True, I generally have to refer to the specs to figure out which one goes to what or peek inside. But I believe that we've digressed from the actual topic at hand. I only wrote this small piece to help those who were having lockups.

Still a great topic for anyone interested. Thanks, both of you. A solid primer: Anatomy of Switching Power Supplies |

|

|

|

OMG, facepalm #2 (twice in one day!)

once again, an investment thesis depending on the whims of central bankers whom you should trust the least.

When you're done breaking your nose, take note: CME raises margin requiremets 27%. Of course, they waited until gold was declining just as with silver. However, the act has been much less effective than it was in silver three months ago. Leveraged investors are going to be knocked out of the game entirely. This is systematic control of an asset. If that can't be seen, there's no amount of hard data that will convince such an individual. Statistical concentration had developed prior to the Frankendodd act being implemented on July 15th and was followed by an almost immediate ramp up in the price of gold. Now, a further removal of margin players from the pool while unleveraged big money is statistically concentrated on the buy side. As MatthewLM pointed out, silver is in backwardation again. The activity is subtle because the price action is so glaring. Looking at factors outside of the price action (and beyond even the volume) will take you down the rabbit hole. This is a shake-out to ensure the run on major banks that have obligations does not yet occur. They are holding the system together. Once that control finally breaks, gold will be impossible to obtain at any fiat-denominated price. Gold will be traded only for real goods; other assets. i remember so well from 2002-2009 guys like Eric Sprott and James Turk getting up to a podium and saying "why are central banks selling gold? oh well, we'll be happy to take gold off their hands. haha!!!". And the price kept rising.

From 2002-2009 they were right. They're still right. so, i submit to you, now when they are buying, the price can very well keep dropping.

Let's get that logic straight: - Biggest buyers sell and asset rises in spite of selling.

- Biggest buyers buy and asset is supposed to drop?

In the first scenario, demand overwhelmed central bank selling. In the second scenario, central banks are now part of that demand. In what way does that portend a drop in prices? You're going to get blasted and rush to reverse your positions at the worst possible time. Impatience will drain your trading account. If you insist on trading, take what profits you've made and put on a fully hedged position from here so it won't matter which direction the price goes. |

|

|

|

Volume alone does not dictate direction. This is an obvious transfer of wealth from new entrants and/or weak hands to interests recognizing gold as money. Like taking candy from a baby.

this is /GC, another gold futures contract. this goes back to 6/05. see that volume bar all the way to the right? highest volume EVER since the creation of this contract. ignore at your peril.

That's like saying that Bitcoin will crash because the price has risen as more participants invest in it. The same price drop would occur if just one giant fund sold several tonnes in one order. With high volume, it's a lot of little guys bailing out while the big fish scoop up the goodies. As offered above: like taking candy from a baby - by startling it into dropping the candy. Start thinking like a big fish, leave the emotions behind. What needs to be paid attention to is the fact that there are three instances where you could've claimed the same as what you're saying now. "Highest volume ever with the drop in early 2008!" "Highest volume ever on a decline at the end of 2009!" "Highest volume ever with the fall in mid-2011!" All of those during the time since housing collapsed and triggered a global panic. That was the point when control really started slipping and it's getting to a stage where control is lost. Not there yet, but it will get there. I'll be buying hand-over-fist this week, then selling in stages above $2000/oz. None of my physical metal is for sale at any price. |

|

|

|

its amazing how much we agree upon yet also disagree upon. i would guess at least half of the total investors out there believe in technical analysis and would disagree with you as do i.

i believe in fundamentals supplementing technicals. but there are those who only follow technicals and would say that ALL information is imbedded in the charts and no fundamentals need be known. as good as you are with fundamentals, you cannot possibly know everything especially those things going on under the surface. i have come to respect those individuals more and more as the years go by.

Isn't it? Fishing sounds better. Less to disagree on. Maybe after gold goes past $10,000/oz.  I've learned the principles that can be applied from those whom have been right about precious metals over the past decade or longer; standing on the shoulders of giants, whether using fundamental or technical analysis. It's the ol' give a man a fish or teach him how to fish. Patience has been the hardest lesson by far. |

|

|

|

Hang on to see where today's dip ends up and then buy buy buy!!

