NotATether

Legendary

Offline Offline

Activity: 1582

Merit: 6717

bitcoincleanup.com / bitmixlist.org

|

|

March 07, 2024, 10:19:36 AM |

|

This could be interesting. But I must think about how to implement it. I don't how it works in other countries, but we usually pay 15% tax over the gains here. So, I would also need to add an average price and the tax percent, to calculate it correctly. What do you think JayJuanGee? I thought that we discussed this previously and largely rejected it because there are so many variabilities in both tax treatments, but also how tax treatments could be offset by the individual too (including if they might have some of their funds in tax privileged accounts). I would not be opposed to any kind of an additional general slider that might incorporate anticipated extra "fees or taxes" that a person could self-select a percentage expectation. I don't think it's that hard. I mean now, a person can calculate the tax deductible by themselves and then subtract it from the periodic withdrawal amount, but that is not very convenient to do by hand, especially for those of us lurking here who can't math  Basically, there is only capital gains tax to worry about, so one percentage, and it's going to be different per country. So the tax value will be "blended" into the annual withdraw rate percentage to bring it up slightly. We just need to figure out by how much. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

March 12, 2024, 01:35:57 AM

Last edit: March 12, 2024, 09:09:38 AM by bitmover Merited by JayJuanGee (2) |

|

Hey JayJuanGee and everyone. The share button is now working. You can now share your work with anyone using a shareable URL, similar to the giveaway manager  You can test here: https://bitcoindata.science/withdrawal-strategy?U2FsdGVkX19F2rGk8qQjC+Lmnxh93CWBbEELB6jW90ftg5WQCSY/ML0wm55EcLlJ |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

joker_josue

Legendary

Offline Offline

Activity: 1638

Merit: 4558

**In BTC since 2013**

|

|

March 12, 2024, 07:52:56 AM |

|

It's a good idea to create a sharing link. It would be interesting to see what kind of strategies other users use. They can use 1BTC as the input amount. The idea is just to see the strategy. But bitmoving your share link doesn't work. It gives error 500. Either way, I tested and created a link, and everything worked. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

March 12, 2024, 09:10:45 AM |

|

It's a good idea to create a sharing link.

It would be interesting to see what kind of strategies other users use. They can use 1BTC as the input amount. The idea is just to see the strategy.

But bitmoving your share link doesn't work. It gives error 500. Either way, I tested and created a link, and everything worked.

Ops, thanks for noticing. There was a typo. Now fixed. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 12, 2024, 05:05:39 PM |

|

It's a good idea to create a sharing link.

It would be interesting to see what kind of strategies other users use. They can use 1BTC as the input amount. The idea is just to see the strategy.

But bitmoving your share link doesn't work. It gives error 500. Either way, I tested and created a link, and everything worked.

