|

Dickiy

|

|

August 21, 2023, 03:36:23 PM |

|

I agree with everything that you said Tony116 - yet surely, I think that it remains important to point out that there can be some difficulties in terms of some older people to actually begin to invest into BTC if they cannot have any kind of high confidence of an investment timeline of 4-10 years or longer, and surely, even if they are not able to commit to at least a 4 year investment timeline, that still might not preclude them from investing into bitcoin, but it surely might either affect the level of their abilities to be aggressive in their bitcoin investment but also the amounts that they might even allocate to bitcoin.

I do personally suggest that any newbie is within an acceptable bitcoin starting range if s/he considers a 1-25% allocation into bitcoin (in terms of measuring their overall quasi-liquid investment portfolio assets), and so for example if someone were to consider that 10% would be adequate for themselves to get started into bitcoin; however, if such person is older (maybe 70 or 80 years old?), then they may well have to consider a lower than 10% number - mainly based on the uncertainties within a 4 year timeline, including extreme volatility concerns.. and including that they might need some of their capital to be liquid in much shorter than 4 year timelines.. but still that same person could well still consider a smaller allocation, like 5% or even something lower than that - even though if all things were equal and if they had a longer timeline, they may well be able to justify 10% allocations into bitcoin,

so timeline can surely make a decently BIG difference in terms how anyone my look at their own practical abilities to even invest into bitcoin or how aggressive that they might be able to be, if they do choose to take some kind of a bitcoin stake.

You are right, for elderly people over 70-80 years old, age can be a big barrier when we recommend bitcoin to them because to be able to profit from bitcoin, they need to hold bitcoin for at least 4 years if the cycle is repeated. So I think when recommending bitcoin to them, we should emphasize that bitcoin investment takes a long time and let them make the best decision for themselves. It's really a big hurdle, but we shouldn't let that stop us from recommending bitcoin to them. Because maybe their desire is not necessarily profit but most likely, they want to experience new technology like bitcoin. I think at that age, money is no longer a big deal for them. If my grandfather also likes to invest in bitcoin. I am willing to use my own money for him to experience because at my grandfather's age, money is not the most important thing. Well that's right, of course when someone has entered the elderly stage then most likely they will not take this too seriously, they will tend to see what benefits they get and maybe besides that whether they will immediately be able to enjoy the results or not, an elderly person has a mature mindset and if some facts about BTC cannot make them convinced then they will not jump into it and maybe not at all interested, while on the other hand they have to wait first with a fairly long time to be able to enjoy the benefits of BTC itself. That's right, on the other hand of course this will be a big hurdle for some people who will recommend it. They are quite old and it makes sense that money is no longer the main thing for them because they just sit back and enjoy the rest of their lives, and the new technology about BTC might be the opportunity to make them feel interested in trying it. |

|

|

|

|

|

|

|

|

|

You can see the statistics of your reports to moderators on the "Report to moderator" pages.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

BigBos

|

|

August 21, 2023, 03:54:21 PM |

|

Bitcoin is currently over 26k$ today, and most of us now buy it for sure, especially those who do DCA in Bitcoin because it's a big deal and opportunity and then just hold it again.

The price at which bitcoin is right now is opportunity to buy more and also for who missed the opportunity to buy when bitcoin was around this amount. Honestly this is a good time to buy again to hodl because this opportunity can take a while to turn around again. Whenever opportunity comes like this people who can afford to buy should not look down at it because even if bitcoin goes down this period it won't be something too serious because it is not gonna stay down for a longtime. This has been true from the beginning. Buy Bitcoin when its price drops. Bitcoin has been giving us opportunity for a long time. Now it's giving us more opportunity. Let's say the price drops from here, it will recover quickly. But when the price of Bitcoin goes up, we need to see that today is an opportunity so that we don't wish we had bought in time. Bitcoin will always have price fluctuations. You need to take advantage of these days. Bitcoin is at a good price point for Hodl. And indeed this is a very good time to buy more than what we previously planned, do not hesitate to start because we can already see from the history of BTC movements over the past few months. Right now BTC is making a correction, and the price has now touched the support point in June yesterday and this is the third lowest support in 2023. This means that starting next month I am very confident that BTC will start its rise at least until it touches the resistance point in the last month at around $32k, but I hope that BTC will continue its rise. That's right, now is a very good opportunity to buy as much as possible and then hold it for at least the next few months if you are too afraid to face price fluctuations, now is a good step to apply technical analysis. I would strongly recommend that you start now, don't regret it when the opportunity is gone. Honestly, I have looked at the history of price movements since the beginning of 2023 and can conclude that now is the right time to stockpile more when the price is at the third lowest support this year, I see no doubt in this condition. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 21, 2023, 03:58:24 PM |

|

This has been true from the beginning. Buy Bitcoin when its price drops. Bitcoin has been giving us opportunity for a long time. Now it's giving us more opportunity. Let's say the price drops from here, it will recover quickly. But when the price of Bitcoin goes up, we need to see that today is an opportunity so that we don't wish we had bought in time.

Bitcoin will always have price fluctuations. You need to take advantage of these days. Bitcoin is at a good price point for buying, accumulating and Hodl.

FTFYYou did not really say anything wrong, yet many of us likely realize that we need to ongoingly attempt to account for the likelihood that an overwhelming majority of regular people (aka normies) do not have any coin or they are low coiners, and perhaps even active participants in this forum (including this thead) fit within a similar situation - except that probably if we are members of this forum and perhaps more actively involved in various forum threads, then we likely are a little further down the BTC accumulation path - as compared to the regular person. It seems that part of the rationale behind this thread is attempting to emphasize various ways to make sure that each of us is erroring on the side of BTC accumulation - even at the same time as there likely are some decently varying ideas regarding which strategies are going to work best to ongoingly remain BTC accumulation/stacking focused.. so surely many of us who are active in this thread likely already agree on the fact we should have BTC accumulation/stacking goals even if we might not quite agree upon the various ways that we might better accomplish BTC accumulation in a way that we feel that we can maximize our own abilities to get the best (or better) bang for the buck... which there likely are not any real solutions to resolve that almost no matter what we do there is likely going to continue to be tensions in terms of each of us having questions about whether we might be doing a better job in accumulating BTC or might we be able to do better? [edited out]

You are right, for elderly people over 70-80 years old, age can be a big barrier when we recommend bitcoin to them because to be able to profit from bitcoin, they need to hold bitcoin for at least 4 years if the cycle is repeated. So I think when recommending bitcoin to them, we should emphasize that bitcoin investment takes a long time and let them make the best decision for themselves. It's really a big hurdle, but we shouldn't let that stop us from recommending bitcoin to them. Because maybe their desire is not necessarily profit but most likely, they want to experience new technology like bitcoin. I think at that age, money is no longer a big deal for them. It seems to me that we need to be careful in terms of either being patronizing towards the eldery in terms of acting like we know something that they do not, even though it may well be the case that we do.. but surely everyone knows things that others do not know, so in that regard, there seems to always be quite a bit of value in terms of approaching elderly people and others in terms of their own agency and their own needs to make their own choices. At the same time, if we are having any kind of conversation with anyone, whether elderly or not, there likely is a bit of a direction that is back and forth in terms of the conversation may well end up going in a variety of directions, and whenever we might be talking about finances, there may well be quite a bit of sensitivities in regards to the amount of information that we might have in regards to the various balances that anyone might be making and choosing (or not choosing) to disclose some of the details that we might have to make some estimations about how we might frame the subject..or the recommendation... that ultimately leaves them with the choices regarding how to get in, how much to put in and then maybe they might need more help in terms of setting up accounts, unless we are choosing to sell them bitcoin ourselves, which brings its own potential set of issues (not necessarily bad). If my grandfather also likes to invest in bitcoin. I am willing to use my own money for him to experience because at my grandfather's age, money is not the most important thing.

