ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

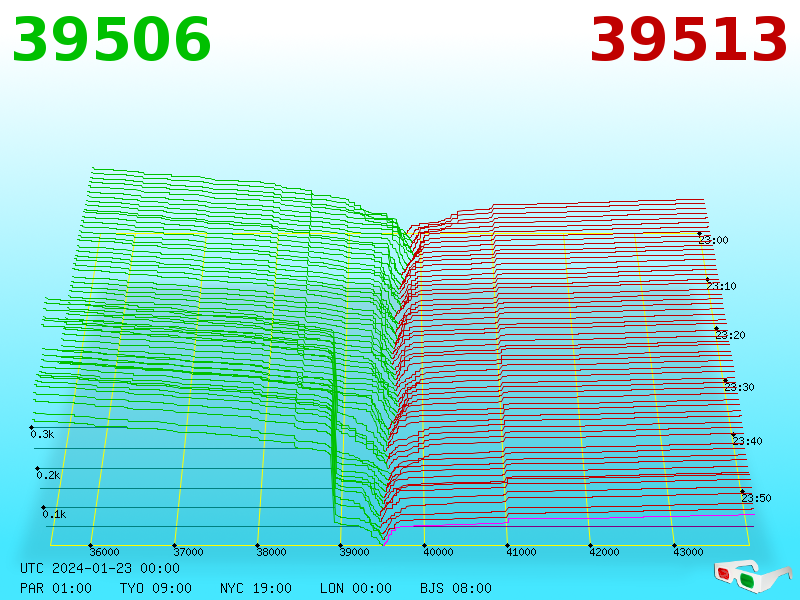

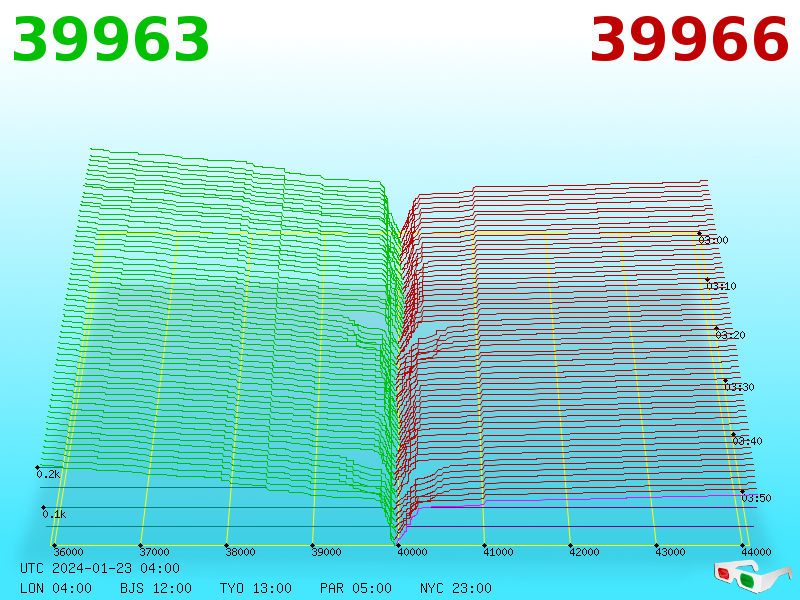

January 23, 2024, 12:03:29 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10225

Self-Custody is a right. Say no to"Non-custodial"

|

for 2024 I tripled my dca amounts, and i did a little bit of guessing;

- I think that for this year my avg cost price will be about 45k$usd

- 2025 ATH will be about 140k$usd and with the next correction cycle the ATL will be 49k - 56k$usd range

My thought process is that I'm accumulating now in 2024 at the probably the next ATL range in 2026/7.

Im not overly concerned about avg cost price, and that was my biggest learning from 2023. I ran the numbers and I would prefer to have more btc and higher avg cost price, than less btc and a lower cost price.

