JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 18, 2023, 01:06:34 AM

Last edit: November 18, 2023, 02:30:23 AM by JayJuanGee |

|

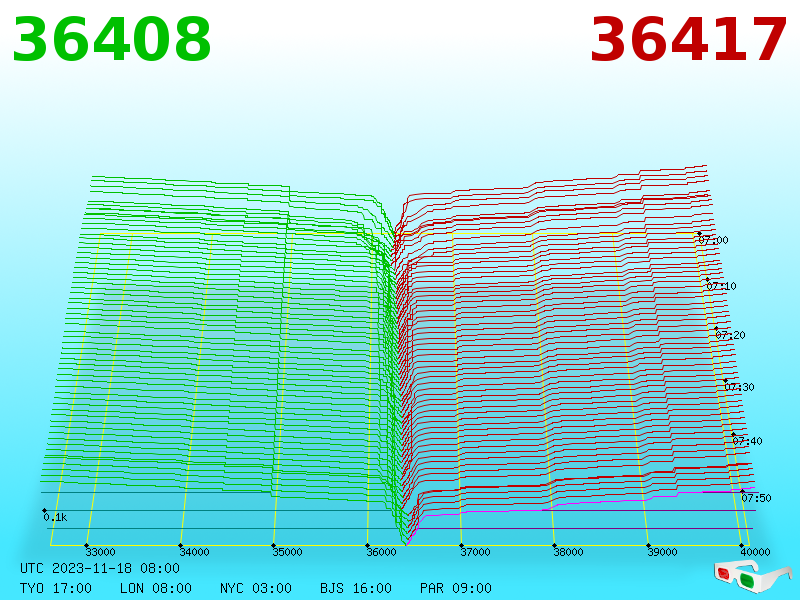

Was a bit of a chore. How do you do it Buddy?  Wow!!!! That was a pretty good piece of animation to show CB's output from the last 24 hours- ish, and fairly quick to post it, too... a bit obscure in your reference to it (or your lack of description to be more precise), which likely was part of the reason that no other member had clicked on your link, reposted and/or actually noticed what you had posted. DCA strategy be damned, now is the time to fill your bags. Anyone left straggling behind after the ETF approval news comes out has only themselves to blame.  What if someone had been DCAing to the max for the past 4-6 years, and such person might not really have any extra cash to throw towards bitcoin, and probably such person is already doing pretty good, even if some of their coins were bought in 2021 and early 2022 at higher prices than current prices. Or? maybe you are referring to the fence sitter who failed/refused to buy BTC in the last year and a half or so while prices were mostly lower than the current price and perhaps the last year and a half had prices lower than where we might be going. Perhaps? perhaps? |

|

|

|

|

|

|

|

Every time a block is mined, a certain amount of BTC (called the

subsidy) is created out of thin air and given to the miner. The

subsidy halves every four years and will reach 0 in about 130 years.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3836

Merit: 7977

|

|

November 18, 2023, 01:31:09 AM |

|

My ears are burning.

|

|

|

|

|

|

danadc

|

|

November 18, 2023, 01:38:17 AM Merited by JayJuanGee (1) |

|

Countries worldwide have a way of seeing bitcoin, some see it as digital gold, for me it is and it is more than that, it is the future in reality, it is the opportunity that is being presented to you right now and many do not want to see it . The developed countries in Europe, the USA, are the ones that Arrive and have the fastest information, therefore they are faster in terms of technological advances, in this article there is a good Impact because it talks about Latin America , it can be quite Strange, but in that area there is a lot of money, and they want the best , Bitcoin is becoming more Popular , and in fact, could we Talk about a high Impact? Bitcoin Adoption in South America Increasing Despite Fee SpikeMore Latin American (LATAM) countries are considering Bitcoin adoption as they follow in the footsteps of El Salvador. However, a surge in BTC transaction fees could make daily usage impractical.

El Salvador was the first country to adopt Bitcoin as legal tender, but a number of others in the region could follow.

According to strategist Samson Mow, Ecuador and Peru are among the nations that could adopt Bitcoin as legal tender.

“Many countries in Latin America will be adopting Bitcoin,” he told Reuters last week. El Salvador was first, but “we know that many other countries in the region are starting to look towards it,” he added.

Bitcoin adoption advocacy group JAN3 commented:

“It’s undeniable that countries with rampant inflation see the most adoption out of people’s sheer necessity to protect their income and savings.”

