|

Matagal na nakasunod ang ETH sa top currencies and we know naman if may BTC is sure may sunod na ETH, kaya feel ko if itong next target na ito sure ako mag surpass pa ito sa last price ng ETH, currently we are sitting now sa 3k price ng ETH eh if nag approve dito tsaka sa features ng ETH network naman is talagang panalo yung mga hodl. Lalo ngayon next halving is alam naman nating may dump na mangyayari at yung mga naka USDT is tamang abang lang sila ng possible coins na good to hodl. Ako is BTC currently talaga pero mas okay na hindi lang single pot ang assets natin.

|

|

|

|

Update: Seven (7) days remaining before the game starts, we are counting on your participation. Cast your votes now and chance to win! |

|

|

|

|

Stick pa din ako sa mga top 10 coins na naka listed syempre once nag pump itong BTC to be followed na din yung iba coins, so ako play safe this coming bullrun because mistakes already from the last bull run eh never again, pero ayun nga kasabay na din nito is nag labasan na yung ibang mga coins pati projects so dito is if may extra time kalang naman is pwede ka mag try mag grind for other tokens kasi pansin ko ang trend right now is hindi na NFT eh kundi puro Airdrop na kaya solid talaga yung x100 nyan ng walang investment pero take care nadin sa pag pili yung ilan kasi rug para na din iwas sa sayang oras.

|

|

|

|

|

Bitcointalk Account: Peanutswar

My vote goes to: GazetaBitcoin, kuriboh, Mame89

|

|

|

|

Akda ni: fillipponeOrihinal na paksa: Debunking the "Bitcoin is an environmental disaster" argument

Kamakailan lang ay marami akong na papakinggan patulong sa Bitcoin tulad ng ang “Bitcoin is sobrang nakaka sama sa kalikasan”, “Ang Bitcoin ay sayang lang sa enerhiya” at iba pang mga katulad nito. Ang mga ganiyang usapin ay kasing tanda na tulad ng Bitcoin, kahit si Satoshi ay pinag usapan ito, ay sinabi nang wala itong katotohanan, pero narito ako para ayusin ang mga bagay bagay para sa usapin na ito. Susubukan kong bigyan ng “kasagutan”ang mga ito na may kasamang mga datos mula sa website at iba pang maaring pagkuhaan. Para maging maayos ang pag presenta at ma “depensehan” ang Bitcoin. - Depensa

- Televisions, aeroplanes, Christmas lights, plastic, ang mga lahat ng iyon ay gumagamit ng enerhiya para mapagana: Gaano kadami ang ginagamit ng mga iyon? Bakit hindi tulad ng Bitcoin ang dami ng pag kunsumo ng mga iyon?.

- Ayon sa datos mula sa Cambridge Bitcoin Electricity Consumption Index, ang mga gamit na hindi ginagalaw o ginagamit mula sa United States lamang ay maari na gamitin ang kunsumo para patakbuhin ang bitcoin network ng higit isang taon at kalahati (maari ninyo tignan mula dito ang pag baba).

- Ang pag mimina ng bitcoin ay maganda para maganda sa kapaligiran hindi tulad ng pag mimina tulad ng mga tumataas na klase ng gamit (Ginto)

Bitcoin is recognised as a store of value, making it comparable to gold. In 2020, 3,200 tonnes of gold was mined, equating to approximately 90,301,440 million tonnes of CO2 emitted.

In comparison, Bitcoin is estimated to emit around 37 million tonnes of CO2 throughout 2021, with China powering 65% of the hash rate in March 2021. China pledges to be net zero by 2050, along with most of the world, under the Paris agreement. Under the assumption this is achieved, this would indicate Bitcoin will be powered by renewable energy by 2050, making it a zero-carbon technology. In addition, gold mining is renowned for being one of the most destructive industries responsible for polluting drinking water with cyanide, mercury and other heavy metals whilst destroying pristine environments and causing damaging health effects. Removing reliance on the need for gold not only has the potential to decarbonise the gold reserve industry but also reduces these negative environmental and health impacts. However, the reliance on countries sticking to the Paris Agreement is needed in order to decarbonise Bitcoin.

