Show Posts Show Posts

|

|

Pages: [1] 2 3 4 »

|

|

1

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: December 14, 2020, 01:55:23 PM

|

Wow. This is a very nice initiative. I'm sure it would have aid my trading journey a lot more if I learnt of this some years ago. I believe it is especially good for newbies who are just starting out in trading.

I'd have suggested you add the stop loss and take profit features but I realized someone already mentioned it which is good by the way. Having Stop Loss is especially beneficial for newbies who don't have a risk management plan.

I know you've gotten more ideas on how to improve the app by the several responses given already in the thread.

I doff my hat to you on this great idea.

Thanks! The stoploss and take profit functionality has been recently added to the app. Enjoy! |

|

|

|

|

2

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: December 01, 2020, 12:08:22 PM

|

Nice, just found this, really feel like I'm learning much faster this way.

Super cool UI also.

What's planned next and when can we expect any new features?

Thanks! We just pushed new version with some of the most requested features - Volume Bars and Stoploss/Take-profit functionality. Indicators are coming soon! And we also might introduce a multiplayer/challenge mode. Stay tuned! |

|

|

|

|

3

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 26, 2020, 10:55:55 PM

|

Interesting stuff. If I understand correctly, all the data that's there is static and doesn't change? You cannot actually place a demo investment on an asset and see it's value? Basically, the app does the job of reading how the candle chart works or how to analyze it rather than teaching the actual trading? Would love to see if we can have a demo investment with fake coins and have the value of the coin randomly go-up or down making the chart and its history very dynamic. Sort of replicating the actual market.

Almost every exchange has demo/paper trading. But that's slow - you make a trade and wait hours or days ... What this app does is gives your learning x100 boost because you can fast-forward time and test patterns in seconds which would have taken you days in demo account. |

|

|

|

|

4

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 19, 2020, 11:55:35 PM

|

This is cool . Congratulations for your work and for your idea . What technologies did you use to build this app? Also I were the developer I would improve the app by adding some APIs that work in real time with bitcoin's price.

Tech stack: Node/React (in TypeScript). Postgres DB. Hosted with Vercel (previously Zeit/Now). ECharts for charting. |

|

|

|

|

5

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 19, 2020, 11:53:22 PM

|

So your bias is reduced - you really don't know what will happen next.

Isn't it even better if people can use a live price chart from CMC or TradingView? That way anyone can literally try to trade using their skills and not relying on historical performance. I think it would serve better as an alternative for demo trading platform. This app is all about training pattern recognition. If you use live chart, you have to wait hours or days for results. With this app, you have to click "Next" and you have your result in seconds. |

|

|

|

|

6

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 19, 2020, 11:50:04 PM

|

What criteria do you use for the APP? Do you apply only AT? What indicators do you use to determine that you open a trade and close it? I imagine you do it for very short time intervals, scalping style.

The initiative is very good, I imagine that you connect the indicators directly from the APP to TradingView. It would be excellent if you could place the volume, so that the analysis of the people is not merely chartist, so you open the possibility of being able to study the volume later.

Thanks, volume will be added soon. |

|

|

|

|

8

|

Economy / Service Announcements / Re: I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 15, 2020, 12:31:23 PM

|

Is this simply trading on historic and not live charts? I guess it could require no internet to trade , or no? - Minimal bias - accomplished by picking random asset/time and hiding them.

What exactly will be hidden, coin chart history? Will probably check it out later and bookmark. I have couple of trading simulators bookmarked to compare in the future. The main point is to practice trading - making trades and fast forwarding time to see how your trades played out. Training pattern recognition skills x100 faster than paper trading, because you can fast forward time. You are trading historical charts. When you open the app, it selects and shows you random asset (coin) and time, and it hides that information - all you see is chart. So your bias is reduced - you really don't know what will happen next. |

|

|

|

|

9

|

Economy / Service Announcements / I Created an App that Helps You Practice Trading - TradingGYM

|

on: November 13, 2020, 02:16:25 PM

|

I was looking for an app that helps you practice trading, something that could replay historical candles and allow to trade on them at a point in time, kind of like a trading simulator. We all know there is paper trading, but it has slow feedback loop - make a trade, wait for hours/days. I wanted something that combines all the things that I'm looking for:- Quick start in seconds - no download, install, registration, etc.

