I recently saw a video of Jordan Belfort (the wolf of wallstreet) talking about BTC he was pretty much totally against it saying he thinks the govn't will never allow an anonymous (even though btc isn't anon) global currency that makes it easy to launder money. He thinks the govn'ts will step in and squash btc.

Just curious what does the community think is this just FUD or is what he saying some legit concerns?

Jordan Belfort is just an old wolf from Wallstreet. In order not to become a FUD we should ignore and not be exaggerated what he has said, we don't know who he works for?... personal or group ?... Maybe he's also an investor who hopes that the value of bitcoin will fall and he himself will buy as much as possible when the price's low. |

|

|

|

Previously I had predicted, this year bitcoin would set its second best record in the fourth quarter of this year. But because of the existence of rejection a number of Bitcoin ETFs by the SEC it seems that what I have predicted will be contrary to reality. As we detailed above, given the headwinds faced by both of these metrics over the month of August, we expect them to grow at a modest pace over coming months. As a result, we believe that the Bitcoin will very likely remain below $10,000 for the rest of the year.

I think $10K is a good price for this year. Currently Bitcoin costs about $6500, so BTC can grow up to +40% under favorable circumstances. I guess that if the SEC rejects the Bitcoin ETF this September, the BTC price will fall deeper than $6000. But their forecast will be correct in any case because Bitcoin will remain below $10K. I really agree with your answer, but I don't think BTC will fall deeper than $ 6000, but most likely BTC will move between $ 6000 - $ 8000. |

|

|

|

|

This year is not the right time for bitcoin to grow above $ 100k. Bitcoin still takes 2, 3 or 5 years to go to $ 100k. In the third quarter, bitcoin still gets price pressures, to grow above $ 7k only, bitcoin is still come on.

