I'm not accusing OP of being a scammer, but BitcoinTalk is a target for scammers because many users in the forum have money, and they are held in crypto which can be moved around very easily.

Neither do I at the moment, although it smells like it. In other cases as soon as I saw the offer of the "system" I have tagged the OP as a scammer but in this case it has a certain plausibility as well as nuances, but certainly someone who knows how things work is not fooled by how he sells it (as if it were easy to earn thousands per month with his system). I always give people the benefit of the doubt, and we should also try to avoid calling people in the forum "scammers", unless proven guilty. Let's wait for someone else to try the service, and his/her "review". Hahaha. Although, and it's obvious, we should be very careful if the posters giving positive reviews were either brand new accounts or newbies. But did anyone go to his site? I didn't click the link. I probably should make another VM for clicking anything potentially suspicious. |

|

|

|

--Snip--

I was actually thinking about what you posted, and you may be right. Perhaps it shouldn't be how much a person could purchase now, and chase life-changing gains. Bitcoin is more about self-sovereign ownership of our own assets, freedom, and censorship-resistance, NOT entirely to get rich. Although getting rich and doing that with Bitcoin would be nice. Remembering the ethos upon which the foundation of Bitcoin was built on, then DCA, buy at any price NOW if you can is probably what people should do. Your first paragraph is especially a good framing Wind_FURY. In that regard, bitcoin provides us with a lot of various kinds of empowerment that is not merely about getting rich - even though getting rich seems to have had historically been an additional benefit that people have been receiving by building their BTC stash and mostly HODLing their BTC stash through many years. Some people only come for the get-rich part of bitcoin and they are focused on the getting rich part and not even giving any shits about the empowering part, and surely some of these people will evolve in their thinking and understanding of bitcoin, but some of them will never get over the mere monetary focus, which I suppose in several senses if still valid, even though it is incomplete and somewhat superficial way of thinking about and understanding bitcoin... .. even though as long as we keep building and holding our BTC, we can have very good chances of being able to end up doing both, too.. whether our original intentions had been exclusively on one or another, it still seems that both will continue to play out in the coming years.. and there are some who even say that it is inevitably based on math, even though many of us realize that it is not inevitable, yet bitcoin is a pretty amazingly designed system.. that is likely to persist and even to go up in value, which surely makes it more beneficial to any individuals to be sure to employ consistent, persistent, ongoing and perhaps even aggressive (without over doing it) accumulation strategies. I'm guilty of that. ¯\_(ツ)_/¯ I started my journey through "trading" shitcoins thinking I would get rich, lost some of my savings, then I made the decision to put almost 100% of my savings until 2019 into Bitcoin. It was greed that attracted me here, but as I researched and learned more and more about "my investment", it stopped entirely being just an "investment", but it also became a back up/fall back in case the entire financial system fails/in case I need censorship-resistant transactions if we end in a world of CBDCs We should stay for the ethos. |

|

|

|

That's probably a Doomsday way of looking at the situation, but perhaps that's the right way of looking at the situation because there are bad actors everywhere.