- Easy to use UI/UX.

- Minimal bias - accomplished by picking random asset/time and hiding them.

- Make trades and fast forward time for a super quick feedback/learning loop.

So I created it - TradingGYM. It's an early version, but I wanted to get the MVP out ASAP and see if this is useful to other traders as well. The Mobile version has a more lightweight UI, but in Desktop you can change some settings like candle size and commission. Any suggestions are very much welcome. Super interested to see if this helps anyone improve their performance.  |

|

|

|

|

11

|

Economy / Trading Discussion / Is Buy and Hold Really the Best Strategy in Crypto?

|

on: August 26, 2020, 10:58:50 AM

|

Some people say that Buy and Hold is the best strategy and can't be beaten. They hear phrases like “ 95% of traders lose money” and automatically assume that all trading is bad and markets can not be outperformed. In my Medium post, I’m going to show you, that holding might not be the best option if you put in a little bit of work. To do that, I compare Buy and Hold returns for 25 coins with several basic trend-following strategies in different time periods (over 3.5 years of data and then a little extra).READ THE POST HERE!The source code of strategies and raw test results (CSV) is pushed to my Github. Let me know what you think! Thanks!  |

|

|

|

|

14

|

Economy / Trading Discussion / Re: I tested 17 Advanced + 15 Neural Net Trading Strategies with Top 30 Coins from J

|

on: August 23, 2019, 04:54:51 PM

|

Thanks! As for MKR, from my research: Maker (MKR) is a token that gives voting rights to the borrowing system that is used to generate the decentralized stable coin Dai.

So MKR itself isn't stable coin, and it's not meant to be. It's token for another stable coin. Also, if you look at the price you can see it fluctuates way to much to call it stable. As for BNB, it's purpose doesn't matter. If you can trade it, you can make profit or lose. It's tradeable. Which means it's usable for trading system tests. |

|

|

|

|

15

|

Economy / Trading Discussion / I tested 17 Advanced + 15 Neural Net Trading Strategies with Top 30 Coins from J

|

on: August 19, 2019, 01:48:21 PM

|

I have collected the most popular open source strategies (for Gekko platform) and I am constantly testing them and sharing results in my Medium posts.In my latest post, I look back at the first half of 2019 and backtest the strategies against time period from Jan 1st to Jul 1st. I have imported data for Top 30 coins (based on Market Cap) and I'm using 32 strategies for testing. For traders who like to automate their business, Gekko should be familiar name, but for everyone else - Gekko is one of the most popular open source Crypto trading platforms out there. I would describe it as an execution platform for YOUR strategies, not a bot that you brainlessly launch and it does everything for you while you browse lambo.com trying to decide between yellow and orange. Let me know if this is useful to you. Thanks! |

|

|

|

|

16

|

Economy / Trading Discussion / Re: Crypto Trading 2018 in Review: I backtested 32 strategies with full year of data

|

on: January 21, 2019, 07:54:48 PM

|

Great analysis. Lots of traders and wanna be traders are made to believe earning percentages which are unrealistic, and they are sometimes blind ti the possibility of losses which is inevitable when starting out.

I am not an active trader as yet, still trying to polish my skills. And always open to new strategies.

Thanks! It's sad, but those unreasonable expectations mostly come from "Trading Gurus", who don't actually trade but sell ebooks, courses and bots for unreasonable prices. On the other hand, market is a zero sum game, the more such "10% per day" traders, the higher chances for you to win, theoretically. |

|

|

|

|

17

|

Economy / Trading Discussion / Re: Crypto Trading 2018 in Review: I backtested 32 strategies with full year of data

|

on: January 19, 2019, 07:40:39 PM

|

|

@clrpod

Yes, 323% was the best but that was on a single coin for single strategy in single timeline. If you take average from all coins, result is worse (like <100%). And since past performance is not indicator of future results, it most probably would have been even worse if you tried this now.

