|

Lida93

|

|

November 24, 2023, 09:50:12 PM |

|

At a certain point, there may be a need for an investor to delve into something that is certain to provide a faster return, perhaps in a short period of time.

Why? Isn't bitcoin potentially volatile enough? What more "faster return" is necessary, and at what point would a person "need" to engage in such extra risk taking, when bitcoin is already risky? No doubt bitcoin is potentially volatile with its own peculiar risk and returns but investing (diversifying) in other different projects that's not cryptocurrency is another form of expansion that returns made from there can be utilize into accumulating and increasing your bitcoin portfolio, in my opinion a good diversification can be a supportive ground for a bitcoin investor not to tamper with his bitcoin investment at any financial emergency storm that might hit. If the money is there enough to diversify the risk factor shouldn't be an excuse not to diversify. None diversification of businesses is like driving a car on along journey without having a spare tire with you for flat tire emergency along the long. Be careful in mixing your metaphors too much. One of the advantages of bitcoin remains position size, and if you go into a business, you usually will have a lot of upfront costs and time investments too. With bitcoin you can adjust the the amount that you buy regularly, and you can also make sure that you have a sufficient extra cashflow for both income replacement and also emergencies.. ..so the mere fact that you don't diversify further is not the same as driving without a spare tire because hopefully you have already figured out your various amounts, and as you continue to build your bitcoin, there may be points in which diversification is starting to make sense, especially if you might start to have a couple of years of income within your cash reserves and your BTC investment.. but how you go about adding other ways of diversifying can be quite varied in how people might do it, whether they continue to buy BTC and then add other things that they are buying or if they slow down on their BTC buying or if they stop it completely... alright JJG, I get the sharp end of your point now. And about the metaphors I'll think of something about that.  but it might be possible to make lump sum investments in some other assets, whether it is stock or property or something else (should not be shitcoins unless it is limited to small amounts such as less than 10%) so that your total value is not just in bitcoin and cash.

There's a question I'll like you to lend your thoughts, something about cryptocurrency diversification and since you have raised the discuss I feel I use this opportunity to ask you for a clarification about it to get your thoughts. Ii read a comment sometime this year that says investing in bitcoin and other altcoins isn't diversification, as in investing in different cryptocurrencies shouldn't be termed as diversification since they are all cryptocurrencies, that an actual diversification of Investment should be in different lines of businesses, example bitcoin and real estate. JJG, what do you think? |

|

|

|

|

|

|

|

|

Transactions must be included in a block to be properly completed. When you send a transaction, it is broadcast to miners. Miners can then optionally include it in their next blocks. Miners will be more inclined to include your transaction if it has a higher transaction fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

Ever-young

Full Member

Offline Offline

Activity: 1176

Merit: 160

★Bitvest.io★ Play Plinko or Invest!

|

|

November 24, 2023, 10:45:13 PM |

|

If an investor could eradicate greed and be more discipline in times of investment it will do them more good than harm because I realized that the reason why most people aggressively invest on Bitcoin is because they feel that it will make them have a more higher returns than slowly investing without knowing that is better to invest slowly and consistently to reach your goal than aggressively investing and being cut up by unforseen challenges.

Sometimes greed and risk is all we need in other to get that good profit that we desire, and I see no wrong for someone to buy and hold bitcoin as much as they could when they have the money, if you can afford it their is no point in stopping your self from buying and holding as many bitcoin as you can afford, so those investors who have enough money to pump into bitcoin is not to be consider being greedy but they are just taking the right step preparing their self for what’s to come in the next bull run or how ever long it might take for the price to hit their desire target. And then again, their is not like “it’s as if the money they spend the more profit they make” the truth is, the money you can be able to accumulate the higher profit that you will be expecting when the price of bitcoin will go up those who hold less can not be compared with those who hold larger amount, the profit percentage might be the same depending on the entry price and time of selling but the high you hold the hirer the profit, the only time I can be against anyone buying more bitcoin is if they can’t afford the money they pump in it but they either use others funds or borrow just to accumulate, if they can afford it then they are free to buy as many as they went. |

|

|

|

|

Roseline492

|

|

November 25, 2023, 12:35:57 AM |

|

At a certain point, there may be a need for an investor to delve into something that is certain to provide a faster return, perhaps in a short period of time.

Why? Isn't bitcoin potentially volatile enough? What more "faster return" is necessary, and at what point would a person "need" to engage in such extra risk taking, when bitcoin is already risky? No doubt bitcoin is potentially volatile with its own peculiar risk and returns but investing (diversifying) in other different projects that's not cryptocurrency is another form of expansion that returns made from there can be utilize into accumulating and increasing your bitcoin portfolio, in my opinion a good diversification can be a supportive ground for a bitcoin investor not to tamper with his bitcoin investment at any financial emergency storm that might hit. If the money is there enough to diversify the risk factor shouldn't be an excuse not to diversify. None diversification of businesses is like driving a car on along journey without having a spare tire with you for flat tire emergency along the long. Be careful in mixing your metaphors too much. One of the advantages of bitcoin remains position size, and if you go into a business, you usually will have a lot of upfront costs and time investments too. With bitcoin you can adjust the the amount that you buy regularly, and you can also make sure that you have a sufficient extra cashflow for both income replacement and also emergencies.. ..so the mere fact that you don't diversify further is not the same as driving without a spare tire because hopefully you have already figured out your various amounts, and as you continue to build your bitcoin, there may be points in which diversification is starting to make sense, especially if you might start to have a couple of years of income within your cash reserves and your BTC investment.. but how you go about adding other ways of diversifying can be quite varied in how people might do it, whether they continue to buy BTC and then add other things that they are buying or if they slow down on their BTC buying or if they stop it completely... alright JJG, I get the sharp end of your point now. And about the metaphors I'll think of something about that.  but it might be possible to make lump sum investments in some other assets, whether it is stock or property or something else (should not be shitcoins unless it is limited to small amounts such as less than 10%) so that your total value is not just in bitcoin and cash.

There's a question I'll like you to lend your thoughts, something about cryptocurrency diversification and since you have raised the discuss I feel I use this opportunity to ask you for a clarification about it to get your thoughts. Ii read a comment sometime this year that says investing in bitcoin and other altcoins isn't diversification, as in investing in different cryptocurrencies shouldn't be termed as diversification since they are all cryptocurrencies, that an actual diversification of Investment should be in different lines of businesses, example bitcoin and real estate. JJG, what do you think? Yeah actually let me try if I can answer your question, so however first you need to understand the word diversification it means expanding or enlarging your investment to some other things, but however chosen altcoins to invest could also be known as diversification because irrespective of there general name which is crytocurrency but they have different sub names, but however I would not advised you to invest on altcoins as a diversification because they are not worth it. If you are looking for were to diversify some of your investment, altcoins shouldn't be an option or perhaps you could just stick to only on Bitcoin. |

|

|

|

FinePoine0

Full Member

Offline Offline

Activity: 392

Merit: 122

★Bitvest.io★ Play Plinko or Invest!

|

|

November 25, 2023, 12:56:32 AM |

|

As the bullrun is getting closer we shouldn't be taken aback seeing some altcoins doing better all in disguise only to carpet flat after many would have innocent invested their money. I bet that many of the altcoins prices won't be rising along with bitcoin when the bullrun eventually kick start, they rather be doing the opposite. I rather be doing my little DCA holding strategy with bitcoin with the little % from my monthly income while waiting for the bullrun, it better to partake in it with the little you can than sitting on the fence.

