and how to deal with that.. including that this tool focuses on bitcoin, but at the same time, since it is taking advantage of changes (volatility) of the dollar and likely ongoing debasement of the dollar, we can attempt to create sustainable withdrawal practices around that.. .

I think it is worth to invest in such currencies only if you live there. All my expenses are in BRL , so it is OK for me if the price USDBRL go up or down In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats).

I could add fixed value of other currencies in today's rate The chart of historical btc price in a hundred currencies is a bit complicated (doable, but high development time, even to find and fix the data, since 2010) |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats).

I could add fixed value of other currencies in today's rate The chart of historical btc price in a hundred currencies is a bit complicated (doable, but high development time, even to find and fix the data, since 2010) Even if it takes a decent amount of time, if it is helpful, then might it still not be a good thing to add.. and maybe some tools might only go back to certain dates, they might not all go back to 2010? We could potentially consider the easy currencies first and maybe if we add less common currencies, then maybe those currencies would ONLY go back as far as the date that the API allows.. but yeah, it still might get down to concerns about how much time needs to be spent and whether it is worth it? Maybe we could talk more specifically in PMs regarding how much time is "high development time?" Just now I had to go back and look at your currency converter, https://bitcoindata.science/bitcoin-units-converterand I did notice that that particular converter is ONLY dealing with current price conversions and so yeah that particular converter is not providing an option for historical conversions - yet I would imagine that there would be some sites that might do some limited kinds of historical conversions? |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Doan9269

|

|

February 12, 2024, 12:11:55 PM |

|

In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats).

We will definitely appreciate this when we are being able to view our local currencies to their amount worth in USD. From my own localized currency in fiat also, we prefer the use of USD just because its a measure of identifying the value of a currency growth over time while its dominance has nothing to do with any financial improvement upon any investment made in it, so i would rather prefer the use of bitcoin over any other form of currencies while USD is just an estimate to the value of my holdings. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 12, 2024, 02:03:54 PM |

|

In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats).

We will definitely appreciate this when we are being able to view our local currencies to their amount worth in USD. From my own localized currency in fiat also, we prefer the use of USD just because its a measure of identifying the value of a currency growth over time while its dominance has nothing to do with any financial improvement upon any investment made in it, so i would rather prefer the use of bitcoin over any other form of currencies while USD is just an estimate to the value of my holdings. Of course, bitmover and I are referring to having a unit converter within this particular tool so that all of the fiat (currently dollar value) references would be for the selected local currency, because if you merely want a contemporary conversion of your currency, you could just look at bitmover's currency converter - and maybe in that regard, as an interim solution, maybe we just want to start by adding such unit conversion link in the thread (even though there is already a unit converter link at the top of the thread). As to your other point regarding how much value to hold in your local currency, versus the dollar versus bitcoin, I think that it is becoming more and more widely known that there are so many folks who do hold/reference dollars rather than their local currency, even if they might not hold dollars, but then they also have a lot of preferences of holding dollars because historically it has had a tendency to appreciate (or at least hold its value better) against the local currencies.. and not as many folks realize that bitcoin is even better than the dollar because bitcoin's short-term volatility frequently clouds thinking, including that it does not even take that much of a zoom out before anyone should be able to see the magnitude of such bitcoin value holding... so yeah, then it comes down to how much of your local cash and/or dollars do you need to hold and then the rest should probably go into bitcoin.. for holding 4-10 years or longer.... which can seem like an eternity for so many folks to think in terms of holding some kind of asset/currency for 4-10 years or longer in order to have decent chances of increasing the quantity and quality of options that they have in their life a wee bit down the road. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