@kawetsriyanto

Thanks, I describe Turtle and Bestone in Part2, I suggest checking that and especially source code. Keep in mind you need to heavily backtest this yourself before thinking about going LIVE, don't take my results for granted!

@wuvdoll

I feel you're suspicios and that's good - you should always be very very skeptical when reading articles about trading. I'm NOT saying "Follow strategy X and get +300%", that's not how it works. Past results don't guarantee anything in the future, but at least they serve as a bit of reality check. Because if you get negative 80% in backtest, you can be pretty sure that this is not working.

As for strategies, they are not mine, they are open source, I've collected them from Github, forums and Discord channels. And I'm not recommending them. Also I'm not saying they are bad. This is just an experiment to show you a bit more realistic results.

As for importance of backtesting - every serious algo trader backtests the hell out of strategies. How can you not? Imagine manufacturing a car and not testing it, just putting pieces together and hoping it sticks. Bad plan.

@CryptoNeed

Thanks, glad you enjoyed the post!

|

|

|

|

|

19

|

Economy / Trading Discussion / Crypto Trading 2018 in Review: I backtested 32 strategies with full year of data

|

on: January 14, 2019, 08:17:31 PM

|

I was getting a bit tired of seeing a lot of unrealistic results/expectations posted in this forum and also people asking if they can get 10% a day, so I collected 32 open source Gekko strategies from Github and backtested them against full year, to show a bit more realistic view of how much profit could be made if I followed these strategies for a whole year (2018). Keep in mind - reality is always worse than backtest.You can see my results HERE.

