acquafredda

Legendary

Offline Offline

Activity: 1316

Merit: 1481

|

|

December 11, 2020, 08:42:11 AM |

|

Maybe Michael Saylor sees this as a challenge. He might be thinking that because he was the one to start all this then he needs to be leading the one and only company which is going crazy about bitcoin.

Honestly, I do not know if he is a sort of dictator who is surrounded by yes men but the amount of power that requires doing what he is doing must be very high.

One day he will be either recognized as somebody who made MSTR super wealthy or a fool. I do not think there can be a middle ground.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You can see the statistics of your reports to moderators on the "Report to moderator" pages.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 11, 2020, 09:57:24 AM

Last edit: May 16, 2023, 12:53:45 AM by fillippone Merited by JayJuanGee (1) |

|

Maybe Michael Saylor sees this as a challenge. He might be thinking that because he was the one to start all this then he needs to be leading the one and only company which is going crazy about bitcoin.

Honestly, I do not know if he is a sort of dictator who is surrounded by yes men but the amount of power that requires doing what he is doing must be very high.

One day he will be either recognized as somebody who made MSTR super wealthy or a fool. I do not think there can be a middle ground.

There is no need to be a dictator when you own almost all the CLASS B shares that gives you 10X the voting power.  When you own the 67% of the voting rights in the firm, you can basically do whatever you want. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

tbterryboy

|

|

December 11, 2020, 05:11:34 PM |

|

I can't believe they keep buying more and more from these prices as well. I just think that bitcoin is not at a price where I would be willing to buy thousands of it right now, they did a great job by buying very early on before this bull run started and that makes sense, I would understand it if they bought more of it early on as well, but looking at the situation right now, it is very high and I doubt it would worth this much that easily.

In any case I would have to say they are brave for buying this many this early, I just think best course of action for them would be not buy more, not sell , and just keep holding the ones they have, that way they could get a lot better profits in the future, if they keep buying from higher price they could increase their averages to a less wanted price.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 11, 2020, 05:27:52 PM

Last edit: December 11, 2020, 05:40:03 PM by fillippone Merited by JayJuanGee (1) |

|

I cannot even keep track of their intentions. They started with a 400 millions issue, then 550, but apparently they ended up with 650 millions: MicroStrategy Completes $650 Million Offering of 0.750% Convertible Senior Notes Due 2025YSONS CORNER, Va., December 11, 2020 — MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy”) today announced the closing of its previously announced offering of 0.750% convertible senior notes due 2025 (the “notes”). The aggregate principal amount of the notes sold in the offering was $650 million, which includes notes issuable pursuant to an option to purchase, within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $100 million aggregate principal amount of the notes granted to the initial purchaser of the notes, which the initial purchaser exercised in full on December 9, 2020 and which additional purchase was also completed today. The notes were sold in a private offering to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).

This means a potential to up to 36,000 BTC! Context: Negative Yielding Bonds hit 18 Trillions Worldwide.

100% possibility to lose money if held to maturity.

BTC is the only hedge against this.

#phase5  https://twitter.com/fillippone1/status/1337447410654728194?s=20 https://twitter.com/fillippone1/status/1337447410654728194?s=20 |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 11, 2020, 06:29:25 PM |

|

Maybe Michael Saylor sees this as a challenge. He might be thinking that because he was the one to start all this then he needs to be leading the one and only company which is going crazy about bitcoin.

Honestly, I do not know if he is a sort of dictator who is surrounded by yes men but the amount of power that requires doing what he is doing must be very high.

One day he will be either recognized as somebody who made MSTR super wealthy or a fool. I do not think there can be a middle ground.

