bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

April 10, 2024, 11:14:58 AM |

|

I was thinking about the following hypothetical the other day:

Let's assume that bitcoin goes to 100-300K (let's say, 200K average) this cycle and somewhere along the line you sell a substantial % to invest in property, luxuries, etc ( whichever you choose).

In 10 years afterwards, bitcoin goes to 5 mil, which means that you only "captured" just 4% of the potential value.

How would you feel about it? I guess, it would also depend on the remainder (that you didn't sell), but still.

Personally, I know that years later, I am not particularly fond of my decisions to sell AMZN, AAPL and TSLA early, even though I made very nice gains on them.

Sometimes, I consider these occurancies as my investment follies, but, again, you cannot be 100% efficient.

Of course, it is possible to NEVER sell btc and, basically, put this decision on the shoulders of descendants, but you cannot guarantee that they would be wise about it, right?

At least, I can't.

At some point, I would have to start to spend btc and this point is coming relatively soon.

Alas, to spend even a relatively small amount of btc on things like kitchen remodeling causes a bit of mixed feelings on my part as I contemplate the scenarios described above.

That could be one expensive kitchen 5-10 years down the road.

Withdrawals from IRA are taxable and I put all my stables back into the market during 2023.

I would probably do a mix of "things", but don't want to take on HELOC or anything like this.

Decisions, decisions...

Borrow against your bitcoin, no capital gains tax either. That is how rich people do it I am reading. Now I would not trust some random new startup to facilitate this but fine against IBIT in your brokerage account. sounds like a not-your-keys-not-your-coins situation to me... What, you selling your corn including covering for CGT? |