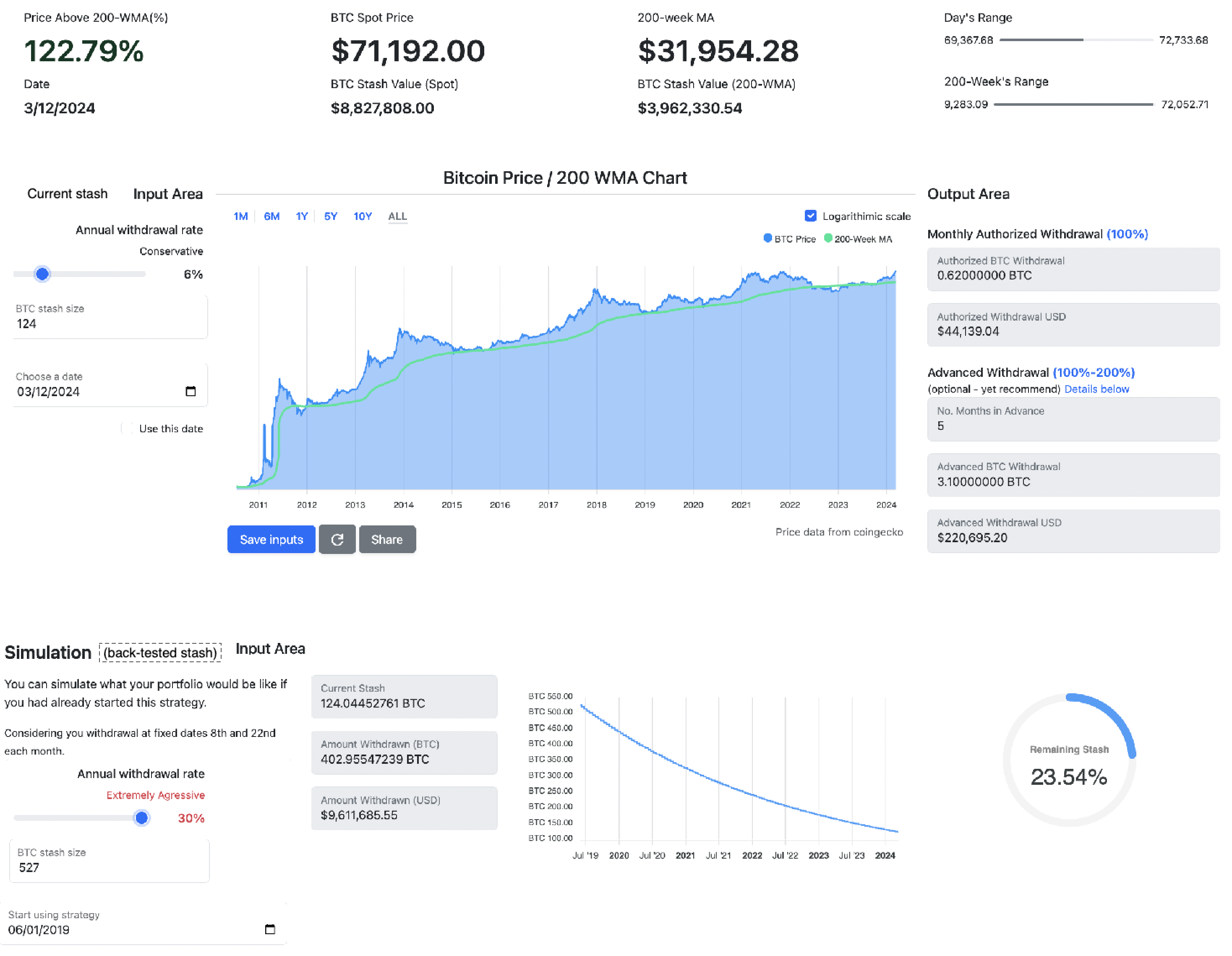

Ops, thanks for noticing. There was a typo. Now fixed. I just did it, and it worked for me. Thanks. It seems to save the percentage withdrawal, portfolio size and the date and it seems to always check the box "use this date", whether the "use this date" box was checked in the original data or not. I don't find that to be problematic, and I consider the share link to be able to make some kind of a point about data as of a specific date and then to share that... so we are adding utility through these kinds of features. I do still contend for the reasons that I had outlined earlier that there should be a separate input area for the back-testing data (referred to as simulation) versus the current data (in the top). Yet even with the shared data as of today, the share button does allow us to describe some sustainable withdrawal situation and then to proclaim that the tool shows that even with the most aggressive withdrawal of 30% starting from June 2019 would have had retained it's dollar value. So again, see my example, of starting out at fuck you status of $2 million on June 1, 2019 (which would have had been 537 BTC), and then after nearly 5 years of withdrawing at 30% per year (on a twice a month basis), nearly $9.4 million would have had been withdrawn, and the remaining BTC stash as of today would have still been nearly 126.4 BTC, and we would have to enter that separately to see it's worth more than $4 million in terms of the 200-WMA (and more than $9 million spot price right now)Of course, past performance does not equal future results, so that would be part of the justification to be careful in terms of ongoing employment of aggressive withdrawal strategies.. but surely each person has to figure out what works for him/her in terms of timing when to start withdrawing BTC. Also using the feature of advance withdrawal could contribute towards a withdrawing too many BTC too soon. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

March 12, 2024, 06:48:28 PM |

|

I do still contend for the reasons that I had outlined earlier that there should be a separate input area for the back-testing data (referred to as simulation) versus the current data (in the top).

I don't think i get it. Maybe you can draw on paintbrush, so I can understand this suggestion better. It looks in a separate input area to me. Maybe you are suggesting a different page? |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Chibit01

Jr. Member

Offline Offline

Activity: 42

Merit: 5

|

|

March 12, 2024, 07:39:22 PM |

|

Wow that's great it is actually a good and welcome development from the site developer it will be more easier to explain and expansaite topic for one another here ... |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 12, 2024, 08:14:36 PM |

|

I do still contend for the reasons that I had outlined earlier that there should be a separate input area for the back-testing data (referred to as simulation) versus the current data (in the top).

