|

ginsan

|

|

January 23, 2023, 04:32:46 PM |

|

This reminds me of every drop that has occurred in every quarter of the past 4 years, Where long time players in Crypto certainly had a moment at that time to buy btc at low prices but most of them relatively neglected to accumulate more BTC in their bag .  source: read heredid see the consequences that Saylor did from 2020 of course he already had a peak when btc reached $65k but basically he is the true holder I have ever seen. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

|

|

|

|

|

|

If you want to be a moderator, report many posts with accuracy. You will be noticed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

February 05, 2023, 09:55:34 AM Merited by JayJuanGee (1) |

|

Michael Saylor's new interview with Morgan Brennan, where he took a ride, sympathized with the criticism that poured out on Charlie Munger after his call for a ban on cryptocurrencies in America. Saylor believes that such statements coming from Charlie Munger are related to his lack of awareness about the technologies that bitcoin reveals. In fact, the CEO MicroStrategy does not exclude the need for regulation in the crypto industry, and gives an example of FTX calling SBF an entrepreneur irresponsibly implementing good ideas. And told how MicroStrategy promotes the introduction of Bitcoin and Lightning technologies as a global, never gets turned off monetary system. https://twitter.com/saylor/status/1621548108269191168 |

|

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

According to an updated report filed by MicroStrategy with the SEC to date (February 16, 2023), they have sold 218,575 common shares for gross proceeds of approximately $46,600,000. MicroStrategy further stated that it intends to use the net proceeds from this offer for general corporate purposes, including, among other things, the acquisition of bitcoins. Source: https://www.sec.gov/Archives/edgar/data/1050446/000119312523041097/d454381d424b5.htm |

|

|

|

|

|

Moeda

|

This reminds me of every drop that has occurred in every quarter of the past 4 years, Where long time players in Crypto certainly had a moment at that time to buy btc at low prices but most of them relatively neglected to accumulate more BTC in their bag .  source: read heredid see the consequences that Saylor did from 2020 of course he already had a peak when btc reached $65k but basically he is the true holder I have ever seen. Actually Bitcoin history is an important record for us to be able to hold Bitcoin. We have studied the movement of Bitcoin every year, and we continue to talk about these moments. Aside from what crypto gurus or Entrepreneurs like Michael Saylor talk about, everyone is aware of the growth in the price of Bitcoin, but very few dare to hold onto it, let alone in large quantities. When it comes to 2020, maybe it's been too long. Without us knowing it in 2023 from a price of $ 17k, and increased to $ 25k in a matter of days. An $8k profit is a pretty big number, but is everyone capitalizing on the moment? Maybe not. And when the price of $ 24k started to worry about buying, for fear that the price would drop like before. This is the problem of all of us today who only work with small capital. Unlike Michael Saylor, we know his net worth is $7B. Maybe he doesn't worry about anything when investing, because he can make the market price go up, or turn it into drops. Before the price of Bitcoin increased in the previous few weeks, there was talk that the price of Bitcoin would increase. However, there are people who deny such information, and there are those who believe it. In fact, I often find information about Bitcoin price movements that are raised by newbie accounts. And they share sources of information from the media they find. I believe they are experienced people, but just want to hide their previous identity. Like information about MicroStrategy investing in large amounts of Bitcoin. Of course before they invest, there are some people who already get this information faster and they take advantage of the moment. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 18, 2023, 09:13:40 PM |

|

This reminds me of every drop that has occurred in every quarter of the past 4 years, Where long time players in Crypto certainly had a moment at that time to buy btc at low prices but most of them relatively neglected to accumulate more BTC in their bag .  source: read heredid see the consequences that Saylor did from 2020 of course he already had a peak when btc reached $65k but basically he is the true holder I have ever seen. Actually Bitcoin history is an important record for us to be able to hold Bitcoin. We have studied the movement of Bitcoin every year, and we continue to talk about these moments. Aside from what crypto gurus or Entrepreneurs like Michael Saylor talk about, everyone is aware of the growth in the price of Bitcoin, but very few dare to hold onto it, let alone in large quantities. When it comes to 2020, maybe it's been too long. Without us knowing it in 2023 from a price of $ 17k, and increased to $ 25k in a matter of days. An $8k profit is a pretty big number, but is everyone capitalizing on the moment? Maybe not. And when the price of $ 24k started to worry about buying, for fear that the price would drop like before. This is the problem of all of us today who only work with small capital. Unlike Michael Saylor, we know his net worth is $7B. Maybe he doesn't worry about anything when investing, because he can make the market price go up, or turn it into drops. Before the price of Bitcoin increased in the previous few weeks, there was talk that the price of Bitcoin would increase. However, there are people who deny such information, and there are those who believe it. In fact, I often find information about Bitcoin price movements that are raised by newbie accounts. And they share sources of information from the media they find. I believe they are experienced people, but just want to hide their previous identity. Like information about MicroStrategy investing in large amounts of Bitcoin. Of course before they invest, there are some people who already get this information faster and they take advantage of the moment. There are always going to be folks who are able to take advantage of the market and to take advantage of price momentum, whether we are talking about bitocin or otherwise, including possible insiders; however, it seems to me that Saylor/MSTR can largely be taken at their word in terms of pretty much buying at any price, and not fucking around with trading or trying to manipulate (except to the extent to which he might be ongoingly describing BTC prices as "going up forever.")... so Saylor largely seems to be a buyer at any price, even though maybe in recent times, he might be appreciating that he may have overstepped his bounds by failing/refusing to wait for dips, which largely seems to demonstrate to me, that he does not really have any better or more priviledged position than the rest of us in terms of his mostly betting on UP in a persistent way. Saylor/MSTR also does not sell BTC, even though they could purposefully manipulate the BTC price down if he were to want to with his more than 130k BTC, and sure normies (likely no coiners, bitcoin naysayers, shitcoiners, fence sitters) accuse Saylor all of the time of either engaging in such BTC price manipulation practices or having intentions to engage in such practices.. which largely seem to be a bunch of baseless bullshit... perhaps to either trick normies out of their coins or to contribute towards normies failing/refusing to sufficiently/adequately stack sats in order to prepare themselves for UP (no guarantees of UP for sure, but those who do not sufficiently/adequately prepared for UP are likely going to just have to buy their BTC at higher prices, and how much that they have to spend to stack their BTC stash likely has a lot to do with how long they diddly daddly around and fail/refuse to take sufficient actions to get started stacking). ... wait around to your own peril...lot's of no coiners and low coiners out there, and we are still early as fuck.. especially if you consider that BTC adoption is likely quite less than 1%, and some of those folks who actually do own some BTC are quite likely under prepared for UPpity (ie lowcoiners). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 02, 2023, 11:31:51 PM Merited by JayJuanGee (1) |

|

A lot of chatter on Twitter about the close relationship between Microstrategy and Silvergate. MicroStrategy Says It Doesn’t Have Any Assets Custodied With SilvergateBusiness software company MicroStrategy (MSTR) said it has no assets custodied with Silvergate Capital (SI) and is in no other way financially linked to the bank other than a commitment to repay a loan in 2025, the company said on Thursday.

The Microstrategy loans is an asset to Silvergate Capital. This asset can be sold to other counterpart, so that proceeds can be used to satisfy Silvergate creditors. This asset sale doesn't mean absolutely nothing for Microstrategy, hose collateral is not at risk of being liquidated. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

March 07, 2023, 07:13:28 AM Merited by JayJuanGee (1) |

|

A lot of chatter on Twitter about the close relationship between Microstrategy and Silvergate. MicroStrategy Says It Doesn’t Have Any Assets Custodied With SilvergateBusiness software company MicroStrategy (MSTR) said it has no assets custodied with Silvergate Capital (SI) and is in no other way financially linked to the bank other than a commitment to repay a loan in 2025, the company said on Thursday.