|

|

|

|

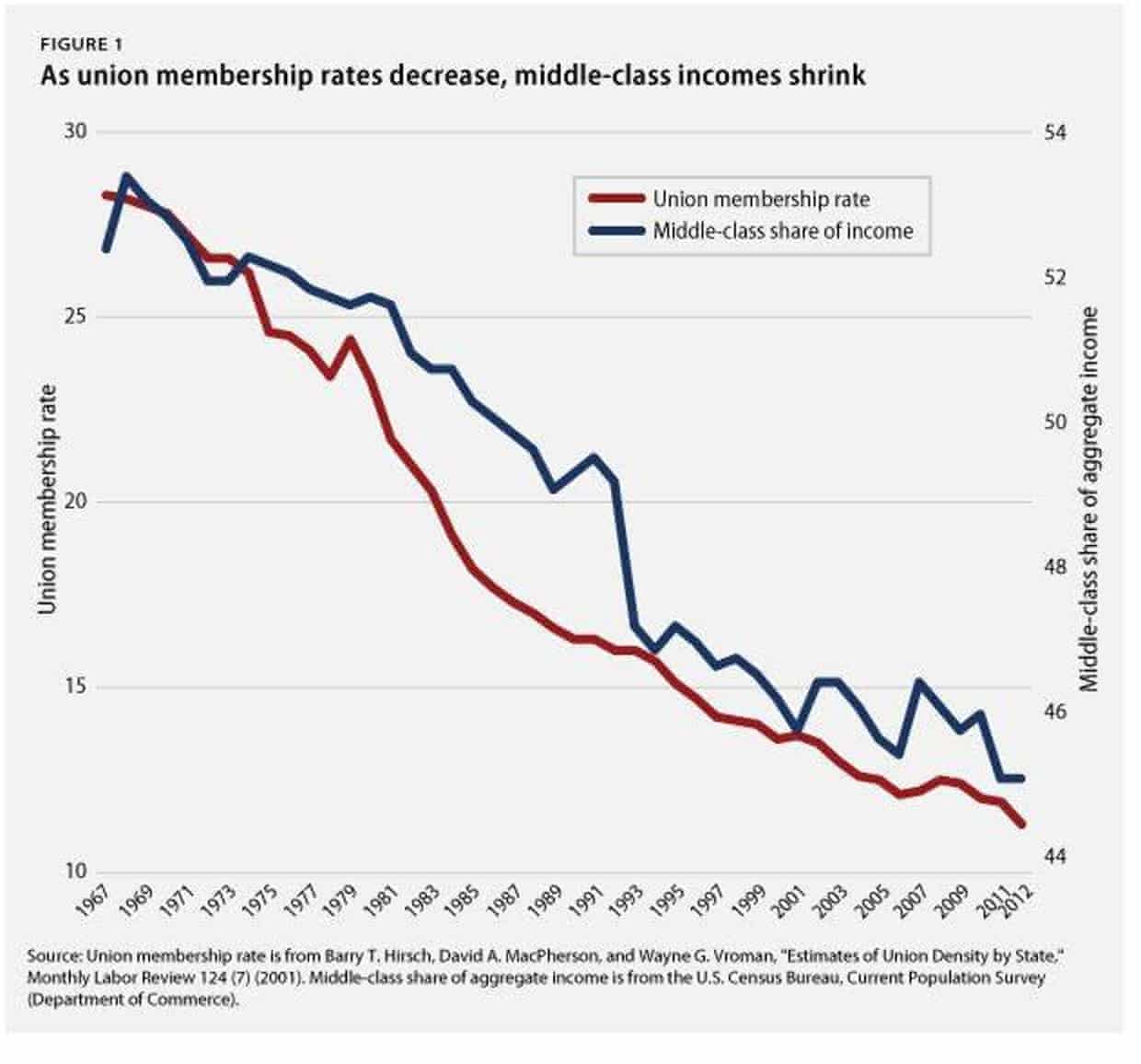

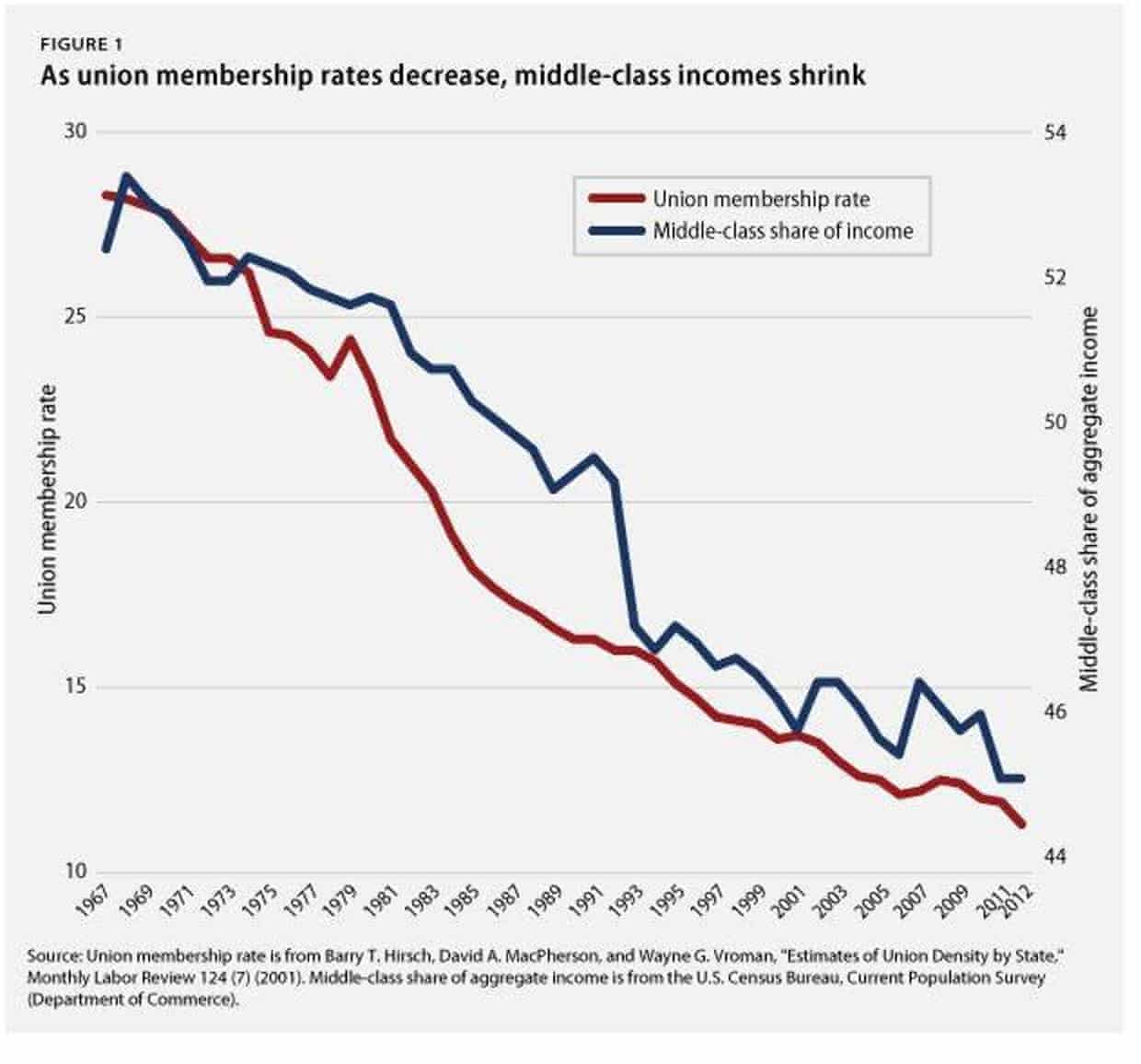

America doesn’t have a jobs crisis. It has a ‘good jobs’ crisis – where too much employment is insecure, and poorly paidThe official rate of unemployment in America has plunged to a remarkably low 3.8%. The Federal Reserve forecasts that the unemployment rate will reach 3.5% by the end of the year. But the official rate hides more troubling realities: legions of college grads overqualified for their jobs, a growing number of contract workers with no job security, and an army of part-time workers desperate for full-time jobs. Almost 80% of Americans say they live from paycheck to paycheck, many not knowing how big their next one will be. Blanketing all of this are stagnant wages and vanishing job benefits. The typical American worker now earns around $44,500 a year, not much more than what the typical worker earned 40 years ago, adjusted for inflation. Although the US economy continues to grow, most of the gains have been going to a relatively few top executives of large companies, financiers, and inventors and owners of digital devices. America doesn’t have a jobs crisis. It has a good jobs crisis. When Republicans delivered their $1.5tn tax cut last December they predicted a big wage boost for American workers. Forget it. Wages actually dropped in the second quarter of this year. Not even the current low rate of unemployment is forcing employers to raise wages. Contrast this with the late 1990s, the last time unemployment dipped close to where it is today, when the portion of national income going into wages was 3% points higher than it is today. What’s going on? Simply put, the vast majority of American workers have lost just about all their bargaining power. The erosion of that bargaining power is one of the biggest economic stories of the past four decades, yet it’s less about supply and demand than about institutions and politics. Two fundamental forces have changed the structure of the US economy, directly altering the balance of power between business and labor. The first is the increasing difficulty for workers of joining together in trade unions. The second is the growing ease by which corporations can join together in oligopolies or to form monopolies. By the mid-1950s more than a third of all private-sector workers in the United States were unionized. In subsequent decades public employees became organized, too. Employers were required by law not just to permit unions but to negotiate in good faith with them. This gave workers significant power to demand better wages, hours, benefits, and working conditions. (Agreements in unionized industries set the benchmarks for the non-unionized). Yet starting in the 1980s and with increasing ferocity since then, private-sector employers have fought against unions. Ronald Reagan’s decision to fire the nation’s air-traffic controllers, who went on an illegal strike, signaled to private-sector employers that fighting unions was legitimate. A wave of hostile takeovers pushed employers to do whatever was necessary to maximize shareholder returns. Together, they ushered in an era of union-busting. Employers have