I don't think i get it. Maybe you can draw on paintbrush, so I can understand this suggestion better. It looks in a separate input area to me. Maybe you are suggesting a different page? I am not sure if Paintbrush will help because I am talking about the same categories for the simulator. % withdrawal, stack size and start date. In other words, the simulator should run separately from the current.. authorized withdrawal amount. Edited: O.k. Below I added a paintbrush example. Don't get me wrong. I like the information that is being provided, and I can still figure out both historical and future projection matters because I know what I am looking for, but there can be a bit of confusion for a new person coming to the tool regarding when we are projecting a sustainable withdrawal rate from here into the future to provide an authorized amount to withdraw versus if we are going to project from the past to the present through the simulator. So for example, if we use $2 million as our default entry-level fuck you status, then right now, I can look at the tool, and I can see that today it takes 62.6 BTC in order to be at FU status (based on the 200-WMA valuation). However, on June 1, 2019, I needed 537 BTC in order to be at FU status in terms of dollar value and the 200-WMA on that date. As the below image shows if I want to back test the tool, then the 537 can go into the tool and it shows that withdrawing at the most aggressive rate of 30% annually will reduce the stash down to 124 by today. This analysis works for someone who is looking at himself having a larger stack in the past and spending down to his current BTC stack size.. but if we currently have not yet reached our fuck you status or close to our fuck you status, we should be forward looking and not backward looking. even though the backward looking tool provides valid information.. to see how a person might have spent his stash down. but it does not do anything to tell us how many BTC we need right now. Many of us who are still building our BTC stack size are considering how many BTC that we need now or into the future in order to be able to start to use the tool, to start withdrawing under the parameters of the tool and potentially to keep our BTC stacks sustainable in terms of their maintaining their dollar value in order that we can continue to withdraw without depleting our principle, in terms of the dollar value. The tool does not help us to backload our current stash in terms of BTC value because that question is mostly irrelevant.. our current BTC stash is too small in order to work in the past, but our current stash will work into the future as long as we have 62.6 BTC now, when we needed to have 537 BTC on June 1, 2019 in order to be in the same place. So yeah, if we are going to look up the history, then we can put the equivalent number of BTC into the stash in order to use our fuck you status dollar value, but we should be putting that into the simulator side with the 2019 date and not into the current date if we were going to project forward from here versus projecting from the past to here, since the current date only projects from here forward and the stash sizes would be different. Ok.. here is a Paintbrush illustration that shows examples of separate and independent inputs for each of areas... note an ability to put a different stash size and withdrawal rate added to the simulator input area.  |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

March 28, 2024, 12:27:29 AM

Last edit: March 28, 2024, 07:13:18 PM by bitmover Merited by JayJuanGee (1) |

|

Hello JayJuanGee, You may have noticed the page is broken. I was getting data from coingecko, and they decided to close their API. {

"error": {

"status": {

"timestamp": "2024-03-28T00:23:30.584+00:00",

"error_code": 10012,

"error_message": "Your request exceeds the allowed time range. Public API users are limited to querying historical data within the past 365 days. Upgrade to a paid plan to enjoy full historical data access: https://www.coingecko.com/en/api/pricing. "

}

}

}

I will look somewhere else for a free bitcoin price data API... maybe someone has a good suggestion? Maybe binance (this is probably the easiest choice, BTC USDT data from binance) I have stored locally price data from 2010 to 2021  |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 28, 2024, 02:02:57 AM |

|

Hello JayJuanGee, You may have noticed the page is broken. I was getting data from coingecko, and they decided to close their API. { "error": { "status": { "timestamp": "2024-03-28T00:23:30.584+00:00", "error_code": 10012, "error_message": "Your request exceeds the allowed time range. Public API users are limited to querying historical data within the past 365 days. Upgrade to a paid plan to enjoy full historical data access: https://www.coingecko.com/en/api/pricing. " } } } I will look somewhere else for a free bitcoin price data API... maybe someone has a good suggestion? Maybe binance (this is probably the easiest choice, BTC USDT data from binance) I have stored locally price data from 2010 to 2021  Yes. .I noticed that I was getting spinning beachballs, and I was hoping that it was merely a temporary glitch.. and maybe there is a certain rotation that happens with the data sources from time to time... and too bad about these kinds of set backs when the data was showing a lot of informative dynamics that so far are not very capturable in other locations. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

Yes. .I noticed that I was getting spinning beachballs, and I was hoping that it was merely a temporary glitch.. and maybe there is a certain rotation that happens with the data sources from time to time... and too bad about these kinds of set backs when the data was showing a lot of informative dynamics that so far are not very capturable in other locations.