The Microstrategy loans is an asset to Silvergate Capital. This asset can be sold to other counterpart, so that proceeds can be used to satisfy Silvergate creditors. This asset sale doesn't mean absolutely nothing for Microstrategy, hose collateral is not at risk of being liquidated. And as a consequence, Silvergate Bank announced the termination of its own payment network SEN (Silvergate Exchange Network), such an announcement can now be seen at the top of the home page of their website. SEN was used in particular Binance.US , Kraken and Gemini. https://www.silvergate.com/ |

|

|

|

|

|

ginsan

|

|

March 07, 2023, 09:03:30 PM Merited by JayJuanGee (1) |

|

A lot of chatter on Twitter about the close relationship between Microstrategy and Silvergate. MicroStrategy Says It Doesn’t Have Any Assets Custodied With SilvergateBusiness software company MicroStrategy (MSTR) said it has no assets custodied with Silvergate Capital (SI) and is in no other way financially linked to the bank other than a commitment to repay a loan in 2025, the company said on Thursday.

The Microstrategy loans is an asset to Silvergate Capital. This asset can be sold to other counterpart, so that proceeds can be used to satisfy Silvergate creditors. This asset sale doesn't mean absolutely nothing for Microstrategy, hose collateral is not at risk of being liquidated. And as a consequence, Silvergate Bank announced the termination of its own payment network SEN (Silvergate Exchange Network), such an announcement can now be seen at the top of the home page of their website. SEN was used in particular Binance.US , Kraken and Gemini. https://www.silvergate.com/ I have seen this news and there seems to be no confusion regarding the rumored proximity of microstrategy to Sivergate capital. Well their bankruptcy has occurred in the last 3 months as published by https://www.linkedin.com/feed/update/urn:li:share:7038920782495793152 assuming a loss of $1 billion. some new rumors, it seems that some of sivergate capital's top shareholders will inject fresh funds to help it out of the liquidity crunch. https://twitter.com/qsjy9898/status/1632616756991885312?t=UzO5eYmL7owq8XGBWMkSew&s=19with this incident there is a little explanation from Saylor which was broadcast by SQUAWK https://twitter.com/BNBTCCRYPTO/status/1631429221737168898?t=YAhuUOqtxDIYJ1Ok15RLnA&s=19 |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

March 17, 2023, 10:58:10 AM |

|

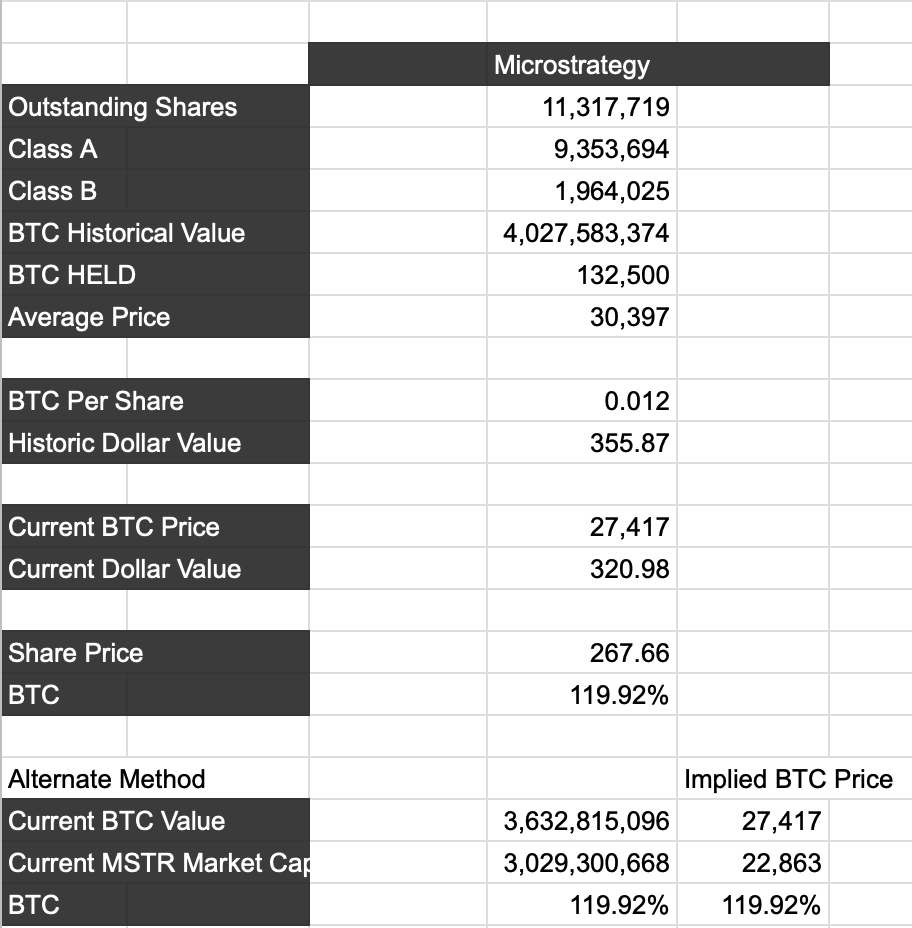

Anyone knows the reason the $MSTR price is suddenly severely lacking the value of the number of bitcoin per share?