been firing workers who attempt to organize, threatening to relocate to more “business friendly” states if companies unionize, mounting campaigns against union votes, and summoning replacement workers when unionized workers strike. Employer groups have lobbied states to enact more so-called “right-to-work” laws that bar unions from requiring dues from workers they represent. A recent supreme court opinion delivered by the court’s five Republican appointees has extended the principle of “right-to-work” to public employees. Today, fewer than 7% of private-sector workers are unionized, and public-employee unions are in grave jeopardy, not least because of the supreme court ruling. The declining share of total US income going to the middle since the late 1960s – defined as 50% above and 50% below the median – correlates directly with that decline in unionization. (See chart below).  Perhaps even more significantly, the share of total income going to the richest 10 percent of Americans over the last century is almost exactly inversely related to the share of the nation’s workers who are unionized. (See chart below). When it comes to dividing up the pie, most American workers today have little or no say. The pie is growing but they’re getting only the crumbs.  Over the same period time, antitrust enforcement has gone into remission. The US government has essentially given a green light to companies seeking to gain monopoly power over digital platforms and networks (Google, Apple, Amazon, Facebook); wanting to merge into giant oligopolies (pharmaceuticals, health insurers, airlines, seed producers, food processors, military contractors, Wall Street banks, internet service providers); or intent on creating local monopolies (food distributors, waste disposal companies, hospitals). This means workers are spending more on such goods and services than they would were these markets more competitive. It’s exactly as if their paychecks were cut. Concentrated economic power has also given corporations more ability to hold down wages, because workers have less choice of whom to work for. And it has let companies impose on workers provisions that further weaken their bargaining power, such as anti-poaching and mandatory arbitration agreements. This great shift in bargaining power, from workers to corporations, has pushed a larger portion of national income into profits and a lower portion into wages than at any time since the second world war. In recent years, most of those profits have gone into higher executive pay and higher share prices rather than into new investment or worker pay. Add to this the fact that the richest 10% of Americans own about 80% of all shares of stock (the top 1% owns about 40%), and you get a broader picture of how and why inequality has widened so dramatically. Another consequence: corporations and wealthy individuals have had more money to pour into political campaigns and lobbying, while labor unions have had far less. In 1978, for example, congressional campaign contributions by labor Political Action Committees were on par with corporate PAC contributions. But since 1980, corporate PAC giving has grown at a much faster clip, and today