OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

November 14, 2023, 05:50:42 PM |

|

Holy stock rally Batman! I can’t remember the last time my stock portfolio was so green. Definitely feels like a shift has been made in the investment world. A bit curious why Bitcoin hasn’t followed suit and gone up a significant amount today, but I guess after the recent rally the market needed a breather. Still good news that money is flowing back into equities.

Some indicator triggered on the S&P, which triggered only 17 times in about 80 years. Zweig Breadth Thrust (ZBT). AFAIR i did already write a short post about that. |

|

|

|

|

|

|

|

|

|

|

|

The Bitcoin network protocol was designed to be extremely flexible. It can be used to create timed transactions, escrow transactions, multi-signature transactions, etc. The current features of the client only hint at what will be possible in the future.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4732

Merit: 4239

Leading Crypto Sports Betting & Casino Platform

|

|

November 14, 2023, 05:57:08 PM |

|

Holy stock rally Batman! I can’t remember the last time my stock portfolio was so green. Definitely feels like a shift has been made in the investment world. A bit curious why Bitcoin hasn’t followed suit and gone up a significant amount today, but I guess after the recent rally the market needed a breather. Still good news that money is flowing back into equities.

There's no correlation anymore. They've been writing about it for months. For instance, here's Coindesk in July: Bitcoin's (BTC) fortune is no longer tied to sentiment in the U.S. stock markets. The 90-day rolling correlation of changes in bitcoin's spot price to changes in Wall Street's tech-heavy equity index, Nasdaq, and the broader index, S&P 500, has declined to near zero thestreet.com, 2 weeks ago Despite being a fundamentally decentralized asset, the bitcoin price historically tracks with traditional assets. But its recent decoupling from the S&P 500 could signal a changing outlook from mainstream investors. (...) TheStreetCrypto’s George Tung reported in the video above. “In 2023 … there’s 0% correlation… That’s because we have this flight to quality. A lot of people are paying attention and not happy about what’s going on with inflation, with printing, with debt, with everything else that’s going on. And plus, people are not oblivious to the fact that institutions are jumping into the space and about to pump bitcoin.” No correlation is a pipe dream. Obviously investments are related to some extent, but Bitcoin’s low market cap has always rallied significantly harder as price discovery is being reached. Those thinking this market will be less correlated in the future than the past, I have some bad news for you in relation to the coming spot ETF funds… |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

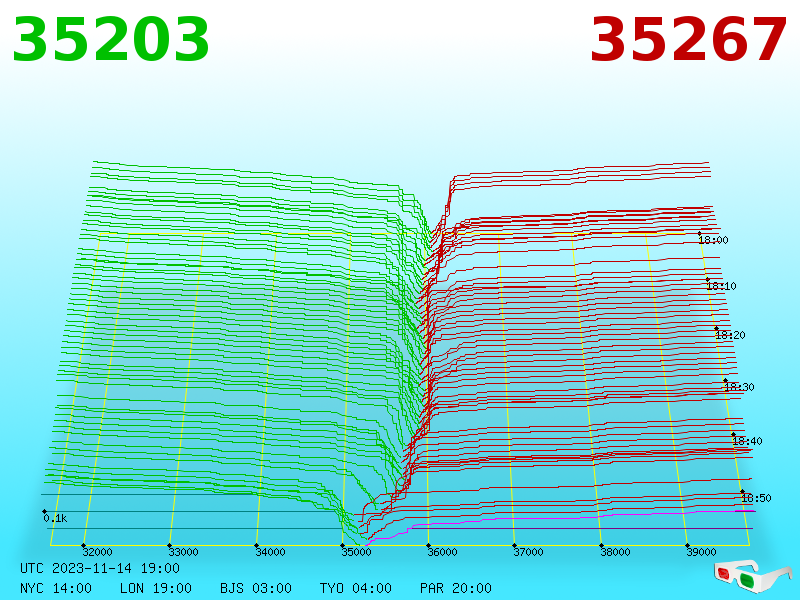

November 14, 2023, 06:03:27 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

coolcoinz

Legendary

Offline Offline

Activity: 2618

Merit: 1103

|

|

November 14, 2023, 06:09:10 PM |

|

Bitcoin always has been not correlated to various equities and/or tech stocks, even though there have been so many claims about correlation.

Once upon a time in 2020...  S&P is black. No correlation is a pipe dream. Obviously investments are related to some extent, but Bitcoin’s low market cap has always rallied significantly harder as price discovery is being reached. Those thinking this market will be less correlated in the future than the past, I have some bad news for you in relation to the coming spot ETF funds…

IMO Bitcoin can experience a much larger growth than stocks in the long run, especially when all the ETFs get approved they'll have to face the lowest liquidity of bitcoin in history. Imagine your clients expect you to have x amount of bitcoin in stock, for instance 100k, by next month and the competing fund needs to buy 300k at the same time and total trading volume on exchanges like bitstamp is 2k... We can expect the correlation to continue to be low if bitcoin begins to rally due to no liquidity and large demand. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 14, 2023, 06:38:21 PM |

|

Holy stock rally Batman! I can’t remember the last time my stock portfolio was so green. Definitely feels like a shift has been made in the investment world. A bit curious why Bitcoin hasn’t followed suit and gone up a significant amount today, but I guess after the recent rally the market needed a breather. Still good news that money is flowing back into equities.