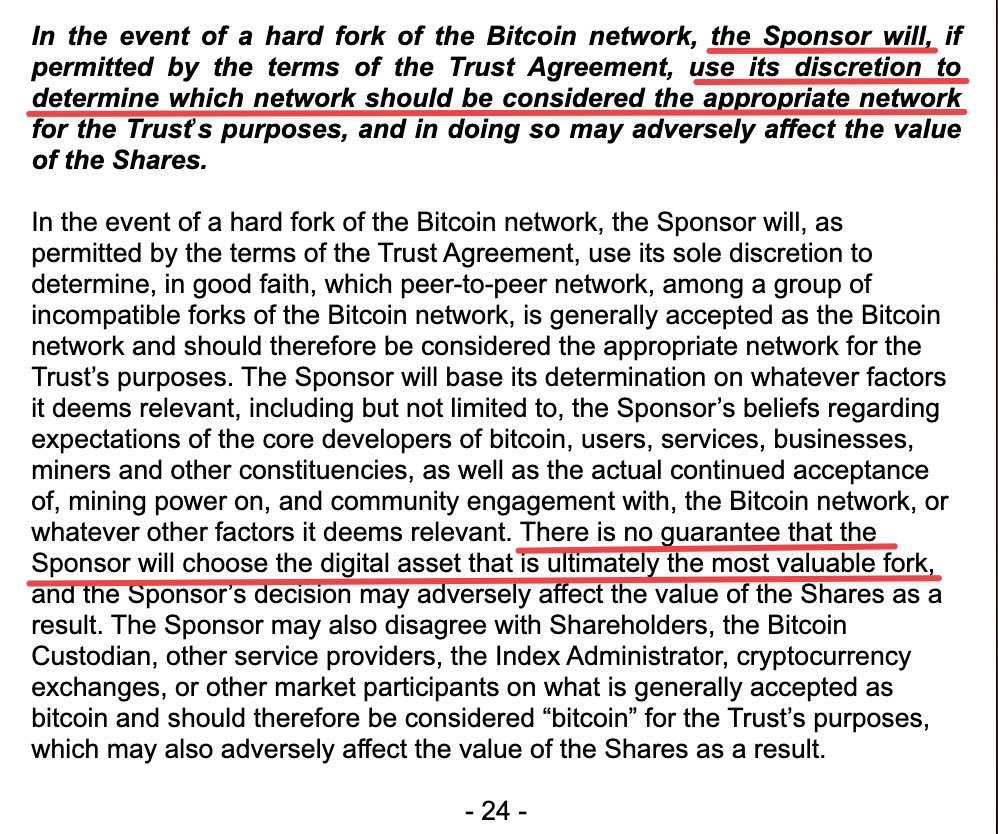

I don't worry too much about it, because of the "in good faith" clause. Not that I trust them, but I trust the American claim culture enough to know it would end up in a lawsuit if they screw their customers. What they said in their proposal, very clearly, is that they have the right to choose which fork they consider "Bitcoin". It won't necessarily be the fork with the highest value, or the fork what the community considers Bitcoin, or what their ETF holders consider "Bitcoin", OR what ANYONE ELSE considers as "Bitcoin". They are their own entity giving themselves the power to consider which fork will be "Bitcoin". They can use that to start a hash war in my opinion. |

|

|

|

Welcome news. This also lends credence to the notion that, rather than being a deliberate "attack", as some claim, this was largely just an inconsiderate use of resources. A near-miss of a " Tragedy of the commons", if you will. If they're genuinely trying to make their usage more efficient, this should eventually bring some resolution to the conflict. And is a far more constructive approach than looking to block or otherwise prevent people doing stuff. It obviously IS an inconsiderate use of resources, especially precious limited capital held in Bitcoin units. Although, the high fees that were paid to mint those NFT/BRC-20 were also good for the health of the network, because they were redistributed back to the Bitcoin economy through the miners selling those coins to pay for their expenses. If BRC-20 users keep trying to sustain the unsustainable by sending more money into the Bitcoin economy, then that's absolutely good for the growth of the network. |

|

|

|

Who is "the Sponsor" in this? Even if they act in good faith picking the correct chain, I'm missing details on what happens to the value in a possible Fork chain. When the BCH Fork happened, the value of the Forkcoin varied, but could have been sold for 10-20% of the Bitcoin value. If they keep that instead of sharing it with the ETF investors, it just adds to the list of reasons to keep your own keys. I raised that same concern before, but only a few wanted to share their thoughts and opinions. That part in BlackRock's proposal is dangerous because they, and the rest of the "ETF Cartel" composed of their fellow asset managers, could come together with a combined holding of more than 50% of the total supply in the future. I believe with such amount of the total supply, they could push their weight on the network and they might start making demands on what path of technical development Bitcoin should follow. Possibly start a hash war. That's probably a Doomsday way of looking at the situation, but perhaps that's the right way of looking at the situation because there are bad actors everywhere. |

|

|

|

I'm going to hold back for now but the way the OP is selling his system sounds pretty scammy to me. If it's so easy to have an ROI of between 3 and 5% per day, let's say 4%, multiplied by 30 days average of a month a 120% monthly return. But if we dig a little we will see that it is nowhere near as easy as the OP paints it, and khaled0111 and others have explained it well. All these systems that sound so wonderful are usually good only to fill the pocket of the one selling them. I knew this thread would be tough to post on a crypto forum...