the gulf is huge. It is no coincidence that all three branches of the federal government, as well as most state governments, have become more “business-friendly” and less “worker-friendly” than at any time since the 1920s. As I’ve noted, Congress recently slashed the corporate tax rate from 35% to 21%. Meanwhile, John Roberts’ supreme court has more often sided with business interests in cases involving labor, the environment, or consumers than has any supreme court since the mid-1930s. Over the past year it not only ruled against public employee unions but also decided that workers cannot join together in class action suits when their employment contract calls for mandatory arbitration. The federal minimum wage has not been increased since 2009, and is now about where it was in 1950 when adjusted for inflation. Trump’s labor department is busily repealing many rules and regulations designed to protect workers. The combination of high corporate profits and growing corporate political power has created a vicious cycle: higher profits have generated more political influence, which has altered the rules of the game through legislative, congressional, and judicial action – enabling corporations to extract even more profit. The biggest losers, from whom most profits have been extracted, have been average workers. America’s shift from farm to factory was accompanied by decades of bloody labor conflict. The shift from factory to office and other sedentary jobs created other social upheaval. The more recent shift in bargaining power from workers to large corporations – and consequentially, the dramatic widening of inequalities of income, wealth, and political power – has had a more unfortunate and, I fear, more lasting consequence: an angry working class vulnerable to demagogues peddling authoritarianism, racism, and xenophobia. Robert Reich is chancellor’s professor of public policy at the University of California, Berkeley, and was secretary of labour in the Clinton administration. His latest book, The Common Good, was published earlier this year https://www.theguardian.com/commentisfree/2018/jul/29/us-economy-workers-paycheck-robert-reich .... 80% of workers living paycheck to paycheck could partially explain why more consumers haven't bought bitcoin: The majority of workers are unable to collect sufficient disposable income to invest in crypto currencies. This could mean that future economic improvment, better job markets and wage hikes could be correlated with a rise in the userbase and crypto holdings. That's assuming that 80% of workers living paycheck to paycheck is preventing many who would like to buy bitcoin from purchasing due to monetary and wage constraints. Also note this piece while containing good info and a good historical overview was authored by a berekeley economist in liberal california who could be resorting to FUD to mislead people into unfairly blaming Trump for everything. That means there will be a White Hole for bitcoin there, maybe later after they get severance from where they work. Right, more precisely it's "some information, declared lost/removed/hidden" and applause for Berekeley for his victory in his misleading actions. |

