Zlantann

Legendary

Offline Offline

Activity: 854

Merit: 1005

|

|

August 03, 2022, 12:58:47 AM Merited by JayJuanGee (1) |

|

MicroStrategy is going through both administrative and financial repositioning to be able to face current realities. According to reports splitting the roles of Chairman and CEO will enable the company to effectively pursue its two corporate strategies of acquiring and holding bitcoin and growing their enterprise analytics software business. As Executive Chairman Micheal Saylor will be able to focus more on bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations. Another administrative restructuring is appointing Andrew Kang in May this year as the new Chief Financial Officer. Andrew is more financially grounded or experienced than the former CFO Phong Le who is more administratively sound. Like you rightly predicted @fillippone about the financial report. The report is not as bad as I assumed it would be. Although last year's second quarter financial position was better than this year in some areas but the report shows that the company is still solid considering that MicroStrategy has a long-term time horizon. And the firm's core business is insulated from near-term bitcoin price volatility because it has sufficient liquidity to cover interest payments and has no near-term debt maturities. The Company still remains one of the biggest believer and supporter of Bitcoin holding about 129,699 bitcoins acquired for a total cost of $4 billion, or $30,664 per bitcoin with zero interest to sell them. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

|

|

|

|

|

|

Even in the event that an attacker gains more than 50% of the network's

computational power, only transactions sent by the attacker could be

reversed or double-spent. The network would not be destroyed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

348Judah

|

|

August 03, 2022, 11:53:46 AM |

|

Micheal Saylor is stepping down as CEO. He will retain the Chairman title: Here's another opportunity for microstrategy to reposition its new strategies by the reorganization of it board of executive members, i like the action taken by Michael Saylor, here he creates more opportunities for the interest of the company in creating room for Phong Le to participate in giving his qota, i know definitely that Phong Le will perform better even than he has been giving when he was the president. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

aylabadia05

|

|

August 03, 2022, 03:18:57 PM |

|

When I read through to the end one of the articles related to the change in the position of CEO of MicroStrategy from Michael Saylor to Phong Le, it was a really good step in my opinion in an effort to maintain the sustainability of the MicroStrategy company. After 33 years, Michael Saylor giving up CEO to Phong Le is certainly surprising because Phong Le is so far not well known among the crypto community. Michael Saylor is known to be very vocal in fighting for Bitcoin rather than the products of his own company as mentioned in the article. Hopefully the change in CEO position from Michael Saylor to Phong Le can have a good impact. Source: https://coinmarketcap.com/alexandria/article/coinmarketcap-news-august-3-michael-saylor-the-new-ceo-of-bitcoin |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15450

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 05, 2022, 12:46:07 PM |

|

Recently, MicroStrategy has been doing very badly, all reports were with large losses, and skeptics of MicroStrategy's bitcoin strategy have increasingly chosen short positions on the company's shares.

Microstrategy price is now only a function of BTC price. They are basically a dead company with no real products. Microstrategy is the next Berkshire Hataway. In 40 years time, nobody will remember when Microstrategy used to sell software (do you remember when Berkshire Hataway used to manufacture textiles products?). |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10210

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 06, 2022, 02:09:14 PM |

|

Micheal Saylor stepped down as CEO. There was a feeling that, as a manager, he was bad and this had been dragging on for him for a long time, since 2000, when he bankrupted MicroStrategy.

For sure, you are reading way too much into this matter, and perhaps even failing/refusing to recognize/appreciate the more obvious explanation in regards to the likely practical need for Saylor to sever off (and delegate) various CEO responsibilities of the software aspect of the MSTR operations to someone that he trusts (referring to Phong Le) - which likely frees up Saylor to NOT have to think about various aspects of that part of MSTR's business. Recently, MicroStrategy has been doing very badly, all reports were with large losses, and skeptics of MicroStrategy's bitcoin strategy have increasingly chosen short positions on the company's shares.