|

- You can figure out what will happen, not when /Warren Buffett - Pay any Bitcoin address privately with a little help of Monero. |

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 17, 2023, 04:36:36 PM |

|

Anyone knows the reason the $MSTR price is suddenly severely lacking the value of the number of bitcoin per share?

For sure, I am not claiming to have any specific knowledge - and the latest that I had heard was that a decent amount of MSTR's loans were held at Silvergate, even with a claim that the collateral for such loans was not held at Silvergate - but I had not seen any meaningful clarification regarding the safety of that collateral. Personally, I hardly see any reason to worry about if there might be aspects of uncertainties if a loan (or payments) might start to come due in 4-5 years - and there had already been statements from Saylor that there was not any risk (did he overstate the legality of the matter) that payments (or even the whole loans) would end up getting triggered to have to be paid earlier than their agreed upon date (4-5 years from now), and for sure if the collateral were actually at risk (and it was not believed that the collateral was actually safely held - if specifics are not provided in regards to how it is held (or by whom)) then any kinds of uncertainties, whether real or imagined could lead to price disparities (or diminution) in regards to MSTR's current market share prices. I know that I am not really providing any answers, but I don't claim to have any answer - except maybe I have some similar questions regarding the security of any coins held by MSTR - including coins held in collateral (and by whom? is there a need to know?).. I personally have fewer worries about any of their outstanding loans getting called (become due) early - and I suppose I had been reassured by Saylor's statement (or was it a tweet?) in that direction... not that I am an investor in MSTR.. but surely there has been nearly persistent and building MSTR FUD which sometimes can have short-term effect on BTC prices (or sentiments). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 18, 2023, 12:17:32 AM

Last edit: May 15, 2023, 10:26:49 AM by fillippone Merited by hugeblack (4), JayJuanGee (1) |

|

In the OP you can find a link to a spreadsheet. There you can find this:  Each share of Microstrategy is worth 267.66 USD, while the Bitcoin they hold are worth 320.98 USD. This is a hefty 20% discount. Probably the reasons are the market is discounting some hassle related either from Sivlergate distress or rather a difficulty for Microstrategy to go on with their Bitcoin Strategy due to more adverse banking system. I don't know, but it's a good trade to jump on. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Gayong88

Member

Offline Offline

Activity: 1540

Merit: 22

|

|

March 18, 2023, 07:20:30 AM |

|

Each share of Microstrategy is worth 267.66 USD, while the Bitcoin they hold are worth 320.98 USD.

This is a hefty 20% discount.

In my opinion, if we pay attention to the discount on the market price of Microstrategy's stock, I think it has a cause and effect as well where the level of market concern related to regulatory issues or security breaches can contribute to the price of Microstrategy's shares. |

|

|

|

|

ginsan

|

|

March 19, 2023, 09:34:21 PM Merited by fillippone (3) |

|

btc touched $28k today. the entry point that microstrategy makes in the average buy is in the $30k range so this is a beautiful period in the shadows that I feel in saylor mind. i think btc will touch $30k in the near future. quite a quick reversal considering that in the previous month btc touched $15k or its lowest point since touching ATH $69k. well for this year Q1 may be ending soon, is there any rumor that Saylor will buy the first btc of the year or he will skip Q1 to buy btc within this year. the last time microstrategy bought btc was on 24/12 and this has been the last purchase or they are waiting for the right moment to make an entry  |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 23, 2023, 12:17:26 PM |

|

btc touched $28k today. the entry point that microstrategy makes in the average buy is in the $30k range so this is a beautiful period in the shadows that I feel in saylor mind. i think btc will touch $30k in the near future. quite a quick reversal considering that in the previous month btc touched $15k or its lowest point since touching ATH $69k. well for this year Q1 may be ending soon, is there any rumor that Saylor will buy the first btc of the year or he will skip Q1 to buy btc within this year. the last time microstrategy bought btc was on 24/12 and this has been the last purchase or they are waiting for the right moment to make an entry  I strongly doubt that Micheal Saylor is trying to time the market. I guess his buying pattern is more dictated by funding issues (be cash flows from operations, equity or debt proceedings). Anyway, I like it. It’s time to buy some more. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5633

