Nicely made video. The Legendary Treasure of Satoshi Nakamotohttps://www.youtube.com/watch?v=iIWViimqRMUPremiered Apr 20, 2024

The Legendary Treasure of Satoshi Nakamoto is the incredible story of Bitcoin’s creation, its mysterious creator, and his immense treasure. It will take you on a thrilling spiritual journey that will make you question what’s real, what isn’t, and awaken your very soul. Written and narrated by Tomer Strolight and Directed and Edited by Bevan Waite. |

|

|

|

Quoted for image, but what does it mean? The blue line shows the bitcoins in circulation. The red line shows the inflation rate, going down the stairs with each halving. |

|

|

|

The fees are very high, I read that it is because of the launch of something called RUNE, (I don't know what it is about)... but I will probably have to accumulate some BTC from DCA on an exchange before withdrawing... unfortunately. I hope things get back to normal soon.

Does anyone have any alternative to this, of keeping some BTC in an exchange for a while? before withdrawing to the wallet? I don't think there's much to do except wait

Withdraw sats over the Lignting network. Kraken and Cash App support it and even Coinbase is finally working on it. Zero fees and instant, even today. LOL. I’m guessing you haven’t actually used Lightning recently… I’m seeing plenty of people complaining about channel costs and failed transactions. You’re better off using a shitcoin. The beauty of this terribly managed fee market is that nobody can afford to move BTC to exchanges, so the weekend should be pretty quiet. Try it for yourself instead of reading about it and recommending shitcoins. Used it on the day with most bitcoin fees in history, sats withdrew instantly and for free. Currently I am testing https://aquawallet.io/ which is self custodial and I must say I am impressed so far. |

|

|

|

[edited out]

My local coffee shop McDonalds doesn't accept Bitcoin yet but I just sit outside of it with a sign that reads "The Bitcoin tx fee is too damn high today! A little help please." and eventually someone buys my coffee. FTFY hahahahahaha I know you well enough to realize that you are not so cultured as to go to an actual "coffee shop."      and if you are in USA zelle is fine up to $1000 usd.

frankly sending btc on the main chain for any thing under 1000 is dumb..

LN may get better eventually,but btc is much more a buy and hodl store of wealth than anyother thing.

I use zelle for nocoiner people

I use doge and ltc for small sends as it is easier than LN

I use main chain for large purchases of mining gear.

Spend $, hoard BTC. It's the best way. Another name for that is Gresham's law. Which largely means that we spend our worse money before we spend our better money, so in that order of things we would end up spending our BTC last, unless we put ourselves into some kind of a liquidity pickle in which sometimes if there is a liquidity crunch we might be forced to sell the thing that is most liquid, which might be bitcoin in some circumstances (which likely means that we messed up.... but sure sometimes mistakes are made, especially if we don't keep enough of some of the worser money to be able to spend prior to spending the better money, namely bitcoin). Thank you. I feel as though people didn't see the difference... I know it's pretty subtle and if you've seen the original, on seeing the revised halvening version your mind might play tricks but I posted this one for the last 10 blocks. They will get out of synch with one another because I changed the timing on a couple of frames - apologies in advance.   Whatever difference might exist is beyond my ability to figure it out. In other words, I need some kind of a further hint.  https://www.youtube.com/watch?v=vJG698U2Mvo https://www.youtube.com/watch?v=vJG698U2Mvo |

|

|

|

The fees are very high, I read that it is because of the launch of something called RUNE, (I don't know what it is about)... but I will probably have to accumulate some BTC from DCA on an exchange before withdrawing... unfortunately. I hope things get back to normal soon.

Does anyone have any alternative to this, of keeping some BTC in an exchange for a while? before withdrawing to the wallet? I don't think there's much to do except wait

Withdraw sats over the Lignting network. Kraken and Cash App support it and even Coinbase is finally working on it. Zero fees and instant, even today. |

|

|

|

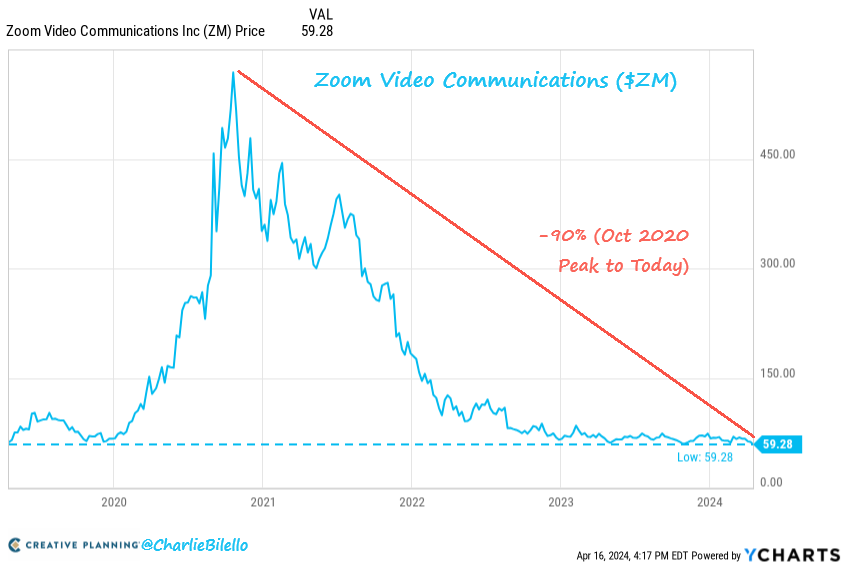

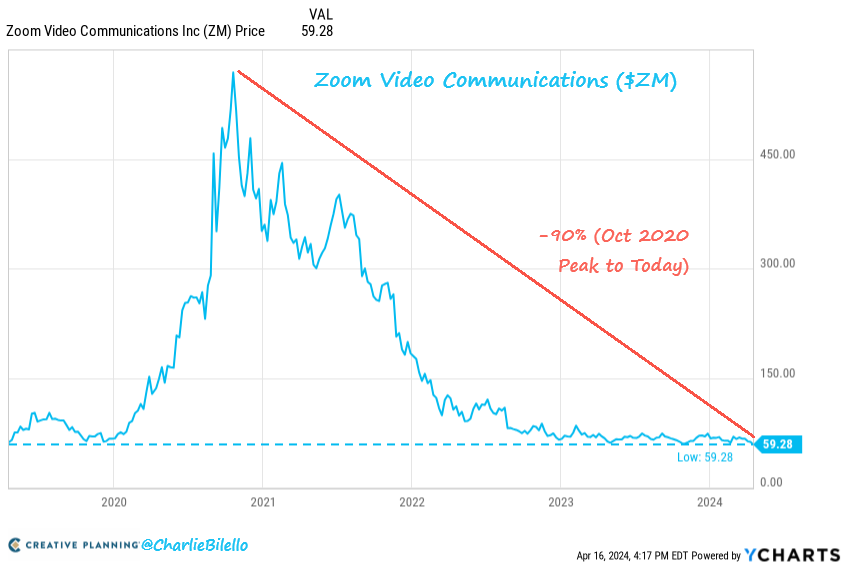

When in doubt, Zoom out they said.  |

|

|

|

|

^ Incredible it has been 10 years already, still going strong. I am going to have my own private little party for sure, cheers.

|

|

|

|

Honestly wish I could buy more bitcoin. It is just so obvious by now it will outperform everything and anything over the next 10 years while the majority still hasn't got a clue what is coming.  |

|

|

|

I think you mistake me for Biodom. I have never sold any "AMZN, AAPL and TSLA"

[edited out]

Not sure how you still got that part since I realized the mix-up and removed it shortly after posting, while your response is 1.5 hours later. But it proves my point whether it is you, Biodom or anyone else selling assets for dollars. Anyway, it is up to each individual. And I get the restraint putting real bitcoins as collateral. However with bitcoin ETF's like IBIT/FBTC we have now entered legacy finance in which it is common practice for many decades, severely reducing risk of getting rug pulled IMHO. |

|

|

|

I was thinking about the following hypothetical the other day:

Let's assume that bitcoin goes to 100-300K (let's say, 200K average) this cycle and somewhere along the line you sell a substantial % to invest in property, luxuries, etc ( whichever you choose).

In 10 years afterwards, bitcoin goes to 5 mil, which means that you only "captured" just 4% of the potential value.

How would you feel about it? I guess, it would also depend on the remainder (that you didn't sell), but still.

Personally, I know that years later, I am not particularly fond of my decisions to sell AMZN, AAPL and TSLA early, even though I made very nice gains on them.

Sometimes, I consider these occurancies as my investment follies, but, again, you cannot be 100% efficient.

Of course, it is possible to NEVER sell btc and, basically, put this decision on the shoulders of descendants, but you cannot guarantee that they would be wise about it, right?

At least, I can't.

At some point, I would have to start to spend btc and this point is coming relatively soon.

Alas, to spend even a relatively small amount of btc on things like kitchen remodeling causes a bit of mixed feelings on my part as I contemplate the scenarios described above.

That could be one expensive kitchen 5-10 years down the road.

Withdrawals from IRA are taxable and I put all my stables back into the market during 2023.

I would probably do a mix of "things", but don't want to take on HELOC or anything like this.

Decisions, decisions...

Borrow against your bitcoin, no capital gains tax either. That is how rich people do it I am reading. Now I would not trust some random new startup to facilitate this but fine against IBIT in your brokerage account. sounds like a not-your-keys-not-your-coins situation to me... What, you selling your corn including covering for CGT? Well, I think that's exactly the thing. I have corn, you have an IOU (ETF). And do you think it's possible to go from real BTC into an ETF without selling BTC first? I suppose you'll have to pay CGT there too right? That being said I actually might consider risking part of my stash for a never ending credit... as long BTC goes up forever... Laura  No you don't have bitcoin when you sell it for dollars. And you would have to sell more of it to cover for taxes. Borrowing against your assets is how rich people do it, you do you. Since we are into the subject of IOU's you seem to dislike, can you explain what a dollar is? |

|

|

|

|

Lol at the headlines. Inflation is .1% above expectations.

And when you sell bitcoin because inflation is higher, you really don't get it.

|

|

|

|

I was thinking about the following hypothetical the other day:

Let's assume that bitcoin goes to 100-300K (let's say, 200K average) this cycle and somewhere along the line you sell a substantial % to invest in property, luxuries, etc ( whichever you choose).

In 10 years afterwards, bitcoin goes to 5 mil, which means that you only "captured" just 4% of the potential value.

How would you feel about it? I guess, it would also depend on the remainder (that you didn't sell), but still.

Personally, I know that years later, I am not particularly fond of my decisions to sell AMZN, AAPL and TSLA early, even though I made very nice gains on them.

Sometimes, I consider these occurancies as my investment follies, but, again, you cannot be 100% efficient.

Of course, it is possible to NEVER sell btc and, basically, put this decision on the shoulders of descendants, but you cannot guarantee that they would be wise about it, right?

At least, I can't.

At some point, I would have to start to spend btc and this point is coming relatively soon.

Alas, to spend even a relatively small amount of btc on things like kitchen remodeling causes a bit of mixed feelings on my part as I contemplate the scenarios described above.

That could be one expensive kitchen 5-10 years down the road.

Withdrawals from IRA are taxable and I put all my stables back into the market during 2023.

I would probably do a mix of "things", but don't want to take on HELOC or anything like this.

Decisions, decisions...

Borrow against your bitcoin, no capital gains tax either. That is how rich people do it I am reading. Now I would not trust some random new startup to facilitate this but fine against IBIT in your brokerage account. sounds like a not-your-keys-not-your-coins situation to me... What, you selling your corn including covering for CGT? |

|

|

|

|

If you haven't sold all the chairs by now and be all-in you can't be saved.

|

|

|

|

I was thinking about the following hypothetical the other day:

Let's assume that bitcoin goes to 100-300K (let's say, 200K average) this cycle and somewhere along the line you sell a substantial % to invest in property, luxuries, etc ( whichever you choose).

In 10 years afterwards, bitcoin goes to 5 mil, which means that you only "captured" just 4% of the potential value.

How would you feel about it? I guess, it would also depend on the remainder (that you didn't sell), but still.

Personally, I know that years later, I am not particularly fond of my decisions to sell AMZN, AAPL and TSLA early, even though I made very nice gains on them.

Sometimes, I consider these occurancies as my investment follies, but, again, you cannot be 100% efficient.

Of course, it is possible to NEVER sell btc and, basically, put this decision on the shoulders of descendants, but you cannot guarantee that they would be wise about it, right?

At least, I can't.

At some point, I would have to start to spend btc and this point is coming relatively soon.

Alas, to spend even a relatively small amount of btc on things like kitchen remodeling causes a bit of mixed feelings on my part as I contemplate the scenarios described above.

That could be one expensive kitchen 5-10 years down the road.

Withdrawals from IRA are taxable and I put all my stables back into the market during 2023.

I would probably do a mix of "things", but don't want to take on HELOC or anything like this.

Decisions, decisions...

Borrow against your bitcoin, no capital gains tax either. That is how rich people do it I am reading. Now I would not trust some random new startup to facilitate this but fine against IBIT in your brokerage account. |

|

|

|

|

Halving in two weeks and people abandoning ship rocket. You can't fix stupid.

|

|

|

|

|

We are going to $100k and far beyond. A tingling feeling I slowly developed over the last decade. It is not as well calibrated as some OG's spider senses, but when it tingles I better trust my senses since it has been far more remunerative than anything else I have done in life. A humbling fact that makes me just watch the thing in awe.

Thank you Bitcoin and cyberpunks.

|

|

|

|

Think I haven't seen this shared yet on the WO, fingers crossed. https://laanwj.github.io/2024/03/19/finally.htmlFinally I couldn’t really believe my ears when I heard the judge declare that: CSW is not the author of the Bitcoin White Paper. CSW is not the person who operated under the pseudonym Satoshi Nakamoto in the period 2008 to 2011. CSW is not the person who created the Bitcoin System. CSW is not the author of the initial versions of the Bitcoin software. After years of gaslighting and harassment (I just noticed that my first post about this was from 2016, back when Gavin fell under his influence), I did not expect this much sanity from the legal system. Remember: Craig Wright is a fraud. Not only that, but an all-out awful person that uses his fraud as a pretense to willingly ruin people’s lives. He deserves whatever is coming to him. Or, just to be forgotten. Now that this is over, I might become more active in bitcoin development again. No promises though. The last few years have been difficult for me, for this reason and others. But it absolutely helps to have this out of the way. This is not only a win for bitcoin, but for open source development in general. It’s good to remind copyright trolls that even if they have enormous financial backing and the willingness to forge pile after pile of documents, they will lose. Here’s a copy of the whitepaper to celebrate: bitcoin.pdf (SHA256 b1674191a88ec5cdd733e4240a81803105dc412d6c6708d53ab94fc248f4f553). Written on March 19, 2024 |

|

|

|

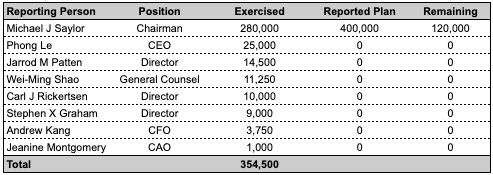

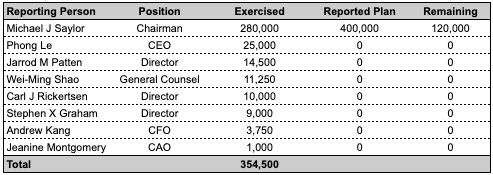

The guy you are quoting is an idiot. Saylor is selling MSTR options that he got 10 years ago that will otherwise expire. 5000 shares per day in Q1. Saylor has been fully transparent about this in their Q3 financial results. He buys bitcoin privately with the proceeds.

Nice to hear that. Do you have a source for this information? I was blaming MS because he was selling shares, instead of Bitcoin he was telling everyone that shares would perform better than Bitcoin. Of course, if these shares are the result of options exercise this changes the framework a little bit, even if he can exercise the option and remain long the stocks without selling those. I did provide the source. But to be more specific @49:18:  https://www.microstrategy.com/investor-relations https://www.microstrategy.com/investor-relationsMore details in the 10Q on page 77 (Nov 1, 2023): Rule 10b5-1 Information

On September 19, 2023, Michael J. Saylor, the Chairman of our Board of Directors and our Executive Chairman, entered into a 10b5-1

trading plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) of the Exchange Act with respect to the sale

of up to 400,000 shares of our Class A common stock underlying a vested stock option, which expires if unexercised on April 30, 2024.

Under this trading plan, on each trading day from January 2, 2024 to April 25, 2024, Mr. Saylor plans to exercise and sell 5,000 shares

with respect to the stock option, subject to a minimum price condition. To the extent less than 5,000 shares are exercised and sold on a

given trading day, the balance can be added to the number of shares exercised and sold on any future trading day up to and including

April 26, 2024, which is the last date on which shares may be exercised and sold under the plan.

https://assets.contentstack.io/v3/assets/bltb564490bc5201f31/blt4bfd39c423aa82dc/6544de43a6f13604076c86e4/form-10-q_11-01-2023.pdf |

|

|

|

^ [...] Saylor is selling MSTR options that he got 10 years ago that will otherwise expire. 5000 shares per day in Q1. Saylor has been fully transparent about this in their Q4 financial results. He buys bitcoin privately with the proceeds.

"Here is the YTD overview of the options exercised by the $MSTR executives and officers. Saylor has 120,000 left to exercise from his current award. 24 trading days left of his 5,000 a day exercise activity:"  https://x.com/BenWerkman/status/1771612423142707239 https://x.com/BenWerkman/status/1771612423142707239 |

|

|

|

For sure, you (UnDerDoG81) seem to be inspired to sell based on emotions and possibly greed rather than logic.

Good luck with that.

Seems he has no clue about how the market works and simply relies on the price movement rather than logics behind it, no doubt most persons come to the bitcoin market only during bull run. Glad, you share insights on this. It is a correct notion to think that most people come to Bitcoin during bull runs and FOMO in and that in fact shows that price movement and emotion are intrinsically linked. Thus you need to do the opposite of the emotive crowd. In which case I'm not so sure UnDerDoG81 has it wrong necessarily. We have seen many cases in which we are waiting on X, now the halving, only for that to turn out to be a big old nothing burger and we just slide down. "Logic" tells us that with the massive ETF inflow and the halving we should see 100K. But it also won't surprise me that we first dump and get to 100K next year instead. It doesn't matter when exactly, the outcome is inevitable. And the mind adjusts quickly: soon people hope to be able to buy the sub $100k dip. |

|

|

|

|