Of course, bitmover and I are referring to having a unit converter within this particular tool so that all of the fiat (currently dollar value) references would be for the selected local currency, because if you merely want a contemporary conversion of your currency, you could just look at bitmover's currency converter - and maybe in that regard, as an interim solution, maybe we just want to start by adding such unit conversion link in the thread (even though there is already a unit converter link at the top of the thread). As to your other point regarding how much value to hold in your local currency, versus the dollar versus bitcoin, I think that it is becoming more and more widely known that there are so many folks who do hold/reference dollars rather than their local currency, even if they might not hold dollars, but then they also have a lot of preferences of holding dollars because historically it has had a tendency to appreciate (or at least hold its value better) against the local currencies.. and not as many folks realize that bitcoin is even better than the dollar because bitcoin's short-term volatility frequently clouds thinking, including that it does not even take that much of a zoom out before anyone should be able to see the magnitude of such bitcoin value holding... so yeah, then it comes down to how much of your local cash and/or dollars do you need to hold and then the rest should probably go into bitcoin.. for holding 4-10 years or longer.... which can seem like an eternity for so many folks to think in terms of holding some kind of asset/currency for 4-10 years or longer in order to have decent chances of increasing the quantity and quality of options that they have in their life a wee bit down the road. I discovered an api with data from 2013 basically all currencies. https://api.coingecko.com/api/v3/coins/bitcoin/market_chart?vs_currency=brl&days=max&interval=daily&precision=2I will take a look. I will probably add support for other local currencies using this api. Data fromm 2010 to 2013 may be supported only for usd. I will see if I can get euro too. About dolar reference... I track my overall portfolio in usd value. Specially for long term analysis. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

Doan9269

|

In which I cannot remember if we might want to add other currencies to this tool.. do you think that there might be some value in that? I am sure some folks might appreciate looking at their own currency rather than USD (even though surely USD remains the dominant shitty fiat out of all of the various shitty fiats).

We will definitely appreciate this when we are being able to view our local currencies to their amount worth in USD. From my own localized currency in fiat also, we prefer the use of USD just because its a measure of identifying the value of a currency growth over time while its dominance has nothing to do with any financial improvement upon any investment made in it, so i would rather prefer the use of bitcoin over any other form of currencies while USD is just an estimate to the value of my holdings. Of course, bitmover and I are referring to having a unit converter within this particular tool so that all of the fiat (currently dollar value) references would be for the selected local currency, because if you merely want a contemporary conversion of your currency, you could just look at bitmover's currency converter - and maybe in that regard, as an interim solution, maybe we just want to start by adding such unit conversion link in the thread (even though there is already a unit converter link at the top of the thread). I've gone through the link provided and I see it's something worth recommending for use, I will try in my own capacity as well to make this available for as many as possible from my locale to use this conversion and a big thanks and a welcome job to bitmober for bringing such idea, the site is well ok for easy use. As to your other point regarding how much value to hold in your local currency, versus the dollar versus bitcoin, I think that it is becoming more and more widely known that there are so many folks who do hold/reference dollars rather than their local currency, even if they might not hold dollars, but then they also have a lot of preferences of holding dollars because historically it has had a tendency to appreciate (or at least hold its value better) against the local currencies.. and not as many folks realize that bitcoin is even better than the dollar because bitcoin's short-term volatility frequently clouds thinking, including that it does not even take that much of a zoom out before anyone should be able to see the magnitude of such bitcoin value holding... so yeah, then it comes down to how much of your local cash and/or dollars do you need to hold and then the rest should probably go into bitcoin.. for holding 4-10 years or longer.... which can seem like an eternity for so many folks to think in terms of holding some kind of asset/currency for 4-10 years or longer in order to have decent chances of increasing the quantity and quality of options that they have in their life a wee bit down the road.

Recently, it has been trending on the internet whereby you see many people and experts giving some sort of financial advice on the way people save their earnings, they largely got recommendations for the use of dollar against the local currency considering the fall in the local currency value in respect to dollar, but it's more important that they will also have to realized this that they could get more better with bitcoin even than what the fiat could get them, I appreciate this efforts altogether in giving people more enlightenment towards using a sustainable means of withdrawal and currency conversion with bitcoin. |

