dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

April 07, 2020, 07:47:40 AM

Last edit: September 10, 2023, 01:49:33 PM by dragonvslinux Merited by El duderino_ (2) |

|

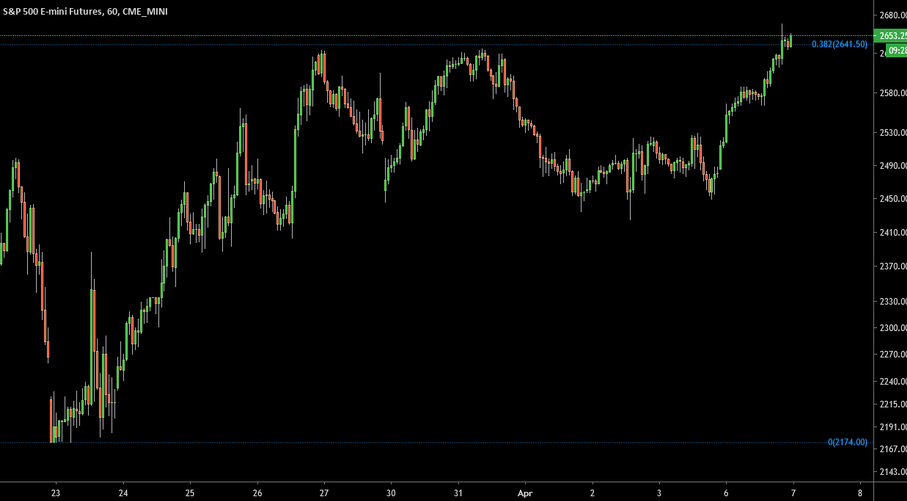

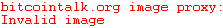

I would say we can remain cautiously bullish as long as the market holds above that $6,650 pivot. The pivot held nicely over the weekend and we retained bullish bias. Stock market futures gapped up Sunday and hit the upside limit Monday. BTC moving in lockstep with stocks, both now hovering at their last local highs:   Anyone ignoring this correlation needs to have their head examined. When stock markets are closed, BTC moves have zero follow-through. When the markets are open, BTC follows stocks. Stocks are currently breaking above their late March double tops, so we could see significant upside in the coming week as trapped sellers and shorters get squeezed. The same goes for BTC. I still stand by what I said in this post: https://bitcointalk.org/index.php?topic=5196072.msg54149908#msg54149908I'm seeing more and more calls from bulls expecting the $9,000s or $10K. I personally don't think the 200-day MA and March pivots in the low $8,000s will be so easy to surpass. It feels like bulls are beginning to get greedy. Shorts are being squeezed now, but it feels like we're trapping bulls for later. And there goes another one right in my thread: Looking good  Here's a target for that ascending triangle:  To clarify, I wasn't calling for $9K-$10K, I was being lazy and merely bringing out my tape measure based on the mid-term bullish price action and it's potential. Is that target likely? I don't think so, as unlike most triangle targets there is a lot of resistance in the way. Most people are looking to de-leverage positions, not buy in imo. First off: selling the re-test of the 50 & 200 Day MA death cross at the 50 Day MA ($7,484), then selling the 200 & 100 Day flat MA resistance confluence ($8,110-$8,130). Then we can see if the triangle resistance level flips to support or not before considering bullish or bearish re-positioning. As if the 100 Week MA doesn't hold ($7,082) this week and price gets rejected hard, the 200 Week MA would be likely for another re-test of support (as referenced in the Weekly analysis above; that of being relatively neutral and in a wide range). The sunglasses were for dollar cost selling opportunities, if it wasn't obvious. Ideally before tomorrows Daily TD 9 sell signal  |

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

JL0

Full Member

Offline Offline

Activity: 817

Merit: 158

Bitcoin the Digital Gold

|

|

April 07, 2020, 10:56:05 AM |

|

What you say about this there?  I've had an eye on it: If it's not officially invalidated yet, I would consider it unlikely. It's looking rather lopsided now. The red squiggle is how it should have played out, if it were going to:  If your head and shoulders look like that, you'd better see a doctor.  That was probably it with that H&S  The doctors only accept patients in an emergency. When the corona crisis is over I will go to the ophthalmologist  |

|

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 07, 2020, 09:30:09 PM |

|

We saw marginal higher highs but bears are trying to hold onto this rising wedge pattern and the 50-day MA:  This situation is unpredictable. I can't apply a reliable EW count. Here's the bottom line: BTC likes to break upward from bearish wedges, but upside stop buys are no longer reliable. This rally is very obviously not impulsive, so this is not the time to expect a miraculous rally that breaks the February highs and begins a new monthly uptrend. Bitmex predicted funding rate just flipped positive and futures spreads are now positive too. Bitfinex longs are rising while shorts are dropping. Bulls are definitely getting greedier and they are going to be punished eventually. We may spike to the low $8,000s or even the $9K area (the latter is unlikely IMO) but.......be ready for the downside. It's coming. |