There's no correlation anymore. They've been writing about it for months. For instance, here's Coindesk in July: Bitcoin's (BTC) fortune is no longer tied to sentiment in the U.S. stock markets. The 90-day rolling correlation of changes in bitcoin's spot price to changes in Wall Street's tech-heavy equity index, Nasdaq, and the broader index, S&P 500, has declined to near zero thestreet.com, 2 weeks ago Despite being a fundamentally decentralized asset, the bitcoin price historically tracks with traditional assets. But its recent decoupling from the S&P 500 could signal a changing outlook from mainstream investors. (...) TheStreetCrypto’s George Tung reported in the video above. “In 2023 … there’s 0% correlation… That’s because we have this flight to quality. A lot of people are paying attention and not happy about what’s going on with inflation, with printing, with debt, with everything else that’s going on. And plus, people are not oblivious to the fact that institutions are jumping into the space and about to pump bitcoin.” No correlation is a pipe dream. Obviously investments are related to some extent, but Bitcoin’s low market cap has always rallied significantly harder as price discovery is being reached. Those thinking this market will be less correlated in the future than the past, I have some bad news for you in relation to the coming spot ETF funds… So we may well agree somewhat about the historical correlation of bitcoin and stocks not really being present, and surely I would not be arguing that there are not periods in which bitcoin may well appear to be correlated for extendedly long periods of time... but those little surprises from time to time do make differences, so for example between about 2013 and present, in the last 10 years, stocks may well have doubled in price, and what has bitcoin done? something like 20x to 40x depending on from where you had been measuring. Yeah there were quite a few periods of correlation contained therein. An ETF may well bring greater correlation, but the EFT twats may not have as much power as they believe to control King Daddy... remember some of the mid 2017 statements (was it in regards to the CME futures and some of that?).. yeah they were able to make it appear that they were controlling king daddy for a short period of time.. but would you really say that they had been successful? Sure some might say that bitcoin has ONLY tripled from the around $10k prices when CME futures were introduced.... and so whatever, we will see how some of these matters play out, and surely there are a lot of efforts to make self-custodial illegal or some variation of that, so it is not like we are without some future battles on a variety of fronts that may or may not end up negatively affecting BTC's price and/or suppressing it... Perhaps? perhaps? The future is not guaranteed in either direction, so part of the reason to NOT get overly enthusiastic about upside BTC price performance that may or may not end up playing out.. and so hopefully each of us know how to attempt to manage our funds and our expectations in regards to more than just a narrow set of scenarios. Bitcoin always has been not correlated to various equities and/or tech stocks, even though there have been so many claims about correlation.

Once upon a time in 2020...  S&P is black. Yes, of course there are ways to find those kinds of patterns of seeming correlation, and rely upon them to your detriment, which surely has happened to BTC HODLers from time to time when they fail/refuse to recognize BTC's lack of correlation merely because they are looking at evidence and arguments of short-term correlation that does not reflect longer time frames in which you may well end up getting reckt as fuck because you failed/refused to pee pare ur lil selfie for the possibility of BTC UPpity... because you bought into some nonsense and you ended up sizing your position based on such misleading and lacking in long term view information. another thing, good luck if you are following the supposed BIG brains that had been arguing correlation and then now are arguing lack of correlation and who are likely to flip back to correlation when it is convenient, and hopefully you do not get reckt too badly if you end up relying on their representations. |

|

|

|

|

JimboToronto

Legendary

Offline Offline

Activity: 4004

Merit: 4465

You're never too old to think young.

|

|

November 14, 2023, 06:42:02 PM |

|

Yo!  |

|

|

|

|

|

Odusko

|

|

November 14, 2023, 06:45:47 PM |

|

Feels like the market is running out of steam and taking a breath. Will be interesting to see which direction the market points to when people get back to work in a few hours.

In Belgium, work is already ongoing Nice @El duderino_ let's see how that works toward achieving a positive outcome in the coming days. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

