What's that casinos actual monthly revenue? If you could answer that, you could answer how much is being bought and being burned.

A big casino with big business and good profit will be able to assign part of their profit for buy back and burn program. They need to have good profit, then make decision to assign some percent of profit for this program. Big or small fund for buy back and burn program mainly depends on their business income and profit. If Shuffle can provide their users information, like you are discussing, on their user dashboard, it will be very helpful. I don't know Shuffle team have this information for users to access publicly with their accounts and dashboards or only release this information in regular report like weekly, monthly or quarterly. The best is allow user to have it anytime, permissionless through a dash board. If they don't have it at the moment, they can consider to build it. I was merely asking avp2306 a rhetorical question to make him understand that Shuffle and the casino he mentioned, BetFury, are different. There might be a situation when one casino token's market conditions may not be as good as another casino's token because of their financial performance. Shuffle and BeFury may be the same, but the are definitely NOT the same company. |

|

|

|

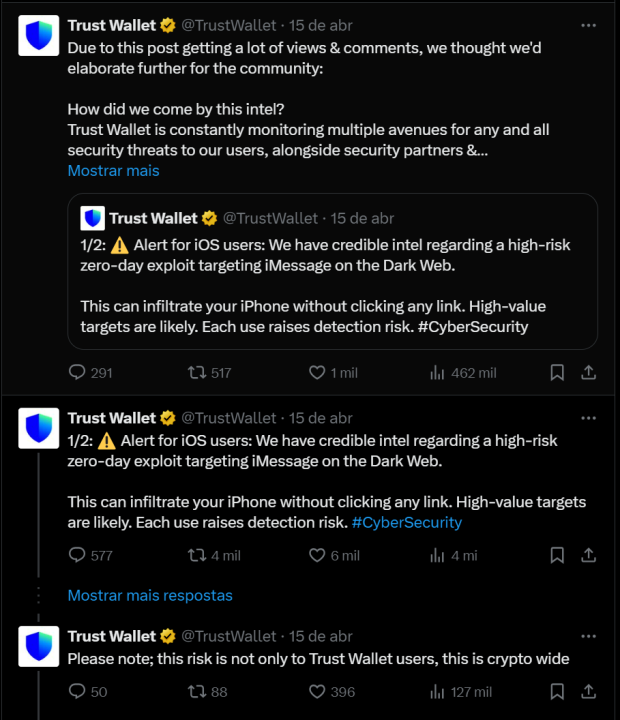

👀 There was a user in the forum who joked that if you buy an Apple smart phone, you'll be spied on by the CIA and if you buy a Huwawei smart phone, you'll be spied on by China. But with all those discoveries of Zero Day exploits in Apple products, there's probably some truth that these companies are infiltrated and that their products are bugged, no? Tin-foil hats on. |

|

|

|

Can you explain how do you see that potentially killing the market. Shuffle is literally buying and burning them from the market, so lower the price is, more they are going to burn, and no matter how the big the wall in the bottom would be, eventually there's just nothing left to sell with those prices.

Although that's true, I believe how much tokens are actually burned also depends on the casino's net gaming revenue. Plus you also have to account for market speculation. No one would care about the mechanism behind any token or buy the token if the DIP keeps on DIPPing. That will not be good for SHFL. I am assuming there's gaming revenue of course. Without it burnings aren't going to be effective. But if there is enough revenue, then market speculation can only be unhealthy, if it's artificially inflating the price, market speculation as sellers dumping will just be very healthy in the long run. But without bullish market speculation, or increase in current revenue, i have to admit that price could drop from here. As currently more tokens are being issued then burned. But i would totally welcome that as i will be grabbing this token as much as i can if this ever goes to $0.1. I believe sellers won't be dumping if casino gaming revenues are high because, - Higher burn rate. More tokens burned means more scarcity. More scarcity + Higher burn rate mean you should HODL.  - The cryptocurrency market is full of traders/speculators. More "traders/speculators" because casino gaming revenues are high = You should HODL.  I believe the only condition that will make SHFL's market valuation absolutely bearish is, low revenue + bear market. But that's probably a golden opportunity to buy. ¯\_(ツ)_/¯ Depends on the volume since for example https://coinmarketcap.com/currencies/betfury/ if they have 3.5 billions plus circulating and they burn few millions of token on some time then it will take a long time for people to feel that scarcity and even if there's burning of tokens happening many people didn't feel any effect of this actions done. That's why this actions is not appealing to investors anymore and they should find another solution to increase the interest of investor to accumulate their token. People want nowadays change and mostly people always seek for utility and better exchange where it listed that's why BFG and other casino coin didn't get much attention from a lot of investors. Hopefully SHFL will be still in good situation. But also I think devs know how to make a move to catch the interest of people since for sure they already scout the other casino tokens and provably perform more better than those which came first. What's that casinos actual monthly revenue? If you could answer that, you could answer how much is being bought and being burned. Because if the token has low market volume, then there's low demand, OK. BUT it's absolutely also undervalued if the token burn is concurrently high because casino's revenue is high. THAT'S a Golden Opportunity to buy at very discounted prices while the market hasn't made the adjustment ser. |