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

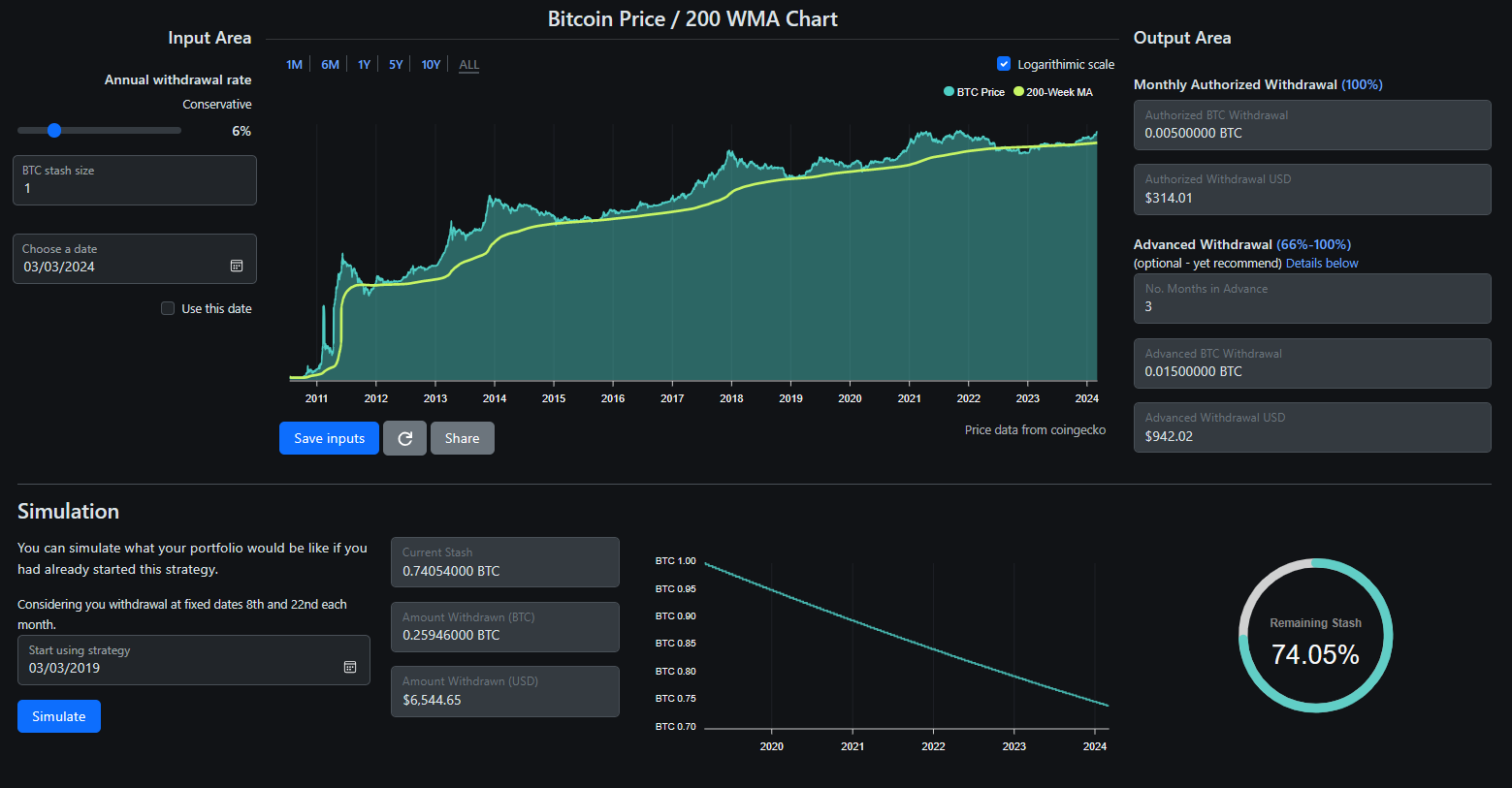

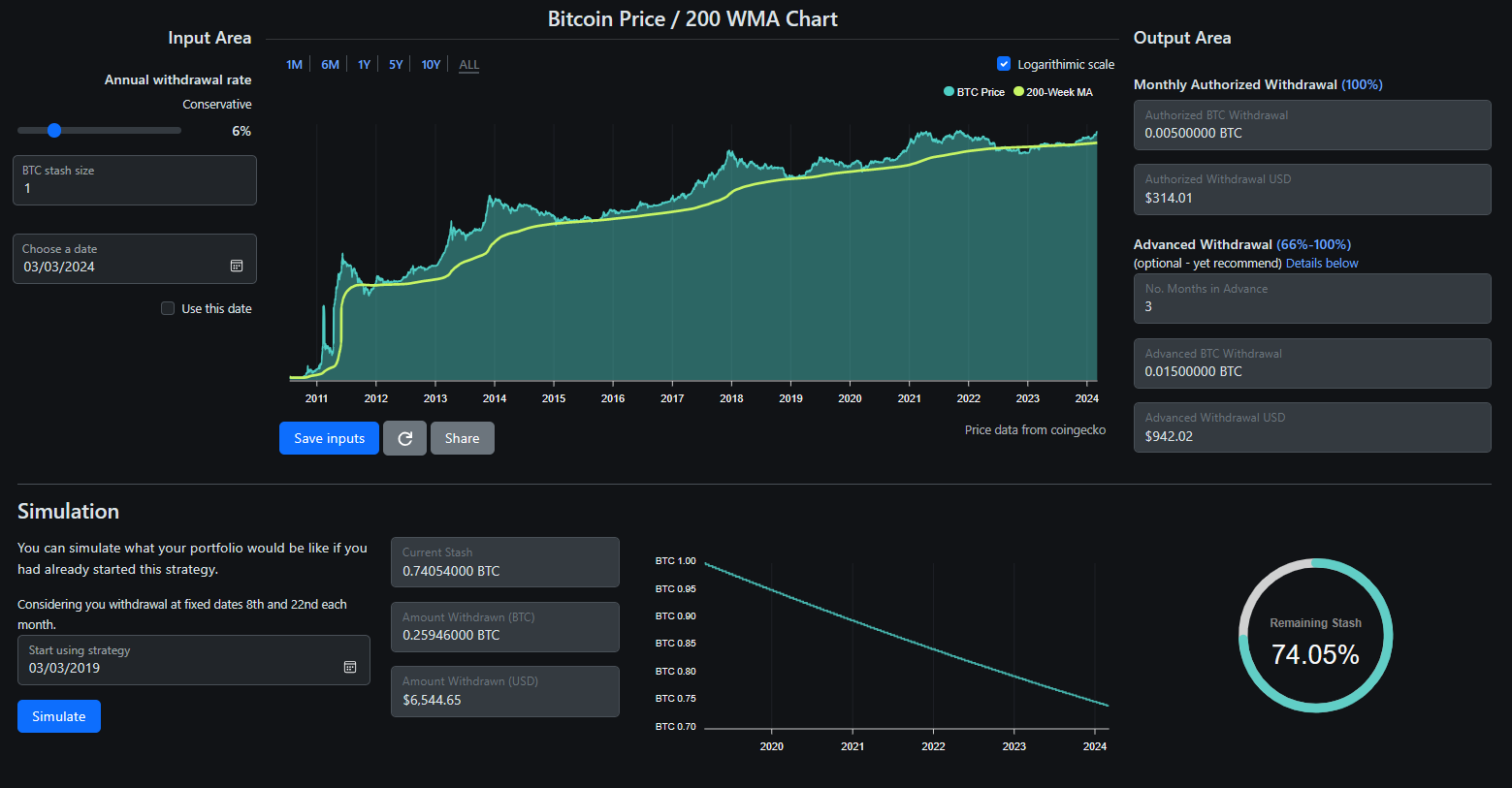

Hey! I made the update I said.  Share button is still not working. But the other ones are. I will fix this share stuff soon! Please tell me what you think JayJuanGee, if you have any suggestions. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