Historically you can see similar kinds of outcomes. The guy who bought 20 BTC in 2015 for an average of around $300 per BTC and sat on them for 8-ish years, is likely worse off than the guy who started buying BTC aggressively near the 2015 $500 price peak, and maybe the second guy did not lump sum with as much (maybe half) but he continued to buy every week or maybe even an equivalent amount of BTC every year as the guy who had lump summed into BTC and then sat on his investment. I'm quite liking the resiliency of the btc market in light of all this etf stuff, i'm starting to think that this might disrupt the 4 yr cycle though in the future. I would imagine too that the skittishness of wall street may also cause deeper dips too, as much as people are bullish on new money entering the market, the money leaving the market could also increase. Is it about to get wilder in the wild wild west?

I would not count out the four-year cycle until maybe after there is evidence of it disappearing rather than speculating that it might disappear. there is not even any strong evidence to suggest the 4-year cycle is going to disappear, merely because BIGGER player have gotten into BTC and are likely trying to manipulate it. Looking at the bigger picture, nothing bad is happening - everyone who thinks the price is too high will have the opportunity to buy cheaper, and on the other hand, the more Grayscale sells, the better for the future. Such a concentration of BTC in the possession of only one company is always nothing but a big risk.

The Grayscale sold BTC seems to be going to Black Rock and maybe Fidelity.. so a shifting of the risk rather than an elimination of the risk, but we will see. Yea....so what if others pick it up and more. This trade is too simplistic to be true (on balance). I don't give a hoot how much they sell as long as they match the underlying. As of 19th GBTC had BTC566,973 in the fund, the claim that they lost BTC18,3k today, and the days isn't even over, is hard for me to believe but would be nice to see, pull that band-aid off already! Where the 534 000 BTC number came from i couldn't follow at all  percentage of dormant bitcoin in GBTC would be interesting to speculate on, but they've been seeing average outflows of about BTC12k per trading day, so at this rate about 46 more trading days until they hit 0. And that's the root of the problem, market doesn't believe that others are picking it up and more I had been thinking that most of the outflows would be from tax privileged accounts, and that the non-taxed privileged accounts would likely not want to incur a tax event by selling their GBTC. I wonder how many of the GBTC shares were held by tax privileged accounts as compared with non-tax privileged accounts. I got 2 pieces in the 39.5k - 39.8k range.

My Ladder goes down to 33224

Get your corn on sale

At this rate, we might get to the bottom of the don't wake me up zone. Fuck!!! Then there might be a need to wake up and possibly do something... I mean that waking up would me that I may well need to look at my orders and those kinds of things. Hi guys in last month I have been always asking my self one question, one scenario about ETF and I dont see such thing mentioned on news, so if someone can please explains me what i am thinking wrong, because i bet there is some protection again such scenario or I am thinking something on wrong way.

So like i understand largest bitcoin holders (if we count out Satoshi Nakamoto who could benefit even more) have around 100k bitcoins right ? and if someone out of them would put all on them at once on sell he would drag price down a lot right ? I assume we would go down to 30k, 20k ?

So why he cant do this if he have money to also enter into ETF big scale. Or perhaps thats plan of people at Blackrock, Grayscale?

I am thinking on next scenario.

One of top bitcoin holders enter ETF, put shorts on ETF, dump all their bitcoin, wait for dust to settle, close shorts on ETF, he go LONG, he buys again bitcoin

What am i thinking wrong ? if Satoshi nakamoto was some big company who could quickly buy ETF on large scale he could get fast insanely right and get a hold of even larger sum of bitcoin ?

What am i thinking wrong? This probably cant happen because of?

Individual holders can do what you are saying, and it is thought that Satoshi would have around 1 million bitcoins rather than 100k bitcoin. ETFs have to keep their BTC to the quantity of their shares, so they cannot sell coins unless their clients sell shares. Large players are usually not going to take those kinds of chances, but sure, they can engage in various kinds of manipulations by selling on one end and hedging on another side... but they can sometimes get callled out on such a thing and not have enough coins to succeed in such manipulation attempts. |

|

|

|

|

|

True Myth

|

|

January 23, 2024, 12:24:23 AM |

|

for 2024 I tripled my dca amounts, and i did a little bit of guessing;

- I think that for this year my avg cost price will be about 45k$usd

- 2025 ATH will be about 140k$usd and with the next correction cycle the ATL will be 49k - 56k$usd range

My thought process is that I'm accumulating now in 2024 at the probably the next ATL range in 2026/7.

