cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 06:20:40 AM

Last edit: September 15, 2011, 02:48:10 PM by cypherdoc |

|

yes, absolutely. in the sense of: "perhaps you ought to consider quoting me as i am the only one i know that had predicted this manipulated central bank induced USD rally weeks ahead of it happening". there is a huge distinction btwn what that lame article you referenced was saying and what i predicted. just saying "i think it might rise now b/c its time" is way diff than saying "why or when" it might rise. the fact that its CB intervention means everything and is precisely why it has ramped so viciously.

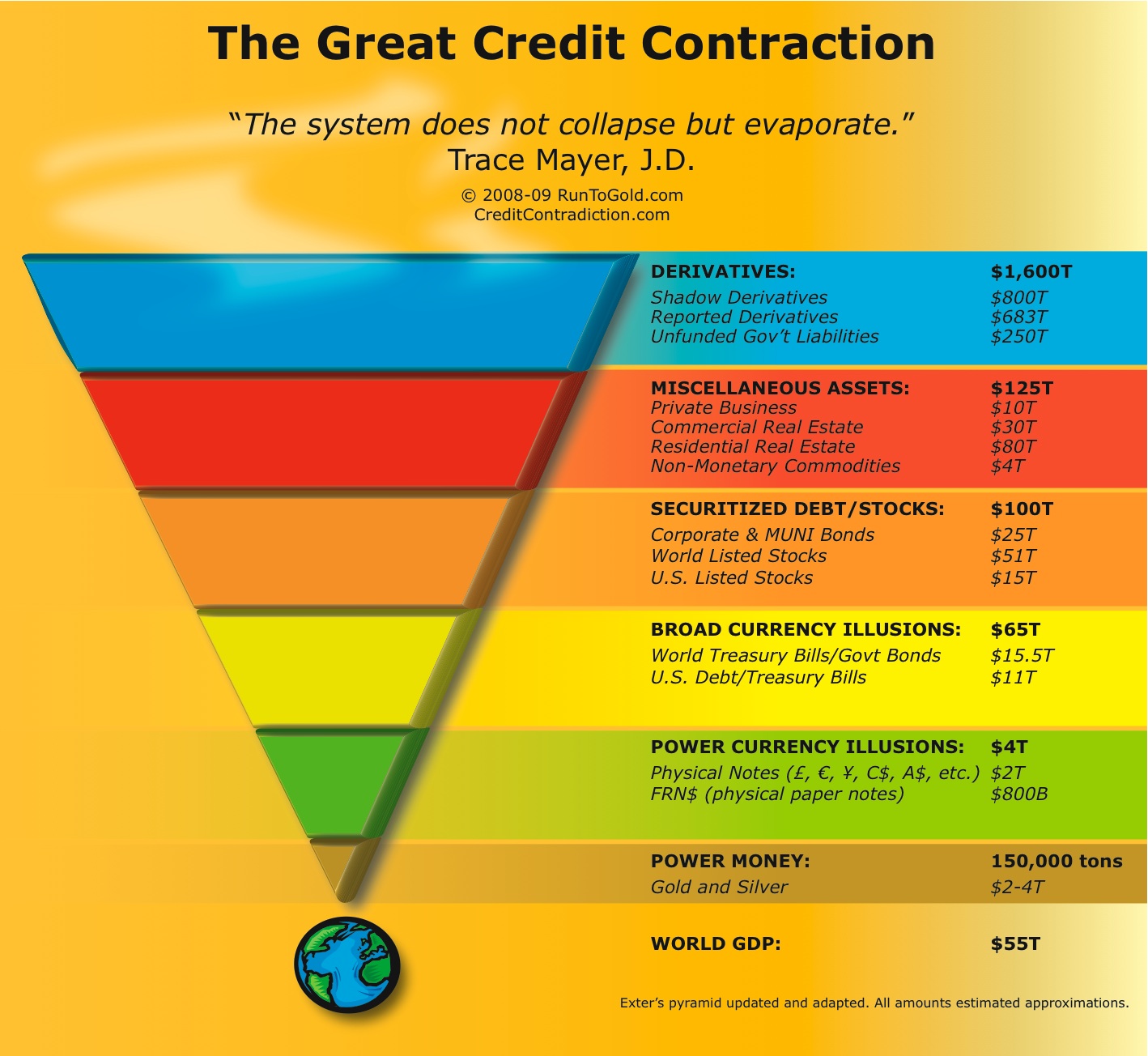

Of course, Jim Rogers has never made mention of the manipulative games going on. LOL! you throw up another article pulled out of your ass that just quotes Rogers as buying b/c everyone's pessimistic. nothing in there about manipulation by the Fed or CB's. clearly you don't want to acknowledge that i am the only one we know about who called for a Fed/CB intervention to prop the USD and did it weeks ahead of time. such is the tunnel vision of a zealot. at least i now know what i'm dealing with.  Some such as yourself are better at calling the short-term gyrations than others. Some are better at long range shifts. That doesn't mean you stand alone. Also, call me crazy but I prefer having a life.  now come the veiled criticisms/excuses. i suggest if you're going to engage in high level discussions like we've been doing you put in the time like me. with time and effort come insights.  It's been proposed that there will be a hammer-like action in gold. This time it's just on a much larger scale. The long trade for this stage is about half over; it's the short trade that will be the show-stopper. For several months, at least. why do you always quote yourself? You mean this pyramid?  no, no. i'm know Trace Mayer's work well. i've read his book where this graph came from. actually i think he stole it from someone but thats ok. i really like that guy and he likes Bitcoins too along with his buddy Bill Rounds. i miss his more regular posts and podcasts. we already talked about this earlier in thread and no i'm not going to go find it right now. the USD reserve currency system is based on debt. banks borrow USD from the Fed at below mkt rates and from each other at he Fed Funds rate and go out into the world and speculate in emerging mkts esp China the last decade. these USD's are mopped up by the foreign CB's and they keep most of these in reserve and then inflate their own currencies on top of the USD reserves. hence my inverse pyramid analogy of debt and currency built upon debt. most of the debt in the emerging mkts is USD denominated. problem is when we get financial crises and everyones debt starts imploding they scramble for USD's to try and prop up those bad debts and the pressure to maintain enough USD reserves becomes intense and worse overseas and is really why the USD goes up. its not so much for the safe haven status as that they are FORCED to liquidate bad bets and buy USD's to cover as much of the bad debt as possible. hence the shrinkage of virtual USD's worldwide. this is why the Fed is forced to provide swap lines nowadays and why most of the TARP and bailout money had to go to prop up overseas banks. Are you speaking of the same emerging markets where manufacturing has moved while those in developed nations rust or are taken over by government? The same ones where agriculture is still a large component of national production as opposed to "developed" countries where 98% of its citizens couldn't grow enough food to feed themselves for a year if they wanted to? These are same growing environments that have built brand-new infrastructure and have positive prospects while the "Masters of the Universe" panic and try to save their own hides.

i am indeed. you are in severe denial. i point to all emerging US stock mkts year to date as evidence to my assertion. ALL are worse off than the Dow or S&P year to date. what evidence do you submit other than a blanket "this is how i see it"? It sounds like you're suggesting the USD is here now and forever. Haven't you said that nothing lasts forever? There's a turning point coming up in gold, but it isn't the end. there you go again quoting yourself. no, i just think the deflationary depression comes before the hyperinflation, the reverse of what you predict.

If, or rather when that happens, the world goes to war as the US cannot sustain itself in its current form. America will try to hold onto everything it can by force rather than endure the difficult transition of shifting to greater productivity instead of consumption. Should America not become violent, that would shock me - nothing of its past or current behavior suggests that will occur.

at least you perhaps inadvertently agree with me that there will never be a one world currency if you believe in war. It isn't the fact that this dollar rally happened that's interesting, but the extent to which it has risen in such a short time.

this came as no surprise to me. not when you predict that the USD rally will come from CB intervention as i have. i have said several times the USD will "skyrocket". this is how markets are manipulated. in the middle of the night interventions when most investors are asleep at the wheel to create maximum psychological impact at the open via a huge GLD gap down; extreme ramps to force margined gold players out of their positions; small descending triangle formations to "tempt" bulls in gold into buying and leveraging up before "the trap" is snapped shut; extreme ramps in the USD to force USD shorts to cover overextended positions; waiting until sentiment reaches extremes before initiating an attack; all the while to create huge profits for insider bank traders that have been notified ahead of time. this is where technical analysis combined with intuition and a thorough understanding of fundamentals, criminality, and sentiment come in handy. i can "see" the setups. It was interesting, not surprising. The move was obviously imminent. As for the sequence that it took place in, the specific technique was curious. are you a narcissist or what? or perhaps a self promoter?