Source: https://beincrypto.com/bitcoin-adoption-south-america-fee-spike/El Salvador is an example for the world, it seems very incredible to me that this Country has Dared to do everything with that President Bukele, and I hope one day to visit the "Bitcoin City" , this country will Quickly rise because its premise is to have Bitcoin always. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 02:01:15 AM |

|

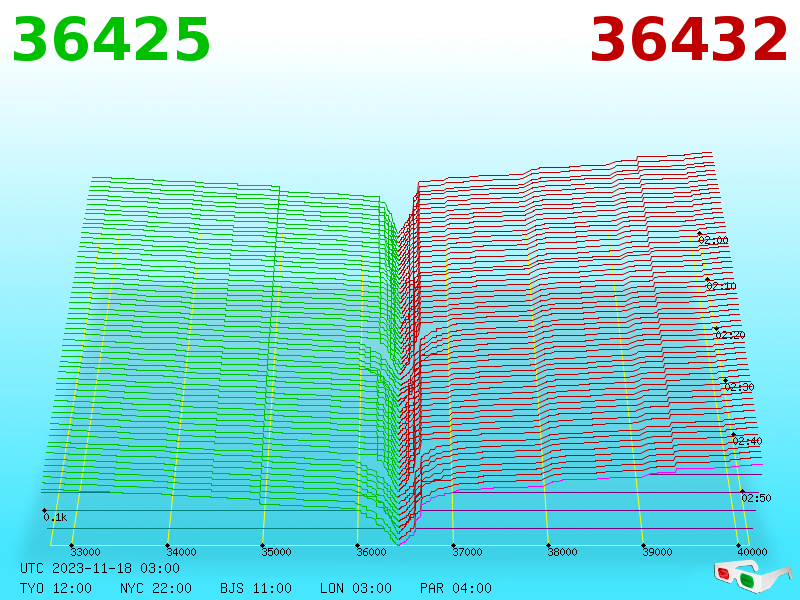

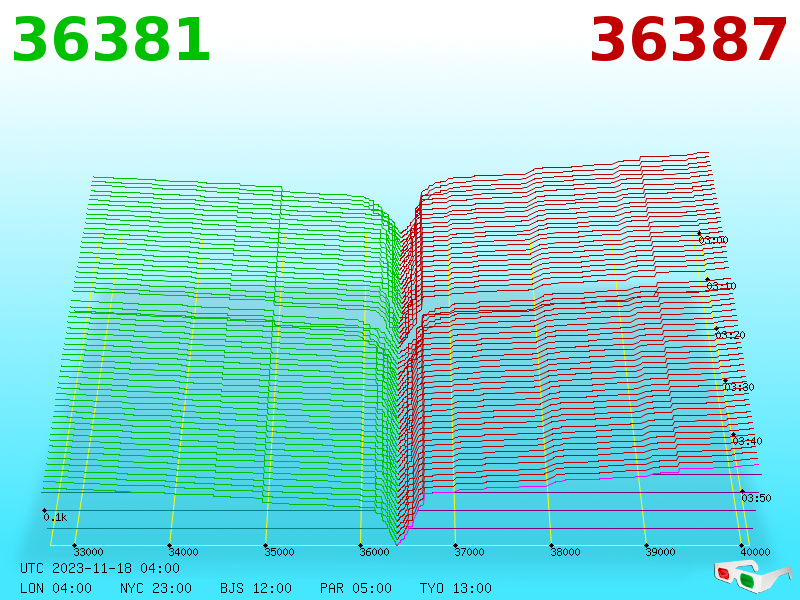

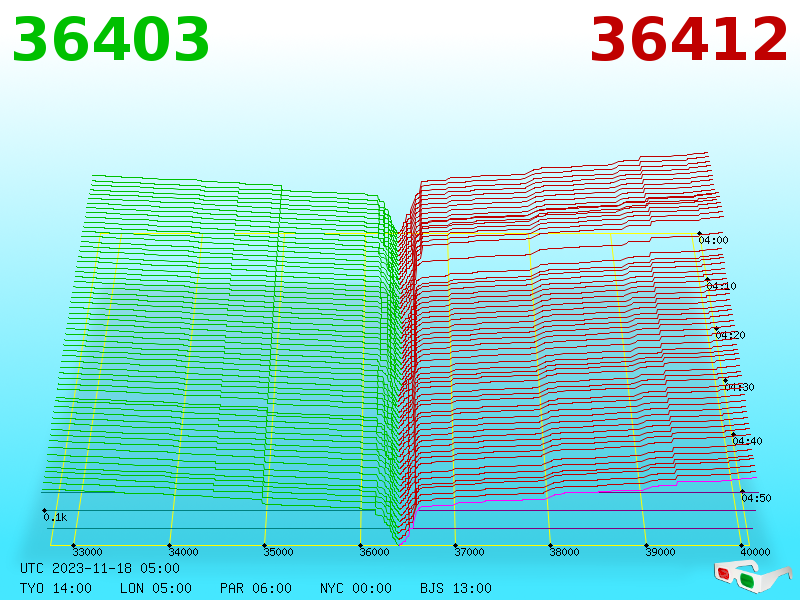