Hey! I made the update I said.  Share button is still not working. But the other ones are. I will fix this share stuff soon! Please tell me what you think JayJuanGee, if you have any suggestions. I like it. It is interesting, and it helps to inform some potential suggestions. The format also looks nice. In order to test it out, I entered in the fuck you status number of coins for June 2019, and even if we were to employ the most aggressive withdrawal rate (of 30%), our dollar value of our coins continued to grow throughout the period, which goes to show that historically using any withdrawal rate within the tool would have resulted in both conservatism in regards to withdrawal and also an ongoing growth of the dollar value of the BTC, even if the BTC stash may have had ended up shrinking stupendously. The fact that even the most maximum of withdrawal rates had not historically ended up with depletion of the BTC stash, it may well be better if the withdrawal percentage would increase to higher rates, maybe even all the way up to 100%, and for those higher rates we might want to call them intentional depletion rates, even though it could be possible that they still do not end up depleting the BTC stash in terms of ongoing increase in value.. depending on future BTC price movements and also depending on how much the 200-WMA continues to go up. On the other hand, I do expect that BTC is going to experience a lot lower future BTC price (and 200-WMA) appreciation values (you can see that I have already accounted for much lower values in my Entry-level fuck you status chart - even though currently, it is looking too conservative), because there are most likely ceilings in BTC's addressable market. Since past results do not translate into future results, I remain comfortable to keep with the seemingly conservative recommendations of the tool in regards to how the withdrawal rates are labeled... even though it seems that any withdrawal rate under 10% may well likely end up being considered ways to continue to grow your BTC investment holdings (in terms of dollar value of your holdings) in spite of engaging in ongoing withdrawal within the bounds of the tool. Maybe another punchline could be that historically in bitcoin, as long as we are using the 200-WMA as our BTC valuation, there may be no need to reach full fuck you status in order to pull the fuck you lever, and we might well be able to start to use BTC portfolio stash amounts far less than expected in order to get started with our living a fuck you status lifestyle.. but we still need to reach a certain number of BTC in order to make it practical to get started with such withdrawals, since it is likely that dollar debasement is going to continue and we are going to want to continue to ensure that we have a sufficient cushion - which is supposed to be part of the justification of the tool in terms of not depleting the principle of our BTC stash and being able to live off of BTC's ongoing price appreciation, without over doing it.. Once we get to a status of being able to withdraw from our BTC stash, it should not matter in the negative that we end up having some extra cushion in the dollar value of our BTC holdings. Of course, I am only referring to strict withdrawal rather than the extra steps that would be required for any guys who might be engaging in advance withdrawals that presume selling the BTC and potentially buying back months if the BTC spot price drops at least a couple of levels below the range in which they had ended up employing the advance withdrawals. Suggestions:For some reason I am a little discombobulated by the lack of separation in regards to the entrance of the current stash size versus the historically projected stack size. So for example, when I enter 540 BTC which would have had been the fuck you status level for June 1, 2019, and if I indicate an annual withdrawal rate of 30%, the tool shows that currently, I still would have 174 BTC (which is more than 3x current fuck you status - see my entry-level fuck you status chart), and in such a scenario I would have had withdrawn $11.5 million over the past nearly 5 years. Of course, right now if I only have 174 BTC remaining, then that would be my current amount in which I would consider how much do I want to (or that I am authorizing myself to) withdraw and I choose if I want to stick with the same rate of withdrawal or to employ a different rate.. of course in this case, I cannot go any higher since the tool maxes out at 30%. It's almost like I would prefer to have the current period for projecting forward and the simulated past period to have their own input and output areas, even though that would lead to a certain level of redundancy - and maybe it would have to be on a separate page if the two concepts (or two calculators might potentially interfere with each other?). It seems to me that the simulator portion of the tool is not engaging in withdrawals of months in advance or buying back months, so the simulation does not need to have the advance withdrawal portion of the tool when it is calculating how the numbers would have had played out historically. In other words, for the current portion, I know what is my current BTC stash size (which I might actually have that number of BTC or I might be imagining an amount of BTC that I want to put into the tool or I might want to use of fraction of the amount of BTC that I already have and put that amount of BTC into the tool). For historical portion (and/or the simulation), if I was using the tool and engaging in historical withdrawal, if I want to end up with the same amount of BTC that I have now, then by definition, I would have had to have started with more BTC than now in order to still have the number of BTC that I have right now. It is not practical for me to apply my present stash to past withdrawals, even though sure I might want to see what the historical numbers look like for my present stash size, yet at the same time, if I hypothesize using my present BTC stash size for past withdrawals I know that with the use of this tool, I currently would not have as many BTC as I have right now, which seems to justify having redundant input areas and redundant output areas for the current projection forward and for the projection of past performance (or the simulation) based on how many BTC I might have had in the past or how many BTC I speculate myself to have had in the past. I am interested to hear what other guys have to say. Does anyone understand it? or find it useful for anything in the ball park for what we might be trying to achieve here? I know that there were a few guys who mentioned their desires to see how the tool would perform historically, so here is the chance for some of those guys to chime in. Do "we" (royal that is) need to name any names or to ask directly to certain members in regards to the guys who said that they wanted some kind of historical rendition of the tool? |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 04, 2024, 09:40:16 AM |

|

I wish that one day I will get to be paid in this platform I have acquired alot of knowledge and has been very well fascinated with everything going in on this group it has been a system of confidence and continueoues learning which will impact alot of by deminshing mayopic reasonings to set you for the future marketing strategy.....