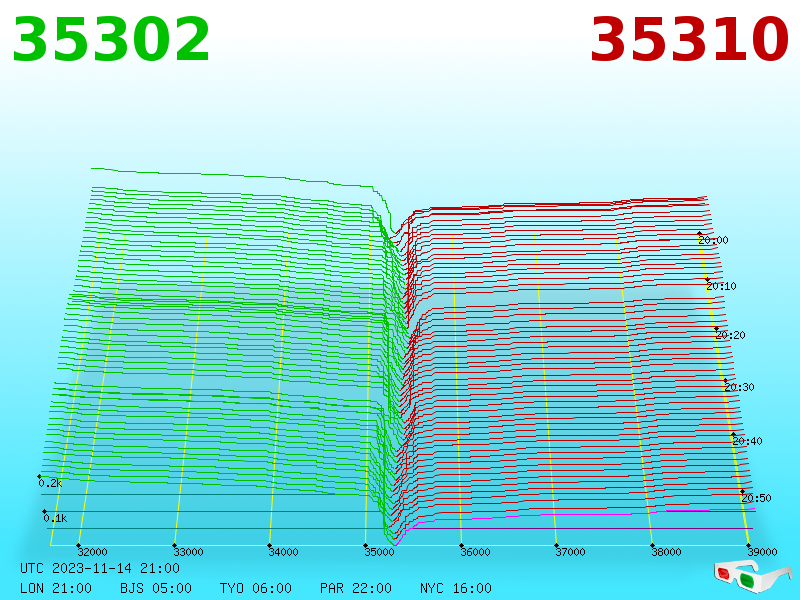

November 14, 2023, 07:03:24 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4116

Merit: 7824

'The right to privacy matters'

|

|

November 14, 2023, 07:50:19 PM |

|

buddy are you going to give us some cheap corn? |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12032

BTC + Crossfit, living life.

|

|

November 14, 2023, 08:02:27 PM |

|

What is happening

Exactly what I don’t like

but what is needed.

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 14, 2023, 08:03:23 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

eXPHorizon

Full Member

Offline Offline

Activity: 1176

Merit: 132

Precision Beats Power and Timing Beats Speed.

|

|

November 14, 2023, 08:36:49 PM |

|

It is time to get serious. 🐻🐻❄️🐨🧸 |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 14, 2023, 09:03:28 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 14, 2023, 09:51:27 PM |

|

What is happening

Exactly what I don’t like

but what is needed.

I am not sure if such correction is needed, but it is hard to imagine that a 42% up from around $27k to $38k in around a month without any kind of correction is sustainable.. even though historically, we have seen that sometimes dee cornz will go UPpity without a correction for quite a bit of time. I am agreeing with you in part of the sentiment in terms of my still mauling over what should be my new don't wake me up zone.. ..maybe $30k-ish on the lower end?.. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 14, 2023, 10:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

infofront (OP)

Legendary

Offline Offline

Activity: 2632

Merit: 2780

Shitcoin Minimalist

|

|

November 14, 2023, 10:37:54 PM |

|

Poll reset. The market is looking a little uglier ATM, but I'm not lowering price ranges on the poll yet   |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9525

#1 VIP Crypto Casino

|

|

November 14, 2023, 10:45:05 PM |

|

If we’re bottoming out here then I’d say it’s very bullish. Hopefully we’ve found a new floor, which could set us up for an end of year rally to new yearly highs.

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

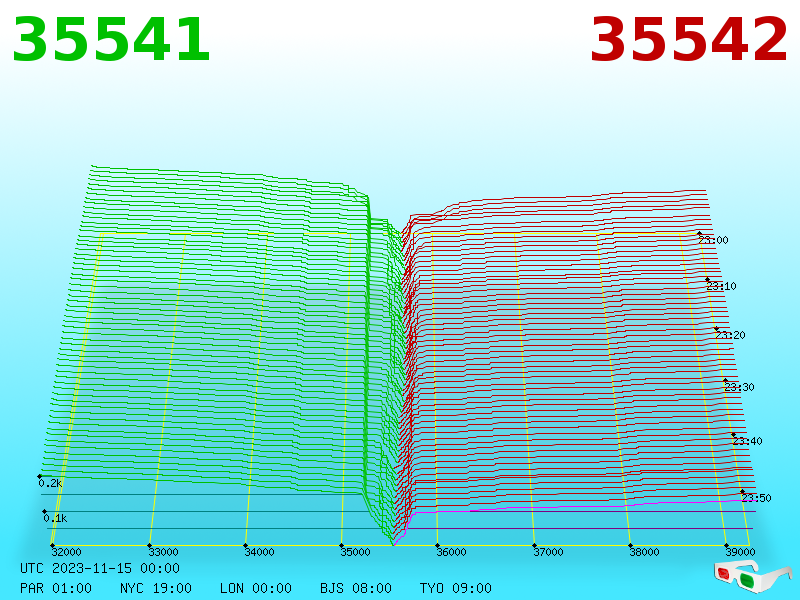

November 14, 2023, 11:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

OROBTC

Legendary

Offline Offline

Activity: 2912

Merit: 1852

|

|

November 14, 2023, 11:43:57 PM |

|

If we’re bottoming out here then I’d say it’s very bullish. Hopefully we’ve found a new floor, which could set us up for an end of year rally to new yearly highs.

I wouldn't know, but a low today would be nice. Go BTC go. On a related note, a guy I know who is a "Medium Shot" in BTC World told me he was very optimistic. He runs money in BTC companies, and his company is apparently doing quite well. He thinks the SEC will approve all the ETFs (or most anyway). However, he told me he has no special or insider knowledge. Soooo, with the dip and his encouraging words, I bought a little BTC today. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 15, 2023, 12:01:17 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll