this is deflation at work. those excess reserves can't possibly come out from the banks. look at the stock asset destruction of the banks esp this AM. they NEED those excess reserves to stay alive. they might not be enough...

The capital that was in financials is moving elsewhere. Destruction of the banks by reallocation; wealth didn't disappear. Banks can't use their excess reserves because they're needed just for survival. How can the banks continue to profit and keep themselves running? Government assistance in the form of funny money, whether that's from printing or forced guidance of the investment community - squeezing capital into banks and bonds by making other options unattractive. We'll see in an hour or so. |

|

|

|

BerkShares, anyone? This is an ideal situation for Bitcoin, but until it's easy enough to use via handheld devices and/or paper bills with some form of encoding on them (QR codes?), the technology barrier will remain too high. Not to mention the eventual issue of price stability with a deflationary system.

|

|

|

|

at the peak of the 2008 bubble securitization fx'd almost like money but this has not been the case since the financial crisis. this is where inflationists miss the deflationary argument. they think these bad debts still represent liquid money and not debt.

Aside from this beginning of the paragraph, I agree. The deflationary argument isn't missed, it's just based on different assumptions. When assuming that the debt will be discharged at a loss, I arrive at the same conclusion you do. Bad debt doesn't represent liquid money, no. It is just locked-up and unable to be either redeemed or made use of. The debt hasn't vanished: it's still tied to assets by the respective creditors and debtors; the creditor has been swapped out for another in the case of the Fed. It can't be made to disappear unless the Fed were to take all of the write-downs - forgive all the debt it's acquired. That would do a lot of damage, if not destroy the institution and economy in general. Or, the debt needs to be replaced with a liquid form of money. Maybe we should offer our definitions of bad debt so we can be sure we're on the same page. My understanding of bad debt is simply a contractual agreement in which at least one party is not able to or is unwilling to meet the obligations to the other party or parties. Can it get more legalese? There is a difference between debt that is simply extended credit which can be withdrawn, and debt that is effectively monetized by market actions. The Fed's printing is really just a formality, so it doesn't matter whether it continues or not (although pressure will persist for it to proceed).

no idea what you're talking about here. The bad debt as money notion. Since the bad stuff is already out there and completely gumming up the works, the options for the economy are: die now (deflation) or die later (inflation, then deflation). The "formality" is that the Fed is only going through the motions of what it's officially supposed to do - dead man walking. no its not if i understand you correctly here. you're claiming existing debt is equal to money. this is wrong. during the good times debt instruments were so liquid they were almost considered like cash; no more. the debt has become bad debt which is now defaulting and decreasing the virtual USD supply and thus the total amount of USD's in the system thus driving up its value.

If the debt is written off there are still assets that were associated with the debt, no? What happens to them? Is the creditor or debtor helped or harmed; was the debt "good" or "bad" from the creditor's perspective, or the debtor's? When does the transition from "good" debt to "bad" debt make that same debt disappear? Bankruptcy proceedings? What is the actual destruction process? If you can explain your understanding of the mechanism for this, I'd greatly appreciate it. As far as I see now, there is no pause or reset button for this game and the line between a mere asset and money remains blurred. What's being described is like putting piles of cash into a safe and forgetting the combination to open it. It's no longer liquid but it's still there, you just can't get to it. Now what? Some form of common money is needed to keep the show going, pay the bills. Who would believe you when you tell them you locked your money in your own safe and can't get to it? (US to China: sorry, we can't pay because, uh...) You'll come off as either foolish, stupid or a liar. (War?) Wouldn't it be easier to duplicate the money that's locked up to act as a replacement until the safe can be opened? (Everything's fiiiiine, really! Nothing to see here, it's all good, we swear on the Founding Fathers! Just give us another month or twenty!) Now that both sides (creditors and debtors) involved with the debt that's been tied up are in a frozen position (creditors receiving income & debtors using credit lines), they'll need liquid assets to keep going. How much will they need? Well, how much was held in reserve (if any), what's the minimum to maintain solvency and how much was the debt worth? Be honest - $700 billion, $2 trillion, $1.4 quadrillion? Ok, now can both sides survive a resonable time before reality sets in? Repeat that situation millions of times, at all scales. Everything is already broken, the Fed is just handing out the playbill. It comes with a complimentary $1 billion for those who can afford seats to begin with. Almost forgot the kicker: what happens when the safe is re-opened? Are the safe owners richer, or is it just an illusion? I think in percentages. perhaps the Fed regarded this as a small price to pay to reinflate the markets. doesn't mean they are linear thinkers as well. at this point they see the danger in letting it ramp to $2000 or higher.

these crises are occurring b/c of constant Fed intervention causing boom bust cycles by suspending the business cycle.

So there wasn't danger in allowing gold to rise past $500/oz? $1,000/oz? $1,600? What happens when $2,000 is broken? Will the Fed see danger in allowing the price to go past $2,500 or $3,000? What I'm getting at is: at what point does the Fed finally decide, enough is enough? If the Fed intervening is causing these boom/bust cycles, do you think it stands to reason that the problem might grow so great that the Fed can't manage the problem? When will the Fed get out of the way and allow the business cycle to right itself? Is that even possible now, or will the whole system snap in two? my OP and this entire thread has been clear where i stand. deflation, the end of the gold bull and a generational rise in the USD.

I was thinking more about the next two months, but that works. So a gradual or rapid decline in gold from here with a corresponding lift-off in USD? the contraction in the shadow banking system of securitized debt argues against those same securities effectively acting as money. they're contracting from defaults:

The chart shows securitized debt is contracting while traditional forms of debt are rising. The "bad" debt doesn't just disappear - the valuation is reallocated, often losing some of its attributed value along the way, but certainly not all of it. Another issue is how these "defaults" are occurring. Where has it been stated that the debt is being defaulted on? Use of that term is dangerous; likely to cause a cascading panic among counterparties. Is the bad debt really being defaulted on through bankruptcy and write-offs, or simply being reclassified? Either way, the debt still doesn't just disappear. If it's an accounting change, then nothing has really changed. Even in the case of bankruptcy and write-offs, the asset and/or debt involved reverts to one party. For the loser, it's like having grown and learned how to use a sixth finger, then being forced to cut it off because someone else wants it for skin grafting after his face was blown off when he lit a firework. Default causes some loss of value, but there is still a shift in asset allocation (again, assets don't disappear as if via magic) that proves detrimental overall. I think I've beaten a dead horse enough for now. There are more immediate developments to pay attention to at the moment: Persuant to the physical gold premium issue discussed earlier: $17 gold and $2.48 silver premiums in China. Spread far enough, the paper/physical connection fully severs and the banks lose all control. Demand must be alleviated in the short term. One last point - has anyone been paying attention to the Japanese Yen? The final round may be in the chamber. Bernanke's playbook reads: kick USD up, smack gold down, announce terrible news that reverses those positions. Bitcoin should also do well if there's more inflation in store... |

|

|

|

Dollars are not an IOU for gold. Does the issuer of dollars owe you gold? No. This used to be the case but not anymore. USD is fully a fiat currency backed only by it's value in exchange, which is backed by the businesses and consumers which use it.

cypherdoc is basically suggesting banks will purposefully destroy themselves to "save the dollar". I think such action would be good for gold as well. This will never happen though.

