fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 24, 2019, 12:19:58 PM |

|

R^2=99% is impressive. We know Bitcoin is digital gold, now we have the mathematical proof of it. “Cyber-money will no longer be denominated only in national units like the paper money of the industrial period. It probably will be defined in terms of ounces of gold.”

-The Sovereign Individual (1997) Davidson & Rees-Mogg

#bitcoin

https://twitter.com/100trillionUSD/status/1192032782912040960?s=20 https://twitter.com/100trillionUSD/status/1192032782912040960?s=20Very interesting reflection came out from this tweet: https://twitter.com/cclerici/status/11925482917975695361/..@100trillionUSD applied the SF on the BTC price measured in gold. This model has a mind blowing 99% r^2. One thing anyway puzzles me: I can think BTCUSD going parabolic because USD breaks down... but BTCXAU? Is BTC going to break gold too? Digital gold breaking physical gold? 2/... Gold has worked in real terms for centuries because it was the only SoV around. If another (better) SoV is found, then Gold would drop to his intrinsic (industrial) value. This can trigger some steep BTCXAU appreciation. This is my only explanation, but still I am puzzled. PlanB replied: Puzzles me too. It could be that btc will extract monetary premium from gold, and then stocks, real estate etc, but that is just my first thought. Very interesting! https://twitter.com/100trillionUSD/status/1192553080207945729This means that when/if Bitcoin will succeed as a SoV, all other inferior SoV will be stripped of that function, returning to their "industrial value". This is a real paradigm shift. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 09, 2019, 11:25:42 PM

