|

Looks like the campaign is dead. It's been weeks since there's been any word about it.

|

|

|

|

The NFL game between Bears and Steelers has been pending payout since Monday. Can you process that result?  |

|

|

|

|

It looks like the website is having issues. I'm not able to see my FUN token information (balance, WOF spins, purchase history) but the free faucet spin is still working. Also, interest history is another thing that is missing.

|

|

|

|

Inflation is built into the fiat economy.

The fact that countries have an inbuilt inflation target should be enough to prove that.

To think that inflation is just transitory is absolutely ridiculous. You might as well be saying to yourself that fiat is going to last forever even though all the fiat currencies that we have ever seen in history have gone down in flames irrespective of their country of origin.

Everyone knows that inflation is a regular part of monetary policy, by design, in fiat economies. What people mean by temporary inflation in the current context is whether or not the elevated inflation we're currently experiencing is temporary or a new normal. 5% is much higher than we've experienced in a long time, 1990 in fact was the last time the annual inflation rate for the year was over 5% and it was only above 5% for that one year. Prior to that was the high inflation environment that ran from 1973 to 1982, and sometimes saw inflation rate reach 10% in those years. The economy is so vastly different now it may not even be a meaningful comparison, but that's how long it's been not a concern. |

|

|

|

Loool. You don't even recognize one of the most influential people in crypto in this picture in our haste to dismiss the wholly legitimate arguments he's presenting. He's right about it too. The vast majority of crypto "adopters" that have pushed the price so high don't actually care about decentralization. Rude truth is that the majority of crypto enthusiasts are just FOMOing in trying to get rich. And it's funny that people bitch about the USD losing 2% per year somehow thing a currency they can't predict the value of tomorrow is somehow better.

It's more than 2 percent per year, it's 5 percent for USD, 2 percent would be a dream for most folks. 2 percent is the value that the fed aims for, under ideal conditions. And as I'm sure you know, the endless spending the US government is so familiar with does not help the inflation problem. It's historically not 5% per year, not even close. The inflation rate over the last 11 years averages 2% per year, and that's including the large increase in 2021. It's been remarkably stable despite the massive quantitative easing. And even assuming we used your wrong number of 5% per year, that would still be vastly superior as a currency to one that regularly depreciates 10% in a day. That's an unusable currency that doesn't allow for any type of long term planning because volatility is a terrible quality for a currency to have. The inability to plan long term is a death knell for any economy. Year Annual Inflation Rate 2011 3.0% 2012 1.7% 2013 1.5% 2014 0.8% 2015 0.7% 2016 2.1% 2017 2.1% 2018 1.9% 2019 2.3% 2020 1.4% 2021 5.4% Source: https://www.usinflationcalculator.com/inflation/current-inflation-rates/ |

|

|

|

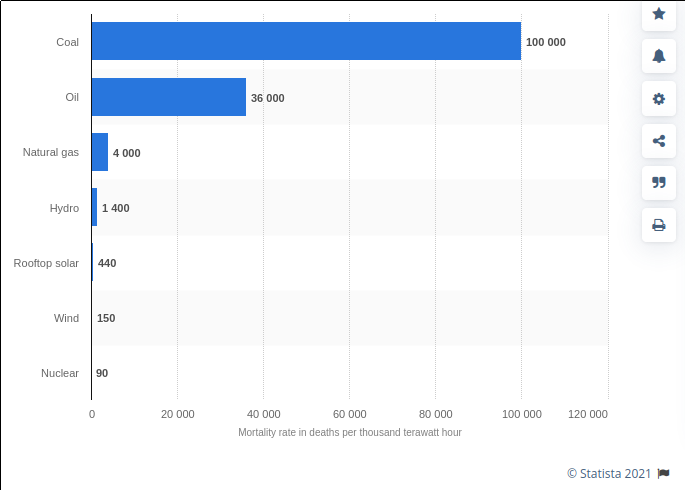

You don't really have safety concerns with green energy alternatives Compared to nuclear safety, that's not true:  It's good to note that basically anything causes less deaths than fossil fuel. This source has nuclear above all forms of green renewable sources. https://ourworldindata.org/grapher/death-rates-from-energy-production-per-twhLooking only at mortality though doesn't take into account the environmental drawbacks of nuclear though. To your point, nuclear offers far more energy for far less deaths compared to fossil fuels, but that doesn't refute my point from my last post that nuclear creates hazardous materials that need to be safely secured and stored because of how dangerous it is. |

|

|

|

Perhaps we should first find out how effective the China cbdc so far since it was launched then you can draw up some ideas what will happen in other countries if cbdc is introduced,