If you aren't aware of the GLD Puke Indicator, it's been extremely accurate in determining the lows. If I had been aware of this in 2008, I'd be a billionaire right now. Source information.  |

|

|

|

So, sounds like we should start buying and holding onto that silver for a few years, aye?

Yes, but gold is the prime monetary metal. Hold some of each, even if it's a fraction of an ounce in gold. |

|

|

|

(pretty pictures)

Reading tea leaves from spoon-fed graphs do little to help you actually understand a market. As I said, just hold onto your physical gold. |

|

|

|

facepalm

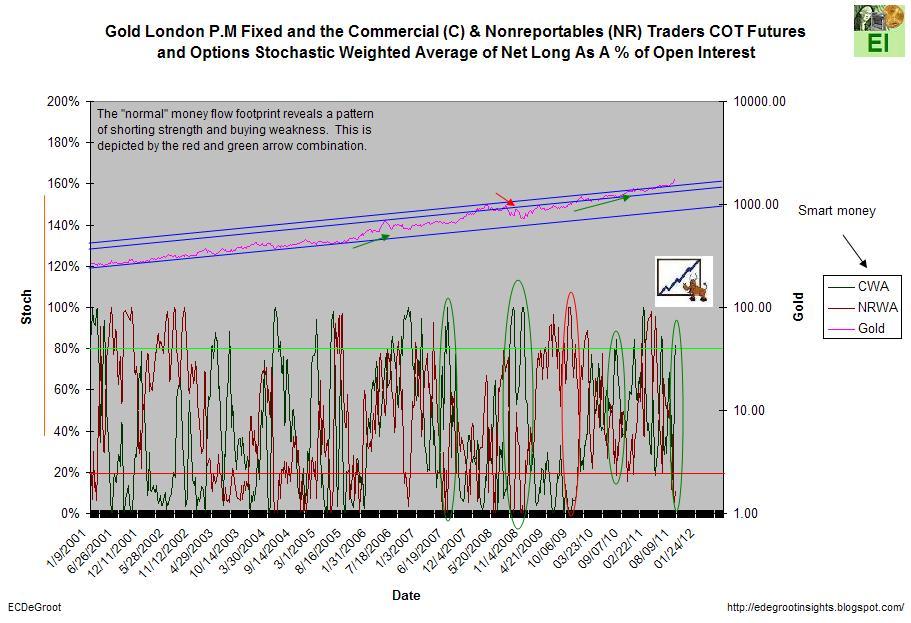

Don't hurt yourself, I know logic and math can be hard for some people.  I'll explain: the chart shows that the very rich are buying while you and anyone else listening to the media are selling. Like taking candy from a baby. I'll even go a step further and provide direct links to the source information: About the CoT reportsDisaggregated Commitment of Traders Historical DataDisaggregated Explanatory NotesIf you choose to rely only upon the data available from thinkorswim, that's your choice. The information is available for you to do your own due diligence. When you're shocked by gold's continuing strength, you have none to wonder at but yourself. |

|

|

|

Priceless! Thanks for sharing. DZZ ramping.

DZZ does not lead the gold price, nor other leveraged instruments any longer. Physical does now. the carnage has only begun.

100% accurate. A comparison of the 1980 gold rise to today from Gene Arensberg. Volume (capital flows) on all gold related instruments (both long and short) is soaring and will breach the levels of yesterday.

Volume alone does not dictate direction. This is an obvious transfer of wealth from new entrants and/or weak hands to interests recognizing gold as money. Like taking candy from a baby.  |

|

|

|

At this point the Fed is simply waiting to pull the trigger on Quantative Easing round 3, the only bullet left in their arsenal in the fight against recession. When that happens, gold will go crazy.

THIS is your investment thesis? Depending on what you think the Fed will do? the waves of bad news for gold will keep coming over the coming months. it will start perhaps with the lack of any meaningful QE from Jackson Hole. then next months Comex opex will disappoint. then the USD will start ramping. then even (get this) an announcement from Ben that the Fed has decided to RAISE interest rates despite what they said.

"THIS is your investment thesis? Depending on what you think the Fed will do?" Whatever you do, don't sell your physical gold. |

|

|

|

how many more years do you expect this 11 yr bull to run?

you've been set up.

At least four more years before stabilizing. I'm starting to suspect that you are not yet capable of projecting out that far. Any further explanation from me will be pointless. The GLD short puts that I bought at the beginning of the week are now closed and additional Jan '12 long calls have been opened. Bullish vertical put spreads due to expire in September are maintaining neutral Theta. Now, I let them sit and patiently wait because the daily gyrations are largely irrelevant. |

|

|

|

This is great!  I was thinking of buying......but where's the bottom? Buy the blood. The gap by $1680 is the target for the shorts to breach. If the gap is filled before the end of the month, there will be a rally of unbelievable proportions. If it isn't filled this month, there will be a large run up before the hammer falls again to push it back down into the $1600s. This is no different from previous battles at much lower numbers. Same game, more players. Metal holders must be enticed to sell in order to supply Venezuela-style delivery demands from the bullion banks. Venezuela is not the only entity requesting physical delivery. It's the equivalent of a bank run, only silent and behind the scenes. If the banks don't deliver in a timely fashion, the game is over and the price of gold immediately will rocket to tens of thousands. I think the game will keep going for at least several more months, if not years. That doesn't mean gold will capitulate; it will simply continue its gradually-accelerating ascent to a multi-decade parabolic blow-off. These daily and weekly runs are nothing. For the rest of this week, the battle will probably be contained between $1740 and $1880. Any intraday spikes are irrelevant to big money - the daily closing numbers are the minimum relevant values. |

|

|

|

|

The short-sighted perspectives are raging across the newswires and people are believing them. It's astonishing.

Let me get this right:

Gold falls 8% from it's recent record high and all of a sudden, it's the end of gold? Meanwhile, the S&P plummeted almost 19% and that isn't even from a wild run up. The dollar continues to muddle around at record lows, showing no sign of genuine strength or an impending retracement and being down over 17% from it's 3-year high. Treasuries have hit a blistering 13% rally that looks exactly like the 25% rally at the end of 2008, whereupon almost that entire gain was puked back up over the course of the next six months.

Am I to believe that the rally in treasuries is sustainable, but gold isn't when treasuries are backed by supposed reserve of what... gold? Is the suggestion that the dollar is going to find the fuel for a 20%+ rally? And the equity markets are going to be left to languish when they're the most visible indicator of wealth in the country, even though it may be illusory?

Reason and practicality demand attention over desire and whimsy. One day does not make a trend, nor does one week for that matter.

|

|

|

|

^ my man. right on.

I'll second that. The GSR is one of the easiest long-term trades to work, if you can sit tight and let it run; and is that ratio ever at a wall right now...  |

|

|

|

I agree with everything you just said, miscreanity. That doesn't happen to me very often.

I'm pretty agreeable.  I don't know.  Treasuries definitely aren't the sunshine and roses safety solution that capital needs, but old habits die hard. The government's playbook includes a line that states: "If you make the rules, you can change the rules." As a last resort, gov't can play dirty. Think Frankendodd. For now, the repo market twist look like the best option. You really need to read Alasdair Macleod's article on that. The gist of it is that the Fed will make it more desirable to enter repo contracts than to sit in treasuries or other "safe" instruments, probably by offering better contract terms than the paltry short-term treasury rates. As long as enough of those contracts wind their way back to Fed authorized participants (which can be forced by changing the rules), credit will effectively have been extended to the government. In effect, it's a colossal shell game: "We loan money to the banks, the banks loan money to the gov't, the Fed bumps up the base monetary supply and loans more to the banks..." That will allow for business as usual and the games will continue for a while longer, but it's now in full Enron-mode; i.e. vapor. That first phase of getting money into the banks is over, so now it's time for banks to start lending to government since nobody else is buying (other nations don't have to sell, just stop buying - interest still accrues like quicksand on existing debt). The banks are becoming trapped in the vortex they unwittingly created; little more than puppets of the government they thought was theirs to control. That still doesn't explain why gold should be dragged down, especially when its been behaving as a safe haven. As dollar velocity increases, its volatility will rise as well. Sure there'll be that initial surge of demand you described, but as the effect wears off and capital flows into assets, more money is needed. The more money in the system, the more destructive a deflationary crunch will be. Eventually, no amount of money injection will work and the post-inflationary deflation will finally and violently take hold. Either way, gold stands as the king among assets because it also functions as money. I know you're still skeptical of it resuming that role; why is it receiving safe haven flows, then? yes, he did get the housing call right but i've always been severely disappointed in his solution for MORE fiscal stimulus.