That's a reasonable way to look at it, just take it a step further. How do businesses and consumers save their accumulated wealth? A primarily transactional currency cannot maintain stable pricing (thus keeping the economy stable overall) while also acting as a store of value. Right now, everyone is jumping from one transactional fiat to another, or assets that don't perform as gold does. Save in gold. Spend in dollars/fiat. Two sides of the same coin. It may be a chicken & egg issue as far as whether gold as money came first or some form of representative fiat did, but gold certainly came before the dollar. The dollar was initially backed by gold and silver. Just because a direct connection isn't present doesn't mean there isn't a relationship. The floating exchange forms a tie on its own, much like fluid coupling in a transmission. Bitcoin (and any similar crypto-currency) is the only currency I know of that truly transcends that connection. |

|

|

|

However, as has been pointed out various times in this thread, higher aggregates will evaporate in our economy, which was not possible in the Axis economies. Paper money just kept piling up.

those paper marks were not debt and could never be cleared from the economy thru default. USD debt however is vaporizing as we speak decreasing the amt of virtual USD's.

Sure, if debt were simply debt. Securitization has changed debt into a form of money - it now functions as such. There is a difference between debt that is simply extended credit which can be withdrawn, and debt that is effectively monetized by market actions. The Fed's printing is really just a formality, so it doesn't matter whether it continues or not (although pressure will persist for it to proceed). gold bulls are making a big deal about Operation Twist and how the extra liquidity is going to drive gold much much higher.

Cause and effect are reversed here. Again, the functional monetization has already taken place. Gold is not dependent upon the formality of the Fed introducing monetization to maintain liquidity; everything is already in place for gold's upward revaluation. The base monetary inflation is reactive and simply locks that fate in. also the famous Volcker quote that the CB's failed back in the 1970's to "suppress the price of gold" as being a mistake. why can't the gold bulls take that statement for what it is? what it is is a lesson to CB's to never let that happen again b/c they lost a lot of money in the HT of the 1970's. this time they won't let it happen again. what ever happened to the accepted theory that the Fed used the gold price as a warning sign that their profligate activities were getting out of hand? everyone assumes they've forgotten that tenet but i say they haven't.

The quote in question from February 12th, 1973 is available at Jesse's. It is from Volcker's memoirs. "Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake." Paul Volcker, Nikkei Weekly 2004 Note the bolded section in the full sentence. When taken in context, it suggests a controlled appreciation in gold's price, not an all out assault to keep it down. Many held US dollars because they were conveniently convertible to gold, much like Perth Mint certificates are today. At that time, gold was still set at a fixed rate in relation to the dollar, so the same trick of severing the connection is not available this time around. What happened after the dollar was no longer directly backed by gold? Demand for gold via dollar convertibility, now being viewed by other nations as unreliable, shifted to direct ownership of gold. As Jesse states in the Volcker post linked above: "The banks love to whack gold and silver prior to a market operation. This way if the metals rally, they have less opportunity to break out and run even higher." By running the price down prior to revealing QE3/OT/Flood-the-world-with-snakeoil, gold and silver will simply run up to resistance at prior record highs instead of hitting new ones. Subsequently, their rise will continue, but it won't be with as many participants as it almost certainly would've been if gold were nuzzling its peak when the banks let loose. Instead, many will be surprised and in disbelief that the price could continue to rise, then hesistant to re-enter for fear of another top. That's the systematic "intervention in gold sales to prevent a steep rise in the price of gold" in action. It is good to keep in mind that commodity trading firms did not merge with the major banks until after the gold bull in the 1970s. Having these trading houses under their wing, the bullion banks now stand to gain from gold appreciation rather than be raked across the coals. The question has been posed before, but wasn't answered: if gov't has the power to permanently maintain a low price in gold, why did it rise at all? In fact, why do these crises even occur? Other than that, I agree with your and netrin's assessment. Also, gold will be sold - but with dollars unreliable as a store of wealth (again), that (massive amount of) capital will flow into gold. As for how things will unfold - a spike in gold's (and silver's) price to entice selling (the cure for high prices is high prices) prior to futures delivery deadline at the end of the month, followed by another violent smash down at the beginning of October. The same will repeat after options expiration in October - a large spike rise in gold's price during the latter half of October. Finally, the debt crisis in Europe will be proclaimed "solved" and the pols will pat each other on the back while the system continues to crumble under their feet. Regardless of the fact that the same pattern arose in 2008, this is very apparent from everything but price action. Use all the tools at your disposal when it comes to gold, or resort to running blind. The gold price analysis I'm describing has already been explained in detail; cypherdoc, maybe you could post your most clearly explained analysis to make assessing the accuracy of differing methods easier to follow. |

|

|

|

The problem with assuming the USD is everything is that it's also a derivative: of gold. Not anymore. By definition, perhaps. In function, I disagree. Explanation? If banks fail, the gold and silver shorts will fail along with the paper markets right?

So good for physical gold and silver in such an event no?

Assuming the relevant banks fail, yes. And yes, it would be good for precious metals so long as there isn't a cataclysmic collapse of society. |

|

|

|

... buying b/c everyone's pessimistic. nothing in there about manipulation by the Fed or CB's.

Jim Rogers does not use the term 'manipulation' explicitly. Rampant monetary inflation is not manipulation? Perhaps we should have an agreed-upon definition, because virtually everything being done now is manipulative, as far as I'm concerned. The markets are being whipped around by the major institutions and that's been their entire means of preventing collapse - keeping market participants too confused to make a cohesive decision one way or another. You called for a USD rise, which is fine. I took no issue with that, only your insistence that your concept is radically new when it isn't. The mechanism has been described by others. Please keep the focus on the concepts and avoid ad hominem arguments. now come the veiled criticisms/excuses.

It was a compliment. why do you always quote yourself?

... It's also easier to quote than retype.