To me it will same as any other government owned project which is heavily centralise and control the people, however, if people are given the option to choose between cbdc and other crypto, many people won't bother about cbdc.

it's not up for the people to chose but the government. if the government of the country will have their cbdc, the people in this country will use cbdc obviously. you can only wish they allow crypto as well. china will have the advantage to dominate in the future because they are the first to have a working cbdcThis is wrong, see my above post. Adopting a CBDC will prevent commercial banks from being able to lend, which will prevent companies and individuals from being able to borrow money, which will grind their economy to a halt. I would love to see China try to implement a CBDC, as it will delay or even prevent them from being able to take over the world. China wants to issue a CBDC in order to impose further control over their citizens, but I believe this will backfire spectacularly. Stable coins currently have a certain level of risk, (as do bank accounts with commercial banks), and this is not the case with accounts with the central bank. There's nothing about a CBDC that stops lending based in the CBDC. It doesn't even prevent fractional-reserve banking. If anything, it would give the government a lot more information about the level of money supply expansion in real time as the all the data would be available as it happens. The information would help inform monetary policy. |

|

|

|

~ My question is can Elon musk sustain this new found financial spot for how long? We have seen bill gate coming back to this spot from time to time and occupying it for a longer time. Now that Elon musk is said being the richest in the world , is he going to keep to this status longer or we are yet going to hear another story of selling off assets because Elon musk is now known as a public stage man   So what do you think? It all depends upon how well his Tesla and SpaceX stock will rally and the new found billions is because of the rally in his stock market. I really do not care if he sustains the wealth or not and the reason i am not a big fan of Elon Musk is because of the constant shilling in the cryptocurrency space and the number of investors who lost a ton of money because of his shilling degrades everything he does. He wasn't shilling, he was trolling. Anyone who lost money buying doge deserved their losses. Guess some people just have to learn the hard way that FOMOing into garbage investments is risky, especially if they're not smart enough to realize it's a stupid move on their own. Does Elon trolling idiots degrade the work he does at Tesla or SpaceX? Lol, no. He's got some major personality defects, but there's no denying the world-changing work he's doing. |

|

|

|

This is really a strong message! Look at the nocoiner standing there, proudly presenting his (her?) findings. I would believe all of it, except for the fact that this guy (girl?) feels the need to create a presentation about it! If crypto is worth so much attention from all those people who say it can't work, I can only conclude I'm on the right track.

I guess many people still really believe the "modern financial system" works in their favour. Bankers love that flawed idea! Loool. You don't even recognize one of the most influential people in crypto in this picture in your haste to dismiss the wholly legitimate arguments he's presenting. He's right about it too. The vast majority of crypto "adopters" that have pushed the price so high don't actually care about decentralization. Rude truth is that the majority of crypto enthusiasts are just FOMOing in trying to get rich. And it's funny that people bitch about the USD losing 2% per year somehow thing a currency they can't predict the value of tomorrow is somehow better. |

|

|

|

I will concede that my point might come off as quibbling about a minor thing, but there is something specific and special about bitcoin that has lured Saylor into it.. and to cause his company to supplement its focus onto bitcoin, and maybe at some point, the company moves away from other aspects of its business, even though I believe that their software portion does remain quite profitable, but maybe even that part of their business ends up getting more intertwined with bitcoin, since Saylor surely does seem to appreciate the value in attempting to be creative in various ways to incorporate bitcoin into what he and his company is doing.....

Nah, Microstrategy was a dying company before Bitcoin. And now it's a dying company holding a large chunk of coins. As far as I know MSTR was a company with no profit, or even results or any type to justify their activity. Now they are devoting all of their resources to service their bitcoin investment and knowledge, in order to make new commitments to the orange coins. The actual activity hds been degraded to ancillary to this business. MSTR was profitable but revenues were declining prior to getting into bitcoin. While it certainly not healthy to have declining revenues for multiple years in a row, I wouldn't categorize them as being so bad that they were "dying." But they certainly weren't on the up and up, however severely you want to categorize that. FY Revenue (thousands) Net Income (thousands) 2017 504,543 17,643 2018 497,638 22,501 2019 486,327 34,355 2020 480,735 -7,524 Over the four years prior to bitcoin, revenue dropped just under 5% but was dropping slowly and consistently. They definitely needed something to make them relevant, and Saylor very keenly recognized bitcoin was it. |

|

|

|

Inflation is inevitable. It is a fact that we must all accept. But from the highest structure of society, the people at the top are the ones who mainly worry about it because they are the ones who will be heavily affected by it. worth more than this, we can't stop it, it's even more interesting: sometimes organizations decide to get back into the game and ask for a raise, masking inflation "sometimes better than sometimes sometimes better sometimes worse" for some workers. so we will always face inflation in life no matter in any profession.

Nah, it's mostly the lower classes that feel inflation the most for two reasons. 1) The rich are insulated from inflation by investments that appreciate with inflation instead of holding cash and the fact that any inflationary effects are not a significant portion of their net worth. 2) Lower classes mostly have cash-based assets and no investments that negate the impact of inflation, and any inflationary effects are a significant portion of what little assets they have. As much bitching about inflation as the rich do, it's not nearly as impactful to them as the lower classes. |

|

|

|

|

Why would fiat disappear, and more importantly why would an objectively inferior currency like bitcoin replace it?

Bitcoin is practically unusable as a currency over any period of time because of it's absolute failure to hold a steady value. People rail on the USD for depreciating slowly but predictably, but think that something you won't know the value of tomorrow is somehow a better system? It's completely idiotic. If bitcoin was a viable currency, the concept of stablecoins would never have arisen. Stablecoins arose to do the one thing bitcoin will never be able to do- hold a predictable value, which is the most important aspect of a currency.

|

|

|

|

China can, A. BRRR-print, and pump their economy with Yuan to stop the crash, OR B. Let the economy fix itself by leaving it alone, and let it be through a recession. For Bitcoin HODLers, we can, A. Relax, OR B. embrace another golden opportunity to buy the dip and HODL.  You can rest assured that ever if China is presented with two choices between letting something resolve itself or staging a huge power-grabbing intervention, they will take the latter every time. The chinese party is obsessed with control, and they've turned their society into an Owellian nightmare that is only increasing the amount of control they exert over everyday life. The Chinese government, the latter, has always been totalitarian. The truth was showing signs of maturity and partial support for market rules. But totalitarianism does not tolerate freedom, which began to break through in everything and everywhere. Therefore, the most anticipated turn of events is "tightening the screws", a decrease in freedoms, an increase in totalitarian methods in management. Well, as a result - the curtailment of the economic "miracle" Exactly, I just wrote something similar in the other Evergrande thread. Coincidentally, also in response to you. The totalitarianism is exactly why the party can't tolerate a free Hong Kong or an independent Taiwan. Having free societies of ethnically chinese inhabitants could inspire people to question the party's rule over mainland china, so it is imperative from the party's point of view to bring both Hong Kong and Taiwan to heel, and sooner rather than later. |

|

|

|

I agree that the biggest problem of China is the local governments debt,not Evergrande.

However,I think that the central government of China and the PBOC have enough reserves to support the local governments to pay their debts,at least for a while.The reserves aren't that big,the huge crisis with come,when China runs out of it's foreign currency reserves.AFAIK,China owns lots of US government bonds.

They could sell the US bonds and get some cash in order to pay off the debts of the provinces.

The economic growth of China seems like a bubble that will pop some day.I'm sure that the new Great Depression will begin from China,not from the USA.

I do believe that we should not be considering China as a great power if they fail to keep growing with debt. I mean look at the situation they are in right now, it is obvious that they should be able to grow with the man power they have, and they still fail compared to places that have quarter the amount of people they have with so much more wealth. I believe CCP will eventually fail not because they are not good at finances, but because of human rights problems. There are other smaller and poorer nations that keep on saying they are willing to work for cheaper and western nations started to listen to them as well which is looking like taking away jobs from China and moving to other smaller nations. This is the real reason why China is losing, because they grew big and everyone is hating how they are treating both their citizens and everyone else so they are looking for other nations. Who is going to rise up in China when they have no access to information other than what the party allows them to know and no weapons to fight with? It's not like America where guns are readily available, let along military-style weapons. The last time people rose up they got crushed in Tienanmen Square, and yet the people don't really even know this happened because references to it are illegal in China and it's been scrubbed from public knowledge. Everything the party does now is to cut off dissent before it happens. That's why Hong Kong and Taiwan are such threats to the party, having open societies of culturally similar people so close to them undermines the way the party runs things and gives people ideas about life being better without them. That's why the party isn't willing to tolerate them being independent. So, no, I don't think their track record on human rights is really going to inspire an uprising because people can't organize and don't have weapons. |

|

|

|

This man is a phenomenon, he's a true businessman, whether you like it or not. It's surprising that he reached the top within a few years, surpassing the wealthiest of all. He used to be involved in the most renowned companies, such as PayPal, in which he was a co-founder. I know that he has pissed the crypto community off, but this man is a true genius.