|

|

|

|

|

|

|

|

|

|

|

No Gods or Kings. Only Bitcoin

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

April 10, 2024, 12:01:17 PM |

|

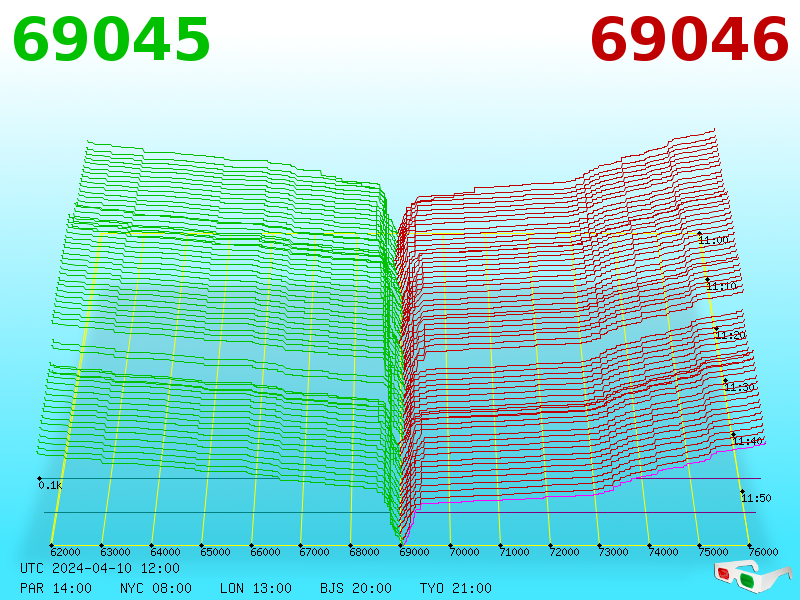

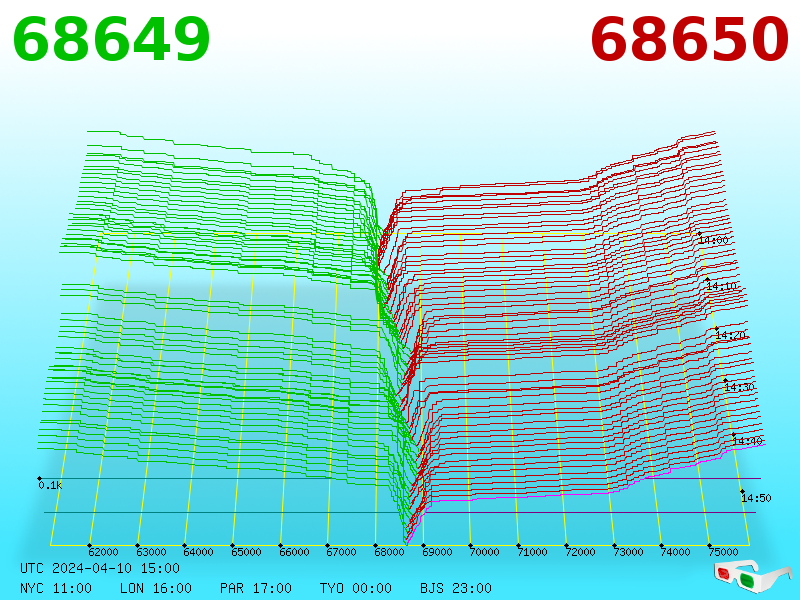

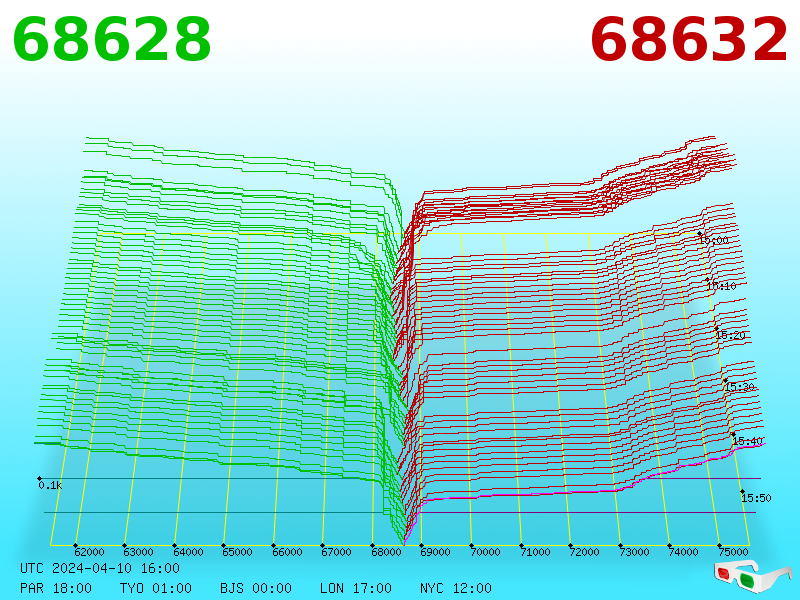

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7972

|

|

April 10, 2024, 12:35:01 PM |

|

|

|

|

|

|

somac.

Legendary

Offline Offline

Activity: 2050

Merit: 1184

Never selling

|

|

April 10, 2024, 12:36:04 PM |

|

Bit of movement on the old FX crosses right there. Bitcoin has actually taken it pretty well, so far at least.

Don't know why the CPI was such a shock to be honest.

|

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

https://www.newsbtc.com/news/bitcoin/drivers-bitcoin-price-crash/Here Are The Drivers Behind The Bitcoin Price Crash To $68,000

Scott Matherson by Scott Matherson April 10, 2024 in Bitcoin Reading Time: 3 mins read

Bitcoin has again experienced a price decline since briefly climbing above the $72,000 mark on April 8. This price dip is believed to be due to a couple of factors, which no doubt present a bearish outlook for the flagship crypto.

Inflation Data Expected To Come In Hot

The March Consumer Price Index (CPI) data is scheduled to be released on April 10. Some market experts predict that the report will show a rise in overall inflation. This could lead to the Federal Reserve taking a hawkish stance on interest rates, negatively impacting Bitcoin’s price and the broader crypto market.

This would explain why Bitcoin’s price has declined lately, as crypto investors remain on the sidelines ahead of the CPI report. However, if the inflation figures come in favorable, this could restore investors’ confidence in the economic situation and provide a much-needed bullish outlook for the crypto market.

Also, considering that January and February’s inflation data exceeded expectations, it is necessary to highlight what last month’s data exceeding expectations could mean in the long term. So far, the Fed has continued to hold interest rates steady at about 5.3%, and there was even optimism at the beginning of the year that there could be rate cuts at some point this year.

However, with inflation continuing to stay well above the Central Bank’s target of 2%, there is a growing feeling that they might be forced to take drastic measures at some point. That is ultimately not good for Bitcoin’s price, especially since different crypto analysts gave bullish predictions partly based on their assumption that there would be several rate cuts this year.

Spot Bitcoin ETFs Are Back In The Red

The Spot Bitcoin ETFs have also contributed to Bitcoin’s recent decline. These investment funds experienced a net outflow on April 8 and 9, leading to a significant Bitcoin dump on the market. Specifically, these outflows came from the Grayscale Bitcoin Trust (GBTC), which recorded an outflow of $303.3 million and $154.9 million on April 8 and 9, respectively.

Meanwhile, the other Spot Bitcoin ETFs have not recorded impressive inflows during this period, which shows their demand has slowed. For context, 6 out of the 10 Spot Bitcoin ETFs (excluding GBTC) recorded zero inflows on April 9, while 5 out of 10 recorded zero inflows on April 8. BlackRock’s iShares Bitcoin Trust (IBIT) also recorded a relatively low inflow of $21.3 million that day.

At the time of writing, Bitcoin is trading at around $69,300, down over 2% in the last 24 hours, according to data from CoinMarketCap.

