I_Anime

Full Member

Offline Offline

Activity: 364

Merit: 153

Cashback 15%

|

|

March 03, 2024, 07:09:05 PM |

|

As I have mentioned in various other places, my first year and a half in bitcoin from late 2013 to mid-2015, I was almost exclusively in BTC accumulation, so whenever I sold any amounts of BTC, I would immediately replace whatever I sold. Even though I had largely concluded that I had reached my overall BTC accumulation goal by late 2014 (which was to invest an amount that equalled 10% of my investment portfolio into BTC), I continued to accumulate some BTC in 2015 (the BTC price was quite low through the whole year, but also my additional cash was not really very much), and so by the middle to end of 2015 I was getting to be around 13.5% accumulation into BTC into my quasi-liquid investment portfolio, so I started to consider that I had gotten into a state of 0ver-accumulation - or a conclusion that I had too much BTC, so I was not really sure about how to deal with my over-accumulation status, except to create a plan to be able to sell BTC on the way up, some variation of Risto's SSS plan. well I went through the post but I think I would go through with it again for more solid understanding, this part quoted you actually said something that caught my interest, concerning the selling of some profit in your bitcoin and replacing it. We all know that whenever bitcoin dip your coin don't reduce in quantity but the value does. But when you selling from it you are actually reducing the quantity of your bitcoin right. And we know buying low price would give more advantage's buying in high price , like when Bitcoin was $25k those if you purchase $1k worth of bitcoin at that time you would endup with 0.04 BTC , but if you purchase that same amount which is $1k worth of bitcon when the price was $50k you would endup with 0.02 worth of Bitcoin, which is lesser than when you purchase at $25k. So In a scenario where I purchased $1k dollar worth of bitcoin at the price of $25k, having 0.04 bitcoin and lateron the price rose to $50k and I sold out 0.02 from my bitcoin that am holding, having the mindset of replacing it back, and lateron price experience a surge to the price range of $69k and kept increasing. If I want to replace it then what step should I take should I wait or the or should I increase the money want to I wanna use to purchase to coverup 0.02 bitcoin at that price range of $69k and above. Please hope this wasn't confusing, and if I had made any mistake please do so in correcting me . |

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

salad daging

|

|

March 03, 2024, 07:54:11 PM |

|

I made a small investment in 2022 which I am currently investing in DCA method. I didn't let myself get greedy on this little bullrun, up $64k a couple of days ago but I didn't sell the investment. I expect Bitcoin to exceed $100k after the halving. If I don't need money urgently during the bull market in 2025, I will not sell my investment, I will hold it for 2030 plus period.

It would be extraordinary if you were able to hold your investment until 2030 from 2022, because from the increase in prices that you have seen now, of course you yourself already know how much profit you have made from this. But if you still want to get something bigger than the current one, it's certainly not wrong for you to try it because Bitcoin investors must have a long-term investment plan. I am also still holding back part of my investment during this time because I also believe that the price of Bitcoin can reach the price you mentioned, although I only hope to see a new ATH in Bitcoin this year because that is also more likely to be expected by everyone now That hasn't happened yet because 2030 is still a long time away. He has only lasted 2 years until now while holding on until 2030 is not easy especially if you can't manage your cash flow well. If you have an investment plan in the next 10 years then now never look at the profits that are in your mind because it's still too far away, it's better how the accumulation can last for a long time because of course the obstacles will be even harder if you can't handle it well, so I think now maintain good cash flow then everything will be smooth in the accumulation. Almost most investors have now been able to survive until the ATH now, because they see the benefits are close, but if there is someone from the ordinary people who can withstand the current cycle then he is great for excluding profits in the bullish now. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|

adultcrypto

|

|

March 03, 2024, 08:22:50 PM |

|

I have seen many people who earn bitcoins and manage all their life expenses with it. I agree with you that investment in Bitcoin needs to be long-term. Because it is not possible to extract full profit from Bitcoin if not in long term. According to me, some part can be spent for special needs and the rest is better to invest.

When you earn Bitcoin and use it for your living expenses, that is different from investment which we are discussion here and also different from the long time hodl as well. Assuming such person have a fraction of the earned Bitcoin he is saving regularly, similar to what the DCA method, then it could fit into this discussion. So instead of opening another long chapter in this discussion which will serve as a deviation, we can just focus on how to buy and how to hodl. Regarding the DCAs strategy have been designed the impact of trading investing, fixed asset remain regular over time. It's have no limited to BTC but it can apply to any others investment.

DCA strategy is is a method of buying bitcoin at a certain intervals on a regular basis and not for trading investing. Don't confuse yourself with this thing. I don't know what you are referring to as fixed asset, but for the purpose of this thread DCA is a method of buying bitcoin. We are not discussing other investment assets here. His comment is just filled with unnecessary wordings that will end up getting him confused. If I say I know what he is actually driving at, it means I am being economical with the truth. It is good you gave that clarification so that people will not get confused further by his placement of DCA method with trading investing. |

|

|

|

|

ginsan

|

|

March 03, 2024, 08:40:49 PM |

|

That hasn't happened yet because 2030 is still a long time away. He has only lasted 2 years until now while holding on until 2030 is not easy especially if you can't manage your cash flow well.

If you have an investment plan in the next 10 years then now never look at the profits that are in your mind because it's still too far away, it's better how the accumulation can last for a long time because of course the obstacles will be even harder if you can't handle it well, so I think now maintain good cash flow then everything will be smooth in the accumulation.

Almost most investors have now been able to survive until the ATH now, because they see the benefits are close, but if there is someone from the ordinary people who can withstand the current cycle then he is great for excluding profits in the bullish now.

You are right if the target is 10 years, of course it requires a lot of patience and there are many obstacles that we have to overcome. Perhaps one of the most crucial things is the existing profits which can trigger a wrong decision if we are influenced by the desire to take short-term profits. For this reason, I agree with you that we should never calculate how much profit there is and it is better for us to continue accumulating bitcoin throughout our investment journey. Well of course many people don't want to repeat the mistakes of the past so it's not surprising that currently holders are holding onto their bitcoins for longer periods. The ATH target is quite close but that is no longer our benchmark as we want to see BTC price reach $500k. we have to see the big difference that is happening now because if I remember maybe in the past it was very rare for companies to have bitcoin as a reserve in their treasury but now we have seen many large companies continue to buy bitcoin in large amounts. For this reason, I predict that the price of Bitcoin will continue to increase and we must take advantage of every opportunity to continue buying. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

Franctoshi

|

|

March 03, 2024, 10:01:59 PM |

|

In as much as you are right that every investment requires the right knowledge before venturing into it. Bitcoin doesn't require much from you in terms of knowledge. The more you are wasting time to know have more knowledge about bitcoin before investing the more you are wasting your time and if you don't have a portfolio in bitcoin you are not a holder. Provided you know which wallet to store your bitcoin and how to buy from cex or dex I think you are fine. After all you are buying for the long term, and you can know other things you wish to know along your holding period. Bitcoin doesn't require any professional knowledge before you can buy and hold.

Are you letting us know that so far it's about buying Bitcoin that it isn't necessary for the investor to gain proper knowledge about Bitcoin? I doubt if you said so, according to you if you know “which wallet to store your Bitcoin and which exchange to buy that's fine”......well, from your point you only thought of owing Bitcoin and without thinking about its security measures to safeguard your Bitcoin which is crucial. For me, anyone who wants to own/buy Bitcoin should study Bitcoin better and do not be in a rush to invest because it's not a get-rich-quick scheme business or something that pumps and dumps that someone miss the pumps, it's better to first understand why and what you are investing your money in, Because Bitcoin is here to stay and besides we have DCA strategy which you can use to buy Bitcoin overtime and no need to be in a hurry, I believe in having the proper knowledge about Bitcoin first before investment so you take your investment responsibilities and have no one to blame. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|

nara1892

|

|

March 03, 2024, 11:01:22 PM |

|

That hasn't happened yet because 2030 is still a long time away. He has only lasted 2 years until now while holding on until 2030 is not easy especially if you can't manage your cash flow well.