You gotta admit, acquafredda, that you do have a wee bit of a tendency to phrase matters in terms of extremes. Sure Saylor is being bold as fuck.. and maybe even getting a lot of attention for recent pumpenings in the bitcoin price, but it is quite likely that bitcoin gives little to no shits about these pumpenings and it may well have been inclined to pump anyhow.. Sure, it does not hurt that we seem to be getting a bit of institutional fomo from some of the BIG players that Saylor seems to be poking and prodding and acting a bit outrageous, and even getting some backlash from longer term BTC bulls. Actually Saylor seems to be serving as a kind of angel whale that many of us were wishing for through much of 2015, 2016 and even into 2017.. and we seem to be getting such a figure this time, when such figure(s) were either absent or silent in the 2015-2017 bullrun. Lucky for us HODLers... and if you either sold too early, waiting on the fence or failed and refused to put in enough BTC because you are overly bearish about the ramifications of these kinds of bold measures, then too bad for you... you snooze you lose... hahahahahaha They are just using bitcoin as an investment plan as many people do with GOLD. We have seen how news can crash a market in a short time.No matter his claim is true or not but now his single tweet can create panic in the market. These are some institutions that will be responsible for the future mega dump of the market.

Maybe maybe not. Don't let these kinds of fears cause you to either sell to early, sit on the fence or fail/refuse to buy enuff BTC to pee pare ur lil selfie for UPpity. I can't believe they keep buying more and more from these prices as well. I just think that bitcoin is not at a price where I would be willing to buy thousands of it right now, they did a great job by buying very early on before this bull run started and that makes sense, I would understand it if they bought more of it early on as well, but looking at the situation right now, it is very high and I doubt it would worth this much that easily.

Saylor has provided a very articulated case for why he is buying now, and if you are attempting to compare $20k now to $20k in 2017, you may well be failing and or refusing to account for the passage of three years and other aspects of bitcoin including its most compelling current price prediction models. In any case I would have to say they are brave for buying this many this early, I just think best course of action for them would be not buy more, not sell , and just keep holding the ones they have, that way they could get a lot better profits in the future, if they keep buying from higher price they could increase their averages to a less wanted price.

You seem to be thinking quite small tbterryboy... and not really putting yourself in the kind of cash rich position that Saylor and his company finds itself in... So even though Saylor seems to be being bold, he is merely considering ways to attempt to preserve cash value while being a bit public about it and probably he has to be a bit public about it, unless he were to be able to convert his public company to a private company. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 11, 2020, 07:38:49 PM |

|

Honestly, I hope Microstrategy completes these leveraged buys and then BTC immediately crashes 40%.  That's the kind of test this guy needs. Everything is hunky-dory while the market is trending up. Let's see what happens to that exuberance, and how MSTR's shareholders feel, when Bitcoin brutally shakes the trees as it historically always has and people begin to question his price predictions. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 11, 2020, 07:54:47 PM |

|

Honestly, I hope Microstrategy completes these leveraged buys and then BTC immediately crashes 40%.  Surely would be a decent test of their resolve if such a thing were to happen, because there does seem to be a bit of arrogance in a kind of presumed idea that Saylor might believe that that much money might be able to pump BTC.. but I am not even sure if he is actually trying to pump BTC's price, even if that is what people try to attribute to his motives. That's the kind of test this guy needs. Everything is hunky-dory while the market is trending up. Let's see what happens to that exuberance, and how MSTR's shareholders feel, when Bitcoin brutally shakes the trees as it historically always has and people begin to question his price predictions.

If it is a quickie correction, then that might already be accounted for, and it does not seem likely to have a long dip.. but hey, nothing is guaranteed in bitcoinlandia.. and Saylor's timing might really be such that he will not suffer such a test of his resolve... even if you, exstasie, are wishing such bad fortune's upon him.      |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 12, 2020, 06:27:14 AM |

|

Hahahahaha

I agree with a lot of what you were saying jaysabi, and I was about to send you a merit for outlining the situation like that, until you started beating up upon so called "bitcoin maximalists."

