JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 18, 2023, 03:52:29 AM |

|

When I first got into bitcoin, I was actually buying every week with my set budget and also trying to find dips within the week in order to maximize my BTC buys for each of the weeks within my set budget for each of the weeks, but most people are not that passionate, and they might well be better off by not being passionate, and just exercising "set it and forget it" so after a year or two, they look at their investment rather than watching it every week like I had been doing and maybe many of the active forum members are willing to do... but normies do not necessarily want to be very active in terms of their BTC investment and that is one of the reasons why DCA can be so powerful for normies who do not want to study or watch their investment with any kind of particularity.

Actually this was the same kind of buying strategy or rather method by brother normally use for accumulation of Bitcoin, what he does was that he will have a targeted amount of Bitcoin to be accumulated within a month and with the strategy of watching the market all the time to buy from any little dip he sees so that's the kind of strategy he normally use, according to him he said the method allows him to minimize the amount of money used in accumulating Bitcoin. What I understand from this method is that it has to do with a lot of patient and consistently watching the market in other to have a good entry, so is very stressful method and I can't imagine myself using that strategy but however irrespective of the little advantage it may have but it can never be compared with DCA method, because it allows you to set a target and hit it without considering the price movement. The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

The block chain is the main innovation of Bitcoin. It is the

first distributed timestamping system.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

YUriy1991

Full Member

Offline Offline

Activity: 910

Merit: 218

#SWGT PRE-SALE IS LIVE

|

|

October 18, 2023, 04:35:37 AM |

|

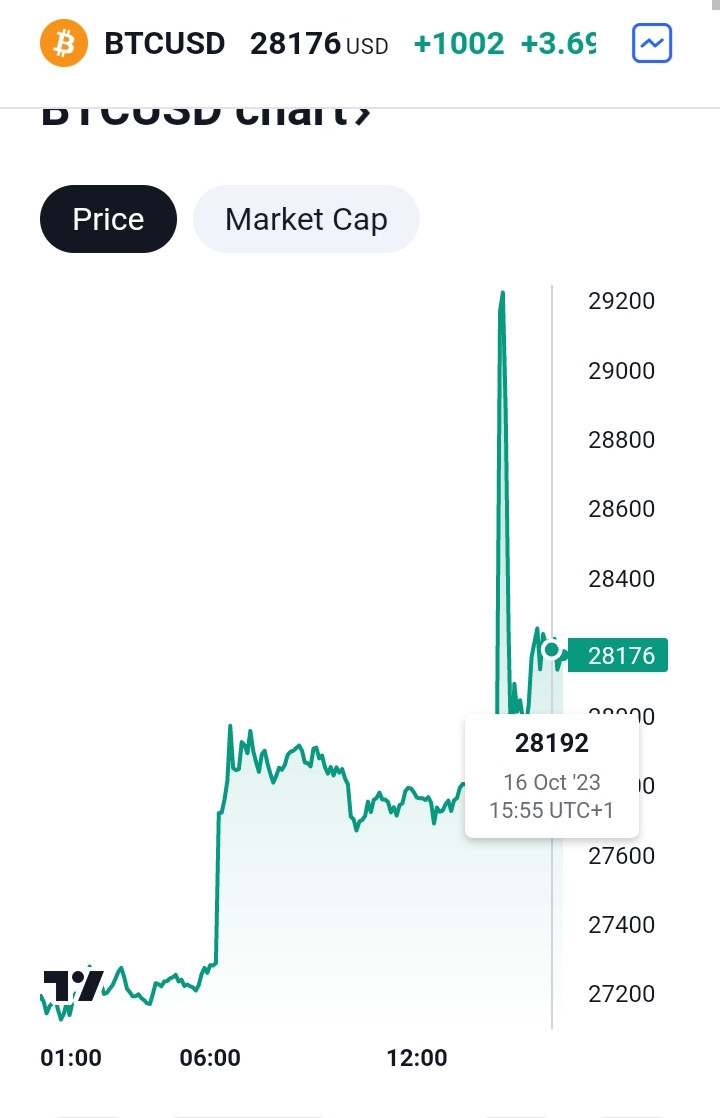

This is one of the reasons why is totally not advise able for investor to consider weather Bitcoin will continue dipping or moving uptrend before they could start accumulating, take a look at how many percentage Bitcoin price has moved within 24 hours, however most persons that missed the opportunity will be regretting to have bought earlier, so let's continue accumulating Bitcoin and smile tomorrow.  Source: https://www.tradingview.com/symbols/BTCUSD/Yes and in my opinion Volatility will likely remain high in the next few days. Even if the delay returns, of course it won't be a disaster for Bitcoin and remember, ETFs don't change Bitcoin at all.  However, it should be noted that Bitcoin prices can experience unexpected price fluctuations in a short time. So, take advantage of this moment, don't be provoked and continue and don't change our original plan to save our BTC. True, but once you get over it (my secret is that I look for the long term goal), it's going to be easy and smooth ride and then after a year or two it will be just like regular, clockwork for you to invest and do DCA without you feeling as if it is being force on you. Of course, there will be weeks that you might not able to buy because of some contraints, but still you can go back and start all over again and continue where you left behind.