Im not overly concerned about avg cost price, and that was my biggest learning from 2023. I ran the numbers and I would prefer to have more btc and higher avg cost price, than less btc and a lower cost price.

I'm quite liking the resiliency of the btc market in light of all this etf stuff, i'm starting to think that this might disrupt the 4 yr cycle though in the future. I would imagine too that the skittishness of wall street may also cause deeper dips too, as much as people are bullish on new money entering the market, the money leaving the market could also increase. Is it about to get wilder in the wild wild west?

This is also my thought on accumulation right now. I'm guessing end of cycle bottom may be anywhere between $60k to $35k. As mentioned before, I'm in Bitcoin for the long haul with no need to sell for many years. Therefore, buying now is the same as buying at the hypothetical cycle bottom (or better). I too am curious how Wallstreet money will affect the cycles. I know ultimately the hope is that Bitcoin vs USD is "more stable". As you mentioned, "big money" could also have the opposite effect. It is hard to say if they will treat Bitcoin as a Digital Gold or if they will treat it as a manipulation playground. Time will tell. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10225

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 23, 2024, 12:59:11 AM |

|

for 2024 I tripled my dca amounts, and i did a little bit of guessing;

- I think that for this year my avg cost price will be about 45k$usd

- 2025 ATH will be about 140k$usd and with the next correction cycle the ATL will be 49k - 56k$usd range

My thought process is that I'm accumulating now in 2024 at the probably the next ATL range in 2026/7.

Im not overly concerned about avg cost price, and that was my biggest learning from 2023. I ran the numbers and I would prefer to have more btc and higher avg cost price, than less btc and a lower cost price.

I'm quite liking the resiliency of the btc market in light of all this etf stuff, i'm starting to think that this might disrupt the 4 yr cycle though in the future. I would imagine too that the skittishness of wall street may also cause deeper dips too, as much as people are bullish on new money entering the market, the money leaving the market could also increase. Is it about to get wilder in the wild wild west?

This is also my thought on accumulation right now. I'm guessing end of cycle bottom may be anywhere between $60k to $35k. As mentioned before, I'm in Bitcoin for the long haul with no need to sell for many years. Therefore, buying now is the same as buying at the hypothetical cycle bottom (or better). I too am curious how Wallstreet money will affect the cycles. I know ultimately the hope is that Bitcoin vs USD is "more stable". As you mentioned, "big money" could also have the opposite effect. It is hard to say if they will treat Bitcoin as a Digital Gold or if they will treat it as a manipulation playground. Time will tell. I doubt that we are going to get a "stable" bitcoin for the next 10 years or so, and maybe we have to see how things go from there... perhaps once BTC's 200-week moving average meets gold's market cap.. or maybe BTC's 200-week moving needs to be around 10x higher than gold's market cap before bitcoin spot price will start to stablize.. and in today's dollars and today's gold marketcap, my fuck you status chart projects the meeting of gold's market cap to be around 2038-ish.. but if we are thinking that 10x gold's market cap would be more suitable for BTC to start to stablize, then according to my entry-level fuck you status chart, that is not going to arrive until about 2062.. and yeah, maybe I am wrong, but going by that, I doubt that we are going to have stable BTC prices for the next 30-40 years. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