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

March 24, 2023, 04:07:56 PM |

|

~snip~

I strongly doubt that Micheal Saylor is trying to time the market.

It never seemed to me that he was looking for a good time to buy, although it seems to me that he would have been very happy if he could have invested a lot more money while the price was under $20k. Of course, his company already has a very nice amount of BTC, and when you have that in mind, it's easy to plan your next move. Be that as it may, even though Saylor remained optimistic even when it looked like the price was going to go towards $10k, I'm sure it's a lot easier for him today than it was a few months ago. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

imamusma

|

|

March 24, 2023, 04:16:30 PM Merited by JayJuanGee (1) |

|

It never seemed to me that he was looking for a good time to buy, although it seems to me that he would have been very happy if he could have invested a lot more money while the price was under $20k. Of course, his company already has a very nice amount of BTC, and when you have that in mind, it's easy to plan your next move. Be that as it may, even though Saylor remained optimistic even when it looked like the price was going to go towards $10k, I'm sure it's a lot easier for him today than it was a few months ago. I'll admit that Michael J. Saylor is one of the most optimistic bitcoin investors so far. He can invest in bitcoin when the price is low, he can also buy at a higher price. I must have been really happy when he never wanted to sell his bitcoin, and so far Michael J. Saylor is a very different investor from Elon Musk. Michael J. Saylor could raise himself as a red flag for the bitcoin market if he wants to sell some of his bitcoin in the future. Many people are wary of him because of his high bitcoin holding. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

Gayong88

Member

Offline Offline

Activity: 1540

Merit: 22

|

|

March 24, 2023, 04:28:27 PM |

|

btc touched $28k today. the entry point that microstrategy makes in the average buy is in the $30k range so this is a beautiful period in the shadows that I feel in saylor mind. i think btc will touch $30k in the near future. quite a quick reversal considering that in the previous month btc touched $15k or its lowest point since touching ATH $69k. well for this year Q1 may be ending soon, is there any rumor that Saylor will buy the first btc of the year or he will skip Q1 to buy btc within this year. the last time microstrategy bought btc was on 24/12 and this has been the last purchase or they are waiting for the right moment to make an entry  I strongly doubt that Micheal Saylor is trying to time the market. I guess his buying pattern is more dictated by funding issues (be cash flows from operations, equity or debt proceedings). Anyway, I like it. It’s time to buy some more. Michael Saylor, a well-known Bitcoin advocate, is more likely to be driven by funding issues than trying to time the market. This could mean that his purchases are influenced by factors such as cash flow from operations, equity or debt processing. What motivates Saylor's buying patterns, as there could be a variety of factors at play. But what I love is that he has been an outspoken supporter of Bitcoin and openly expresses his belief in its long-term value by expressing positive sentiment to buy more Bitcoin. |

|

|

|

|

ginsan

|

|

March 25, 2023, 10:16:35 PM |

|

btc touched $28k today. the entry point that microstrategy makes in the average buy is in the $30k range so this is a beautiful period in the shadows that I feel in saylor mind. i think btc will touch $30k in the near future. quite a quick reversal considering that in the previous month btc touched $15k or its lowest point since touching ATH $69k. well for this year Q1 may be ending soon, is there any rumor that Saylor will buy the first btc of the year or he will skip Q1 to buy btc within this year. the last time microstrategy bought btc was on 24/12 and this has been the last purchase or they are waiting for the right moment to make an entry  I strongly doubt that Micheal Saylor is trying to time the market. I guess his buying pattern is more dictated by funding issues (be cash flows from operations, equity or debt proceedings). Anyway, I like it. It’s time to buy some more. most likely as you said where large funding will be more flexible for Saylor or MS to increase their btc holdings at the bottom price or below the average entry price that they do. I also found several people on social media asking the same thing    source : https://twitter.com/Bitcoinfinity/status/1637339281579720706?t=hkqJmBB-SHPx36wA2isMHw&s=19but one thing I can say to Saylor, most likely he will wait for the average entry price that they did to be reached this year and even this month because they/Saylor were at minus 50% at the end of last year it would be more efficient to get funding latest or he again has the option to take out more loans to buy btc because he is that type of person. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 26, 2023, 05:57:26 PM Merited by fillippone (3) |