Website maintenance takes some effort. Ddos and broken API in less than a month! I discovered some free api here: https://blog.rmotr.com/top-5-free-apis-to-access-historical-cryptocurrencies-data-2438adc8b62I will take a look and setup one this week! |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 28, 2024, 02:51:31 AM |

|

Yes. .I noticed that I was getting spinning beachballs, and I was hoping that it was merely a temporary glitch.. and maybe there is a certain rotation that happens with the data sources from time to time... and too bad about these kinds of set backs when the data was showing a lot of informative dynamics that so far are not very capturable in other locations.

Website maintenance takes some effort. Ddos and broken API in less than a month! I discovered some free api here: https://blog.rmotr.com/top-5-free-apis-to-access-historical-cryptocurrencies-data-2438adc8b62I will take a look and setup one this week! Ok. great. Hopefully one of them ends up working for us, and is satisfactory... |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

joker_josue

Legendary

Offline Offline

Activity: 1638

Merit: 4558

**In BTC since 2013**

|

|

March 28, 2024, 07:56:41 AM |

|

Thank you for sharing this discovery. Sometimes we are looking for an API to collect some data more easily, and it is not easy to find something free. I will save this link and analyze it for future projects.  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

Hello JayJuanGee, You may have noticed the page is broken. I was getting data from coingecko, and they decided to close their API. {

"error": {

"status": {

"timestamp": "2024-03-28T00:23:30.584+00:00",

"error_code": 10012,

"error_message": "Your request exceeds the allowed time range. Public API users are limited to querying historical data within the past 365 days. Upgrade to a paid plan to enjoy full historical data access: https://www.coingecko.com/en/api/pricing. "

}

}

}

I will look somewhere else for a free bitcoin price data API... maybe someone has a good suggestion? Maybe binance (this is probably the easiest choice, BTC USDT data from binance) I have stored locally price data from 2010 to 2021  Tool is back online. I was able to continue using coingecko. As coingecko allow up to 365 days of historical data in their free plan, and as historical data is static, I just downloaded all historical data. I also made a small code to check for changes in the last days of their free api plan. So, it will theoretically update our downloaded historical data once a day. Looks to be perfect. let's see in the next days if it updates well! |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

MusaPk

|

|

March 31, 2024, 11:19:38 AM |

|

Hey, I was able to continue using coingecko API. Website is working again. I will give more details about how I managed to do it in the Withdrawal Strategy ANN Website is working again! https://bitcoindata.science/withdrawal-strategyCheers!

Tool is back online.

I was able to continue using coingecko.

As coingecko allow up to 365 days of historical data in their free plan, and as historical data is static, I just downloaded all historical data.

I also made a small code to check for changes in the last days of their free api plan. So, it will theoretically update our downloaded historical data once a day. Looks to be perfect. let's see in the next days if it updates well!

Good job done bitmover. Hopefully it will work, if coingecko is providing past data for free. There are many users who keep an eye on that tool very often because quick glance of Bitcoin spot price vs 200-WMA and the Bitcoin withdrawal strategy. Hopefully in few days things will get more clear about the new fix. Everyone can fix the issue with paid plan but you fixed the issue using this novel approach. Kudos to your effort. |

|

|

|

NotATether

Legendary

Offline Offline

Activity: 1582

Merit: 6717

bitcoincleanup.com / bitmixlist.org

|

Bitmover, I just realized that we might also need a DCA strategy tool for buying bitcoin  But that would depend on many things like your current income and what percentage of it you would like to spend. In addition to that, maybe it can even have some sort of dynamic DCA that looks at moving averages which will influence the amount of bitcoins someone will need to buy. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

April 04, 2024, 09:40:18 AM Merited by JayJuanGee (1) |

|

Bitmover, I just realized that we might also need a DCA strategy tool for buying bitcoin  But that would depend on many things like your current income and what percentage of it you would like to spend. When discovered btc I didn't do any btc. I used other investments to buy it.. I reallocated in very few months (about 3). Thankfully, signature campaigns are somewhat of a DCA for me. But a typical dca strategy is nice. In addition to that, maybe it can even have some sort of dynamic DCA that looks at moving averages which will influence the amount of bitcoins someone will need to buy.