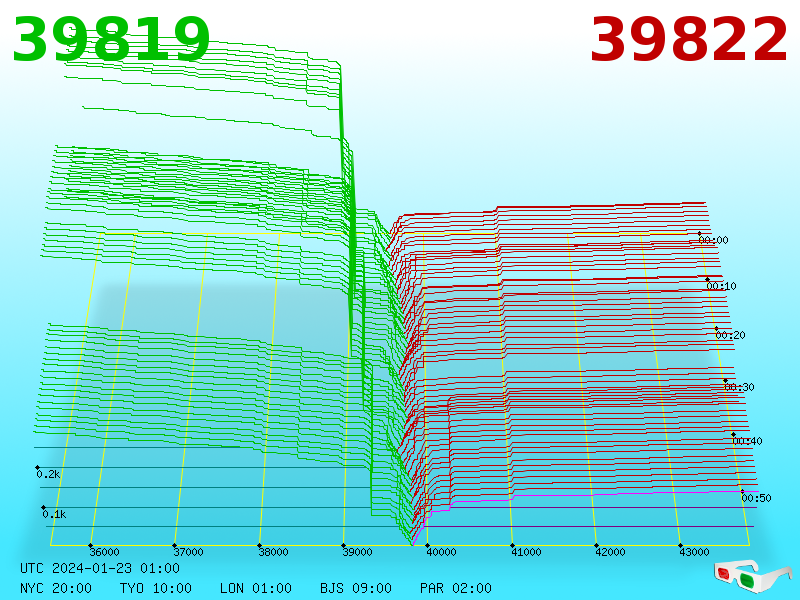

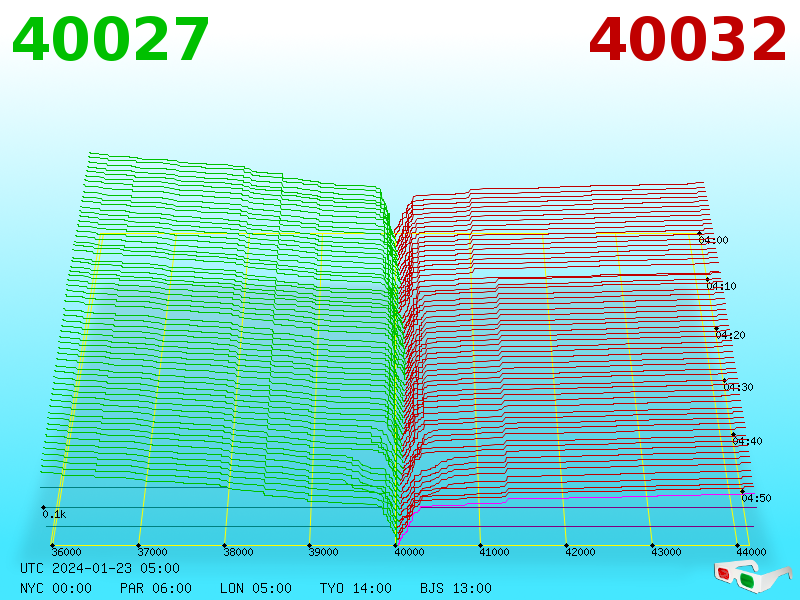

January 23, 2024, 01:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2492

Merit: 2914

|

|

January 23, 2024, 01:09:06 AM Merited by JayJuanGee (1) |

|

for 2024 I tripled my dca amounts, and i did a little bit of guessing;

- I think that for this year my avg cost price will be about 45k$usd

- 2025 ATH will be about 140k$usd and with the next correction cycle the ATL will be 49k - 56k$usd range

My thought process is that I'm accumulating now in 2024 at the probably the next ATL range in 2026/7.

Im not overly concerned about avg cost price, and that was my biggest learning from 2023. I ran the numbers and I would prefer to have more btc and higher avg cost price, than less btc and a lower cost price.

I'm quite liking the resiliency of the btc market in light of all this etf stuff, i'm starting to think that this might disrupt the 4 yr cycle though in the future. I would imagine too that the skittishness of wall street may also cause deeper dips too, as much as people are bullish on new money entering the market, the money leaving the market could also increase. Is it about to get wilder in the wild wild west?