It's true that there are many things that make our investment temper sometimes rise and sometimes be held back by something and exactly as you said, just adjust it to our respective financial conditions and start again if we feel it's time to enter the market again because of the DCA method according to my assumptions is a relaxed and unhurried but serious investment technique. |

|

|

|

Makus

Full Member

Offline Offline

Activity: 322

Merit: 215

Bitcoin!!

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. Reason I asked that question I believe there are times where the market just goes sideways without adding or removing any large significant amount to the market for up to a week, and in such cases I don't think your strategy would be able to accumulate for that week. I am a very busy person, not sure if I would be able to adopt the system, but I'll love to make a trial for a month and see how it goes, but my modified strategy would be, if my buy target wasn't meet for the week, at the end of that week I'll just buy irrespective of the price, so I will not be tempted to skip accumulation for that week. |

|

|

|

|

|

DaNNy001

|

|

October 18, 2023, 05:03:04 AM |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. Reason I asked that question I believe there are times where the market just goes sideways without adding or removing any large significant amount to the market for up to a week, and in such cases I don't think your strategy would be able to accumulate for that week. I am a very busy person, not sure if I would be able to adopt the system, but I'll love to make a trial for a month and see how it goes, but my modified strategy would be, if my buy target wasn't meet for the week, at the end of that week I'll just buy irrespective of the price, so I will not be tempted to skip accumulation for that week. I haven't actually tried such method before that requires me to actually watch or set a buy order for the week because I know how volatile the market can be and I think if the investor is not a principled one, you might end up using the actual funds for other stuff that's if the target isn't reach for that week, no offense but I think the DCA method of just having a specific target to reach regardless of how the market moves is more preferable especially if you are someone who is always occupied with other schedule just like you explained but also their is the fact about sacrifices, that's taking out time to watch the market or should say I say study it but I think this can be done through many simple ways too am currently using a price alert notification app on the Bitcoin price and this would be very helpful in terms of following up with this strategy. |

|

|

|

|

Roseline492

|

|

October 18, 2023, 06:31:42 AM Merited by JayJuanGee (1) |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Okay I understand @Jay the method is pretty cool because is substitute to DCA strategy, that if your plans of accumulating some certain amount by buying some dip and however if a dip those not occur within the week you are accumulating, you go back to your normal DCA method. Actually is a cool strategy, I love it, one of the good things about this strategy is that the possibility of accumulating a higher amount of Bitcoin on weekly basis using that method will be higher because just like you said if the current Bitcoin price is $28,500 and we set our order on $27,820, with this it increases the chances of getting a higher amount of Bitcoin using the weekly accumulating budget because considering how volatile the market is there is always a chance of going ups and downs making the method effective and if it doesn't workout DCA is there to back it up, that's a very smart method @Jay. |

|

|

|

|

rachael9385

|

|

October 18, 2023, 06:58:22 AM |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. Reason I asked that question I believe there are times where the market just goes sideways without adding or removing any large significant amount to the market for up to a week, and in such cases I don't think your strategy would be able to accumulate for that week. I am a very busy person, not sure if I would be able to adopt the system, but I'll love to make a trial for a month and see how it goes, but my modified strategy would be, if my buy target wasn't meet for the week, at the end of that week I'll just buy irrespective of the price, so I will not be tempted to skip accumulation for that week. You might be right, but seriously, I don't think that waiting for the dip is a good idea. Why? Because it might be that while you are waiting for Bitcoin to dip, it must have been on peak mode, so it is good that when you have the money you should not hesitate to tap the buy button. If an investor is using the DCA method to accumulate Bitcoin, he/she shouldn't wait for the dip, it is just for the person to take advantage of every little opportunity that Bitcoin has provided. That's all. Sometimes, I do believe that it is only Bitcoin traders that have the time and the whole day to keep on watching the price chart of Bitcoin so that they will know when to buy and when to sell, but for investment, I don't think it's a good idea for an investor to be watching at the price of Bitcoin without buying just because he/she is waiting for the dip. With the help of the DCA method, I believe that 1btc is still 1btc, so if you are waiting for the dip to dip or get dipper, I think you are wasting time. It is just a waste of time. Buying when you have the money is a good one than waiting for the dip. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | | | [ | 1,000x

LEVERAGE | ] | [ | .

COMPETITIVE

FEES | ] | [ | INSTANT

EXECUTION | ] | | | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ | ████████████████████████████████████████████████████████

.

TRADE NOW

.

████████████████████████████████████████████████████████ | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ |

|

|

|

|

SeriouslyGiveaway

|

|

October 18, 2023, 07:46:07 AM Merited by JayJuanGee (1) |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

- The method you're talking about is using small weekly savings to buy Bitcoin. But I'm wondering, what if you have a substantial amount you intend to invest in Crypto, let's say $100,000? How would you use DCA in that case? - For me, my approach is to divide my capital into three parts. Every time Bitcoin corrects more than 20%, I put in one part of the capital. From the beginning of the year until now, I've only executed one of these parts. The other two parts are still waiting for the next correction cycles. |

|

|

|

|

Dr.Bitcoin_Strange

|

|

October 18, 2023, 09:23:08 AM

Last edit: October 18, 2023, 08:12:53 PM by Dr.Bitcoin_Strange Merited by JayJuanGee (1) |

|

But I'm wondering, what if you have a substantial amount you intend to invest in Crypto, let's say $100,000? How would you use DCA in that case?