Last edit: December 09, 2019, 11:44:15 PM by fillippone |

|

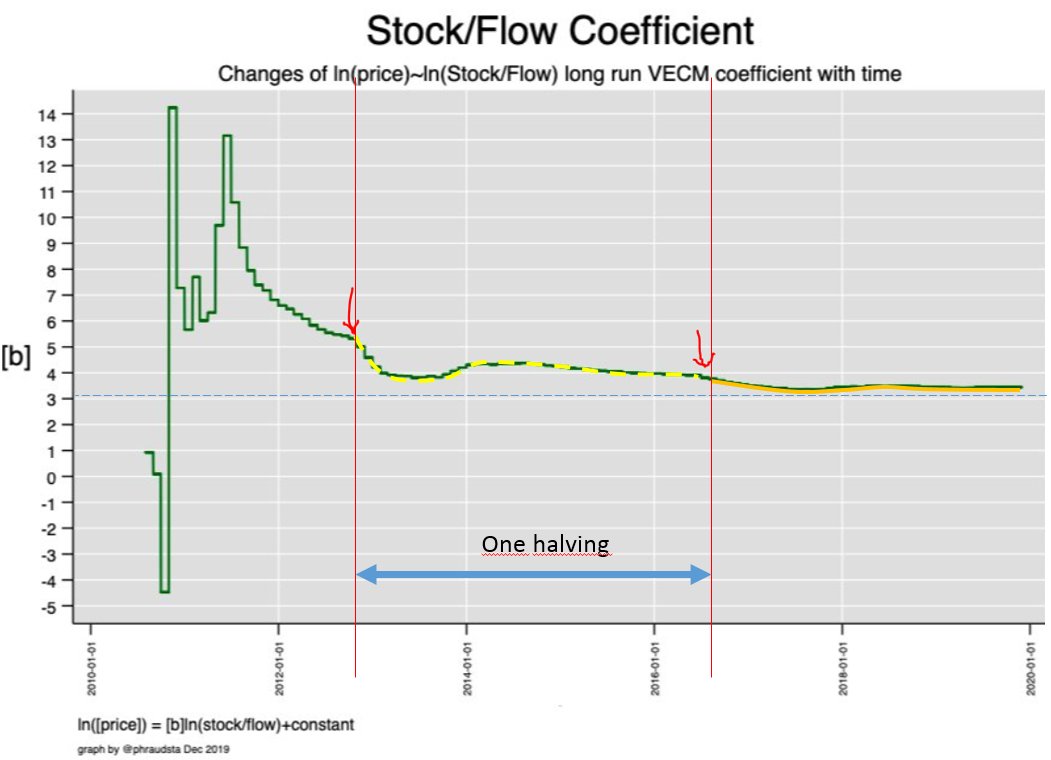

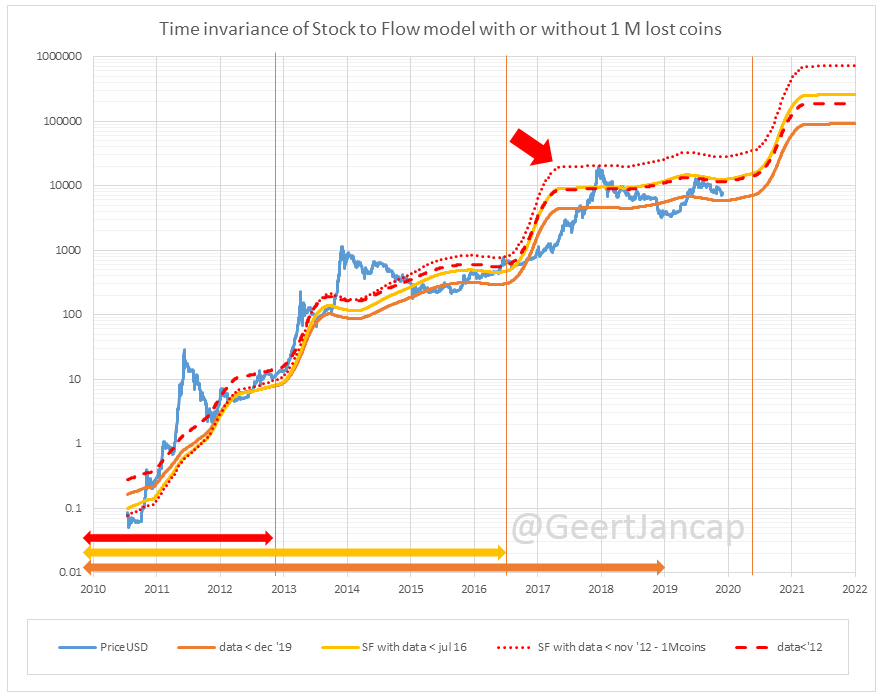

Another great tweet! We already knew parameters were stable in time, but this comes as a nice confirmation! So the biggest win today is that from now on, the 1 Million lost coins do nót have to be taken into account anymore. Because, even without discounting them, the model has been shown to have stabilizing coefficients. @phraudsta @BurgerCryptoAM @100trillionUSD   https://twitter.com/geertjancap/status/1204069538033209345?s=21 https://twitter.com/geertjancap/status/1204069538033209345?s=21Stable parameters while using different subset are adding robustness to the model. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 17, 2019, 01:27:44 PM

Last edit: December 17, 2019, 03:23:19 PM by fillippone Merited by JayJuanGee (1) |

|

Halving is a thing on Google Trends! Google Trends: Bitcoin Halving Refutes ‘Nonexistent’ Retail Interest  Bitcoin (BTC) investors and mainstream consumers are paying more attention to the cryptocurrency’s block reward halving in May 2020. According to data from Google Trends on Dec. 17, worldwide searches for “Bitcoin halving” have significantly increased in the course of 2019, over a year before the halving occurs. We see from the image the interest for halving has already surged: not only it has been more searched than the complete halving in 2016 (I guess the area below the line is already bigger), but also it is actually been rising since March, time of publication of PlanB article on Medium. The sad thing is: if halving is a well known fact bewteen investors, and probably this mean they know something about the SF model: why the is the price still struggling? Tuur Deemester doesn't seems to worried about this:

Nonetheless, the heightened profile of the halving in particular did not go unnoticed among analysts. Commenting on the data, Adamant Capital co-founder Tuur Demeester noted that many still perceive the halving as a Bitcoin price catalyst.