I have a hunch bitcoin volatility might decrease significantly with so many big actors in play. The next correction could be a little higher than your guesstimate of 49k-56k. Another factor pushing in the same direction: each halving has a decreasing weight. Miner income appears to be shifting from block rewards to transaction fees already. We might never go back to the incredibly wild swings of the past. Maybe we should get ready to just wild swings? |

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4326

Merit: 3524

what is this "brake pedal" you speak of?

|

|

January 23, 2024, 01:31:49 AM |

|

We might never go back to the incredibly wild swings of the past. Maybe we should get ready to just wild swings?

and miss out on the sheer terror of crazy price swings for no reason at all? jeez that would be boring. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

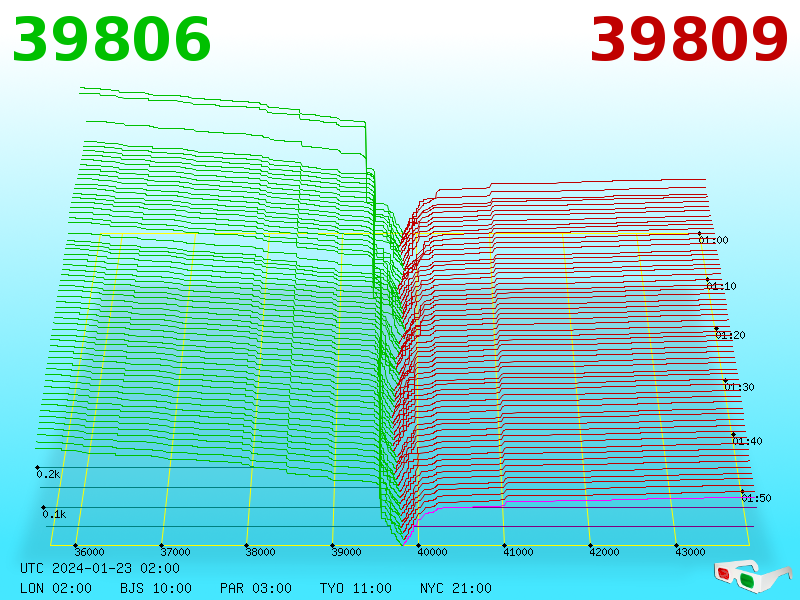

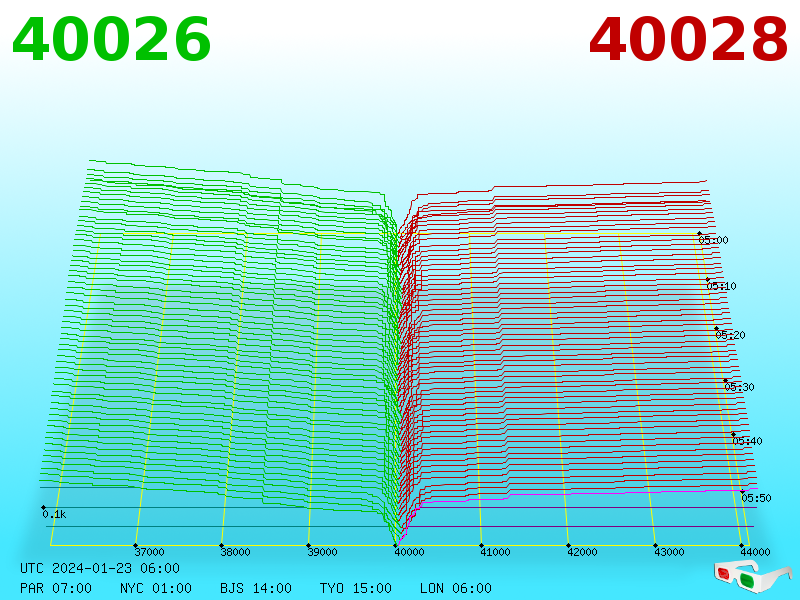

January 23, 2024, 02:03:23 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

smartcomet

|

|

January 23, 2024, 02:38:44 AM |

|

https://cointelegraph.com/news/global-crypto-users-surpasses-half-a-billion-2023-crypto-com-reportA research report from Crypto.com estimates the number of worldwide cryptocurrency users surged to 580 million people in 2023.

The company estimates that the global number of cryptocurrency users increased by 34% in 2023, growing from 432 million to 580 million people.