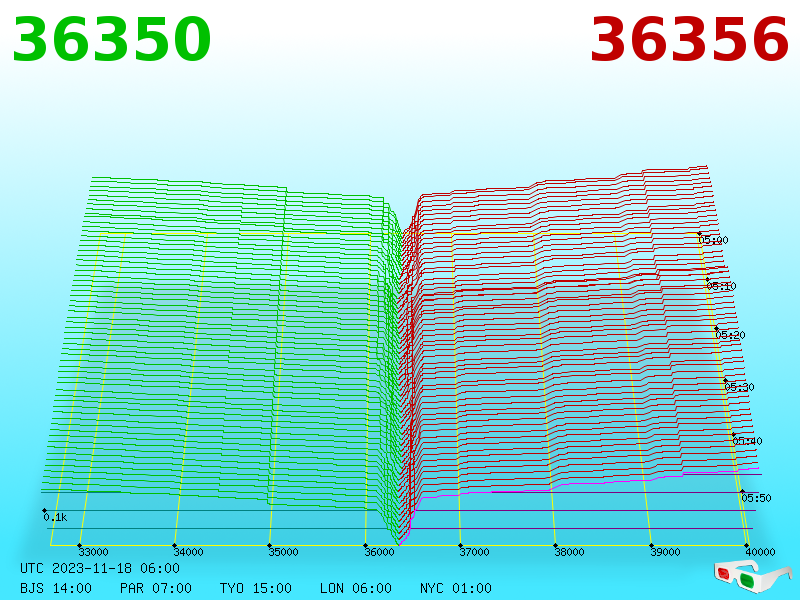

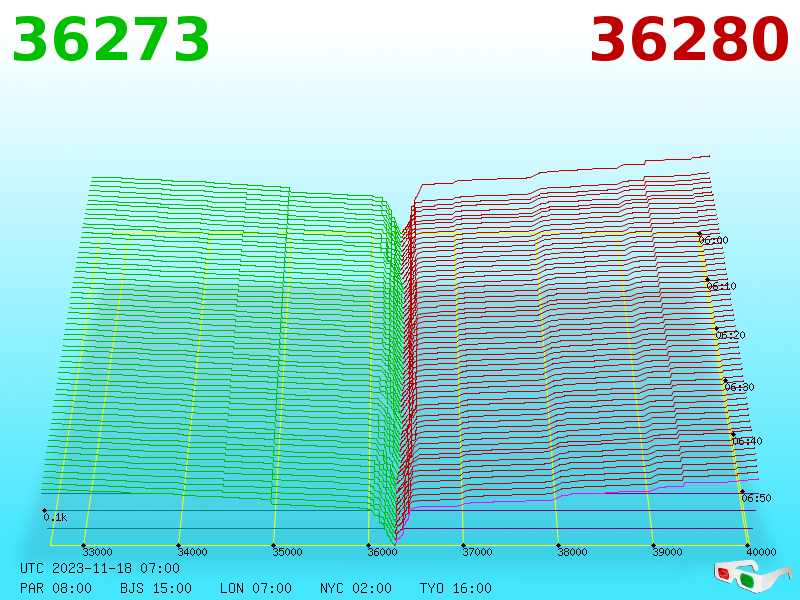

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

Hold On For Dear Life Is that a picture of a shitcoin? ....especially since HODL no does not work like that with dee cornz, unless you have been leveraging and/or otherwise employing gambling tactics with it. Beautiful.. there will be no ETFs and Disinflation is happening cause of less Bljatcoiners. I am loving it now only farms need to go offline so the people have a lower electricity bill.

