No its all handled for you, there is no loss from being away it just stacks up spare wheel spins. Wait for 24hr as far premium giving you the spins but it shows up the same place as the faucet and you can go from there and spin once or the sum total of spins altogether, it gives that summary box in blue shown above.

Thanks, I figured there was probably a lag time between buy FUN and getting the WOF, I just didn't know what it would look like or where to go to find it, or if I needed to do anything specific. If it's just on the page by the faucet spin, I'm sure I'll find it easy enough. Glad the spins will stack too. Sometimes I forget to do the spins, so it's nice I won't lose them. |

|

|

|

I just got about 9000 sats from 3 wheel spins, pretty lucky in a straight sequence as the 5k tier one is a bit rarer then that normally. I dont dream about the big prize so much as it does require exceptional luck, if I can just win regular then maybe go on to win a few of the sports bets thats cool by me.

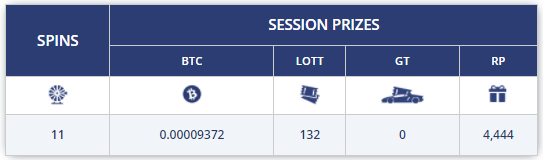

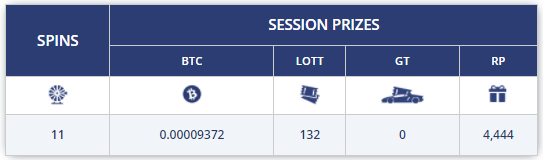

you got lucky, I just got 42 for my 3 wof today. lottery, RP and sat. but fine, will try it again tomorrow. I just curious to get a golden ticket which look rarely also to get.  It's sad for you bro, I hope you've been more lucky the next day.  For me today has been one of the biggest ones. I just won 9372 sats and 4444 RPs with only 11 WOF spins. I think it's the first time I see that.  Amazing  Today is the first day I dipped into the FUN token thing. I'm not familiar with the WOF spins/interface associated with that. Since there is no longer a 30 day timer before the first WOF spins kick in, how do I access those? And do the daily spins stack if you don't use them in a particular day, or do you have to use your daily spins in each 24 hour period or lose them? |

|

|

|

New York's heavy handed, inefficient and authoritarian policies continue to alienate residents. Forcing them to flee new york for texas or florida. It doesn't appear relief in new york will come anytime soon. Politicians are obsessed with raising taxes, increasing overregulation and redtape and otherwise taking steps to cripple their own business and finance sectors. These promises by new york politicians to "support cryptocurrencies" are likely more of the same. Desperation pleas intended to stall residents and fool them into thinking things will change.

Texas and florida are emerging as crypto friendly states. New york feels forced to do the same to remain competitive and offer attractive living conditions to residents. But these promises by new york have been common for many years and always failed to materialize.

The myth of people fleeing New York has largely been debunked. The data doesn't support the premise on any meaningful level. While there is anecdotal stories of people leaving, there are also widespread ancedotal stories of people who have left returning. When you drill down into hard data, the narrative falls apart. While 19,000 Manhattanites moved to Florida, 10,000 said they plan to move back. In fact, more residents — 20,000 — moved to the neighboring borough of Brooklyn than to Florida. Some of those who left for northeastern suburbs are already returning to the city, and that's also happening in the Bay Area. While San Francisco saw rates of permanent moves increase the most, per USPS data, temporary moves also more than doubled in the area, compared to 17% nationally.

Cristobal Young, a sociology professor at Cornell University and author of “The Myth of Millionaire Tax Flight: How Place Still Matters for the Rich,” predicts that relocation will remain minimal because wealthy people generally stay put.

“They live where they became successful, where they have industry connections, employees and customers, and where they sit on nonprofit boards,” he said. Young, who has studied the effects of tax increases in California and New Jersey, said they barely caused an uptick in interstate migration, which stands at about 2.4% a year among U.S.-based millionaires.

https://archive.curbed.com/2020/7/13/21319909/coronavirus-urban-exodus-cities-moving-suburbshttps://www.businessinsider.com/new-york-city-san-francisco-urban-exodus-migration-myth-bofa-2021-4https://www.bloomberg.com/news/articles/2021-03-10/wall-street-a-listers-fled-to-florida-many-are-eyeing-a-return |

|

|

|

but admit the fact that Bitcoin is not created in purpose of Asset or Holding

It is deemed an asset now because it's volatility/liquidity is still very high, The original intention for it as an alternative currency will come into play when its liquidity has reduced, and almost all the mineable bitcoin has been mined. The value will by then become stable and the original intention the creators have for it will materialize. I don't see a reason for this to lead to price stability. If the world is still denominated in fiat currencies, then chasing the limited supply of bitcoin (assuming the store of value premise is still relevant) will mean the price will still be based on speculation and thus likely suffer from high volatility. This is what keeps it from being a useful currency. Also, with the elimination of block rewards, fees are likely to go up to subsidize the cost of mining, further reducing any utility as a currency. |

|

|

|

So ironic seeing the biggest centralized payment processors trying to say that they're trying to bank the unbanked...

What exactly is the irony here? Is Visa not offering a banking solution to the unbanked? Through pre-paid cards, you don't even need a traditional bank account, and using the card then instantly gives you access to Visa's global merchant network, which by the way is orders of magnitude bigger than the Bitcoin network. The irony to me is that at this point Visa is better at solving what bitcoin was invented for than bitcoin is. |

|

|

|

Not a possibility in my opinion.

If they wanted to actually ban a game then they'd have to not only draft it into their legislation (which is going to pose some issues at least in democratic countries), but also find a way to actually police the ban.

It's very hard to mutate any data stored on the blockchain that is designed to be immutable. Games and coins that are hosted on the blockchain are therefore quite resistant to political pressure.

You don't need to change the blockchain in order to cut off access. It's as simple as getting ISPs to block access to the sites. The easiest way to enforce taxes is to get the cooperation from the website itself, and if they refuse, you deny them people the ability to access the site through the ISPs with a court order declaring the website out of compliance with your laws. Cut off the flow of customers to the website and they'll be likely to comply. |

|

|

|

Hell, Jim Cramer built an entire career out of yelling aggressively. Genuinely laughed out loud at that.  They're essentially the same untrustworthy personalities peddling pseudo-nonsense, but for some reason have devoted followings, most likely by virtue of simply appearing on mass media, which implicitly gives them credibility. But at some point people must question it, no? When Schiff has been regularly promising for 20 years that gold is going to hit $5,000 within a few years, and in that entire time it has only been over $2,000 for like a week, surely the people who listen to him must start having doubts? I suppose I just continue to be amazed at how long someone can peddle complete bullshit before they lose their following. I think indoctrination is a very difficult thing to overcome. These followers have completely bought into a "certain future outcome." In the case of Schiff, it's that the dollar is eventually going to fail and so even if you're wrong on the timing, it's just the timing that's wrong, not the premise. So if you believe the dollar is ultimately doomed, Schiff has investment advice to sell you on how to position your investments. But honestly, you get a lot of the same thing in the crypto community. A lot of maximalists have also bought into the premise that the dollar is ultimately going to fail and do it unquestioningly, they just believe in a different remedy (bitcoin as the savior instead of gold). But I see no difference in the extreme thought patterns between the two sides. It won't matter how long the dollar endures, to the true believers the failure of the dollar is always imminent and never questioned. |