That's very certain that many altcoins won't roll along with bitcoin in price during the bull run. Some would have lost their value during the bearish market and the ones that survived it to the bull run won't increase as much when compared with bitcoin. Every investor in bitcoin can be confident that, before the bull run ends, they will make some profits from their bitcoin investment. Bitcoin is always the best, because those who are modern today are ready to use Bitcoin. Bitcoin is the only long-term investment possible, but other Altcoins are not. Because I have seen thousands of Altcoins still disappearing from the market. So for long-term investment, definitely support Bitcoin. As for altcoins, you are unsure which one will provide you with the desired profits because of how unpredictable the crypto market can be. But if you love to take risks on altcoins, diversify your investment in top coins.

You can never survive investing with Altcoins. Altcoins are not long-term holdings because the altcoin market is always bearish. Investing in Altcoins always has a high chance of losing 100% of your wealth. Among them are coins like FTX, Luna and many others that have completely disappeared from the market. And the wealth of thousands of people has turned into zero balance. So it is better to stay away from Altcoin investment. |

|

|

|

|

Litzki1990

|

Yes, that's true JJG sometimes they have bigger obstacles in their investment journey, whether it's selling too early or delaying buying. Sometimes I wonder why those who bought at high prices sell their Bitcoin holdings at low prices. Yes, we know that many of us buy dips and hope that big profits will come our way, but this is only possible for people who are patient and ready to go through many obstacles in their investments.

Yes, it happened to me that I made a fatal mistake in the previous years because I sold Bitcoin to gamble and that would be a valuable lesson to improve so as not to fall into the same hole. Revolution in adapting a new plan and experience is one of the keys to improving the situation for the future. Bitcoin has brought changes to those who are on the right path to becoming millionaires in the current era. For this reason, the journey of people who got to know Bitcoin earlier might be quite interesting to read about their history.

All other coins in the market are dependent on Bitcoin and Bitcoin is able to hold its value well in both market conditions. It is clear that Bitcoin price changes have a great impact on all other coins in the market. When the value of Bitcoin increases, the value of all other coins in the market increases, and when the value of Bitcoin decreases, the value of all other coins in the market decreases. If a new member is asked to distinguish between Bitcoin and ALT Coin, that new member will distinguish between the two and put Bitcoin ahead and trust Bitcoin. There is nothing to compare Bitcoin with ALT Coin for long term investment. Those who have held Bitcoin for a long time in the past will not have to think twice about which coins to buy when they plan to hold again in the future. There is no need to analyze the Bitcoin market to hold your investment deeply because temporary changes in the market have no effect on long-term investment. Since investments are made with the intention of deep holding, the expectations of a long-term investor are very high. I think we don't need to think about which coins we will hold deeply in long term plan but we should plan how deeply we will hold our investment. By keeping bitcoin in plan we must hold investment for long term and if we can hold bitcoin in long term plan then this long term hold can be turning point in our life. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

[edited out]

Yes, that's true JJG sometimes they have bigger obstacles in their investment journey, whether it's selling too early or delaying buying. There are a lot of mistakes that normal people can make, without even realizing that they are falling into a pattern, and there can be a tendency to invest money that you need down the road, and you don't really realize that you have not shored up your cashflow. Sometimes I wonder why those who bought at high prices sell their Bitcoin holdings at low prices.

It is hard to always know what happened, but frequently if someone invests too much then they are expecting the price to go down and not prepared for it to go down, and surely there can be advantages to the BTC price going down, even if you had preferred for the price to go up, which is buying more when it goes down. So it can take a long time to actually get ahead of your investment in order that the price is always coming to you rather than you going to the price, so if you just continue to buy in a DCA kind of way, that can be one way of getting ahead of the BTC price, even if it might take 2-3 years to actually get to a point that your cost per BTC is actually less than the current price. It is not guaranteed to happen, but so far anyone who persistently buys BTC, has been ending up getting into profits, even though sometimes it could take 2-3 years before the "being in profits" stage can actually end up happening. A person who panics, and does not continue to buy but then sells and buys will likely NOT really get to any kind of stage in which his./her holdings is in front of the price.. and it seems such a simple strategy to merely just continue to buy (sure buying on the dip is fine, but buying at any price might well end up being fine in order to keep a person in the right kind of mindset of continuing to build the number of BTC that s/he has in his/her holdings and keeping some faith that that BTC is going to be profitable in the future.. even though it is not guaranteed, it has been a pretty good place to put money and likely to continue to be a good place to put money. Yes, we know that many of us buy dips and hope that big profits will come our way, but this is only possible for people who are patient and ready to go through many obstacles in their investments.

One or two years can feel like a real long time when the BTC price is moving against you and you might even be feeling potentially wrong about your choice to get involved in bitcoin..and surely whether you keep buying can be a kind of test, even if you might get worried that you are running out of money, maybe you have to buy smaller amounts just to keep some cash in reserves in case the BTC price drops further (from its already having had dropped more than expected). Yes, it happened to me that I made a fatal mistake in the previous years because I sold Bitcoin to gamble and that would be a valuable lesson to improve so as not to fall into the same hole.

Some people do not learn from their mistakes and they get sucked into an ongoing gambling direction. Some people cannot help it. There are these expressions about "GO BIG or go home" and people really end up practicing those kinds of strategies rather than slow, steady and reasonable strategies and just making sure that their various kinds of extra cashflow and cash reserves are sufficiently stocked so that they won't have to dip into their BTC that is surely at a time that is not of their own choosing and when they might be feeling poor. Revolution in adapting a new plan and experience is one of the keys to improving the situation for the future.

I am not sure if I would call it revolutionary adapting, but maybe instead just keeping some resolve, and buying a bit more BTC can actually be quite helpful, so there could be ways to do some side projects that might not pay a lot, but the extra money is completely available to buy more bitcoin.. so you might feel good about those little extra stacking efforts, even though it might be stressful to be buying bitcoin at what seems to be prices that are low and could go lower... but you just suck it up and figure out ways to frame your efforts to stack more sats in positive ways. Bitcoin has brought changes to those who are on the right path to becoming millionaires in the current era. For this reason, the journey of people who got to know Bitcoin earlier might be quite interesting to read about their history.

It is not ONLY the stories of millionaires who are interesting, and surely the ones who were able to bring themselves out of poverty can be quite inspiring, even though they still might be in a kind of poverty, but they end up with more freedoms and abilities to choose their work. Sure, many folks might consider if they might invest $10 per week and to do that for years and years and years, and after 10 years, they have ONLY invested around $5,200, and so surely there could be some ways to see if their investment is growing, and even if the investment ends up being $10k or even $20k after 10 years, there can be some good feelings that the investment had put them into a better place with more options, even though it might not be fuck you status... and surely after 10 years of persistently investing into bitcoin at $10 per week, there may also be some opportunities that end up coming up in which they might be able to double, triple or even 10x the amount that they are investing into bitcoin without really stressing themselves out any more, and they might even have their lives improving merely from being able to find a place to store wealth that does not lose value and has pretty good chances of increasing in value.. especially if someone is young enough to be able to live 10 years or even 20, 30 or 40years longer, and there can be some guilty feelings too, if you see some of the people who are doing way worse financially (and psychologically and maybe even health-wise) because they did not engage in discipline to invest into bitcoin and to even gravitate towards more aggressive kinds of BTC accumulation strategies in order to NOT lose too much focus on the goals of ongoing accumulation and keeping the coins safe from loss, or getting robbed or getting rug pulled. As the bullrun is getting closer we shouldn't be taken aback seeing some altcoins doing better all in disguise only to carpet flat after many would have innocent invested their money. I bet that many of the altcoins prices won't be rising along with bitcoin when the bullrun eventually kick start, they rather be doing the opposite. I rather be doing my little DCA holding strategy with bitcoin with the little % from my monthly income while waiting for the bullrun, it better to partake in it with the little you can than sitting on the fence.