“It's very clear that retail interest in BTC is nonexistent and investor sentiment is pretty bad right now. Question is whether the halvening could provide a bullish narrative - the Google trends data imo suggests it could,” he wrote on Twitter on Tuesday.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 20, 2019, 06:10:23 PM

Last edit: May 16, 2023, 06:54:32 AM by fillippone Merited by JayJuanGee (1) |

|

Very nice presentation! Great explanation of bitcoin stock-to-flow model by Manuel Andersch of

@BayernLB

at the

@ValueOfBitcoin

conference

https://twitter.com/100trillionUSD/status/1208082599354208258?s=20 Bitconometrics and what‘s driving the Bitcoin price | Manuel Andersch Bitconometrics and what‘s driving the Bitcoin price | Manuel AnderschIn this presentation Manuel Andersch, Senior FX Analyst at BayernLB is discovering the path which leads to what he calls "bitconometrics". Working with different quantitative models to value Bitcoin he found the stock-to-flow ratio the most promising one and explains why. This presentation was performed during the Value of Bitcoin Lecture on December 11th 2019 in Munich - more information: https://vob-conference.comFollow the Value of Bitcoin Conference on Twitter - http://www.twitter.com/ValueOfBitcoin |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 20, 2019, 11:32:55 PM Merited by JayJuanGee (1) |

|

The sad thing is: if halving is a well known fact bewteen investors, and probably this mean they know something about the SF model: why the is the price still struggling? Because this isn't the only factor affecting price. We can't view the halving in a vacuum. Compared to 2016, the market is experiencing considerably higher volatility in the year preceding the halving. The August-November 2015 rally was only 150% and was followed by a 5-month tightly ranging correction. Compare that to the 350% rally seen earlier this year and the 6-month bloody correction that followed. This time around, there is more volatility in both directions. I think that's more a function of price feedback than any relationship to the halvings themselves. If the market goes on to mimic the April-June 2016 rally into next year's halving, that will be due to investors pricing in the halving. Put another way, it probably hasn't been priced in yet. We've still got 5 months before the event takes place. A lot can happen in that time. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 21, 2019, 09:51:51 AM

Last edit: December 21, 2019, 11:51:01 AM by fillippone Merited by JayJuanGee (1), babo (1) |

|

Because this isn't the only factor affecting price. We can't view the halving in a vacuum.

Well, one might well think this is true. The model has a R^2 coefficient of 95%. This means that SF2 Allow you to explain 95% of the price of BTC, while the factors different from S2F only account for 5%. So probably different factors are only temporary white noise (random news, only affecting the price in the short term) or a consequence of S2F (store of value, mass adoption, investment case). This is why I think this model is a paradigm shift in the valuation of bitcoin. PlanB analysed this objection in SLP #86:

PlanB: Yeah. I don’t know of course, but it’s an interesting point that the stock-to-flow multiple before we dive into that, let me say that the R-squared that I mentioned in the article, and that I mentioned just in the podcast, it’s not understood by everybody. So maybe I should talk a little bit about that. The R-squared is a goodness-of-fit measure. So it tells you how good the model fits the data, and an R-squared of, say, below 50 or 60% is not very good. It’s bad. It basically says there’s no fit. And a 100% R-squared means that you have a perfect fit, a perfect model, and you almost never see that because it’s a model. It’s not the reality. There is always some noise that disturbs it.

PlanB: So the 95% of the stock-to-flow model is really, really good. It shows that the relationship between stock-to-flow and value, and well the chance that it is caused by anything at all than stock-to-flow is close to zero. And a lot of people reject the stock-to-flow model because it doesn’t take into account things like demand or Forex and hacks, and economic news, and all that, but what would it add? It would only add like 5%, the missing 5%.

PlanB: We already have 95% good model. So in my opinion all those other factors even demand as important as it is, all those other factors are noise and stock-to-flow is the real signal that we have to keep focused on.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

Because this isn't the only factor affecting price. We can't view the halving in a vacuum.

Well, one might well think this is true. The model has a R^2 coefficient of 95%. This means that SF2 Allow you to explain 95% of the price of BTC, while the factors different from S2F only account for 5%. So probably different factors are only temporary white noise (random news, only affecting the price in the short term) or a consequence of S2F (store of value, mass adoption, investment case). This is why I think this model is a paradigm shift in the valuation of bitcoin. PlanB analysed this objection in SLP #86:

PlanB: Yeah. I don’t know of course, but it’s an interesting point that the stock-to-flow multiple before we dive into that, let me say that the R-squared that I mentioned in the article, and that I mentioned just in the podcast, it’s not understood by everybody. So maybe I should talk a little bit about that. The R-squared is a goodness-of-fit measure. So it tells you how good the model fits the data, and an R-squared of, say, below 50 or 60% is not very good. It’s bad. It basically says there’s no fit. And a 100% R-squared means that you have a perfect fit, a perfect model, and you almost never see that because it’s a model. It’s not the reality. There is always some noise that disturbs it.