|

|

|

To someone who doesn't have a permanent address, one could simply request for a certification from the village saying that he/she is a resident of where he/she is currently staying. Whereas bitcoin does not discriminate against anyone. Well, this is exactly what I'm saying. Bitcoin has its own share of Visa-like claims. Visa's "A network working for everyone" is similar to Bitcoin's "does not discriminate against anyone." Visa's everyone obviously refers only to those who are banked. Those who are not are not covered by everyone. In the same manner that Bitcoin's anyone refers only to those who have access to electricity, internet, smart phones, and so on. Those who do not have access to these do not belong to anyone. Just as Visa does not literally mean everyone, Bitcoin does not also mean anyone. Stahp. You're making too much sense. Obviously you were able to tell what is obvious extrapolation in a marketing claim and not blow it out of proportion and somehow work yourself up into taking offense to it like OP did. Simply put, bitcoin isn't any more accessible to people than Visa is, but I would say that Visa is certainly easier to learn and understand to the uninitiated than bitcoin is. As a fan of bitcoin, I'm still rational enough to understand that bitcoin's only advantage over a centralized payment platform is immutability, and I understand what a limited use case that advantage is. Speed, cost, and reliability all go to Visa in a head to head match up. Does that make it better? In most cases I'd say yes, but if immutability is your biggest differentiator, then perhaps not. |

|

|

|

While most of the illegal activities in the world take place in USD and I am far from saying that bitcoin is actually worse than any other asset on that regard, I have read many news about the American withdrawal from Afghanistan and how the US government froze some billions of USD belonging to the previous government or perhaps (debatable) to the country itself. Obviously, this could not have happened if those assets were held in bitcoin or other crypto. It seems that not everything is good in self-sovereignty?

BTW, this is not a statement saying that Taliban are terrorist, just wondering about some other cases in which states were clearly linked to terror.

Yes, obviously and unequivocally any financial system that cannot be blocked or sanctioned provides safe haven for terrorists and other bad actors to facilitate their illegal and harmful actions. There are people on these boards who instead of acknowledging reality get angry when you state this obvious fact. The inability to acknowledge reality disqualifies all their other opinions, as they’ve proven themselves too partisan and to irrational to be taken seriously. And no need to equivocate. The Taliban is 100% a terrorist organization, as much now as it was before they were overthrown by the western allies. I am not surprised by the rants from left-wing that government should control all the financial activities and there should be no anonymity. The argument is that anonymous modes of payments are being used for terror financing, and for criminal activities. But apart from these "assumptions", I am 100% sure that you don't have any concrete proof with you to link Bitcoin with Taliban. To date, there hasn't been a single incident which links the Taliban to cryptocurrency. Your argument is based on just assumptions and not real data. Taliban gets close to 100% of their funds in the form of fiat. But obviously, you don't want to focus on that part. Maybe calm down, take a deep breath, then re-read my post in full and make a special point to read for comprehension this time. When you do, take particular note that I didn't say anything about the Taliban using bitcoin. I'm addressing two separate points in the OP, which is easy to tell because I separated the two points into two separate paragraphs. You worked yourself into a tizzy for no reason. Next time you respond to something I write, make sure it's actually on topic. |

|

|

|

I don't know what to think anymore, until not too long ago, professional investors either dismissed Bitcoin or said it was a scam, a ponzi scheme etc. Now it seems that they are changing their minds Saylor's style. In the case of Fidelity, it's not that they have changed their mind, as they started mining in 2014, but they have just come off the hook with a prediction that a couple of years ago would have seemed too crazy to us: Fidelity Predicting $100 Million per Bitcoin by 2035"... the firm is putting out bullish reports on Bitcoin and sees the leading digital asset hitting $1 million before this decade is over and a whopping $100 million by 2035.

This much hopium was difficult to digest for some as one Redditor noted, “Bitcoin is not gonna reach $100 million. That would give it a market cap of $2,100 trillion. The total wealth of the entire world is $418 trillion.” I suppose that here they take into account inflation by massive printing, because otherwise it is simply impossible. Honestly it just looks like someone who was desperate to make headlines because nobody with a functioning brain would take this seriously. As the article points out, with would give bitcoin a market cap 5x the total wealth of the entire world, which puts it firmly in the realm of technically impossible. People who make such reckless predictions for attention should be permanently black booked from participating in future discussions. |