That's very certain that many altcoins won't roll along with bitcoin in price during the bull run. Some would have lost their value during the bearish market and the ones that survived it to the bull run won't increase as much when compared with bitcoin. Every investor in bitcoin can be confident that, before the bull run ends, they will make some profits from their bitcoin investment. As for altcoins, you are unsure which one will provide you with the desired profits because of how unpredictable the crypto market can be. But if you love to take risks on altcoins, diversify your investment in top coins. Fuck shitcoins. There is no reason to get involved in them, and if you cannot resist your desire to gamble and to fuck around with them, then limit your investment to no more than 10% of the size of your bitcoin holdings and your ongoing strategy should stick with 90% bitcoin.... including any new money that comes in.. make sure you get 90% in bitcoin before getting distracted into shitcoins.. and another bad thing about getting distracted into shitcoins, you are also distracted into dumb ideas.. which may well contribute to your abilities to understand bitcoin as well as you should. Are you attempting to distinguish between someone who is just getting into bitcoin and investing versus someone who has been investing for a long time? There's a difference.

True JJG, perhaps it is not very appropriate for them to measure the degree of difference in the time they have run in Bitcoin investments. Where early investors or those who have known Bitcoin for a longer time in 2013 of course they can buy at a cheap price. And for new investors or those who known Bitcoin this year they buy Bitcoin at a more expensive price but that only measures the entry level they. The initial investor's investment journey might be better used as a combination to motivate us in our long-term Bitcoin investment journey. Buy aggressively or instantly depending on each strategy and all they need to do is balance your income and expenses to avoid disrupting they investment journey. I think many of the big investors from 2013 bought large amounts of BTC at cheap prices and they either immediately forgot about it or checked back in 10 years or 20 years. Yes they are billionaires now. The important point here is to stay in the process and enjoy what we do. Regardless of those who have been in bitcoin for a long time or those of us who are still new to bitcoin, all of them must have their own experiences and mistakes but struggling to continue to correct the mistakes we have made is something that really needs to be improved for evaluation so that we are even better. Sure it does not hurt to try to get feedback with members who have been around longer, but at the same time each of us has to plow our own path and figure out our own details, so I find it a bit problematic to be getting too distracted into what other members were able to do with even less capital... We have to deal with facts in front of us and sure attempt to learn from others, but at the same time, don't forget that some of the grueling and difficult tasks that we carry out might even be more challenging than some of the OLDER (longer term) members had carried out. $10 per week is not going to work out as well now as it did in the past 10 years if someone had been ongoingly investing in bitcoin at that rate, but if we are ONLY able to do $10 per week, then we might be in our own hero's journey to keep investing at that rate, and maybe even we might end up being more of a hero if we are able to increase our weekly investment amount without necessarily unduly putting ourselves into too much financial and/or psychological stress due to such BTC accumulation-oriented budgetary increases. Many people are still considering about prices that are considered too high for now and are not willing to start because expecting the time when bitcoin was lower will also be useless because in the end everything has its own time because not necessarily if we know bitcoin from the first time we can also invest well because there will definitely be some mistakes made such as selling bitcoin too fast from the target to be achieved and so on.

Yep some people fail to act because they are strategizing too much and then if they do act, sometimes they are also strategizing too much when they believe that they are going to play the waves and it might not work out very well for them, as compared to just a consistent and persistent BTC accumulation style that may well be a bit less than aggressive, but it is the less aggressive (and maybe even whimpy) style that ends up balancing out so that the person is able to get started rather than putting his/her own obstacles by getting too worked up about buying on dips that may or may not end up happening.. Now we just have to focus on what we are doing now with the process that we believe that bitcoin is worth considering as an investment.

I think so .. get our shit together if it is not together.. or just go over our plans from time to time to make sure that we are employing the plan in a way that is sufficiently comfortable. Regardless of the time that has happened it will also not be repeated and we do not need to feel sorry for what has happened because after all there are positives that can be taken because maybe if we did not make mistakes before we would not be like now and have a broader view of bitcoin.

Well, 5-10 years down the road, you may end up looking like a genius to those people who might just start to consider getting into bitcoin 5-10 years from now.. or even if they have been considering bitcoin for the past 5-10 years, it may take another 5-10 years before the finally end up acting and starting to regularly accumulate bitcoin, like the probably should have already have had been doing, but they could not figure out any ways to get started, and so the fact that you are started and maybe you have even been acting for a year or two, may well put you way ahead of others, even if your current BTC holdings might not be above water yet. but it might be possible to make lump sum investments in some other assets, whether it is stock or property or something else (should not be shitcoins unless it is limited to small amounts such as less than 10%) so that your total value is not just in bitcoin and cash.

There's a question I'll like you to lend your thoughts, something about cryptocurrency diversification and since you have raised the discuss I feel I use this opportunity to ask you for a clarification about it to get your thoughts. Ii read a comment sometime this year that says investing in bitcoin and other altcoins isn't diversification, as in investing in different cryptocurrencies shouldn't be termed as diversification since they are all cryptocurrencies, that an actual diversification of Investment should be in different lines of businesses, example bitcoin and real estate. JJG, what do you think? Generally the idea of diversifying accross asset classes is to attempt to achieve some level of non-correlation, and so in the crypto space, they are all dependent on bitcoin doing well, so the shitcoins are correlated to bitcoin, so you likely do not get any advantage investing into any of them. It is like you are adding extra risk, but they are pretty much going to perform in line with bitcoin...and bitcoin is already a risky asset so why add more risk by investing into shitcoins. Of course, you can do what you want, and part of the reason that I suggest to not put more than 10% of the size of your bitcoin holdings into any shitcins (or all shitcoins combined that you choose to buy) is partly based on the idea that you are likely not getting any extra advantage by exposing yourself to them and then having to study aspects of their ecosystem or attempt to evaluate their claims regarding what they claim to be offerring that may not even be enough to distinguish themselves from bitcoin. Attempt to remember another dynamic is that for any shitcoin to knock out bitcoin, it is going to need to be at least 10x better than bitcoin, and surely many of them will make claims of being better or providing some other service that bitcoin might not currently provide, but is that 10x better than bitcoin in order to displace bitcoin as some of them make claims to be able to displace bitcoin and to take market share away from bitcoin, even though sometimes they are not really clear about what it is that they are supposedly providing, such as ethereum being a way to pump and dump shitcoins, and is that anything that is actually needed., Don't get me wrong,I am not even suggesting that all of the shitcoins are going to disappear in the coming 20 to 50 years, so there will frequently be various kinds of distractions, and maybe that does not really hurt bitcoin, even though it is irritating and maybe sad sometimes, yet a lot of people are going to get distracted into various shitcoins, and it is up to you how much you want to get involved in that nonsense and likely mostly waste your time.. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

SeriouslyGiveaway

|

|

November 25, 2023, 04:41:15 AM |

|

If an investor could eradicate greed and be more discipline in times of investment it will do them more good than harm because I realized that the reason why most people aggressively invest on Bitcoin is because they feel that it will make them have a more higher returns than slowly investing without knowing that is better to invest slowly and consistently to reach your goal than aggressively investing and being cut up by unforseen challenges.