If you have an investment plan in the next 10 years then now never look at the profits that are in your mind because it's still too far away, it's better how the accumulation can last for a long time because of course the obstacles will be even harder if you can't handle it well, so I think now maintain good cash flow then everything will be smooth in the accumulation.

Almost most investors have now been able to survive until the ATH now, because they see the benefits are close, but if there is someone from the ordinary people who can withstand the current cycle then he is great for excluding profits in the bullish now.

You are right if the target is 10 years, of course it requires a lot of patience and there are many obstacles that we have to overcome. Perhaps one of the most crucial things is the existing profits which can trigger a wrong decision if we are influenced by the desire to take short-term profits. For this reason, I agree with you that we should never calculate how much profit there is and it is better for us to continue accumulating bitcoin throughout our investment journey. That's right, I also agree with that, maybe there are or even many investors who plan too early about the long-term accumulation they want to do on bitcoin without thinking first from various angles about whether they will be able to be patient for that long or not, it's very clear that definitely there will always be or even many temptations that look very tempting, such as the condition of Bitcoin which has experienced quite a good increase which indirectly interferes with their confidence and patience to maintain accumulation for longer according to the initial planning, and usually in terms of worries it can also be very disturbing, especially when Bitcoin experienced a fairly significant bearish phase which ultimately made them feel worried. But actually, this is a normal thing because investment is always about profits and losses, where feelings of happiness will arise when your assets experience rapid growth in terms of profits and there will also always be worries that we will feel in several situations. Therefore, of course, maybe I would also agree with your idea above that it is better for us to focus more on consistently maintaining the plans we have made before rather than taking profits too early just because you are too "tempted" by what you see, which means Patience can sometimes be more profitable, but on the other hand we also need to be careful and vigilant in the journey. |

| | .

.Duelbits│SPORTS. | | | ▄▄▄███████▄▄▄

▄▄█████████████████▄▄

▄███████████████████████▄

███████████████████████████

█████████████████████████████

███████████████████████████████

███████████████████████████████

███████████████████████████████

█████████████████████████████

███████████████████████████

▀████████████████████████

▀▀███████████████████

██████████████████████████████ | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | ███▄██▄███▄█▄▄▄▄██▄▄▄██

███▄██▀▄█▄▀███▄██████▄█

█▀███▀██▀████▀████▀▀▀██

██▀ ▀██████████████████

███▄███████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

▀█████████████████████▀

▀▀███████████████▀▀

▀▀▀▀█▀▀▀▀ | | OFFICIAL EUROPEAN

BETTING PARTNER OF

ASTON VILLA FC | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | 10% CASHBACK

100% MULTICHARGER | │ | | │ |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10178

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 03, 2024, 11:46:13 PM |

|

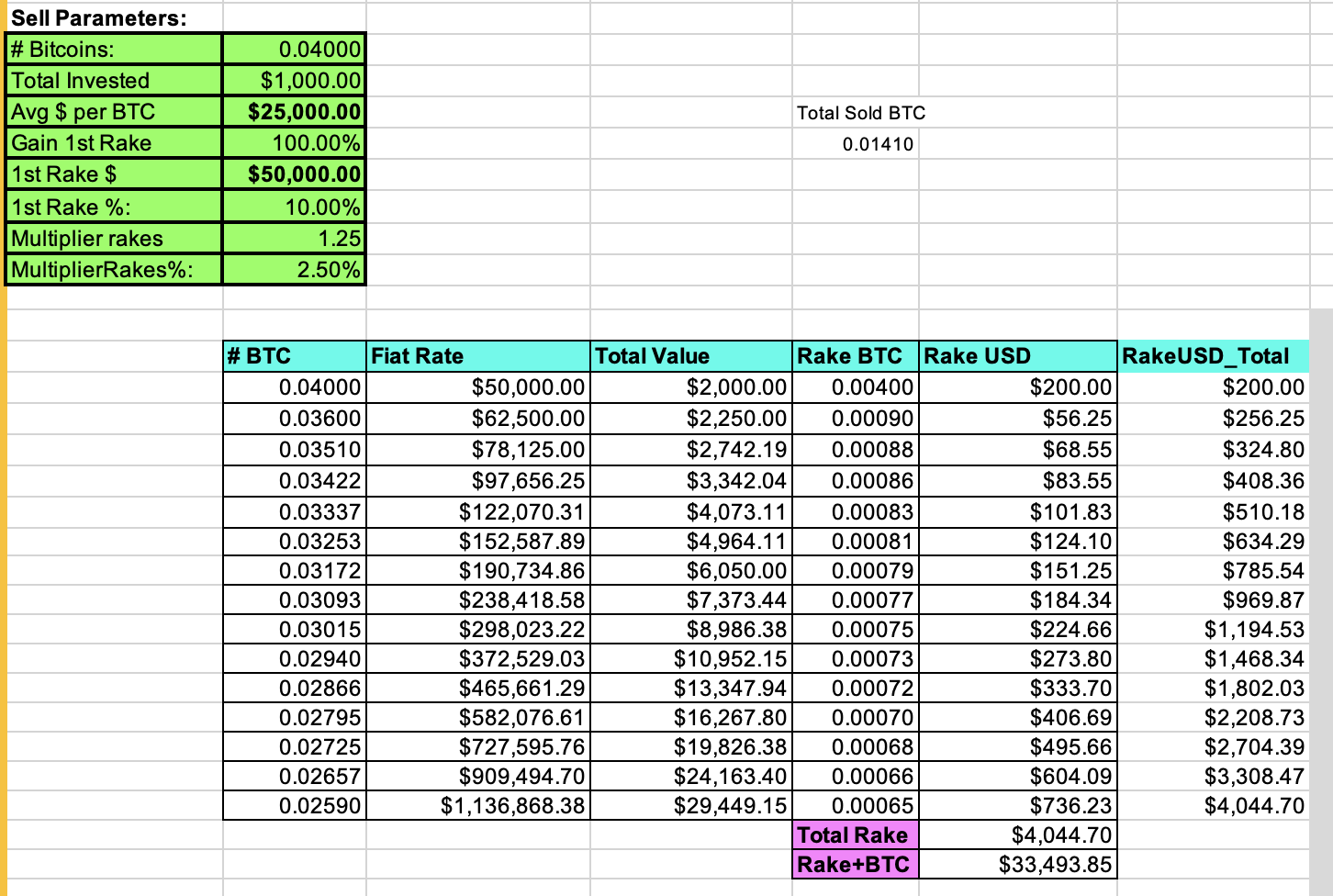

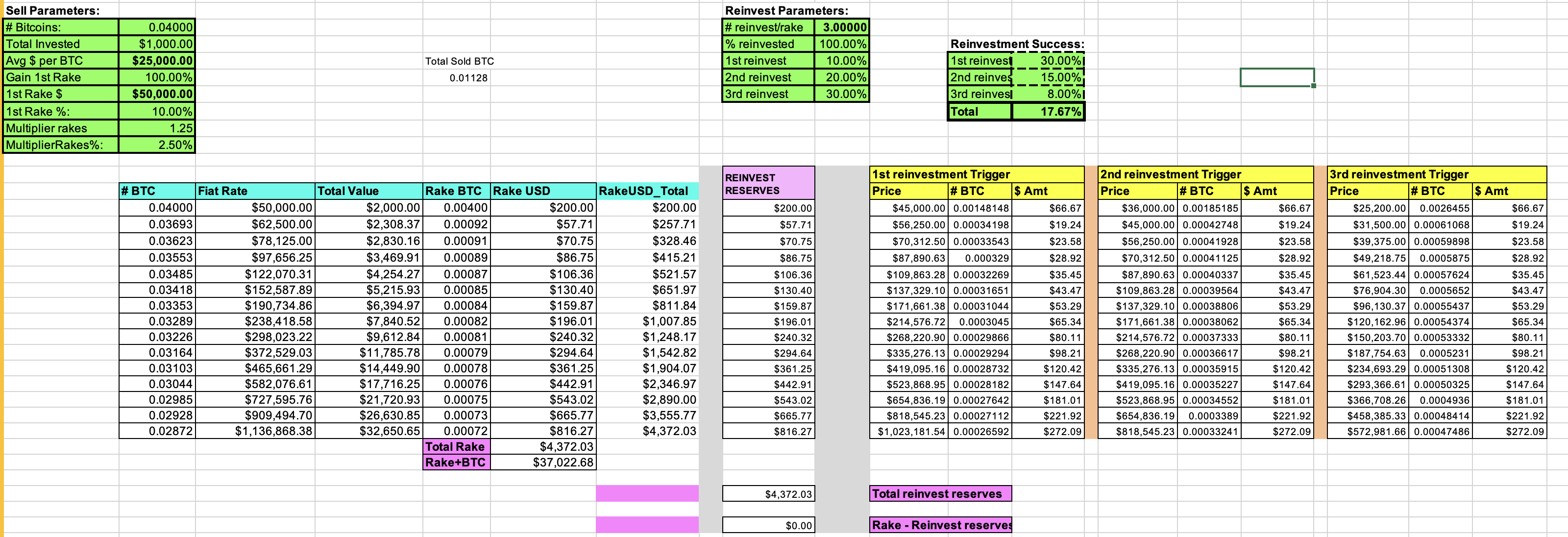

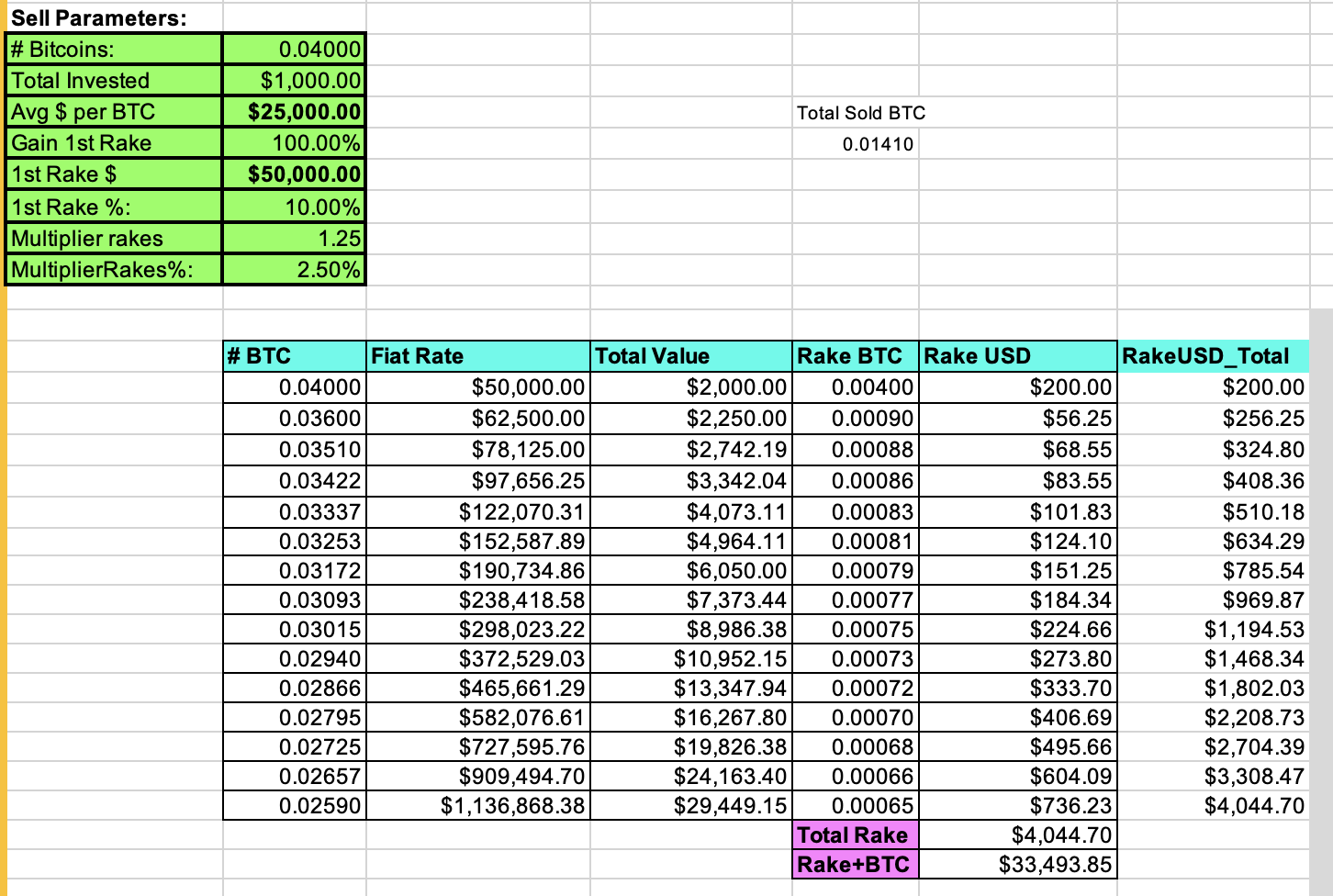

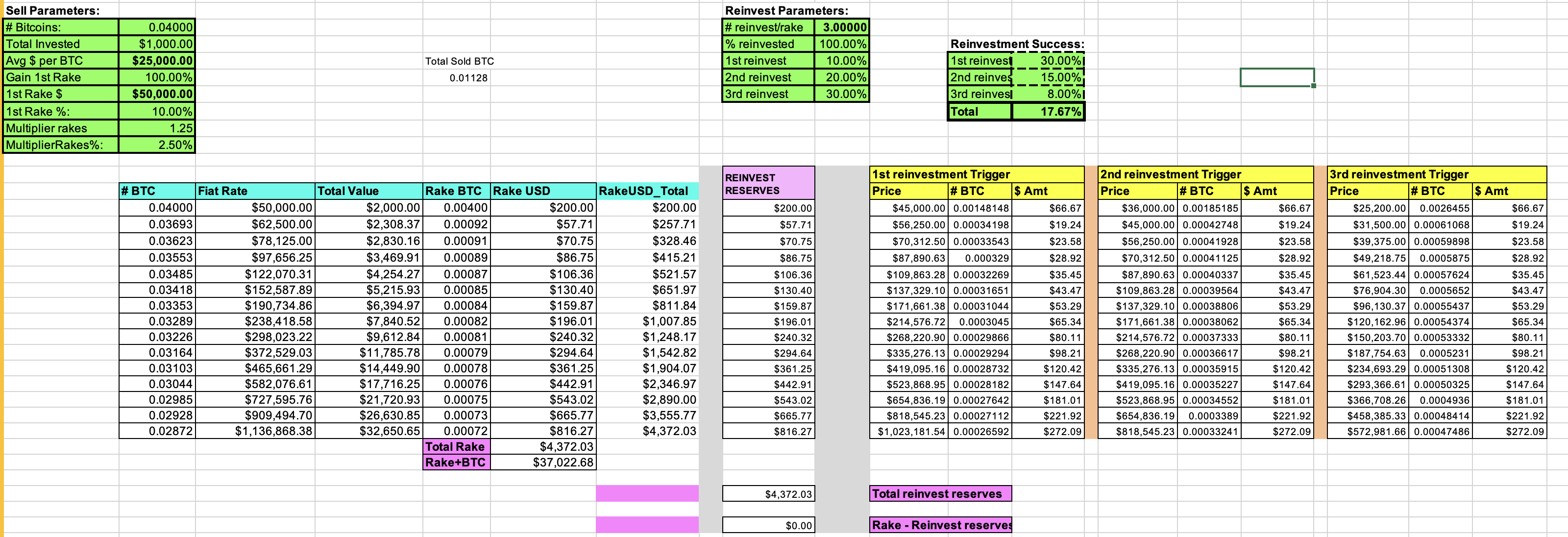

As I have mentioned in various other places, my first year and a half in bitcoin from late 2013 to mid-2015, I was almost exclusively in BTC accumulation, so whenever I sold any amounts of BTC, I would immediately replace whatever I sold. Even though I had largely concluded that I had reached my overall BTC accumulation goal by late 2014 (which was to invest an amount that equalled 10% of my investment portfolio into BTC), I continued to accumulate some BTC in 2015 (the BTC price was quite low through the whole year, but also my additional cash was not really very much), and so by the middle to end of 2015 I was getting to be around 13.5% accumulation into BTC into my quasi-liquid investment portfolio, so I started to consider that I had gotten into a state of 0ver-accumulation - or a conclusion that I had too much BTC, so I was not really sure about how to deal with my over-accumulation status, except to create a plan to be able to sell BTC on the way up, some variation of Risto's SSS plan. well I went through the post but I think I would go through with it again for more solid understanding, this part quoted you actually said something that caught my interest, concerning the selling of some profit in your bitcoin and replacing it. We all know that whenever bitcoin dip your coin don't reduce in quantity but the value does. But when you selling from it you are actually reducing the quantity of your bitcoin right. And we know buying low price would give more advantage's buying in high price , like when Bitcoin was $25k those if you purchase $1k worth of bitcoin at that time you would endup with 0.04 BTC , but if you purchase that same amount which is $1k worth of bitcon when the price was $50k you would endup with 0.02 worth of Bitcoin, which is lesser than when you purchase at $25k. So In a scenario where I purchased $1k dollar worth of bitcoin at the price of $25k, having 0.04 bitcoin and lateron the price rose to $50k and I sold out 0.02 from my bitcoin that am holding, having the mindset of replacing it back, and lateron price experience a surge to the price range of $69k and kept increasing. If I want to replace it then what step should I take should I wait or the or should I increase the money want to I wanna use to purchase to coverup 0.02 bitcoin at that price range of $69k and above. Please hope this wasn't confusing, and if I had made any mistake please do so in correcting me . You are referring to my post that relates to my raking tool that is based on rpietla's SSS plan. And, rpietla has a thread on that too that is linked within that post. The foundation of the raking tool is that there is a presumption that you have already accumulated more than enough BTC, so there is a certain presumption that whenever you sell any BTC, you are selling with an expectation that you might never be able to buy back, so in that regard you would not sell for small profits, even though you may well only sell a small portion of your BTC holdings. For example, no more than 10% of your BTC stash for every time that it doubles in price. The tool that I created does have a section in which you can calculate a probability that you would be able to buy back the BTC that you sold in up to three possible levels, so it is not exactly intended to be used for trading, even though you could sell some small parts of your BTC holdings and then just keep the money (proceeds available) in case