Anyone who actually has some kind of studying of bitcoin and with even half of a brain can appreciate that short-term reflections on MSTR's balance sheet has a lot of potential to mislead folks into understanding the strengths of MSTR's current position - even if it is NOT looking so wonderful on itsQuarterly balance sheets.  But here Micheal Saylor recently published an infographic of the dynamics of the company's stock since they began to support the bitcoin strategy and the numbers there turned out to be better than many blue chips. Sure, it provides another way of looking at the matter - and you might consider Saylor to be engaging in a bit of spin, so you can take those comparisons for what they are worth.. .. I doubt that there is any real level of misleading in his providing such an alternative perspective. Recently, MicroStrategy has been doing very badly, all reports were with large losses, and skeptics of MicroStrategy's bitcoin strategy have increasingly chosen short positions on the company's shares.

Microstrategy price is now only a function of BTC price. They are basically a dead company with no real products. For sure, I agree with what you are saying fillippone in regards to the overall package of MSTR's value coming through it's holding such a domineering position in bitcoin as compared to the rest of the value of the company - but I would hardly concede about any representation that MSTR's software component is either dead and/or not any kind of a real product - because essentially, MSTR still receives a pretty substantial income flow from the software aspect of its business that allows it to service its various loans and to discretionarily continue to buy more BTC whether DCA, buying on dips and/or lump sum investing. I doubt that Saylor is lying (or misrepresenting his company in any kind of meaningful way) when he had made assertions that MSTR's getting involved in bitcoin had drawn a decent amount of attention to the software part of its business and put their software services on the road map in greater ways than it had been on such road map previously - similar to what seems to have had happened with El Salvador. A large number of people had no fucking clue that El Salvador actually existed as a country and/or knew anything about it prior to it's getting involved in bitcoin, and after El Salvador got involved in bitcoin, then many folks became El Salvador experts (proclaiming that El Salvador should have done, x, y, z and a, b and c, instead of getting involved in bitcoin blah blah blah).. Microstrategy is the next Berkshire Hataway. In 40 years time, nobody will remember when Microstrategy used to sell software (do you remember when Berkshire Hataway used to manufacture textiles products?).

You may well be correct about this point.. even though there could be some ways that MSTR decides to make adjustments to it's software business that connect that aspect of its business in various bitcoin related ways---- yet it surely seems that there could be some ways in which some of MSTR's software business might continue to persist and to potentially allow some quasi-correlated complementing of what MSTR continues to do in the bitcoin space.... I remain a bit hesitant to make too many proclamations in regards to its software business going away completely. but yeah 40 years is a long time to predict into the future.. because we have to get through a few more BTC cycles.. Saylor has not even been through a whole BTC cycle.. He's barely touching upon his 1/2 of a cycle anniversary... so talking about 10 cycles down the road seems like a long-ass time in the so far fast pace of the bitcoin world... and/or other crazy things that are going on outside of the bitcoin world in these here times - even though in 40 years, many of us expect bitcoin to be playing a pretty decently dominant role around then, and my odds of even being a live are pretty damned low.. hey, see you in 2062.   |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15450

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 17, 2022, 07:59:31 AM |

|

.. hey, see you in 2062.   I really hope that in 2062 an AI feeded with all my past post will be able to answer you, or a similarly traded AI to answer you. But of all the long shot prevision I have made in my life, I think this one is amongst the safest. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

Die_empty

|

|

August 17, 2022, 11:12:17 AM |

|

.. hey, see you in 2062.   I really hope that in 2062 an AI feeded with all my past post will be able to answer you, or a similarly traded AI to answer you. But of all the long shot prevision I have made in my life, I think this one is amongst the safest. I think some prominent members of this forum should start thinking of saving all of their post in a very safe device because in few years some of them would become a priceless information bank. Or we should start having compilation of post on different topics of Bitcoin in form of ebooks this would help to keep these vital information for the next generation to access easily. It would be easier for someone to get a compilation of post on a topic in a single document, then to use the search engine. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10210

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 17, 2022, 07:46:06 PM |

|

.. hey, see you in 2062.   I really hope that in 2062 an AI feeded with all my past post will be able to answer you, or a similarly traded AI to answer you. But of all the long shot prevision I have made in my life, I think this one is amongst the safest. I don't really expect to be around in 2062 either, and if I am I am going to need a lot of help with physical tasks.. so maybe AI could be helpful.. and I am not even sure how that might fit into the whole scheme of things - such as representing me or representing my wishes. I am trying to figure out some ways in which to create institutions and practices that might outlive me, and perhaps Saylor is doing a similar thing - and to question what might be the state of Microstrategies or how such company might be composed by the time we get to 2062.. There may well be various Saylor companies that mostly revolve around bitcoin - and maybe some of them will still have some relationship to some of the current software development cashflow in which they are involved, too? |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

August 29, 2022, 06:05:27 PM Merited by fillippone (3) |

|

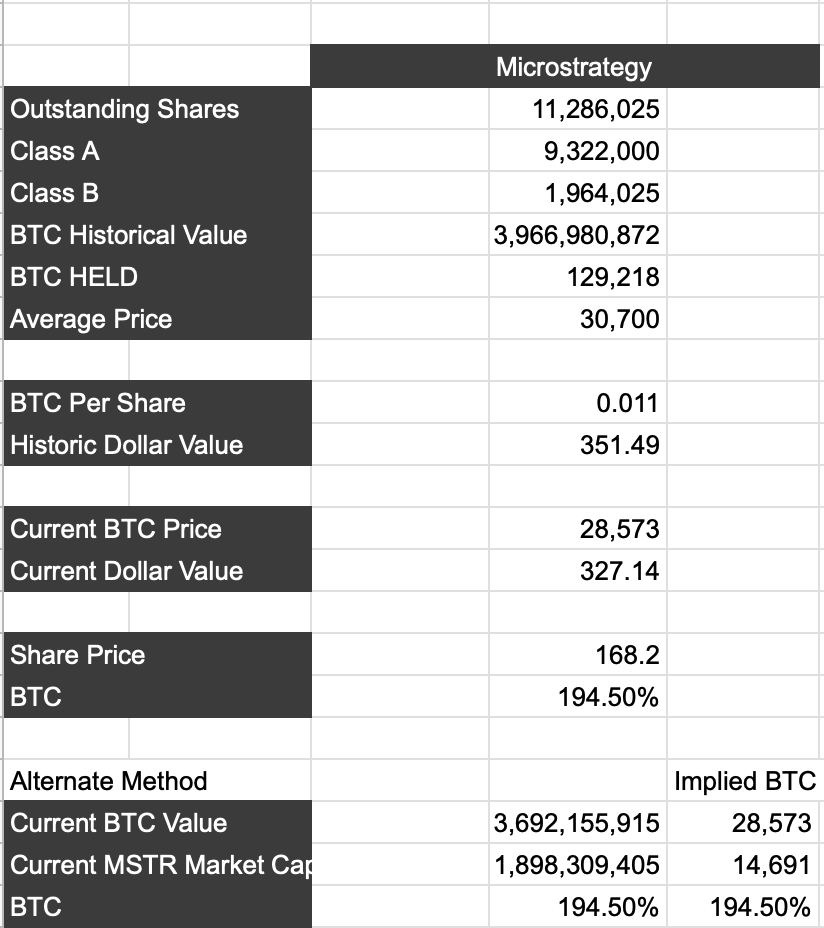

According to my Computations, MSRT is trading at a substantial discount compared to bitcoin Market Value:  Bitcoin bought by Microstrategy now accounts for the 195% of the total Market Capitalization. Buying Microstrategy shares equals buying bitcoins at 14,691 USD! Thanks @fillippone, recently bought some MSTR because of your data. And today is a happy day since I believe I actually own 4.085% more synthetic sats than I thought I did? 129,218 BTC / 11,286,025 shares = 0.01144938 BTC per share. @fillippone, I believe in the meanwhile MicroStrategy added a few spare coins to their pocket. You might already have an updated Excel file locally? Thanks. |