|

|

|

The vaccine is not a panacea, it does not cure a disease! Its purpose: - in the best case - "isolate" the spread of the virus by a strong immune response from the body, preventing the virus from infecting the body and making it a carrier - in the "worst" - significantly reduce the load on the body in case of illness. Reduce the risks of severe or fatal consequences. So even basic vaccination, even in the presence of new strains, lowers the mortality curve compared to the unvaccinated community. I am very glad that in Ukraine, at the moment, a total vaccination has been organized, with all vaccines certified by WHO (Koronovac, Modern, Pfizer, Astrazeneca). And now the figure has already been reached, of the total number of residents of the country, 8% and 12% fully vaccinated and with the first dose. PS I received the second dose of Moderna the week before last  Agreed with the points, and I also believe that being fully vaccinated reduces your chance of dying from COVID by a factor of 100 times or more. But I am having doubts with every passing day. Countries that had achieved more than 50% vaccination coverage (such as the United States and the United Kingdom) are witnessing a huge spike in infections and new deaths. Also, a few of the studies now claim that the antibodies provided by the mRNA vaccines such as Moderna and Pfizer last only for 6 to 12 months. The main problem now is that very little time has passed since the beginning of the pandemic. 2 years, in fact, is very little to get a real, comprehensive picture of the situation. The same statistics are kept differently in different countries. What can we say about the real effectiveness of vaccines that have been developed "on the knee", plus the appearance of mutations. Yes, there was not very positive news about the increase in the incidence, and this is attributed to new mutations. On the other hand, today medicine has already received a "feedback"; a stable section of the genetic code of the virus was also recently isolated, which will help to develop / modify vaccines and fight mutations much more efficiently ... Now the situation reminds me a little of the situation with the outbreak of the influenza virus ("Spanish flu") at the beginning of the 20th century, at the beginning there was also the highest mortality rate, there were several global outbreaks, but now we treat the flu with essentially one pill, or preliminary vaccination The flu, even today, is not treated so easily with vaccinations. There are so many different strains of the flu, and scientists model which ones are spreading and how quickly in order to try and create the vaccine that will be most effective in combating the flu each particular year. They take the genome of what they predict to be the 3 or so most prevalent strains and model the vaccine to after those. But there are many other strains that you could be infected with instead, so it still all comes down to probability and luck. |

|

|

|

It's riskier to invest in altcoins, because it's easier to manipulate their price.

This is just my own opinion, but I believe that the majority of the world wants Bitcoin and will get rid of their altcoins in a bear market to be wealth assured.

This is certainly true for the lesser altcoins, but many of the largest alts trade pretty closely to how bitcoin trades. This is because so much of the worth of these alts comes directly from btc:alt conversion rates, and arbitragers keep the spreads largely in line. So whatever bitcoin is trading up or down, the alts generally tend to mimic. |

|

|

|

Amazon's plans are rumored to be colossal. I have no doubt that a giant like Amazon can make it all happen.

That Amazon has made that announcement is still pending for them to put more action to it because action is higher so that things can start growing. Although , bitcoin price is increasing and high now to fivety thousand, this may help more increase if Amazon carry out that because it is a large institution. I hope Amazon will provide bitcoin service for payments soon, I often shop on Amazon and hope to be able to create and store bitcoins on Amazon's service so that when transactions are only internal and the fees are very cheap. I'm sure if Amazon accepts bitcoin it will certainly skyrocket and reach $100k in the current year. I don't see Amazon accepting bitcoin as a huge needle mover for the price, and definitely not a 2x increase on an already elevated price. It just doesn't change the thesis for owning bitcoin at all. It's not going to generate any meaningful business for Amazon, there's nobody who currently would shop at Amazon if only they accepted bitcoin! And people interested in bitcoin aren't interested in it as a currency, only as a store of value or get rich quick scheme. So Amazon offers nothing for that except the perception that it's going to be a big deal for other people, which is fleeting. |