Most people coming into this market are primarily looking to get rich quickly, so they often overlook investing in Bitcoin for the long term. When it comes to short-term profitability, Bitcoin can't be compared to the rest, but in the long run, Bitcoin is an investment opportunity that cannot be ignored. You can sleep well if you hold onto Bitcoin for many years, but the same cannot be said for the majority of other Altcoins. It takes patience and a clear direction to focus solely on investing in Bitcoin and holding for the long term. |

|

|

|

|

Fuso.hp

|

|

November 25, 2023, 06:14:54 AM |

|

If an investor could eradicate greed and be more discipline in times of investment it will do them more good than harm because I realized that the reason why most people aggressively invest on Bitcoin is because they feel that it will make them have a more higher returns than slowly investing without knowing that is better to invest slowly and consistently to reach your goal than aggressively investing and being cut up by unforseen challenges.

Most people coming into this market are primarily looking to get rich quickly, so they often overlook investing in Bitcoin for the long term. When it comes to short-term profitability, Bitcoin can't be compared to the rest, but in the long run, Bitcoin is an investment opportunity that cannot be ignored. You can sleep well if you hold onto Bitcoin for many years, but the same cannot be said for the majority of other Altcoins. It takes patience and a clear direction to focus solely on investing in Bitcoin and holding for the long term. Not many, but all have the same goal of making money using money. We usually make investment decisions knowing that money is at risk in the hope of something good. Investment will not make us rich quick but trust in investment and holding that investment for long time will definitely change our condition. For those who are planning to invest to get very rich in a short period of time, I would suggest that you change your plans a bit. Instead of worrying about short term profits, you can make long term investments with the hope of huge profits. I think every investor should read all the posts in this section because most of the posts in this section are very informative for an investor. By reading the posts in this section, an investor will know the right information about investing and those who have the wrong idea that they will become rich overnight in a short period of time by investing in a short period of time will change their minds. Long term investment plan is the right investment plan for an investor. To begin with I have read the posts in this section thoroughly before and most of the posts suggest investing in Bitcoin and holding that investment for a long time. After reading the posts in this section all my misconceptions about investing have been cleared and I now understand that long term investing is a viable investment plan for an investor and I now believe in long term investing. Those who are new investors buy bitcoin without thinking so much and keep that bitcoin for long time and if possible increase your investment amount you will realize the result at the end of time. |

|

|

|

Mayor of ogba

Full Member

Online Online

Activity: 294

Merit: 163

★Bitvest.io★ Play Plinko or Invest!

|

|

November 25, 2023, 06:44:58 AM |

|

Mate, are you trying to say that we should also invest in altcoin? So that our eggs will not only be on Bitcoin investment. It is never good to invest in altcoin because you are not the dev of the altcoin, and if anything wrong happens at the back end you will not know. Investing in altcoin is just like someone playing gambling and you will lose your money if you are investing in altcoin because altcoin is a pump-and-dump token, that is after your money. As far as crypto is concerned, there is nothing like Bitcoin because you will not only make a profit from your Bitcoin investment, but Bitcoin gives you total control over your money, no third party will decide how you will use your Bitcoin, and you can also use your Bitcoin to send money to your family members staying abroad.

I understand your point relating to the risk factor of this altcoins but at a point I had to settle down and make close observation into this altcoins and I feel at some point they are worth investing into but extreme caution needs to be taken. Just the way strategies are applied in accumulating Bitcoin that is how strategic you need to be when buying this altcoins, quote me here Not for a long term hold. Altcoins are most a pump and dump coin, we know after making waves and all that it must surely dump and very difficult to see any altcoins bounce back so why can't I venture into the market at a very short period of time might be weeks and earn that profit when it's pump and before it's dump I sell. Bitcoin is the ultimate and no other currency stands a chance but considering the fact that just with little investment in altcoins you can make profits from it within a short period of time and still add those profits into my Bitcoin portfolio. Altcoins are risky? Yes. Bitcoin is risky? No. That is one difference between them considering the risk factor This is one of the reasons why you should not invest your funds in altcoins because they are pump-and-dump coins that can not deliver what they promise to their investors. Most altcoins are a scam after taking investors' funds they will rug-pull the coin and run away with investors' money. With Bitcoin, you will not experience all these problems, and your investment in Bitcoin will be safe, all you need is to buy Bitcoin with a DCA strategy and Bitcoin always recovers its price. The word investment doesn't apply literally to altcoins as they are not viable and reliable for long term plan. Altcoins are liken to gambling, so in my opinion it's better for anyone to use the money he's planning on investing in an altcoin to rather use it for actual gambling in a casino, in that case you are conscious that you are now gambling with your funds so it's a 50-50 chance of loss or profit if your lucky.As the bullrun is getting closer we shouldn't be taken aback seeing some altcoins doing better all in disguise only to carpet flat after many would have innocent invested their money. I bet that many of the altcoins prices won't be rising along with bitcoin when the bullrun eventually kick start, they rather be doing the opposite. I rather be doing my little DCA holding strategy with bitcoin with the little % from my monthly income while waiting for the bullrun, it better to partake in it with the little you can than sitting on the fence. I don't think gambling is the best option compeard to altcoin investment. We all know that altcoin are alternative to bitcoin and has a lesser attraction compeard to bitcoin but that doesn't mean altcoin should be totally neglected. We always talk about diversification of potfolio. What do you really think about it? Because i see it as investing in different altcoin apart from the usual BTC . Fake altcoin project looming around Crypto market might create a bad inpression on altcoin, but there are some altcoin that has an investment value. Let's take for example etherium. It has stand as next of kin to bitcoin and has an investment value. It better off to invest in etherium or BNB than gambling your money, because there is no volatility on gambling. But in Crypto currency if you invest and loose, there is a tendency for you to regain back your lost when the market is green. But in gambling if it fails, that's just the end. When speculating on altcoins be specific. Like saying I rather gamble with my money Dan investing in meme or fomo. Why I say gambling and investing in altcoins are the same thing is because in gambling you are not sure of winning your bet and in altcoins investment, you are not also sure of making a profit from your investment. For instance, you can see what happened in the bear market, so many altcoins have done ---95 % in price which means they are dead projects and will never recover in price. And so many investors have lost their money in such altcoin investments. If you do not want t to experience this, don't invest your money in altcoins. When you invest your money in Bitcoin your investment is safe because Bitcoin gives you the freedom to move your money whenever you want and it also recovers in price. Remember there could only be a total of 21,000,000 Bitcoins. |

|

|

|

|

Fara Chan

|

|

November 25, 2023, 08:00:45 AM |

|

Yeah actually let me try if I can answer your question, so however first you need to understand the word diversification it means expanding or enlarging your investment to some other things, but however chosen altcoins to invest could also be known as diversification because irrespective of there general name which is crytocurrency but they have different sub names, but however I would not advised you to invest on altcoins as a diversification because they are not worth it.