You are really living in a fantasy. Maybe goldkingcoiner's earlier post was directed towards folks like uie-pooie?... since you seem to have had failed and refused to buy bitcoin in the last few years, even though you claim to have had exposure some time prior to the GOX blow up in early 2014 - but surely hard to know if anything coming from you is anything other than a childish fantasy - maybe grandma does not have enough to give you an allowance or a raise in your allowance if you happen to have one, but and maybe that would be the ONLY recognition how you might not have figured out how to earn some actual money in order to actually get some corn exposure rather than just fantasizing about BTC price moves that are not very likely to happen.. sure there could be 5-15% odds of some kind of a scenario that actually would give you some kind of short-term satisfaction that might even last for a year or so, but the kind of downity that you seem to be expecting would probably be lower than 5% odds, and maybe I am even stretching it (being charitable) to allow that high of a percentage for your views to have some reality in playing out. I love ya JJG

You might as well love your “smart” TV or toaster for all that matters. Personally, out of the two options, I would prefer to be compared to a smart TV rather than to a toaster, since I have more bells and whistles than a mere toaster, even though there is a toaster case-study that suggests toasters are quite complicated gadgets, especially if you consider how they might get build (and sourced) from scratch.... . Thomas Thwaites: How I built a toaster -- from scratch | TED TalkI know. I know. I know. The above article is referring to a basic toaster, not a smart toaster, as presumptively you seem to be comparing me to a "smart" toaster, which is even more sophisticated than the one that Thwaites described in his Ted Talk. You are not alone in the list of JJG lovers. He is loved because of the respect he gave by giving a detail reply to our messages.

Hahahahahaha. It’s a tool, and apparently you are one too. You are getting real personal now. A tool? Phuuuu... fffffaaaaaa     I resemble that statement. I resemble that statement.Has anybody created some sort of animated gif using the latest chart buddy images? It might be funny to use the last 24 images on a rolling basis to give you a feel for how the last day has gone. Or maybe grab 24 images once a day and then be able to show each day’s movement. Seems like something one of you fellas would enjoy creating.

Had the same idea and tried that a few months ago. I downloaded the last 24 CB images and created an animated gif. The result was totally disappointing more like something to trigger epyleptic seizures than show the price development over the last 24 hours. I then concluded that Richy_T must have tried that already and dismissed the idea. Your post provides further evidence to support that DirtyKeyboard's solution came off in a kind of seamless and/or user-friendly kind of a way. According to BBG gang most probable date is January. Last deadline is Jan 10th. So probably before that date. That would be better than dec 2023. So lets hope you are correct. What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. .. but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows? |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3836

Merit: 7977

|

|

November 18, 2023, 02:38:10 AM |

|

~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. |

|

|

|

|

nutildah

Legendary

Offline Offline

Activity: 2968

Merit: 7960

|

|

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4116

Merit: 7824

'The right to privacy matters'

|

|

November 18, 2023, 02:54:33 AM |

|

~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. yep. an eft dec 10 with a jump to 100k by dec 30 means a sale gets taxed and paid asap. an eft jan 10 with a jump to 100k by jan 30 means a sales gets taxed and paid 18 months later. Somif we get eft in dec we may have a lot of selloffs and fast drops for,jan. while the eft in jan may mean hodl works.an d we don’t drop off like mad. but honey badger don’t care so I guess either one is good. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 03:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 18, 2023, 03:04:08 AM

Last edit: November 18, 2023, 04:19:37 AM by JayJuanGee |

|

It is clear you are no Illustrious Greek. If you were you would be half as smart as Antisthenes.. Now your just... eeww, you...