PlanB: So the 95% of the stock-to-flow model is really, really good. It shows that the relationship between stock-to-flow and value, and well the chance that it is caused by anything at all than stock-to-flow is close to zero. And a lot of people reject the stock-to-flow model because it doesn’t take into account things like demand or Forex and hacks, and economic news, and all that, but what would it add? It would only add like 5%, the missing 5%.

PlanB: We already have 95% good model. So in my opinion all those other factors even demand as important as it is, all those other factors are noise and stock-to-flow is the real signal that we have to keep focused on.

I had also heard Plan B say that he largely believe that the model supports a much higher price but he is sticking with a more conservative description, and even with all of that, I still doubt that assertions of 95% explanatory factor of historical results would mean that predictive capacity is 95% or that anyone should be investing in bitcoin in terms of expecting 95% odds of the price reaching $50k to $100k in the next year to 18 months. In other words, there are forces with a lot of capital out there (banks and governments) that could have incentives and even means to attempt to cause the stock to flow model to be wrong in the short to medium term, even if they might not be able to negate it in the longer term. I would think that anyone who is investing in bitcoin based on feelings of surity that even approach anything more than 50/50 regarding some of the future performance expectations of bitcoin, even using stock to flow, might be gambling way too much with their wealth, including the employment of leverage and practices like that might be justified if assigning too high of probabilities to future events... even if they might end up getting it right. Don't get me wrong, I am quite content to have bullish models out there, like PlanB's, so I am not really consciously changing my BTC investment strategy, which might even be justified based on some of the seemingly attempts of greater certainty that seem to come from some of these kinds of charts that have decently high explanatory values regarding so far price performance and imply high value probabilities that the future will follow the models. I am still sticking with my recommendations that anyone still not in bitcoin should be putting 1% to 10% of their available investment assets into bitcoin and NOT be engaging in risky behavior in that direction in terms of making sure that the rest of their cashflow and other investments are in order. I do understand that sometimes there are going to be younger people who are just getting started in investing and sometimes when just getting started, there might be some justification to start with one investment at a time, and maybe in those kinds of circumstances, they would put it in bitcoin while understanding that their investment in bitcoin remains risky.... while at the same time having some of this asymmetric bet aspect to it, as long as they are not leveraging and NOT investing more than they can afford to lose in terms of their own prudent and mostly non-leveraging budgeting justifications. Also, regarding leveraging, don't get me wrong. I think that leveraging can be used to get rich faster than without it, but leveraging should only be used in conservative means in terms of not gambling with it, in my opinion, so it can be used to increase cashflow.. with very clear abilities to be able to pay it back without any major penalties or unreasonable rates.... |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 21, 2019, 08:51:18 PM |

|

Totally agree.

The post was only meant to clarify the assertion that many events impact BTC price in this model.

The numbers of the model do not agree with this view.

Then, a model is a simplification of reality “, hence those statements must be taken into account with due responsibility.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 21, 2019, 10:13:44 PM Merited by fillippone (1) |

|

Totally agree.

The post was only meant to clarify the assertion that many events impact BTC price in this model.

The numbers of the model do not agree with this view.

Then, a model is a simplification of reality “, hence those statements must be taken into account with due responsibility.

I think that the model is really great, and I like the 4 year fractal comparison model and the s-curve exponential adoption model and the 7 network effects model/which is also about adoption... . I just get a bit worried if people start to assign a 95% probability on investing in the future of bitcoin, in that kind of a price expectation model.. which I have already stated my concerns, and similar concerns can be made about the other models, which I like to point out the attributes of those kinds of BTC price/growth prediction models to shitcoin pumpers, bitcoin naysayers, bitcoin fence sitters no coiners and precoiners. Any of those bullish bitcoin models could end up causing a lot of rekkt regular peeps if they don't themselves engage in prudent self-tailored financial balancing. Surely, I am not criticizing your sharing of information related to this topic. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 22, 2019, 09:14:36 AM Merited by JayJuanGee (1) |

|

Because this isn't the only factor affecting price. We can't view the halving in a vacuum.