Sure there can be questions regarding how to treat direct in line family members but then also if we come to some kind of an agreement that we might even be holding their coins.. in the event that they might have some challenges when it comes to setting up their own accounts or their own ways of holding their corn. DCA deviation multiplier

DCA #1 = Base Order - 1% = $29,700

DCA #2 = DCA #1 - 1% * 2 = $29,100 (Base order - 3%)

DCA #3 = DCA #2 - 1% * 2 * 2 = $27,900 (Base order - 7%)

DCA order size mulyiplier

DCA #1 = 1,000 USDT = 1,000 USDT

DCA #2 = 1,000 USDT * 2 = 2,000 USDT

DCA #3 = 1,000 USDT * 2 * 2 = 4,000 USDT

TBH, I did not realize DCA have types. Because I have been advice by legendary members that we should do DCA to get more Coins. But I never heard about types of DCA. And after reading these, I can say, each person can come up with their own DCA strategy which might suits them best. Like if to some person this DCA deviation multiplier is not working fine then they go after the second one. But One thing I did not understand there is what does the meaning of "Base order" here. I hope someone would shed a light on it please. Yeah of course, you can employ your own variation of DCA, but if you do not really understand what you are doing, it is likely best to attempt to employ a more strict variation of DCA first, and make sure that you understand the more strict variation of DCA before you start to get too fancy and then end up doing something that you call DCA but it really is not even close to what DCA should be.. but instead a kind of buying on dips or even a kind of gambling, but you call it DCA because you start out with DCA and then devolve into something else. Let's say we have still $1000 in savings even after doing the DCA when the BTC is at $20k and after some bad news or whatever reason BTC again touches $17k or $18k then I think the wise decision would be to put all $1000 into the market instead still doing DCA at that moment.

You seem to be describing that correctly. So if you have a regular DCA set up, then you might have some dollars that you are holding in reserves, so when the BTC price dips, then you decide how much of that money in reserves that you are going to want to use to buy during the dip.. so if you are still ongoingly employing DCA and then also buying BTC on dips, then that would merely be a form of supplementing the DCA with buying on dips... and there is surely nothing wrong with those kinds of strategies, as long as you are able to figure out why they are different and then your education on the topic helps to inform you how many dollars that you would like to ongoingly dedicate (or reserve) for each of the practices.. and of course, you can change the amount of dollars that you dedicate to each category as your cashflow might change and also if you have situations in which your dollar reserves might build up to high amounts or become depleted more quickly than you had expected (or hoped).. so you can make adjustments to the amount of dollar value that you ongoingly try to maintain in each of the categories of your funding of your BTC accumulation strategies. [edited out]

....but when something unexpected happens, you should at least be the first to allocate the profit for your grandfather's health insurance, not for personal gain. That's a good question regarding how involved any of us might get in terms of either giving advice and/or manageing the funds and/or having some discretion over the direction of the funds (like fiduciary duties).. so are we either gaining fiduciary duties or taking them upon ourselves when it comes to how involved that we might choose to get in the BTC accumulation and/or management of funds. DCA comes with various plans depending on how much someone knows about trading. I'm happy my plan has been good and it's been working for two years. It's easy, make the most of price changes by buying when it's low and selling when it's high. If you're unsure, the base order is the first investment amount you won't go over.

Take your trading bullshit to another thread, and sure your trading or whatever it is that you are describing might work.. who fucking cares? you are in the wrong thread to be framing trading as if you had been talking about DCA, when you are not talking about DCA. You seem to be a disingenuine fuck to be presenting your ideas as if they were DCA.. and in the end you come back to clarify what you meand and then to explain that you had really been talking about trading. ..and some of us, including yours truly, attempted to give you some benefit of the doubt that you were actually talking about some kind of a DCA strategy.. I should have known better. I'm glad you found this helpful and could understand and connect with it. I agree with you. If you read my earlier response again, I pointed out that this strategy is particularly effective for professionals.

Fuck professionals. Who gives any shits? A lot of what we are trying to do is to figure out various ways that people can engage in fairly-straight forward strategies to accumulate BTC.... read the OP and the title of the thread. It's about buying... and sure we interpret that to various kinds of accumulation.. and the more complicated that you end up making your accumulation, then the more difficult it becomes to employ whatever complicated formula that you are suggesting. These experts often have a good amount of money to trade, sometimes on behalf of a company or a group of Bitcoin investors. To meet their target returns within a specific time, they need to use this strategy.

Again, who cares about the amount of money. We have people who might have $1 per week or they might have $100 or they might have $1k or more who can employ basic BTC accumulation techniques, so who gives any shits about the supposed "BIG Balls" players who might happen to have more money .. blah blah blah.. fuck off with that shilling talk. What do you want to sell, Agbamoni? Are you trying to act like you have some kind of authority because you know people with a lot of money? You know, Ryu, some people use trading bots for this purpose. It's a good approach too. With trading bots, you can input certain configurations and connect them to the exchange API you prefer. You set your initial investment amount and you're all set!

Fuck off with the trading bot talk too. Either create your own thread, or go join a thread in which your trading bot talk is on topic. [edited out]

Btw the division is quite good but I think we can still divide it equally such as with $300 in each purchase or DCA made or maybe make it $200 in one time it is also still possible. I think that you are referring to my example of a $1,200 budget and placing them in 4 different price locations. I think that I largely addressed this as a way that some kinds of buy order structures and plans are deficient and they may well cause panic because of their deficiencies, so merely dividing them into equal parts would not necessarily improve the deficiencies that I was trying to point out, but I agree with you that there are some benefits in terms of trying to stay somewhat consistent with amounts, once we might figure out other details, such as what are our increments, how much we have in our budget and how far down we want our buys to go in order to attempt to account for what we believe to be worse case scenarios (and perhaps even having enough of a budget to go beyond what we consider to be worse case scenarios). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Odohu

|

|

August 21, 2023, 04:39:57 PM |

|

I'm not a hypocrite when it comes to experiencing new technology, to be honest, the benefits still hold for people who enter Bitcoin, regardless of the new technology, it's a plus point to be felt by everyone. But when there is no profit to be gained, it does not mean that interest in it has increased. The important point of what we are targeting is long-term profit. Old age and youth are only a limit if we are able to place it according to the level of understanding.