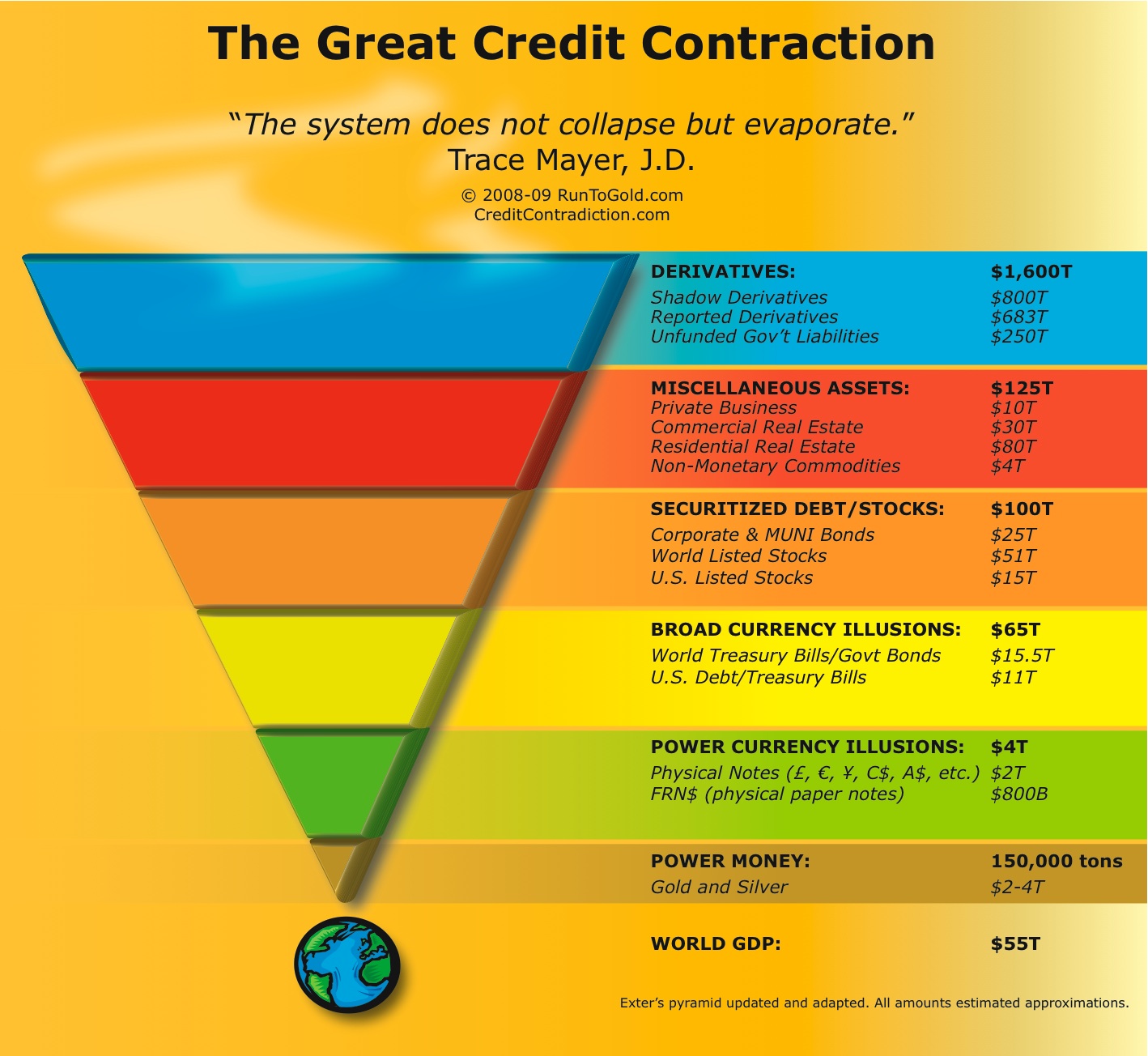

There are a lot of links and quotes in my posts. I add them when they're relevant and make my point further. the USD reserve currency system is based on debt. banks borrow USD from the Fed at below mkt rates and from each other at he Fed Funds rate and go out into the world and speculate in emerging mkts esp China the last decade. these USD's are mopped up by the foreign CB's and they keep most of these in reserve and then inflate their own currencies on top of the USD reserves. hence my inverse pyramid analogy of debt and currency built upon debt. most of the debt in the emerging mkts is USD denominated. problem is when we get financial crises and everyones debt starts imploding the scramble for USD's to try and prop up those bad debts and maintain enough USD reserves becomes intense and worse overseas and is really why the USD goes up. its not so much for the safe haven status as that they are FORCED to liquidate bad bets and buy USD's to cover as much of the bad debt as possible. hence the shrinkage of virtual USD's worldwide. this is why the Fed is forced to provide swap lines nowadays and why most of the TARP and bailout money had to go to prop up overseas banks.

Absolutely - this was one of the things we agreed on. Essentially, N th derivatives. The problem with assuming the USD is everything is that it's also a derivative: of gold. i point to all emerging US stock mkts year to date as evidence to my assertion. ALL are worse off than the Dow or S&P year to date. what evidence do you submit other than a blanket "this is how i see it"?

I point to all but very long-term technical charts and indicators as being suspect, stemming from the fact that manipulation paints false signals. In addition, assets and the means to make use of them are disproportionately distributed throughout the world, with the productive capacity and infrastructure decaying among developed nations. i just think the deflationary depression comes before the hyperinflation, the reverse of what you predict.

This relies as much on policy decision as hyperinflation. at least you perhaps inadvertently agree with me that there will never be a one world currency if you believe in war.

A dominant world currency is very possible. There will be alternatives so long as currencies exist. i don't think you understand. these paper mkts were funded with USD debt. as the debt based paper markets in gold or whatever implode, speculators are FORCED to scramble for "physical" USD's to pay off their losses. these usually come in the form of margin calls and they don't have a choice to plow that money over to physical gold and certainly can't use physical gold to pay off their losses.

Margin calls will hit and losses will occur. So what happens on the other side of the trade? Derivatives form reservoirs into which capital flows. The flow into them doesn't immediately disappear - it's a process. Where does that money go? When paper market volatility is extreme and the price is collapsing, will investors continue to risk leverage in markets on an instrument decoupled from its underlying, in-demand asset? No. After seeing so many lose their shirts in paper, they'll have to buy the asset itself or risk further losses. It's a learning process and those who learn quickest will be the most successful. Write-downs can only occur to a certain extent, that being the level of the derivative-holder's solvency. Beyond that, its assets become forfeit. Valuation thus flows out of that entity and into the recipient by way of asset transfer. Derivatives have been great for turning profits without getting hands dirty. If a trader wouldn't normally be trading the underlying asset, a precarious situation exists for any market. With gold, demand for the asset is rising naturally - i.e. not forced. This is opposite the dollar, which is being forced higher. Should the derivative valuation be crushed and demand still exist for physical, the financial instruments won't matter at all. They key is demand for the underlying asset, not the derivative. Nobody wants a herd of cattle or hundred barrels of oil sitting in his yard, but a hundred ounces of gold? Who would want a bundle of dollars if it's dropping in value relative to real assets? Only those who see the numbers go up, but don't think about what the numbers are going up in relation to. what if those same derivatives get destroyed via forced liquidation? what happens to the BTC price or the gold price? STILL go up?

As explained above, demand for the real asset is all that matters, regardless of any initial shock that may occur due to derivative disintegration. Gold is a real asset. Bitcoin is a... surreal asset? A managed market does not offer genuinely valid technical signals. By the same token, manipulation can only go so far. On very long term charts, the technicals will provide a better gauge of the long-term trend. This is why it can be hard to keep up with the daily gesticulations, but easy to see the big movements.

but at the same time you've used technical analysis in this thread many times esp to point out target points for the subsequent parabola thats supposed to come along with several support/resistance lines. which is it? Please re-read. Fundamentals provide overall direction; technicals offer points of interest. Driving fundamentally west from Washington, DC? Stop at the Arlington Memorial and the Grand Canyon on the way to Los Angeles. its been 3 wks now since SLV, /SI, and SLW have rejected off their 61.8% retraces from the bottom of Mays selloff. thats a warning.