Well, one might well think this is true. The model has a R^2 coefficient of 95%. This means that SF2 Allow you to explain 95% of the price of BTC, while the factors different from S2F only account for 5%. No, it just means the long term price regression is a 95% fit to the model. BTC price rises significantly above and falls significantly below its long term regression at various times during its market cycles. You can have significant outliers in both directions without throwing off the regression very much, hence why the model is still a good fit. You are suggesting either - price will never deviate more than 5% from the model, or

- price will never deviate from the model more than 5% of the time

Neither assertion seems reasonable. What I'm saying doesn't contradict PlanB's point either. The whole point of using this model is that it already accounts for all fundamental factors. In fact, that's the logic underlying TA as well; it prices in all fundamentals. It's just that you're only considering today's price. We need to consider the decade-long price regression instead. I predict that people focusing too much on this model will sell way too low during the next bubble for the same reason. They won't account for how far price can overshoot the model. Also, it's important to keep in mind this model relies heavily on extrapolation. That R^2 value may decline significantly over time. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 22, 2019, 10:58:27 AM |

|

I might have been misunderstood, or I might have misunderstood what you earlier wrote.

I never suggested price couldn’t deviate from SF model price, of course this is an unreasonable statement.

What I said is exactly in the long term the SF explain 95% of the value.

Temporary deviation are of course possible, but these have to be considered... temporary.

PlanB be himself analysed those misalignment and also concluded they are skewed to the downside, meaning that SF is also underestimating the actual price.

The main point of the model, or the only point of the model, is that the only long term factor is SF. All other factors are irrelevant for the long term price.

I am not so certain about declining explaining power of the model in the future.

Firstly observing different time frame, or different sampling frequencies parameters and R^2 have demonstrated a very hush stability.

Secondly one version of the mode considers only monthly samples in the 2009-2012 period, so even BEFORE the first halving, has very similar projected price, parameters and R^2 than the full model.

So I have a good confidence that if the model has been stable over the last 10 years it can also be stable over the next 10 years.

Lastly, I am very little concerned about current price. All I wrote in this thread has to do for longer term price (I thought that was clear given the topic).

Nothing of what I wrote has to do with current price, hence nothing has to do with trading advice. Even if this had to be confused with trading advice: DYOR before doing anything.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 22, 2019, 11:33:23 AM |

|

I am not so certain about declining explaining power of the model in the future.

Firstly observing different time frame, or different sampling frequencies parameters and R^2 have demonstrated a very hush stability.

Secondly one version of the mode considers only monthly samples in the 2009-2012 period, so even BEFORE the first halving, has very similar projected price, parameters and R^2 than the full model.

So I have a good confidence that if the model has been stable over the last 10 years it can also be stable over the next 10 years. This says nothing about whether the extrapolation will hold true. Extrapolation is always subject to great uncertainty and is likely to produce meaningless results. I think we're all hoping the trend holds but 10 years is an exceedingly small data set. All we know is the model is a good fit given 10 years of data. Whether it holds true over 20 or 30 years is a very different question. Lastly, I am very little concerned about current price. All I wrote in this thread has to do for longer term price (I thought that was clear given the topic). I was referring to this comment: The sad thing is: if halving is a well known fact bewteen investors, and probably this mean they know something about the SF model: why the is the price still struggling?

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 22, 2019, 11:43:29 AM |

|

<...> All we know is the model is a good fit given 10 years of data. Whether it holds true over 20 or 30 years is a very different question.

10 years is a couple of halvings. In a couple of halvings price will be in the millions USD: this means something is going to break (BTC or USD, still to understand). I think nobody can predict what will happen in 20 years. I was referring to this comment: The sad thing is: if halving is a well known fact bewteen investors, and probably this mean they know something about the SF model: why the is the price still struggling?

I was referring to the fact that if SF model would be taken for granted there would not be point in NOT front run the first halving effect, or even the next ones). So probably either the investors aren’t actually aware of the SF model, or aren’t sure about his prediction, or a combination of those. So I was referring of the price being a few times undervalued, not a few hundreds dollars. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 22, 2019, 01:33:59 PM Merited by JayJuanGee (1) |

|

<...> All we know is the model is a good fit given 10 years of data. Whether it holds true over 20 or 30 years is a very different question.

10 years is a couple of halvings. In a couple of halvings price will be in the millions USD You're talking like BTC is guaranteed to follow the stock-to-flow model. It's not. If the model were guaranteed, the price would be exponentially higher than now. I was referring to this comment: The sad thing is: if halving is a well known fact bewteen investors, and probably this mean they know something about the SF model: why the is the price still struggling?