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

The ground to battle overhead is likely alot harder to get through then what we have done previously. The reason bounces occur with good probability is because a sharp gradient can relate to less volume per pricing, when we are getting back to the area where we had gone sideways previously or halted downwards slightly in a rally attempt then it also becomes a possible stop point in positive movement too. Still it might be a fair guess that we can head back to the 200 day average, does that happen slow or quick this month. If we are less positive then an attempt at 200DMA then if I can take prior range as possible in repetition now then 7482 to 6477 in December seems fair to reconfirm now and would be still positive longer term. Gradient of 50 day or 200 evening out might relate to possibility of passing by it. When stock markets are closed, BTC moves have zero follow-through. Yea I find weekends a time to lay off the gas come back later Sunday to reassess but also its possible that weekends are less harsh or sticky then the in week action, some people might be let off the hook of a bad position if they get a small drift up in the 'days off'. Its slightly incredible BTC graphs never stop, every other asset pricing does. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 09, 2020, 09:11:55 PM |

|

These are some brutal headlines: And yet, stocks are up! This is why I don't really trade fundamentals. Price action is everything. Even if the perma bears are right, the market likes to squeeze them out of their shorts before it actually goes down. There is some resistance here, the 50% Fib retracement and some horizontal S/R, but no momentum divergence yet, and the PA is still bullish. It seems crazy but I wonder if we could make it all the way to the OTE short zone (0.618-0.786) before reversing:  BTC as well, still looking fairly bullish. Bears tried to break below $7,100 twice and bust through that lower trend line but they seem to have failed. Looks like we're coiling to break above that 50-day MA:  If we do break down from here, watch for a reaction off the 13-day mode, as laid out here: I still think we'll eventually hit the low $8,000s, filling this gap in the volume profile and tagging the 200-day MA:  Tim West's TAM system has me second guessing the short term though. On that chart we can see a 13-day mode (see the yellow line ~ $6,700). Per his system, we are on Day 3 of a range expansion out of that mode. If we don't hit ~ $7,800 by today's close, the signal is invalidated. Usually that suggests a retest of the mode (the $6,700 area). Assuming it holds as support, we're on for the $8,000s again. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 10, 2020, 11:46:07 PM |

|

Here is a thought experiment to test our biases. This is an inverse BTC chart. It's flipped upside down. Would you long this chart? Would you short it? |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

One thing to keep in mind is BTC doesn't really have a mind of its own anymore. It just follows the stock market now. When stock and futures markets are closed, BTC price moves basically stop being meaningful. They don't follow through.

Stock futures open in an hour. Let's see what they have to say about next week. If SPX and DOW mini futures open the week bullish, I would say that's very good news for BTC, which is already showing a propensity for upside from here.

BTC Bulls bought up $6,750 and were poised to break upwards. The stock market said no! The weekly opened as a bearish judas swing: BTC immediately reacted, falling almost 5% over 2-3 hours. This is a brutal Eiffel tower:  The SPX now looks like it completed a zig zag correction to the upside, suggesting the relief rally is over. I am however not overly confident in that assessment until it's trading back in the 2,500s. BTCUSD might be overreacting. Evidence is mounting though that the uptrend is over, which would make sense since bulls have become rather piggish lately. I'm still expecting a run down to the low $5,000s at some point, if not lower. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 15, 2020, 05:23:31 AM Merited by JayJuanGee (1) |

|

These factors have me feeling bullish: - Sellers tried to push below the mode and were quickly rejected. That's a bullish reaction.

- Holding the upper half of the daily Bollinger Bands suggests buyers are still in control.

- Maybe most importantly: the stock market continues to float upwards. I'm seeing a good deal of bears throw in the towel on their shitty puts and bottom shorts but sentiment still feels 50-50. The way price is floating, it seems like bears still need to be squeezed some more.