Of course it's a warning: that's the idea. Market moves can take a long time to unfurl. This helps to scare out those trading without patience. It helps to have unlimited cash-flow in the form of an illusion to blind the populace. The price activity we're seeing has been exhibited very often just before options expiration. With physical delivery of gold and silver becoming overwhelming in the futures markets, any additional strain will be prevented at all costs. If that includes throwing what the banks know is worthless paper at the problem, then that's what will happen. Is it in the banks' best interests to have thousands of new millionaires minted because they held some well positioned longs in precious metals? Look at the price action recently - from the beginning of each month, PM prices are hammered right up to options expiration. After options expiration, prices rise. Behind the scenes, the numbers strongly suggest short covering: the banks are getting out of Dodge. Add to that the FOMC decision coming up; this is no surprise, only the exact events are curious because they echo past events. 20 year, weekly chart of /GC gold future. High correlation to gold spot and long term.

NO parabola?

Try a logarithmic chart, or you'll see exponential rises everwhere. From August 26th: When the parabolic rise becomes evident on logarithmic charts, then itís panic time.

With deflation, extant interest rates are more valuable to the lender and crushing to the debtor.

+1 this is why i don't think bankers let HT happen. There's a problem: the banks are now stuck holding each others' debt. The crap that was flushed down the financial sewers finally clogged up the works and is backing up into the bankers' own homes. If it's impossible to break the clog, the next best thing is to dilute the junk so that it isn't so toxic anymore, consequences be damned. LOL! The $DXY came within a penny of my 76.20 target. i guess the Fed has decided to make this a valid breakout. oh my, there's going to be hell to pay.

Painted charts are picture-perfect. Be nimble and mind your stops - best to you with your trading. Once again, options expiration followed by the FOMC next week. You may as well consult a Ouija board for the daily predictions. The targets of $1,740 and $1,680 remain, with $1,700 a likely point to be retested intraday during the Fed announcement. |

|

|

|

How does this happen, exactly? The GLD trust moves physical unleveraged, unencumbered gold, as I'm sure you know. So how could its price diverge from physical for more than however long it takes to ship gold? Or are you raising a more fundamental issue with confidence in enforcement of contracts, etc, that could arise in a scenario where fiat/existing-monetary-system really starts breaking down?

Yes, GLD is supposed to be backed by gold bullion that is completely unencumbered. There is question as to the "unencumbered" status, but we don't need to touch on that topic for now. It's only necessary to know that there is some flexibility available to GLD management in keeping the fund backed by gold. In order to redeem any of the physical gold from GLD, a block of 100,000 shares must be redeemed in one shot. Also, this can only be done by an "Authorized Participant". This is impossible for the majority of investors, even with approval to go through the "Authorized Participant" for the redemption process. At several points during its existence, the GLD fund has experienced major outflows of metal that do not seem warranted by any stretch. The largest instances of these are what trigger the GLD Puke Indicator. GLD is used as a trading vehicle as well as for exposure to gold. Because of this, and the popularity of the fund with neophytes, it's easy for large interests to squeeze out those unprepared. Those big "authorized" players then pick up all the shiny GLD shares which can be redeemed as needed. This is how the divergence occurs: as demand for gold continues while supply decreases, the fund will have an increasingly difficult time sourcing the asset. During these downdrafts in gold's price, major chunks of the metal in trust have been redeemed and will be again. If that's followed by a major rise in the price of gold with no supply available, the paper price will rise without a commensurate increase of gold held in the trust. With little to no supply during a true bubble-like situation, the price of gold will not come down. Any of the approved institutions can still withdraw from the fund, taking additional gold with them. When this happens, the paper price represented by GLD will plummet while the physical metal will be virtually impossible to obtain. The GLD fund will then be forced to close and investors who couldn't get out (individual investors, retirement funds, etc.) will take a 100% loss because there won't be any gold remaining to back the ETF. That point has obviously not been reached yet and there are other funds which have much more stringent standards and easier redemption mechanisms, but I wouldn't want to even be exposed to the possibility of being caught in such a situation. Sure, China's got the reserves to do so. It makes them look like the good guy and puts a yoke on the collective neck of the Eurozone nations. Also, since China has been buying up real assets for the past few years with it's depreciating US dollars, this is another means for the country to make its USD stockpile continue to work instead of just sitting there losing value. There has to be a buyer for distressed assets. China (and other well-positioned nations) will be buying up foreign debt in distressed sales using the same crap paper they were paid. Paying back the debt will mean that the debtor nations will effectively become slaves (indentured servants, to be more euphemistic) to China - unless the debt can be paid off with worthless currency or war breaks out. This is the global transfer of wealth - it's taking place in more than gold. |

|

|

|

If you lick it, you get a buzz. I wont be buying any gold from you then. I don't lick all the gold, just some of the freshly minted bars. Tastes like licorice. Besides, not for sale!  |

|

|

|

I'm more of a Goldschlager man, myself.   since when have they been trustworthy? they don't even make good calls anymore.

Deceptive tactics before the feigned retreat. There would be non-stop rising without pause in gold if this were the real loss of control. Whats with this obsesion of eating gold a lot of paperbugs have? You can not eat paper neither (well, you can but you get me) and they defend it as money. If you want to eat get food, money is not for eating, money is a mean of exchange. Why would you want to eat money?!?

If you lick it, you get a buzz.  In all seriousness, it demonstrates an admittedly semantic difference between inherent value and a mere property of the substance. For the absolute basic existence of humanity, food is necessary. Without it, we die; we can live our entire lives without gold. On a different level, gold could be considered to have inherent value for an economy (such as one without the infrastructure to support crypto-currencies). Not necessarily that either perspective is right or wrong, just an issue of which one is appropriate at the current time. yes, absolutely. in the sense of: "perhaps you ought to consider quoting me as i am the only one i know that had predicted this manipulated central bank induced USD rally weeks ahead of it happening". there is a huge distinction btwn what that lame article you referenced was saying and what i predicted. just saying "i think it might rise now b/c its time" is way diff than saying "why or when" it might rise. the fact that its CB intervention means everything and is precisely why it has ramped so viciously.

...

look. i made this call on 8/9/11. IF i happen to be right on this top but happen to be off by only a month and $100 i'd bet most ppl here on this thread would call me "A Legend" looking back at this years from now as opposed to someone just yelling "fire". not that thats my motivation though.

Of course, Jim Rogers has never made mention of the manipulative games going on. Some such as yourself are better at calling the short-term gyrations than others. Some are better at long range shifts. That doesn't mean you stand alone. Also, call me crazy but I prefer having a life.  funny you should mention that. this last weekend when i was debating this with hugolp, i came to the realization that my viewpoints are clearly US centric and based on the USD being the worlds reserve currency.

... you would then argue that means gold is still a great buy b/c the ROW demand will surely send gold skyrocketing.

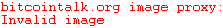

It's been proposed that there will be a hammer-like action in gold. This time it's just on a much larger scale. The long trade for this stage is about half over; it's the short trade that will be the show-stopper. For several months, at least. however. if you'll recall my inverse pyramid example...

... emerging mkts are going to be hurt even more than us. i could very well see that foreigners will be forced to sell their gold to eat or pay taxes. THIS is what i think the CB's are gunning for and is the clearest example of USD hegemony. a worldwide collapse in the gold markets. obviously i'm betting they'll be successful via brutal liquidity drains and no more QE. they need to save the system that has made them Masters of the Universe.