Delving deeper into the statistics, Crypto.com reveals that Ether ETH ownership had risen from 89 million users to 124 million, while Bitcoin

BTC ownership had increased from 222 million to 296 million people by the year’s close.

Cryptocurrency users are about 11% of internet users worldwide, so we are entering into Early adopters of S-curve, and Majority adopters are saving to buy in the future.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

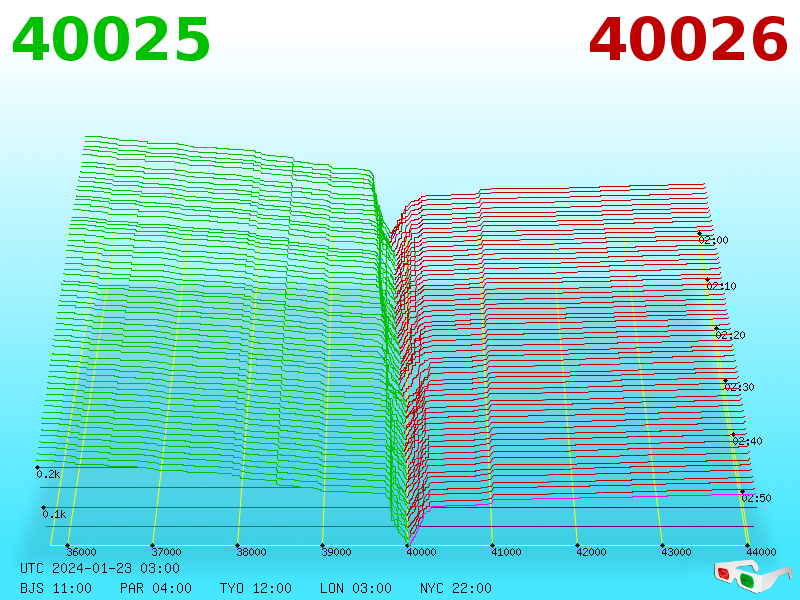

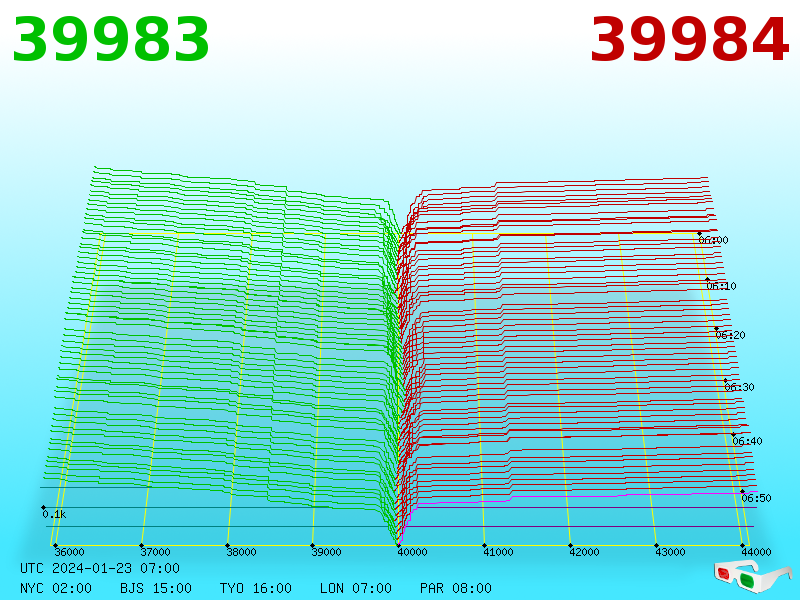

January 23, 2024, 03:03:25 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Negotiation

|

|

January 23, 2024, 03:04:53 AM |

|

#BTC Price: $40068.31 USD is up 0.51% in the past 2 hours. Source. Source.$41K calling ...

|

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4116

Merit: 7862

'The right to privacy matters'

|

|

January 23, 2024, 03:51:29 AM |

|

#BTC Price: $40068.31 USD is up 0.51% in the past 2 hours. Source. Source.$41K calling ... nope under 40k as I type. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 23, 2024, 04:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

