lmao, your analogies are fucking hilarious!

|

|

|

|

All of a sudden, a sinkhole opens up under the house and it goes into freefall. Unless one of them looks outside, it will just seem like someone forgot to pay the gravity bill, so they try tying weights on themselves to counteract their floating.

Sounds like a bunch of shattered knees and ankles when they hit the bottom of that sinkhole. Maybe a few hips and backs too. ! Hmm... three in one day - connected? Were they bankers? They are all vying for who gets to land on top of everyone else. sounds like those guys wanted to hit the pavement as hard as they could. They think there is enough hang time to change their position. That's the bet. aka Wile E Coyote  |

|

|

|

Difference: 101% ADVANTAGE BITCOIN

Gold getting schooled? It's older and more experienced. There are still some tricks up its shiny sleeve. Then it'll have to pass the torch. |

|

|

|

He might have a lot now, but might not have had a lot from the get go. Exactly. So what's his profit model now? Grow Bitcoin itself. |

|

|

|

4 digits coming soon  Select one: <18mo <16mo <12mo |

|

|

|

Now that's more like it. I'd just wonder how Pirate knew he'd be raided a month in advance. Plus, unless everyone with access to the dead man contingency were incapacitated, the funds could still be returned.

Or the wallet.dat's are seized before the contingency can be executed. And it's a win-win for Pirate whether the contingency is prevented or successful. Either gov't seizure of funds creates animosity toward gov't, or the contingency plan returns the funds and now Pirate has a large, distributed support base with funds that can't be frozen. Best of all... |

|

|

|

miscreanity, you have more patience than I. I give up and this is my last post to this thread.

I've almost been in tears from laughing so hard at some of the stuff posted in this thread. Gotta have fun with it! |

|

|

|

All of a sudden, a sinkhole opens up under the house and it goes into freefall. Unless one of them looks outside, it will just seem like someone forgot to pay the gravity bill, so they try tying weights on themselves to counteract their floating.

Sounds like a bunch of shattered knees and ankles when they hit the bottom of that sinkhole. Maybe a few hips and backs too. ! Hmm... three in one day - connected? Were they bankers? |

|

|

|

Sysadmins in important positions the world over use Bitcoin, this is why it could never be made "illegal" to own/use, the world's largest hedge funds, governments, and contractors would lose too many of their best networking/infrastructure professionals.

We run your computer systems...  |

|

|

|

Inside information from which evil genius? The adaptive nature of the network makes that extremely unlikely.

You work for the U.S. Department of Justice. You know that in mid August, FBI agents are going to seize all exchanged in the US, charge the operators with money laundering, arrest five of the largest dealers on SR, arrest 25 of the largest customers, and announce that the UIGEA will be applied vigorously against any US financial institution that conveys money to a bitcoin exchange. In this hypothetical, I think it's fair to say you would want to take bitcoin loans in early August! I agree that Pirate's rates are so exorbitant that even inside such knowledge would not assure he could cover the loans over this long time scale, so I agree that this "legitimate" scheme is unlikely. Now that's more like it. I'd just wonder how Pirate knew he'd be raided a month in advance. Plus, unless everyone with access to the dead man contingency were incapacitated, the funds could still be returned. |

|

|

|

miscreanity: in defense of Vandroiy, the imminent collapse of bitcoin theory has the advantage of not being economic nonsense. If you're entering a period of hyperinflation, 7% is actually great rate. Vandroiy apparently doesn't believe that it wins Occam's razor, but it at least explains the observations. I don't think it's an intentionally cynical theory, it just happens to be a viable theory.

Alternative theories--say, that shadowy buyers are willing to pay substantial premiums for bitcoins week after week--don't really make sense because you have to buy back into bitcoin to repay the loans, and then some. It also runs into a problem that Pirates supporters emphasize how 100% legal he is (even though he used to joke about money laundering early on). Such transactions would look a helluvalot like structuring.