the BTC price drops to a certain percentage amount and then you would buy back using some or all of your proceeds from what you had sold earlier. I tend to describe these kinds of tactics in terms of insurance for downside rather than trading or necessarily wanting to get more BTC buy buying back lower, but if the BTC price happens to go down to a great enough extent to trigger the buy back of some or all of the BTC, then that would be a kind of side benefit.. even though the overall presumption from my perspective is to sell such a small amount that you are not intending to buy back.. but if the BTC price goes down you would end up buying back. You can set those buy back levels wherever you like and you can also attempt to use all proceeds to try to buy back lower or you can remove the proceeds so that you are not using proceeds from whatever you sell to buy back in the event that the BTC price goes lower. There is also a link within that post in which you can go to fillippone's Google spreadsheet and you can input your own numbers in order to play around with the various possibilities to see how the numbers might vary. Of course, in your example, if you bought $1k worth of bitcoin at $25k and you ended up getting 0.04 BTC, then you could sell half of that amount at $50k to get your $1k back, and potentially try to buy back cheaper. I surely don't play around with my BTC in those kinds of BIG ways (you would be gambling rather than investing), but instead if you might start to withdraw some BTC starting at $50k and you ONLY have 0.04 BTC, then maybe I might consider potentially selling up to 10% of the BTC stash the first time that the BTC doubles, and then if I wanted to stay consistent, but I did not want to wait for the BTC to double each time, then instead I might sell up to 2.5% of the BTC stash every time that the BTC price went up an additional 25%. So if we did not calculate buying back, and we strictly consider selling without buying back, then formula for the selling rakes that I described would look like this:  You see that the total value of the BTC holdings in terms of dollars keeps going up and you are not raking off more than just a portion of the profits, so that you still are able to enjoy compounding effects, which you run the risk of not enjoying compounding effects if you sell off too much of your principle. Of course you can play around with the numbers, and you may well prefer to shave off higher portions, but I think that you are nutso if you shave off half the profits merely because the BTC price doubled, then you have absolutely no compounding effect and you end up losing a lot of bitcoin's potential Upward price power. For sure, in the end, you can do what you want. Now let's say that you want to use 100% of the proceeds to try to buy back lower, so you try to figure out your chances of buying back upon certain price drops, which surely is going to have lower probabilities the lower that you expect to be able to buy back, so you can plug those into your expectations and it might look something like this.  You set three buy back orders with a 10% drop, a 20% drop and a 30% drop, and you assign probabilities of 30%, 15% and 8% respectively. With the buy back you end up with more BTC with the passage of time and you also end up having had raked more BTC into dollars (meaning a higher dollar value raked). So there can be advantages to buying back, as long as you attempt to set some realistic expectations and don't overly expect to be able to buy back, which would include not selling a lot on the way up so that you can profit on the upside. Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