|

|

|

I don't watch much TV on the TV itself nowadays, so I don't know if anyone has been talking about this ad or not: https://www.youtube.com/watch?v=lbvl60_CZl8" What a load of bullshit", I found myself saying aloud after witnessing that for the first time. How can it be working for everyone when so many people in the world are unbanked? And how much of the wording in that was deliberately chosen to mirror the kinds of things we say about Bitcoin? It feels very much like a pre-emptive first strike on their part, possibly demonstrating some insecurities about the threat their business model now faces. Anyone else get the sense they had crypto in mind when they wrote the script for it? Not at all, honestly you’re really reaching hard to clutch at your pearls here. The simple fact remains that bitcoin isn’t used as a currency and it’s not particularly useful as a currency, and centralized networks like Visa will always work faster and better than bitcoin’s slow, expensive transactions. Which is fine, because again, no one should consider bitcoin a currency. If it wasn’t for the lambo dreams and memes, no one would even give a damn about crypto. The worl’s fascination with it is at a get rich quick scheme, and the technology interests a vast minority of the users. |

|

|

|

First of all, Bitcoin price doesn't always go up as we all know. It starts going up generally when there is a good rally or a bull run. Let's say that the price is always going up. In that case, there are still two types of people whose usage purposes are totally different. Or there are three types of people. Some people only like to trade their Bitcoin in exchanges or HODL their coins. Some people like to use Bitcoin only when they decide to buy something. And some other people like to do these things both at the same time.

The premise is “why use bitcoin if it is always expected to go up.” What it actually does is not relevant, so you’ve fundamentally misunderstood the question. And it is unquestionable that among unsophisticated investors (i.e., retail investors) that bitcoin can only go up. That’s why every time there’s a dip, the mantra on these boards is you have to buy every dip. The subtext of that is any dips are only temporary and the bull case will reestablish soon. |

|

|

|

While most of the illegal activities in the world take place in USD and I am far from saying that bitcoin is actually worse than any other asset on that regard, I have read many news about the American withdrawal from Afghanistan and how the US government froze some billions of USD belonging to the previous government or perhaps (debatable) to the country itself. Obviously, this could not have happened if those assets were held in bitcoin or other crypto. It seems that not everything is good in self-sovereignty?

BTW, this is not a statement saying that Taliban are terrorist, just wondering about some other cases in which states were clearly linked to terror.

Yes, obviously and unequivocally any financial system that cannot be blocked or sanctioned provides safe haven for terrorists and other bad actors to facilitate their illegal and harmful actions. There are people on these boards who instead of acknowledging reality get angry when you state this obvious fact. The inability to acknowledge reality disqualifies all their other opinions, as they’ve proven themselves too partisan and to irrational to be taken seriously. And no need to equivocate. The Taliban is 100% a terrorist organization, as much now as it was before they were overthrown by the western allies. |

|

|

|

~

Not sure if he has the moral compass to return the loot. He could have told the project themselves ahead of the hacking and shows the vulnerabilities of their application. With that there is no hacking at all and everything will not blown out of proportions. So to make the matter worst, the hackers could spent time in jail because that stealing. But he avoided it by returning everything and getting $500k bounty instead. So everything ends good, and lessons are learned here That defeats the purpose of the hacker doing a white hat hacking, by telling them to be alert, the hack will not be realistic because I am sure that if they up the security at that time, they won't be able to keep it up everyday so they try to make it look like it's business as usual so it's much more realistic. Also, there are innumerable stories of people alerting software companies to security flaws and the companies not taking them seriously or outright ignoring the reports. But a highly publicized hack is something the company cannot ignore, so much more likely to get better and faster results to upgrade the security. |

|

|

|

I couldn't put the full title in the subject line due to character restrictions, but here is the full question:

If bitcoin was fully adopted into everyday life, why would it ever be used for day-to-day transactions if the general consensus was that the price would always appreciate?

After reading several posts on this forum many people seem to think that Bitcoin will always go up. If this were to be the case, why would people spend Bitcoin at all? In this theoretical time, wouldn't it just be a poor financial decision to do?

Or is it thought that in this future where there is widespread adoption the price would stop being so volatile and for the most part stabilize?