After our conversation that very day, I sat down to reflect and flashback to my university days. I remember that some key computer related courses were taught be advanced men. Their wisdom and passion for impact was amazing and they taught algorithmic approach to modeling Engineering systems effortlessly. I feel it will be a little incorrect to assume that appreciating and understanding Bitcoin and the underlying technology have anything to do with age. It is rather a matter of passion. So I agree with you completely that the assumption of age limitation is not entirely correct. We can spread the knowledge of Bitcoin to the elderly who are even more attentive to learn than some young guys facing various forms of youthful distractions already. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

Aanuoluwatofunmi

|

|

August 21, 2023, 04:53:19 PM |

|

I'm not a hypocrite when it comes to experiencing new technology, to be honest, the benefits still hold for people who enter Bitcoin, regardless of the new technology, it's a plus point to be felt by everyone. But when there is no profit to be gained, it does not mean that interest in it has increased. The important point of what we are targeting is long-term profit. Old age and youth are only a limit if we are able to place it according to the level of understanding.

After our conversation that very day, I sat down to reflect and flashback to my university days. I remember that some key computer related courses were taught be advanced men. Their wisdom and passion for impact was amazing and they taught algorithmic approach to modeling Engineering systems effortlessly. I feel it will be a little incorrect to assume that appreciating and understanding Bitcoin and the underlying technology have anything to do with age. It is rather a matter of passion. So I agree with you completely that the assumption of age limitation is not entirely correct. We can spread the knowledge of Bitcoin to the elderly who are even more attentive to learn than some young guys facing various forms of youthful distractions already. Age is never a barrier to holding bitcoin or investing in it, bitcoin is not what the academic institutions can also analysis for justification over fiat for it acceptance but the relevance of bitcoin had made it all simple and applicable for everyone interested in learning or knowing what a decentralized digital currency is, there are many ways we could persay that bitcoin is what the world current economy situations wants without age limit just as fiat never have any age barrier for usage, bitcoin is for everyone, while everyone interested will learn the process and make an opportunity through its adoption. |

|

|

|

|

naira

|

|

August 21, 2023, 05:20:59 PM |

|

Age is never a barrier to holding bitcoin or investing in it, bitcoin is not what the academic institutions can also analysis for justification over fiat for it acceptance but the relevance of bitcoin had made it all simple and applicable for everyone interested in learning or knowing what a decentralized digital currency is, there are many ways we could persay that bitcoin is what the world current economy situations wants without age limit just as fiat never have any age barrier for usage, bitcoin is for everyone, while everyone interested will learn the process and make an opportunity through its adoption.

You're right, but it's a shame you didn't read our previous conversation about Bitcoin both young and old. So this context has actually been resolved that the most important issue is in terms of the level of understanding, not the context of the age range. Actually it's all simple, just adjust it, bitcoin for anyone I agree. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 21, 2023, 06:22:15 PM

Last edit: August 21, 2023, 07:01:55 PM by JayJuanGee |

|

Age is never a barrier to holding bitcoin or investing in it, bitcoin is not what the academic institutions can also analysis for justification over fiat for it acceptance but the relevance of bitcoin had made it all simple and applicable for everyone interested in learning or knowing what a decentralized digital currency is, there are many ways we could persay that bitcoin is what the world current economy situations wants without age limit just as fiat never have any age barrier for usage, bitcoin is for everyone, while everyone interested will learn the process and make an opportunity through its adoption.

You're right, but it's a shame you didn't read our previous conversation about Bitcoin both young and old. So this context has actually been resolved that the most important issue is in terms of the level of understanding, not the context of the age range. Actually it's all simple, just adjust it, bitcoin for anyone I agree. To me it seems to come down to some individual specifics, but right from the start, we should be able to anticipate that age could have a BIG determining part, but not necessarily eliminate the person's determination regarding getting into bitcoin. So if we look at the factors, they look like this: When you invest into bitcoin, at minimum you should be attempting to consider: 1) cashflow, 2) how much bitcoin you have already accumulated, 3) other investments (including cash reserves), 4) view of bitcoin as compared with other investments, 5) timeline, 6) risk tolerance, 7) time, skills, goals (investment/lifestyle targets , which includes figuring out the extent that you are in BTC accumulation, maintenance or liquidation stage) 8 ) abilities to strategize, plan, research and learn along the way including tweaking strategies from time to time to consider: 8 a) trading, reallocating, use of leverage and/or financial instruments. I am not going to say that some of these are not important, yet several of the top factors are more basic and some to the later factors such as 7 & 8 are a bit more mushy, and really 8 a) are more advanced strategies and sometimes still might need to be considered by someone getting in and/or out of bitcoin. So age mostly affects timline, but surely we could see how age might affect each and every one of the factors, so we should not necessarily be too quick to judge why someone might need to modify their approach as compared with someone else, whether that is age or some other things that might be going on with that particular person at that particular time in their life. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Crypto_I.N

Member

Offline Offline

Activity: 141

Merit: 25

|

|

August 21, 2023, 08:10:57 PM |

|

DCA comes with various plans depending on how much someone knows about trading. I'm happy my plan has been good and it's been working for two years. It's easy, make the most of price changes by buying when it's low and selling when it's high. If you're unsure, the base order is the first investment amount you won't go over.

Wait, this is wrong. how do you equate DCA with trading? In this case you should be able to distinguish trading and Investment because they have different meanings even though there is a buying factor but the purpose is different and trading has nothing to do with DCA. I think we should be wiser in addressing a condition where you are currently on the wrong path when talking about investment and DCA but switching to trading. |

|

|

|

|

|

Salahmu

|

|

August 21, 2023, 11:49:14 PM

Last edit: August 22, 2023, 12:14:36 AM by Salahmu |

|

You are right, for elderly people over 70-80 years old, age can be a big barrier when we recommend bitcoin to them because to be able to profit from bitcoin, they need to hold bitcoin for at least 4 years if the cycle is repeated. So I think when recommending bitcoin to them, we should emphasize that bitcoin investment takes a long time and let them make the best decision for themselves.

If my grandfather also likes to invest in bitcoin. I am willing to use my own money for him to experience because at my grandfather's age, money is not the most important thing.

Yeah actually it may or may not be a barrier to them depending on their purpose which they may intend for it, looking at it on different pastpective some persons at that age could be looking for an avenue or a platform were they could invest their money in other to secure their children future because most persons at that age may also have ground children which they loved, so referring them to Bitcoin will help them utilize the opportunity of investing ahead the future of his ground children with the belief that before they will come of age it would have yielded a good profit. This is also similar to a man I heard that bought some amount of Bitcoin for his children future, at least with this they would have something to start with when the time comes. In otherwise it becomes a barrier Recomending Bitcoin to 70-80 years old because before they will start profiting it may take a long time of holding considering how volatile the market is and time may not really be on there side considering there age. |

|

|

|

|

|

| | | .

Duelbits | | | | | █▀▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄▄▄▄ | TRY OUR

NEW UNIQUE

GAMES! | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀DICE .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

███▀▀ ▀▀███

███ ▄▄▄▄ ▄▄▄▄ ███

███ ██████ ██████ ███

███ ▀████▀ ▀████▀ ███

███ ███

███ ███

███ ███

███ ▄████▄ ▄████▄ ███

███ ██████ ██████ ███

███ ▀▀▀▀ ▀▀▀▀ ███

███▄▄ ▄▄███

███████████████████████████████ | | | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀MINES .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

████████████████████████▄▀▄████

██████████████▀▄▄▄▀█████▄▀▄████

████████████▀ █████▄▀████ █████

██████████ █████▄▀▀▄██████

███████▀ ▀████████████

█████▀ ▀██████████

█████ ██████████

████▌ ▐█████████

█████ ██████████

██████▄ ▄███████████

████████▄▄ ▄▄█████████████

███████████████████████████████ | | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀PLINKO .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

█████████▀▀▀ ▀▀▀█████████

██████▀ ▄▄███ ███ ▀██████

█████ ▄▀▀ █████

████ ▀ ████

███ ███

███ ███

███ ███

████ ████

█████ █████

██████▄ ▄██████

█████████▄▄▄ ▄▄▄█████████

███████████████████████████████ | | 10,000x

MULTIPLIER | │ | | | | ▀▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄▄█ |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

August 22, 2023, 11:21:06 AM |

|

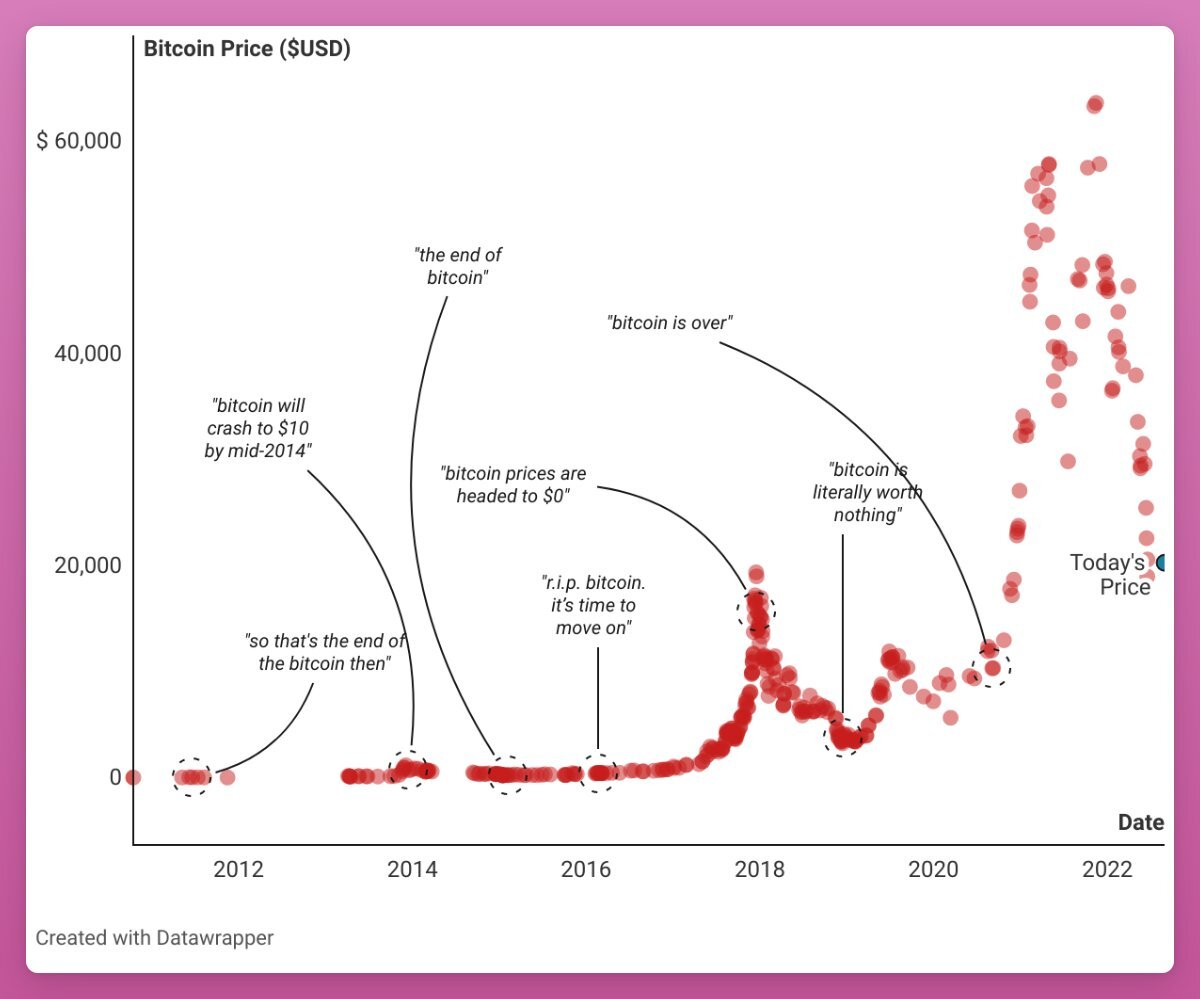

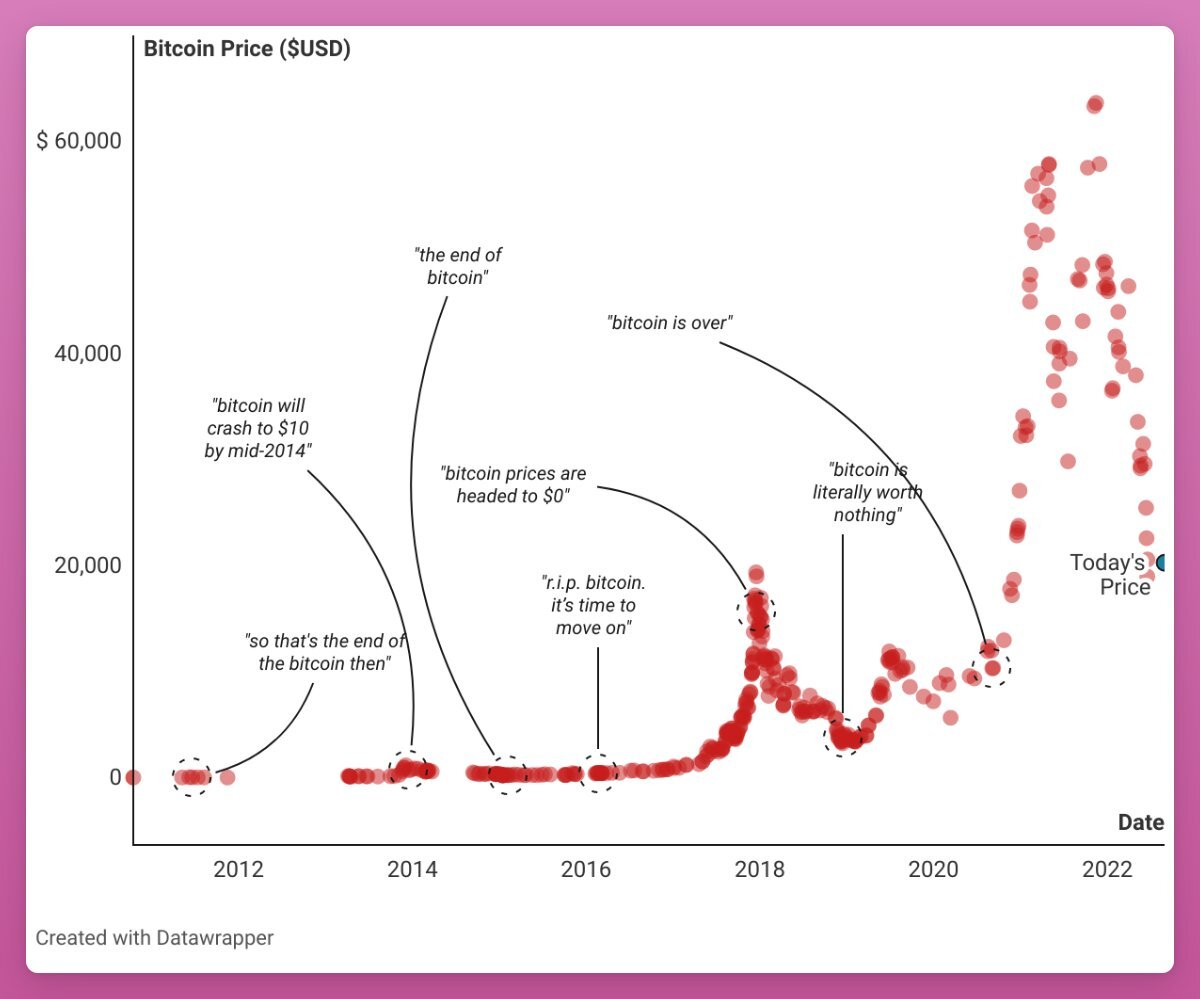

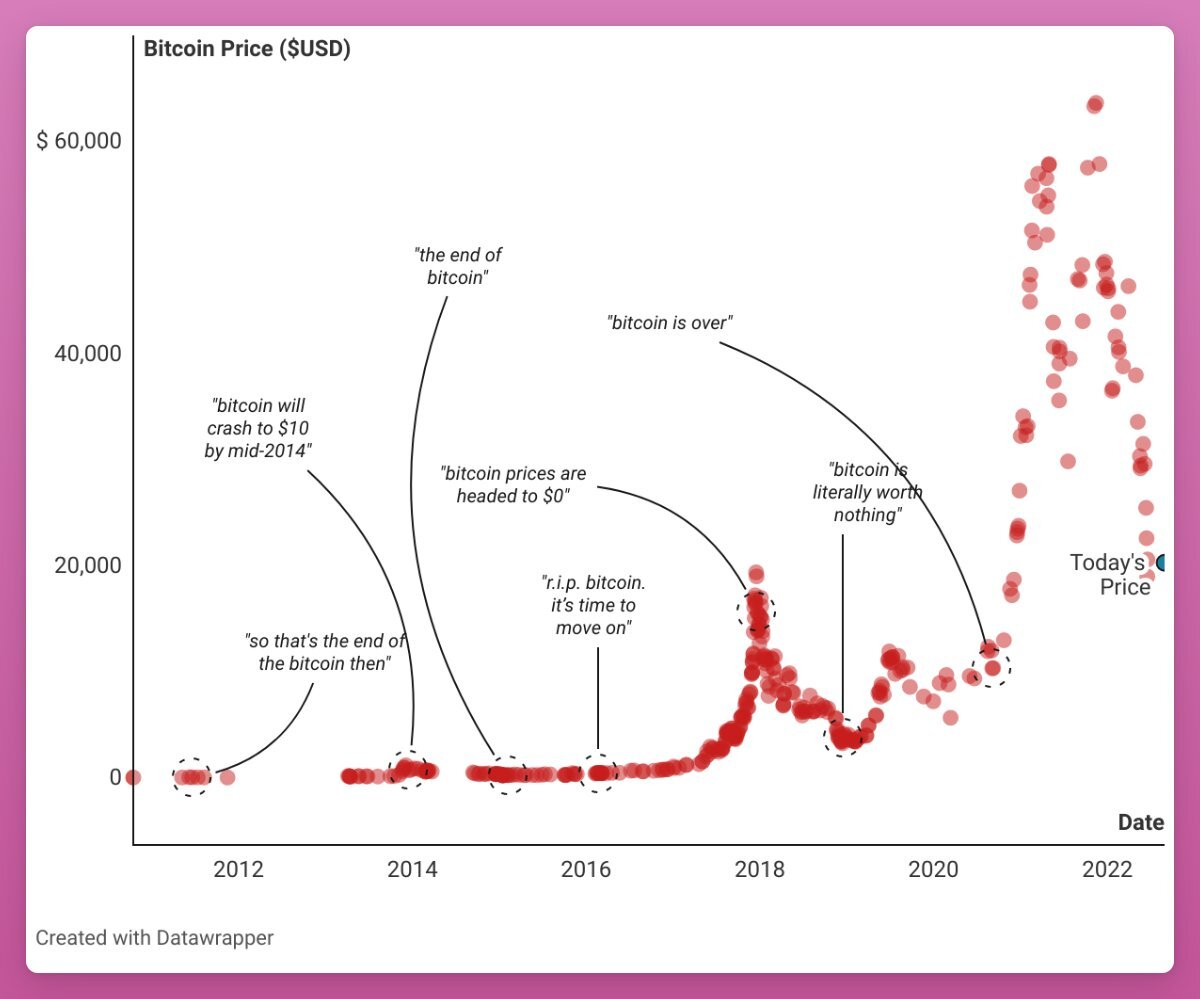

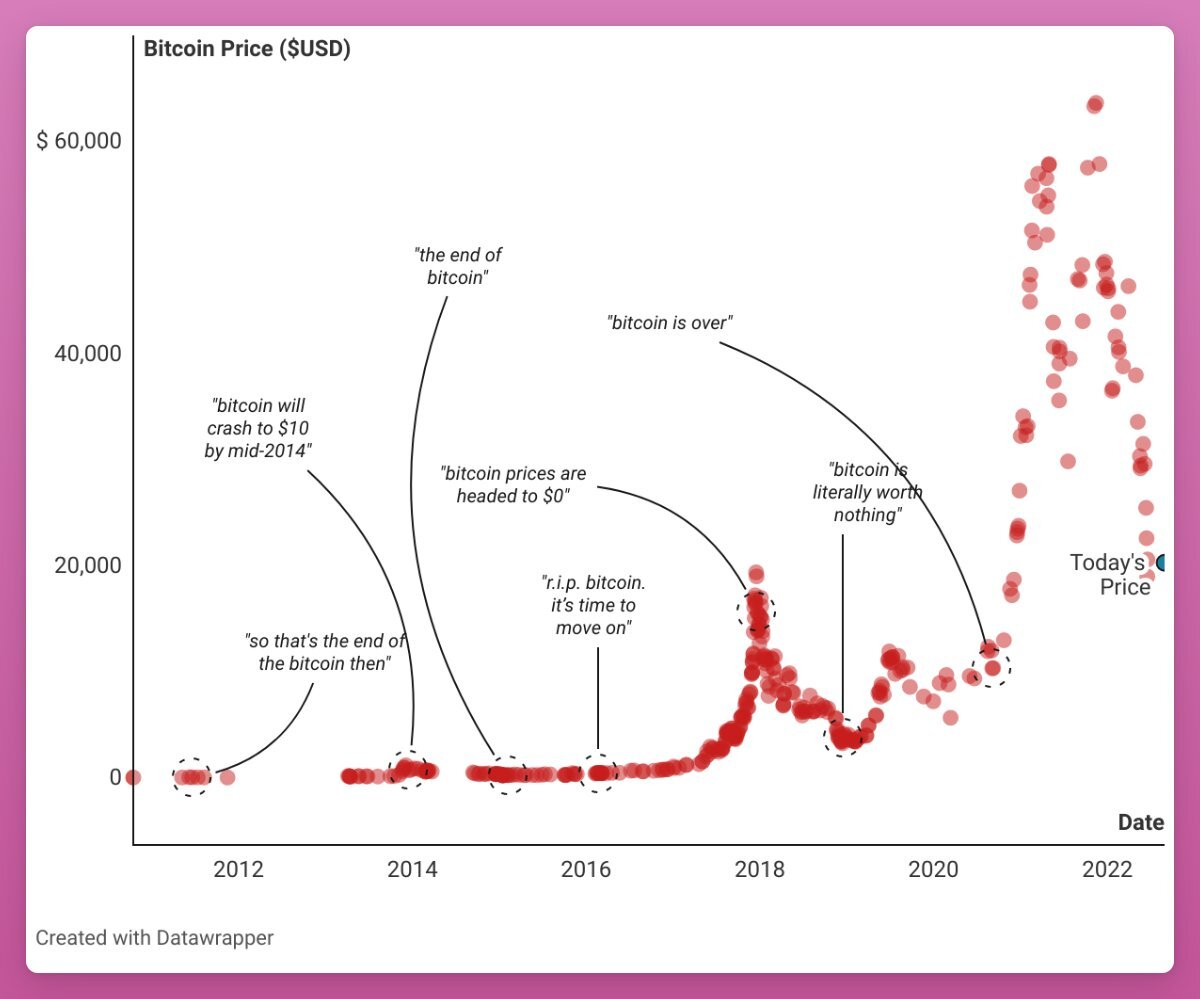

They said Bitcoin will "never recover".  Look at the red dots in that chart. After the recent "mini-crash", expect another few months of "it is dead"/doom and gloom towards Bitcoin from respected economists, the morons from legacy finance, and mere FUDsters. There are many of them, and ALL of them were always proven WRONG AGAIN AND AGAIN. Just HODL! |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

Odohu

|

|

August 22, 2023, 11:45:18 AM |

|

They said Bitcoin will "never recover".  Look at the red dots in that chart. After the recent "mini-crash", expect another few months of "it is dead"/doom and gloom towards Bitcoin from respected economists, the morons from legacy finance, and mere FUDsters. There are many of them, and ALL of them were always proven WRONG AGAIN AND AGAIN. Just HODL! What if these guys do this to intentionally drop the price in order to buy low and sell high? We tend to look this guys only from one perspective but the truth is that, to them it is all about a game of profits. They don't attach emotions and are never loyal to anything. It might seem that they were proven wrong time and time again but they might actually be balancing their books in the whole thing. If you pay close attention, you will noticed that Elon Musk seems to have deployed that method to cash out. Don't be surprise if he comes back again and accumulate Bitcoin citing one uncoherent reason for coming back... but then, he would have bought very low to sell high fee years from now. This guys are playing money game... |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

EarnOnVictor

|

|

August 22, 2023, 12:43:24 PM Merited by JayJuanGee (1) |

|

They said Bitcoin will "never recover".  Look at the red dots in that chart. After the recent "mini-crash", expect another few months of "it is dead"/doom and gloom towards Bitcoin from respected economists, the morons from legacy finance, and mere FUDsters. There are many of them, and ALL of them were always proven WRONG AGAIN AND AGAIN. Just HODL! Just look away, those who have been taking back their words and eating back their mockery will continue to do so. Bitcoin has shamed many people many times, this is not going to be new, it could only surprise when they continue their mockery and still get to be put to shame continually, that's folly. Even now, Bitcoin has not fallen to an alarming extent that any reasonable person would make a mockery of it, it's not like what happened in May 2021 that truly called for panic during the China banning and Elon Musk's betrayal. What happened recently is what could happen to any market where there are bear and bull seasons, it's nothing. We are in the bearish trend and I knew this before it happened as crossing $29,400 convincingly could not mean well for the coin. Let's see how things unfold around $24,700-$25,000 this time. I strongly doubt if the market would breach the level convincingly, and if this is true, it won't be long before Bitcoin gets back on its feet and move around $30,000 even before the much-expected bull run that could see it hit $100,000 for the first time. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

livingfree

|

|

August 22, 2023, 01:00:58 PM |

|

What if these guys do this to intentionally drop the price in order to buy low and sell high? We tend to look this guys only from one perspective but the truth is that, to them it is all about a game of profits. They don't attach emotions and are never loyal to anything. It might seem that they were proven wrong time and time again but they might actually be balancing their books in the whole thing.

It's been like for several years that this is no longer a speculation but really happening. That's why if there were some bad news for the past few days, there were for sure these big players that have bought already on the dip price. If you pay close attention, you will noticed that Elon Musk seems to have deployed that method to cash out. Don't be surprise if he comes back again and accumulate Bitcoin citing one uncoherent reason for coming back... but then, he would have bought very low to sell high fee years from now. This guys are playing money game...

I won't be surprised if he comes back and announces that he bought back and not just with a couple of millions but with another hundred millions to excite the market again. That will drive the demand again even for just simple words of encouragement that he tells to the world for buying Bitcoin. But, we're not reliant on that as individual and long term investors. |

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | | | BK8? | | | .

..PLAY NOW.. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 22, 2023, 02:41:25 PM |

|

They said Bitcoin will "never recover".  Look at the red dots in that chart. After the recent "mini-crash", expect another few months of "it is dead"/doom and gloom towards Bitcoin from respected economists, the morons from legacy finance, and mere FUDsters. There are many of them, and ALL of them were always proven WRONG AGAIN AND AGAIN. Just HODL! I guess that you are making a certain kind of point with the chart regarding ongoing wrong bitcoin price predictions, but wouldn't it also be a good idea to provide a link to the chart so that we can see from where you get it and maybe some other context for the various dots within the chart? [edited out]