As derivatives collapse and US dollars are rushed into, instruments that formed the paper gold markets will completely devolve. Where will those USDs go next? Physical gold, among other real assets. Just because paper instruments are destroyed doesn't mean the demand disappears. The paper lie can only hold so long as the majority doesn't realize what's behind it.

This means that you will see a complete divergence: GLD goes to pennies while bullion premiums go through the roof. The officially stated price doesn't even have to rise for that to happen. In fact, that will serve to keep those oblivious to these activities still in the dark.

i don't think you understand. these paper mkts were funded with USD debt. as the debt based paper markets in gold or whatever implode, speculators are FORCED to scramble for "physical" USD's to pay off their losses. these usually come in the form of margin calls and they don't have a choice to plow that money over to physical gold and certainly can't use physical gold to pay off their losses. how much further does Goldcorp (GG), a bellwether gold stock, have to fall beneath its breakout line for it to be considered a "failed breakout"?

A managed market does not offer genuinely valid technical signals. By the same token, manipulation can only go so far. On very long term charts, the technicals will provide a better gauge of the long-term trend. This is why it can be hard to keep up with the daily gesticulations, but easy to see the big movements. but at the same time you've used technical analysis in this thread many times esp to point out target points for the subsequent parabola thats supposed to come along with several support/resistance lines. which is it? |

|

|

|

|

|

|

|

|

|

|

|

|

|

It is a common myth that Bitcoin is ruled by a majority of miners. This is not true. Bitcoin miners "vote" on the ordering of transactions, but that's all they do. They can't vote to change the network rules.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 01:53:13 PM |

|

has the depth of the failure for GG below its breakout line accounted for the manipulation yet?

edit: how about GDX, GDXJ, SLW, PAAS, NEM, ABX, AEM?

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 02:02:23 PM |

|

its been 3 wks now since SLV, /SI, and SLW have rejected off their 61.8% retraces from the bottom of Mays selloff. thats a warning.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 02:35:47 PM |

|

another point about the gold derivatives. you know how so many ppl here on the forum want to see Bitcoin derivatives trading? why? b/c they think correctly this will help drive UP the BTC price by increasing liquidity and trading options for speculators. speculators like them b/c they can be bought with a click of a button. if call options on BTC go up then they drag the actual BTC price UP. the SLV and GLD have worked wonders for the gold price since they were introduced which has helped keep a cap on gold miner during the past 11 yrs.

now ask yourself the opposite question. what if those same derivatives get destroyed via forced liquidation? what happens to the BTC price or the gold price? STILL go up?

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 03:09:18 PM |

|

kjj: i remember back when those premiums were wacky. i can't remember exactly what ppl eventually concluded about that back then but i being a member of Bill Murphy's Le Metropole Cafe at the time, i think he was ascribing it to the silver backwardation on the Comex at the time. you're right, it was a sign of things to come.

but what are the odds that it will repeat itself?

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 03:24:46 PM |

|

20 year, weekly chart of /GC gold future. High correlation to gold spot and long term. NO parabola?  |

|

|

|

|

kjj

Legendary

Offline Offline

Activity: 1302

Merit: 1024

|

|

September 15, 2011, 03:32:38 PM |

|

kjj: i remember back when those premiums were wacky. i can't remember exactly what ppl eventually concluded about that back then but i being a member of Bill Murphy's Le Metropole Cafe at the time, i think he was ascribing it to the silver backwardation on the Comex at the time. you're right, it was a sign of things to come.

but what are the odds that it will repeat itself?

Well, that's the question now, isn't it? Might have been a freak event, never to reoccur. Or it might have been the first in a series of clear warning signs that we are losing control of the monster we've created. If there is ever another big liquidity crunch like 2008-2009, I think that you are right that the paper prices will fall again, but I also think that the premiums will go up to match or exceed the fall in paper. But I don't see a replay of 2008-2009 happening again, at least not while people that remember the last event are still alive and still in positions where they can stop it. So, the next event should be different. |

17Np17BSrpnHCZ2pgtiMNnhjnsWJ2TMqq8

I routinely ignore posters with paid advertising in their sigs. You should too.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 03:43:51 PM |

|

kjj: i remember back when those premiums were wacky. i can't remember exactly what ppl eventually concluded about that back then but i being a member of Bill Murphy's Le Metropole Cafe at the time, i think he was ascribing it to the silver backwardation on the Comex at the time. you're right, it was a sign of things to come.

but what are the odds that it will repeat itself?