I_Anime

Full Member

Offline Offline

Activity: 364

Merit: 153

Cashback 15%

|

|

March 04, 2024, 12:21:34 AM |

|

As I have mentioned in various other places, my first year and a half in bitcoin from late 2013 to mid-2015, I was almost exclusively in BTC accumulation, so whenever I sold any amounts of BTC, I would immediately replace whatever I sold. Even though I had largely concluded that I had reached my overall BTC accumulation goal by late 2014 (which was to invest an amount that equalled 10% of my investment portfolio into BTC), I continued to accumulate some BTC in 2015 (the BTC price was quite low through the whole year, but also my additional cash was not really very much), and so by the middle to end of 2015 I was getting to be around 13.5% accumulation into BTC into my quasi-liquid investment portfolio, so I started to consider that I had gotten into a state of 0ver-accumulation - or a conclusion that I had too much BTC, so I was not really sure about how to deal with my over-accumulation status, except to create a plan to be able to sell BTC on the way up, some variation of Risto's SSS plan. well I went through the post but I think I would go through with it again for more solid understanding, this part quoted you actually said something that caught my interest, concerning the selling of some profit in your bitcoin and replacing it. We all know that whenever bitcoin dip your coin don't reduce in quantity but the value does. But when you selling from it you are actually reducing the quantity of your bitcoin right. And we know buying low price would give more advantage's buying in high price , like when Bitcoin was $25k those if you purchase $1k worth of bitcoin at that time you would endup with 0.04 BTC , but if you purchase that same amount which is $1k worth of bitcon when the price was $50k you would endup with 0.02 worth of Bitcoin, which is lesser than when you purchase at $25k. So In a scenario where I purchased $1k dollar worth of bitcoin at the price of $25k, having 0.04 bitcoin and lateron the price rose to $50k and I sold out 0.02 from my bitcoin that am holding, having the mindset of replacing it back, and lateron price experience a surge to the price range of $69k and kept increasing. If I want to replace it then what step should I take should I wait or the or should I increase the money want to I wanna use to purchase to coverup 0.02 bitcoin at that price range of $69k and above. Please hope this wasn't confusing, and if I had made any mistake please do so in correcting me . You are referring to my post that relates to my raking tool that is based on rpietla's SSS plan. And, rpietla has a thread on that too that is linked within that post. The foundation of the raking tool is that there is a presumption that you have already accumulated more than enough BTC, so there is a certain presumption that whenever you sell any BTC, you are selling with an expectation that you might never be able to buy back, so in that regard you would not sell for small profits, even though you may well only sell a small portion of your BTC holdings. For example, no more than 10% of your BTC stash for every time that it doubles in price. The tool that I created does have a section in which you can calculate a probability that you would be able to buy back the BTC that you sold in up to three possible levels, so it is not exactly intended to be used for trading, even though you could sell some small parts of your BTC holdings and then just keep the money (proceeds available) in case the BTC price drops to a certain percentage amount and then you would buy back using some or all of your proceeds from what you had sold earlier. I tend to describe these kinds of tactics in terms of insurance for downside rather than trading or necessarily wanting to get more BTC buy buying back lower, but if the BTC price happens to go down to a great enough extent to trigger the buy back of some or all of the BTC, then that would be a kind of side benefit.. even though the overall presumption from my perspective is to sell such a small amount that you are not intending to buy back.. but if the BTC price goes down you would end up buying back. You can set those buy back levels wherever you like and you can also attempt to use all proceeds to try to buy back lower or you can remove the proceeds so that you are not using proceeds from whatever you sell to buy back in the event that the BTC price goes lower. There is also a link within that post in which you can go to fillippone's Google spreadsheet and you can input your own numbers in order to play around with the various possibilities to see how the numbers might vary. Of course, in your example, if you bought $1k worth of bitcoin at $25k and you ended up getting 0.04 BTC, then you could sell half of that amount at $50k to get your $1k back, and potentially try to buy back cheaper. I surely don't play around with my BTC in those kinds of BIG ways (you would be gambling rather than investing), but instead if you might start to withdraw some BTC starting at $50k and you ONLY have 0.04 BTC, then maybe I might consider potentially selling up to 10% of the BTC stash the first time that the BTC doubles, and then if I wanted to stay consistent, but I did not want to wait for the BTC to double each time, then instead I might sell up to 2.5% of the BTC stash every time that the BTC price went up an additional 25%. So if we did not calculate buying back, and we strictly consider selling without buying back, then formula for the selling rakes that I described would look like this:  You see that the total value of the BTC holdings in terms of dollars keeps going up and you are not raking off more than just a portion of the profits, so that you still are able to enjoy compounding effects, which you run the risk of not enjoying compounding effects if you sell off too much of your principle. Of course you can play around with the numbers, and you may well prefer to shave off higher portions, but I think that you are nutso if you shave off half the profits merely because the BTC price doubled, then you have absolutely no compounding effect and you end up losing a lot of bitcoin's potential Upward price power. For sure, in the end, you can do what you want. Now let's say that you want to use 100% of the proceeds to try to buy back lower, so you try to figure out your chances of buying back upon certain price drops, which surely is going to have lower probabilities the lower that you expect to be able to buy back, so you can plug those into your expectations and it might look something like this.  You set three buy back orders with a 10% drop, a 20% drop and a 30% drop, and you assign probabilities of 30%, 15% and 8% respectively. With the buy back you end up with more BTC with the passage of time and you also end up having had raked more BTC into dollars (meaning a higher dollar value raked). So there can be advantages to buying back, as long as you attempt to set some realistic expectations and don't overly expect to be able to buy back, which would include not selling a lot on the way up so that you can profit on the upside. Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling. You know asking questions would give you proper understanding (which just did for me). Thanks for the clarity really appreciate it, this actually nice and easy to make use of . Well I haven't gotten to the stage in my bitcoin accumulating to think of start using such epic strategy, I don't want to any means trade with my bitcoin but to hold till I have meet my accumulation goal. But I would make sure to copy the link of this reply so that I can easily access it when needed, Because it as just answered my question properly . |

|

|

|

|

Bloodseekers

|

|

March 04, 2024, 01:48:15 AM |

|

Yes, you are right, not everyone who bought Bitcoin in 2022 is still holding their Bitcoin until now and even if there are, they may have sold some of what they have for various reasons. To be able to hold a certain amount of Bitcoin in the long term certainly requires good planning. and also we must have an income that can meet the needs we need because if we do not have good planning and a steady income then it is very unlikely that we will be able to hold on for a long time.

I made a small investment in 2022 which I am currently investing in DCA method. I didn't let myself get greedy on this little bullrun, up $64k a couple of days ago but I didn't sell the investment. I expect Bitcoin to exceed $100k after the halving. If I don't need money urgently during the bull market in 2025, I will not sell my investment, I will hold it for 2030 plus period. If you have started investing in Bitcoin since 2022 and until now have used the DCA method, of course you have a very good understanding of how Bitcoin works. We can see that when there is an increase like a few days ago, you can still restrain yourself from taking action. which will indeed make you miss out on the bigger profits you can get in the coming year, but if you still choose to hold on until 2030 and keep adding to your investment, of course you will be able to easily achieve what you want from the investment profits you get. |

|

|

|

|

|

Publictalk792

|

|

March 04, 2024, 01:54:16 AM |

|

That's right, I also agree with that, maybe there are or even many investors who plan too early about the long-term accumulation they want to do on bitcoin without thinking first from various angles about whether they will be able to be patient for that long or not, it's very clear that definitely there will always be or even many temptations that look very tempting, such as the condition of Bitcoin which has experienced quite a good increase which indirectly interferes with their confidence and patience to maintain accumulation for longer according to the initial planning, and usually in terms of worries it can also be very disturbing, especially when Bitcoin experienced a fairly significant bearish phase which ultimately made them feel worried. But actually, this is a normal thing because investment is always about profits and losses, where feelings of happiness will arise when your assets experience rapid growth in terms of profits and there will also always be worries that we will feel in several situations. Therefore, of course, maybe I would also agree with your idea above that it is better for us to focus more on consistently maintaining the plans we have made before rather than taking profits too early just because you are too "tempted" by what you see, which means Patience can sometimes be more profitable, but on the other hand we also need to be careful and vigilant in the journey.

I agree with what you said. It's very important for investors to have a good plan and stick to it. Wanting to make money fast and being scared of missing out on profits can make people make quick decisions that don't match their original plan. To be successful in investing it's important to think longterm and be patient when the market goes up and down. It's normal to feel different emotions, like excitement when prices are high and worry when they're low. But it's crucial to believe in the research and plans you made before and not make quick decisions based on shortterm changes in the market. |

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

Tmoonz

Full Member

Offline Offline

Activity: 140

Merit: 100

Eloncoin.org - Mars, here we come!

|

|

March 04, 2024, 02:29:46 AM |

|

According to your post type only those who sign this forum only invest in bitcoin?. You may be earning bitcoins weekly from this forum. But those who have other investors how will they invest? The basic idea of the DCA method is to store bitcoins in small amounts over a long period of time. The more bitcoins an investor can purchase on a regular monthly or weekly basis, the longer his investment will last. Many people are hoarding bitcoins from a weekly source of income and will invest in bitcoins according to their income. I think not everyone on this forum invests in Bitcoin. But it is a place from which there is much to know and understand. Must understand before starting any business and this one of the best platform where we learning about BTC and trading BTC. In as much as you are right that every investment requires the right knowledge before venturing into it. Bitcoin doesn't require much from you in terms of knowledge. The more you are wasting time to know have more knowledge about bitcoin before investing the more you are wasting your time and if you don't have a portfolio in bitcoin you are not a holder. Provided you know which wallet to store your bitcoin and how to buy from cex or dex I think you are fine. After all you are buying for the long term, and you can know other things you wish to know along your holding period. Bitcoin doesn't require any professional knowledge before you can buy and hold. This is one of the sensitive part that many has tend to argue with but however I have considered @jjG's suggestion of having the basics knowledge and considering factors such as: 1) stable source of income 2) methods of buying ( lump sump or dca) 3) provisional emergency, reserved and float funds and as well as taking care of your basic needs. It is best to get started with the fundamental knowledge and learn more on your way up because wanting to know much before entering the market might probably leads to procrastination of not having Bitcoin in your portfolio because Bitcoin is still a growing world class asset. |

|

|

|

|

Hewlet

|

|

March 04, 2024, 06:22:49 AM |

|

Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling.