A crypto forum but where many of us have been betting for over a decade, as well as knowing finance, statistics and scams. Plus OP didn't need to mention anything about "knowing" that it would be "tough to post" in a form such as BitcoinTalk. It would be tough to post anywhere, ESPECIALLY in a gambling forum, not BitcoinTalk, where anyone including OP would probably think twice before posting "a system". I'm not accusing OP of being a scammer, but BitcoinTalk is a target for scammers because many users in the forum have money, and they are held in crypto which can be moved around very easily. |

|

|

|

--Snip--

I was actually thinking about what you posted, and you may be right. Perhaps it shouldn't be how much a person could purchase now, and chase life-changing gains. Bitcoin is more about self-sovereign ownership of our own assets, freedom, and censorship-resistance, NOT entirely to get rich. Although getting rich and doing that with Bitcoin would be nice. Remembering the ethos upon which the foundation of Bitcoin was built on, then DCA, buy at any price NOW if you can is probably what people should do. |

|

|

|

Although it's an almost guaranteed profit, there are few problems with arbitrage betting (aka arbing)!

Usually, it's hard to find an opportunity like the one you mentioned in OP because of the difference between the odds.

Second, supposing you find one, you will need a huge bankroll to make a good profit not to mention that most casinos will limit your account after few wins.

Then and most importantly, many casinos consider arbing illegal and may ban your account if they find out about it.

I'm replying to an old post, but it's relevant. Plus OP said,

If you had a 20k bankroll you could make $1054 in a day betting these games. Then you would have to withdrawal all the money, wait for it to deposit in your bank and then re add to the sites. (or if you're lucky, half the bets will win on each site so you don't need to reconcile on each)

But how much of these opportunties does an arber actually have? Everyone would be doing it if it was truly "easy money", and if there are enough opportunties to be taken. Because logically, if there are more and more people arbing in sports-betting, then there would be less and less opportunties because the odds would become more and more efficient. |

|

|

|

Shuffle will have Birthday on February 1st. Don't forget to keep an eye on the platform and their ANN.

February 1st is shuffle birthday, will there be any surprises from the shuffle team on that date? Let's wait guys As posted in X few hours ago, there will be $10k wager race on February 1st. https://twitter.com/shufflecom/status/1750824664233136575It will be 24 hours race so it will be really quick race and of course we need to have decent bankroll if we want to participate in this birthday race. Not really sure how many winners will share the prize, but maybe you can try with few hundreds dollar if you are interested. But I believe that's going to be the problem. If you change your betting/gambling behavior just to win a few hundred dollar, you might lose more than a "few hundred". But it's probably good to play an hour or two extra than your normal schedule during February 1, but without changing your betting behavior in the site. But don't expect anything.  There will be 2 benefits if you can wager alot, first is the chance to win one of the prizes in the race and increased your VIP level to receive the revamped reward. Maybe there will be giveaway as well for birthday celebration, so lets just wait  That would definitely be a very welcome surprise. BUT one more time - Don't expect anything.  |

|

|

|

THE actual point is he's not a stupid person with below-average intelligence, and that might be not debatable. I'm also merely being fair, and we should always be giving people the benefit of the doubt. Bitcoin Cash SV flat-earthers are probably the exception.

But does Jamie Dimon hate Bitcoin? YES because the "idea of Bitcoin" is a threat to legacy finance. Is he stupid in anything about Bitcoin? YES, this man is absolutely misinformed.

I don't think intelligence enters the equation on this one. It's his morality I'd call into question. I suspect any misinformation he spreads is deliberate. He knows there won't be any consequences, because Bitcoin is not a company and there's no one to file libel or defamation cases against him. He can effectively say what he likes without fear of penalty and he knows there are people out there who will believe him. He's definitely not stupid, he's just a crook. And one of the most prolific crooks of the modern age at that. But as an intelliegent human being, he can't merely be stupid about it. He could use the Ponzi argument, the "it's destroying the environment" argument, or the "too volatile to be a currency" argument, BUT saying that "SATASHI" will return and print more coins or erase them all? That human being, ser, is absolutely misinformed. Doesn't he have an assistant doing all the research for him? He should probably hire Roger Ver as his top advisor for Bitcoin FUD. |

|

|

|

It depends on individuals, If someone invest 30% of his salary on bitcoin, I think no matter the emergency involved the remaining 70% will be enough for any situation that may arise