I was referring to the fact that if SF model would be taken for granted there would not be point in NOT front run the first halving effect, or even the next ones). So probably either the investors aren’t actually aware of the SF model, or aren’t sure about his prediction, or a combination of those. So I was referring of the price being a few times undervalued, not a few hundreds dollars. It still seems like you are focusing on today's price. Bitcoin's price markups are exponential and quite fast so it really doesn't matter if it's "a few times undervalued." We should fully expect price to remain both above and below the model for significant periods of time, just as it has throughout history. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 22, 2019, 02:03:30 PM |

|

I give up this conversation.

I think I made my points clear enough but you still point out things I didn’t mean.

Picking single (incomplete) sentences out of my context of the post don’t add value to the discussion.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 22, 2019, 03:48:49 PM Merited by fillippone (2) |

|

I give up this conversation.

I think I made my points clear enough but you still point out things I didn’t mean.

Picking single (incomplete) sentences out of my context of the post don’t add value to the discussion.

Don't give up fillippone. Keep posting. Sure you don't have to engage with exstasie, if you don't want to, but I don't think that he is trying to be hostile to you. He seems to merely be attempting to explain the limits of the model from his perspective, and framing what the model says in a way that is different from you. I find it interesting, too, about how much actual BTC prices might end up in fact deviating from the model, and some people will still proclaim that the model still applies (and they might or might not be correct). Surely, there are a lot of us, including myself, that agree that the model has a very high explanatory value, and even though I don't really understand the math, exactly, I have no real reason to dispute the 95% R^2 value is either correct, or damn close to being in the ballpark of correct. It can go back a little to the point that I mentioned earlier regarding how much status quo institutions banks and governments might want to fight the momentum of the truth of the dynamics of the model to either make the model become untrue or to make it appear to be untrue. Likely the stronger the strength of the model, the more likely powerful status quo cannot either get the model to break or get it to appear to be untrue for a very long period of time... because the more that the model is close to being true in terms of past facts and likelihood that past facts are going to apply to future world dynamics, the more accurate of an explanation it is regarding both the past and the future and the more likely the BTC price is going to gravitate towards the mean that is in the future aspect of the model.. whether fucktwat manipulators want the btc price to gravitate in that direction or not. We will see... we will see. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

December 22, 2019, 04:18:34 PM

Last edit: December 22, 2019, 05:02:02 PM by Last of the V8s |

|

https://youtu.be/R6k5cmdscfg Bitconometrics and what‘s driving the Bitcoin price | Manuel Andersch https://youtu.be/K2s2afJC5v4 Why Stock to Flow and Market Capitalization Co-Integration only works with Bitcoin | Jörg Hermsdorf both videos from the Value of Bitcoin Conference some months back, but recently uploaded. edit whoops!

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 22, 2019, 04:59:43 PM |

|

https://youtu.be/R6k5cmdscfg Bitconometrics and what‘s driving the Bitcoin price | Manuel Andersch https://youtu.be/K2s2afJC5v4 Why Stock to Flow and Market Capitalization Co-Integration only works with Bitcoin | Jörg Hermsdorf both videos from the Value of Bitcoin Conference some months back, but recently uploaded. Thank you! First video was posted here above on this very page, the second one is very interesting! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

December 22, 2019, 05:14:59 PM |

|

I read up to this point: Bitcoin has unforgeable costliness, because it costs a lot of electricity to produce new bitcoins And it was enough for me to stop reading any further. It is utility that gives value to something, not its cost of production. No matter how much one bitcoin is worth in terms of production costs (electricity, time, effort, etc), if it loses its utility (right now mostly as a vehicle of speculation, and as a store of value, to a degree), its price will be zero, and no amount of scarceness will be able to fix it. In simple terms, when someone talks about scarcity without referencing utility at the same time, they are likely not very competent in economic matters So value comes through utility, and scarcity adds a price tag to it |

|

|

|

|

tartibaya

|

|

December 22, 2019, 09:08:22 PM |

|

Friends Gold production cost is low? Or how other mines are produced. Bitcoin production is very costly and needs to be found as an alternative. However, only for this reason the use of bitcoin will not stop. I think a new structure will be created with LN.

|

|

|

|

|

|