You mean this pyramid?  Are you speaking of the same emerging markets where manufacturing has moved while those in developed nations rust or are taken over by government? The same ones where agriculture is still a large component of national production as opposed to "developed" countries where 98% of its citizens couldn't grow enough food to feed themselves for a year if they wanted to? These are same growing environments that have built brand-new infrastructure and have positive prospects while the "Masters of the Universe" panic and try to save their own hides. It sounds like you're suggesting the USD is here now and forever. Haven't you said that nothing lasts forever? There's a turning point coming up in gold, but it isn't the end. When I brought up the greatest insult of being ignored, the same applies to the US dollar. Once it becomes irrelevant, the lie crumbles into dust. There is only one thing that can realistically make the dollar irrelevant: a large portion of the world shifting to a different currency (Euro, Yuan, gold, Bitcoin, etc.). If, or rather when that happens, the world goes to war as the US cannot sustain itself in its current form. America will try to hold onto everything it can by force rather than endure the difficult transition of shifting to greater productivity instead of consumption. Should America not become violent, that would shock me - nothing of its past or current behavior suggests that will occur. It isn't the fact that this dollar rally happened that's interesting, but the extent to which it has risen in such a short time.

this came as no surprise to me. not when you predict that the USD rally will come from CB intervention as i have. i have said several times the USD will "skyrocket". this is how markets are manipulated. in the middle of the night interventions when most investors are asleep at the wheel to create maximum psychological impact at the open via a huge GLD gap down; extreme ramps to force margined gold players out of their positions; small descending triangle formations to "tempt" bulls in gold into buying and leveraging up before "the trap" is snapped shut; extreme ramps in the USD to force USD shorts to cover overextended positions; waiting until sentiment reaches extremes before initiating an attack; all the while to create huge profits for insider bank traders that have been notified ahead of time. this is where technical analysis combined with intuition and a thorough understanding of fundamentals, criminality, and sentiment come in handy. i can "see" the setups. It was interesting, not surprising. The move was obviously imminent. As for the sequence that it took place in, the specific technique was curious. The pattern you described is especially important to grasp. The same has occurred in gold, only inverted. Has any of this fixed the problems? No. Has anything been done to actually fix the problems? No. The same pattern will therefore continue, the overall long-term trend intact. now you're just being defiant. give me a little credit here. the fact that Dan Norcini and other gold bulls are just now coming to this realization of CB intervention that i had a month ago is significant. there IS a fire. i've listened to Dan every Friday for as long as KWN started after Eric King broke off from FSO. he is an example of a linear thinker. not to mention that he owns a bullion business if i recall correctly which severely biases his views. this is a high stakes game of tactical chess. i'm not just one or two moves ahead of him, i'm twelve moves ahead.

I realized there was something particularly special about gold a long time ago, but I don't claim that I discovered why this was by myself and in a vacuum. Credit where credit is due, when claims are justified. We all laugh at Al Gore for his claims regarding the internet. Even if we come to realizations on our own, it's good to keep in mind that they don't come to us from nowhere. If I have seen further it is only by standing on the shoulders of giants. ~Isaac Newton Twelve moves ahead might win a battle, but being ahead in the wrong direction will lose the war. Gold still is not the bubble. you would be wise to not ignore this failed breakout. i've already told you the confusion and diverging signals is b/c we're at a fundamental transition btwn bull and bear markets. as we get in gear to the downside then the picture suddenly clarifies to everyones horror.

A "fundamental transition" is the explanation? That describes the situation, but not the mechanism. as i said above, i'm neutral about foreigners and gold. i still think its dangerous for them b/c of the severe drain in liquidity they will experience as the CB's drain liquidity out of the system to kill gold.

These "foreigners" are anything but netural about gold, especially in Asia. Plenty of them are as savvy as the greatest western minds, if not more so because of longer-term vision. i used to think that gold would go up in deflation or inflation too. until 2008. i learned. it won't protect in a CB coordinated effort to kill it via a severe drain in liquidity.

We're seemingly knee-deep in deflation. Has gold gone down? Did it sell off with equities? Speaking of equities, how did the mining companies do? Oh right, some new records while everything else was plummeting. of course you have to learn from these guys which is why i read and listen to all the same guys you do. but heres the thing: you have to learn NOT to stand on the shoulders of giants but learn to stand on your own 2 feet. much of what they're saying is herd mentality and based on linear thinking. YOU are smarter than them. thats one thing i know for sure  Thanks. I've mentioned the logistic nightmare of doing all of your own studies all the time. It's unrealistic. Understanding and using what's of value is far better than re-inventing the wheel every step of the way, and it keeps you competitive. Don't fight the tide just because it's there. This also ties in with my bit about enjoying life instead of incessantly hovering over price charts. ok, everyone listen up, i'll go out on a limb and make my next non linear prediction: somewhere along the line here you'll get an announcement from some CB that they are going to sell some of their gold. i wish i could give you an exact time but i'd guess somewhere in the range of 6 months. this will further accelerate the panic out of gold and will help serve the interests of the CB's to save their precious monetary system. i KNOW you haven't read this anywhere. who knows? maybe they'll trade gold in for Bitcoin  Bitcoin? I wish. Maybe in a few more years. The topic of central banks selling their gold has been pondered ad infinitum. This is a minor issue compared to the overall trend. If a central bank does decide to sell (from Libya, perhaps?), the flow will be absorbed so fast you won't have a chance to blink or catch your breath before it's gone. There's no need for exclusively linear, non-linear or head-up-your-ass thinking. Just diversify and prepare; go heavy with what you think is most beneficial. Most situations share a lot of the same preparation techniques. But in the end we all have to think for ourselves.

One of the best points in this thread.  miscreanity calls gold an asset as do i. i believe that gold as an asset can inflate just like any other asset via USD inflation. the derivatives mkt is no different. as is the gold derivatives mkt. gold pundits argue that if we get a gold derivatives implosion there will be a scramble for physical gold which will drive it to the moon. but you have to ask yourselves: what were those derivative positions funded with? Answer: USD's. so if anything, a gold derivatives implosion should cause a scramble for USD's (or a shrinking of the total virtual USD's depending on how you like to think about this) causing a further skyrocketing of the USD. if THAT happens, what becomes of the physical gold price?

When I make a return from trading derivatives, I go and buy physical gold. What happens when demand for gold is higher, especially amid a more educated public? Physical gold demand explodes. As derivatives collapse and US dollars are rushed into, instruments that formed the paper gold markets will completely devolve. Where will those USDs go next? Physical gold, among other real assets. Just because paper instruments are destroyed doesn't mean the demand disappears. The paper lie can only hold so long as the majority doesn't realize what's behind it. This means that you will see a complete divergence: GLD goes to pennies while bullion premiums go through the roof. The officially stated price doesn't even have to rise for that to happen. In fact, that will serve to keep those oblivious to these activities still in the dark. how much further does Goldcorp (GG), a bellwether gold stock, have to fall beneath its breakout line for it to be considered a "failed breakout"?

A managed market does not offer genuinely valid technical signals. By the same token, manipulation can only go so far. On very long term charts, the technicals will provide a better gauge of the long-term trend. This is why it can be hard to keep up with the daily gesticulations, but easy to see the big movements. USD price for gold is pretty much irrelevant, if you use gold as a store of value.

Another excellent point. Decoupling.

...