I will be delighted for my BTC address to be among the one that will be posting in here as one of the ones in payment roll...

It will be a thing of joy to be participating in the forum as a full member which I know they will be happening soon have a nice day gallant gentle men and women

|

|

|

|

|

NotATether

Legendary

Offline Offline

Activity: 1582

Merit: 6695

bitcoincleanup.com / bitmixlist.org

|

|

March 04, 2024, 11:21:52 AM |

|

@bitmover

It just hit me, that your tool does not take into account any taxes that have to be paid on each withdrawal.

So the amount of cash you will effectively have will be lower than the monthly amount that is withdrawn.

Why don't you make an input field for tax percentage, which is then factored into the algorithm? 0% would mean there is no tax and should probably be the default.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

bitmover (OP)

Legendary

Offline Offline

Activity: 2282

Merit: 5901

bitcoindata.science

|

@bitmover

It just hit me, that your tool does not take into account any taxes that have to be paid on each withdrawal.

So the amount of cash you will effectively have will be lower than the monthly amount that is withdrawn.

Why don't you make an input field for tax percentage, which is then factored into the algorithm? 0% would mean there is no tax and should probably be the default.

This could be interesting. But I must think about how to implement it. I don't how it works in other countries, but we usually pay 15% tax over the gains here. So, I would also need to add an average price and the tax percent, to calculate it correctly. What do you think JayJuanGee? It's almost like I would prefer to have the current period for projecting forward and the simulated past period to have their own input and output areas, even though that would lead to a certain level of redundancy - and maybe it would have to be on a separate page if the two concepts (or two calculators might potentially interfere with each other?). It seems to me that the simulator portion of the tool is not engaging in withdrawals of months in advance or buying back months, so the simulation does not need to have the advance withdrawal portion of the tool when it is calculating how the numbers would have had played out historically.

In other words, for the current portion, I know what is my current BTC stash size (which I might actually have that number of BTC or I might be imagining an amount of BTC that I want to put into the tool or I might want to use of fraction of the amount of BTC that I already have and put that amount of BTC into the tool).

For historical portion (and/or the simulation), if I was using the tool and engaging in historical withdrawal, if I want to end up with the same amount of BTC that I have now, then by definition, I would have had to have started with more BTC than now in order to still have the number of BTC that I have right now.

It is not practical for me to apply my present stash to past withdrawals, even though sure I might want to see what the historical numbers look like for my present stash size, yet at the same time, if I hypothesize using my present BTC stash size for past withdrawals I know that with the use of this tool, I currently would not have as many BTC as I have right now, which seems to justify having redundant input areas and redundant output areas for the current projection forward and for the projection of past performance (or the simulation) based on how many BTC I might have had in the past or how many BTC I speculate myself to have had in the past.

For now, I added just the month withdrawal, without any advanced. This can be added, however we must think about how to do it. For example, does the advanced withdrawal will work like a a super aggressive withdrawal? For example, can I just multiply the current month x 5, if that is the case, for example? Or do I have to compensate it later? And if i need to compensate later, when? This might be very subjective for this tool. About future withdrawals, I would need to fix a withdrawal percentage every month, because we cannot predict the price. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 04, 2024, 03:55:44 PM

Last edit: March 04, 2024, 04:19:39 PM by JayJuanGee |

|

@bitmover

It just hit me, that your tool does not take into account any taxes that have to be paid on each withdrawal.

So the amount of cash you will effectively have will be lower than the monthly amount that is withdrawn.

Why don't you make an input field for tax percentage, which is then factored into the algorithm? 0% would mean there is no tax and should probably be the default.