Thank you friend, but now we’re in trouble - multiple triggering that AI fagot abomination. Btw, since we’re at it, you are the single most honest person filled with integrity, I’m aware of in this forum. Couple others are close, but not there yet. The four of you should get a room. meaning: You and exp, billy no coiner and exp's grandma. ~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. Sure, I already understand that there could be angles that relate to taxes, yet capital gains would ONLY apply for the 2023 year to purchases and sells that are made in 2023 with the assumption that the spot ETF were to be approved in 2023... of course there would also be some buys in 2023, but if the sales were in 2024, then 2024 would be the taxable year. Surely there could be some other matters that relate to taxes and reporting, but launching a new product prior to the new year rather than after the new year seems to give more options to investors rather than fewer options, and so from the investor's perspective it would seem to justify wanting to launch the spot ETF earlier rather than later (in order to have more options), yet the SEC may likely be somewhat neutral in regards to the calendar year matter, I would think that investing companies would rather give their customers more options rather than fewer options, even though launching in 2023 could well put some clients at a disadvantage if they were planning to ONLY be ready to transition into an ETF after the beginning of the year, but there were to end up being a price run up in 2023 because the product ended up launching in 2023 rather than in 2024 when they were planning to get in. Yeah, I am writing a lot, and even accounting for some possible tax ramifications of one year versus another, yet I still don't feel like I have much of any clue why it would be preferable (from Phillip's perspective or from anyone else's except maybe officials merely just wanting to delay as long as feasible) that the Spot ETF product launch in January 2024 as opposed to December 2023. Edit: Maybe this part was sort-of answered by Philip in the below post. ~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. yep. an eft dec 10 with a jump to 100k by dec 30 means a sale gets taxed and paid asap. an eft jan 10 with a jump to 100k by jan 30 means a sales gets taxed and paid 18 months later. Somif we get eft in dec we may have a lot of selloffs and fast drops for,jan. while the eft in jan may mean hodl works.an d we don’t drop off like mad. but honey badger don’t care so I guess either one is good. Sure there could be shenanigan's either way, but it all seems a kind of wash. in the whole scheme of things in terms of potential preferability of whether a Spot ETF is launched later rather than sooner, or January 2024 as opposed to December 2023. And yeah, I am presuming a pump on the news of an actual BTC Spot ETF approval, but I am not really sure how much of a pump and/or how it might play out and if that would be creating any major buys and sells within the 2023 calendar year (even if the approval were to occur sometimes in December.. yeah, some of the BIGGER players play those kinds of games, but it may or may not work as expected for some of them, even if some of them are BIGGER players). Edited to attempt to make some ideas a bit more clear. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 04:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4116

Merit: 7824

'The right to privacy matters'

|

|

November 18, 2023, 04:13:50 AM |

|

It is clear you are no Illustrious Greek. If you were you would be half as smart as Antisthenes.. Now your just... eeww, you...

Thank you friend, but now we’re in trouble - multiple triggering that AI fagot abomination. Btw, since we’re at it, you are the single most honest person filled with integrity, I’m aware of in this forum. Couple others are close, but not there yet. The four of you should get a room. meaning: You and exp, billy no coiner and exp's grandma. ~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. Sure, I already understand that there could be angels that relate to taxes, yet capital gains would ONLY apply to purchases and sells that are made in the same year, and surely there could be some other matters that relate to taxes and reporting, but launching a new product prior to the new year rather than after the new year gives more options rather than fewer options, and so would justify wanting to launch earlier rather than later (in order to have more options), yet the SEC may likely be somewhat neutral on the calendar year matter, I would think that investing companies would rather give their customers more options rather than fewer options, even though launching in 2023 could well put some clients at a disadvantage if they were planning to ONLY be ready to transition into an ETF after the beginning of the year, but there ended up being a price run up because the product launched in 2023 rather than in 2024 when they were planning to get in. Yeah, I am writing a lot, and even accounting for some possible tax ramifications of one year versus another, I still don't feel like I have much of any clue why it would be preferable (from Phillip's perspective or from anyone else's except maybe officials merely just wanting to delay as long as feasible) that the Spot ETF product launch in January 2024 as opposed to December 2023. Edit: Maybe this part sort-of answered by Philip in the below post. ~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. yep. an eft dec 10 with a jump to 100k by dec 30 means a sale gets taxed and paid asap. an eft jan 10 with a jump to 100k by jan 30 means a sales gets taxed and paid 18 months later. Somif we get eft in dec we may have a lot of selloffs and fast drops for,jan. while the eft in jan may mean hodl works.an d we don’t drop off like mad. but honey badger don’t care so I guess either one is good. Sure there could be shenanigan's either way, but it all seems a kind of wash. in the whole scheme of things in terms of potential preferability of whether a Spot ETF is launched later rather than sooner, or January 2024 as opposed to December 2023. And yeah, I am presuming a pump on the news of an actual BTC Spot ETF approval, but I am not really sure how much of a pump and/or how it might play out and if that would be creating any major buys and sells within the 2023 calendar year (even if the approval were to occur sometimes in December.. yeah, some of the BIGGER players play those kinds of games, but it may or may not work as expected for some of them, even some of the are BIGGER players). My fear is we do the eft in dec and run up solid. A lot take profits in Jan and we tank solid. The whole bull momentum gets slowed. With mining slower bullruns are better the last year with gradual up tick has been good for me. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 18, 2023, 04:27:03 AM |

|

[edited out]