FinePoine0

Full Member

Offline Offline

Activity: 392

Merit: 122

★Bitvest.io★ Play Plinko or Invest!

|

|

January 23, 2024, 04:17:17 AM |

|

#BTC Price: $40068.31 USD is up 0.51% in the past 2 hours. Source. Source.$41K calling ... Bitcoin Price Dives Below $40K, Can Bulls Save The Day? Bitcoin price extended its decline below the $40,000 support zone. BTC is consolidating losses and remains at risk of more downsides below $38,500. Bitcoin price is gaining bearish momentum below the $40,500 zone. The price is trading below $40,500 and the 100 hourly Simple moving average. There is a connecting bearish trend line forming with resistance near $40,850 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair might correct above $40,000 but the bears could remain active near $40,500. Details: https://www.newsbtc.com/analysis/btc/bitcoin-price-dives-below-40k/ |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 23, 2024, 05:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 23, 2024, 06:03:26 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 23, 2024, 07:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

DirtyKeyboard

Sr. Member

Offline Offline

Activity: 266

Merit: 477

Fly free sweet Mango.

|

|

January 23, 2024, 07:19:46 AM |

|

ChartBuddy's 24 hour Wall Observation recap . . .All credit to ChartBuddy |

|

|

|

|

DaRude

Legendary

Offline Offline

Activity: 2789

Merit: 1816

In order to dump coins one must have coins

|

|

January 23, 2024, 07:22:31 AM |

|

Yea....so what if others pick it up and more. This trade is too simplistic to be true (on balance). I don't give a hoot how much they sell as long as they match the underlying. As of 19th GBTC had BTC566,973 in the fund, the claim that they lost BTC18,3k today, and the days isn't even over, is hard for me to believe but would be nice to see, pull that band-aid off already! Where the 534 000 BTC number came from i couldn't follow at all  percentage of dormant bitcoin in GBTC would be interesting to speculate on, but they've been seeing average outflows of about BTC12k per trading day, so at this rate about 46 more trading days until they hit 0. And that's the root of the problem, market doesn't believe that others are picking it up and more Bloomber

Crypto Funds Saw Outflows Last Week After Debut of Bitcoin ETFs

Global demand for cryptocurrency investment products eased last week, with funds seeing $21 million in outflows, according to a report from CoinShares.

This doesn't line up with my numbers, but after reading into it i realized that they're talking about all crypto (including shitcoins) but according to their source bitcoin only outflow is even worse at $-24,7MM they only have $656MM inflow under "Other" category which i couldn't really follow When I wrote this post on https://bitcointreasuries.net/entities/50 there was data for 21th Jan, showing 14K outflow to 552K BTC. Later they deleted it and now it shows 566K. May it was a mistake, since 21st was Sunday. Tomorrow we will know what are the outfolws for today. Looks like another day of -14.292 BTC outflow for GBTC, bringing them down to BTC552.681 more than 10% has already been liquidated... |