This could be interesting. But I must think about how to implement it. I don't how it works in other countries, but we usually pay 15% tax over the gains here. So, I would also need to add an average price and the tax percent, to calculate it correctly. What do you think JayJuanGee? I thought that we discussed this previously and largely rejected it because there are so many variabilities in both tax treatments, but also how tax treatments could be offset by the individual too (including if they might have some of their funds in tax privileged accounts). I would not be opposed to any kind of an additional general slider that might incorporate anticipated extra "fees or taxes" that a person could self-select a percentage expectation. It's almost like I would prefer to have the current period for projecting forward and the simulated past period to have their own input and output areas, even though that would lead to a certain level of redundancy - and maybe it would have to be on a separate page if the two concepts (or two calculators might potentially interfere with each other?). It seems to me that the simulator portion of the tool is not engaging in withdrawals of months in advance or buying back months, so the simulation does not need to have the advance withdrawal portion of the tool when it is calculating how the numbers would have had played out historically.

In other words, for the current portion, I know what is my current BTC stash size (which I might actually have that number of BTC or I might be imagining an amount of BTC that I want to put into the tool or I might want to use of fraction of the amount of BTC that I already have and put that amount of BTC into the tool).

For historical portion (and/or the simulation), if I was using the tool and engaging in historical withdrawal, if I want to end up with the same amount of BTC that I have now, then by definition, I would have had to have started with more BTC than now in order to still have the number of BTC that I have right now.

It is not practical for me to apply my present stash to past withdrawals, even though sure I might want to see what the historical numbers look like for my present stash size, yet at the same time, if I hypothesize using my present BTC stash size for past withdrawals I know that with the use of this tool, I currently would not have as many BTC as I have right now, which seems to justify having redundant input areas and redundant output areas for the current projection forward and for the projection of past performance (or the simulation) based on how many BTC I might have had in the past or how many BTC I speculate myself to have had in the past.

For now, I added just the month withdrawal, without any advanced. This can be added, however we must think about how to do it. I would not want to add any presumed extra advanced monthly withdrawal to the simulator - because the extra monthly withdrawal is complicated and very discretionary. I largely mentioned the advance monthly withdrawal not being in the simulator because I anticipated that it would not have been in there and should not have had been in there. The tool is already complicated enough, just the idea of it, since so many folks gravitate towards calculating their strategies towards spot price, and this tool is attempting to ground calculations based on the 200-WMA, even though in the real world, the price that we get for making sales is going to be spot price at the time of any of our sales. Sure, you could put something like monthly withdrawals into the simulator for the middle of the range as an automatic, but then once it gets executed then the clock would start to run in regards to if the middle of the next range is hit in order to calculate potential additional months of withdrawal, and so if the BTC price continues to move up an then it hits the middle of the next range, then further advance months could be withdrawn automatically but how much could be withdrawn may well depend upon how much time has passed between the earlier withdrawal and the next withdrawal, but then if the price moves down a couple of levels, then some of the months could be bought back (perhaps starting at the middle of the range of at least 2 levels down, but we would have to invent a formula for that (or an input fields that say how many levels down is going to be the buy back and then what percentage will be bought back at each level and then how much time passed between the sale and the buying back). It is way too complicated and discretionary and without any formulas that would likely be needed to be customizable. I think that it almost defeats the whole purpose of the tool to be getting too caught up and distracted into seemingly trading dynamics rather than the intended sustainable withdrawal ideas that would not revolve so much around the potential trading aspects of the advance withdrawal ideas. The reason that I put advance withdrawal within the framework in the first place is to have some discretionary options in place to be able to get some guidelines regarding the extent to which the BTC price as compared to the 200-WMA is at any point in time is becoming frothy and/or overly-frothy, and there are surely degrees of frothiness in the BTC price, so the more frothiness the greater the ability to withdraw more months in advance, yet it may not even make sense to withdraw months in advance at certain levels of BTC's price performance. For example, right now when we are going through the middle of noman's land (from $55k to $82k-ish), and it might not make sense to be withdrawing month's in advance in places like this, even though the tool allows for it.. and a person might even get nervous about withdrawing 23, 35, 47 or 59 months in advance for some of the higher ends (the 200-400% range or the 400-650% range or the 650 to 900% range or the 900% to 1,400% range or the 1,400% range), even though the tool allows those specific levels of advance withdrawals at each of those levels. The 2021 price run ONLY got into the lower end of the 400-650% range, and only during the early peak. The second 2021 peak, even though the BTC spot price ended up higher, it was only in the lower end of the 200-400% range. The 2013 and the 2017 price runs surely ran into the supra 1,400% range, the highest for the tool, which I am not sure if those kind of discrepancies are going to to happen again (especially the level of the one in 2013 in which BTC spot price reached more than 2,600% higher than the 200WMA), yet we later saw that they would have been good times to sell extra to make it through the subsequent bear market (but we did not know that at the time or in advance). So maybe I should be bothered by the tool even recommending the consideration of advance withdraw, which causes me to consider that maybe I should attempt to explain within the tool a bit better what I am wanting to say about my recommendation to consider and to employ advance withdrawal - which I probably don't even know what I mean, exactly.. . because I am probably trying to say that it should be seriously considered to use the advance withdrawal.. but at the same time to have some kind of idea within your own thinking about when you might employ such idea, and in the mean time a place to put the withdrawn money and realize that it could later be used to live off the money if the BTC price drops or to be used to buy back months in order to go back to using using the tool for sustainable monthly withdrawals.. because if you sell months in advance then you cannot sell further months if the price drops below that range until the months have passed.. and all of this would be self-directed and potentially complicated to keep track of. For example, does the advanced withdrawal will work like a a super aggressive withdrawal? For example, can I just multiply the current month x 5, if that is the case, for example?