Edit: Information on China's energy policy

China uses the most cost-effective renewables and could viably generate 60% of its energy with green energy by 2030. It is estimated the renewable energy implementation could save China around 11% in monetary cost. Feasibly following the laws of economics, Bitcoin miners will be more likely to use renewable energy sources if they are cheaper. Therefore, reducing Bitcoin's carbon footprint.

Reddit Source

- Iba pang ginagawa ng mga tao na maaring maihaluntad sa resulta.

Ayon sa pag aaral recent study, ang panonood ng Netflix na isang oras ay nakakagawa ng 100g na CO2.

Netflix ay mayroong 205 milyon na subscriber.

Kada Netflix subscriber ay nanonood ng halos halos dalawang oras, ang pinaka mataas.

Kaya ang Netflix ay isa sa pinapanood na halos 149 bilyon noong nakaraang taon.

Kada isang oras ay halos 100g ng CO2, at panonood ng Netflix, at 15 mlyon na metric tons ng CO2 ang nadadagdag sa atmosphere natin kada taon. Hindi lang Netfix ang one-third ng nasa industriya ng Bitcoin. Paano pa pag dinagdag natin ang iba pang kanilang serbisyo.

- Akusasyon

- Ang mga minero ng China ay isa sa pinaka malking ambag sap ag gawa ng Bitcoin. Kung saan malaking pursyento ng ng kuryente ang kanilang kinunsumo, lalo na sap ag gawa ng mga fossil sources, uling, at iba pang ecological footprint para sa Bitcoin.

- Depensa

- Ang mga minero ay talagang merong binipesyo sa too lang para sa paghahanap ng mga enerhiya para sa mababang halaga. Isang energy market, tulad ng iba ang gobyerno ay gumawa ng hakbang dito tulad ng isang supply at demand ng isang bagay. Para sa isang malaking enerhiyang magagamit ay dapat ito ay magamit ng maayos kundi ito ay masasayang lamang.

- Maraming minero ang naka pokus sa hydroelectric plants (tulad ng China) kung saan napaka lakas nila kumunsumo mag mna at kung saan ibebenta nila ito ng mura. Sa madaling salita noong 2017, halos 250twh ang nagawa ng Yunman dams, 155twh ang nagamit (95twh ang nasayang at hindi na maaring magamit pa).

- Ayon sa mga pagaaral na ang bitcoin mining ay gumagamit ng halos 39% ng renewable sources (solar, hydroelectric, wind, geothermal, etc.) at 25% ng mga nakukuha mula sa nuclear power at mga fossil fuels. Ang porsyentong ito ay halos tumataas na lalo sa China, kung saan malaki ang pag babago na ng carbon footprint.

- Ang bitcoin ay nakakatulong para sa industria ng enerhiya; halimbawa nito ang pag pigil sap ag gamit ng “Renewable Curtailment” as well as tulad ng mas mataas ang kita sa pag gamit ng gas kesa sa pag gamit nito para sa gas flaring para na din mabawasan ang carbon emissions. Isa ang hydroelectric sa pagkakaroon ng mababang Low-carbon energy, kasama na din ang mga nuclear at renewables na maaring pagkakitaan at maibenta ang mga sobra nito para sa pag mimina ng bitcoin.

- Ang sobrang laking enerhiya ang ginagawa pero hindi ito nagagamit ng maayos, at masasabing sayang lang maari pa sanang magamit (mapamahagi sa networks, thermal dispersion in endothermic engines etc ...) na kung saan ay ginagamit lamang sa isang particular na lugar tulad ng (e.g, power plants sa pinaka mababang halaga at pati ang nuclear power plant). Kung saan ang Bitcoin ay isa din sa maaring mag ambag ng malaki para sa mga resources na hindi masasayang.