you know, if not for constantly going through the thread that constantly reshapes my mentality and thought process on how much BTC is enough before ever thinking of selling, 0.04 BTC which is around $2.5k looked like a big deal for me cause my current weekly DCA accumulation amount is at $40 and I haven't done all that long for my ten year projection and the urge to sell part during this bullish period had once come in. I guess the best thing to do is to remove any thought of selling our holding out of our mind untill we reach our set out goal during which we can consider using the taking strategy which I feel if followed properly will keep us in good profit but the only issue is that after selling part of your holding holding when the market is bullish, chances are that Bitcoin price might not necessarily go bearish to a price you will be comfortable to buy within a short period of time which like you've pointed out will almost look as though you're gambling with your holding. |

|

|

|

|

Agbamoni

|

|

March 04, 2024, 08:52:08 AM Merited by JayJuanGee (1) |

|

In as much as you are right that every investment requires the right knowledge before venturing into it. Bitcoin doesn't require much from you in terms of knowledge. The more you are wasting time to know have more knowledge about bitcoin before investing the more you are wasting your time and if you don't have a portfolio in bitcoin you are not a holder. Provided you know which wallet to store your bitcoin and how to buy from cex or dex I think you are fine. After all you are buying for the long term, and you can know other things you wish to know along your holding period. Bitcoin doesn't require any professional knowledge before you can buy and hold.

Are you letting us know that so far it's about buying Bitcoin that it isn't necessary for the investor to gain proper knowledge about Bitcoin? I doubt if you said so, according to you if you know “which wallet to store your Bitcoin and which exchange to buy that's fine”......well, from your point you only thought of owing Bitcoin and without thinking about its security measures to safeguard your Bitcoin which is crucial. For me, anyone who wants to own/buy Bitcoin should study Bitcoin better and do not be in a rush to invest because it's not a get-rich-quick scheme business or something that pumps and dumps that someone miss the pumps, it's better to first understand why and what you are investing your money in, Because Bitcoin is here to stay and besides we have DCA strategy which you can use to buy Bitcoin overtime and no need to be in a hurry, I believe in having the proper knowledge about Bitcoin first before investment so you take your investment responsibilities and have no one to blame. Knowledge and capital works hand in hand for an investor. Recently we saw some little misunderstanding about the Nigerian government with the Binance centralized exchange where P2P trading and other functionalities for the Nigerian crypto enthusiast was halt. What am saying is essence is that imagine a situation where deposit and access to investment asset in the exchange was closed and no one can be able to access them from Nigerian a lot of investors will loss because they failed to have the knowledge that they are not supposed to keep their investment in a CEX rather in a private wallet. What is the point of investing when you lack knowledge to manage your investment. Obviously, you will lose all your investment with time. The only thing is that some beginners feel you have to have 1- or 2-years knowledge and experience before you can begin investment. No, a week or two is enough to gain knowledge at most the basic knowledge an investment need to know. Like secuirty, strategy, management e.tc. |

| | .

Duelbits | │ | | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | ██████████████████████████████████████████████████████

.

PLAY NOW

.

██████████████████████████████████████████████████████ | █████

██

██

██

██

██

██

██

██

██

██

██

█████ | |

|

|

|

Ricardo11

Member

Offline Offline

Activity: 364

Merit: 42

#SWGT PRE-SALE IS LIVE

|

|

March 04, 2024, 02:46:10 PM |

|

Only 5k more is needed, then Bitcoin is successful to break her previous ATH. Bitcoin price is currently above 65k, it has increased by 28.8% in seven days, which is amazing. Bitcoin is bringing good times to every holder. Since Bitcoin only needs 5k more to break ATH, I expect it to happen very soon, as the value of Bitcoin is increasing at a much faster rate now. And now seeing the success of this bitcoin, many people will be attracted to bitcoin, who were previously turned away from bitcoin.

|

|

|

|

|

batang_bitcoin

|

|

March 04, 2024, 03:16:54 PM |

|

Only 5k more is needed, then Bitcoin is successful to break her previous ATH.

$3k more as Bitcoin gets $66k just now.  And now seeing the success of this bitcoin, many people will be attracted to bitcoin, who were previously turned away from bitcoin.

Many have been always attracted to Bitcoin but we don't know how many of them really are putting their money on their mouths. It's because the attraction and desire is there but if they don't do anything with that, they're just watching the market to go up as they watch us to enjoy this run that Bitcoin is having. |

▄▄████████▄▄

▄▄████████████████▄▄

▄██████████████████████▄

▄█████████████████████████▄

▄███████████████████████████▄

| ███████████████████▄████▄

█████████████████▄███████

████████████████▄███████▀

██████████▄▄███▄██████▀

████████▄████▄█████▀▀

██████▄██████████▀

███▄▄████████████▄

██▄███████████████

░▄██████████████▀

▄█████████████▀

█████████████

███████████▀

███████▀▀ | | | .

| | ▄▄███████▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀ | .

ElonCoin.org | │ | | .

| │ | ████████▄▄███████▄▄

███████▄████████████▌

██████▐██▀███████▀▀██

███████████████████▐█▌

████▄▄▄▄▄▄▄▄▄▄██▄▄▄▄▄

███▀░▐███▀▄█▄█▀▀█▄█▄▀

██████████████▄██████▌

█████▐██▄██████▄████▐

█████████▀░▄▄▄▄▄

███████▄█▄░▀█▄▄░▀

███▄██▄▀███▄█████▄▀

▄██████▄▀███████▀

████████▄▀████▀█████▄▄ | .

"I could either watch it

happen or be a part of it"

▬▬▬▬▬ |

|

|

|

I_Anime

Full Member

Offline Offline

Activity: 364

Merit: 153

Cashback 15%

|

|

March 04, 2024, 04:05:07 PM

Last edit: March 04, 2024, 04:21:26 PM by I_Anime |

|

That's right, I also agree with that, maybe there are or even many investors who plan too early about the long-term accumulation they want to do on bitcoin without thinking first from various angles about whether they will be able to be patient for that long or not, it's very clear that definitely there will always be or even many temptations that look very tempting, such as the condition of Bitcoin which has experienced quite a good increase which indirectly interferes with their confidence and patience to maintain accumulation for longer according to the initial planning, and usually in terms of worries it can also be very disturbing, especially when Bitcoin experienced a fairly significant bearish phase which ultimately made them feel worried. But actually, this is a normal thing because investment is always about profits and losses, where feelings of happiness will arise when your assets experience rapid growth in terms of profits and there will also always be worries that we will feel in several situations. Therefore, of course, maybe I would also agree with your idea above that it is better for us to focus more on consistently maintaining the plans we have made before rather than taking profits too early just because you are too "tempted" by what you see, which means Patience can sometimes be more profitable, but on the other hand we also need to be careful and vigilant in the journey.

I agree with what you said. It's very important for investors to have a good plan and stick to it. Wanting to make money fast and being scared of missing out on profits can make people make quick decisions that don't match their original plan. To be successful in investing it's important to think longterm and be patient when the market goes up and down. It's normal to feel different emotions, like excitement when prices are high and worry when they're low. But it's crucial to believe in the research and plans you made before and not make quick decisions based on shortterm changes in the market. yeah you get the gist, having patient (holding) in your bitcoin investment and same time accumulating more quantity of bitcoin would help you alot. In securing an healthy investment, that would yield you good!! Profits. Just imagine those that quickly sold their bitcoin when the price hit $50k , Now bitcoin as surpassed $66k they would be regretting their actions now , wishing and same time saying had I known I wouldn't have sold my bitcoin. So don't be such that are always fonds of missing great opportunities if you know have missing some life changing opportunity in investing in bitcoin, because you didn't understand how bitcoin work which cause you to not start investing on time. But now still good, because I don't think we are bullish enough well for me is hodl |

|

|

|

Ruttoshi

Sr. Member

Offline Offline

Activity: 308

Merit: 267

Baba God Noni

|

|

March 04, 2024, 04:16:33 PM Merited by JayJuanGee (1) |

|

Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling.

