And also it may not be ideal but its OK if full nodes exceed the home hobbyist's budget. If it takes some $ to rent a small data center to become a full node we will still have "permissionless innovation" for small startup companies. This is what really matters.

EDIT: On the other topic, I also don't think scalability is this huge doom and gloom issue for bitcoin, so long as we allow it to happen! Worst case, when BTC is adopted worldwide it may not be usable for small payments, and you may need to rent a kick-ass cloud computer to run a full node. But that's an effect of too much success... I wish we had that problem today! :-) This is why I'm not in a huge rush to post my ideas on a scalable blockchain. [today I'm running a full node at home on an old junker laptop I bought for $25 on ebay. We have a long way to go]

Centralization isn't avoided by such shell games. It is no longer permission-less when your hosting company requires you to be compliant with coming global (G20) regulations on crypto as the war on cash advances. Having such an extreme bandwidth, connectivity, and processing power footprint means it is unlikely you can obfuscate your activity on a home internet connection over Tor or other anonymity network (preferably a high-latency anonymity network so it doesn't have Tor's vulnerability to timing analysis attacks). Anonymity comes from blending normal activity with targeted activity.

The simple reason why I still do not understand the concerns over increased blocksize and scalability, is because the mining mechanism is not impacted by blocksize at all.

And you haven't understood the technical conversation then. And that is a problem with having any discussion here. it seems to me that the Nasdaq is not only going to want it but demand it if they want to transact shares off the blockchain. seems to me that Goldman Sachs is not only going to want it but demand that Circle be able to act as a MSB so they can get a return. seems to me that the NYSE is not only going to want it but demand that Coinbase be able to act as a MSB so they can get a return. i also think that guys like Arthur Levitt, Vikram Pandit, Eric Schmidt, Reid Hoffman, Li Ka Shing, Richard Branson, the Winklevii, Andresen, Sheila Bair, Blythe Masters are NOT going to take kindly to their millions of investment capital being vaporized by some politicians. i also highly doubt that the Chinese Mandarins are going to cooperate with the USG apparatchiks to prop up a sinking USD. not to mention Iran & Russia. |

|

|

|

I'd need to know what kind of image file to provide (size, format,...)

Any image of size 128x64. Python Imaging Library will take care of conversion into black-white. wonderful, thanks!  the flying spaghettig monster looks impressed EDIT: or maybe it's shocked to find itself inside a trezor device  is it possible to do this with 12.04 Ubuntu? python-Trezor doesn't seem to work for me  |

|

|

|

EDIT: On the other topic, I also don't think scalability is this huge doom and gloom issue for bitcoin, so long as we allow it to happen! Worst case, when BTC is adopted worldwide it may not be usable for small payments, and you may need to rent a kick-ass cloud computer to run a full node. But that's an effect of too much success... I wish we had that problem today! :-) This is why I'm not in a huge rush to post my ideas on a scalable blockchain. [today I'm running a full node at home on an old junker laptop I bought for $25 on ebay. We have a long way to go]

precisely. another way of saying it is "you can't have a universal money if it's not universal". |

|

|

|

EDIT: On the other topic, I also don't think scalability is this huge doom and gloom issue for bitcoin, so long as we allow it to happen! Worst case, when BTC is adopted worldwide it may not be usable for small payments, and you may need to rent a kick-ass cloud computer to run a full node. But that's an effect of too much success... I wish we had that problem today! :-) This is why I'm not in a huge rush to post my ideas on a scalable blockchain. [today I'm running a full node at home on an old junker laptop I bought for $25 on ebay. We have a long way to go]

precisely. |

|

|

|

I think that you are right in general. But there is a small hole. If a miner creates 125000 fake transactions he could not broadcast them, keeping them for the block he mines and therefore collecting his own txn fees. Therefore the net loss is only the CPU effort to make these fake txns. It would be better if he loses txn fees.

can you repackage this argument and clarify the point? It would be really painful for a malicious miner if he had to pay TXN fees on those 125000 txns. And he DOES have to do so because the txns would trigger the spam detector (actually I'm not sure if the spam detector is a rule-of-thumb or a requirement -- but they'd be a requirement if we used my txn-fee expands block idea). But unfortunately the miner will pay the transaction fees to himself, so no loss. By requiring miners to pay half of the txn fees to the prior block a malicious miner loses half of his txn fees... thanks. now i understand your point. but the attacking miner still won't do this b/c it is highly expensive (CPU wise) to have to construct all that garbage, broadcast them (full nodes won't validate/relay the blocks if the fake 125K tx's are not in their unconfirmed tx set), hash them into a Merkle tree, & POW the bloated block. and the risk of orphaning is way high. |

|

|

|

I think that you are right in general. But there is a small hole. If a miner creates 125000 fake transactions he could not broadcast them, keeping them for the block he mines and therefore collecting his own txn fees. Therefore the net loss is only the CPU effort to make these fake txns. It would be better if he loses txn fees.

can you repackage this argument and clarify the point? |

|

|

|

@cypherdoc & @anonymint:

Cypher, he's not full of shit talking about txns being orthogonal to blocks. He's on the right track. I mean I would not have used the term orthogonal but the real confusion here is that a reformulation needs to tweak the definition of what a block and txn is, so using those terms creates confusion and mental blocks. Think about it this way:

Today every node needs to see the full information of every other part of the network. This is inherently not scalable. What if every mobile phone in the world received everybody's email and chats? The idea is silly.

In fact, the ONLY way to scale is to limit the information propagation across the network. But you need to preserve the essential security of having blocks record transactions, so I would have said that blocks and txns should be not-quite-entirely-orthogonal.

A long time ago I wrote that Satoshi's genius was to realize that disks have gotten so large that you could put the entire world's transactions on a single $100 drive. But in fact he was wrong -- you might be able to store them all, but you can't send them all. On the other hand, its quite possible that he was not trying to replace credit cards, only bank accounts and wire transfers... in which case my hunch is that Bitcoin at 20MB or 100MB blocks works fine. And also it may not be ideal but its OK if full nodes exceed the home hobbyist's budget. If it takes some $ to rent a small data center to become a full node we will still have "permissionless innovation" for small startup companies. This is what really matters.

what you claim sounds reasonable but i'm not entirely convinced given the growth in storage and bandwidth capacity over the last few years. nonetheless, i was very excited by the pruning release. that could and should solve the storage issue completely. as for bandwidth, i'm hopeful for something along the lines of IBLT. we'll see. |

|

|

|

I agree this has potential. It'd be a clean, permanent solution with nothing arbitrary about it. Sometimes we just don't see the simple things? Too-large-blocks are already disincentivized by their slow propagation and resulting higher orphan risk. I read that many pools already use a "soft limit" well below 1 MB because of this. It would probably make most sense for a miner to calculate the cost of the orphan risk (needs some assumptions, I guess) and contrast that with the potential additional tx fees being earned and make tx inclusion decisions based on that calculation. what will happen when block propagation will be O(1)? (see: https://gist.github.com/gavinandresen/e20c3b5a1d4b97f79ac2) The scenario was discussed at length. The most obvious risk is that the larger pools could easily drive others out by pumping up the sizes creating more centralization. Essentially a bandwidth attack. can you explain O(1) and O(1) 2? |

|

|

|

can they pull the $DJT out of the ditch yet again? i doubt it. looking weak with the divergence growing ever larger:  |

|

|

|

right now there are 675 tx/block on average. each pay around 0.0001 BTC/tx in fees. that equates to 675*0.0001= 0.0675BTC/block in tx fees. that is miniscule and accts for why miners construct small blocks mainly to capture block rewards. if the cap is removed, i figure that to be economically attractive for a miner to create a bloated block just for the sake of mining for extra fees they would have to be at least worth 50% of the current 25 BTC block reward or 12.5 BTC in fees, give or take. that equates to an extra 12.5/0.0001= 125,000 tx's required per block. where are those extra tx's going to come from? answer: 1. they won't magically appear until the Bitcoin economy grows itself to that point which will take several years. 2. an attacking miner can try to manufacture them himself to torment small miners. would he do this? NO. the creation of an extra 125,000 worth of tx's would cost time and energy to create, sign, broadcast and then hash the POW for all those extra tx's and for what purpose? some fuzzy theory about driving unspecified small miners out of business as a result? no, he will continue to mine small, efficient blocks according to the avg output of the rest of the miners mainly to chase the block rewards. this dynamic will continue for many years. here's how i answered theymos on Reddit: [–]theymos 2 points 2 days ago* The network needs to completely agree on this. Say that there's no limit, but most miners are producing 1 MB blocks for whatever reason. Then someone mines a 3 MB block. If half of the economy accepts blocks only up to 2 MB in size and half of the network accepts blocks up to 3 MB in size, then these two halves of the network will split forever and never again be able to transact with each other (as long as they don't change). This breaks the network. There are various things that you might think of to solve this problem, and they've probably all been thought of before. The most common first-impression idea is that you'll have miners decide it. (In fact, you may have been implicitly assuming that this is how it would work, but currently even if 99% of miners mine too-large blocks, they will be ignored by the Bitcoin economy.) The problem with this is that miners nearly always have an incentive to create larger blocks because it gives them higher fees, but they don't have much incentive to be worried about the long-term consequences of larger blocks. You should not be prevented from running a full node (the only type of node with any real security) because a handful of miners in China decide to mine blocks that are too large for your bandwidth/hardware to handle. permalinksaveparentreportgive goldreply [–]cypherdoc2 1 point just now the way i would answer this is where is the tripling of tx's and the fees required to mine a 3MB vs 1MB block going to come from? if that miner is an attacker, would he manufacture his own fake tx's to create a 3MB block? no. it would be too expensive and risky for him to do so, not only from time and energy needed to create them and hash them into a valid POW but also in terms of foregone block rewards that he might miss from being orphaned and screwing around with the system. permalinksaveparenteditdisable inbox repliesdeletereply edit: the only caveat to my argument, in the 3MB vs 1MB case, is if the bloating miner can pull enough unconfirmed tx's that have been constructed by ordinary users out of his current set in his mempool in order to create that 3MB vs 1MB block. which is why i asked this: What % of the unconfirmed TX set gets included into every block?