Yeah, that's about when I wrote him off as a grade-A douche. I've heard he throws cool parties, though. even in 2011 they can't move gold around the world w/o all the listed problems and concerns in the article. how are nations supposed to perform balance of payments of gold from debtor to creditor nations on an ongoing basis if we go back to a gold std? it'd be crazy complicated and expensive. we need something digital/instantaneous. did someone say Bitcoin?

There's no need to physically move the reserve bullion (just as dollar reserves are rarely ever 'move'); the existing system works insofar as gold is concerned (large-scale distributed storage with registered ownership of numbered bars). It's the leverage (and in turn the current custodianship) that's at issue. That built up during a fixed gold standard, but with gold freely floating via market exchange that rigidity is nullified, allowing it to form the basis for all currencies and goods exchangeable against it. Market forces determine gold's value and values of everything else in relation to it; actually a very elegant system in its universality and self-correcting nature. Then the real issues shift to the fiat currencies instead of gold, but that's after the revaluation everything is undergoing - you could even look at these crises as price discovery on an epic scale. Because gold is floating at that point, it and Bitcoin would effectively be mirrors of each other. Bitcoin is definitely the future and has some additional benefits but like it or not, gold is here to stay. |

|

|

|

That has been an indication of capitulation selling by holders of GLD shares.

that doesn't make sense. holders of GLD can only sell their shares, not the bullion itself. Fixed!  The suggestion is that weak and/or amateur hands that bought recently are panic selling. Meanwhile, bullion can be obtained by redeeming baskets of shares worth the equivalent of a 400oz good delivery bar. That means big money is grabbing lots of shares during these shake-downs, like a baleen whale scooping up shrimp. GLD is like low-hanging fruit for them; immediately available and simple to obtain. how about capitulation buying from investors like Roubini? he's an economist afterall. gotta be right.  He may have suggested the QE route, but he did call the housing crash and subsequent problems. You can rely on him to understand the problem, just not offer a proper solution. That's beside the point, though. There are all kinds of calls for high prices in gold from various sources that people have grown to distrust. Is that intentional or a bid to maintain legitimacy? Does it matter? There's still too much conflicting information and sentiment for me to say that the clamor for gold is indicating a top. I'll take it with a grain of a salt and make my own decision; that's still looking for gold in the mid-$2000 to $3000 range by late October to November before the real smack-down occurs. thats a great article. and this is the real money backing thats supposed to fit into the new digital age?

Why wouldn't it fit? The world recognizes gold, but not Bitcoin yet. Such a change will be a process, not an instantaneous transition. Don't worry, give it time and we'll be rewarded for our BTC holdings - it'll be a lifetime worth of profit. |

|

|

|

the return will be waiting to buy assets at the bottom of the Depression for pennies on the dollar. the wealth transfer at the end of the Depression of the 1930's was historic.

That's what I'm looking at as well. Not many people will be able to avoid drawing down their savings to survive, leaving those with appropriate wealth management to scoop up dirt-cheap real assets. Because its time:

we're at the top of a trading cycle in silver and today we formed whats called a swing high along with a downturn of several long term indicators shown in the bottom of my picture. notice how the RSI, MACD, and Money Flow Index have been weakening for almost 4 months. we hit the top of the overbought trading cycle today and should enter a drawn out downphase that could last months. SLV in one day has turned down and is just hovering above $40. it should slice down thru $40 like a knife thru butter.

edit: sorry, the Money Flow Index got chopped off the bottom of my chart. you'll have to take my word for it.