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

|

Google+

|

|

August 29, 2022, 07:38:11 PM Merited by fillippone (3) |

|

source : read hereThe last time I saw saylor buy a btc drop at $20817 and it happened in June. Well, if we look at the last two months there has been no activity from Saylor to buy Btc when the price falls. so my question is saylor is running out of money to accumulate more Btc or will he step in when btc price drops deeper. for now I see from the total btc he has with the average purchase price I can confirm he lost almost $ 1.3 billion. a pretty fantastic number. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15450

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 29, 2022, 09:58:56 PM

Last edit: May 15, 2023, 11:45:58 AM by fillippone Merited by LFC_Bitcoin (3), bitebits (2) |

|

According to my Computations, MSRT is trading at a substantial discount compared to bitcoin Market Value:  Bitcoin bought by Microstrategy now accounts for the 195% of the total Market Capitalization. Buying Microstrategy shares equals buying bitcoins at 14,691 USD! Thanks @fillippone, recently bought some MSTR because of your data. And today is a happy day since I believe I actually own 4.085% more synthetic sats than I thought I did? 129,218 BTC / 11,286,025 shares = 0.01144938 BTC per share. @fillippone, I believe in the meanwhile MicroStrategy added a few spare coins to their pocket. You might already have an updated Excel file locally? Thanks. The online Excel report the correct amount:  That is almost the exact same figure reported by @Google+ (probably a different rounding). The link to the Excel is in the OP. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10210

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 30, 2022, 12:00:59 AM |

|

source : read hereThe last time I saw saylor buy a btc drop at $20817 and it happened in June. Well, if we look at the last two months there has been no activity from Saylor to buy Btc when the price falls. so my question is saylor is running out of money to accumulate more Btc or will he step in when btc price drops deeper. for now I see from the total btc he has with the average purchase price I can confirm he lost almost $ 1.3 billion. a pretty fantastic number. It really sucks to be Saylor (MSTR) right now. HOLDing almost 130k BTC.. and with around $10 million of cashflow coming in every month in dollars.. Does he (his company) buy MOAR cornz or not? That must suck to be him/his company in that (seemingly precarious) position. Don't you think?   |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Google+

|

|

August 31, 2022, 09:42:55 AM |

|

I understand, He can take out a loan (if the situation is precarious) to run the DCA option as he did a few months ago. The hype of her purchase could trigger a huge backlash, Is not that it as she expected.

I know that this may be a difficult path for Saylor because of her financial support, the investment loss is quite large, so the next decision will be made carefully.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10210

Self-Custody is a right. Say no to"Non-custodial"

|

I understand, He can take out a loan (if the situation is precarious) to run the DCA option as he did a few months ago.