but it would still be a risk in terms of increased network latency with orphans and the foregone honest blocks. |

|

|

|

|

What % of the unconfirmed TX set gets included into every block?

|

|

|

|

-

when you first registered March 2013 the price was $34. do you feel silly now?  I spoke to rpietila in January on Skype. I got around to writing a syndicated article "Bitcoin : The Digital Kill Switch" by March and joined the forum to share it. Around that time of Dec. 2012, I was suffering severe tinnitus, difficulty swallowing, and other adverse symptoms in a tail-spin collapse with my Multiple Sclerosis (after sending it into complete remission at the end of Sept using high dose vitamin D3 for week, then quitting). I was distracted on fighting to survive. At the time I didn't know I had M.S.. I thought it was expected long-term head and throat effects from high # strain HPV infection I contracted in 2006. well then, you should feel even worse. in Jan 2013, the price was 13 and you've been a FUDster ever since. |

|

|

|

-

when you first registered March 2013 the price was $34. do you feel silly now? |

|

|

|

then you need to explain this:

I already did. Again I already alluded to the word "orthogonal" which was in one of my posts in this thread which preceded the one you quoted. You can't seem to correlate all my posts on an issue, thus apparently the low reading comprehension. if tx's don't have to be "put in blocks" in your altcoin, logic follows that there are no blocks. blocks were fundamental to Satoshi's design and have provided a level of open security of data never seen before in human history. i think you're full of shit. In my novel new design, transactions don't have to be put in blocks in order to be confirmed. That is a very strong head scratching hint for you!

Your theory is all gvts are in bed together with all the banks and big retailers

And people like you said the NSA isn't recording everything until Edward Snowden leaked. please provide quote where i said that obfuscating again. you said i "said" that. details i guess don't matter to you, thus you are not to be taken seriously. I don't need to. Your general cognitive dissonance and denial is indicative of the effect. If you had compiled all the corroborating data I have, you would realize how foolish you appear to me.

any "proof" you've provided here is just plain old news articles most of us are already aware of. your interpretation of those articles is what i disagree with. Specifics else you are just obfuscating the debate. As a programmer you should appreciate that specifics of implementation often changes the entire design. People think they know something to be true based on some generalized haze in their mind and when we drill down they say, "Oh my Gurd, you were correct". i am not a programmer but it's hard to feel sorry for someone who claims he understands Bitcoin when you totally missed the runup from the early days and enter in March 2013 and missed the biggest runup of them all.

I told you I don't want to introduce more of my personal circumstances into this discussion, but this is the second time you've hit me over the head with the same character assassination. FYI, rpietila pinged me when BTC was $10 and I agreed with him to proceed to sell silver and go in big. I told him I couldn't do it, because my illness has so messed up my brain that I didn't trust myself (had uncharacteristically lost $100,000 in 2012 betting on options following some idiot promoter after having built my stash with sound thinking to 18,000 oz of silver by 2008) and was in capital preservation mode so I could survive my malaise to fight again on better days. Also there were other factors going in my personal family life in addition to the M.S. which were causing my actions and thinking to be volatile and rash, which is another reason I decided to exclude myself from speculative investing from that point forward. I decided that my best performances in life had been coding and entrepreneurial and that I didn't have the right circumstances and psychology for managing speculative investing. And I precisely achieved my objective to stay afloat without making any more catastrophic errors so that now I am ready to fight again as my Multiple Sclerosis appears to be under abatement with the high dose vitamin D3 treatment and I just finished coding 5000+ LOC social network over a span of 2 months. Thus proving to myself I am back to coding productivity and poised to move on to bigger and more productive actions. Also I was handicapped to a large extent on investing (especially in physical silver) by my choice to live in Mindanao. But this does not harm my ability to code and in fact appears to give me more solitude and focus. now you claim you called it just b/c it fell from 1200. i'm not even finding your technical discussion to be that interesting b/c it involves many assumptions i don't agree with. and worse, those assumptions are based on doom and gloom political factors.