It isn't time until the market says it's time.  There's no doubt - the charts and indicators certainly are screaming for a correction. At the same time, it's dangerous to discount peripheral information that can potentially be more relevant. This whole thing just feels like it's going to whip around in an effort to throw off those who can't hang on. SLV isn't GLD, but they're functionally close enough in a monetary sense. I do want to point you to one item; the GLD total NAV tonnes in the trust ( source). There's an indicator that I came across while reading FOFOA's blog called the GLD Puke Indicator (yes, puke). It has had an almost perfect record of predicting a rise in gold within a day or two; it triggers a buy signal when the amount of gold in the trust has declined by >1%. That has been an indication of capitulation selling by holders of GLD. Here is the relevant information, in tonnes: | Date | 08/22 | 08/23 | | Tonnes | 1,284.402 | 1,259.569 |

1259.569 / 1284.402 == 0.981 or a 1.9% decline. That's an even greater decline than the ~1.8% drop on August 11th. In light of the fact that Jackhole is coming up, along with futures options expiration, there could be more selling pressure imminent to squeeze the weak hands further and/or at least hold the price below the $1850 level. If that's unsuccessful, we could see yet another rocket up approaching the $2000 level. I'm leaning toward the effort of maintaining the price level until the end of the month. Ponder this for a moment: | Date | 08/08 | 08/22 | | Share | $167.12 | $184.59 | | Tonnes | 1,309.922 | 1,284.402 |

How is it that the price per share is up over 10% while the tonnes held in the trust declined by almost 2%? That's either shoddy fund management, or the metal was needed elsewhere. Venezuela? COMEX deliveries? Perhaps other sovereign funds that have requested delivery? Eric Sprott is always looking for billions of dollars more in metal... The last margin increase didn't do much to gold or treasuries; more like a speedbump. A lot of strong hands that can pay 100% margin want their metal delivered. Not to mention insatiable global demand. When the margin rates are increased in rapid succession or to a 1:1 ratio, I'll raise an eyebrow. Finally, here's an interesting and creative solution to the issue of getting all the gold from BoE to Venezuela. |

|

|

|

Isn't silver better than fiat in times of distress? Aren't precious metals supposed to be a safe heaven for people during crisis?

Silver and gold are "precious" for thousands of years. What if a new kind of crisis would come? Would their prices plummet to earth?

Yes; yes; only if it can't be traded for food.  |

|

|

|

you know what?

Hey type-A, deep breaths!  The greatest insult is to be ignored... to get to your question. i think M2 is ramping b/c everyone is cashing out of money mkt funds as they are forced to liquidate bonds from the debt downgrade and move USD's into regular bank accts. this is why you're seeing Bank of NY Mellon charging for holding deposits. because they can. so its misleading to say the Fed is pumping new money into the markets.

if you read my earlier posts in this thread, yes the USD can skyrocket from here if enough debt liquidation is forced thru defaults or margin calls raising the demand for cash to pay off these bad debts. you can look at this 2 ways; an overall decrease in the number of virtual plus real USD's floating around or as a scramble to grab the real USD's to pay off the bad virtual USD debts. either way the USD rises.

the $DXY is at the bottom of its consolidation channel. from here we should get a huge ramp. talk about a panic from that happening...

Great analysis. I don't think I can add anything to it. What comes after the dollar hits a boost? It isn't worth it to have cash sitting around without a return. If there is a decent rate, what's being invested in to generate that return? |

|

|

|

$40 for SLV will not hold.

Ok... why? Remember, the argument for silver being an industrial metal cuts both ways. A recovery rally sparking off would give momentum to silver while gold stagnates or even drops somewhat, not even considering the increasing physical shortages of the precious metals. Silver moves in close relation with gold, so silver moving higher will provide headroom for gold to rise as well instead of acting as an anchor as it does now. The GSR would fall as well, increasing investment demand relative to gold. That double influence has propelled silver many times before and there's no reason to expect that to change. so the fact that Gordon Brown sold the BofE's gold in 2000 and that the central banks of the world were selling for most of the noughts while i and the smart money were buying means now they're correct and we should follow their lead?

If it were a link about the BoE, that argument would be relevant. Not all central banks are created equal, nor are they all subject to the same pressures. Developed nations have fiat issues to be concerned about and would have to sell their gold reserves to stabilize their respective currencies while developing nations are building capital and seek to preserve it by buying gold as a reserve. i'm gonna give all you guys a huge tip here that i just spotted. just for my fellow bitcoiners:

look at the VOLUME on DZZ, the double inverse short of gold today. ENORMOUS. someone knows something the fundamentals can't possibly fathom.

edit: highest volume EVER by a factor of 2.

looks like i have lotsa company in DZZ. the volume today is now MORE than double its highest volume ever on 8/9/11. which side of the boat do you want to be on?