It's literally taken him his whole life to get as rich as he is, what are you talking about with "a few years." People who build world-changing companies are often billionaires. That's how capitalism works. It's been this way since the Rockefellers and Vanderbilts and Morgans of the world first amassed huge fortunes for building such world-changing companies, and it continues today with the Gates and Buffets and Musks of the world. But none of it was done "in a few years." It took all of them literally their whole lives to get as rich as they did. |

|

|

|

Do you think crypto will be the future for payments in space ?

How will they pay people long distance ... from planet A to planet B ?

Starting over on a new planet will reset everything you think you know about economics. The utility of your wealth on Earth is of no practical value to people on Mars unless there is a way to transfer that wealth into things you actually need on Mars to survive, and we're probably hundreds of years out from having cross-planet commerce after we establish a colony, assuming we even will. Money will have no practical value on Mars because there is no excess anything to spend money on. Every ounce of effort of the settlers will be devoted to survival. An economy can only develop when there is voluntary excess savings from what you create past what you need to survive, and that's not likely to happen for hundreds of years. |

|

|

|

It's primarily based on Tesla stock, so his fortune is tied very much to what Tesla's stock price does. My own opinion is Tesla is disgustingly overvalued. It's valued like it's the only EV maker in the world and given tech company multiples instead of automobile multiples, so as competition ramps up and Tesla continues to have quality and safety problems, this stock will eventually run into reality. Same for Elon's net worth. |

|

|

|

i will miss rp bonus,  Not as much as the botters will. Looool. The RP bonus was something I tried a bunch of times, but I always had to make sure that if I activated it I was going to be able to spin at least 13 times in a day, otherwise you lose RP on the deal. Involved setting an alarm after every hour to make sure I come back and spin the free spin. After doing that several times, I decided it was way more work than it was worth. Still trying to grind out to to 100k, I can't even remember how many years it's been now... But basically since whenever RP was initiated. |

|

|

|

The bizarre thing is that GAAP accounting rules require them to book a profit or loss on the unrealized gains (it's called mark-to-market) on a quarterly basis, but as these gains are unrealized there is no tax implication associated with them.

If I'm not mistaken (and I'm by no means an accountant), most corporations don't have to use mark-to-market accounting. Financial companies do, or often do, but I'm not sure if MSTR is required to. The reason I'm chiming in about this is because I remember reading a history of Enron, and Jeff Skilling was lobbying the company to use mark-to-market because it would allow Enron to value its assets however it wanted to (and they often overvalued the ones that were hard to value in order to inflate their balance sheet). In any case, if a company is using that method of accounting, there's nothing really bizarre about having to report a profit/loss on a quarterly basis. That's the whole point of m-2-m. No, the rule by FASB affects all companies that issue public accounting reports as part of a regulatory regime and has to abide by FASB rules. The rule, called ASU 2016-01, was implemented in 2016 and went into effect in 2018. From the rule release, they address who is affected up front: Who Is Affected by the Amendments in This Update?

The amendments in this Update affect all entities that hold financial assets or owe financial liabilities. It's not limited to "financial" companies by any stretch, as you can see it was written so broadly as to involve literally every company that "[has] financial assets or owe financial liabilities." And yeah, reporting unrealized gains in your company's cash flow makes your cash flow metric meaningless for obvious reasons because it includes gains and losses as "net income" for assets you haven't sold. It's kind of a big stupid deal if you ask me. For what it's worth, Warren Buffet agrees, writing to shareholders in a 2017 letter: “The new rule says that the net change in unrealized investment gains and losses in stocks we hold must be included in all net income figures we report to you. That requirement will produce some truly wild and capricious swings in our GAAP bottom-line… For analytical purposes, Berkshire’s ‘bottom-line’ will be useless.” |

|

|

|

This really might not be a temporary rise in inflation. We have already been waiting for a global economic recession for a long time. And I believe that it will happen in the near future. And these might be little signs of it. As long as FED continues to print money like there is no tomorrow, it will cause dollar to lose in value a lot in time. And this will not affect only the USA of course.

Just about the whole world experienced a recession in 2020 during the COVID lockdowns. I don't know that we're "waiting" for another recession so much as still recovering from the one we just had. The question is if inflation is going to make the economic recovery much harder than it needs to be, as stimulus is the obvious answer to economic recession, and stimulus is really dangerous when you're already undergoing inflation. |

|

|

|

|