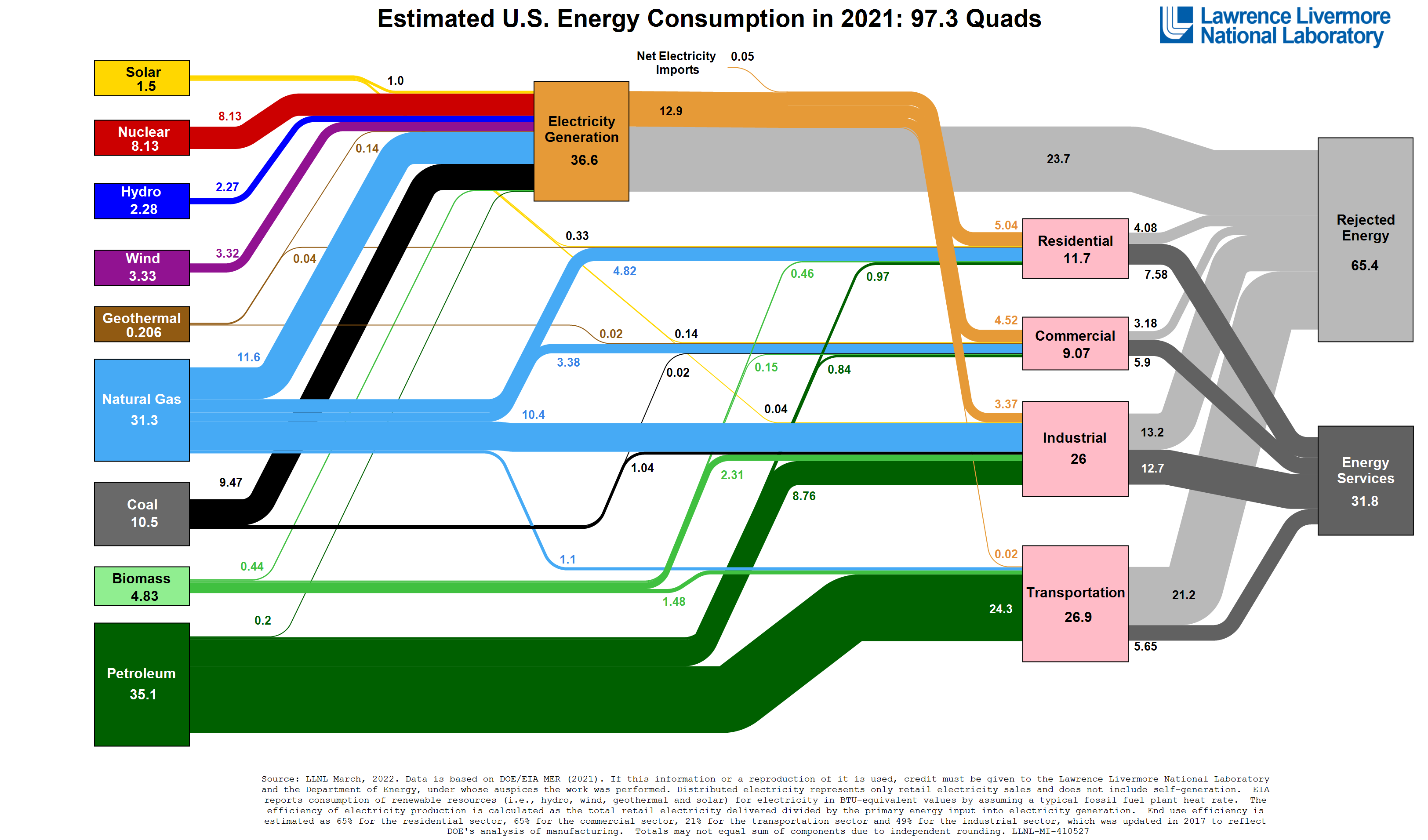

Notice that rejected energy accounts for around two-thirds of all electricity generation. This energy is produced but ultimately does not go to practical work. The amount wasted annually is around 66.7 quadrillions of BTUs (for short: "quads") of power. For perspective, that is the energy equivalent of wasting 2.3 billion metric tons of coal every year.