you know, if not for constantly going through the thread that constantly reshapes my mentality and thought process on how much BTC is enough before ever thinking of selling, 0.04 BTC which is around $2.5k looked like a big deal for me cause my current weekly DCA accumulation amount is at $40 and I haven't done all that long for my ten year projection and the urge to sell part during this bullish period had once come in. I guess the best thing to do is to remove any thought of selling our holding out of our mind untill we reach our set out goal during which we can consider using the taking strategy which I feel if followed properly will keep us in good profit but the only issue is that after selling part of your holding holding when the market is bullish, chances are that Bitcoin price might not necessarily go bearish to a price you will be comfortable to buy within a short period of time which like you've pointed out will almost look as though you're gambling with your holding. I like the explanation, and it is not a compulsory thing to do, if you don't understand how to go about it, so that you don't end up messing around with your bitcoin by selling it in a way that it will affect your bitcoin hodling compounding profit. I am still in my accumulation stage, and I will like to continue with using DCA strategy, and any other additional method of accumulation to enable me focus on my bitcoin target, because I think that I don't want to sell any yet using that method explained by JJG. It is our choice to use whatever way that we think will work for us based on our own cash inflow. In as much as you are right that every investment requires the right knowledge before venturing into it. Bitcoin doesn't require much from you in terms of knowledge. The more you are wasting time to know have more knowledge about bitcoin before investing the more you are wasting your time and if you don't have a portfolio in bitcoin you are not a holder. Provided you know which wallet to store your bitcoin and how to buy from cex or dex I think you are fine. After all you are buying for the long term, and you can know other things you wish to know along your holding period. Bitcoin doesn't require any professional knowledge before you can buy and hold.

Are you letting us know that so far it's about buying Bitcoin that it isn't necessary for the investor to gain proper knowledge about Bitcoin? I doubt if you said so, according to you if you know “which wallet to store your Bitcoin and which exchange to buy that's fine”......well, from your point you only thought of owing Bitcoin and without thinking about its security measures to safeguard your Bitcoin which is crucial. For me, anyone who wants to own/buy Bitcoin should study Bitcoin better and do not be in a rush to invest because it's not a get-rich-quick scheme business or something that pumps and dumps that someone miss the pumps, it's better to first understand why and what you are investing your money in, Because Bitcoin is here to stay and besides we have DCA strategy which you can use to buy Bitcoin overtime and no need to be in a hurry, I believe in having the proper knowledge about Bitcoin first before investment so you take your investment responsibilities and have no one to blame. Knowledge and capital works hand in hand for an investor. Recently we saw some little misunderstanding about the Nigerian government with the Binance centralized exchange where P2P trading and other functionalities for the Nigerian crypto enthusiast was halt. What am saying is essence is that imagine a situation where deposit and access to investment asset in the exchange was closed and no one can be able to access them from Nigerian a lot of investors will loss because they failed to have the knowledge that they are not supposed to keep their investment in a CEX rather in a private wallet.I know that it is not advisable to keep your bitcoin in an exchange, but I don't see how an investor from Nigeria who has his bitcoin currently in an exchange, because he is buying with little amount for as low as $50-$100 a week so that it can be saved till it gets up to $500 and above before sending it to your private wallet, so that in future, when transaction fee is high it will not affect your output, will be affected by Naira being removed from Binance and no more p2p for Nigerians. The reason why I said that it is not a problem is because, you are not selling but you are piling it up, and Binance did not restrict anyone from Nigeria from transferring their coins to other wallet. So the person that has his coins in Binance will simply transfer his coins to his self custody wallet, without a problem. You cannot make use of p2p in Binance does not mean that if you are having your bitcoin there, it is stuck. However, the investor from Nigeria can still use other exchanges like Kucoin, and OKX to buy bitcoin because the law on Binance did not affect them. I bought bitcoin recently from Kucoin, is just that their transaction fee for transfer is 10% of the amount that you want to transfer.

|

| .

Duelbits | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

Miles2006

Full Member

Offline Offline

Activity: 224

Merit: 149

Cashback 15%

|

|

March 04, 2024, 04:52:36 PM |

|

Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling.

you know, if not for constantly going through the thread that constantly reshapes my mentality and thought process on how much BTC is enough before ever thinking of selling, 0.04 BTC which is around $2.5k looked like a big deal for me cause my current weekly DCA accumulation amount is at $40 and I haven't done all that long for my ten year projection and the urge to sell part during this bullish period had once come in. I guess the best thing to do is to remove any thought of selling our holding out of our mind untill we reach our set out goal during which we can consider using the taking strategy which I feel if followed properly will keep us in good profit but the only issue is that after selling part of your holding holding when the market is bullish, chances are that Bitcoin price might not necessarily go bearish to a price you will be comfortable to buy within a short period of time which like you've pointed out will almost look as though you're gambling with your holding. I like the explanation, and it is not a compulsory thing to do, if you don't understand how to go about it, so that you don't end up messing around with your bitcoin by selling it in a way that it will affect your bitcoin hodling compounding profit. I am still in my accumulation stage, and I will like to continue with using DCA strategy, and any other additional method of accumulation to enable me focus on my bitcoin target, because I think that I don't want to sell any yet using that method explained by JJG. It is our choice to use whatever way that we think will work for us based on our own cash inflow. Firstly, I cannot advice anyone to take his/her profit at an early stage when investing, making bitcoin investment sound as gambling and it can be misleading for newbies, you will feel like you're smart enough taking profit but if lacking the strategy to balance back then it'll be difficult to handle. I will go with the idea of buying until he/ she has reached a balanced level. Secondly this strategy is not so perfect for investors who just started and still acquiring the knowledge about bitcoin, knowing fully well bitcoin knowledge is broad and no one can actually learn everything within a week likewise this strategy, most investors who practice such strategy are experienced investors so I will not stick with the idea of taking profit when still accumulating. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10178

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 04, 2024, 04:59:20 PM |

|

Now if your goal is to accumulate BTC and you feel that you have not accumulated enough BTC, yet, then you probably should not be employing any kind of tools to sell BTC with expectations of being able to buy back, since it seems that you need to first get to a certain high enough level of BTC so that you generally have the sense that you have accumulated enough BTC to be able to feel comfortable shaving some BTC off along the way as the BTC price likely goes up with the passage of time. I hardly would consider 0.04 BTC to be even close to enough BTC to start such a selling on the way up technique since you are likely still accumulating BTC.. so you would be selling with one hand and buying with the other, yet at the same time, I am not opposed to those who might continue to buy BTC with a DCA method and then try to supplement with some kind of raking strategy, even though it seems a bit contradictory and you may well end up either confusing yourself and/or realizing that instead of buying and selling, maybe you should just focus on buying until you have enough (or more than enough) first before prematurely fucking around with selling.

you know, if not for constantly going through the thread that constantly reshapes my mentality and thought process on how much BTC is enough before ever thinking of selling, 0.04 BTC which is around $2.5k looked like a big deal for me cause my current weekly DCA accumulation amount is at $40 and I haven't done all that long for my ten year projection and the urge to sell part during this bullish period had once come in. I guess the best thing to do is to remove any thought of selling our holding out of our mind untill we reach our set out goal during which we can consider using the taking strategy which I feel if followed properly will keep us in good profit but the only issue is that after selling part of your holding holding when the market is bullish, chances are that Bitcoin price might not necessarily go bearish to a price you will be comfortable to buy within a short period of time which like you've pointed out will almost look as though you're gambling with your holding. It seems that if you have ONLY bought $40 of BTC since you started then you are far away from getting to a stage of reaching a point that you can start selling any BTC. Yet of course, that is your choice. In the end, it is probably better to think in terms of what are your current income and your expenses in order to figure out how many months (or years) worth of expenses/income do you want to have in your holdings before you might start to consider the employment of various raking strategies... and like I said, from my own point of view the raking strategies are not necessarily intended for the purpose of buying back lower, but surely you could end up in that position once you start to employ such raking strategies... but the main thing is to reach a level of sufficient accumulation and/or even over accumulation in such a way that the raking strategies make sense. it is up to you to figure out if the raking strategies make sense. I personally did not even consider the $1k invested (reaching a size of 0.04 BTC to be practical, and it really seemed short-sighted to me to be considering selling half of it merely based on the BTC price doubling. So that was part of the motivation for plugging those numbers into the raking formula. ... so largely the formula that I was using was to authorize selling 10% every time the price doubled, and again that ONLY makes sense to start to employ that strategy after you have reached a high enough level, and if you have already decided that you have more than a 10-year timeline, then you would be buying right now rather than selling. and if you have ONLY bought $40 since August, it is not easy to consider that you are taking serious the idea of buying BTC, especially if you are talking about selling rather than buying. Knowledge and capital works hand in hand for an investor. Recently we saw some little misunderstanding about the Nigerian government with the Binance centralized exchange where P2P trading and other functionalities for the Nigerian crypto enthusiast was halt. What am saying is essence is that imagine a situation where deposit and access to investment asset in the exchange was closed and no one can be able to access them from Nigerian a lot of investors will loss because they failed to have the knowledge that they are not supposed to keep their investment in a CEX rather in a private wallet.