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7795

'The right to privacy matters'

|

|

April 10, 2024, 12:53:39 PM |

|

https://www.newsbtc.com/news/bitcoin/drivers-bitcoin-price-crash/Here Are The Drivers Behind The Bitcoin Price Crash To $68,000

Scott Matherson by Scott Matherson April 10, 2024 in Bitcoin Reading Time: 3 mins read

Bitcoin has again experienced a price decline since briefly climbing above the $72,000 mark on April 8. This price dip is believed to be due to a couple of factors, which no doubt present a bearish outlook for the flagship crypto.

Inflation Data Expected To Come In Hot

The March Consumer Price Index (CPI) data is scheduled to be released on April 10. Some market experts predict that the report will show a rise in overall inflation. This could lead to the Federal Reserve taking a hawkish stance on interest rates, negatively impacting Bitcoin’s price and the broader crypto market.

This would explain why Bitcoin’s price has declined lately, as crypto investors remain on the sidelines ahead of the CPI report. However, if the inflation figures come in favorable, this could restore investors’ confidence in the economic situation and provide a much-needed bullish outlook for the crypto market.

Also, considering that January and February’s inflation data exceeded expectations, it is necessary to highlight what last month’s data exceeding expectations could mean in the long term. So far, the Fed has continued to hold interest rates steady at about 5.3%, and there was even optimism at the beginning of the year that there could be rate cuts at some point this year.

However, with inflation continuing to stay well above the Central Bank’s target of 2%, there is a growing feeling that they might be forced to take drastic measures at some point. That is ultimately not good for Bitcoin’s price, especially since different crypto analysts gave bullish predictions partly based on their assumption that there would be several rate cuts this year.

Spot Bitcoin ETFs Are Back In The Red

The Spot Bitcoin ETFs have also contributed to Bitcoin’s recent decline. These investment funds experienced a net outflow on April 8 and 9, leading to a significant Bitcoin dump on the market. Specifically, these outflows came from the Grayscale Bitcoin Trust (GBTC), which recorded an outflow of $303.3 million and $154.9 million on April 8 and 9, respectively.

Meanwhile, the other Spot Bitcoin ETFs have not recorded impressive inflows during this period, which shows their demand has slowed. For context, 6 out of the 10 Spot Bitcoin ETFs (excluding GBTC) recorded zero inflows on April 9, while 5 out of 10 recorded zero inflows on April 8. BlackRock’s iShares Bitcoin Trust (IBIT) also recorded a relatively low inflow of $21.3 million that day.

At the time of writing, Bitcoin is trading at around $69,300, down over 2% in the last 24 hours, according to data from CoinMarketCap.

good read my buddy is a 77 year old retired banker. he was telling me exactly what you posted above. ⬆️ my gut tells me rates go up or flat next time. my gut tells me they want the crash and burn the market. why so trump wins and the USA goes extremely right wing. I look at the left and the right as hulk hogan and the undertaker from wrestling. a big show designed to take your money. another example would the rock. a good is now a bad guy. either way you pay $$ to him. i think the rally to 100 💯 k will be postponed. |

|

|

|

|

El duderino_

Legendary

Online Online

Activity: 2492

Merit: 12015

BTC + Crossfit, living life.

|

|

April 10, 2024, 12:59:34 PM |

|

Despite a good sun

Keep disliking the red on my screen

#HodlTheHalvingIsNear

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

April 10, 2024, 01:01:15 PM |

|

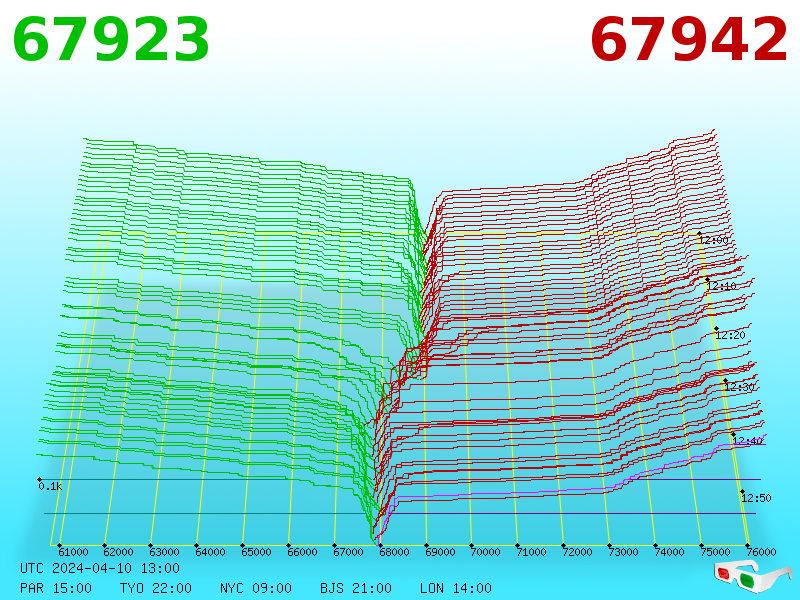

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

Lol at the headlines. Inflation is .1% above expectations.