My fear is we do the eft in dec and run up solid. A lot take profits in Jan and we tank solid. The whole bull momentum gets slowed. With mining slower bullruns are better the last year with gradual up tick has been good for me. From the perspective of preferring bullruns to playout a bit more slowly (if they might end up occurring), then I would see why there would be a preference for January rather than December, so maybe along those same lines, the SEC might prefer to put off some of the exuberance a bit too.., which would also justify January rather than December - even if the puppet master of the SEC (aka blackrock) might be pushing the SEC to have the approval in 2023 rather than 2024.. but you never even know with Blackrock, they might also be o.k with being able to continue to gather up cheap coins for a bit longer (one month-ish).. if they might already have pretty good ideas that approval is going to be taking place, but it is just a matter of it happening in January instead of December. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 05:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 06:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4732

Merit: 4237

Leading Crypto Sports Betting & Casino Platform

|

|

November 18, 2023, 06:38:40 AM |

|

Altcoins are collapsing while Bitcoin is still holding strong. It’s funny once you view alts as ways for people to get their hands on more Bitcoin. Every time it goes up from people hoping to get some quick gains, you can see folks cashing out to get their hands on those sweet sweet BTC. Don’t be a bagholder. Be a Bitcoiner.

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3850

|

|

November 18, 2023, 06:47:35 AM |

|

~snip

What's the difference? mid-December or so, prior to the Christmas Holidays or prior to January 10 and after New Year's.. There seems to be a bit of a crunch in time between new year's and January 10.. but getting it out of the way prior to various holidays might allow for some resolution of the matter.. ..

but then I suppose if they were to wait until after the holidays, then they don't have the holidays getting in the way... but I don't see much of any difference.. unless there is a bit of desire to continue to delay a wee bit.. to make sure that they are not missing anything and prepared once the ETFs go on line.. which could be a bit of a "nothing burger" even though I am anticipating that probably we would end up getting more pump rather than a dump, once they do actually go live.. a pump just seems more likely .. but who knows?

I don't know the US tax code (and from what I understand, nobody does) but up north, capital gains taxes are paid in the year they are realized. There could be advantages to waiting until the new year. yep. an eft dec 10 with a jump to 100k by dec 30 means a sale gets taxed and paid asap. an eft jan 10 with a jump to 100k by jan 30 means a sales gets taxed and paid 18 months later. Somif we get eft in dec we may have a lot of selloffs and fast drops for,jan. while the eft in jan may mean hodl works.an d we don’t drop off like mad. but honey badger don’t care so I guess either one is good. This is not entirely so, in my opinion. You are supposed to pay cap gains (especially when they are large) at the pay date for that quarter in a form of Estimated tax, otherwise if you are paying in 18mo and a LARGE tax is due (more than $1000), you will be hit with penalties (with a special proviso that no penalties are applied if you paid totally in taxes at least the same amount as the year before). Of course, if you are paying in 18 mo and basically square (+/- $1000), then less need for the estimated tax, which I always pay quarterly anyway. So, in my case, if i sell a chunk in December, I would pay estimated tax by Jan 17, and if i sell in January, then the next estimated tax pay date would be April 15, typically (in this case coinciding with the general tax day). I never try to extend 18 mo as i don't have a 18 look ahead to see what I would have to pay then. Paying estimated is easy peasy when you actually got those cap gains. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 07:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

psycodad

Legendary

Offline Offline

Activity: 1604

Merit: 1564

精神分析的爸

|

Has anybody created some sort of animated gif using the latest chart buddy images? It might be funny to use the last 24 images on a rolling basis to give you a feel for how the last day has gone. Or maybe grab 24 images once a day and then be able to show each day’s movement. Seems like something one of you fellas would enjoy creating.

Had the same idea and tried that a few months ago. I downloaded the last 24 CB images and created an animated gif. The result was totally disappointing more like something to trigger epyleptic seizures than show the price development over the last 24 hours. I then concluded that Richy_T must have tried that already and dismissed the idea. Your post provides further evidence to support that DirtyKeyboard's solution came off in a kind of seamless and/or user-friendly kind of a way. * psycodad tips hat Indeed, it looks really good and he got it down to a reasonable size to post to talkimg too. Respect. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 18, 2023, 08:03:22 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll