Sounds like most like Binance. I will check Binance.us. Again, appreciate all your replies.

If you want to use Binance.us, check their information about fee https://www.binance.us/feesAs same as Binance global, you can enjoy cheaper trading fee if you use BNB to pay for fee. Get a 5% discount on Advanced Trading (Spot Trading) fees when you pay with BNB.

Check the table below to see how fees vary by tier.

|

|

|

|

The question is addressed to hodlers who have been hodling bitcoin for years

Sooner or later there will come a moment when we will sell the bitcoins we hodl and have to invest this money in something else to create passive income

You can take profit all your bitcoin or part of your bitcoin and continue to hold the rest. It makes sense to take profit and get money to use, nothing wrong but if you take profit or sell all your bitcoin to invest in some other things like real estate, I don't support it. It's not good idea for your portfolio because real estates can be built up more but there will be no more than 21 million bitcoins. ROI chart of Bitcoin and other assets show Bitcoin has best ROI. https://casebitcoin.com/charts#roi_chartWithdrawal strategy https://bitcoindata.science/withdrawal-strategy |

|

|

|

Do you believe in it or do you just really want it? \

If dominance of Binance in CEX market place and cryptocurrency market becomes bigger, it will be worse. We need more decentralized, more choices to purchase, trade our bitcoins and cryptocurrencies. We don't want too much centralization in Binance or only some big exchanges. Decentralized is future we aim at but it will be harder with more and stricter regulations from governments. Usually, after such a fiasco, things go downhill in any serious business where the client thinks logically, but fortunately for CZ, the people who need his services do not (mostly) behave logically.

Reminders about risk of storing bitcoin on a website, a service are here for many years. People don't lack of warnings to be informed about this risk but they just ignore risk and store their coins on CEX. Reminder: do not keep your money in online accounts |

|

|

|

I have a ccode saved in order to bypass the time waste that is filling a captcha, specially with Tor where you have to cycle through endless circuits in order to find one that works, but I was trying to log in in another computer where I didn't have the ccode saved.

Admin does not like Cloudflares but he did not find a good alternative for Cloudflare. Cloudflare does not work well with Tor and captcha on Tor. If you only use Tor, prepare your backup to use the Captcha bypass code on different device. If you make mistake and feel that current code is no longer save, you can reset it to have a new captcha bypass code. https://bitcointalk.org/captcha_code.phpWriting it down on a paper and bring it to you is not bad backup way because captcha bypass code is not too long and you can type it manually. You can simply write down the code, and don't write your forum account user name. |

|

|

|

You are right but that thread is specific to gamblers and not only cyber security. But it is majorly about cyber security. I see no reason why moderator moved it to off-topic. It neither belongs to off-topic where gamblers will not see it.

Off-topic is better than Trashcan. If moderator considers that reported topic is low value, it can be move to Off-topic. If it is zero-value, malicious, they can move it to Trashcan. Mods can of course make mistakes just like regular users can as well. Users are also free to complain about mod actions in Meta. Sometimes things are also subjective. If we are talking about this thread below you could argue it could fit in maybe gambling discussion or maybe even rep or service discussion subs but I don't think it's wrong in off topic. I wouldn't disagree if it was sent to the trashcan either. People sometimes also have their own biases. I've seen people in the past complain about a thread being moved and they're mostly annoyed that they can't get paid for it in that specific sub.

|

|

|

|

4 months... must be a joke. It is probably just a warning to the other exchange and casino owners. (and theymos lol)

It is fair or unfair sentence for CZ, depends on each person and their stance on it. I believe there is no place in the world can give us completely fairness but from CZ case, I see it looks good that CZ still got supports from the judge Richard Jones. How Changpeng Zhao's 'Good Guy' Reputation Secured a 4-Month Prison SentenceIs CZ a good guy or bad guy? Again, there will be different thinking among us on it but I imagine that if CZ is sentenced in another country, like in China, North Korea for example, he will be sentenced to death if the government want to do that. In the USA., it's simply impossible. Judge Richard Jones said he spent the weekend poring over the voluminous letters of support for the ex-CEO of Binance until the book they were contained in literally fell apart

|

|

|

|

What is you research process for events like bitcoin halving ? From where did you learn about it and its impact on bitcoin prices.