- For me, my approach is to divide my capital into three parts. Every time Bitcoin corrects more than 20%, I put in one part of the capital. From the beginning of the year until now, I've only executed one of these parts. The other two parts are still waiting for the next correction cycles. If I remember correctly, the price of Bitcoin was $20,250 as of January this year, and to have such a substantial amount of money, I would have just invested in all of it. The reason is that Bitcoin will not go back below $20k this year or even next year. In my opinion, Bitcoin has given people the opportunity to buy when the price was $20k at the beginning of the year and even was below $19k last year, which means no investor will see the $20k price again till probably the next bear market. Having been in the Bitcoin space for some years now, I think there are some low prices I will see Bitcoin drop to, and I might not consider using the DCA at the moment. The reason is because if I buy at the low prices, let's say $15k–$20k, I know that definitely the price will spike again and go above that, which will guarantee me a huge profit. All I have to do is hold my asset tight, sit back, and wait for the bull market. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

Hewlet

|

|

October 18, 2023, 09:29:05 AM |

|

In other words, from time to time we will analyze our position and our assets and we might even start to determine that we can change our strategy because we have accumulated enough BTC... whether that happens in 1-2 years or maybe it takes 15 years to 20 years, this will vary from person to person regarding how long it might take for the person to start to consider that s/he has enough and s/he can transition from accumulation stage to maintenance stage. and sure maybe the transition will not be 100% clear because even if someone is in maintenance stage they still might accumulate BTC from time to time, but not be so concerned about accumulation because overall such person has determined that s/he has gotten enough bitcoin.

Am being inquisitive right now. So your saying that there might be a time when one feels he has accumulated enough bitcoin and would decide to only maintain the Bitcoin he has accumulated. I am aware of people saying that accumulating Bitcoin has been an obsession to them irrespective of the amount of Bitcoin they have they still accumulate as much of it as possible since they have the money to put it in. Assuming someone is obsessed is it something that is wrong or it is good especially in this present time? If only I could Pm so you teach me your ways  |

|

|

|

Kemarit

Legendary

Offline Offline

Activity: 3066

Merit: 1352

|

|

October 18, 2023, 09:49:59 AM |

|

In other words, from time to time we will analyze our position and our assets and we might even start to determine that we can change our strategy because we have accumulated enough BTC... whether that happens in 1-2 years or maybe it takes 15 years to 20 years, this will vary from person to person regarding how long it might take for the person to start to consider that s/he has enough and s/he can transition from accumulation stage to maintenance stage. and sure maybe the transition will not be 100% clear because even if someone is in maintenance stage they still might accumulate BTC from time to time, but not be so concerned about accumulation because overall such person has determined that s/he has gotten enough bitcoin.

Am being inquisitive right now. So your saying that there might be a time when one feels he has accumulated enough bitcoin and would decide to only maintain the Bitcoin he has accumulated. I am aware of people saying that accumulating Bitcoin has been an obsession to them irrespective of the amount of Bitcoin they have they still accumulate as much of it as possible since they have the money to put it in. Assuming someone is obsessed is it something that is wrong or it is good especially in this present time? If only I could Pm so you teach me your ways  Others might have a certain target though, let's say 1 BTC as this is what everyone is aiming to be a member of 1 BTC club. And for starter this is going to be very hard to accomplished, but for those who have been doing it for years, thru DCA and whatever strategy suit them, they could have been saving more than that. If you are interested, you can see it here:  https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html https://bitinfocharts.com/top-100-richest-bitcoin-addresses.htmlSo you can see where you at right now as far as accumulating BTC. And I will agree that it's a never ending quest to acquire it. We might be selling at some point, but for sure you will want to get it back as soon as you can. I wouldn't say it's an obsession though, you still have to look at it as an asset that you will have to make some profits later. |