I don't know that I'm "beating up on them" unless identifying their motivation to believe what they believe is beating up on them. If you disagree, say why. I note that you only seemed to disagree but didn't say what in my assessment made it wrong in your opinion. I'll hear it out. I already said what I was going to say.. it was my response, and I believe that I backed it up or explained myself sufficiently. You do not need to agree (and of course, it appears that you do not). I'm just trying to square what the maximalists say vs. what their actions would show if they were true believers. Because if you were convinced that bitcoin was going to make you rich, like guaranteed rich, and it was only a matter of time, you would want to be buying as much as you can at as low of a price as you can.

Not necessarily. The future is based on a series of probabilities, and also individuals have cashflow concerns as well. Sure some people might be able to lump sum invest, but others are better able to manage their investments by figuring out their individual circumstances and then dollar cost averaging and attempting to reach their investment target with the passage of time - and hopefully as their wealth (or net worth) increases. That would require NOT spreading the gospel to keep the price as low as possible for as long as possible.

Maybe, maybe not. People have all kinds of ways of communicating their own strategies and their beliefs. But that's not what they're doing, so then I try to figure out why they're evangelizing if it's against their own economic interests if they're such true believers, and the conclusion I've reached is the one I already stated.

Your further explanation sounds more crazy than your earlier post. i was all with you on the overall theory until you got into specifics. Perhaps I find that you are trying to lump too many people into some kind of similar category. It's not about being right, it's about convincing others they're right because that's the only thing that sustains or increases the price. I see the same behavior and motivations with short sellers. Being "right" about their bet isn't the point, what causes price movements is other people agreeing they're right. That does not mean to say that I think bitcoin holders are in a desperate situation, as you characterized my point, so let me dispel that notion. I'm only making a comment on motivation and likening it what I see in other (non-bitcoin) markets, because no matter the medium (bitcoin, stocks, etc.), economic motivation dictates actions.

There is some truth in what you are saying, but still seems like you are trying to take one angle too far when price is affected by a multitude of factors, including some of the ones that you are pointing out. I don't feel that I need to say anything more than what I have already said on this particular topic... at least not at this point. It's nearly impossible to have a spirited discussion with you because it's never clear you're understanding my point you're responding to (which could entirely be my fault for expressing it horribly!) but also because your responses are so vague and abstract that further response wouldn't be intelligible. For example, You: "Maybe, maybe not. People have all kinds of ways of communicating their owns strategies and their beliefs." I know what this means generally, but how does this respond specifically to the very specific point I'm raising to which you are responding? That being, that if you think Bitcoin is going to the moon, how does having it go to the moon NOW benefit you in the long term when keeping the price as low as possible so you can buy as much as possible over time would ultimately result in you having far more money in the future? This specifically is what I'm talking about when I say that the "evangelists" are working against their own economic interests if they actually believe what they say. Earlier mass adoption = higher prices sooner = less bitcoin you could have bought at cheaper prices = less future money for you. This is a very specific premise I've raised, so how is the vague response you answered with even addressing the premise? Without a specific example to illustrate your counterpoint, it looks like you're just dismissing it without a basis for it. I don't mean to be rude, I just can't have a conversation about such vague ideas when it's clear we're both talking past each other. |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 12, 2020, 06:58:23 AM |

|

Honestly, I hope Microstrategy completes these leveraged buys and then BTC immediately crashes 40%.  That's the kind of test this guy needs. Everything is hunky-dory while the market is trending up. Let's see what happens to that exuberance, and how MSTR's shareholders feel, when Bitcoin brutally shakes the trees as it historically always has and people begin to question his price predictions. From the perspective of spectacle, this would be would be fascinating to see his demeanor and the tone of his messaging through such an ordeal, especially one that persists for a stretch of time. I would also be interested to see the MSTR investor response seeing as how 1) they have very little recourse with so little control of the company, and 2) I would say that the risks of investing in MSTR stock have been adequately disclosed to them through SEC filings at this point that nobody buying MSTR has a reasonable basis to say they weren't aware of the risk bitcoin volatility played in the stock valuation. I don't think that an actionable claim could be established as long as they continue to disclose those risks prominently, although I do think that a shareholder lawsuit would present enough trouble to the company that settling would be the most likely result rather than trying to litigate it out. But on this second point, this is far, FAR from the reality at this point. It would take a hard crash that persists for several quarters that really drags on the stocks value before this ever enters the realm of possibility. Maybe Michael Saylor sees this as a challenge. He might be thinking that because he was the one to start all this then he needs to be leading the one and only company which is going crazy about bitcoin.