|

|

|

|

That's right, there's still many people who are insensitive to the value of bitcoin because most of the users of bitcoin use it more as an investment asset rather than using it as a payment method, as a result the value of satoshi's almost untouched by them.

|

|

|

|

|

Hackers are like viruses that often attack software inside a PC. The higher the quality of the anti-virus that we install/make, yet they will continue to try to break it down. The only way's perhaps by encouraging investors to use offline wallets. Sorry, that's all I know.

|

|

|

|

Short list of my top 3 coins that will see the biggest gains by 2020:

1. Matrix AI Network

2. NEO

3. EOS

Ethereum, Litecoin, Eos, Cardano and Monero, they have all become my favorite altcoins since mid-2018. Their quality and reputation are no doubt. You missed 2019, cause by 2020 there are only 50 coins in the market those are the projects with use cases and has a real product.

Yup maybe that's true, but who set this up?... |

|

|

|

If anyone willing to explain their portfolio and why they are holding will be appreciated.

I have lost a lot since January but hodling still and wants to buy more.

Any Good project suggestions will be helpful.

Since June 2018, in addition to Bitcoin I still hold, Ethereum, Litecoin, EOS and Monero. The reason, because the four coins I bought had clear prospects going forward. You have lost a lot maybe you have sold it at that time, in my opinion that method is a very bad method. Supposedly, what you do's HODL at that time in a few months, maybe you will get more benefits after that. Those who shout to buy more because they and myself are people who believe in the growth of crypto prices and I make a purchase but on the basis of my own initiative/not on the invitation of others. |

|

|

|

I bought bitcoin when it was around $14,500 in January and I am still holding because I am not discouraged. I have great hope that bitcoin is going to increase in price and volume in some years to come.

You're right, friend. Bitcoin currency will definitely experience a price increase in the future. As usual, there's often a decline (even a prolonged period) rather than an increase (which can still be counted on our fingers). Even so, we don't need to despair because although increases are rare sometimes bitcoin prices increase significantly. |

|

|

|

Hello community. After the last bitcoin is extracted, will it become a mass payment unit in the world? Its price on crypto-exchanges will be stable? Share your thoughts, I'm very interested.

I think the conditions will not be much different from what is happening at this time, because the price of bitcoin will have provisions, namely based on the amount of supply and demand. So bitcoin supply and demand will become a separate law for the growth of its value. |

|

|

|

I once read for security wallet, this is just for discussion how to secure the wallet. I do not think there is a security system and there will be no theft in the wallet. If you choose your wallet or phone software, you need to be extra careful! Remember that bitcoins are stored inside your device. If your computer or phone breaks down, your bitcoin is gone too! Thieves can also take your bitcoin if it gets access. Consider the following tips to avoid losses: Perform regular backups regularly Save the backup on another device like in flash or another computer. Use the encryption feature With encryption, each transaction requires a login with a password. This prevents thieves who manage to gain access to your computer. Do not forget the password Losing a password equals losing your money! Wallet does not provide a password forgot feature. Learn more please learn how to secure your wallet here: http://bitcoin.org/en/secure-your-walletDo you guys have a better idea to avoid theft in the wallet? Your Knowledge and Ideas will be more helpful if shared. So far I haven't personally experienced a case that's so heavy on my wallet, and I still feel comfortable. So I can't go any further, with knowledge as far as I know I think what you say's true that's by doing an encrypted backup. Because with an encrypted backup at least it can make us feel safe and comfortable. |