We have a beautifully defined range now. Breaking above $7,200 triggers a daily range expansion signal. The $7,466 high (right where the daily upper band is) should also be a reliable breakout level by now, with upside targets in the $8,000s. A break below $6,555 and I would flip to bearish, with the first target being the $6K area.  |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 15, 2020, 11:43:43 PM

Last edit: April 15, 2020, 11:53:57 PM by exstasie Merited by El duderino_ (2) |

|

Time to pay attention. Watch out for a head fake, but be ready to react! I want to see a clear break below the April 13th low before committing to the bear case.  Crude oil is on the edge of a cliff, threatening to break below its March lows. The stock market is looking a bit wobbly in response. In fact, the intraday downtrend in stock futures looks impulsive. All the more reason to pay very close attention to what happens right now in all 3 markets.   |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

There's that head fake. Like I always say, the market loves to fake out one direction before breaking out in the other. That's a strong 4-hour hammer candle on good volume. Nice spike in Bitfinex shorts as well. We've trapped some bears.  Key upside levels to break: $7K and $7,200. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 19, 2020, 09:25:32 PM |

|

All eyes on the weekly futures open in 35 minutes. BTCUSD tried to float upwards over the weekend, but as I've said before, BTC price moves don't follow through when the markets are closed. If stocks remain bullish, then this sideways consolidation could be a running flat wave (ii) preceding a significant upside breakout today or tomorrow:  My sense of the news cycle and overall sentiment is we probably haven't topped out yet. Sometime in the next couple weeks, optimism about epidemic containment will probably start giving way to concerns about a second wave of infections, the horrible earnings numbers that keep coming out for Q1, and the seemingly growing need for more stimulus or other relief. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

This looks ugly. Crude oil totally collapsing:  Stock futures teetering on the edge, bearish divergence, lower highs and lower lows:  BTC following stocks as usual. A nasty 4-hour bearish engulfing and H&S triggered:  This is looking very bearish unless the market breaks and holds above $7,227 (Coinbase). Looks like we might finally be headed back to the $5,000s. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

April 22, 2020, 12:19:31 PM |

|

Price action is still choppy, no clear trend at the daily time frame. The Bollinger Bands are getting tight so it's time to pay attention:  Above the $7,227 daily pivot things begin to look interesting again. A break above the $7,466 pivot will clearly trigger a bullish range expansion. Below $6,456 triggers a bearish range expansion. The lower BB at $6,572 is a warning level. Between $6,572 and $7,227 it's a chop market and I have no strong bias. The stock market is looking bit droopy though..... |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

Bulls are above the daily bands and the April 7th pivot. Ideally we'll see a candle close above the upper band ~ $7,500 today, then we'll see an advance beyond today's high as confirmation of a new daily uptrend. The 0.618 of the downtrend and the 200-day MA are both right around $8K. First target is a wick above there. Given all the consolidation near $7K, final targets are in the upper $8,000s. Let's hope the stock market cooperates.  The low of today's 4-hour breakout candle ($7,120) marks an obvious failure. Super wide stop level from here, although it still provides 3:1 reward vs. risk on a run to $8,700+. We can roll up stops as the market forms local support. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

Not much follow through on last week's breakout. No closes above the bands, just chopping upwards very slowly. Maybe the market wants to see higher highs in stocks first. Nothing interesting happens on the weekend anymore either with so much uncertainty in the global markets. The market also continues to be choppy and unpredictable, not great for short term trading. Up is up though, and it still looks like bulls want to bust out of this BB squeeze, or at least keep grinding up against the upper band:  Let's see what stock market futures do when they open in a few minutes. It could be telling. Lower time frames still open to the possibility of a Bart top. $7,120 is the low of last week's 4-hour breakout candle and the daily BB basis. Holding below there would be a first warning that bears are coming. Holding above on any drop and floating back up to the highs would suggest more bullish chop. My current sense of the news cycle: optimism still reigns as economies partially reopen and investors bet on further reopening. Stocks and BTC will probably keep chopping upwards in the shorter term. Earnings season not weighing too heavily yet, with some big names like Apple releasing financials end of week. In May or June, I think optimism will wane as crushing economic numbers continue to emerge in spite of reopening. Fear around a second wave of infections could intensify this turn in sentiment. For BTC, the halving as a "sell the news" catalyst fits well with this stock market outlook. ALT/BTC charts have been uptrending all month. I've seen more than a few altcoin traders talking about "alt season." I'm really not sure since the March crash broke lots of bullish structures and might need time to rebuild. Something to keep an eye on. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