Honestly, I do not know if he is a sort of dictator who is surrounded by yes men but the amount of power that requires doing what he is doing must be very high.

One day he will be either recognized as somebody who made MSTR super wealthy or a fool. I do not think there can be a middle ground.

There is no need to be a dictator when you own almost all the CLASS B shares that gives you 10X the voting power.  When you own the 67% of the voting rights in the firm, you can basically do whatever you want. Lol, I would posit that owning 67% of the voting rights of the firm and having the ability to do whatever you want is exactly the definition of a dictator. Whether or not you think he's a benevolent dictator is another matter, but still a dictator by definition.  |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 12, 2020, 07:08:59 AM |

|

Hahahahaha

I agree with a lot of what you were saying jaysabi, and I was about to send you a merit for outlining the situation like that, until you started beating up upon so called "bitcoin maximalists."

I don't know that I'm "beating up on them" unless identifying their motivation to believe what they believe is beating up on them. If you disagree, say why. I note that you only seemed to disagree but didn't say what in my assessment made it wrong in your opinion. I'll hear it out. I already said what I was going to say.. it was my response, and I believe that I backed it up or explained myself sufficiently. You do not need to agree (and of course, it appears that you do not). I'm just trying to square what the maximalists say vs. what their actions would show if they were true believers. Because if you were convinced that bitcoin was going to make you rich, like guaranteed rich, and it was only a matter of time, you would want to be buying as much as you can at as low of a price as you can.

Not necessarily. The future is based on a series of probabilities, and also individuals have cashflow concerns as well. Sure some people might be able to lump sum invest, but others are better able to manage their investments by figuring out their individual circumstances and then dollar cost averaging and attempting to reach their investment target with the passage of time - and hopefully as their wealth (or net worth) increases. That would require NOT spreading the gospel to keep the price as low as possible for as long as possible.

Maybe, maybe not. People have all kinds of ways of communicating their own strategies and their beliefs. But that's not what they're doing, so then I try to figure out why they're evangelizing if it's against their own economic interests if they're such true believers, and the conclusion I've reached is the one I already stated.

Your further explanation sounds more crazy than your earlier post. i was all with you on the overall theory until you got into specifics. Perhaps I find that you are trying to lump too many people into some kind of similar category. It's not about being right, it's about convincing others they're right because that's the only thing that sustains or increases the price. I see the same behavior and motivations with short sellers. Being "right" about their bet isn't the point, what causes price movements is other people agreeing they're right. That does not mean to say that I think bitcoin holders are in a desperate situation, as you characterized my point, so let me dispel that notion. I'm only making a comment on motivation and likening it what I see in other (non-bitcoin) markets, because no matter the medium (bitcoin, stocks, etc.), economic motivation dictates actions.

There is some truth in what you are saying, but still seems like you are trying to take one angle too far when price is affected by a multitude of factors, including some of the ones that you are pointing out. I don't feel that I need to say anything more than what I have already said on this particular topic... at least not at this point. It's nearly impossible to have a spirited discussion with you because it's never clear you're understanding my point you're responding to (which could entirely be my fault for expressing it horribly!) but also because your responses are so vague and abstract that further response wouldn't be intelligible. Well that's too bad. I guess. For example, You: "Maybe, maybe not. People have all kinds of ways of communicating their owns strategies and their beliefs." I know what this means generally, but how does this respond specifically to the very specific point I'm raising to which you are responding?