|

|

|

For those of you that think that Bitcoin is going down this article proves that it's still the strongest in the cryptocurrency world. Not since December 2017 has Bitcoin been such a dominant part of cryptocurrency. Full article here: https://bitcoinist.com/cryptocurrency-market-54-bitcoin/This phenomenon is familiar to my ears and eyes. Bitcoin has long been a priority coin for a large number of investors and other cryptocurrency users. Because, bitcoin is the only coin that excels in the crypto market. |

|

|

|

I have a friend who is interested in getting into bitcoins but he does not have a lot of savings or any major investments. He also has a lot of debts to pay and has an average wage job with a family of 4 to raise. When we were talking yesterday, I thought: who really would benefit the most from investing in bitcoin or cryptocurrency? Can those who are like my friend get into bitcoin even though he has no major investment? Or is bitcoin only for those who can afford it?

We understand that buying one bitcoin is very expensive, but don't worry, you can buy a small amount of bitcoin, for example $ 10 as said by Pooya87. With money of $ 10 your friend already has bitcoin even though there are only a few satoshi. In investing in bitcoin / cryptocurrency, the party that benefited the most's of course the bank, because every user who wants to sell bitcoin they have is sure to use an account / ATM managed by the bank. |

|

|

|

There are just couple of question I need some answering from people with enough experience in crypto.

Any particular tips on when to invest token when the prices are low?

And how can one manage to hold the tokens even the prices are bleeding?

Is there a specific time where one can pinpoint the best way to accumulate tokens?

Thanks for sharing your thoughts!

Investing tokens is not much different from investing in other coins, such as Ethereum, Litecoin, Eos and so on. For me there are no specific tips or strategies in doing so, the important thing is to buy as much as possible when the price is low. When the token you buy the price drops sharply, it would be nice for you to do HOLD, HOLD is the right strategy to deal with a plummeting market situation. I think, the special time isn't necessary if we want to collect the token, you can go back to the method which I mentioned above. |

|

|

|

|

Sometimes I feel jealous when I hear someone's success story, who buys bitcoin when it's cheap, and then they become suddenly rich from the difference that occurs at the price of bitcoin. If only at that time I bought it maybe I was rich now like them.

|

|

|

|

|

Try to keep holding it, this way you will not experience any loss at all. By holding it for a long time, surely you will feel tremendous benefits in the future. Because, holding is a one on one successful property, IMO.

|

|

|

|

hello guys

you think Neo will hit 200$ again?

or it will be dead ?

I don't think it's possible he won't be able to jump even higher except $ 75 and he won't die as you say. The condition of Neo at this time's very pathetic he's tossed around in the open sea as if he has lost his supporters. Hopefully there's a miracle for this coin. |

|

|

|

Hello! I want to buy 300 NEO coins for a long time. A good idea? I believe in a lot of X2-X3

Now the value of Neo continues to decline to $ 19.52 and is increasingly alarming after the existence of policy changes from its government. But I really believe the value of Neo will reach x2-x3 this year because before when the Chinese government fully supported it the Neo value of ever shot up to $ 80US and was the #1 coin in his country. |

|

|

|

Honestly, many people seek cryptocurrency more because of its volatility. Whether they do it consciously or not, they wish to make large money quickly.

Crypto volatility is a unique feature of cryptocurrency that is similar to gold, and makes it attractive, for investors, as well as other users. I think they do it consciously and full of trust, because if not, they are not possible will plunge into this type of investment. |

|

|

|

yes, crypto currency is difficult to predict but we must remain positive thinking and believe that the price of bitcoin will surely recover soon and will have a high price again

Patience is all you need more than strategy because the prices is volatile so all you need is wait for the values in the market to grow again. Patience is also the main requirement which must be owned by every bitcoin user, so that later they can control their emotions in the future and can avoid selling bitcoin, because of a sense of panic. |

|

|

|

|