Well, that's the question now, isn't it? Might have been a freak event, never to reoccur. Or it might have been the first in a series of clear warning signs that we are losing control of the monster we've created. If there is ever another big liquidity crunch like 2008-2009, I think that you are right that the paper prices will fall again, but I also think that the premiums will go up to match or exceed the fall in paper. But I don't see a replay of 2008-2009 happening again, at least not while people that remember the last event are still alive and still in positions where they can stop it. So, the next event should be different. first of all, there IS another big liquidity crunch going on right now and i submit its worse than then b/c we never solved the underlying issues and just swept them under the rug by doubling the national debt by bailing out the criminals. AND the fact that there is no one left to bailout gov'ts like Greece and the rest of the pigs except for a bloated ECB/EFSF. altho its hard, i try to minimize my reliance on peripheral indicators and instead try to focus on the price. obviously fundamentals are important too and this premium percent helps to sort out the story altho i wouldn't rely on it. |

|

|

|

|

kjj

Legendary

Offline Offline

Activity: 1302

Merit: 1024

|

|

September 15, 2011, 04:19:59 PM |

|

first of all, there IS another big liquidity crunch going on right now and i submit its worse than then b/c we never solved the underlying issues and just swept them under the rug by doubling the national debt by bailing out the criminals. AND the fact that there is no one left to bailout gov'ts like Greece and the rest of the pigs except for a bloated ECB/EFSF. M2 suggests that rather than right now being a new second problem, the first one from 2008 is still ongoing. But I think that there will be no new round of widespread asset dumping because cash will just magically appear out of thin air the minute that it looks like it is necessary to prevent another panic. The memory of 2008 is still fresh in the minds of those that can make it happen, and I don't think they'd hesitate for a minute to prevent a replay, no matter the long term consequences. That's why I think that the next round will look different. |

17Np17BSrpnHCZ2pgtiMNnhjnsWJ2TMqq8

I routinely ignore posters with paid advertising in their sigs. You should too.

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 04:28:13 PM |

|

first of all, there IS another big liquidity crunch going on right now and i submit its worse than then b/c we never solved the underlying issues and just swept them under the rug by doubling the national debt by bailing out the criminals. AND the fact that there is no one left to bailout gov'ts like Greece and the rest of the pigs except for a bloated ECB/EFSF. M2 suggests that rather than right now being a new second problem, the first one from 2008 is still ongoing. But I think that there will be no new round of widespread asset dumping because cash will just magically appear out of thin air the minute that it looks like it is necessary to prevent another panic. The memory of 2008 is still fresh in the minds of those that can make it happen, and I don't think they'd hesitate for a minute to prevent a replay, no matter the long term consequences. That's why I think that the next round will look different. |

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 05:22:28 PM |

|

|

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

September 15, 2011, 05:24:29 PM |

|

M2 suggests that rather than right now being a new second problem, the first one from 2008 is still ongoing. You're looking at M0-esque BASE money supply. Note that BASE doubles in late 2008, plateaus and rose again modestly (25%) this year. M2 has been more subtle, never raising more than 11% annually with a minima at 2% in 2010, but right back at 10% M2 annual growth today.   to get to your question. i think M2 is ramping b/c everyone is cashing out of money mkt funds as they are forced to liquidate bonds from the debt downgrade and move USD's into regular bank accts. this is why you're seeing Bank of NY Mellon charging for holding deposits. because they can. so its misleading to say the Fed is pumping new money into the markets.

if you read my earlier posts in this thread, yes the USD can skyrocket from here if enough debt liquidation is forced thru defaults or margin calls raising the demand for cash to pay off these bad debts. you can look at this 2 ways; an overall decrease in the number of virtual plus real USD's floating around or as a scramble to grab the real USD's to pay off the bad virtual USD debts. either way the USD rises.

the $DXY is at the bottom of its consolidation channel. from here we should get a huge ramp. talk about a panic from that happening...