Well that is too bad if people might have some of their money (BTC) locked up. Sometimes poor people might take a while before they build up enough of an investment in BTC before it make sense for them to withdraw, and especially in recent times, I have been frequently suggesting to get up to $500 or $1k worth of BTC, which might be 1 million to 3 million satoshis before withdrawing to a private wallet.. based on transaction fees.... but some people might take many months of their savings and even years before they get up to $500 to $1k worth of BTC built up, and I suppose some exchanges are more risky than others, too...so we are not always going to know how much balance to keep on exchanges prior to withdrawing to private wallet, but it makes little sense to me to have a bunch of $10 to $100 transactions that might have their periods of difficulty to have those kinds of relatively small UTXOs. What is the point of investing when you lack knowledge to manage your investment. Obviously, you will lose all your investment with time. The only thing is that some beginners feel you have to have 1- or 2-years knowledge and experience before you can begin investment. No, a week or two is enough to gain knowledge at most the basic knowledge an investment need to know. Like secuirty, strategy, management e.tc.

Fair enough about knowing the basics, but I would describe the basics as having your financial (and perhaps psychological) house in order sufficiently enough to know how much discretionary/disposable income that you have, and so those are kinds of basic financial management, and you can get started in bitcoin by just knowing if you have extra money that you are able to invest, and the more that you invest into bitcoin, the more that you are going to make sure that you are spending within your discretionary income and not money that you need for expenses. So then if you project your income versus expenses out into the future, you would likely realize that there may well be some potential short-falls and/or uncertainties, so in that regard you have to figure out ways to have cushions in your finances such as emergency funds, reserve funds and floats to make sure that you don't run out of money or need to sell any of your investment (into BTC) at a time that is other than your own complete choosing. These kinds of matters can be sorted out as you go and as you invest into BTC, yet you would not want to be overly aggressive with your investment into BTC until you have solid grounds in terms of your personal financial management, but you can get started within basic ideas about whether or not you have some extra discretionary income to get started and then work out the details regarding how to continue to invest as you make sure that your finances and psychology is in order, which could take a bit of time, if you had not previously been an investor. [edited out]

I like the explanation, and it is not a compulsory thing to do, if you don't understand how to go about it, so that you don't end up messing around with your bitcoin by selling it in a way that it will affect your bitcoin hodling compounding profit. I am still in my accumulation stage, and I will like to continue with using DCA strategy, and any other additional method of accumulation to enable me focus on my bitcoin target, because I think that I don't want to sell any yet using that method explained by JJG. It is our choice to use whatever way that we think will work for us based on our own cash inflow. For sure, I was attempting to show a more modest version of selling on the way up, rather than selling 50% after a doubling, but yeah, it does not make a lot of sense to me either to be selling based on a mere accumulation of $1k worth of BTC that was 0.04 BTC, and with ONLY a short amount of time in BTC. [edited out]

Knowledge and capital works hand in hand for an investor. Recently we saw some little misunderstanding about the Nigerian government with the Binance centralized exchange where P2P trading and other functionalities for the Nigerian crypto enthusiast was halt. What am saying is essence is that imagine a situation where deposit and access to investment asset in the exchange was closed and no one can be able to access them from Nigerian a lot of investors will loss because they failed to have the knowledge that they are not supposed to keep their investment in a CEX rather in a private wallet.I know that it is not advisable to keep your bitcoin in an exchange, but I don't see how an investor from Nigeria who has his bitcoin currently in an exchange, because he is buying with little amount for as low as $50-$100 a week so that it can be saved till it gets up to $500 and above before sending it to your private wallet, so that in future, when transaction fee is high it will not affect your output, will be affected by Naira being removed from Binance and no more p2p for Nigerians. The reason why I said that it is not a problem is because, you are not selling but you are piling it up, and Binance did not restrict anyone from Nigeria from transferring their coins to other wallet. So the person that has his coins in Binance will simply transfer his coins to his self custody wallet, without a problem. You cannot make use of p2p in Binance does not mean that if you are having your bitcoin there, it is stuck. However, the investor from Nigeria can still use other exchanges like Kucoin, and OKX to buy bitcoin because the law on Binance did not affect them. I bought bitcoin recently from Kucoin, is just that their transaction fee for transfer is 10% of the amount that you want to transfer. [/quote] Your explanation sounds correct, Ruttoshi... sometimes options close, but that would not necessarily mean that the Binance users in Nigeria had been rug pulled, even if one of their on/off ramps might have been closed.. but surely sometimes one thing happens that leads to another thing, and sometimes we might need to recognize signs of our coins potentially being more at risk when there are greater levels of hostility that might take place within any particular jurisdiction. People can sometimes get nervous and panic because they might not know which options are available to them. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

I_Anime

Full Member

Offline Offline

Activity: 364

Merit: 153

Cashback 15%

|

|

March 04, 2024, 05:39:19 PM |

|

So then if you project your income versus expenses out into the future, you would likely realize that there may well be some potential short-falls and/or uncertainties, so in that regard you have to figure out ways to have cushions in your finances such as emergency funds, reserve funds and floats to make sure that you don't run out of money or need to sell any of your investment (into BTC) at a time that is other than your own complete choosing This is where most people has failed in their bitcoin investment. Due to greed (norms we humans are emotional beings) but still we should learn how to manage those emotions so that it won't overwhelm us . Most people go all in without no proper planning thinking of even having a good emergency funds to cover some future expenses , inorder to have huge ROI. Which would increase the chances of them running to their investment at the end for survival. Is good to in huge amount of money in bitcoin and also back it up with some nice DCA inorder for you to meet your accumulation goal pretty fast, knowing that you financially capable. But if you know you are managing with your funds same time investing, there's no need for you going all in at ones, there's a reason why DCA strategies is there for you, it would help to accumulate large quantity of bitcoin in a long run and also give you the chances to buy at any price movements reducing the risk . but some people might take many months of their savings and even years before they get up to $500 to $1k worth of BTC built up, and I suppose some exchanges are more risky than others, too...so we are not always going to know how much balance to keep on exchanges prior to withdrawing to private wallet, but it makes little sense to me to have a bunch of $10 to $100 transactions that might have their periods of difficulty to have those kinds of relatively small UTXOs you're right and it won't be safe holding your asset for long in an cex account, Ruttoshi if kucoin is actually 10% of the amount of coin you want to transfer is taken as fee. I think such exchange would be good for those that are new in bitcoin accumulation with the use of DCA . If a user whose DCA amount is as low as $10 , want to transfer their bitcoin that they purchased from their cex account to their private account the fee would be 10% of $10 right. And 10% of $10 would be 1. Which means they would pay fee of $1 to transfer $10 and they would end up with $9 in their portfolio if am not mistaken. So such fee won't put that much impact in affecting their DCAing which would lead to them not holding their asset in cex account For that long..🤷 |

|

|

|

|