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1854

Merit: 2841

All good things to those who wait

|

|

January 23, 2024, 07:28:00 AM Merited by OutOfMemory (1) |

|

It seems that the situation is getting from bad to worse by each hour. This is not a normal trading, so to speak of any support line is pointless. The support is when the last bitcoin of Greyscale will be sold. I won't be surprised if we see covid like apocalyptic dump. Too bad I don't have any fiat left to buy moar. I guess the plan is to keep the rate 1.5% until the BTC outflows stop. And then lower it to 0.3%. But people are not so stupid to return to Greyscale knowing that they will raise the rate again. So, instead of leading the parade to 100K, Greyscale chose to be the new far more ominous MtGox. Well, it seems that we have to wait a bit longer to see 100K. Honey badger doesn't care.  Dude...why do you care so much about GBTC when the OVERALL ETF flow is positive? Besides, I calculate that GBTC is basically on par with their NAV right now (0.18% discount) All this whining about GBTC is pointless...reminds me about whining about bitcoin's use of electricity. EDIT: to all GBTC fear mongers: compare 5d chart of GBTC vs IBIT. Which one outperforms? Sorry, it is GBTC, haha. Just to clarify GBTC have sold 6% of total since ETF launches. I mentioned on the thread why this isn't a reason to panic, but it is a cause for concern. The upside is there is only 94% left to be sold, it'll hopefully go to new ETFs via OTC to reduce selling pressure on spot market, and otherwise be done within 4 months (based on current estimate and data). Until new data is released, there isn't much else to go on, and sure there is still net positive inflows into the ETFs, so this isn't s disastrous situation what so ever. If I were to "wildly guess" on why price has dumped -15% since ETF launch, it's because many speculated that price would dump after the ETF launch, not much else. But obviously this is wild speculation and calling a local top at $46K after the ETF launches was too early for some, so it does need further confirmation, but otherwise price direction remains pretty clear right now without needing to over analyse. Price is currently moving downwards (convince me otherwise). After the halving, with price stability, confidence in ETFs, I truely believe Bitcoin's price is going to melt faces and reach new ATH before the end of the year. Probably much earlier than the usual 4 year cycle, ie rather than winter probably more likely summer or autumn. With these new ETFs there isn't going to be much of a cap on Bitcoin's price rise (such as retail money), that much is granted, but we're not there yet. I've said it before, but I feel like I realise why Bitcoin's market cap was never sustainable above $1T: because ETFs weren't available. It's all good and well principles such as "not your keys not your coins", which every retail investor should practice, but institutions don't give a fuck about custody of coins. They care about safe investments, with reliable fund managers, in order to preserve capital etc. 2025 will likely be epic. <snip>Why should one prefer the well established Blackrock, Fidelidy, etc. with their low fees and fair play, over some FTX kinda shady company with high fees? Well: 1. With high volatility yearly fee of 1.5% is irrelevant because every day it moves more than that, so if you try to flip one ETF for another, you can easily lose money. 2. In the last 5 days GBTC outperformed IBIT by 0.7% and FBTC by 0.8%, check it out. 3. Your statement is a borderline defamation...do you actually know that they are what you say they are or you just spewing stuff and hope that it will stick?

Well, your logic is like the principle buy low sell high. Sounds true, but in reality most of the daily traders do the opposite. Trying to defend Greyscale leadership is pointless. They prefer to take the big money now, rather than to try to keep their clients. And definitely they are not caring what damage this will inflict on the price. Btw, there are some good explanations for what's going on, like this one: "Note: the more we think about it and talk to ppl, prob only a small minority of the GBTC outflows are likely going to the Nine right now as much of it was FTX and traders who arb-ed discount. Also the proportionality of the flows to the size of the firm is almost perfect, indicating flows due to reach/distribution/hustle." https://twitter.com/EricBalchunas/status/1748696162725458229It seems that others think in the same way: https://twitter.com/real_vijay/status/17496903145695027251) The reason for #Bitcoin's recent drop in price, despite the ETF floodgates being opened, is directly related to GBTC redemptions by bankruptcy estates such as FTX. And the reason GBTC is held by so many companies in bankruptcy is directly tied to the fraud by @BarrySilbert 2/ Despite many conflicts of interest @BarrySilbert encouraged lending to companies performing the ill-conceived GBTC arb trade because this increased the assets under management at his portfolio company Grayscale. 3/ In another case, DCG (which @BarrySilbert is CEO of) owed Bitcoins to its other child company Genesis ( now also in bankruptcy) and instead of paying Bitcoins he paid with GBTC, which DCG was loaded to the gills with. Genesis will now also need to liquidate its GBTC. 4/ This mess is going to take some time to unwind (don't worry, it eventually will). No one is more responsible and deserves more blame for this mess than @BarrySilbert. He is now under investigation by several regulatory bodies and law enforcement agencies. 5/ I wrote a long thread explaining the details of @BarrySilbert's fraud and the GBTC arb trade that ended up toppling several companies in this very long tweet thread: https://twitter.com/real_vijay/status/1721385528510251182 |

|

|

|

|

|

Poll

Poll