The potential for Bitcoin-powered renewables is already evident in China. A 2019 report by Coinshares found that approximately 75% of Bitcoin mining comes from renewable energy sources, much of which stems from newly created hydroelectricity. These new revenue streams have brought power plants online, which otherwise would not have been economically viable given existing conditions.

- Ang Bitcoin ay isang baterya.

So, if we think of Bitcoin as a battery, what can we do with it? The critical properties of Bitcoin's battery are: 1) always on and permissionless (no need to find customers, just plug and go) and 2) naturally seeking low-cost electricity: it will always buy when the price is right. Given those properties, Bitcoin's battery can assist renewable builds (and electric grids more generally) in several ways: - Interconnection lines: When developing new energy resources, you must apply them to connect them to the grid. Texas alone has over 100 GW of renewables in its lines. These lines can take years to clear. In the meantime, these assets could be online and earn Bitcoin.

- Project finance: Renewable developers need capital to finance build-outs before they have customers. Bitcoin's battery is always ready to be the first customer.

- Geographic issues: Sometimes, the sunniest, windiest places are not the ones with the most customers, so it's hard to justify the development of new renewables. Bitcoin's battery solves this, becoming a "virtual transmission line" of sorts.

- Timing & grid balance: Sometimes, when the sun shines and when the wind blows is not when we need the most electricity. Yet, electric grids are marketplaces that must balance supply and demand perfectly. Therefore, grid-connected renewables often have to "curtail" (turn off) if they produce too much energy at the wrong time. Bitcoin's battery is ready to buy 24/7/365 when the price is right, turning up and down as needed and participating via direct power purchase agreements and demand response programs.

- Underperformance: Related to the timing & balance issues above, often, renewables produce more energy than is needed on their grid, leading to subpar financial performance. Bitcoin's battery is ready to buy if no one else will.

- Cleaning the grid: Even outside of renewable generation, Bitcoin's battery can help improve both emissions and the energy mix. For example, Crusoe Energy attaches efficient turbines and mining equipment to existing gas flaring sites, both improving emissions and converting energy into Bitcoin's battery. Taking this a step further, you could even then take those profits and reinvest them in on-grid renewables elsewhere, another twist on the idea of Bitcoin as a "virtual transmission line" (aka battery).

- Akusasyon

- Ang Bitcoin network ay isa talaga sa mga hindi makunsumo, kung titignan sa PoW na kada gamit ng Bitcoin ay makukumpara ito na para ka lang gumagamit ng Visa.

- Depensa

- Ang enerhiyang ginagamit sa Bitcoin network ay para mas mapainam ang seguridadpara sa mga nais umatake sa Bitcoin (kung saan mas kinakailangan pa nila ng mas maraming enerhiya o di kaya ay gumawa nito) na mas mataas pa dapat sa enerhiyang ginagamit ng Bitcoin network.

- . PoW isang magandang bagay pag sa pagmimina tulad nalang sa mga ibang industriya. Isang mababang enerhiya lang ang magamit ay paniguradong may apekto sa kita, kaya mas pinipili nilang gumagamit ng mataas na enerhiya.

- Ang pag gamit ng mining ay hindi mataas tulad ng gastos ng pag transaksiyon, may ilang pdin dito pinag babasihan ng e.g isang transaksiyon ng bitcoin ay tulad ng pag gamit ng isang Visa circuit, ay talagang hindi makahulugan. Ang pag gamit ng mining ay para magamit ng maayos ang isang system (mas doble ang gastos para ito ay masigurang ligtas sa mga atake sa network) sa isang hindi ligtas na network. i.e ang bawat isa ay dapat sumangayon na nalagay sa ledger. Sumatutal ang pinagkaibahan laamng ay ang circuit security system at pagkakaroon tulad ng banking systems. Magkano ng aba ang ginagastos ng buong mundo para lamang sa mga pag babayad ng bank para ito ay maging ligtas, na may kasamang authorisation, settlement, clearing, reconciliation, etc. Hindi pa dito kasama ang pag gawa, pag operasyon, mag sasaayos, pag babantay sa mga ATM, bank branches, vaults, at iba pang kasama dito

- Ayon sa sulat na it article, Conio's Guido D.Assori (kung saan pumirma ng pinaka unang SegWit transaksiyon), ito ay isang magandang katangian at hindi sira sa systema.