|

|

|

Thoughts in general?

"My thought". The NBA definitely chose the right player to make an example of in this matter. It brought the message/warning across, and it didn't give them a hard decision because he isn't a player whose name is spelled L-E-B-R-O-N. Because if it was actually a player such as Lebron or one of those "highly-endorsed" players, then we could truly expect the NBA to hide this matter from the public, OR have the player make a "public apology" + a suspension, but not a life-time ban. Maybe yes or no on this matter. It’s subjective because there’s rules about this specific matter which even popular names are not exempted to the punishment especially if there’s a player already received punishment on same violation. I doubt popular player will do idiotic move like this because they already have enough salary and good career. Only minor role player can be tempted to this since they feel that their salary is not worthy while they don’t enjoy the game that much because they have few ball time. But if Lebron caught doing this. The public will surely enraged if the punishment is not the same to Porter. Please get the context. I didn't say Lebron would do something like that. I'm merely saying that, in general, if someone becomes popular enough I believe that it would be very hard for the NBA to make the unpopular decision even if the person deserves it. Jontay Porter is the best situation for the NBA because they can make an example of him, and it would absolutely be NOT a loss to ban him from playing in the NBA for life. |

|

|

|

You're right, with an amount of his capital at $1,000,000, he should either be starting to diversify, OR if he wants to invest in just one asset - make that investment HODLing Bitcoin. And he didn't merely buy and held a shitcoin, he took a long position in a shitcoin perpetual contract WITH LEVERAGE. He may not be a newbie, but the mental insanity with what he did is real. He's a gambler, not a trader nor an investor.

If he puts his hopes on shitcoin then he is gambling for years, he is not making a healthy investment in a safe asset, say bitcoin, but he believes more inecoin in the hope that it can go up by using high leverage, this is the mistake they have been doing all year. I can't understand how not a beginner does this ridiculous action, logically if I have that much, I might play in shitcoin 10% of total assets or below, I don't want to go crazy because of his own actions, ahhh but he will regret his mentality. In my opinion, and although we should encourage people to buy the DIP and HODL Bitcoin, it's actually understandable if plebs with a very small amount of capital decide to gamble in a shitcoin + leverage. But for an investor who has $1,000,000 and insists on trading shitcoins, which are already volatile, and doing that with leverage then he is gambling with his mental insanity. Let's pretend he bought Bitcoin with an average price of $65,000 TODAY. Come back to this topic during 2025. I believe the investment would grow, and be worth at least $5,000,000 in fiat value. |

|

|

|

Although illegal, the Dark Markets that were built and that are currently being built, with Bitcoin as the currency to make that economy work is a very important Bitcoin use case in my opinion.

I thought they switched to actual-anonymous coins such as Monero a long time ago in the Dark Markets. You know with all the transparency Bitcoin has and with what happened to that Silkroad crap back in the days... They probably should, but because Bitcoin is a more liquid currency that's easier to obtain because it's more available and it's listed in ALL crypto exchanges, Dark Markets have no choice. If they don't accept Bitcoin, they will fall behind to those services that accept Bitcoin. Ransomware hackers use Bitcoin especially because of that fact. |

|

|

|

Thoughts in general?

"My thought". The NBA definitely chose the right player to make an example of in this matter. It brought the message/warning across, and it didn't give them a hard decision because he isn't a player whose name is spelled L-E-B-R-O-N. Because if it was actually a player such as Lebron or one of those "highly-endorsed" players, then we could truly expect the NBA to hide this matter from the public, OR have the player make a "public apology" + a suspension, but not a life-time ban. |

|

|

|

I agree with you a lot Princess but I don’t agree with you about shitcoins not having a future, the way you sound right now makes me believe you think all other coins aside Bitcoin are shitcoins.

Actually, aren't they? Shitcoins are shit. Whether they have been shit for a while, or new . Why is Bitcoin so different from shitcoin? Here's why. Bitcoin has value because it can be exchanged for and used in place of fiat currency, but it maintains a high exchange rate primarily because it is in demand by investors interested in the possibility of returns. . Emphasis on the last part. Bitcoin can easily be traded for cash or assets like gold - instantly and with incredibly low fees. This makes Bitcoin a great investment for people looking for short-term profit, as well as those considering long-term investment due to its high market demand. The total number of BTC ever to be in existence is capped at 21 million. This scarcity creates a sense of value and exclusivity, similar to precious metals like gold. Insofar as the demand for Bitcoin increases over time, the limited supply acts as a catalyst, driving its price higher and higher, do you get that? Bitcoin (BTC) Market cap $1.30 Trillion Current price $66.221 . Shitcoin 1(ETH) Market cap $390 Billion Current price $3,254 . ShitCoin2 (BNB) Market cap $86.3 Billion Current price $577 . Shitcoin 3(SOL) Market cap $69 Billion Current price $154.53 Investing in shitcoins is simply gambling. Shouldn't be referred to as investment. If you didn't get it, read it again. Any and every coin that isn't Bitcoin is shitty. Bitcoin has proven to be the one and only time and time again. That's actually not the right explanation on what makes a shitcoin a shitcoin. Or it's probably just people having different definitions on what shitcoins actually are. BUT if you ask me, shitcoins are those networks that have incentive structures that don't make sense. They may be sort of working today, but that doesn't mean there isn't an attack vector that could be exploited tomorrow. Those coins that you have in your list all use Proof of Stake. That itself makes POS networks open to attack vectors that could originate from flaws in its incentive-structure. |

|

|

|

Going back to the topic, what can Jerome Powell do to truly curb inflation and put it under control? It might be higher for longer for the rest of the year/cancel the three rate cuts in their schedule. They perhaps should also tighten more. There's a risk that a recession might happen, but if Powell doesn't do it, inflation itself might cause the recession. How many "soft landings" have there been in U.S. history?

If we remove the "normalizing the US regime" option, there isn't much left other than increasing the interest rates instead to try and battle inflation. In any case, things in the world are getting too unstable to predict anything anymore. On top of all that, China is acting like more of a weasel these days which makes things even more complicated and less predictable. Keep in mind that US regime sees China as its biggest threat and has majority of its resources focused on "battling" China. Ser, you are talking entirely about something else. I'm merely talking about Jerome Powell, CPI, and interest rates. The strategy of increasing interest rates to lower the inflation has a lot of prerequirements.

<snip>

The problem is, they have no idea what else to do! Playing with interest rates is the only thing they can come up with LOL but it has an ugly consequence called recession.

Assuming those prerequisites you ticked off are in fact necessary (and I'm not really doubting you), then yeah....the US has painted itself into an economic corner and may use the only tool it thinks it has at its disposal, interest rate adjustments. But while the latest number was higher than it has been for months, it still isn't anywhere near as high as it was from May 2021 until the end of 2022. Bleak as things may appear, I take some solace in that fact (even though I still think we're all fucked in the long term because of the constant money printing). It's no wonder precious metal prices have been skyrocketing as of late, and I'm surprised that hasn't been discussed more on bitcointalk. Gold has soared past its ATH if I'm not mistaken, but I would have expected a ton of " BTC vs. gold" or other related threads dealing with gold. Ah well. Stock up on seeds, water, and build that bunker if you haven't already. If not for yourself, then for your kids. But how high inflation currently is today isn't the point. The point is it's sticky, and because of that, the Federal Reserve can't cut the rates and pivot to QE if they actually need to. Jerome Powell's choices are, - Hike more, risk a recession and kill inflation. - Do nothing, and wait for inflation to cause the recession for him. Sooner or later something will break. |

|

|

|

US regime's "adventures" overseas > higher expenses > bigger budget deficit > trillions printed to cover it > high inflation > high interest rates > recession > catastrophe

I'm not entirely sure if you agree with Milton Friedman, but Inflation has ALWAYS been a monetary phenomenon, https://www.youtube.com/shorts/78dY6WeHJ44Inflation in the United States is not the fault of anyone else, but only the fault of the Federal Reserve and the people in charge of the government. Why? Because no one else has a money printer except the Federal Reserve, and no one else can control government spending except the Cabal. Exactly. As he said and I'm paraphrasing "Inflation is the result of rapid increase in the quantity of money". The way they're printing money now is just unbelievable. A trillion dollar every 100 days, that's crazy. As for the change, nothing short of a regime change in USA would suffice. But I already gave the "trail" of why they are printing money and where it is going. It is not that hard to find this chain/trail and at least try to do something at the source. For example the illegal US presence in Syria (illegal even according to US constitution since the gov. doesn't have congressional permission for it) is part of that adventure started by the war criminal Bush that has cost American taxpayers over $12 trillion and counting. It shouldn't be that hard to put a leash on the government. Last I checked Americans were still under the impression that they have democracy.  Real change? I believe not under the current system. Going back to the topic, what can Jerome Powell do to truly curb inflation and put it under control? It might be higher for longer for the rest of the year/cancel the three rate cuts in their schedule. They perhaps should also tighten more. There's a risk that a recession might happen, but if Powell doesn't do it, inflation itself might cause the recession. How many "soft landings" have there been in U.S. history? |

|

|

|

OK, so you're telling me all the times I ever got paid in Bitcoin for services/products, that wasn't a use?

All the times I ever used Bitcoin to purchase any sort of physical or digital item, that also wasn't a use?

Seems like the person who wrote the script for this video has extremely limited hands-on experience with Bitcoin. I don't even have an account on a single exchange anymore.

Although illegal, the Dark Markets that were built and that are currently being built, with Bitcoin as the currency to make that economy work is a very important Bitcoin use case in my opinion. There's also the development of the ransomware "market", another very important use case for Bitcoin. It helped generate new ways for hackers to get incentivized for finding software security vulnerabilities, and it forces software vendors to release faster security updates. But people in general are too stupid to see such developments. |

|

|

|

Most likely this person or trader isn't not experienced enough, because PEPE coin has been hyped by many people in crypt currency world and it became popular for a short time but look at its price now, and that is the wrong move that person does, risking too much money in future trade, thinking that he could doubled or earn a lot from a single trade which is looks like he didn't think it throughly and must be pressured to trade futures in order to not miss the opportunity but in reality that is the trap mindset of a trader, 2 things that person does, is he used futures and increasing the leverage which is a very big mistake if you are not experienced enough then stay away from futures because it can eat you whole if you make the wrong decision in that trade, imagine the regret and stress that persin is going through now, I don't want that feeling.

Inexperienced? He's been in crypto for over 7 years and has made $1M try if I do it probably won't reach that number, I think he has been experience so he can make a lot of money in crypto. But this is his own fault that I think all his assets are in PEPE not diversifying, then he traded futures without stop-loses or he forgot? I don't know what happened exactly. This is clearly a fatal mistake, the money that has been lost a lot is unlikely to come back again in a short time, but that's the risk in futures will be liquidated if not doing a good enough discipline. You're right, with an amount of his capital at $1,000,000, he should either be starting to diversify, OR if he wants to invest in just one asset - make that investment HODLing Bitcoin. And he didn't merely buy and held a shitcoin, he took a long position in a shitcoin perpetual contract WITH LEVERAGE. He may not be a newbie, but the mental insanity with what he did is real. He's a gambler, not a trader nor an investor. |

|

|

|

But from the viewpoint of the Ordinals/soon Runes users, if they have paid the fees and they're transactions are following the consensus rules, are they truly "exploiting" the system?

Yes. In the same way, you could try to copy-paste the whole chain from some altcoin into Bitcoin, by using "a coin in a coin" scheme. Or copy-paste all posts from bitcointalk and put it into Bitcoin transactions. Or even abandon GitHub, and copy-paste all commits behind "OP_SHA1 <commitHash> OP_EQUALVERIFY <developerPublicKey> OP_CHECKSIG". The purpose of Bitcoin is not to be "the global chain for every use case". Ser, I'm confused because none of what you have just said make sense. What matters is the protocol as is right NOW. Bitcoin is still a decentralized, permissionless, censorship-resistant protocol isn't it? If the Core developers propose a "fix" for the "bug", it would need to go through the proper process, unless UASF. As Satoshi said:

Piling every proof-of-work quorum system in the world into one dataset doesn't scale.

And then he also continues:

Bitcoin and BitDNS can be used separately. Users shouldn't have to download all of both to use one or the other. BitDNS users may not want to download everything the next several unrelated networks decide to pile in either.

So, if other use cases would use some separate chains for that data, it could be fine. They could build some honest, valuable protocol out of that. But the problem is, that they just decided not to, and abuse the Bitcoin network instead. And yet another sentence, from the same post:

The networks need to have separate fates. BitDNS users might be completely liberal about adding any large data features since relatively few domain registrars are needed, while Bitcoin users might get increasingly tyrannical about limiting the size of the chain so it's easy for lots of users and small devices.

Which means, that if you put all of those additional features on separate chains, then Bitcoin can still stay "easy for lots of users and small devices", and just take a role of "a notarization chain", providing Proof of Work to timestamp all other chains. But if you put "everything on Bitcoin" instead, then guess what: the current limits will take down existing payments. Because it is always a choice: confirm this payment, or this Ordinal. Which means, that if you allow using and abusing Bitcoin for everything else than the payment system, then it may stop being useful for payments, and lose its utility. I'm not saying Satoshi is wrong, plus currently there are solutions being built/have been built, but it's irrelevant because if users want to inscribe/etch digital artifacts in the blockchain, and if they are willing to pay for the fees/follow the consensus rules, then who could stop them? |

|

|

|

Can you explain how do you see that potentially killing the market. Shuffle is literally buying and burning them from the market, so lower the price is, more they are going to burn, and no matter how the big the wall in the bottom would be, eventually there's just nothing left to sell with those prices.

Although that's true, I believe how much tokens are actually burned also depends on the casino's net gaming revenue. Plus you also have to account for market speculation. No one would care about the mechanism behind any token or buy the token if the DIP keeps on DIPPing. That will not be good for SHFL. I am assuming there's gaming revenue of course. Without it burnings aren't going to be effective. But if there is enough revenue, then market speculation can only be unhealthy, if it's artificially inflating the price, market speculation as sellers dumping will just be very healthy in the long run. But without bullish market speculation, or increase in current revenue, i have to admit that price could drop from here. As currently more tokens are being issued then burned. But i would totally welcome that as i will be grabbing this token as much as i can if this ever goes to $0.1. I believe sellers won't be dumping if casino gaming revenues are high because, - Higher burn rate. More tokens burned means more scarcity. More scarcity + Higher burn rate mean you should HODL.  - The cryptocurrency market is full of traders/speculators. More "traders/speculators" because casino gaming revenues are high = You should HODL.  I believe the only condition that will make SHFL's market valuation absolutely bearish is, low revenue + bear market. But that's probably a golden opportunity to buy. ¯\_(ツ)_/¯ |

|

|

|

There's the clear inequity under current rules that one byte of data in an OP_RETURN output is worth 4WU and one byte in witness data as exploited by inscriptions is only 1WU. If you want data on the blockchain to be treated equally, current rules simply don't do it and I consider this a fault/bug and/or ongoing exploit.

But from the viewpoint of the Ordinals/soon Runes users, if they have paid the fees and they're transactions are following the consensus rules, are they truly "exploiting" the system? It's not their fault it's there. They're merely using it because the system allows them to. Plus if it wasn't Casey Rodarmor, it would be another developer that would use this "hack/bug" and make something from it.