Most people care about price on the market and profit or chance to get profit. They don't care about technical developments, adoption, value of Bitcoin. For Bitcoin halving and its impacts on Bitcoin price, you can see the chart and make your own thinking or conclusion. Pi cycle top and bottom indicator is a good one to use because it helps you to find top and bottom range. When you see the top and bottom range, you can make your entries and exits. https://www.lookintobitcoin.com/charts/pi-cycle-top-bottom-indicator/https://charts.bitbo.io/pi-cycle-top/ |

|

|

|

Definitely. I would still prefer a self studying rather than hiring a mentor, there's actually a lot of resources out there and there's a lot of established traders that they can follow, they don't have courses to offer but they share insights of the market in their social media which is also a great way to increase knowledge as you will learn things from other people's perspective. Though there are really some legitimate mentors but you couldn't tell nowadays especially online, there's a lot of scammers than the legit one, so it's really better if you could try to self study and if it doesn't work maybe that's the time to seek for mentor.

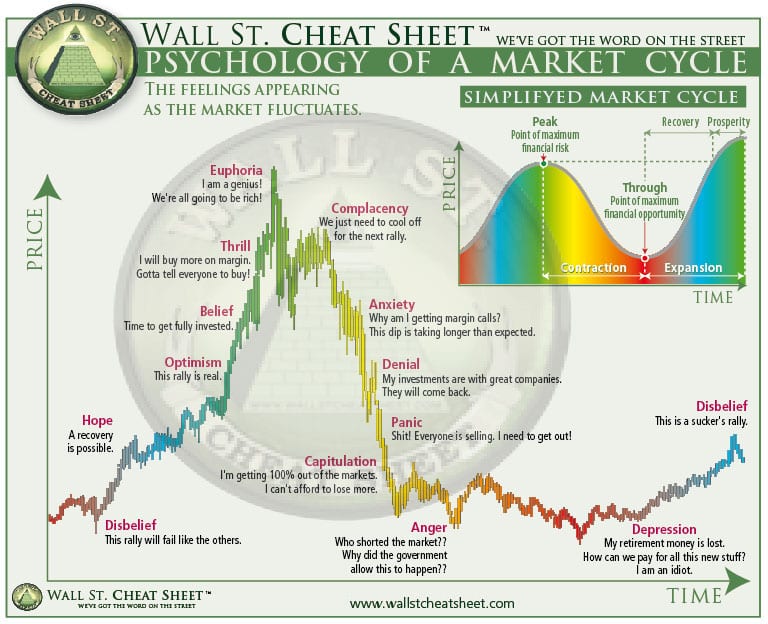

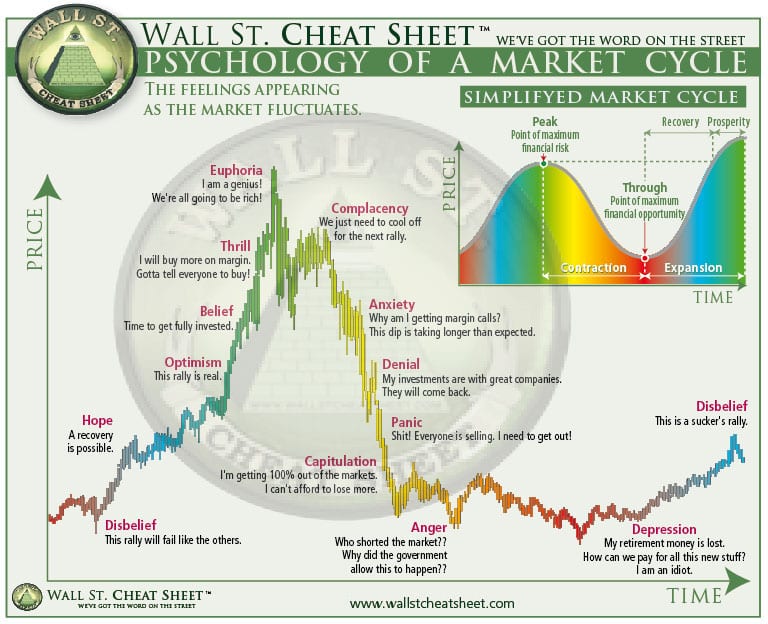

With modern society and open source projects, free courses and educational resources are available on Internet. It is much more easily to access educational resources nowadays than 20 years ago and it's free. People can have money, pay it for courses, hire mentors but not all mentors are actually good with their practical tradings. If they can get profit for themselves, how do they help you? It's the first point. The next important point is, the mentor can not help you to control yourself, from emotion (fear, greed, panic, uncertain) and can not help you to control your decisions on your computer. You decide it all and only your learning about market psychology cycles and experience are helpful for yourself. Psychology of market cycles It's the most important thing to learn but you don't actually need to find what phase you are in very exactly. Bottom and peak in Bitcoin market should be considered as a range, not an exact price. So with a price range, you will have enough time to enter in bottom range and exit in peak range. |

|

|

|

As simple as that, yes it does because Bitcoin halving has a mechanism impact to influence the supplies

Supply increases with time until 2140 and halving does not reduce the Bitcoin supply. It only reduces new supply in next 210,000 blocks for next four years if you compare next four year new supply with bitcoin mined in previous four years. preserves decentralized notations on a specific max volume of Bitcoin in the market to maintain stable rewards on the Bitcoin industrial structures.

I really don't understand what you want to say and discuss here. And thereafter the halving comes the bull run and the OP will agree with me that every bull runs is accountable to surge an ATH which is resulted just after the halving.

A bull run does not need to lead to a new all time high. With Bitcoin, so far, with three previous bull runs, it is true but it can be changed in this cycle or next cycles. Bitcoin already broke 2021 all time high before the halving but will it break 2024 ATH again, make a new ATH, no one knows. By saying "A bull run does not need to lead to a new all time high", I implied about altcoins. Many of them don't make new all time highs with a new big bull run of cryptocurrency market. We can say Bitcoin is different than altcoins but in many years later, when Bitcoin block subsidy becomes very small, effects from a Bitcoin halving might be smaller and very mildly. It will be not surprising if in future, Bitcoin will not make a new ATH after a halving. |

|

|

|

I don't think so because think about other investors who were already positioned before the Bitcoin block halved

Bitcoin block or Bitcoin block size does not halve. Its block subsidy halves after the halving from 6.25 BTC for one block before the halving to 3.125 BTC after the halving. these people or some may add some Bitcoins to their bags.

So for me, overall it's all good in the hood right now, even Bitcoin block halving is already done, we still above $60,000 and it's more likely gonna create new all-time high again this time.

People who see good technology and security of Bitcoin blockchain, believe in bright future for Bitcoin, and already purchased bitcoin before the halving, will likely buy more after the halving if they have more money for investment. How long will they hold their bitcoin after the halving will be different by investor to investor. Each of them have difference source of capital and different taste of risk acceptance and price target as well as available time for holding. They are part of the market and a bull run actually need new capital from new joiners. |

|

|

|

There are periods of time when it becomes very expensive to send small amounts of Bitcoin. It does impose a kind of 'mandatory HODL time period' for small-scale Bitcoiners.

I agree that with Bitcoin, a longer holding time, a better chance for a holder to get more profit but I really dislike situation when we have to hold our bitcoins while we don't want to hold it with a funny reason behind. We have no other choices because of very expensive transaction fee. It is not a good advertisement for Bitcoin because we have keys (private keys), we have coins and we have need to move our bitcoins whenever we want. Can not do it because of expensive transaction fee, is a big barrier to bring more new people to Bitcoin community. It's big fear that you have bitcoin but can not do it, because if you do it, when transaction fee is unrealistic expensive, you will convert your bitcoins to satoshi dust. |

|

|

|

The value of bitcoin can be expected to at least double with every new cycle, along with the number of people using bitcoin.

So miners will also be receiving at least double the volume of transactions fees as bitcoin becomes more popular and more users are entering the space.