Bilang pag bibigay halaga na nakasaad sa artikulo, kung saan sinagot ni Paolo Attivissimo's ang mga akusasyon para sa konsumo ng bitcoin na halos 7 transaksiyon lamang kada sigundo.

All this energy for 7 transactions per second?

The third attack would be that Bitcoin would move 7 transactions per second, and that in a nutshell for a system of this kind even a few kilowatt hours would be wasted (curious, then, that Attivissimo remembers this after accepting Bitcoin donations for years, on his blog, of this big problem).

Quickly: this number unfortunately arises from a profound misunderstanding of the real decoupling between the technological infrastructure called "blockchain" and the transfer of value named in Bitcoin.

It's frequent, but that doesn't make it any less wrong.

Premise: "It's a feature!", i.e. the size of the Blockchain is deliberately small.

Being able to write on a blockchain must be a luxury, in order for it to remain decentralized, so that everyone, at any time and with relatively little effort, can autonomously verify the correctness of transactions on the network, and not just the large banking institutions.

However, now at every moment of the day, on cryptocurrency exchanges, on custodial platforms, by means of pegged tokens, on sidechains, on Lighting Network, by means of CFDs, Bitcoins are intermediated and exchanged, or contracts that are traced back to their value , with varying degrees of enforcement.

And this happens through a number of transactions that are much more than 7 per second, believe me! To expect the opposite would be like demanding that our morning coffee paid for at the bar be recorded by all the backups of all the nodes of all the interbank circuits in the Eurozone.

So how many transactions, really?

In general it is an unmeasurable number, and it will be less and less, the estimates will be more and more heuristic, also thanks to privacy preserving platforms.

We can say, to make the general idea, that every transaction that takes place on an orderbook of any platform, which represents Bitcoin, can only exist thanks to the fact that, underneath, there is the Proof Of Work which, if necessary, allows the settlement of a precise state of a chain of transactions of indefinite length (my token goes to you, who gives it to him, who gives it to the other, who breaks it in three and gives it to the other, who collects 8 ). Don't you expect all the coins you exchange to end up noted down somewhere?

Simply, people rely on intermediaries every day to exchange value in Bitcoin without using a blockchain directly.

The global concept of decentralization is maintained, relocation increases with confidence on the last mile (not always! LN!) but the connecting element always remains the last, only, true, mandatory, digital ledger in which the compensation movements.

Therefore, comparing the imaginary 7 transactions (which is a number that was good in 2013, today there are many more even on-chain) to the world's ability to transact Bitcoin, and linking it to PoW, is a bit like pretending that there are, at all times, a sufficient number of armored cars to move all the gold in all the vaults of the world that intend to exchange gold.

Of course, that's not how it works.

Ang Bitcoin ay hindi lamang pang payment system kundi pang settlement system. Kung ikukumpara ay hindi para sa payment circuits (credit cards), kung saang mayroong settlement layers (SWIFT, CHIPS) or Fedwire.

Para sa partikular na aspeto, maari ninyong basahin ito ng maigi Mausisang pag tingin sa Epekto ng Bitcoin Mining sa Kapaligiran

Bitcoin is a settlement system, not a payments aggregator

First things first. What is Bitcoin, and what is it not?

Bitcoin is a settlement system like FedWire. It is not a payments aggregator like Visa. I constantly see Bitcoin compared to Visa, MasterCard, or PayPal. This is the primary source of mathematical atrocities whereby Bitcoin's overall electricity cost is divided by its transactions and then compared to something it's not. Energy use per settlement transaction is a nonsensical metric by which to judge Bitcoin's energy use.