And when you sell bitcoin because inflation is higher, you really don't get it.

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7795

'The right to privacy matters'

|

|

April 10, 2024, 01:37:56 PM |

|

Lol at the headlines. Inflation is .1% above expectations.

And when you sell bitcoin because inflation is higher, you really don't get it.

yep it looks like I will be getting some cheap corn today or tomorrow. |

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

April 10, 2024, 01:59:24 PM |

|

#random

Oh! If you guys are looking for a new PC/PS5 game to play, I'm totally addicted to Helldivers 2. What an incredible team-based game wow!

One of the best team-play shooters I've played since Counterstrike.

The violence and destruction is gratuitous!

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

April 10, 2024, 02:01:15 PM |

|

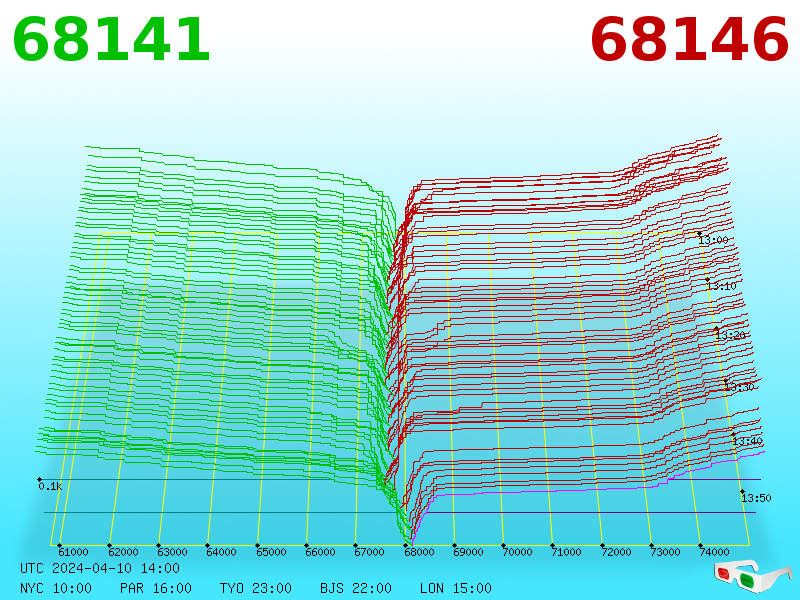

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

April 10, 2024, 02:10:07 PM |

|

Lol at the headlines. Inflation is .1% above expectations.

And when you sell bitcoin because inflation is higher, you really don't get it.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

April 10, 2024, 03:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

April 10, 2024, 04:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9519

#1 VIP Crypto Casino

|

|

April 10, 2024, 04:08:52 PM |

|

Vivek4real_US #Bitcoin ETFs took the price from $45K to 70K. That's an 80% increase within just 3 months. Expect a similar outcome from 🇨🇳 Asia approving #Bitcoin ETFs next week, along with halving. Are you mentally prepared for $100K?  https://x.com/vivek4real_/status/1778050635239166060 https://x.com/vivek4real_/status/1778050635239166060My body is ready.

|

|

|

|

|

LoyceV

Legendary

Offline Offline

Activity: 3290

Merit: 16577

Thick-Skinned Gang Leader and Golden Feather 2021

|

|

April 10, 2024, 04:42:17 PM |

|

The Bitcoin Price Crash To $68,000 LOL    |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9519

#1 VIP Crypto Casino

|

The Bitcoin Price Crash To $68,000 LOL    Oh no, buying at $150 per coin was such a mistake. Pls ser, muh familia. |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2066

$120000 in 2024 Confirmed

|

|

April 10, 2024, 04:58:09 PM |

|

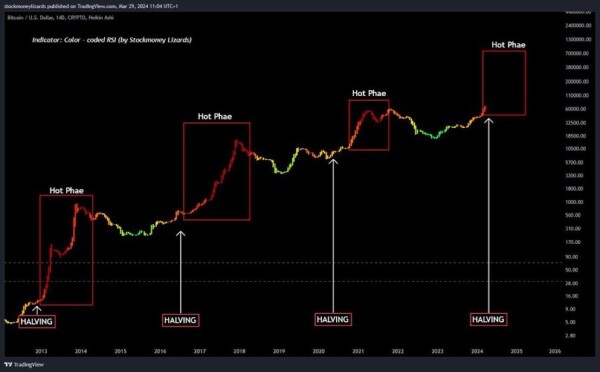

Good ol bitcoin

|

|

|

|

|

|

Poll

Poll