|

|

|

|

Frankolala

|

|

October 18, 2023, 11:19:31 AM |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. Reason I asked that question I believe there are times where the market just goes sideways without adding or removing any large significant amount to the market for up to a week, and in such cases I don't think your strategy would be able to accumulate for that week. I am a very busy person, not sure if I would be able to adopt the system, but I'll love to make a trial for a month and see how it goes, but my modified strategy would be, if my buy target wasn't meet for the week, at the end of that week I'll just buy irrespective of the price, so I will not be tempted to skip accumulation for that week. You might be right, but seriously, I don't think that waiting for the dip is a good idea. Why? Because it might be that while you are waiting for Bitcoin to dip, it must have been on peak mode, so it is good that when you have the money you should not hesitate to tap the buy button. If an investor is using the DCA method to accumulate Bitcoin, he/she shouldn't wait for the dip, it is just for the person to take advantage of every little opportunity that Bitcoin has provided. That's all. Sometimes, I do believe that it is only Bitcoin traders that have the time and the whole day to keep on watching the price chart of Bitcoin so that they will know when to buy and when to sell, but for investment, I don't think it's a good idea for an investor to be watching at the price of Bitcoin without buying just because he/she is waiting for the dip. With the help of the DCA method, I believe that 1btc is still 1btc, so if you are waiting for the dip to dip or get dipper, I think you are wasting time. It is just a waste of time. Buying when you have the money is a good one than waiting for the dip. You are not getting what JJG said, let me explain to you from what I understand about the strategy that JJG said is similar to DCA. You must not wait for the dip, by sitting down and relaxing. What is said is that since you have set an amount for weekly regular DCA which is $100. You will always buy every week with $100, but if it happens that you are expecting a dip during the week, you can relax and keep on observing the market to see if the dip will come. Just like JJG said that, if you make an order to DCA $100 weekly, and bitcoin price is at $28500, you can wait till the last day of the week before buying. So that if bitcoin price did not dip below $28500 on the last day, you can simple use all your $100 to buy for that week and expect the dip the next week. OR because you feel that the dip will come but still not around,you can limit the $100 DCA to $50 and buy bitcoin on the last day of the week so that you can carry over the balance of $50 to the next week, when the dip might come so that you can now add the $50 left to the new week DCA budget to make it $150. This shows that if the dip comes during the next week, you will buy more bitcoin with $150 than when you would have bought with only $100. On the other hand, because you are using this pattern to accumulate, when the dip comes because you know that, your DCA weekly funds is $100, during the dip, you can take advantage of the market and use like $500 to buy at once. Note that the $500 that you used to buy is not for just five weeks budget, but you are buying with $100 from the week budget which you are on, let me say today for instance is my buying day and I have assigned $100 for this week. I will now take $50 each from 8 weeks ahead which becomes $400 +$100 for this week. I am to DCA with $500 this week because bitcoin price is at dip, and when the price increases again, I can now continue to DCA with the remaining $50 left from the 8 weeks which I took from, for another 8 weeks. It is still like DCA because, you are buying every week but with different amount sometimes, due to planing for the dip and to take advantage of the dip. JJG, I love this strategy but I have never taught of it, the only time that I thought of something like this, was when bitcoin price was 25k+, that I met my boss to me 20% of my salary for three months in advance to enable me buy at that price 25k+, which he did. I am now using half of the money that I am suppose to use for weekly DCA to accumulate now because, I need to keep on accumulating and I have used some part of my DCA funds to buy then when the price was 25k+. This strategy wouldn't be good for beginners who just started because it might be hard to practice, compare to the regular DCA pattern that a specific amount is used always disregard of bitcoin price. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

Ndabagi01

|

|

October 18, 2023, 11:38:50 AM Merited by JayJuanGee (1) |

|

Everyone knows quite well that bitcoin investment or even other cryptocurrencies investment is all about risk, and it's obvious that a risk takers always have an opportunity to accelerate, so bitcoin investment is not investment of dependent or assurance, because it with falling and rising or fluctuating, so whosoever investment in bitcoin need to know the advantages and the disadvantages of bitcoin because of the price rotation which is never be constant or been in one particular price since the existence of bitcoin, A risk is what is involved in bitcoin investment and that's while it's acknowledging to invest in bitcoin with a spare money

Understanding what the bitcoin market is all about is one of the most important things to know about bitcoin before diving in. When comparing cryptocurrencies, bitcoin is always distinguished from the rest, and the rest are referred to as altcoins due to the consensus on which bitcoin differs significantly. They both have pros and cons, but when comparing them, if one does not want to be greedy or hungry to make it big quickly by taking an irreversible risk, one should choose bitcoin. As a first-time cryptocurrency investor, you don't need to be told that bitcoin will be the first cryptocurrency you'll be introduced to, even if the person specialises in other cryptocurrencies. Before learning about bitcoin, I felt cryptocurrency and bitcoin were two separate things due to the wave it has already created in my place, which other altcoins are not renowned for. If you're looking for a low-risk investment with a guaranteed profit over a certain period of time and resistance to market volatility, bitcoin is the way to go. If you're coming in for any other purpose than the aforementioned, bitcoin will not get you there quickly, and altcoin will cause you to lose your money and your belief in cryptocurrencies. This is one of the reasons why is totally not advise able for investor to consider weather Bitcoin will continue dipping or moving uptrend before they could start accumulating, take a look at how many percentage Bitcoin price has moved within 24 hours, however most persons that missed the opportunity will be regretting to have bought earlier, so let's continue accumulating Bitcoin and smile tomorrow.

The news that caused bitcoin's price to rise in such a short amount of time is a solid indicator of how bitcoin will move in the market when the bullish season approaches. This is a strong indication that one should not put off accumulating bitcoin. There is never a better moment than now, and it is never too late to begin investing in bitcoin. Don't try to miss out while remembering that you'll just invest what you won't need for daily requirements for the time being. With patience and market knowledge, a long-term reward in bitcoin is certain. |

|

|

|

stadus

Legendary

Offline Offline

Activity: 3080

Merit: 1292

Hhampuz for Campaign management

|

|

October 18, 2023, 12:13:51 PM Merited by JayJuanGee (1) |

|

That's a good start when you aren't comfortable enough in life. I think $10 a week is very affordable. Consider it a long-term investment, maybe over 20 years if possible, as you never know how much it will grow during that time. We do spend on our personal wants, so I believe we can minimize expenses and redirect that money into investing in Bitcoin.