What if the person is underemployed? You started your statement well that it depends on individual and by that individual I want to believe you are referring to individual needs, his income and other factors such as his confidence in Bitcoin. We must acknowledge the peculiarity of wealth distribution, which have some people living in surplus and others barely able to feed. So their investment decision will be determined by their circumstances. The percentage should not be a factor here before some persons will draw conclusion that a particular percentage is what should be invested in Bitcoin. It depends entirely on the situation of the individual. How can you that to start a debate. Obviously, and logically, if the person is under-employed then his/her problem is not if/when/how to buy Bitcoin, but where and how to find his/her next job. Plus such a person would develop mental insanity with Bitcoin's volatility if all of his/her rent and shopping money is held Bitcoin. That person will be forced to sell. By under-employment I mean people whose salary is just enough for their basic needs and little savings but not enough to afford privileges like vacation, luxuries, even buying a house as they can only rent. Such people spend as much as 80% of their income on food, rent, school fees of children and normal healthcare but not serious surgeries. People at that stage easily resort to borrowing when they have serious emergencies which do not come always though. Unfortunately, majority of workers in my country fall into this category. Minimum wage in my country is about $30 with inflation at 29%, a country of 200 million people that have over 83 million people living below $2.5 per day. So my use of that word is a reflection of the realities on ground here. Under this circumstances, the best an individual can do is inject max 10% of their income to Bitcoin while setting up emergency fund with the remaining 10% since 80% is already expected to be used for basic needs. These are just my estimations, there could be variations. OK, then in that situation, I truly hope that they could save enough to buy and HODL enough to make life-changing ROI, OR they learn enough about Bitcoin, the network, and its ethos, then simply hold/use it for what it is. But practically speaking, it's very hard to have conviction to HODL, if the real world requires something from you, especially including your money saved in Bitcoin. It's also why the younger generation have the luxury of having more conviction. Because they have less responsibiities, it would be easier for them to keep large portions of their salaries without worrying for their needs in the real world.

I believe another critical stage is buying the DIPs of the bear market. It was there during 2019 and again during 2022. Currently if you are under-employed, it's probably better for you to save what you can and wait for a other cycle. OR you could get lucky and a Black Swan happens.

Under-employed can still do $10 per week and still be fine with his needs. That one is under-employed does not mean he has no way of saving a little, just that such a person cannot do certain things that money can do because of financial limitations but nothing beats humble beginning. As a matter of fact, they even need the investment more if they have to remedy their situation. Good luck to you, ser and I truly hope you make it. |

|

|

|

It depends on individuals, If someone invest 30% of his salary on bitcoin, I think no matter the emergency involved the remaining 70% will be enough for any situation that may arise

What if the person is underemployed? You started your statement well that it depends on individual and by that individual I want to believe you are referring to individual needs, his income and other factors such as his confidence in Bitcoin. We must acknowledge the peculiarity of wealth distribution, which have some people living in surplus and others barely able to feed. So their investment decision will be determined by their circumstances. The percentage should not be a factor here before some persons will draw conclusion that a particular percentage is what should be invested in Bitcoin. It depends entirely on the situation of the individual. How can you use that to start a debate. Obviously, and logically, if the person is under-employed then his/her problem is not if/when/how to buy Bitcoin, but where and how to find his/her next job. Plus such a person would develop mental insanity with Bitcoin's volatility if all of his/her rent and shopping money is held Bitcoin. That person will be forced to sell.

It is in the planning that the amount to be invested into be Bitcoin will be calculated. The planning is a critical stage because it covers the most important aspect of the investment process, enabling the investor to follow the best course of action.