There could be some interesting relationship between how much you should invest and the current 200-WMA. Maybe at high levels of 200-WMA, no money should be invested at all? Or just a very small amount. And when the price is very low, the investor should make an effort to invest more (the money he didn't invest when 200WMA was very high.) |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

NotATether

Legendary

Offline Offline

Activity: 1582

Merit: 6717

bitcoincleanup.com / bitmixlist.org

|

|

April 04, 2024, 09:54:53 AM |

|

Bitmover, I just realized that we might also need a DCA strategy tool for buying bitcoin  But that would depend on many things like your current income and what percentage of it you would like to spend. When discovered btc I didn't do any btc. I used other investments to buy it.. I reallocated in very few months (about 3). Thankfully, signature campaigns are somewhat of a DCA for me. But a typical dca strategy is nice. Well, it would be nice for people to see how much money they made a profit off of their DCA strategy if you input the day month and year they've start buying it (or maybe just the month and year but that would not work very well because of the volatile BTC price). You could even make a little graph that shows how much in the green (or red) their investment is in, similar to https://hodl.camp. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 04, 2024, 09:33:15 PM |

|

Bitmover, I just realized that we might also need a DCA strategy tool for buying bitcoin  But that would depend on many things like your current income and what percentage of it you would like to spend. When discovered btc I didn't do any btc. I used other investments to buy it.. I reallocated in very few months (about 3). Thankfully, signature campaigns are somewhat of a DCA for me. But a typical dca strategy is nice. In addition to that, maybe it can even have some sort of dynamic DCA that looks at moving averages which will influence the amount of bitcoins someone will need to buy.