Starting with $10 per week does not mean you must remain at that level for 20 years. That is an anomaly as we all aspire to grow in finances. Besides, it is at the current price of Bitcoin, $10 per week will really require so much time to realize a life-changing portfolio as I do not see Bitcoin doing X1000 easily. Therefore, to start with $10 per week requires that plans should also be in place to increase the inflow so that it will become easier to get 1 BTC which I consider something reason to hold for the future. Due to market inflation and various economic factors that might change in the long run, I guess it's good to have an interest in long-term investment. Some people quickly dismiss investing in Bitcoin because they want to own 1 BTC right away, but when they realize the price of Bitcoin is not cheap, they change their minds. So, this weekly commitment to investing in Bitcoin is better than doing nothing at all. Many of us likely realize that bitcoin can be bought in quite small units, so even if so many normies are prone to a similar error in terms of thinking that either they need to get a whole bitcoin, or that it is not worth it to invest into bitcoin, that still does not mean that they are thinking in any kind of informed way that might not be resolved after inveting further into bitcoin. Yes, I believe that I thought something similarly in terms of some of the impracticalities of buying smaller items with bitcoin, but after a bit of study (investigation) into bitcoin, many of us will come to realize how dumb we were (even if we might consider ourselves to be otherwise smart people) to be getting caught up on the unit bias trap. Surely sometimes we do need to be talking about satoshis too.. but surely many people do have difficulties with these kinds of ideas of 8 digits to the right of the decimal place.. and the fact that fractions can have (and do have) value.. including a lot of value.... who would not like to receive a free gift of 0.00901043 BTC? That does not look like a very big number, and if you don't realize that it has value of right around $256 (as I type this post), then yeah you may well end up refusing the gift, but that still should not mean that those of us who are more informed about the topic should not be pointing out their dumbness in that direction. So it can be frustrating.. but a common error to fail to appreciate the value of 901,043 satoshis as being equivalent to $256... merely because it is expressed as what seems to be a relatively small fraction of a bitcoin. The issue with some folks is their lack of patience; they want immediate profits in a short time. However, we all know that Bitcoin doesn't guarantee that, given its unpredictability. We could endure a bear market for three years or even longer before the next bull run. Without patience, this approach might not work for these kinds of investors. Additionally, there are those who seek fixed monthly returns. Instead of investing in Bitcoin, they opt for something like a Ponzi scheme because it promises consistent returns, ultimately falling victim to a scam. In the end, they blame Bitcoin for being a fraudulent investment. It's quite unfortunate that some people fail to grasp what they're getting into. Based on my calculations, if you stick with $20 a week, you would end up investing $20,857 in 20 years. However, the value you'll be holding at that time is likely to be higher than that. So, if you were to get a 10x return on your initial investment, that's $200,000, which I think is a good outcome compared to not having that money at all.

Yeah, but that is not the right way to look at the matter, especially since if you are investing $20 per week for 20 years, you are also buying at whatever the cost was.. so you may well have ended up getting 10x in returns, but it is not like you were able to buy all of those BTC at the lower of the prices, so maybe your early injections of $20 per week get around 100x or more and your latest investments ONLY are at break even prices and maybe you are even losing on some of the latest, but if they all average out to be 10x, then you have to figure how much you put in and how much it is worth. which surely in bitcoin it should not be unrealistic to expect that it will go up and that your earliest of investments will have greater appreciation.. but at the same time the dollar is almost inevitably to go down in value too.. at the same time, when we make our hypotheticals we can build in assumptions about our calculations being based on dollar values of today, which likely would result in the amount of bitcoin value to go up higher than the previous calculated amount in order to have the same expected returns in terms of the 2023 dollar values. Playing around with figures can be pretty tough. I think my calculations might be a bit unrealistic. So, why not consider allocating a fixed percentage of your income, be it from your job or business? Let's say you set aside 5% of your income for Bitcoin investment, and you don't touch it until you're satisfied with its value. I'm talking about a long-term investment, maybe 20 years or even more. Who knows, it might eventually pay off, and you could end up with a substantial Bitcoin fortune that you can pass on to your family. Life is full of uncertainties, so it's wise to prepare for the future. In case our economy takes a plunge, having Bitcoin in your portfolio can be a hedge since it's not tied to any one country's economy. It's likely to survive and its value should keep rising as long as demand continues to grow. The $20 was just a sample amount, though. You can always go higher, take on more risk, perhaps invest $100 per week or more. Since we can make our own calculations and predictions, our target should be something that we find fulfilling.