I've had Vandroiy on ignore for quite a while now, although I may sneak a peak based on what you brought up. Are you referring to a Bitcoin return at 7% being great during fiat hyperinflation, or are you suggesting Bitcoin is going into HI? Either way, please clarify as to whether you mean price increase or expansion of money supply. Ok - for the premium buyers, it doesn't have to be much of a premium, or any at all. And they don't have to be shadowy either. As long as the relative value of Bitcoin continues to rise due to capital inflows from external demand, Pirate can acquire at any price and be assured gains. By a loose estimate, the past two months have seen about 7% weekly gains in price. Curious... Check the math - from late May to now, 10 weeks since $5: 1.07^10=1.967 1.967*5=9.835 The price right now at Gox? Just shy of $9.80  "i was like the boy that cried wolf. but there was a wolf." - harry markopolos "madoff whistleblower" harry markopolos is an investigator who spent ten years trying to expose Bernie Madoff's massive Ponzi scheme that scammed an estimated $18 billion from investors. http://www.youtube.com/watch?v=62L7VxMDg68The difference, from Wikipedia: Harry M. Markopolos (born October 22, 1956) is a former securities industry executive and independent financial fraud investigator for institutional investors and others seeking forensic accounting expertise. He has received public acclaim for uncovering evidence over a period of nine years that Bernard Madoff's wealth management business was actually a massive Ponzi scheme.

Micon has not shown anything but circumstantial claims, often fitting patterns out of context. The same goes for everyone else so far. It isn't without reason, just without evidence. Further: He also couldn't find any evidence the market was responding to any Madoff trades, even though by his estimate Madoff was running as much as $6 billion—far more money than any known hedge fund even then. In Markopolos' mind, this suggested that Madoff wasn't even trading.

The evidence is strongly in favor of Pirate on this one, especially with what happened three weeks ago. In addition to the persistent stability since the beginning of 2012, there's a greater likelihood that Pirate has been using the funds for arbitrage and the other purposes he lists than running a scam. Micon could take a few steps back from zealotry and compile a list of 'high risk' investment opportunities instead of making assertions one way or the other, or a new forum subcategory as MNW & Frankie suggested. Though I have to admit, he and team Ponzi have been a good amount of entertainment the past few days. It's always good to rehash the concepts at times as well. |

|

|

|

This is the kind of action that I expect to see as the market mechanism shears through the connection between financial instruments and the real underlying assets - hundreds of basis point swings in the most major of markets. As before, an acceleration instead of a return would indicate that separation. The only market I know of that isn't currently subject to obscurity through derivatives is Bitcoin. I think it's rather telling that traditional markets have been experiencing an increase in volatility in recent times as Bitcoin has been seeing a decrease. We'll see how long Bitcoin can remain stable as turmoil elsewhere continues escalating. GATA has put together some interesting information with a recent post, including an article from 1983. An important bit: After World War II, the BIS reemerged as the main clearing house for European currencies and, behind the scenes, the favored meeting place of central bankers. When the dollar came under attack in the 1960s, massive swaps of money and gold were arranged at the BIS for the defense of the American currency. It was undeniably ironic that, as the president of the BIS observed, "the United States, which had wanted to kill the BIS, suddenly finds it indispensable." In any case, the Fed has become a leading member of the club, with either Chairman Paul Volcker or Governor Henry Wallich attending every "Basel weekend."

Originally, the central bankers sought complete anonymity for their activities. Their headquarters were in an abandoned six story hotel, the Grand et Savoy Hotel Universe, with an annex above the adjacent Frey's Chocolate Shop. There purposely was no sign over the door identifying the BIS, so visiting central bankers and gold dealers used Frey's, which is across the street from the railroad station, as a convenient landmark. It was in the wood-paneled rooms above the shop and the hotel that decisions were reached to devalue or defend currencies, to fix the price of gold, to regulate offshore banking, and to raise or lower short-term interest rates. And though they shaped "a new world economic order" through these deliberations, according to Guido Carli, the governor of the Italian central bank,, the public, even in Basel, remained almost totally unaware of the club and its activities.