There could be some interesting relationship between how much you should invest and the current 200-WMA. Maybe at high levels of 200-WMA, no money should be invested at all? Or just a very small amount. And when the price is very low, the investor should make an effort to invest more (the money he didn't invest when 200WMA was very high.) Surely there are several factors to account when establishing your BTC position - and the earliest of BTC accumulators probably should be accumulating at any price until the start to get a certain level in which they might be able to be more selective. I probably would not want to be involved with any kind of tool that overly attempts to strategize in regards to when to buy bitcoin, since my frequent suggestion is to attempt to be as aggressive as you can in regards to investing into bitcoin without over doing it, so even though I am not opposed to the theories of holding back in order to buy on dips, yet from my perspective, there could problems for either suggesting waiting to accumulate or advising to wait to accumulate.. so I am not too excited about anything that might contribute towards waiting.. even though I do understand and agree with ideas about having some money available for buying on dips.. and I also agree with front-loading, even though it can be difficult to know when to engage in any of those kinds of behaviors except for being able to appreciate that you might not have enough BTC so there can be various strategies to employ to attempt to increase the likelihood of accumulating more BTC.. .... but then maybe I have another concern that it is more important to have more BTC even if you had to spend more per BTC to get it, rather than having fewer BTC.. Would you rather be a guy who has an average cost per BTC that is ONLY $1k per BTC, but he ONLY has 2 BTC? or a guy who has an average cost per BTC that is $10k per BTC but he has 10 or more BTC? One of the things that seems to make bitcoin special is that it is an asset that is amongst the best, if not the best, asset that is widely available to the whole world's population, so a goal of accumulating as many as you can within your own means of gathering seems to be more important than figuring out your average cost per BTC... while at the same time, once you established enough and/or more than enough BTC within the bounds of your assessments of your needs for cashflow, then you can start to use these kinds of sustainable withdrawal tools and perhaps even largely continue to hold your BTC and allow your BTC holdings to continue to grow (at least in terms of dollar values) since the tools might allow you to figure out ways to strategize your sells in either such a way that you don't have to sell as much or alternatively pace your sales.. ... I still have not completely figured out a way on a personal level to completely use any of the advance month sales because it frequently is not going to feel good to sell large amounts of your BTC unless you are starting to feel that the BTC price is getting into territories of over-exuberance, and I am not even going to concede to knowing when that is going to be, so each person would need to figure out the extent to which s/he wants to sell months of withdrawal authorizations in advance. Bitmover, I just realized that we might also need a DCA strategy tool for buying bitcoin  But that would depend on many things like your current income and what percentage of it you would like to spend. When discovered btc I didn't do any btc. I used other investments to buy it.. I reallocated in very few months (about 3). Thankfully, signature campaigns are somewhat of a DCA for me. But a typical dca strategy is nice. Well, it would be nice for people to see how much money they made a profit off of their DCA strategy if you input the day month and year they've start buying it (or maybe just the month and year but that would not work very well because of the volatile BTC price). You could even make a little graph that shows how much in the green (or red) their investment is in, similar to https://hodl.camp. I find those DCA tools to already be very good tools for figuring out where a person would have had been if he had followed a certain level of strict DCA strategy, even for some period and then selecting another period and then doing some of the math ourselves in regards to if there might have had some periods of lump sum in the buying period or buying dips. So sometimes we might be able to see where our actual bitcoin holdings are, versus where our holdings would have been or could have been if we were to have had followed some other strategy... and sometimes even being able to see if whatever we are currently doing is competitive with some kind of a strict DCA strategy or if we might have over-performed or under-performed such a strategy. The tools are likely ONLY going to take us so far.. and surely one of the advantages of already having had established a BTC stash that might be enough or more than enough is that either this sustainable withdrawal tool, or even my raking tool, can help to give us ideas in regards to how to reasonably manage the stash that we had already established. .and if we had been investing in bitcoin for several cycles, then it becomes more and more likely that we are going to be in sufficient profits.. which is another problem with considering merely simple profits, and from my own point of vies simple profits do not make very much difference, since sure maybe we can sell some of our BTC based on merely being in simple profits, but if we build and hold BTC profits for several cycles, it becomes more and more likely that our BTC holdings will already start to be in a kind of status of compounding profits, which additionally justifies the employment of a sustainable withdrawal status that ends up likely taking advantage of the ability of the BTC holdings to continue to compound in value... .. but then again once someone might be in the process of actually wanting to sustainably withdraw from his BTC stash, he may no longer be as concerned about compounding value, but instead more appreciating of the fact that BTC prices (especially measured by the 200-WMA) are continuing to out perform traditional investments which likely justifies the abilities to employ withdrawal rates that are much higher than if he were to keep his value in traditional investments, so surely it is becoming more apparent to me that a 10% withdrawal strategy has good chances of continuing to be sustainable in bitcoin, which largely means that a guy in bitcoin may well ONLY need to have $800k in bitcoin as compared to $2 million in traditional investments (again measuring by the 200-WMA is currently a reduction from around 60.8 BTC to 24.3 BTC. each of them would constitute around a $6,666 month withdrawal amount... yet having the value in BTC likely causes the lower amount of BTC to be more sustainable than if the higher amount of BTC were sold into dollars and surely of course, since the current BTC price is a bit more than double the 200-WMA, then around 30 BTC could be sold right now to get the $2million fuck you status.. . .and maybe include having to sell a bit more for taxes.. (maybe 36 BTC), so then if the guy is walking away with $2 million in cash then he would presumptively need to invest it somewhere in order to get the 4% withdrawal rate and/or the $6,666 per month of income off of that. I would feel much more comfortable having 24.3 BTC in BTC and using a 10% withdrawal rate in order to get the $6,666 per month of cashflow perpetually and in a sustainable way based on bitcoin's ongoing expected growth rate, and at the same time we can look at actual BTC's 200-WMA growth rate to attempt to verify if we are expecting the amount to come down and/or if our anticipated ongoing 10% withdrawal rate is continuing to be sustainable. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitmover (OP)

Legendary

Online Online

Activity: 2282

Merit: 5914

bitcoindata.science

|

|

April 04, 2024, 11:53:50 PM |

|

Would you rather be a guy who has an average cost per BTC that is ONLY $1k per BTC, but he ONLY has 2 BTC? or a guy who has an average cost per BTC that is $10k per BTC but he has 10 or more BTC?

One of the things that seems to make bitcoin special is that it is an asset that is amongst the best, if not the best, asset that is widely available to the whole world's population, so a goal of accumulating as many as you can within your own means of gathering seems to be more important than figuring out your average cost per BTC... This is very important. I agree 100%. The average cost simple doesn't matter. It is an imaginary number in our heads, which has zero consequences. How much BTC you have (or any other asset) is much more important than how much you paid for it. If you have 10 BTC now and I have 10 BTC now too, it doesn't make any different if my average price is lower or higher than yours. They are worth the same. We should never try to guide our decisions based in average prices imo. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|