Just look away, those who have been taking back their words and eating back their mockery will continue to do so. Bitcoin has shamed many people many times, this is not going to be new, it could only surprise when they continue their mockery and still get to be put to shame continually, that's folly. Even now, Bitcoin has not fallen to an alarming extent that any reasonable person would make a mockery of it, it's not like what happened in May 2021 that truly called for panic during the China banning and Elon Musk's betrayal. What happened recently is what could happen to any market where there are bear and bull seasons, it's nothing. We are in the bearish trend and I knew this before it happened as crossing $29,400 convincingly could not mean well for the coin. Let's see how things unfold around $24,700-$25,000 this time. I strongly doubt if the market would breach the level convincingly, and if this is true, it won't be long before Bitcoin gets back on its feet and move around $30,000 even before the much-expected bull run that could see it hit $100,000 for the first time. I will look at your two other threads, but seems quite incoherent to be suggesting (and even arguing) that bitcoin is in a bearish trend, especially if you attempt to look at actual context of where we are at... which seems to be a kind of in between stage.. that may or may not confirm whether we are out of the bearish trend that started from $69k (in November 2021) and down to the local low of $15,479 in November of 2022... so largely the move has been up.. . .and some current consolidating.. .. and sure maybe we might not end up getting out of the bear trend from $69 to $15,479 - but it still seems to be quite weird (and even misleading.. and too short-term focused.. sure traders love to get into these kinds of lame prognostications) to be labelling whatever has been happening in a kind of flip flopping way (which is to say.. now we are in bull, now we are in bear, now we are back to bull and now we are back to bear.. blah blah blah nonsense) that makes little to no sense when considering the actual context. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Salahmu

|

|

August 22, 2023, 02:47:42 PM |

|

If you pay close attention, you will noticed that Elon Musk seems to have deployed that method to cash out. Don't be surprise if he comes back again and accumulate Bitcoin citing one uncoherent reason for coming back... but then, he would have bought very low to sell high fee years from now. This guys are playing money game...

Yeah I think you have a point because I could remember on 13 may 2022 when Elon musk tweeted about Tesla plans to no longer accept Bitcoin payment immediately the Bitcoin price fell from $54,819 to $45,700, with that it provides an opportunity for him to enter the market to buy larger amounts of Bitcoin and sells as the price goes up, with that method I believe he makes a thousand and millions of dollars even on January 2021 he also Tweeted about doge coin and immediately the price went 300% uptrend in four hours before it starts dropping back, and he must have accumulated enough dogecoin before he tweeted so as to enable him sell on higher price. |

|

|

|

|

|

| | | .

Duelbits | | | | | █▀▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄▄▄▄ | TRY OUR

NEW UNIQUE

GAMES! | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀DICE .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

███▀▀ ▀▀███

███ ▄▄▄▄ ▄▄▄▄ ███

███ ██████ ██████ ███

███ ▀████▀ ▀████▀ ███

███ ███

███ ███

███ ███

███ ▄████▄ ▄████▄ ███

███ ██████ ██████ ███

███ ▀▀▀▀ ▀▀▀▀ ███

███▄▄ ▄▄███

███████████████████████████████ | | | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀MINES .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

████████████████████████▄▀▄████

██████████████▀▄▄▄▀█████▄▀▄████

████████████▀ █████▄▀████ █████

██████████ █████▄▀▀▄██████

███████▀ ▀████████████

█████▀ ▀██████████

█████ ██████████

████▌ ▐█████████

█████ ██████████

██████▄ ▄███████████

████████▄▄ ▄▄█████████████

███████████████████████████████ | | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀PLINKO .▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | | ███████████████████████████████

█████████▀▀▀ ▀▀▀█████████

██████▀ ▄▄███ ███ ▀██████

█████ ▄▀▀ █████

████ ▀ ████

███ ███

███ ███

███ ███

████ ████

█████ █████

██████▄ ▄██████

█████████▄▄▄ ▄▄▄█████████

███████████████████████████████ | | 10,000x

MULTIPLIER | │ | | | | ▀▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄▄█ |

|

|

|

|

naira

|

|

August 22, 2023, 02:54:55 PM Merited by JayJuanGee (1) |

|

When you invest into bitcoin, at minimum you should be attempting to consider:

1) cashflow,

This will be very interesting, Cash Flow is the most important thing that is rightly mentioned to measure our consistency in accumulating Bitcoin based on a certain time span and you could say this point supports DCA to run well. Personally, I still can't be consistent because as a manager I have to be able to prioritize the needs of my beloved child above my own interests. Haha 2) how much bitcoin you have already accumulated,

The second point, definitely the target, or usually one of us prefers the more Bitcoin held the better. But there's no denying that there are people out there who have some kind of predetermined peak target for example Hodl 1 Bitcoin is enough. For me personally, it is still before I can determine the maximum target of ownership. 3) other investments (including cash reserves),

The third point, other investments may for now only focus on buying a few meters of strategic land based on long-term prospects, the funds will have potential if it is located on the side of the road. The rest of the points let someone break it down for all of us to liven up the discussion. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 22, 2023, 04:21:25 PM |

|

When you invest into bitcoin, at minimum you should be attempting to consider:

1) cashflow,

This will be very interesting, Cash Flow is the most important thing that is rightly mentioned to measure our consistency in accumulating Bitcoin based on a certain time span and you could say this point supports DCA to run well. Personally, I still can't be consistent because as a manager I have to be able to prioritize the needs of my beloved child above my own interests. Haha Of course, I could have attempted to flesh this out a bit more, because we may well have various incoming cash that may or may not vary, and we have various monthly expenses and some can be deferred and so we can also project these out for 6 months and or even for a couple of years.. and of course, the upcoming 1-3 months are going to be more important than the further out months with an ability to be more loosey goosey with the numbers the further out the timeline, but if you were too loosey goosey with your numbers and you overly estimated (rather than being conservative 6-24 months out), you may well end up finding when some of those loose numbers have to be tightened up that you are running into cashflow problems because you had projected out in ways that ended up contributed to causing your own crunches late down the road. 2) how much bitcoin you have already accumulated,

The second point, definitely the target, or usually one of us prefers the more Bitcoin held the better. But there's no denying that there are people out there who have some kind of predetermined peak target for example Hodl 1 Bitcoin is enough. For me personally, it is still before I can determine the maximum target of ownership. Even though you might frame these goals in terms of an actual bitcoin number that you might be aiming for based on how many you already have, your whole approach may end up changing based on how many BTC that you are actually holding and whether you are near or far from your BTC accumulation goal.. and maybe even someone who currently has accumulated 1 BTC over the past 4 years .. may well have a plan to try to get up to 2-3 BTC within the next 5-10 years, whether or not that is realistic.. but at least such person is trying to account for where s/he is at and where s/he is wanting to attempt to get to. 3) other investments (including cash reserves),

The third point, other investments may for now only focus on buying a few meters of strategic land based on long-term prospects, the funds will have potential if it is located on the side of the road. Some other investments are more liquid than others, and there can be current value estimations that likely will need to consider how liquid they might be, and then like you suggested, other investments may or may not go up in value... and for someone new to bitcoin, they might consider how much they want to allocate into bitcoin based on their other investments, so if someone might have had been building an investment portfolio for more than 8 years (let's use your forum registration date, naira), then maybe that person might have gotten up to $100k size of all of his her investments.. and maybe those investments might be giving lower value to assets that are less liquid within the investment portfolio, so that person might aim to have anywhere between 1% and 25% into bitcoin. .. which shows that having $25k into bitcoin (right around 1 bitcoin) might be on the relatively aggressive end of the scale for such an investor, but sometimes even with a historical investment timeline of 8 years, sometimes it could take a while to reach high levels of investment or even any kind of need to diversify into other assets, so in your case if you mentioned that you own some property, and then maybe you have cash and bitcoin, so maybe your bitcoin investment might be a much higher than 25% allocation, and that might be o.k. too.. so if you might have some difficulties in terms of being able to in vest more than 10% of your income into bitcoin (or any other investments), if you are going at 10% of your income going into bitcoin, it still might take you 10 years to invest up to the equivalent of your yearly salary, and surely then you hope that whatever you had chosen to invest into is appreciating at a great enough rate in order to give you more than 1 years salary in your investment portfolio by the time you get to 10 years of building such investment portfolio. The rest of the points let someone break it down for all of us to liven up the discussion.