Up is up though, and it still looks like bulls want to bust out of this BB squeeze, or at least keep grinding up against the upper band:  The market finally triggered the daily BB squeeze! Powerful move into the upper $8,000s resistance zone mentioned above:  Half my longs were closed into that wick. Stops are in profit now, letting the rest ride for a possible move into the $9,000s. Happy to be taking some risk off though. Daily R1 pivot is just overhead around $9,200. It could provide a stopping point to this rally. I'll be really impressed if the market can break and hold above the March monthly pivot highs. I notice that everyone is getting really bullish. Remember, people get really bearish near major bottoms (like they were in March) and really bullish near major tops. During BTC rallies no one wants to sell, but the reversal can come very suddenly, and then everyone is running for the exits. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 29, 2020, 09:41:44 PM |

|

Up is up though, and it still looks like bulls want to bust out of this BB squeeze, or at least keep grinding up against the upper band:  The market finally triggered the daily BB squeeze! Powerful move into the upper $8,000s resistance zone mentioned above:  Half my longs were closed into that wick. Stops are in profit now, letting the rest ride for a possible move into the $9,000s. Happy to be taking some risk off though. Daily R1 pivot is just overhead around $9,200. It could provide a stopping point to this rally. I'll be really impressed if the market can break and hold above the March monthly pivot highs. I notice that everyone is getting really bullish. Remember, people get really bearish near major bottoms (like they were in March) and really bullish near major tops. During BTC rallies no one wants to sell, but the reversal can come very suddenly, and then everyone is running for the exits. The trend is your friend ... with caveats...    |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

That's a nice fat wick through the R1 pivot!  The daily candle looks like a bearish shooting star at the moment, but there's still 14 hours for bulls to close it back up. Volume too, looks like it'll end up quite high, high enough to suggest bullish exhaustion. This has the potential to be a significant top. Got the push into the $9,000s I was hoping for, longs closed. Wish I had the balls to short up there but it was too risky. Happy to be back on the sidelines. Let's see how these next 4-hour and daily candles close. |

|

|

|

exstasie (OP)

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

The daily closed as a shooting star after all, a potential top signal:  Very strong volume too, the highest since the March crash. As mentioned earlier, volume extremes often indicate reversal points. However, I'm not convinced about a significant correction until I see sellers follow through below yesterday's low of $8,407. Update on the long term triangle: I can't bet on the bubble scenario myself, not yet. I think it's more likely we keep building out this consolidating range. The proportions and character of the sub-waves really supports the idea of a 2018-2021 triangle.  My trend line is closer to $11K, although in Elliott Wave, breaking that line isn't the determining factor anyway. The B-D line will form the upper bound of the triangle, and Wave D hasn't completed yet. We could even see some short-lived shenanigans above the $10.5K pivot and still come down to build out Wave E. Watching the stock market closely. Lots of terrible earnings numbers being released. Volatility spiked up, and showing some weakness here off the 0.618:  "Buy the lockdown, sell the reopening?" We'll see.  |

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

May 01, 2020, 08:55:35 AM

Last edit: September 10, 2023, 01:49:25 PM by dragonvslinux Merited by El duderino_ (2) |

|

The daily closed as a shooting star after all, a potential top signal:  Very strong volume too, the highest since the March crash. As mentioned earlier, volume extremes often indicate reversal points. However, I'm not convinced about a significant correction until I see sellers follow through below yesterday's low of $8,407. Also realise we reached the measured move from the ascending triangle around $9.5K (wicking to the resistance trend-line in red), the one that neither of us believed would be reached for a number of reasons. To me it looks like the short-term top is in, based on the rejection from this critical resistance level, and therefore a correction will continue until proven otherwise. Looking good  Here's a target for that ascending triangle:  I'm now expecting a pull-back to $6,800 (VPVR POC) to $7,075 (100 Week MA) at minimum, possibly even re-test the 200 Week MA after the halving around $6K. All of these prices would still be long-term bullish however. Others expect the 100 & 200 Day MAs to hold around $8K, though given the failures the previous two times, this seems unlikely to me. It didn't act as any resistance on the way up, therefore unlikely to act as local support on the way down either. I'm also out of long positions and trading account is back in fiat, I'll start paying attention again from $7.5K and lower.  Short-term, we are now on a TD Sequential 9 sell signal on the Daily, that previously called the short-term tops in March & April this year, as well as following an aggressive & sequential 13. For sequential traders, these are alarm bells for selling. This suggests at minimum a 1-4 candle correction as previously occurred, but otherwise I'm learning towards a 9 candle count of downside to confirm a trend change, hopefully with a good buying opportunity on a Red 9 buy signal. In summary, we were oversold at $5K, now we are overbought above $9K, and we've all seen these extreme price swings before and where it leads. If we break through $10K with convincing volume and remain above it, I'll be more or less fully bullish, but the odds of this seem pretty low right now. Lots of sell volume on a Red 8 in oversold conditions on the RSI indicates a cool-off is necessary unless price goes parabolic in an unsustainable way. |

|

|

|

|