I love this boat. This is so beautiful. Already +70 points on XAUUSD... with big leverage.

Does DZZ drive the price of gold? How many clever speculators have been waiting for gold to fall, especially with the price rising almost exactly to a 423.6% Fibonacci projection from the May 1st to 5th decline? If gold retests its $1900 high, how many of them will panic and sell DZZ? When has it ever been good to ride with the masses, much less try to catch a falling knife (DZZ)? The tail does not wag the dog. Here today, smoke tomorrow. Just cash in while you can - I'd sell most of my short positions now. That's the voice of experience: you don't forget losing a one week, seven-figure profit in a matter of hours. i'm really saying none of that shit matters. and since when has Chavez been a good market timer?  When you're small, you have to follow and time the market. When you're a big fish, momentary timing isn't anywhere near as important as volume. Without sufficient counterparties, you can't shift your position (someone has to buy what you're selling or sell what you want to buy), not to mention the finesse required to make a gradual transition that doesn't knock prices around too much. But that isn't even the issue with Venezuela. For Chavez, it isn't even a purchase or sale - it's a transfer from one custodian to another because the current one is suspected of mismanagement. This would be the same as moving your retirement fund from Bank of America to TD because you suspect an imminent failure of the former. Such a vote of no-confidence could easily trigger additional moves from other large holders. Chavez's hourglass will have run out if/when it is dicovered that there is insufficient gold being held by the western facilities. Stop thinking like small-fry and shift your perspective to that of a big fish. You'll accumulate more wealth and sleep better. what you're witnessing is US dollar hegemony in play. the power to turn on and OFF the spigot when the Fed wants. the only way to play this is thinking like a criminal and picking out extremes in sentiment as well as chart parabolas. there would be no greater satisfaction to Ben and the bankers then to smash gold to smithereens right here, right now. and they have the power to do it.

i think the top is in. the ferociousness of todays selloff on HIGH volume, not only on the futures and GLD but especially on the double inverse short DZZ is screaming "LOOK OUT".

at this point i don't think silver clears the April high. until it does, my opinion won't change.

That's for sure - the clout of the biggest player around deciding to throw his weight before he's overpowered. Turning off the spigot is harder than it would seem, though. Expanding the base money supply is easy enough, but how do you withdraw those funds? It isn't like a credit limit that can be reduced, nor are there any counterparties to call debts in from. If "they" have the power, why isn't gold still at $250/oz and silver back below $5/oz? I'm looking for a breach of the $50 level in silver during September. I really don't care about anyone else's trading; that's their business. It's the physical holding that concerns me. Whether there's deflation or inflation, instability means that physical gold will be in demand. When there's enough shortage that no gold is readily available and prices are out of range for the majority of people who haven't gotten it, those without will suffer. It doesn't matter if you think Bitcoin will rule the world - the world still runs on gold. I think technical analysis is only good int he short term. Using it for medium or longer terms is not any good. Technical analysis says something is overbought when it's simply just increasing demand.

I was thinking about selling today but I knew it was too risky to make short term bets. I definitely just want to hold on to gold as central banks kill fiat and more and more people see the benefit to gold.

The same patterns arise on all scales, so technical analysis can apply to a minute chart or a decade chart. It depends on how short a time-frame you're talking about - minutes, hours days... I'd say yes. At the weekly level and beyond, technicals give way to fundamentals (then they can be used to confirm fundamentals). At least with precious metals. You could always buy put options. It can be quick money while waiting for the fundamentals to reassert and carry gold higher. The banks don't even have to kill fiat, just revalue it against gold. EIGHT boxes of salmon, halibut, and cod. one of the most beautiful places on Earth. if you all were here i'd give you each a vacuum pack.  I think we can all agree that's better than gold any day!  |

|

|

|

|

I was thinking of buying......but where's the bottom?

I was thinking of buying......but where's the bottom?