You have many things wrong here. Bitcoin miners do math computation for two main tasks, finding a new block and confirming transactions for Bitcoin users. By finishing these tasks, they will receive rewards in two types: Bitcoin block subsidy; and Bitcoin transaction fees. Bitcoin block subsidy surely halves after a halving. Bitcoin transaction fees is what never sure for Bitcoin miners. It can be high or low depends on time and how Bitcoin users choose to use their fee rates for transactions and demand on Bitcoin mempools. Bitcoin price does not x2 for each past Bitcoin halvings. It increases with higher ROI than x2 but nothing to be sure it will be higher than x2 in this halving and future halvings. Glassnode has a weekly report months ago about Ordinals' effects on Bitcoin transaction fee and income of Bitcoin miners. Inscriptions, Mempools and MinersHalving is only an event and between two Bitcoin blocks, before and after a halving block. Between two halvings, there are 210,000 blocks and time is about 4 years. Many things can happen during 4 years for Bitcoin adoption, mempools, demand and transaction fees. |

|

|

|

No, like I said I don't like slots and I don't play slots, I never do.

Just tried it once for the free spins promotion and got what I expected, money to be thrown out the window. Slots are the biggest nonsense in the gambling industry, also the most dangerous one.

In the future I just ignore promotions with free spins since they are just a waste of money and time.

If you use free spins to play like for entertainment and play for fun, I don't think it is waste of money and time. Without free spins, you will have to spend own money to play, so now with freespins, play for fun is not too bad. If playing free spins to win and have to do extra wager requirements to claim your win from free spins, it will be different things. It will bring risk of losing your own money. If the ultimate purpose is to get money and withdraw it, a gambler must consider more about risk but it is not main purpose of using free spins for playing. I agree with you, slot games are very addictive and risky to lose gambler fund. |

|

|

|

It looks like the very high transaction fee paid for it is not from a mistake or a wallet software bug. In the past, if it is an individual mistake when making a transaction, a wallet bug, mining pools can allow that sender some days to reclaim their paid fee back. It will be refunded after the mining pool get agreement from their miners. With this intentional expensive-fee-paid transaction, there will be no refund in my guess. |

|

|

|

The devs seem very reluctant, but they will definitely have to do something about it. I just hope by the time a decision is made, it's not too late. If I have to pay fees $100 just to transfer $200 worth of BTC, then this is not a good alternative peer to peer electronic cash system.

People are going to try to look for cheaper alternatives and the growth of the Bitcoin network will reduce.

What cause reluctance of developers to fix holes that are exploited by Ordinals and Runes? There is idea and proposal from Luke but it is a type of censorship that is not supported by Bitcoin developers. I agree with fight for freedom and against censorship because it is core value of Bitcoin and vision of Satoshi Nakamoto. We don't live our life with Satoshi Nakamoto's vision but if it is good practically, it can be continued. In contrast, if the vision is no longer good practically, something must be done to fix exploited holes. |

|

|

|

https://coinroyale.com/sports/soccer/uefa_europa_league/uefa_europa_league_2023_24_winner/free https://coinroyale.com/sports/soccer/uefa_europa_league/uefa_europa_league_2023_24_winner/free Europa League Semifinals: Benfica / Marseille vs Liverpool / Atalanta Milan / Roma vs Leverkusen / West Ham If you are sure that Leverkusen will win the Europa League, it is better to bet from now and get 2.25x odds, because the odds for Leverkusen in the final later must be below 1.7x. My prediction for the final is Leverkusen vs Benfica, or maybe Liverpool if they can create a miracle by beating Atalanta with a 3 goal difference tonight. My prediction for Europa League semi finals. Benfica vs Atalanta Roma vs Leverkusen Final match prediction: I am not sure about it but here is my prediction. Atalanta vs Roma / Leverkusen I believe Atalanta will be able to beat Benfica in semi finals but I am really unsure about winner in Roma vs Leverkusen in semi finals. It's not easy for either Roma or Leverkusen to beat each other in semi finals if they meet again in Europa League. |

|

|

|

|