It is probably not as difficult to figure out as you are trying to make it out to be. That being, that if you think Bitcoin is going to the moon, how does having it go to the moon

I doubt that I said that bitcoin is going to the moon. But I did say that there are three great current bitcoin price prediction models namely: stock to flow, 4 year fractal and s-curve exponential adoption based on metcalfe principles and networking effects. The ideas behind those models should be accounted for. NOW benefit you in the long term

I am already benefiting from bitcoin, so I look at that 208 week moving average which is at about $7,200, and it is quite a bit into my fuck you status territory.. so I am good in this range and if BTC prices go up, I am even MOAR better. when keeping the price as low as possible so you can buy as much as possible over time would ultimately result in you having far more money in the future?

sure.. people who are accumulating might think that way. I am not in a BTC accumulation phase. I am largely in maintenance, and I could be in liquidation if I wanted, but I am not really in a rush for that, either. This specifically is what I'm talking about when I say that the "evangelists" are working against their own economic interests if they actually believe what they say.

Good for you. If you are attempting to make a point, then probably you need to be specific in some regards. Earlier mass adoption = higher prices sooner = less bitcoin you could have bought at cheaper prices = less future money for you.

Are we talking about the future? or the past? I am more about going with it is rather than trying to prescribe some kind of desired direction.. just go with the flow and figure out ways to profit from that. This is a very specific premise I've raised, so how is the vague response you answered with even addressing the premise?

If we are talking about what someone who is considering getting into bitcoin should do, then first they should figure out their situation and then try to stack sats and accumulate until they reach their targets. Bitcoin does not give any shits if you want it to go up or down.. you just have to do your best based on what you believe might happen and what you believe your situation to be and how you can maneuver your own situation in order NOT to over extend yourself financially or psychologically. Without a specific example to illustrate your counterpoint, it looks like you're just dismissing it without a basis for it.

Well if you are trying to make some kind of point, then back it up. I think that I said whatever I was going to say already. I don't mean to be rude, I just can't have a conversation about such vague ideas when it's clear we're both talking past each other.

Ok. we can pause for now, until you say something again that might cause me to respond. Then I will respond, if I so choose. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 12, 2020, 10:33:22 AM |

|

A couple of very interesting tweet from Micheal Saylor: Michael Saylor (@michael_saylor) Tweeted: MicroStrategy is not an investment company (IC) per the 1940 Investment Co. Act. An IC is a co. that invests ≥ 40% of assets (less cash & govt securities) in “securities”. Per the SEC, #BTC isn’t a security. Ergo, holding BTC doesn’t cause MicroStrategy to become an IC.

https://twitter.com/michael_saylor/status/1337556620839165952?s=20MicroStrategy is not an ETF/ETP. ETFs & ETPs exist to invest in stocks, bonds or commodities – they’re investment companies per ’40 Act. Like Apple & Microsoft, MicroStrategy is an operating company traded on a stock exchange. We just happen to hold BTC in our treasury reserves.

https://twitter.com/michael_saylor/status/1337556890742624259?s=20This is a weird statement in my opinion. Who is the recipient of this message? The public? The regulators? Oh, speaking of regulators: they are a weird bunch of people. Regulators be like...  I think MicroStrategy is walking on a fine line. I don’t know if the first action will be taken by regulators of the shareholders, even assuming they can do anything with the 33% of voting powers. Anyway it will be interesting when BTC moons and the total BTC investment will be more than 40% of total assets. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

BTCappu

Member

Offline Offline

Activity: 516

Merit: 38

|

|

December 12, 2020, 05:28:06 PM |

|

They have also bought some ethereum as well, they are really going all in with crypto and that is something great for all of us. If these huge companies trust bitcoin and crypto enough to put all their money into crypto, who are we to judge their move and not make the same thing?