First point is Bitcoin is cryptoCURRENCY = meaning must be use in exchange to something for this to have distinguish value. Second point is Bitcoin has been wrong anticipated by people in which going to be Store of value. Third point is Bitcoin is very well trust(though also manipulated) in which the main reason why people seems to be waiting for long term. if bitcoin mate it adopted worldwide , then this is much valuable to spend things that i believe the main thing why people keeps holding instead of spending . On the first point, it may have been the intention but it's certainly not of much practical use as a currency. A currency that can't keep a steady value isn't much of a currency at all. Store of value is still being proved out. There hasn't been enough time to determine if bitcoin will prove a decent historical store of value. |

|

|

|

Bitcoin doesn't exactly have an efficient way to measure "consensus" and further, there's a major difference between what bitcoin users might think versus a consensus by miners, Full nodes are responsible for overseeing and verifying that consensus rules are being respected. Miners create blocks and include transactions whose validity is again controlled by the full nodes. There's a status quo which, for reasons that have nothing to do with consensus, is very difficult to change. It's difficult to change because you need a huge majority of the community to agree to the change. It's not like when you vote for a new president and the person with 52% comes to power. You need much more than that in Bitcoin. It's also difficult to change because interested parties will never vote on something that decreases the decentralization or network security of Bitcoin. Yes, there are always two most important things in the Bitcoin network. The first is decentralization, and the second is security. This is the basis of Bitcoin's value and the basis of Bitcoin's consensus. If these two points are lost, Bitcoin will no longer be valuable. At present, the Bitcoin technology itself has proven its value, and there is currently no force that can tamper with the data of Bitcoin and crack the private key of Bitcoin. On the other hand, Bitcoin is also becoming more and more decentralized, because Bitcoin is currently being dispersed in the hands of more people. In the beginning this may have been true, but bitcoin today is more of a self-fulfilling prophecy than anything else. It has value simply because it has reached a critical mass of people who believe it has value. It's not the decentralization and security that keeps the value either, it's just that there are enough people who bought into the premise to keep it there. Now it's just a speculative asset, relatively few people actually use it for its intended purpose (actual commerce), which is where decentralization and security would actually matter. |

|

|

|

It's a combination of socialism and corruption of their government and over reliance to oil that has caused this hyperinflation that they have been experiencing now and if the leaders of this country invested on infrastructures like hospitals, schools and other public infrastructure then we would've seen something different, they got too complacent that they didn't expect oil to go down in prices.

I doubt the particular form of government in Venezuela is the one primarily causing the economy and the entire country, so to speak, to crumble down. Venezuela is not even truly a socialist country. The problem, of course, is a lot more complicated than it may seem, but I guess it is mainly the government's mismanagement that led to the country's failure. Of course, too much reliance on oil is just one big failure representing mismanagement. That's basically a lack of foresight on the part of the government's experts. Venezuela is definitely a socialist country. It is run by the United Socialist Party of Venezuela, governs the economy with socialist objectives, and has nationalized private businesses in the name of socialism (and then proceeded to run those industries into the ground through cronyism and general incompetence, particularly the oil industry). Prices are set by the government in Venezuela, another classic hallmark of socialism. There is no way you can look at the government and conclude it's not socialist. Well, Venezuela is as socialist as China is a communist, which means it is only as they claim. One of the most basic tenet of socialism is that all members of the society are to fairly benefit from the proceeds of the economy. That is definitely not the case with Venezuela. Socialism was an attractive system which served as an alternative to the growing monopoly and exclusivity of a few privileged members of society during the Industrial Revolution. In essence, Venezuela is not a socialist country. It is what a failed socialism looks like. Economic equality is always the promise, it's never the outcome. That leaves Venezuela as a perfect example of a socialist state in practice. To try and argue that it's not "socialism" because it didn't achieve the impossible promise that socialists make is to ignore the fact that this is exactly what socialism looks like in the real world because it's not a workable economic model. Venezuela is the perfect example of socialism's failures because it is the quintessential socialist state. |

|

|

|

|

For me today has been one of the biggest ones. I just won 9372 sats and 4444 RPs with only 11 WOF spins. I think it's the first time I see that.

For me today has been one of the biggest ones. I just won 9372 sats and 4444 RPs with only 11 WOF spins. I think it's the first time I see that.  Amazing

Amazing