If you are looking for were to diversify some of your investment, altcoins shouldn't be an option or perhaps you could just stick to only on Bitcoin.

The expanded understanding of investment that you say sounds quite good and also very profitable, but because the direction of the advice can also be related to altcoins, I would prefer to use altcoins to trade in the short term or daily because the profits I can get from altcoins can also I converted it to Bitcoin so that my number of Bitcoins can continue to increase because my focus is actually only Bitcoin, not altcoins whose potential is very uncertain at various moments. Bitcoin is always the best, because those who are modern today are ready to use Bitcoin. Bitcoin is the only long-term investment possible, but other Altcoins are not. Because I have seen thousands of Altcoins still disappearing from the market. So for long-term investment, definitely support Bitcoin.

This has been very clear for a long time, mate, there are even thousands of altcoins that have died and disappeared from the market, so this has made Bitcoin a very clear investment direction and also very profitable because it will not experience bad things like what happened to you. There are many altcoins and other shitcoins in the market. You can never survive investing with Altcoins. Altcoins are not long-term holdings because the altcoin market is always bearish. Investing in Altcoins always has a high chance of losing 100% of your wealth. Among them are coins like FTX, Luna and many others that have completely disappeared from the market. And the wealth of thousands of people has turned into zero balance. So it is better to stay away from Altcoin investment.

That's true and sometimes some people only use altcoins to increase the amount of Bitcoin they have in their wallet because some people are already happy with Bitcoin and are also happy with Bitcoin investments. Then the profits from other things from the crypto market will be turned back into Bitcoin so that the amount of investment will also increase over time, so we also have to have ways to utilize less useful things like altcoins in order to increase the actual goals we want. |

| | | | | | | ███▄▀██▄▄

░░▄████▄▀████ ▄▄▄

░░████▄▄▄▄░░█▀▀

███ ██████▄▄▀█▌

░▄░░███▀████

░▐█░░███░██▄▄

░░▄▀░████▄▄▄▀█

░█░▄███▀████ ▐█

▀▄▄███▀▄██▄

░░▄██▌░░██▀

░▐█▀████ ▀██

░░█▌██████ ▀▀██▄

░░▀███ | | ▄▄██▀▄███

▄▄▄████▀▄████▄░░

▀▀█░░▄▄▄▄████░░

▐█▀▄▄█████████

████▀███░░▄░

▄▄██░███░░█▌░

█▀▄▄▄████░▀▄░░

█▌████▀███▄░█░

▄██▄▀███▄▄▀

▀██░░▐██▄░░

██▀████▀█▌░

▄██▀▀██████▐█░░

███▀░░ | | | | |

|

|

|

|

MusaPk

|

|

November 25, 2023, 08:43:29 AM

Last edit: November 27, 2023, 09:20:48 AM by MusaPk |

|

And then again, their is not like “it’s as if the money they spend the more profit they make” the truth is, the money you can be able to accumulate the higher profit that you will be expecting when the price of bitcoin will go up those who hold less can not be compared with those who hold larger amount, the profit percentage might be the same depending on the entry price and time of selling but the high you hold the hirer the profit, the only time I can be against anyone buying more bitcoin is if they can’t afford the money they pump in it but they either use others funds or borrow just to accumulate, if they can afford it then they are free to buy as many as they went.

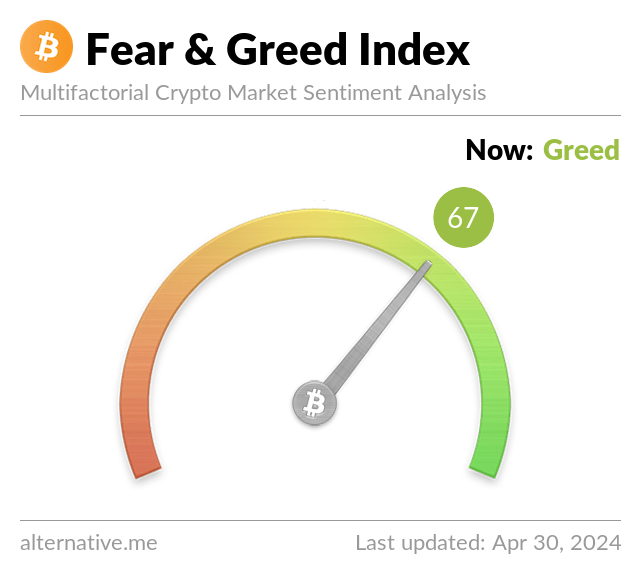

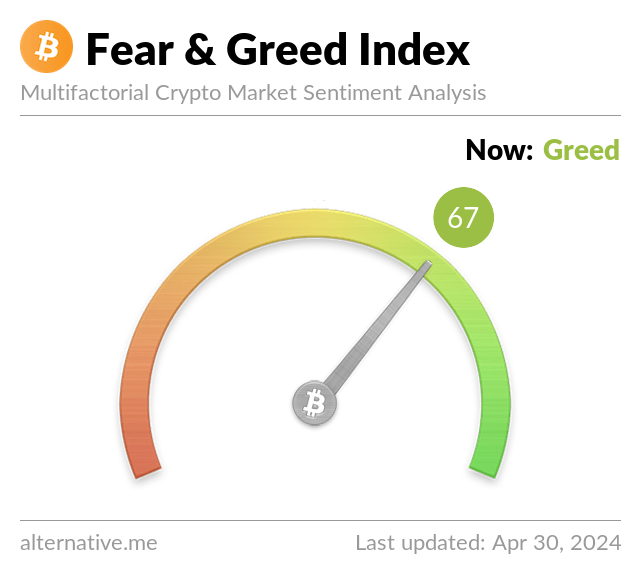

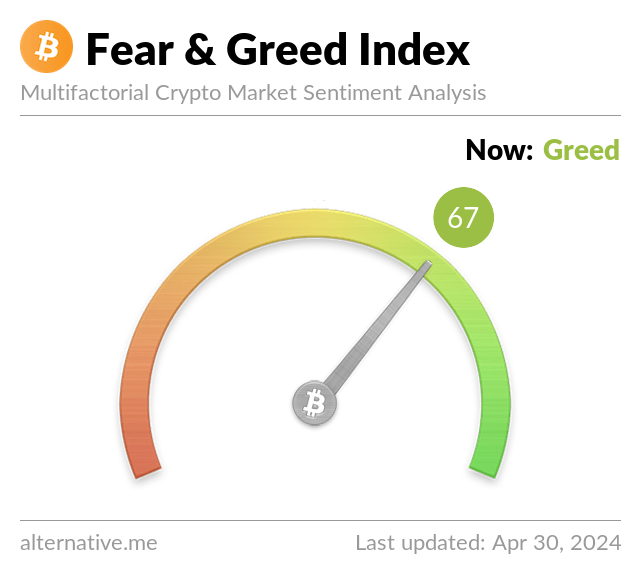

Its more profitable to accumulate Bitcoin when its down then when its up. Like its more beneficial to accumulate Bitcoin when its down to 20k then when its trading on 67k. But its human nature that they are more willing to invest when price goes up rather when its up. See for instance the fear and greed index. Generally the needle is on the left down side of the ring when price is down and its on right side when price goes up.  https://alternative.me/crypto/fear-and-greed-index/ https://alternative.me/crypto/fear-and-greed-index/ |

|

|

|

|

Patrol69

|

|

November 25, 2023, 09:58:03 AM

Last edit: November 25, 2023, 10:08:58 AM by Patrol69 Merited by Popkon6 (2), JayJuanGee (1) |

|

Yeah actually let me try if I can answer your question, so however first you need to understand the word diversification it means expanding or enlarging your investment to some other things, but however chosen altcoins to invest could also be known as diversification because irrespective of there general name which is crytocurrency but they have different sub names, but however I would not advised you to invest on altcoins as a diversification because they are not worth it.