Fair enough. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

red4slash

|

|

August 22, 2023, 07:10:49 PM Merited by JayJuanGee (1) |

|

[edited out]

Btw the division is quite good but I think we can still divide it equally such as with $300 in each purchase or DCA made or maybe make it $200 in one time it is also still possible. I think that you are referring to my example of a $1,200 budget and placing them in 4 different price locations. I think that I largely addressed this as a way that some kinds of buy order structures and plans are deficient and they may well cause panic because of their deficiencies, so merely dividing them into equal parts would not necessarily improve the deficiencies that I was trying to point out, but I agree with you that there are some benefits in terms of trying to stay somewhat consistent with amounts, once we might figure out other details, such as what are our increments, how much we have in our budget and how far down we want our buys to go in order to attempt to account for what we believe to be worse case scenarios (and perhaps even having enough of a budget to go beyond what we consider to be worse case scenarios). Yep, it refers to the example you gave so that the discussion does not widen much, but in the end it also adjusts to the capital we have and I am aware of that, it's just that when there is already an example so that the discussion refers more to the DCA in question, I just give my views on the example you gave earlier. The context may go back to consistency because if indeed we cannot be consistent with large amounts then at least it can be minimised in terms of the amount invested so that the DCA we do runs well. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | | | [ | 1,000x

LEVERAGE | ] | [ | .

COMPETITIVE

FEES | ] | [ | INSTANT

EXECUTION | ] | | | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ | ████████████████████████████████████████████████████████

.

TRADE NOW

.

████████████████████████████████████████████████████████ | ██████

██

██

██

██

██

██

██

██

██

██

██

██████ |

|

|

|

Dictator69

Member

Offline Offline

Activity: 109

Merit: 70

|

|

August 22, 2023, 07:22:59 PM Merited by JayJuanGee (1) |

|

More simply, and from Bitcoin's technical viewpoint - As long as the transaction follows the consensus rules, it will be broadcasted and it will be included in the blocks for confirmation. No prejudice, no stereotypes, just Bitcoin transactions that you may approve or disapprove of.

Means We both are on the same page regarding to this knowledge only. And I hope to get more valuable resources to read like these from you. Do you have any good resources to know more about BTC Blockchain infrastructure like the main components. I know the video in the article is also good, but I am more interested in reading instead of watching. DCA comes with various plans depending on how much someone knows about trading. I'm happy my plan has been good and it's been working for two years. It's easy, make the most of price changes by buying when it's low and selling when it's high. If you're unsure, the base order is the first investment amount you won't go over

Agreed to the point that DCA method is not same for everyone even I can say for sure one might be following the same rule which you shared but they might not be aware of the fact that other are also aware or at least have name for such methods. Like the "order size" and "deviation multiplier" etc. And thanks for shedding light on my question. Yeah of course, you can employ your own variation of DCA, but if you do not really understand what you are doing, it is likely best to attempt to employ a more strict variation of DCA first, and make sure that you understand the more strict variation of DCA before you start to get too fancy and then end up doing something that you call DCA but it really is not even close to what DCA should be.. but instead a kind of buying on dips or even a kind of gambling, but you call it DCA because you start out with DCA and then devolve into something else.

What factors makes one DCA strategy strict one and fancy one. Are these two mentioned ways of DCA are strict or Fancy one. Because from what I have learnt in the short period is in DCA we do not put all of our money at once just like we do in lump sum instead we try to time the market or at least to increase the profit on our holding to get our hands on more Satoshi. And I read some articles too about DCA types, but I did not find any, but I do find an advice that we should do DCA only in those assets or in only those investments which are for longer period of time. You seem to be describing that correctly. So if you have a regular DCA set up, then you might have some dollars that you are holding in reserves, so when the BTC price dips, then you decide how much of that money in reserves that you are going to want to use to................

Understood your points here. In short, I understand that every situation has different DCA strategies. Like when we have more fiat, less fiat, price is on it ATH in some specific time period etc. And thanks for the assistance too. I guess that you are making a certain kind of point with the chart regarding ongoing wrong bitcoin price predictions, but wouldn't it also be a good idea to provide a link to the chart so that we can see from where you get it and maybe some other context for the various dots within the chart?

https://zurichcryptojournal.com/how-many-time-has-bitcoin-be-called-dead/ I do not know if dear Wind_FURY has downloaded the image from the following website or not, but I found it using google lens and google lens helped me a lot in giving online tests. Even in the assignments of making apps in java they gave us diagrams and all I do is use google lens and then upload that image to find out that from which website they have picked the picture and once I able to find the source then it became super easy for me to copy the code. I know that's not a good way, but assignments take huge time and while we have our hands on full of assistance then i do not hesitate to use them Hehe. |

|

|

|

|

|

Furious 7

|

|

August 22, 2023, 09:44:19 PM Merited by JayJuanGee (1) |

|

Now if you are doing extra or changing your DCA, then that is not really strict DCA anymore but instead a kind of hybrid that takes advantage of the dip, in the employment of buying on dips practices.

This might sound impulsive and a pretty barbaric strategy, but if we can afford to do something like that then why not. It is not meant to change the DCA that was done before and the DCA still continues to be done, it's just that we can also take advantage of making some new purchases when a decline like this occurs because this would be a shame to miss. I read your previous discussions and after reading the reply of Furious in previous page, I began to think should we even do DCA in dumps like these because we knew this is the lowest BTC could go. But if we do not know either it's the lowest or not then it is always a good strategy to save some fiat to enter to buy more Satoshi in dips. But still, I think DCA is not something a strict rule which we should follow like we could make decisions of taking entries with the sensitivity of market. Let's say we have still $1000 in savings even after doing the DCA when the BTC is at $20k and after some bad news or whatever reason BTC again touches $17k or $18k then I think the wise decision would be to put all $1000 into the market instead still doing DCA at that moment. It depends on your own strategy and choice, I think. Regardless of whether you want DCA or waiting if you really believe the price you are waiting for will be reached then that is also no problem as long as the focus is still buying regardless of buy on the dips or DCA you determine what you think is best. But in this case I will still do both, DCA is one of the things that I still continue to do and stopping DCA means I have lost consistency in it and it will be annoying on the other hand that does not mean I am not preparing to buy on the dip because it is also still possible for me to do but on the other hand this is also not to be a reference for others because again all have strategies and patterns that they do in collecting bitcoin it's just that this is my version regardless of this is one of greed or impulsiveness I have no problem with it because I have considered my financial condition. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|