Fixing the price of gold, clouding the value that might be obtained by market-based price discovery. The BIS is where the real value is known. We are not privy to the information that these bankers hold amongst themselves, but we can observe the forces in play and efforts to manage them. We can see where failure might occur, and take action. Tomorrow, or perhaps over the coming weekend, I would put a major event occurring in which the foundation of the existing financial system ruptures at a 50/50 chance. After such an event, the possibility exists that the separation in financial and real assets happens. I think that may be more difficult to maintain than some suspect, as there are simply so many sources of information available that it would be impossible to shut them all out without completely severing all forms of communication. If the link remains, oscillations in volatility will make 2008 feel like a mild tremor. As some of the greats have stated - $100+ swings in gold. Daily. Maybe hourly. With my play account, I'm short USD/CHF and short EUR/USD at a 3:2 ratio; EUR/USD set to stop out for a profit at 1.25. I just hope nothing truly tragic takes place. |

|

|

|

Ok so Micon said that BTCS&T is in its final week or two. And looking at the prices of PPT bonds of GLBSE it's clear that a lot of people are withdrawing.

If BTCS&T works the way some have suggested, withdrawals will actually help by allowing high rates to continue longer than they normally would. Maybe we should be thanking team Ponzi? |

|

|

|

The only other case Pirate's scheme would make sense is if he has inside information about the Bitcoin network collapsing in the near future so that the bitcoins he owes become worthless.

Inside information from which evil genius? The adaptive nature of the network makes that extremely unlikely. Is that really the only possibility? I thought conspiracy theorists were more imaginative than that. Now, instead of Pirate himself causing upward pressure on the price by buying bitcoins, he's causing upward pressure on the price by having other people acquire bitcoins in order to "invest" in his business.

Most people prefer to swim in calm waters like that of a swimming pool, not the middle of an ocean during a raging storm with towering swells. Capital flows toward healthy environments, where it isn't attacked or trapped. By influencing the Bitcoin exchange markets to create a safe environment for free flowing capital, Pirate is enabling participation by others who would've found Bitcoin unappealing with its history of high volatility. You make it sound as if there's no valid reason for anyone to use Bitcoin, so Pirate has to entice people to put their money in. There seems to be a blanket assumption that everyone is out to destroy everything for a quick buck and will only follow a scorched earth strategy. It's as though the very idea of productive, progressive efforts simply doesn't exist. To me, that's astounding. Maybe it's because I don't find it thrilling to imagine myself having to look over my shoulder all the time the way super-secret spies do in movies. Or it could be that I think being the only one with a million BTC would be an incredibly isolated experience, not to mention detrimental to confidence in the currency. |

|

|

|

Thanks for your explanation, miscreanity.

Why doesn't the fed give the money to the people unable to repay their loans instead of propping up their balance sheets with it? Would that fix the solvency problem? Probably not, right, because you can't borrow yourself out of a debt problem.

Banker Reply; HAHAHAH MUAHAHAhh ROFLMAO, give, give.. money to workers? They do not know how to manage their money or they would not need our loans in the first place.. Heh, that's probably not too far from the truth. This had been attempted early in the crisis - $500-600 was provided to each taxpayer. The problem from a bank/gov't perspective is that there's no way to guarantee that money will go to consumer spending (or the right kind of spending), thereby supporting economic activity. If it goes toward paying debt down, that exacerbates the banks' condition (the loan may be paid off, but there's still a cashflow shortage). Essentially, attempting to herd cats is much more difficult than just putting the funds into banks where it can then be more effectively directed. At least, that's the gist of the reasoning. In reality, the banks are black holes due to their insolvency and are dragging the entire system down - but because there's no external reference point, it's hard to see what's actually going on. You could picture a family in a house, with each family member representing one of the major world regions. All of a sudden, a sinkhole opens up under the house and it goes into freefall. Unless one of them looks outside, it will just seem like someone forgot to pay the gravity bill, so they try tying weights on themselves to counteract their floating. Now it's a catch-22 where immediate collapse of the banking system as it is today will cause massive disruption because of the extent of dependence upon finance, and continuation of the banks' existence by supplying liquidity is just making the problem even bigger without actually fixing the underlying cause. The central and supranational banks (BIS, IMF, etc) have to decide which course of action will be most effective, and that's direct liquidity infusions into banks. It's like the difference between inhaling a drug or injecting it when you've got a plastic bag over your head and can't breathe. |

|

|

|

You're wasting your time/bits. They really are 100% certain in their minds even though there is no publicly available certain proof.