Just like the 800,000 or so daily FedWire transactions are not a good measure of the total amount of daily Dollar (USD) transactions, Bitcoin's 325,000 or so daily transactions are not a good measure of the total amount of daily bitcoin (BTC/XBT) transactions. This is because most bitcoin transactions are not visible. They take place inside the payment aggregation systems of exchanges, on the Lightning network, and yes, even inside of actual aggregators like PayPal, Square, or MasterCard. Only periodically are they settled onto the Bitcoin blockchain as visible transactions.

Solutions like this are referred to as network layering. This is a tried and tested approach to separating casual retail transactions from heavier settlement transactions, and it is precisely how we already do things in the fiat monetary and payment systems. In such a system, the base layer, like FedWire (or Bitcoin), only acts as the final arbitrator of settlement transactions. Everything else, which is the vast majority of all transactions, happens in higher payment aggregation layers, which are often entirely different systems.

In other words, Bitcoin is not a competitor to Visa, MasterCard or Paypal. Instead, Bitcoin is an independent monetary system that aggregators can make use of.

Presenting Bitcoin's electricity consumption in terms of its daily number of settlement transactions is a red herring.

- Katulad sa kunsidersayon na maaring gawin patungkol sa gold at bitcoin bilang “digital gold”, na may karagdagan pa dito ang maaring gastos at pag iimbak tulad ng gold, at para sap ag mimina, pag tatanggal ng hindi kailangan, pag smelt, pag angkat etc. at iba pang kailangan na idagdag. Hinahamon ko ang ilan sa inyo upang talakayin ang paksang ito partikular na sa “green”, pero katunayan wala pa akong narinig na reklamo sa kainila na ipag bawal ang gold para sa ating kapaligiran.

Isang magandang pagkumpara ang ibinahagi ni Nic Carter pag tuwid sa maling paniniwala ng Bloomberg article sa mining laman ng halos impormasyon na nasa itaas: Noahbjectivity on Bitcoin Mining The Bloomberg columnist Noah Smith has a lot of thoughts on Bitcoin. Some of them are really solid and engage with the reality of the protocol itself, which is rare for a member of the mainstream media circuit. He also discloses that he owns Bitcoin, which is impressive for an economist and an established member. So I'm pretty happy with him overall. I don't want this piece to be interpreted as a blanket critique of Noah's stance on Bitcoin. However, Noah's recent column in Bloomberg, Bitcoin Miners are on a Path to Self-Destruction, makes a few claims that warrant a response.

Noah's basic premise is that Bitcoin miners are effectively hogging the grid in the various places where they operate and risk getting banned entirely. Not only is the notion of a global coordinated ban on mining far-fetched, but Noah relies on a few claims that are dubious at best. Let's investigate.

Ang ilan sa kinikilalang "Sanay" na may magandang akda: Para sa iba pang importanteng impormasyon: |

|

|

|

Restricted na ba ang bansa natin sa pag access ng bc.game website? Hindi na kasi ma open sa end ko, cannot be reached na lumalabas.

Noong una nga is or halos last year lang is talagang na access ko din yung link nila dito sa atin sa pinas, pero this year lang upon trying to access is parang naka restrict sya sa mga ISP natin pero working naman sya pag gumagamit ka ng mirror links nila, currently ayun gamit ko at working smooth naman sya sakin now. |

|

|

|

|

as you said, you just started a month ago, this timeframe is quite short, better to learn more and seek a strategy that is suitable to your trading habit. Those traders you are looking at are the traders who are making a token sniping which means they are waiting to make a trade with the new release coins, newly paired coins etc. If you deal with the same thing of course you need to put additional effort to hunt those coins which has the potential to trade. Don't get carried away with the other's journey take your path and keep learning.

|

|

|

|

|

Pairs royale is one of the new interesting games, which is blackjack, is this underdevelopment?, I tried to play and some of the modals for the position of the cards have an overlap, and if there a chance you will add background music?, seems like too much series I'm just hearing a card flipping, for the removing of the bets, it's possible to make a withdraw all of the bets, for example, I bet 50 I need to click all of those bets i guess withdraw all it once back to balance is ideal well just my cents.

|

|

|

|

|

We are bumping again the thread before the game starts. Eight ( 8 ) days remaining before the game starts.

|

|

|

|

A tendency arises among us. When the value of Bitcoin increases a lot, we start trading more. Which puts our trade management in jeopardy, during which most of the time people face loss.