I am still increasing my portfolio and going in, even at this high price I am not going to change anything at all and will keep investing into crypto for a while more, that is the only method I know how to make money in this world (crypto world) and these huge companies doing the same thing gives me courage to continue since that just means they are doing this with hundreds of millions of dollars and if they are willing to risk that much they must know something is going great in crypto and I trust them.

|

|

|

|

acquafredda

Legendary

Offline Offline

Activity: 1316

Merit: 1481

|

|

December 12, 2020, 05:41:38 PM Merited by fillippone (2) |

|

I can easily admit I am an extremist as I tend to simplify the world into black or white. I hate the shades of gray.

The MicroStrategy/Michael Saylor saga is very entertaining and I am getting more and more curious about what the guy wants to do.

What is his final goal? That is what I would like to understand. Is he really so into bitcoin that he wants to demonstrate something to his world? I cannot get it, I am wrapping my head around it.

Therefore I go back to my B/W world and say again that MSTR will either go nuts or parabolic. We shall see.

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 13, 2020, 01:48:34 AM Merited by fillippone (2) |

|

They have also bought some ethereum as well, they are really going all in with crypto and that is something great for all of us. If these huge companies trust bitcoin and crypto enough to put all their money into crypto, who are we to judge their move and not make the same thing?

I am still increasing my portfolio and going in, even at this high price I am not going to change anything at all and will keep investing into crypto for a while more, that is the only method I know how to make money in this world (crypto world) and these huge companies doing the same thing gives me courage to continue since that just means they are doing this with hundreds of millions of dollars and if they are willing to risk that much they must know something is going great in crypto and I trust them.

Are you making shit up based on hopium, BTCappu? I know that there is a lot of attempts to convolute bitcoin into crypto to try to pump some kind of other nonsense... or to try to suggest that other cryptos are the same as bitcoin.. just to confuse people or to pump some kind of shit ideas and shit ways of failing/refusing to differentiate bitcoin. I thought that Michael Saylor gets bitcoin, and he is not going to get distracted by such nonsense or even dilution of the sound money concepts that are provided through bitcoin.. and other projects merely try to fake their way.. to scam people out of their money or to get their bitcoins. Show me some kind of proof that Saylor and Microstrategy is buying a piece of shit like ethereum or any other crypto besides bitcoin? If I may try to give you some benefit of the doubt, you must be mixing up microstrategy with something else. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 13, 2020, 11:25:51 AM |

|

They have also bought some ethereum as well

<...>

<...> Show me some kind of proof that Saylor and Microstrategy is buying a piece of shit like ethereum or any other crypto besides bitcoin? I second that request made by @JJG. I think I followed MicroStrategy case quite well, but I missed that part. I did more than JJH and I actually actively researched the topic, but I didn’t find anything. I even searched if instead Microstrategy, it was Micheal Saylor holding Ethereum, but I couldn’t find anything either. We are here to exchange opinions and idea, to ultimately learn. We are not here to spread unsubstantiated news, without any reference. Please, be more respectful of the other users. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

LittleBitFunny

Full Member

Offline Offline

Activity: 1428

Merit: 129

The first decentralized crypto betting platform

|

|

December 13, 2020, 02:00:19 PM

Last edit: December 13, 2020, 02:18:14 PM by LittleBitFunny Merited by JayJuanGee (1) |

|

They have also bought some ethereum as well

<...>

<...> Show me some kind of proof that Saylor and Microstrategy is buying a piece of shit like ethereum or any other crypto besides bitcoin? ~ I think I followed MicroStrategy case quite well, but I missed that part. I did more than JJH and I actually actively researched the topic, but I didn’t find anything. I even searched if instead Microstrategy, it was Micheal Saylor holding Ethereum, but I couldn’t find anything either. Although @JJG is a little more sensitive about Bitcoin and spoke a little rude language. But, he told the truth, every altcoin and online project uses the name Bitcoin to promote themselves. The main purpose of these coins is to motivate our eye from bitcoin to the other side. Many times investors are attracted to the fake pump of these coins and get caught by investing. This creates a misconception in their minds about Bitcoin. |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