If you are looking for were to diversify some of your investment, altcoins shouldn't be an option or perhaps you could just stick to only on Bitcoin.

The expanded understanding of investment that you say sounds quite good and also very profitable, but because the direction of the advice can also be related to altcoins, I would prefer to use altcoins to trade in the short term or daily because the profits I can get from altcoins can also I converted it to Bitcoin so that my number of Bitcoins can continue to increase because my focus is actually only Bitcoin, not altcoins whose potential is very uncertain at various moments. We often plan but things don't go according to plan. Turns out we planned one thing and something different happened to us. It sounds great that buying alt coins and selling them at a higher price means you're investing in Bitcoin, but it might be the opposite of what you think. Suppose you buy ALT Coins in short term plan and after purchase you lose much more than you expected instead of profit but you cannot sell ALT Coins at loss and also you cannot invest Bitcoin. I think we should invest in Bitcoin directly without thinking so much. The profit you think you made with ALT Coins you make directly with Bitcoin and it will be safe for you. I don't think it is safe at all to buy ALT coins in hopes of making some profit. Bitcoin is the most reliable digital currency so trust Bitcoin, buy Bitcoin, hold that Bitcoin deep and you are worry free. Since there is no fixed investment level, you can increase your investment anytime you want, so buying Bitcoin will be a good decision for you. This has been very clear for a long time, mate, there are even thousands of altcoins that have died and disappeared from the market, so this has made Bitcoin a very clear investment direction and also very profitable because it will not experience bad things like what happened to you. There are many altcoins and other shitcoins in the market.

If we are in a dilemma about which coin to invest in, whether it's thinking about investing, thinking about Bitcoin, thinking about ALT coins, then we have to understand that we have very little idea about everything. It is easy to decide where to invest even for those who have minimal understanding of the market. If there was only one option to invest that must be to invest in ALT coin then it is a different matter but where there are options to invest in Bitcoin it is definitely foolish to think of investing in other coins in the market. If you have love for your money and don't want to lose your money, you must invest in Bitcoin and if you expect something good from the investment, you must keep the investment for a long time. You can never survive investing with Altcoins. Altcoins are not long-term holdings because the altcoin market is always bearish. Investing in Altcoins always has a high chance of losing 100% of your wealth. Among them are coins like FTX, Luna and many others that have completely disappeared from the market. And the wealth of thousands of people has turned into zero balance. So it is better to stay away from Altcoin investment.

That's true and sometimes some people only use altcoins to increase the amount of Bitcoin they have in their wallet because some people are already happy with Bitcoin and are also happy with Bitcoin investments. Then the profits from other things from the crypto market will be turned back into Bitcoin so that the amount of investment will also increase over time, so we also have to have ways to utilize less useful things like altcoins in order to increase the actual goals we want. There are many ways to make your bitcoin investment rich, where there are many ways to make your investment rich why should we invest in ALT coins to ensure maximum risk of our money. Investing in ALT coins where there is doubt about getting a return on that investment how do you expect to invest in Bitcoin with a portion of the profit you get from that investment. Make investing easy without looking so hard Investing in Bitcoin for the long term makes it so easy that you don't need to look at investing so hard. If you plan to hold Bitcoin for a long time, you can buy Bitcoins with any amount of money at any time in the market because there is always an opportunity to increase the amount of investment. |

|

|

|

|

bounty2505

Newbie

Offline Offline

Activity: 2

Merit: 0

|

|

November 25, 2023, 11:18:22 AM |

|

Do not hold bitcoins in anticipation of future bitcoin halvings. You need to hold for a long time because the original Bitcoin holders are always invested for a long time. But you just mentioned bitcoin halving it's a small bitcoin investment. By using a hardware wallet you can hold bitcoins for a long time. And you can deposit with DCA method every week or monthly equivalent amount of 10 to 15 dollars. Accumulating fiat money causes a lot of ricks because the value of the dollar is only increasing but the value of fiat money is decreasing. So I chose Bitcoin as the best way because the longer I hold Bitcoin the more profit I can make.

Of course, everyone clearly knows that by continuing to keep Bitcoin for a long time, it will provide significant profits in time and I agree that you don't always have to buy large amounts, you can do it in installments with the goal that you will eventually achieve it. The halving era will be here soon. It is certain that next year there will be a significant increase, but it is possible that there will be a correction first, even though it is currently increasing. |

|

|

|

|

promise444c5

Full Member

Online Online

Activity: 280

Merit: 132

Keep Promises !

|

|

November 25, 2023, 11:32:53 AM |

|

Fuck shitcoins. There is no reason to get involved in them, and if you cannot resist your desire to gamble and to fuck around with them, then limit your investment to no more than 10% of the size of your bitcoin holdings and your ongoing strategy should stick with 90% bitcoin.... including any new money that comes in.. make sure you get 90% in bitcoin before getting distracted into shitcoins.. and another bad thing about getting distracted into shitcoins, you are also distracted into dumb ideas.. which may well contribute to your abilities to understand bitcoin as well as you should.

Seriously shitcoins tends to represent their name most times , as you've said I guess most of them are just shitty entirely but shouldn't there be a difference between Alt and shit ?? Just saying, though shit coins are altcoins but we all know why they are called shit it's mostly gamble like to trade shit coins And talking about the 90% van you please talk more about the 90% , is it based on current capital or all accumulative capital in total or maybe we can just say current cash at hand for investment..?? |

|

|

|

|

Litzki1990

|

|

November 25, 2023, 12:43:23 PM |

|

Do not hold bitcoins in anticipation of future bitcoin halvings. You need to hold for a long time because the original Bitcoin holders are always invested for a long time. But you just mentioned bitcoin halving it's a small bitcoin investment. By using a hardware wallet you can hold bitcoins for a long time. And you can deposit with DCA method every week or monthly equivalent amount of 10 to 15 dollars. Accumulating fiat money causes a lot of ricks because the value of the dollar is only increasing but the value of fiat money is decreasing. So I chose Bitcoin as the best way because the longer I hold Bitcoin the more profit I can make.