Its easier to make a trade with the market currently because it becomes more active unlike before that the market is down from the 38-40k range only people who scalps with the market ups and down getting a good gains, but for the long traders its not a good opportunity to them, after we reached another pump came from the Bitcoin we are now seeing more active traders, investors, other coins pairs with the bitcoin reason why it becomes trend and people now get back with the crypto to get in the hype and earned during the bullrun. |

|

|

|

Almost everyone is wrong, and only because; Bitcoin is not at all about all the deep dips but the stabile growth with the high peaks. That's it and that's all of what most of them just don't get.

Not all the time does the market pump and people get profitable still some corrections need to be executed because if the market gets pumped continuously for sure once it reaches the peak of its price there's a crash market will happen and its unhealthy, and we know how bitcoin dominates the market for sure most of the pairs will crash too. Bitcoin already created a history you don't need to get bothered too much with the market price its part of it becomes volatile. If you don't trust the Bitcoin potential possible you will left behind after its sky rocket. |

|

|

|

|

Giving a bump: Nine (9) days before the games starts!

|

|

|

|

|

Why make a Bitcoin bank if you have a full authorization with your bitcoins, you can sell, trade, and invest at any time without having the KYC, restrictions to hold, minimum withdrawals, etc like other banks doing, also the use of the bitcoin will neglect with those rules those proposals not applied with the real use of the bitcoin itself. Your idea is creative but it's not applicable as you expect.

|

|

|

|

I have known Bitcoin and other currencies since 2014, but I did not move a finger. I did not benefit from anything. I mean, I did not invest anything now. I am serious. I liked this forum a lot...

Youve seen a lot of events, updates, changes, and other ways to earn in cryptocurrency bitcoin already shows its potential in those times, if you still doubt Bitcoin it's all up to you if you will risk this time or you will regret it again for this next coming halving. Most people are afraid to lose their money but no investment will assure you an easy ROI, so most of the time there's a risk. You still have time if you will deal it with because the halving is coming now it's your decision whether you will ride or not this time. |

|

|

|

|

People more often check the news so they can secure their funds to sell or buy it depends on the outcome every news, so they can gain profit with this quick action came from economy, and if you are a long term holder of the bitcoin and you are actively doing a DCA you don't need to worry too much with the market because you bought every dump and see the result from the holding from 38k$ we are now sitting at the last ATH and we are now expecting another pump after this halving, but of course don't forget to make a take profit not all the time the market are in the highest point.

|

|

|

|

|

Bitcoin has already built potential and reputation throughout time so that's why people keep holding this coin and people trust it for the long term, like now the halving is now tons of investors again having earnings with the market, and some coins surely will pump and get the ride with the bitcoin but of course they will not last long if their mechanism doesn't work as like the BTC and gets oversupply they can make a pump because of the number of holders and there's no active market activity. Base on my years of experience, i keep trusting BTC

|

|

|

|

Currently nga is medyo matagal ang next game para sa EPL event at para sa mga gusto sumali is open na naman ang BC.GAME for another event takes 10 days before the game starts. Good luck sa mga kabayan na sasali! BC.Game First Goal Prediction! 🔥 BC.Game | Liverpool - Brighton ⚽ 31 March (WIN $50)➥You will predict the first-minute goal and chance to WIN $50! https://bitcointalk.org/index.php?topic=5489172.0 |

|

|

|

|

Start at your own pace if you want to learn with Bitcoin you need to invest time and effort of course, by the way, welcome to the forum, and you are in the right community because related to Bitcoin this is the other source of information you can learn can be the trend, news, trading, services, etc. So now it's up to you where you will focus on those learnings. Sometimes you want to earn as much as possible like the others but you don't see their process before having those earnings in BTC so the same way on your journey. Keep yourself prepared first making taking the risk.

|

|

|

|

|