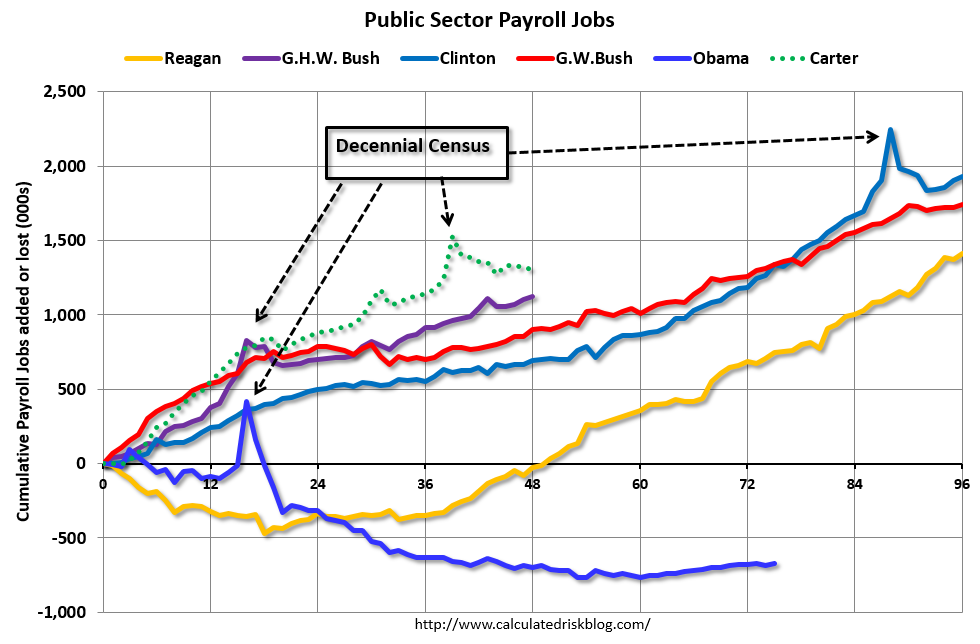

I was correct on silver. I was correct on gold. I was correct on BTC on the way up and down. you couldn't have been more correct than me. check the beginning quote of mine in this thread and follow my posts thru 2011. most ppl know and can verify my claims around gold, silver, & Bitcoin. that's why they're here. you on the other hand are full of shit. btw, you seem to think gvts are going to continue to grow and take over the world. here's a great chart from Calculated Risk that shows shrinkage of the public sector jobs under Obama and since the crisis. it verifies what i've been claiming for quite a while now, deflation is really the dynamic in force right now to the point it is actually shrinking big gvt. that's great news despite the fact that we still have a long, long ways to go towards that goal. And Bitcoin will help facilitate that:  i also think this graph is fascinating. it shows the US national murder rate heading steadily down since the 1990's. i'd like to think that might be because of the internet and a spreading social consciousness worldwide as ppl link up. that means there's hope for a better world perhaps.  also, incremental progress on curtailing the NSA. and you diss the significance of Snowden?: https://www.vox.com/2015/5/13/8603193/house-vote-nsa-spying?utm_campaign=vox&utm_content=chorus&utm_medium=social&utm_source=twitteryour doom and gloom is tiresome. here's the greatest conspiracy of all: is Anonymint a paid NSA shill? |

|

|

|

LOL! End boom and bust by sticking only to bust? The more they squeeze though, the more that making a compelling case for Bitcoin to everyone who learns of it becomes easy. why don't they just tell us what to buy how much of it and when. like if my friend saved up to much money he should be forced by law to take an expensive trip. Peter Schiff will probably be right; another QE before an interest rate hike. Arent they opposite? QE to stimulate and interest rates rise to stiffle spending? If qe happens before rates rise that would be catalyst for total loss of confidence in the people in charge. if i'm right about the stock mkt starting to roll over given the $DJT break of support, then yes, QE before interest rate hike to try and save Wall St. as far as the latter, i think the CB's have already lost alot of ppl's confidence. |

|

|

|

LOL! End boom and bust by sticking only to bust? The more they squeeze though, the more that making a compelling case for Bitcoin to everyone who learns of it becomes easy. why don't they just tell us what to buy how much of it and when. like if my friend saved up to much money he should be forced by law to take an expensive trip. Peter Schiff will probably be right; another QE before an interest rate hike. |

|

|

|

the most dangerous chart on the planet, right now. tomorrow is going to be a big day, i'd guess. either a big down or big up sticksave:  |

|

|

|

|

accelerating to the downside now.

sidhujag, heads up.

|

|

|

|

|

the only thing left is the stock mkt.

the Transports look like they will crack support. once that happens, the flood gates should open. if the $DJI cracks it's secondary low point, we will have confirmation of the long standing multi-month non confirmation which will really open the gates of hell.

sell in May and go away.

|

|

|

|

|