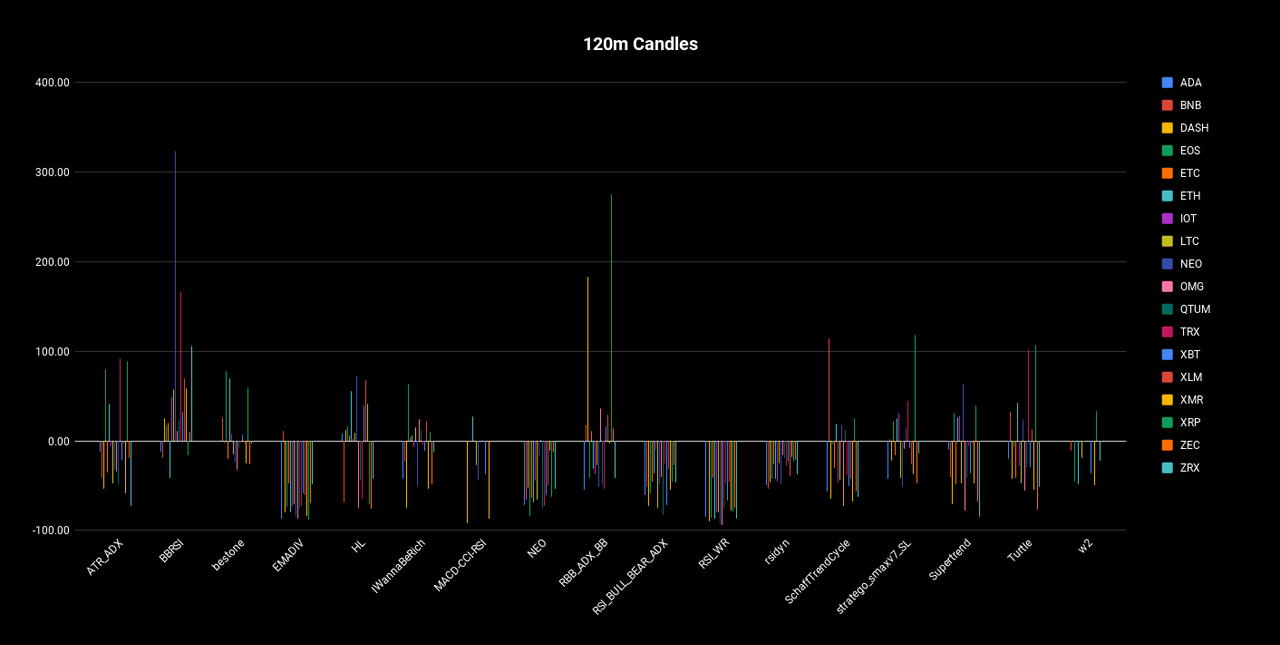

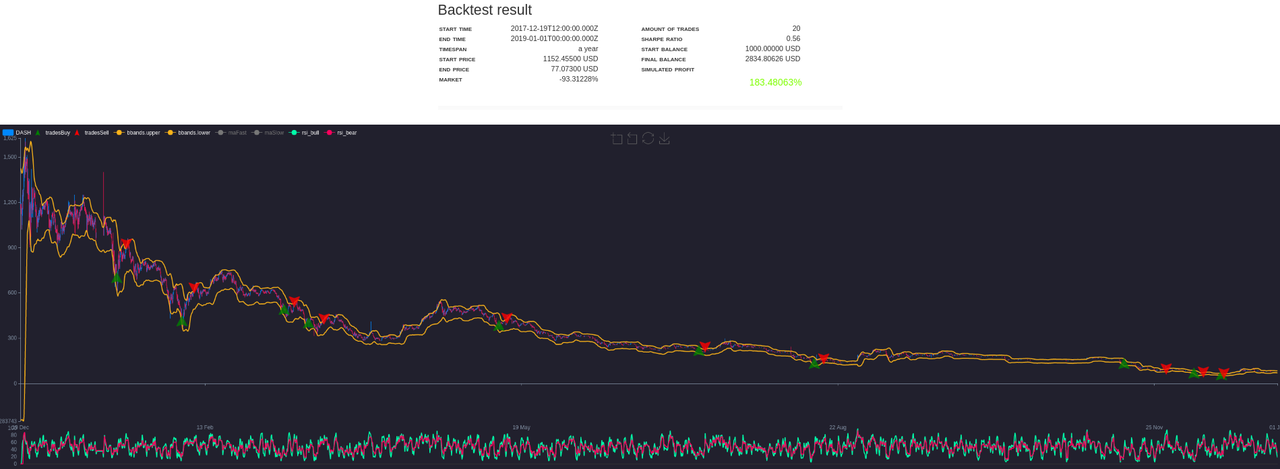

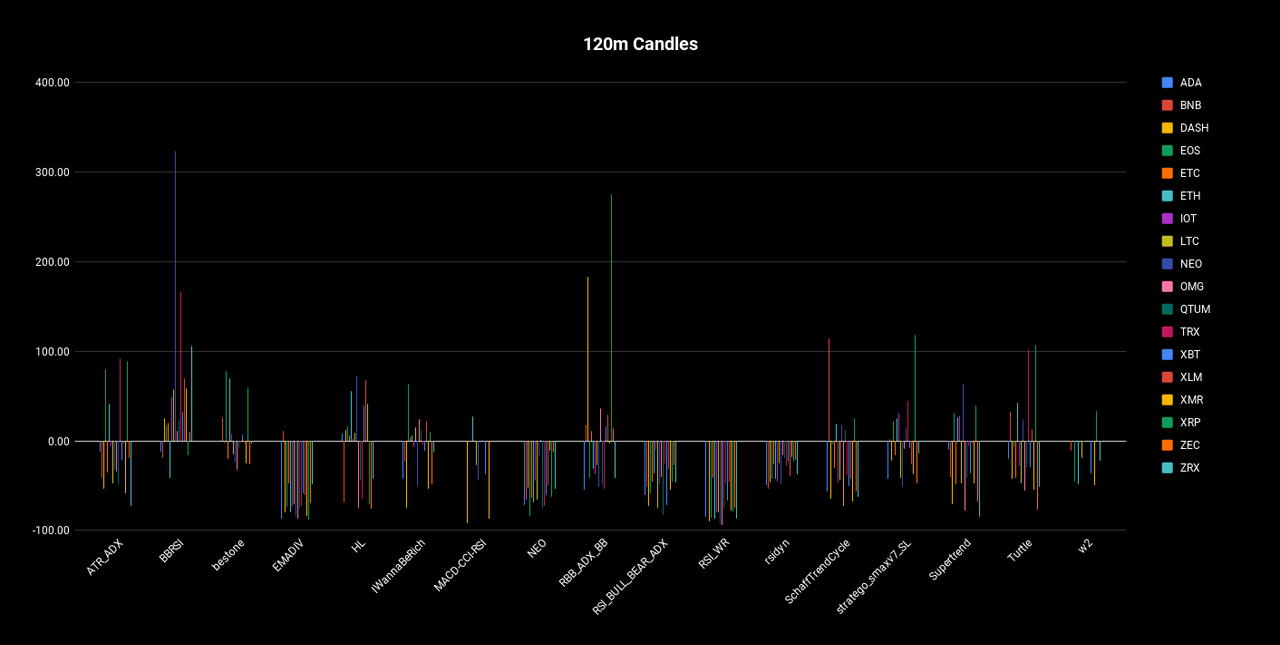

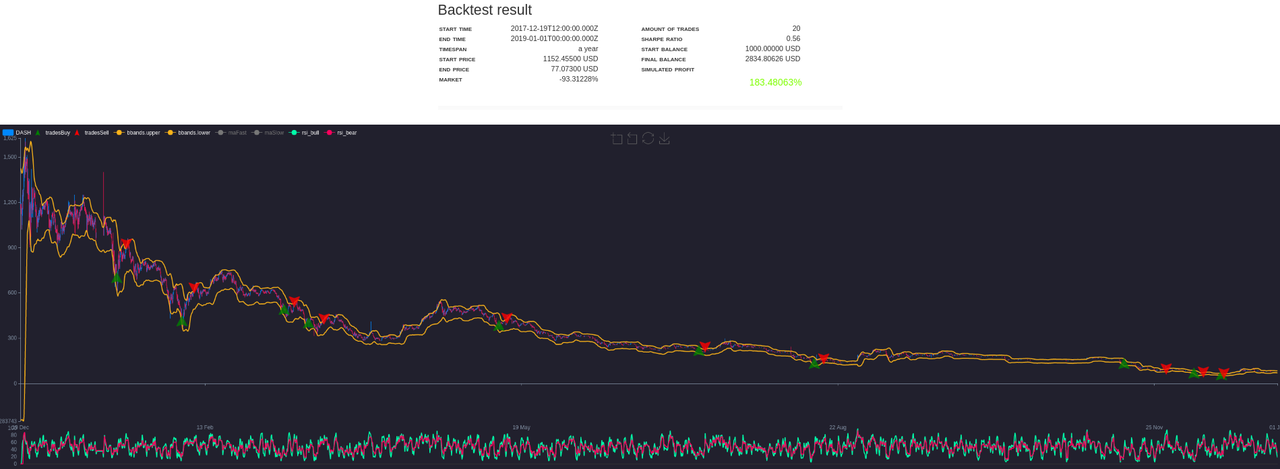

Backtesting a strategy means - I have a code that gets candles and indicators as input (Bollinger Bands, RSI, MACD etc), and then makes BUY or SELL call or does nothing. Based on those calls, Gekko platform calculates profits/losses against historical data (in my case - BTC from Jan1 2018 to Jan1 2019). That's it. This way you can get closer representation to reality compared to just trading some random basic oldschool strategy you found on somewhere that says you can make X% day with it. For example, here is how results for 120m candles look like:  Here are buy/sell decisions from some of the best strategies. Green/Red arrows are buy/sell decisions.    I you are interested, you can also check my profile for more posts like this. https://medium.com/@deandree |

|

|

|

|