|

btc touched $28k today. the entry point that microstrategy makes in the average buy is in the $30k range so this is a beautiful period in the shadows that I feel in saylor mind. i think btc will touch $30k in the near future. quite a quick reversal considering that in the previous month btc touched $15k or its lowest point since touching ATH $69k. well for this year Q1 may be ending soon, is there any rumor that Saylor will buy the first btc of the year or he will skip Q1 to buy btc within this year. the last time microstrategy bought btc was on 24/12 and this has been the last purchase or they are waiting for the right moment to make an entry  I strongly doubt that Micheal Saylor is trying to time the market. I guess his buying pattern is more dictated by funding issues (be cash flows from operations, equity or debt proceedings). Anyway, I like it. It’s time to buy some more. most likely as you said where large funding will be more flexible for Saylor or MS to increase their btc holdings at the bottom price or below the average entry price that they do. I also found several people on social media asking the same thing    source : https://twitter.com/Bitcoinfinity/status/1637339281579720706?t=hkqJmBB-SHPx36wA2isMHw&s=19but one thing I can say to Saylor, most likely he will wait for the average entry price that they did to be reached this year and even this month because they/Saylor were at minus 50% at the end of last year it would be more efficient to get funding latest or he again has the option to take out more loans to buy btc because he is that type of person. With those examples, you are not really bolstering what fillippone had said ginsan. Sure there might be some convenience for Saylor to buy a bit more on the dips, and perhaps Saylor might be regretting that he had never really been motivated by buying on the dip as a serious consideration, yet ongoingly people are trying to assign those kinds of " buying on dips" motivations to Saylor and there still is hardly any evidence that Saylor gives too many ratt's asses about trying to time dips.. or figure out how much of a dip is a dip, and in some sense, for Saylor any BTC price is likely a good bargain - once he and his Company is able to clear such authorizations to buy.... .. based on the various kinds of considerations that fillippone already outlined - including is cash available through cashflow considerations or ability to dip into various sources of cash that might allow him to buy more BTC.. I think with anyone, when the price of what you bought had gone down (including something like BTC), you can retroactively look back and say that you could have waited to buy in order that you would have been able to get more at the current price rather than the higher price that you had paid, so in that regard, Saylor had been showing some of those kinds of appearance of potential regret, but at the same time, he still does not seem to be centrally motivated by that - in spite of the ongoing imposition of those ideas on him. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15399

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 26, 2023, 08:27:39 PM Merited by JayJuanGee (1) |

|

Sure there might be some convenience for Saylor to buy a bit more on the dips, and perhaps Saylor might be regretting that he had never really been motivated by buying on the dip as a serious consideration, yet ongoingly people are trying to assign those kinds of " buying on dips" motivations to Saylor and there still is hardly any evidence that Saylor gives too many ratt's asses about trying to time dips.. or figure out how much of a dip is a dip, and in some sense, for Saylor any BTC price is likely a good bargain - once he and his Company is able to clear such authorizations to buy.... .. based on the various kinds of considerations that fillippone already outlined - including is cash available through cashflow considerations or ability to dip into various sources of cash that might allow him to buy more BTC..

Micheal Saylor never advices on trying to time the market and buy the dips, yet he advocated long investment horizons, 4 year minimums and DCA approach to entry point. In this perspective, and having in mind the Microstrategy buying strategy, the “buy the dip” approach makes little or not sense at all. I think I igsce stated the above various times here on the thread, but regularly we turn back discussing. Buying the dip is necessary if you have a trading approach to bitcoin, with a short investment time. MS instead always talked about investment approach, with a 4 year time horizon. In this context the price oscillation greatly fade away. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|