Perhaps you have recognized the sarcasm in my previous comment, but still you seem to either NOT sufficiently understand the actual financial situation of Saylor (MSTR) (not that I am an expert) and/or you want to subscribe a higher risk gambling approach within your presumption that Saylor is already employing a high-risk gambling approach, so may as well double down on his high-risk gambling approach, no? Don't get me wrong, I have never been much of a fan for Saylor's bitcoin allocation choices (in terms of I have frequently thought that he over does it), but I have been a pretty decent fan of both his seeming financial creativity and his being public in regards to the various ways that he was financing high levels of bitcoin purchases. You seem to have missed my attempt to highlight cashflow within my earlier snarky comment, and as far as I can tell one of the smart and prudent angles of Saylor's approach has been a recognition and appreciation that his company has had a pretty consistent ability to generate decent amounts of cashflows that go beyond their abilities to service whatever loans that they have undertaken in their bitcoin purchases. If Saylor/MSTR were to lose a large percentage of its cashflow in such a way that it is not able to service whatever loans that they have, then at that point they would need to consider liquidating various assets, and the way Saylor presents his views on bitcoin, it would be quite doubtful that Saylor/MSTR would be liquidating bitcoin prior to liquidating other assets... (referring to if the company were to suffer cashflow generating issues). It is also quite possible that they could miscalculate their abilities to generate cashflows, which surely does tend to happen when all markets are cutting back .. so in that sense, if too many cashflows dry up, then their situation becomes way more precarious than they had previously projected it to be. So surely in regards to Saylor's/MSTR's bitcoin investment, ONLY a relatively small portion of it is based on any loans, and at one point when prices were in the high $30ks and low $40ks, Saylor was proclaiming that there was no problems with those loans because Saylor/MSTR had pledged collateral in such a way that the BTC price would have to go down into the $21ks before the loan would end up getting margin called, and at that time, $21ks had seemed somewhat unthinkable. So when BTC prices went down to $21k and below, presumptively Saylor/MSTR had placed whatever additional collateral in order that his outstanding loans had not gotten margin called, and at that point Saylor began to say that he had enough unencumbered BTC that BTC prices would have to go into the $3ks before his loaned out BTC would be subjected to margin calls, and MSTR had more (non BTC) collateral that it could pledge if BTC prices were to get down to those $3k-ish price levels. I can understand why regular people (including you Google+ - presuming that you are a normal people) are going to retain quite a lot of reservations in regards to what various company representatives are going to say (especially when they have a vested interested in the subject matter being discussed), and so many times we witness that various company representatives had been misrepresenting what they had been doing, and they are really caught in lie after lie after lie and when the BTC prices ended up going way the fuck lower than the overwhelming majority of people in bitcoin (including seeming market experts), then surely there were a decent number of companies (so far) who have been caught with their pants down.. and people realize that they had been lying and they no longer had any choice but to have their nakedness revealed. So, yes, I understand that it is reasonable for people to have a decently high level of reservations regarding disclosures and/or representations that companies are making about their financial situation that may well not be as positive and rosie as they are making their situations out to be. I am surely not opposed to having reservations regarding representations that any company is making (including Saylor/MSTR) in regards to their situation, yet so far, it appears that Saylor/MSTR has neither materially misrepresented what he is doing and/or his company's financial situation - which still seems to be pretty solid in spite of the "on the book" losses of a decent amount of value (yes well over a billion dollars) The hype of her purchase could trigger a huge backlash, Is not that it as she expected.

You seem to be overplaying the importance of what other people think in regards to whether MSTR is profitable or not? Sure, there is another portion of MSTR that involves it being a publicly traded company, so in that regard, Saylor has more obligations to the public and/or to various shareholders than he would have if the company were a private one.. Yet based on the level of Saylor's public disclosures that seem to go way beyond minimum legal requirements (and likely he has quite a decent legal staff), I surely have my doubts about any kinds of claims that the share holders would be in any kind of solid position to make any claims against the company - while at the same time, they are able to vote with their feet, and surely there are ways for buyers of MSTR stock are able to get in and out of such stock within the parameters of the market liquidation mechanisms that are available to them (my understanding is that MSTR is traded on NASDAQ, but it is likely traded in other ways too). MSTR share prices as they are shown on NASDAQ do seem to have even more volatility than the BTC price. I know that this may be a difficult path for Saylor because of her financial support, the investment loss is quite large, so the next decision will be made carefully.

Even though on an ongoing basis, a lot of people seem to love to talk about MSTR and the supposed precariousness of its BTC related position, absent some further negative information, I have quite a few doubts about the position of MSTR being even close to as precarious as either you (Google+) or the general bitcoin naysaying public seem to want to paint it. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

A statement was made by the Attorney General of Washington, D.C. Karl Racine that they are suing Michael Saylor, the head of Microstrategy for tax fraud, since Saylor has lived in the district for more than a decade, but has never paid any income taxes in the District of Columbia. Washington is also suing MicroStrategy for conspiring to help Sailor evade taxes that he legally owes, in their opinion, several hundred million dollars earned by him while he lived in the District of Columbia. We are waiting for an official response from MicroStrategy and Michael Saylor. Source: https://twitter.com/AGKarlRacine/status/1565031380471382019 |

|

|

|

|

P2PECS

Member

Offline Offline

Activity: 173

Merit: 74

|

|

September 01, 2022, 02:12:22 PM |

|

I just saw the news.