Frequently we should be attempting to make adjustments in order that we are trying to be as aggressive in our bitcoin investment as we are feeling that we are ready, willing and able to accomplish.. without going overboard and causing ourselves to get reckt. Some people earn more money as the years go on based on the depreciation of the dollar, but others make more money because their skills and promotions pay off, so they might start out working minimum wage, but then when they are 20 years or more into their career, they might be making several multiples higher than minimum wage or they might have even stepped up to making very high wages relative to minimum wage (20x to 100x higher than minimum wage), so there surely may be reasons that the person can increase his/her investment into bitcoin, especially if the person does not necessarily increase consumption proportionate to the increased wage so the increases in wage would end up resulting in more investments based on attempts to live a more modest lifestyle and way below his/her means. There can be hopes that any investments that are made are able to appreciate more rapidly and higher than normal inflation and normal debasement of the currency, and frequently there are differences in the price rises of different kinds of goods, services and assets, so sometimes investment assets will go up a different rate from consumption goods..so then there can be dilemmas regarding where to put value and questions about whether certain goods are services can be deferred or lessened rather than consumed at earlier dates. As I mentioned in my earlier reply, I believe it would be wise to base this on monthly income. I think a 5% allocation is reasonable. As your income increases, you can also increase the amount of your investment. It's important to ensure that, as long as we're living without financial problems, we allocate for our future. This isn't just for us but also for the people we care about. In the future, we can't predict what might happen in the world, and with ongoing conflicts in some countries, it's a reminder that peace and order can't be maintained all the time. We've seen the economic impact of war. If we rely solely on fiat currency for our savings, we could end up like other countries that have experienced hyperinflation. Given these potential problems, Bitcoin can serve as a hedge because it's unlikely to depreciate as drastically as fiat. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

Odohu

|

|

October 18, 2023, 01:04:11 PM Merited by JayJuanGee (1) |

|

Actually this was the same kind of buying strategy or rather method by brother normally use for accumulation of Bitcoin, what he does was that he will have a targeted amount of Bitcoin to be accumulated within a month and with the strategy of watching the market all the time to buy from any little dip he sees so that's the kind of strategy he normally use, according to him he said the method allows him to minimize the amount of money used in accumulating Bitcoin.

It will really work, you can have to find the grind to do it every week or even every month. But for those who doesn't have that patience, they might as well implore the strategy of buying in just one lump sum, and just leave it in their wallet, forget about it and just comeback when we are in the bull run. Buying at once seems more favorable for those who have bulk capital and have already made up their mind to invest same in Bitcoin. They don't see any need keeping those funds or employing DCA since the fund is readily available. This is not a bad strategy provided the intentions are to hold for long to be able to realize profits. Unlike this method, the DCA seems to be more of a continuous process that is suitable for those with a predictable cash flow system of which certain part will be set aside to invest in Bitcoin. Both approaches or a combination of both is not bad because the target is to build a Bitcoin portfolio that will be preserved for the future. So it really depends on each individual. But relatively, I will also used the DCA method, I mean I have been using ever since and it has work perfectly, at least in my case and most likely those old timers here

I am also using the DCA method as well and I can say I have not seen anything like it before. It is easy and convenient to apply, enabling me build a portfolio I never thought I could have because there is no way I can save such amount of money at once. What I understand from this method is that it has to do with a lot of patient and consistently watching the market in other to have a good entry, so is very stressful method and I can't imagine myself using that strategy but however irrespective of the little advantage it may have but it can never be compared with DCA method, because it allows you to set a target and hit it without considering the price movement.

True, but once you get over it (my secret is that I look for the long term goal), it's going to be easy and smooth ride and then after a year or two it will be just like regular, clockwork for you to invest and do DCA without you feeling as if it is being force on you. Of course, there will be weeks that you might not able to buy because of some contraints, but still you can go back and start all over again and continue where you left behind. For weeks you could not buy due to constraints like traveling or work, you can use the following week to cover that by buying twice the size since the funds for the DCA has already been budgeted. You don't have to start all over again because of a little constraint. This is what I think unless there another way to it. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