Of course, everyone clearly knows that by continuing to keep Bitcoin for a long time, it will provide significant profits in time and I agree that you don't always have to buy large amounts, you can do it in installments with the goal that you will eventually achieve it. The halving era will be here soon. It is certain that next year there will be a significant increase, but it is possible that there will be a correction first, even though it is currently increasing. You are sure that the price of bitcoin will increase next year but I can never say for sure whether the price of bitcoin will increase next year. So far I have invested in Bitcoin only with the idea of the market but I have never been able to invest in Bitcoin for sure. The market for Bitcoin and other cryptocurrencies is uncertain, anything can happen at any time and it is impossible to be certain about the market in advance. Try to know the Bitcoin market well and if you try to know, you will come to know at some point that no matter how confident you invest in Bitcoin, your money remains at risk. After getting enough knowledge about the market and analyzing the market, we must accept the risk that remains in the investment. Maybe our little money risk will pay off well in the future. We have enough trust in Bitcoin and we need to use this trust to invest in Bitcoin. Whenever we make an investment relying on Bitcoin, we don't have much to worry about this investment and we can definitely hold our investment for a long time. When an investor plans to hold his investment for a long time at the beginning of the investment, he goes a step ahead in getting better returns from his investment. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

|

rachael9385

|

|

November 25, 2023, 05:21:33 PM |

|

Its more profitable to accumulate Bitcoin when its down then when its up. Like its more beneficial to accumulate Bitcoin when its down to 20k then when its trading on 67k. But its human nature that they are more willing to invest when price goes up rather when its up. See for instance the fear and greed index. Generally the needle is on the left down side of the ring when price is down and its on right side when price goes up.  https://alternative.me/crypto/fear-and-greed-index/ https://alternative.me/crypto/fear-and-greed-index/If we allow risk or greed to take over our mindset, then we will not be able to invest and accumulate Bitcoin at the same time with fear. Although, I agree that our profits all depend on the amount and how frequently we click the buy button, in years to come, 1 Satoshi will be worth a hundred boxes or more, so if we can start from now to buy and hodl then we will not regret our actions because we have invested earlier, accumulated with DCA strategy without any fear or greed. If Bitcoin's price increases, we investors will be very happy about that, but at the same time, there are others that will still want it to drop so that they can buy. Those that are praying for Bitcoin to reduce are the guys that have not yet invested, so they just sit down and wait for Bitcoin to be reduced, so that they can buy. However, I come to think that those that want the price of Bitcoin to be reduced are the ones that are so scared and greedy. At the same time, they don't want to buy at a high price, so they are waiting for the price to reduce. (I am trying to say, people should not mix fear and greed when investing). |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | | | [ | 1,000x

LEVERAGE | ] | [ | .

COMPETITIVE

FEES | ] | [ | INSTANT

EXECUTION | ] | | | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ | ████████████████████████████████████████████████████████

.

TRADE NOW

.

████████████████████████████████████████████████████████ | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 25, 2023, 06:43:34 PM |

|

Fuck shitcoins. There is no reason to get involved in them, and if you cannot resist your desire to gamble and to fuck around with them, then limit your investment to no more than 10% of the size of your bitcoin holdings and your ongoing strategy should stick with 90% bitcoin.... including any new money that comes in.. make sure you get 90% in bitcoin before getting distracted into shitcoins.. and another bad thing about getting distracted into shitcoins, you are also distracted into dumb ideas.. which may well contribute to your abilities to understand bitcoin as well as you should.

Seriously shitcoins tends to represent their name most times , as you've said I guess most of them are just shitty entirely but shouldn't there be a difference between Alt and shit ?? Just saying, though shit coins are altcoins but we all know why they are called shit it's mostly gamble like to trade shit coins Yes, you can try to figure out which shitcoins are less shitty. That is up to you... is it a good use of time or not. In any event, if you go to analyze any shitcoin, you should presume that it is shitty, it is not worth spending time, money or your own energies/efforts investing into it, but if you study it for a while and you are able to overcome the presumption that it is shitty, then you would there after consider how much further to invest into it. .and those kinds of analyses are not relevant to this thread... in terms of decisions that you made that might allow you to justify more than the 10% limit that I suggested.. with any limit and/or starting point, you are of course free to analyze and come to your own determination to go outside those parameters. Another thing that I frequently suggest to newbie investors is that they should start out investing in bitcoin anywhere between 1% and 25% of their investment portfolio, and if they do not have an investment portfolio, then they should start out by investing 1% to 25% of their income into bitcoin in order to start to build their bitcoin portfolio (which will later become part of a larger investment portfolio, even if it may well take several years before expanding beyond bitcoin and cash), and at the same time, even though I provide 1% to 25% starting guidelines, any person is free to come to their own determination, and maybe if they are brand new, they have no information to even figure out whether their investment into bitcoin should be at the lower end of the range or at the higher end of the range, but they should start by figuring out the range first before going beyond it, but if they later can justify reasons to go outside of the range, then I have no problem with the idea of people coming to their own determination, especially if they have figured out reasons why they should go outside of the range besides pure gambling and/or yolo type behaviors but instead study and analysis of themselves, their finances, their psychology and other relevant investment matters which would also include considerations of bitcoin as compared with other possible investment opportunities. And talking about the 90% van you please talk more about the 90% , is it based on current capital or all accumulative capital in total or maybe we can just say current cash at hand for investment..??

If you are brand new to investing into bitcoin, then I recommend that you invest anywhere between 1% to 25% of your investment portfolio into bitcoin, and if you do not have any other investment (besides cash) then I recommend that you invest 1% to 25% of your income into bitcoin, and so in the end that leaves you a lot of flexibility. As far as shitcoins, I recommend only to invest up to 10% of the size of your bitcoin investment into shitcoins, so hopefully you are not reading me wrong into believing that you invest 90% of your portfolio into bitcoin or 90% of your networth, since I am not saying that, but if you have a cashflow and you have established a what are your expenses, and so you have a certain amount of you income that is available to invest, then usually you want to have a minimum of 3-6 months of cash (or other relatively liquid funds) available to cover various shortages of your cashflow and you should also have some extra amounts that are emergency cashflow. You should have those kinds of systems in place before you invest into anything, but sometimes you can build the emergency cashflow and the BTC holdings at the same time with a kind of target of getting to 3-6 months of emergency cash that is not bitcoin. Let's say for example, you make $1k per month, but you know that around $700 to $800 per month are your expenses, so you ONLY have $200 to $300 left over that you could invest, so maybe if you are a beginner, you might devote half of the extra towards building up your cash reserves and the other half to buy bitcoin, but if your target it to have 6 months of cash reserves, then you might need to get to between $4,300 and $4,800 in cash reserves, and it would be your discretion whether you build your bitcoin up at the same pace, because it can take a long time to build up that amount of cash reserves if you only have $200-$300 per month to build it up, and there could be ways to consider getting your pay to exist or cutting some of your monthly expenses..and you will have much more freedom to be aggressive with your bitcoin investment once you have build a decently strong cash reserves. The market for Bitcoin and other cryptocurrencies is uncertain,

But we are not talking about "other cryptocurrencies" here, so why mention such thing? We are talking about bitcoin. Focus is good, no? anything can happen at any time and it is impossible to be certain about the market in advance.

Sure anything can happen, but if we don't have any bitcoin at all, then we better start buying some rather than just looking at it and saying "anything can happen." If we do not buy any bitcoin, then we are not preparing ourselves for bitcoin to go up, but even if we buy some bitcoin, we can still be prepared for bitcoin to go down by still having some money available, just in case BTC prices go down further after we had already bought. Try to know the Bitcoin market well and if you try to know, you will come to know at some point that no matter how confident you invest in Bitcoin, your money remains at risk. After getting enough knowledge about the market and analyzing the market, we must accept the risk that remains in the investment. Maybe our little money risk will pay off well in the future.