I don't know how you see it but I think this caps off the end of a dream. The one that Michael Saylor sold, not the BTC one.

Let's remember that among other things, he recommended everyone to never sell their BTC, but to borrow against it in order to avoid capital gains tax.

I am not saying that this is not legitimate and that there are not people who do it, but his message to the general public is flawed on two sides: on the leverage side, we have seen the number of exchanges that have had problems and the number of trading positions that have been liquidated in cascade due to the drop in price.

And on the tax side, he has not yet been found guilty and he will defend himself, but following the tax advice of someone who is accused of tax fraud and who has already had problems with the SEC for which he ended up paying a penalty does not seem more appropriate.

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15450

Fully fledged Merit Cycler - Golden Feather 22-23

|

I just saw the news.

I don't know how you see it but I think this caps off the end of a dream. The one that Michael Saylor sold, not the BTC one.

I don’t think so. The ideas Micheal Saylor was selling about bitcoin were right, and were so even if he failed in a completely different field of knowledge: abiding to IRS rules. Of course Bitcoin is honey badger and doesn’t care about Micheal Saylor’s fate, but I must say that, bar some hyper bullish claims (“it’s going up forever, Laura”) his understanding of the matter were way above the average garbage you read on mainstream everyday. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

P2PECS

Member

Offline Offline

Activity: 173

Merit: 74

|

|

September 01, 2022, 06:04:30 PM Merited by fillippone (3) |

|

I don’t think so.

The ideas Micheal Saylor was selling about bitcoin were right, and were so even if he failed in a completely different field of knowledge: abiding to IRS rules.

No. The idea of telling the average citizen to sell everything to buy BTC was not correct. Michael Saylor on How To Use Debt in Your Favour 👀 "Mortgage Your Home And Buy Bitcoin."It's not just that this is not right, it's that it's insane. Of course Bitcoin is honey badger and doesn’t care about Micheal Saylor’s fate, but I must say that, bar some hyper bullish claims (“it’s going up forever, Laura”) his understanding of the matter were way above the average garbage you read on mainstream everyday.

Yes, his understanding of the subject is well above average, on this and many other subjects, but very smart people also make mistakes and blunders sometimes. |

|

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3332

Merit: 6826

Cashback 15%

|

|

September 01, 2022, 06:17:15 PM |

|

The ideas Micheal Saylor was selling about bitcoin were right, and were so even if he failed in a completely different field of knowledge: abiding to IRS rules.

Not for nothing, but the lawsuit for this tax evasion accusation was just announced, so I think it's way, way too early to start passing judgement as if we know all the facts (not sure if that's what you were doing, but even so I stand by my statement). And so what if he borrowed against bitcoin holdings and thereby avoided capital gains taxes? That isn't illegal at all. I'm not saying it was a smart thing to do, because I don't, but if the IRS wants to throw people in jail they'd better make sure the law is on their side and they're not just making shit up as they go along. I had a strong feeling Saylor and/or MSTR was going to be hit with one or more lawsuits, but I figured they'd start by the shareholders, not the government. Anyone want to bet there's going to be a massive wave of shareholder lawsuits coming soon? I'm not saying that gleefully, so don't get the wrong idea, but it's the next logical step when the 3-year stock chart now looks like this:  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2156

Merit: 15450

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

September 01, 2022, 09:46:18 PM Merited by JayJuanGee (1) |

|

Anyone want to bet there's going to be a massive wave of shareholder lawsuits coming soon? I'm not saying that gleefully, so don't get the wrong idea, but it's the next logical step when the 3-year stock chart now looks like this:

Given the peculiar voting rights in Microstrategy’s governing bodies, I reckon minority shareholders have no option than a lawsuit to express their voice. What I think is that Micheal Saylor already survived a -90% share price drawdown and survived as CEO, so I see little scope in a similar lawsuit. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|