If trying to employ for the simulator, we would have to figure out formulas for when the withdrawals would be exercised that would thereby account for the date that it was executed, and if further advance withdrawals are authorized and thereby executed by the tool because the BTC price reached the next authorization threshold, then it would need to account for how much time passed since the previous advance withdrawal execution in order to calculate the balance of how many months would be remaining for the next advance withdrawal. Or do I have to compensate it later? And if i need to compensate later, when? This might be very subjective for this tool.

The buying back could be some kind of formula like is used in my raking tool, but it would also have to consider passage of time in terms of how many months could still be bought back. We would also have to consider that when the BTC price drops that the sold months could be bought back at lower amounts, so there likely would be some discretion in terms of calculating if a month is fully bought back. About future withdrawals, I would need to fix a withdrawal percentage every month, because we cannot predict the price.

We have not gotten into discussion of adapting these tools for future withdrawals, which like you said would have to have a prediction element. My entry-level fuck you status chart has a prediction element that seems to be changing all the time, but it attempts to predict the 200-WMA, in a 4-year cycle fashion that may or may not end up playing out, and while my fuck you status chart does not try to predict BTC spot price, a range of possible BTC spot prices could be implied from the attempts to predict the 200-WMA.. which again is all amorphous. I think with any kinds of sustainable withdrawal tool, there is are presumptions about the growth likelihood of the underlying assets, and in the traditional financial world, 4% is considered to be sustainable withdrawal based on expectations that the underlying assets in the investment portfolio will perform at least 4% on average... So in bitcoin, we likely can presume higher than 4%, more like 6-10% seems more than reasonable and even conservative, since I backed tested the tool and even 30% seems to work for BTC, even though I would not want to rely on 30% continuing to be sustainable.. so I personally believe it remains more than conservative enough to continue to stay with 6% to 10% as our defined "moderate" sustainable withdrawal rate. By the way, I consider my raking tool to be way more practical (and straight-forward) for the basic ideas of managing your BTC holdings since there are not as many variables to play with, especially if you are not sure if you have enough BTC yet... so using this sustainable withdrawal tool way too prematurely (before you have enough BTC or able to establish using it with a certain quantity of your BTC), then you may well end up with way less BTC than you should have because you may well end up selling way too many BTC too soon, rather than erroring on the side of HODLing - even though the sustainable withdrawal tool gives a lot of guidelines for establishing a potential monthly budget with a certain quantity of BTC as the base... and yeah it does not hurt to provide guys more and more tools, even if they might end up using them differently from their original design intentions. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|