There is nothing wrong with these ideas, and likely we prepare for the BTC price to go up or to go down by buying and position size and then likely if we do not know very much we continue to study, and if we are lacking in confidence regarding our lack of knowledge about bitcoin, then we likely need to keep our BTC position size down enough so that we are able to study and to gain confidence so that our position size is somewhat lined up with the level of our knowledge and confidence about BTC. We have enough trust in Bitcoin and we need to use this trust to invest in Bitcoin.

Hopefully we are not relying too much on blind trust, but as you mentioned earlier a kind of trust that comes from studying and understanding (as best as we can) what kind of actual factors contribute towards our having confidence in bitcoin's investment thesis.. and why we want to invest and how much we want to invest based on our having had tried our best to study reasons for and against bitcoin's investment thesis and continuing to revisit our ideas about the strength (or lack) of bitcoin's investment thesis with the passage of time and with new information we can attempt to figure out if anything that has been happening challenges our investment thesis.. and if our bitcoin investment size continues to be appropriate, then we continue to stick with it.. and it is possible that even if we continue to study bitcoin, that there may be learnings along the way that may cause us to think differently about bitcoin as compared with earlier, but at the same time the strength of our investment thesis may or may not end up changing along the way. Whenever we make an investment relying on Bitcoin, we don't have much to worry about this investment and we can definitely hold our investment for a long time. When an investor plans to hold his investment for a long time at the beginning of the investment, he goes a step ahead in getting better returns from his investment.

Holding a long time does not cause bitcoin's investment thesis to become more certain, but it could affect how we go about investing into bitcoin if we consider that we are likely going to be holding bitcoin 10, 20, 30 or more years. .but then at the same time, we might be considering that when we are earlier in our bitcoin investment journey we likely are more into building it, but then later on in the longer term, we may well be making some adjustments in regards to if we start to believe that we have accumulated enough or if there might be some preferable changes in our strategy that likely would be informed in part based on how many BTC we have had accumulated and how the BTC had performed as compared to other investments that we hold and as compared to other investments (or consumption interests) that might be available to us at various later points down the road. Its more profitable to accumulate Bitcoin when its down then when its up. Like its more beneficial to accumulate Bitcoin when its down to 20k then when its trading on 67k. But its human nature that they are more willing to invest when price goes up rather when its up. See for instance the fear and greed index. Generally the needle is on the left down side of the ring when price is down and its on right side when price goes up.  https://alternative.me/crypto/fear-and-greed-index/ https://alternative.me/crypto/fear-and-greed-index/If we allow risk or greed to take over our mindset, then we will not be able to invest and accumulate Bitcoin at the same time with fear. Measuring market sentiment is not a very good way to figure out our own strategies, and sure it might affect us in small ways, but it should not be central in terms of our figuring out and following strategies that we have established. Although, I agree that our profits all depend on the amount and how frequently we click the buy button, in years to come, 1 Satoshi will be worth a hundred boxes or more, so if we can start from now to buy and hodl then we will not regret our actions because we have invested earlier, accumulated with DCA strategy without any fear or greed.

That's true. If Bitcoin's price increases, we investors will be very happy about that, but at the same time, there are others that will still want it to drop so that they can buy. Those that are praying for Bitcoin to reduce are the guys that have not yet invested, so they just sit down and wait for Bitcoin to be reduced, so that they can buy.

Yep, and they might be sitting a long time since one of the better things to do is to act upon plans rather than sitting around waiting, and even if the BTC price does drop, will that cause them to buy and will it make any difference towards their overall psychology in terms of if they had just been buying all along instead of waiting for dips that may or may not happen and for the answers to unimportant (or unknowable) questions regarding whether the dip is enough of a dip or not. However, I come to think that those that want the price of Bitcoin to be reduced are the ones that are so scared and greedy. At the same time, they don't want to buy at a high price, so they are waiting for the price to reduce. (I am trying to say, people should not mix fear and greed when investing).

Just buying regularly will have good chances to get the investor into a better mindset, and if they are worried that the BTC price is too much, then just buy less, but probably not so great to stop buying unless you have reached some kind of BTC accumulation goal that justifies making such downward adjustments to regular and ongoing BTC buys. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

ginsan

|

|

November 25, 2023, 08:20:14 PM |

|

It is hard to always know what happened, but frequently if someone invests too much then they are expecting the price to go down and not prepared for it to go down, and surely there can be advantages to the BTC price going down, even if you had preferred for the price to go up, which is buying more when it goes down.

So it can take a long time to actually get ahead of your investment in order that the price is always coming to you rather than you going to the price, so if you just continue to buy in a DCA kind of way, that can be one way of getting ahead of the BTC price, even if it might take 2-3 years to actually get to a point that your cost per BTC is actually less than the current price. It is not guaranteed to happen, but so far anyone who persistently buys BTC, has been ending up getting into profits, even though sometimes it could take 2-3 years before the "being in profits" stage can actually end up happening.

A person who panics, and does not continue to buy but then sells and buys will likely NOT really get to any kind of stage in which his./her holdings is in front of the price.. and it seems such a simple strategy to merely just continue to buy (sure buying on the dip is fine, but buying at any price might well end up being fine in order to keep a person in the right kind of mindset of continuing to build the number of BTC that s/he has in his/her holdings and keeping some faith that that BTC is going to be profitable in the future.. even though it is not guaranteed, it has been a pretty good place to put money and likely to continue to be a good place to put money.

Is it a form of risk that accidentally becomes a burden on their minds so that they are unable to survive when the price of Bitcoin drops significantly? Indeed, investing large amounts of money or doing it all at once will affect their minds because they do not yet have a strong mentality when the situation turns around to what they expected. In that context, investors who start with the DCA strategy may be better prepared when the market situation changes suddenly because they can buy more BTC and those who are not mentally strong may be quite stressed by this situation. However, the essence of this point is of course that long-term investment planning requires many things that must be prepared in advance, such as being mentally ready to face all changes that occur at unexpected times. Being a loyal holder of Bitcoin requires strong mental strength to be able to carry out what has been previously planned. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 25, 2023, 08:36:01 PM |

|

It is hard to always know what happened, but frequently if someone invests too much then they are expecting the price to go down and not prepared for it to go down, and surely there can be advantages to the BTC price going down, even if you had preferred for the price to go up, which is buying more when it goes down.

So it can take a long time to actually get ahead of your investment in order that the price is always coming to you rather than you going to the price, so if you just continue to buy in a DCA kind of way, that can be one way of getting ahead of the BTC price, even if it might take 2-3 years to actually get to a point that your cost per BTC is actually less than the current price. It is not guaranteed to happen, but so far anyone who persistently buys BTC, has been ending up getting into profits, even though sometimes it could take 2-3 years before the "being in profits" stage can actually end up happening.

A person who panics, and does not continue to buy but then sells and buys will likely NOT really get to any kind of stage in which his./her holdings is in front of the price.. and it seems such a simple strategy to merely just continue to buy (sure buying on the dip is fine, but buying at any price might well end up being fine in order to keep a person in the right kind of mindset of continuing to build the number of BTC that s/he has in his/her holdings and keeping some faith that that BTC is going to be profitable in the future.. even though it is not guaranteed, it has been a pretty good place to put money and likely to continue to be a good place to put money.