Agbamoni

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. Reason I asked that question I believe there are times where the market just goes sideways without adding or removing any large significant amount to the market for up to a week, and in such cases I don't think your strategy would be able to accumulate for that week. I am a very busy person, not sure if I would be able to adopt the system, but I'll love to make a trial for a month and see how it goes, but my modified strategy would be, if my buy target wasn't meet for the week, at the end of that week I'll just buy irrespective of the price, so I will not be tempted to skip accumulation for that week. You might be right, but seriously, I don't think that waiting for the dip is a good idea. Why? Because it might be that while you are waiting for Bitcoin to dip, it must have been on peak mode, so it is good that when you have the money you should not hesitate to tap the buy button. If an investor is using the DCA method to accumulate Bitcoin, he/she shouldn't wait for the dip, it is just for the person to take advantage of every little opportunity that Bitcoin has provided. That's all. Sometimes, I do believe that it is only Bitcoin traders that have the time and the whole day to keep on watching the price chart of Bitcoin so that they will know when to buy and when to sell, but for investment, I don't think it's a good idea for an investor to be watching at the price of Bitcoin without buying just because he/she is waiting for the dip. With the help of the DCA method, I believe that 1btc is still 1btc, so if you are waiting for the dip to dip or get dipper, I think you are wasting time. It is just a waste of time. Buying when you have the money is a good one than waiting for the dip. You are not getting what JJG said, let me explain to you from what I understand about the strategy that JJG said is similar to DCA. You must not wait for the dip, by sitting down and relaxing. What is said is that since you have set an amount for weekly regular DCA which is $100. You will always buy every week with $100, but if it happens that you are expecting a dip during the week, you can relax and keep on observing the market to see if the dip will come. Just like JJG said that, if you make an order to DCA $100 weekly, and bitcoin price is at $28500, you can wait till the last day of the week before buying. So that if bitcoin price did not dip below $28500 on the last day, you can simple use all your $100 to buy for that week and expect the dip the next week. OR because you feel that the dip will come but still not around,you can limit the $100 DCA to $50 and buy bitcoin on the last day of the week so that you can carry over the balance of $50 to the next week, when the dip might come so that you can now add the $50 left to the new week DCA budget to make it $150. This shows that if the dip comes during the next week, you will buy more bitcoin with $150 than when you would have bought with only $100. On the other hand, because you are using this pattern to accumulate, when the dip comes because you know that, your DCA weekly funds is $100, during the dip, you can take advantage of the market and use like $500 to buy at once. Note that the $500 that you used to buy is not for just five weeks budget, but you are buying with $100 from the week budget which you are on, let me say today for instance is my buying day and I have assigned $100 for this week. I will now take $50 each from 8 weeks ahead which becomes $400 +$100 for this week. I am to DCA with $500 this week because bitcoin price is at dip, and when the price increases again, I can now continue to DCA with the remaining $50 left from the 8 weeks which I took from, for another 8 weeks. It is still like DCA because, you are buying every week but with different amount sometimes, due to planing for the dip and to take advantage of the dip. JJG, I love this strategy but I have never taught of it, the only time that I thought of something like this, was when bitcoin price was 25k+, that I met my boss to me 20% of my salary for three months in advance to enable me buy at that price 25k+, which he did. I am now using half of the money that I am suppose to use for weekly DCA to accumulate now because, I need to keep on accumulating and I have used some part of my DCA funds to buy then when the price was 25k+. This strategy wouldn't be good for beginners who just started because it might be hard to practice, compare to the regular DCA pattern that a specific amount is used always disregard of bitcoin price. You've done a great job explaining things further to rachael9385 for better clarity. However, there's something I don't quite agree with in your explanation. If my weekly budget for Dollar-Cost Averaging (DCA) is $100, and I anticipate a price dip during the week, it's acceptable to wait until the week's end to make my purchase. But if, as a result of the expected dip, I decide to invest $500 instead of my usual $100, which you calculated to take only $50 per week for 10 weeks. It seems like a way different strategy to me. What's the point of DCA or the suggested strategy JJG talked about when you're putting all your funds in at once? The concern is that the price might dip even more than anticipated over time, and even though you're still buying at a lower price, you'll end up with less Bitcoin. In hindsight, you might wish you hadn't gone all-in on the market. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

|

adultcrypto

|

|

October 18, 2023, 02:40:23 PM Merited by JayJuanGee (1) |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Ohh, now I see your point, the strategy you employed is actually DCA, the only difference is the fact that you wait for the dip before accumulating more, its not a bad one but its time consuming as it requires constant watching of the market, so assuming your targeted price is not meet for the week, do you add the amount to that of next week or you'll abandon that weeks accumulation?. What he meant was that the strategy is similar to DCA not that it is exactly the same thing as DCA. DCA does not really wait for the dips because it is applied irrespective of the price or market condition. The target is to always buy at regular interval. Data presented in the forum by various people who have applied DCA in the past and still applying now shows that even when they put in the same amount of dollars to buy, the quantity of Bitcoin varies because of the price difference. If I remember correctly, the discussion in this thread actually differentiated between buying in the dips and applying DCA. Both have their pros and cons and serve different purposes. - The method you're talking about is using small weekly savings to buy Bitcoin. But I'm wondering, what if you have a substantial amount you intend to invest in Crypto, let's say $100,000? How would you use DCA in that case?

- For me, my approach is to divide my capital into three parts. Every time Bitcoin corrects more than 20%, I put in one part of the capital. From the beginning of the year until now, I've only executed one of these parts. The other two parts are still waiting for the next correction cycles.

If you have the time and discipline to follow this like you planned, I don't see nothing wrong with it. But for me, instead of dividing into three parts, I would have done it in such a way that a lot of those funds would have already entered the market before we get to the end of the year because it is possible that price might leave you behind since we have several good news coming. This year presented us several opportunities to buy and very cheap price so waiting further seems like a sign of doubt or fear and if price goes higher than it is now, you might miss the opportunity to buy low. |

|

|

|

|

Litzki1990

|

|

October 18, 2023, 02:44:34 PM Merited by JayJuanGee (1) |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Those who say they don't have enough money to invest for the long term should do so. We always make short term calculations. If we have the opportunity to invest 50 dollars or more in bitcoin every month, then in the initial stage we will get an idea of what will happen by investing only 50 dollars every month, but if this calculation is made for a long time, then the total amount of the account will increase a lot. We should think twice about every matter one short term and one long term and always give priority to long term calculations. If $50 is invested every month, a person's investment will be $600 at the end of the year. And if that person thinks that he will invest $50 every month regularly for four years then his total investment after four years will be $2400. After four years only his capital will be $2400 and in these four years the market will change a lot and that change will be a positive change but even after the capital of $2400 that investor will get more money as his profit. The amount of money that is invested for a long period of time I think that amount of money works as savings because if not invested the person would have spent 50 dollars more every month. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

|

Moreno233

|

|

October 18, 2023, 03:11:29 PM |

|

The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week.