At the time, I was watching silver much more closely than I was watching gold. One day when spot silver was under $10/oz, I remember the local coin store wouldn't part with a round for less than $20, and if you wanted Eagles, they were at least $22 each. I called around, and other dealers were demanding pretty similar prices. I don't think the gold premium was anywhere near 100%, but it was still pretty steep, maybe 30%-50%.

The price of actual physical metals had very much decoupled from their paper prices. Over time, they converged again, mostly by waiting for the paper prices to rise up to meet the physical prices. The funny part is that I've never ever seen historic data on premiums, so it is easy to forget that it happens, or even to never know about it in the first place.

So, the next time there is a panic (now?) and funds need to dump stuff to buy dollars, the paper price of physical metals will certainly drop, like you say. But that doesn't mean that those prices will have any bearing on the actual transaction prices in the real world.

I'm of the opinion that the situation back in 2008-2009 was very unusual. I wouldn't be willing to bet that the next event of this sort will actually cause the markets to decouple to the same extent, but there are quite a few gold and silver pundits that would be.

This is the heart of the matter. I wish I'd read further before writing my earlier responses. There's a recent video on gold premiums that looks at this. the father in the group pulled out a torn, weathered German Mark of about 20M marks and gave it to me as a gift.

... anyways point being these things are still worthless all these years later. why?

its because they were "printed" into existence and were impossible to remove from circulation once done. this is why the 2 hyperinflations everyone always points to occurred; Zimbabwe and Weimar Germany. they did not have mature debt markets like we do in the US. this is why i don't think we see HT here. these debt dollars (virtual dollars) will just vaporize on default thus shrinking the money supply to be gone forever.

Now we can play "Fall of the Weimar Republic"! Any pictures? My apologies for the smartphone image quality.  Manifested debt (extended credit) has the same effect whether it is printed or a simple ledger entry that has no physical counterpart. Does debt disappear from bank records simply because it's a number in a database? This issue was discussed. If the banks cut all credit lines down to their outstanding balances, that would reign in some of the system's excess. How much is dependent on the outstanding balances. You already established that your lines of credit are clear, but how many have maxed out credit cards and HELOCs? How much of that can be closed out? If it is written down at a loss, how many financial institutions would be around the next day? For that matter, how many companies that have large financial divisions would survive (recall General Motors' GMAC)? Without a workable solution in place that can be fired up the moment the prior system collapse (don't fool yourself - there isn't one; Bitcoin certainly isn't ready yet), you're unwittingly hoping for the same thing the gold bugs are: Armageddon. Sadly, that's the end result at this stage no matter what happens. |

|

|

|

the clam b4 the storm...

Yes, there very often is a clam before a storm. Then it spits in your eye.  |

|

|

|

I don't see what it's used for and how it works. A debit card system will work using particular currencies. If you want to plug in different currencies you'd need to exchange the currency to that which is required by the debit system before or after the transaction.

OT provides exactly the kind of framework necessary to allow transparent transactions among different types of instruments. The overall structure it promotes is basically a flexible market for everything. If you wanted, you could trade umlaut posters for Swaziland textiles almost as easily as you can exchange EUR for USD today. The same mechanism would make BTC payment feasible for anything else. Complete abstraction of financial associations is the result, or securitization of everything. Does anyone know a web resource when I can see historical gold prices on a log scale? Ideally as a dynamic image rather than a Java applet.

What kind of range? Only Gold has annual closing prices since 1792, but you'd have to produce the chart yourself. That shouldn't be too difficult with current spreadsheet software, even for online versions. I did it myself with Kitco London PM fix data going back to the late 90s. That gold chart is a Google Docs Spreadsheet with numerous limitations, including lack of log scale. I really should add 2011 data as well. The Privateer has some good charts as well. Stockcharts also offers an extensive amount of data and charting analysis on a subscription basis. An alternative would be to open a Think or Swim paper trading account and use their charting software, but that might be limited to a few years as well. There are others that I've come across, but I'm not sure of any other dynamic gold charts offhand that offer more than a few years to a decade of data. It only protects to the degree of its intrinsic value. Is there really $10 trillion of intrinsic value in gold? If not then what's supporting it other than speculation and CBs manipulating their currencies?

What intrinsic value? As the saying goes, "you can't eat gold". Its value is derived from its relation to everything else, primarily because of physical properties and the fact that it exists in such a steady and limited quantity. A better question might be: how much is society worth? While the same can apply to paper currency, the difference is that gold does not require management to act as a representative of work effort or wealth. No physical asset functions as well as gold for the purpose of a currency, and no abstract representation has been able to avoid the pitfalls of centralized control and management until Bitcoin came along. With every other currency in a state of violent flux, gold is resuming its currency status. An even more appropriate question now is: how much gold is necessary to stabilize the global monetary system? If it's 20% of all money currently in the world, USD denomination based on base money and debt obligations outstanding, the flow will result in a major revaluation of gold in relation to all other assets. The figure of $10 trillion seems a very low estimate. |

|

|

|

perhaps you ought to consider quoting me as i am the only one i know that had predicted this manipulated central bank induced USD rally weeks ahead of it happening

The only one? We did agree on the dollar rising...  Along the same lines, I could predict an earthquake in California and claim that I knew it was coming when it finally happens. Predicting the timing is exceedingly difficult, so I prefer preparation instead. That way, the trap can be sprung when the conditions are right; the reward reaped when there's little to no fight left in the move. Our disagreement lies with gold anyway, not the USD. I've added a few quotes, but it's often easier to find precise instances of one's own posts - I'd recommending finding the exact points from your own quotes as well as the ones I dig up. That promotes a less biased view and it means I won't have to spend hours going through the thread. as long as the USD stays in its consolidation pattern and doesn't breakdown i don't see gold going much higher. if the USD starts to ramp like i think it will, gold should go down.

the straight down drop in the indices says to me the PPT has stepped back b/c they have an objective; get the USD back up and smash PM's. tinfoil i know.

FOMC should not say anything more about QE. gold should tank and USD do a moonshot.

if i'm wrong i'll admit it. no guts, no glory.

From August 9th, gold went up about $100/oz. Nothing was said directly; everything was deferred to this month. The USD rise was delayed by a few days.

@cypherdoc:

You are soooo right.

Gold will surprise almost everyone when it goes down hard against the USD. We have have seen already the top today (went short at 1766 $ today) . But even if not, it will start from a bit higher levels and still has huge downside.

Based on my chart analysis, 1300-1400 is the first target, but will fall soon to lead then to 1000-1100. And then we will see. If this does not hold, 600-800 are next.

ah, S3052 my favorite tech analyst! yes, i think this will be the short of a lifetime. Had to include this one - a priceless piece from S3052. Is the idea to wait longer for the fall to happen? Another California 'quake prediction. BAC is going to be the next Lehman.

Winner! This one was a solid call. we are now entering phase 2 of the crisis and you're going to see demand for USD increase significantly from here as Europe starts to implode.

The distinction here is that gold is not included in the equation. The USD appreciates against the Euro, and both are depreciating against gold. It isn't the fact that this dollar rally happened that's interesting, but the extent to which it has risen in such a short time. in addition, on 9/6 at 9:24pm, in this thread, minutes after the selloff began i called attention to this as supportive of my theory. Dan doesn't post on his blog until 10:44pm over an hour later.