Yes, but I'm racking up posts. I want to see if I can get more of them than I have bitcoins! |

|

|

|

This is a mathematical certainty, and if you don't get it then you shouldn't really be doing any kind of wealth management. Because if you don't get it, it implies you don't understand the exponential function.

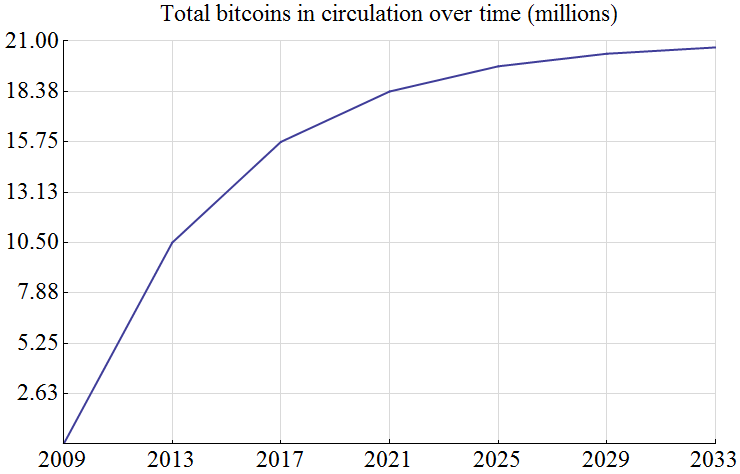

You're thinking of this in terms of bitcoins:  We're thinking of this regarding rate of return:  Which results in this as the assets under management by Pirate:  |

|

|

|

One day you will be able to entirely print a car using a 4D printer.

I'd love to print more time... I just want one that prints cotton candy nipple tassels... |

|

|

|

How about the fact that:

-He'd have to buy the coins back to have bitcoin to pay his investors, which would increase the price and eliminate some of that $0.5/BTC profit.

-Assuming he was able to buy back at $8.75 (unlikely, a 100000BTC buy order would move the market more than $0.25) then he'd have made a net profit of $0.25 per coin, or about 2.8%.

Lovely.

Now assuming those margins, he'd have to trade 1 million BTC per week, or about half the base of the entire currency every month, in order to just pay his interest. More if he actually wanted to take any profit for himself. I think I'm right in saying that's more than the entire volume at the various exchanges? Of course, trades on OTC are hard to quantify, but I have a very hard time thinking it's anything close to that...

There is in excess of 200,000 BTC exchanged per day, so easily more than 1.4mm per week. Large trades are not made all at once. To move billions of dollars, the orders are broken up and run in stages. The same applies here. A spider plans ahead, and the fly stumbles in. You're the fly, Pirate's a spider. There are many flies and few spiders. |

|

|

|

Let's look at a 7% per week, 3,300% per year scheme, i.e. one with an extremely high advertised yield.

Its debt grows at an exponential rate, but the debt plays only an indirect role here. What really matters to the Ponzi scheme operator is the heap of money he is amassing.

Let's not. At this point, anyone who doesn't understand how a Ponzi works hasn't been paying attention for the past 16 pages. Next, the critical flaw: full assumption that Pirate is running a Ponzi, with zero flexibility in that assessment whatsoever. It is 100% impossible to be 100% certain of a Ponzi until it either blows up or is proven to not be one. Since neither of those events have occurred yet, your arguments have been made ad infinitum and won't change anything. It's time for the naysayers to keep the Ponzi potential in mind and start exploring other explanations, like those offered dozens of times. Try some positivity and expand your mind a bit; it does wonders. |

|

|

|

|