Those who say they don't have enough money to invest for the long term should do so. We always make short term calculations. If we have the opportunity to invest 50 dollars or more in bitcoin every month, then in the initial stage we will get an idea of what will happen by investing only 50 dollars every month, but if this calculation is made for a long time, then the total amount of the account will increase a lot. We should think twice about every matter one short term and one long term and always give priority to long term calculations. If $50 is invested every month, a person's investment will be $600 at the end of the year. And if that person thinks that he will invest $50 every month regularly for four years then his total investment after four years will be $2400. After four years only his capital will be $2400 and in these four years the market will change a lot and that change will be a positive change but even after the capital of $2400 that investor will get more money as his profit. You really made some good points about this matter. It is clear now that investment is the best option for people who do not want to continue working even in old age. Bitcoin is a good option to considering for investment and small amount of money invested in it over a long period of time can really grow well. I will apply the DCA method with a part of my earning so that I can plan for my retirement from now because as we get older it becomes more difficult to do some of the work we do now. To avoid regrets, we should all take advantage of the DCA method to buy Bitcoin and hold for the time coming. I believe that Bitcoin will increase more in the future and the value is not going to be diminished. The amount of money that is invested for a long period of time I think that amount of money works as savings because if not invested the person would have spent 50 dollars more every month.

This is one good thing I love about the DCA method - it makes you save money for the future little by little and those savings can save you in the future. You save the money today, the money save you in the future. The DCA method makes this possible for even small cash earners to build something magnificent for the future. This wisdom developed by the creators of the DCA method is a life changer that people can use to bridge the poverty gap across the world. |

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

October 18, 2023, 03:28:56 PM Merited by JayJuanGee (1) |

|

When I first got into bitcoin, I was actually buying every week with my set budget and also trying to find dips within the week in order to maximize my BTC buys for each of the weeks within my set budget for each of the weeks, but most people are not that passionate, and they might well be better off by not being passionate, and just exercising "set it and forget it" so after a year or two, they look at their investment rather than watching it every week like I had been doing and maybe many of the active forum members are willing to do... but normies do not necessarily want to be very active in terms of their BTC investment and that is one of the reasons why DCA can be so powerful for normies who do not want to study or watch their investment with any kind of particularity.

Actually this was the same kind of buying strategy or rather method by brother normally use for accumulation of Bitcoin, what he does was that he will have a targeted amount of Bitcoin to be accumulated within a month and with the strategy of watching the market all the time to buy from any little dip he sees so that's the kind of strategy he normally use, according to him he said the method allows him to minimize the amount of money used in accumulating Bitcoin. What I understand from this method is that it has to do with a lot of patient and consistently watching the market in other to have a good entry, so is very stressful method and I can't imagine myself using that strategy but however irrespective of the little advantage it may have but it can never be compared with DCA method, because it allows you to set a target and hit it without considering the price movement. The strategy that I am describing is pretty damned close to DCA, especially since I was doing it on a weekly basis. Let's say, for example, I had a budget to buy bitcoin of $100 per week, and it was for 26 weeks (which would be $2,600 for 6 months). And if the beginning of the week is Monday and the end of the week is Sunday, maybe I might identify a couple of the dips through the week or maybe I would be waiting for dips that did not end up happening, so by the end of the week (Sunday) I would use either the whole $100 or whatever parts were left to buy at that time.. of course, the beginning of the week could be chosen as any day. and each week there was a new $100 authorized, and let's say that I felt that I did not have time to watch the market, so maybe I would just buy or maybe the price opens at $28,500, and I would set my buy order at $27,820, and if the order did not fill by Saturday, then I would just market buy or maybe set the buy order within $50 of the current price so that I have more confidence that it is going to fill before the end of the week. This is what I do for dip buying, however i modified the timeframe to monthly. If at the end of the month none of the limit buys have filled I buy at market. I sometimes get lump sums during the year, so when market conditions hit certain situations I'm employ the dips buys. You could also call them dca buys since if they don't fill in the month they become DCA# at market buy. I used to use the number of posts in this thread as one market metric, but its turned into a dca debate so I don't any more. Going into my data, I seem to accumulate more through DCA than I do in buying the dip though. I will continue with this strategy for another year, I'm interested in seeing some data for a halving year if this makes much difference or not. I'm still not 100% on whether BTFD & dca as hybrid is right way to accumulate or whether I should be more puritan and pick one over the other e.g DCA only but increase dca amounts with lump. Either way keep stacking :-) |

|

|

|

|

|

pusaka

|

|

October 18, 2023, 04:19:04 PM Merited by JayJuanGee (1) |

|

- The method you're talking about is using small weekly savings to buy Bitcoin. But I'm wondering, what if you have a substantial amount you intend to invest in Crypto, let's say $100,000? How would you use DCA in that case?

Although this question is not directed at me, I am interested in answering this question, especially since I also do the DCA strategy that I do every week. Before getting into the first question, I will say that in this strategy we need consistency and I think that also includes the amount of money we allocate each week, although I prefer to be more flexible, I mean when we have more money why don't we allocate the extra money? (provided that the money is really money that is not intended for other things. If I have the money you mentioned, let's say $100k. That money is enough to buy approximately 3.5 bitcoins if converted at the current price. I have plans to buy at 3, 4 or 5 purchases, and it is situational. I will buy now with the amount of 1 bitcoin, I have a plan like this because I still see bitcoin still has the potential to go back down. And if the price goes back down I will buy another 1 or even more bitcoins. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|