Being first to scream "FIRE!" doesn't mean there is one. this is old info and has been already invalidated. any technical trader knows this.

Can a technician explain why there are so many conflicting technical signals and so much confusion? Is support the result of a line on a chart or real-world supply & demand? Can that distinction be made from price alone? the whole fundamental basis of the gold trade has been to escape a falling USD. now that its rising and looks to have broken out to the upside how can you justify further gold buying?

Then why would Europeans be buying gold as the dollar rose against the Euro? Is the entire world buying gold just because of a falling USD? Correlation is not causation. Beware of such linear thinking.  There was no US dollar in ancient Rome. Gold protects against instability, especially debasement and fraud. putting up all these bullish posts from permabulls doesn't in the least impress me. you will not find an analysis like mine in this thread anywhere in the world. how do i know this? its b/c these thoughts are truly none but my own as a result of years of experience trading and shorting stocks and clear, independent, non linear thinking and game theory. i do read the pundits at times but always with a discerning eye. they are to a man bullish. there is so much more that has gone into my analysis such as intuition and anticipation that i can't articulate via words. and yes, i am humble enough to fully admit i could be wrong.

This thread has more readers than the two of us, but I'll be sure to try harder in another lifetime where impressing you matters to me. Acknowledging those whom we've learned from keeps us from making outrageous claims. Also, I do not have the time to produce every chart and study on my own, so I find those who excel at what they do. It takes time to sift through the chaff to find the wheat. Ah, the magic of specialization and outsourcing! I could be wrong as well, mostly in the short-term... but I doubt it.  i disagree that this bull has to end in a further parabolic move.

... you all now realize that CB's have drawn a big red bullseye on all your foreheads.

That's reasonable to assume; it doesn't have to end in a parabolic rise. It's the probability of that happening which is very high. The banks have been targeting gold for centuries because it clearly shows when they've buggered things up. What else is new? Dan Norcini's article to me is a game changer. the creeping realization that CB's are acting to kill gold should not result in permabulls thinking that just b/c they are aware of the manipulation, then it won't happen. the better response is to sit up, understand the implications of this, and get out of the way now. they will throw the economy under the bus in the name of self preservation. suspicion will turn to realization will turn to doubt will turn to fear will turn to capitulation. this is the psychology of the situation.

See my last statement about gold being targeted. Understand that central banks are net buyers of gold. The manipulations are to keep the power of gold out of the hands of too many whom the banks can't easily control, assuming a powers-that-be conspiracy hat. On the other hand, the banks are also struggling to survive and thus will attack what they see as a threat to their existence: gold. Look at the psychology outside of the US. It is not as you describe. could the end of the bull in pm's partially result from a new technology staring us directly in the face; Bitcoin?

Yes. watch out. looks to me like the resumption of the $DXY ramp and USD crosses starts tonite and thru tomorrow.

Very likely. The fraud will continue to the bitter end. Of course, that's still all paper games. I really don't think it's a good idea to be trading at all right now except to maintain hedges, especially with the FOMC meeting coming up so soon. If you haven't prepared by now, batten down the hatches and ignore the markets for a bit. Because it's ofter easier to link an article and it can be better said by another: Richard Russell at King World News on the anti-gold sentiment. |

|

|

|

The issue is to make the transaction software as compatible with different backends (different monies) as possible.

That's where Open Transactions comes in.  Thanks for the link! Edit: And another thought. The cost of production is around $330/oz. That makes mining extremely profitable at these prices. Is there any reason to doubt that, just like BitCoin, in the long run the high prices will bring in tons of mining capacity until the system reaches equilibrium again (probably with both a higher cost of production and a lower price of gold)?

Excellent chart, that's actually one I haven't seen before. The average cost is significantly higher than $330/oz today. Rising input costs such as energy, fuel, labor and materials have increased the overall production cost. I'd have to verify what the numbers are, but it's still well below $1,000/oz. That's a massive profit margin for a physical product, especially when the margins used to be only a few percent or even negative at times, and only the largest and best-capitalized companies were able to survive. Attraction to such high margins is exactly what's happening: old mines are being reopened while exploration companies are ramping up their efforts and the majors are looking to acquire juniors in order to capitalize on as much production as possible. That's precisely what occurs in Bitcoin mining, although the terms are different and movement of miners/pools is more flexible. History rhymes. |

|

|

|

Thanks. I've given BIS a skim and it fills me with Rathenau's delirium of milliards. I'm looking for more long term ~200 year data. Yes, our 'modern' economy is truly dizzying. Friends not long ago were more likely to believe we live among or are ruled by aliens than accept fractional reserve, much less swaps and other abstract derivatives But I think people are getting a hint that something is http://www.youtube.com/watch?v=31IYm0gQS_A&t=22sUse scientific notation.  I see. For that, you'd probably have to hit individual nation's records. Hopefully it'll be easier to find financial data than death records. I tried looking into census information regarding presumed causes of death during the Great Depression in the United States, and there was virtually no "clean" data available from any of the sources I was able to stir up. It was almost as though nobody died because of living conditions and starvation during the worst decade until WWII began, even though major cities around the rest of the world suffered horrible rates of indigent starving in the streets. Anecdotal evidence suggests it certainly happened in NYC and other metropolitan hubs. Yes, cultural beliefs rooted in emotion seem to prevent any sense from invading most minds until it's bludgeoned into them. Bring on the machines! ... PM's are heading down.

don't forget your original premise for buying gold and silver: relentless Fed devaluation of the USD. now what do you do when the USD is rising? buy more or perhaps sell?

We did agree on the dollar rising, but there's too much brewing under the surface that's supportive of a launch in precious metals to position negatively with them. Instead, buying weakness is prudent. From a little longer perspective, the $1,680 gap still warrants watching. The dollar rally is another issue and very suspicious. Without the Swiss and Norwegian moves, it's improbable that it would've closed above 77. Positive money flows into gold and silver ETFs. Where is the flow coming from? Interests that are better informed than the retail investors being led around by their noses. Gold mining stocks break out relative to S&P. Unbelievable strength in the face of unprecedented deflation: not something to stand against. Gold positioning is at a critical mass. If any large interest (*cough* JP Morgan *cough*) begins short-covering now, it will make the QE1 and QE2-induced rises look like pimples on a gorilla's ass. Apologies in advance for the emesis-worthy imagery. Gold to exceed $2,000 within 45 days. Key is the fact that gold is under-owned as an asset class. For that matter, Bitcoin is under-owned, but for different reasons. The only asset more powerful than one that functions as money is agriculture. Arable land is also a severely under-owned asset class by percentage of population. Jean-Marie Eveillard estimates global ownership is at 0.4% when recent historical highs have been around 5% - so a 5-fold increase in ownership should equate to a minimum of 5-10 times the price, or about $9,000-18,000/oz. However, as demand rises and supply is insufficient to meet that demand, price will escalate more rapidly. That is where the real parabolic rise will come in; there's still some time left before that happens. None of the above analyses are based on what the Fed will do. I'll have more tomorrow. I just learned that Peter Schiff is trying to make a debit card using Visa or Mastercard which interfaces with the gold backed bank he is forming (outside US due to legal reasons).