This is interesting and worth a re-read. My buddy at HSBC made a similar point that went over my head. So if I understand you, BASE, M2 growth hasn't been a result of QE* but was rather the symptom of deleveraging that made QE* 'necessary'. |

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 05:30:21 PM |

|

M2 suggests that rather than right now being a new second problem, the first one from 2008 is still ongoing. You're looking at M0-esque BASE money supply. Note that BASE launches 110% late 2008, plateaus and rose again earlier this year. M2 has been more subtle, never raising more than 11% annually with a minima at 2% in 2010, but right back at 10% M2 supply growth this year.   https://bitcointalk.org/index.php?topic=35956.msg476310#msg476310to get to your question. i think M2 is ramping b/c everyone is cashing out of money mkt funds as they are forced to liquidate bonds from the debt downgrade and move USD's into regular bank accts. this is why you're seeing Bank of NY Mellon charging for holding deposits. because they can. so its misleading to say the Fed is pumping new money into the markets. if you read my earlier posts in this thread, yes the USD can skyrocket from here if enough debt liquidation is forced thru defaults or margin calls raising the demand for cash to pay off these bad debts. you can look at this 2 ways; an overall decrease in the number of virtual plus real USD's floating around or as a scramble to grab the real USD's to pay off the bad virtual USD debts. either way the USD rises. the $DXY is at the bottom of its consolidation channel. from here we should get a huge ramp. talk about a panic from that happening... This is interesting and worth a re-read. My buddy at HSBC made a similar point that went over my head. So if I understand you, BASE, M2 growth hasn't been a result of QE* but was rather the symptom of deleveraging that made QE* 'necessary'. the UST debt downgrade forced money out of retail money market funds, graph above, into bank deposits driving up M2. |

|

|

|

|

kjj

Legendary

Offline Offline

Activity: 1302

Merit: 1024

|

|

September 15, 2011, 06:13:14 PM |

|

M2 suggests that rather than right now being a new second problem, the first one from 2008 is still ongoing. You're looking at M0-esque BASE money supply. Note that BASE doubles in late 2008, plateaus and rose again modestly (25%) this year. M2 has been more subtle, never raising more than 11% annually with a minima at 2% in 2010, but right back at 10% M2 annual growth today. Yeah, my bad. I was looking at and thinking of AMB but typed M2 instead. I like to think of excess reserves as lurking money, not in the spotlight, but still there. The Fed is paying interest on these excess reserves, so clearly they want the banks to keep the money parked there so that it will be available when needed. Yes, I know they aren't paying much interest, but it is still enough to keep the banks from dumping them. |

17Np17BSrpnHCZ2pgtiMNnhjnsWJ2TMqq8

I routinely ignore posters with paid advertising in their sigs. You should too.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 07:50:55 PM

Last edit: September 16, 2011, 01:51:50 AM by cypherdoc |

|

everyone should focus on the $DXY testing support at 76.20. as i argued for gold stocks, if it dips back below this into the channel you need to look for a failed breakout which would be bullish for gold. if it bounces and launches up, look out.

|

|

|

|

|

MatthewLM

Legendary

Offline Offline

Activity: 1190

Merit: 1004

|

|

September 15, 2011, 07:53:39 PM |

|

All it means is the USD is appreciating against other currencies. It's true it makes sense that it will be appreciating in Euros with the Euro crisis.

Gold fundamentals are still there.

|

|

|

|

|

cypherdoc (OP)

Legendary

Offline Offline

Activity: 1764

Merit: 1002

|

|

September 15, 2011, 07:56:40 PM |

|

if the Fed and CB's have been intervening, its now decision time. allow the USD to fail its advance and let the stock mkt and PM's reverse and ramp OR save the USD.

|

|

|

|

|

MatthewLM

Legendary

Offline Offline

Activity: 1190

Merit: 1004

|

|

September 15, 2011, 09:21:47 PM |

|

Banks make money on credit don't they? So why would they want to save the USD? To sustain the system in case it comes falling down? I'm sure most bankers only look on the short term view. Make as much as possible before they make an early retirement and continue to receive the insider knowledge to sustain their wealth thereafter.

If you are right, you'd need more evidence before jumping to conclusions.

|

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

September 15, 2011, 10:50:44 PM |

|

With deflation, extant interest rates are more valuable to the lender and crushing to the debtor.

|

|

|

|

|