I'm not so much following discussions of Core devs, but frankly, my perception is a disturbing unwillingness to tackle this weight unit inequity.

I believe that they should be careful. It might start a hash war again.

I don't need to like what's "inscribed" to the blockchain, it's not my business to judge or censor. Bitcoin is not made to judge or censor.

I don't like it too, it's making on-transactions a little more expensive to use for plebs like us. But what can we do? Literally ANYONE can use Bitcoin the way it allows us to if we pay the fees and follow the consensus rules. |

|

|

|

But what has changed in the world of ESports after 2018? Did the interest from the public who are not committed gaming followers go down, causing companies to reduce their budget for sponsorships as well? Or was it the companies that slowly decreased their budget first, causing for events to gave less marketing and therefore a lesser audience?

I believe after 2018, many of the fans of what you call the "Golden Era" might have grown up and started to have jobs, and other commitments.

Yes you make some valid points. eSports are not as timeless as other sports. You may still good some interest in your 30s, say 40s? But further? It would be hard. Plus many of the stars got really bored and started hating how stressful competitive gaming is. That's probably because video games evolve very quickly and what's popular today will not be very popular three years later. I used to hear about Dota here and Dota there, everyone was playing it. But currently I noticed that those people who were playing that before are now playing a mobile game in their smart phones. The speed of evolution in the video game industry causes its audience to quickly lose interest on the game before and start another interest to the game after.

But I think the real issue was that it was all make-believe. eSports were getting huge funding while not being profitable. The companies making the games were pushing it a lot and on top of that there were tons of sponsors. The economy of eSpoets had yet to find balance. I think some leagues continue to have funding issues and the payment for teams has been reduced drastically. I wonder if most of them are still profitable though. They come and go too fast these days. It seems as if even the best teams depend a lot on a handful of big sponsors that they might have been doomed without.

There's nothing make believe about business, but if it's not that profitable, then no business. |

|

|

|

Why is there not so much interest in this $50 raffle? Very strange. For example, I am not participating as I am not sure as I did not get an answer if the winner has to do KYC in case he wins. Anyway, who knows if he will get paid? So let's see when it's over. Good luck to all Ser, no one answers you because you have been trolling in the topic for weeks. No one is going to take you or your concerns seriously anymore. Plus for the question if a participant needs to do KYC in case he/she wins the raffle, casinos usually have a link for that that contain the terms and conditions. But if they didn't have one for that raffle, I would always assume that KYC is needed.to stop multi-accounting.

If you did not answer me, I could not answer you and show you my signature.Do you realize that you are contradicting yourself?No, I answered you because you're becoming very annoying, but OK, welcome to my ignore list.  |

|

|

|

Why is there not so much interest in this $50 raffle? Very strange. For example, I am not participating as I am not sure as I did not get an answer if the winner has to do KYC in case he wins. Anyway, who knows if he will get paid? So let's see when it's over. Good luck to all Ser, no one answers you because you have been trolling in the topic for weeks. No one is going to take you or your concerns seriously anymore. Plus for the question if a participant needs to do KYC in case he/she wins the raffle, casinos usually have a link for that that contain the terms and conditions. But if they didn't have one for that raffle, I would always assume that KYC is needed.to stop multi-accounting. |

|

|

|

I think right now we are experiencing the fall of eSports betting rather than the rise of it. Though 2019 to now so many good players resigned, became free agents or entire teams disbanded. It's ridiculous to see that for them there is better money in streaming rather than being in a team.

The sponsors and the gaming companies have reduced the money they invest in tournaments too much. Of course now there are more tournaments but the quality has reduced drastically along with the budget and the rewards. Many tournaments these days even don't have any rewards. The golden era was around 2013 to 2018 probably

But what has changed in the world of ESports after 2018? Did the interest from the public who are not committed gaming followers go down, causing companies to reduce their budget for sponsorships as well? Or was it the companies that slowly decreased their budget first, causing for events to gave less marketing and therefore a lesser audience? I believe after 2018, many of the fans of what you call the "Golden Era" might have grown up and started to have jobs, and other commitments. |

|

|

|

|