Nice find - do you have a link? It's like GoldMoney indeed.

Gold Bullion International also seems to be headed in that direction. GoldMoney already facilitates transactions between existing GM account holders. There are hurdles to introducing a gold-backed transactional account, but it will happen. Bitcoin is sort of a proof-of-concept for that. The combination of Bitcoin and gold is exactly what Open Transactions is suited for. Existing infrastructure already exists to make Visa & Mastercard pretty much irrelevant - mobile phones. Independent terminals at a business could simply scan a QR code off a person's phone to facilitate a transaction; a wholly software solution, as the physical hardware is in place. |

|

|

|

I don't know how/what global numbers I could reference. Any specific suggestions?

For a general source for global derivative debt, the BIS releases a semi-annual statement. The calculation methodology has been revised within the past couple of years (just like the official US unemployment calculations), otherwise there would be over $1,400,000,000,000,000 ($1.4 quadrillion) total outstanding instead of less than half that at $600 trillion. And why do banks hold gold, as insurance against the apocalypse? (Ben hasn't answered that for us)

Tradition! Actually it's because banks understand best what gold is and the purpose it has in an economy (sounds a mite conspiratorial). They could've leveraged every asset they wanted while not touching gold, and this gigantic shell game would be able to continue for some time yet. By creating derivatives based on gold, they've effectively turned water into wine - but at an enormous cost. So long as the cost isn't known, the party keeps going. Too bad for the world, the rumors have been flying, suggesting that not all is as it seems - and they're finally taking root. |

|

|

|

Does anyone have an interpretation that I don't see?

Without the explosion of debt, M2-based projections would be somewhat valid for at least the US; building analysis on the US alone is misleading. Leveraged debt is the main determinant of gold's value today, not the existing monetary base as was before a floating rate was finally established in 1971. Because there's been so much securitization of debt and subsequent internationalization of it, the range of backing necessary from a base money supply has been greatly amplified. Had the packaged variants been kept within individual nations' borders, one country's economy (e.g.: Greece or the US) could collapse without severely impacting others - in fact, other nations would then swoop in to pick up firesale-priced assets. That way, there would simply be a percentage change in global ownership. Since that isn't the case, those entities most closely-tied to the existing financial infrastructure will be dragged down with it unless the connection is severed by dumping depreciating assets sooner rather than later. Martin Armstrong discusses the Euro's dilemma of being a unified currency with disaggregate debt (PDF link). In short, a team effort will have a much more difficult time making progress while carrying dead weight than if every member were under heavy burden, but moving under their own power as a group: with 10 individuals pulling a massive weight, if 1 falls down and doesn't get up, that magnifies the difficulty for the remaining 9 than if the 1 that fell down were to get back up again instead of contributing dead mass - not only has working power been lost, but the weight has been increased. The same problem is partially attributable to the situation US states face. If the Euro were to struggle along with a unified debt, progression is possible. If it continues as is, with the PIIGS succumbing, there will be fewer nations left to pay down the debt. Imagine France and Germany having to take on the burden of the PIIGS debt. Instead of France and Germany having well under 100% debt-to-GDP ratios, they will shoot well over that level. No nation makes good on its obligations much beyond that point. Default or debasement of the prevailing currency become the only options, and the former is almost impossible - it's like a person forcing himself to face his worst fear. Applying calculus limits to gold and fiat currencies, yes - the limit for gold's value in fiat terms (due to outstanding debt) approaches infinity. It is foolish to think that would actually be achieved, even with enormous debt monetization efforts. Eventually, the rate of change becomes too rapid for human accommodation: a hyperinflation becomes impossible to sustain and the subsequent deflationary crunch, that the hyperinflation delayed, finally occurs. A very high number in fiat terms, yes (much more than $5k); not infinity. |

|

|

|

i also have a short on the Euro since i'm sure their involved in this USD buying spree. i think the union is toast.

Toast or not, probably a good position for another week. Every currency will be fairly well range-bound. These sharp spike moves occur in a manner which precludes the majority of profit potential. Earlier this year, the Yen had its massive spike and is now back near the lows. I can guarantee the same will happen with the Swiss Franc - population sentiment toward long held notions of a safe haven shift glacially compared to market savvy investors. Not to mention that Swiss financial stability is still viewed as much stronger than most of the world by those in finance, despite recent events. anyone know what happened to the "ALL" button after page 27 of this thread that used to be at the bottom left of this forum page? its a pain to have to pick individual pages hunting for a previous post rather than just scrolling thru ALL of them.

Use the print feature - it'll put the entire topic on one very clean page that's nice for saving to an html file as well. I'm glad this thread wasn't lost. Hooray, Cosby! Hey, if you can't take a joke... This is probably my own personal bias talking, but the impression I have from watching the short term charts for a long time is that for the last few years, they have been drifting up more than they have been drifting down, but the sudden movements have been in the other direction, with more sudden decreases than sudden increases. Again, this is just the impression I have from memory, it isn't backed by any real data.

The uptrend described in the first paragraph is easily apparent on charts from 1 month to 10 years and longer. The logarithmic chart in this post shows the sharp downward spikes fairly well. If that is really what is happening, the narrative I invent is that there is broad interest from common folks in holding metals, while the big institutional players are trying to push prices down by using their resources to create large movements to spook weaker players.

That's one way to look at it and the numbers behind the scenes strongly support that. Another could be that the general populations are divesting while large interests are gradually accumulating so as not to lose their price advantage before the dishoarding is complete. Still other explanations could be offered, but it would seem that there is a definite transition process underway which is geared toward a higher value for gold. what the Fed is trying to do is create a deflationary wave, i think, to force gold holders out of their positions to meet those margin calls on the other parts of their portfolios, like stocks or other commods. this is why you get the "all one market" moves inverse to the USD during the middle parts of the longer term waves (years). investors would rather sell their winners than losers first. w/o leverage then you're "golden"  this is why i've moved my shorts to stocks which are easier pickings for now vs. metals. That's guaranteed to be a big part of. The chairman tries to act as indirectly as he can to avoid disrupting markets, so offering greater investment incentives than gold or forcing a situation where liquidation is necessary just happens to be textbook Fed maneuvering. "if you cant touch it you dont own it!"  Booya! 'nuff said.  One thing that I don't think has been mentioned in this thread yet is the observation that Bernake is a depression-scholar, having done a lot of his academic work on how to *avoid* the natural deflationary wave that should follow a banking crises. So, going on that, we should expect him to position the Fed toward a strong inflationary bias.

That's a good point. Incorporating that knowledge into an overall strategy is prudent. I still prefer to rely on the numbers more than the tea leaves, but at least Bernanke's playbook is open for all to see. Whether the Fed *can* prevent it is another matter.

Has any nation in the history of the world ever succeeded? A more appropriate question might be whether the Fed can help the country survive without being economically decimated. It sure was nice spending extra time away from the computer... |

|

|

|

|

Is there something with me that I've intentionally left js enabled and have been reloading forum pages to see all of the wacky hijinks?

That might be beer on my pants, or I could've peed myself from the hilarity of the first refresh after my initial WTF.

Back to reloading pages. Oh Cos, you so silly. Where's mah Jello Puddin'!?

|

|

|

|

|