December 13, 2020, 08:11:45 PM |

|

They have also bought some ethereum as well

<...>

<...> Show me some kind of proof that Saylor and Microstrategy is buying a piece of shit like ethereum or any other crypto besides bitcoin? I second that request made by @JJG. I was looking into this. Couldn't find any connection between Microstrategy and Ethereum. However, I did stumble onto something interesting. A publicly traded Canadian investment company ("Ether Capital Corp") that is supposedly raising $125 million to pile into ETH: https://twitter.com/RyanSAdams/status/1336376827921707012They only had $14 million in assets as of their Q3 report, but if the $125M rumors are true, that's a big chunk of change for Ethereum: https://www.bloomberg.com/quote/ETHC:CN |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 14, 2020, 02:58:28 PM |

|

They have also bought some ethereum as well

<...>

<...> Show me some kind of proof that Saylor and Microstrategy are buying a piece of shit like ethereum or any other crypto besides bitcoin? I second that request made by @JJG. I was looking into this. Couldn't find any connection between Microstrategy and Ethereum. However, I did stumble onto something interesting. A publicly traded Canadian investment company ("Ether Capital Corp") that is supposedly raising $125 million to pile into ETH: https://twitter.com/RyanSAdams/status/1336376827921707012They only had $14 million in assets as of their Q3 report, but if the $125M rumors are true, that's a big chunk of change for Ethereum: https://www.bloomberg.com/quote/ETHC:CNThe world is a strange place. I cannot follow everyone's perversion. If someone wants to give 125 Million to a 14 Million total asset obscure firm, this can not end well. But this isn't either something am surprised of and I will care about. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 16, 2020, 03:42:02 PM |

|

Micheal Saylor made a very interestibg tweet, regardin his investment thesis: Gradually then suddenly, thoughtful investors will realize that the riskiest decision they can make is to ignore or under-allocate to #Bitcoin BTC. A decision to invest 1% in #BTC BTC is a decision to underperform, increase risk, or destroy wealth in the other 99% of the portfolio. Asset Class Returns over the Last 10 Years... Data via @ycharts  This tweet echoes another one from PlanB, curiously retweeted a few hours earlier: Bitcoin has not alternatives in a diversified portfolio: #bitcoin BTCoutperforms ALL other assets: more return AND less risk (yes you read that correctly "less risk")  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15464

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 18, 2020, 07:45:35 PM

Last edit: May 16, 2023, 12:51:24 AM by fillippone |

|

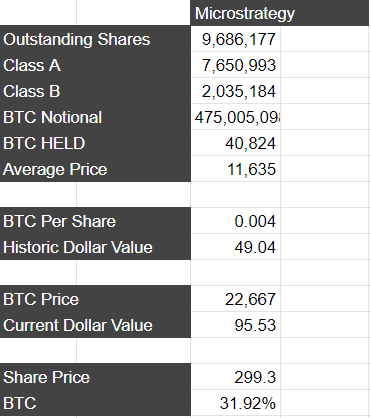

A low effort Tweet hit my Twitter: MicroStrategy now holds 40,824 bitcoins worth $797 million. MSTR has now made $322 million on the cumulative $475 million it invested in #Bitcoin Messari  I think Messari could do some more analytical work on Microstrategy hodling, as per the analysis they published Fillippone Spreadsheets are more than enough! From my Spreadsheets: This is the Recap Of Microstrategy's Buys:  They are now 96% in the money, impressive! Here we have a back of the envelope computations of their ETF transformation:  Basically, Each Share now contains 95 USD in Bitcoin. As a single share of Microstrategy is worth 255 USD, basically this means they are a 32% Bitcoin ETF! Also this is impressive! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|