I believe another critical stage is buying the DIPs of the bear market. It was there during 2019 and again during 2022. Currently if you are under-employed, it's probably better for you to save what you can and wait for a other cycle. OR you could get lucky and a Black Swan happens. |

|

|

|

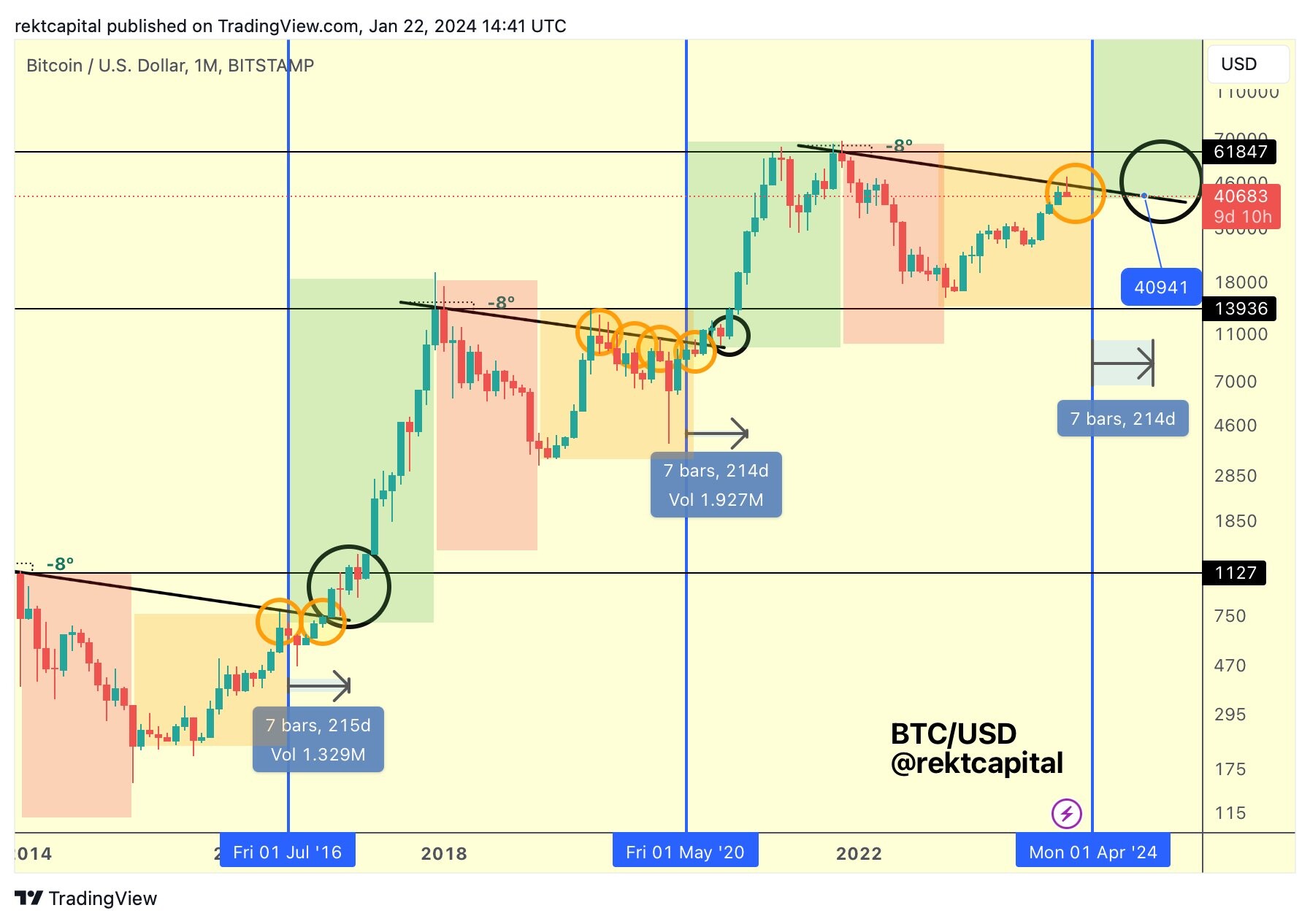

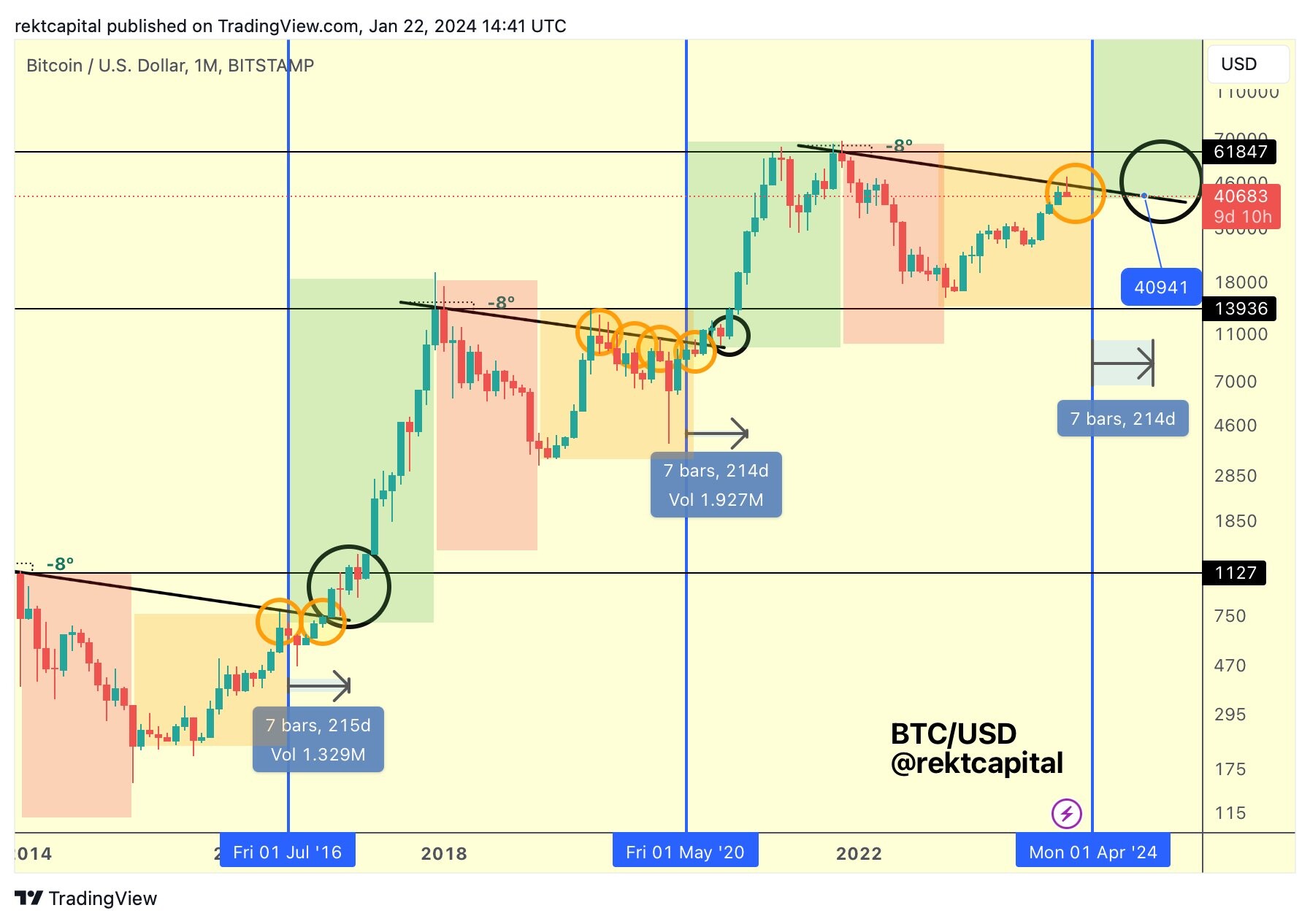

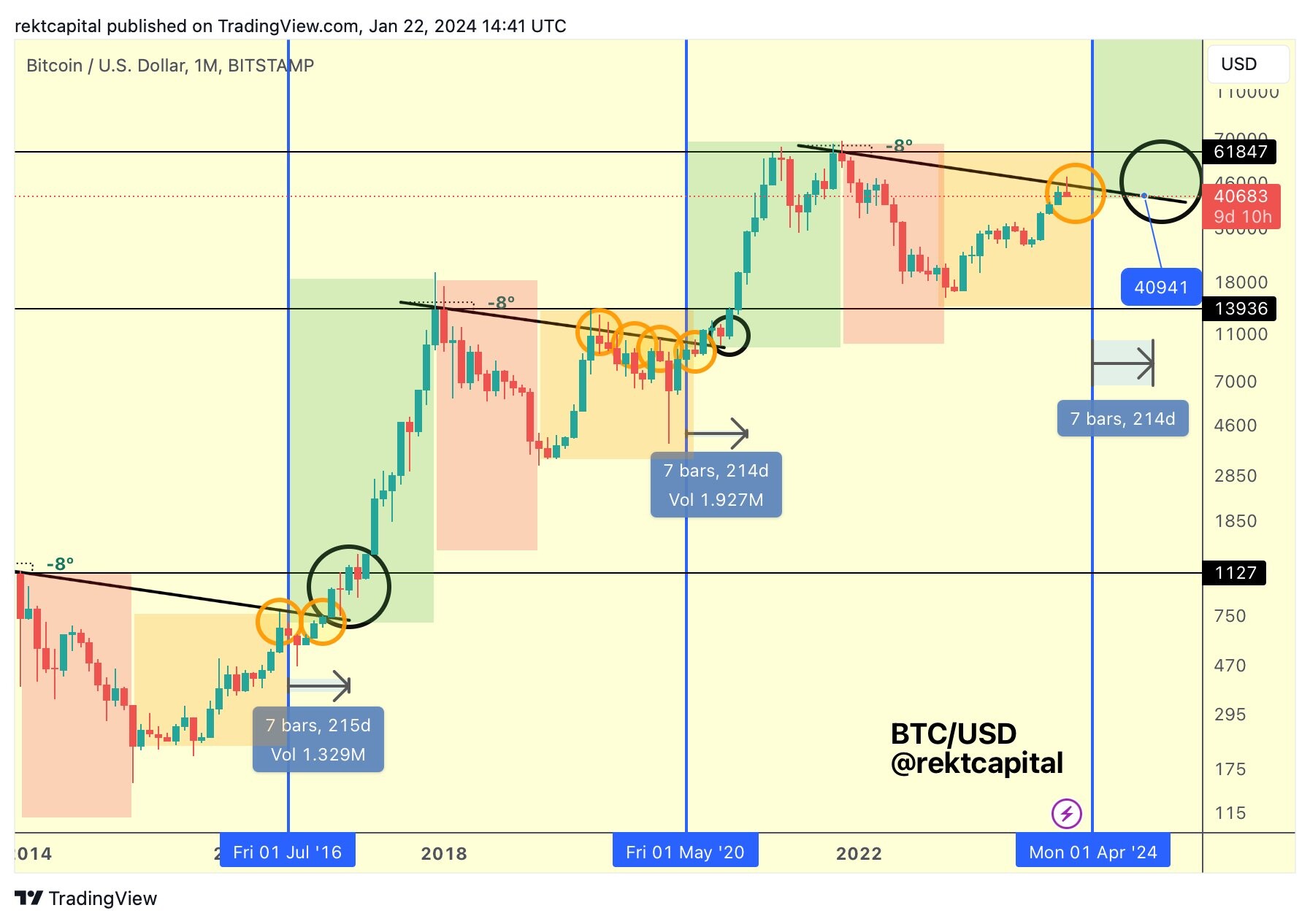

OP, we're in that part of the cycle where all DIPs should be welcomed to buy Bitcoin with a discount. It's the pre-halving phase, and your "mission should YOU choose to accept it" is to look for extra liquidity to buy these Bitcoin DIPs, especially if it's the BIG DIP, which I believe there's a high probability of happening. But it will be painful, and it will make everyone panic. But during 2025, the DIP will not be noticed in a Bitcoin chart that shows the price at six digits.  behind it because the crypto space is recognized for its volatility so if we find any dip we can consider a buying opportunity in the case of Bitcoin to fill our bags more. Indeed there maybe another opportunity of buying again before halving which is near. That would probably depend on the size of DIP. Because most of them, especially the smaller ones, might not have actual reasons behind them except that they are caused by market participants trading back and forth against one another. We also have the minor FUD which happens many times in Bitcoin every year. But saying that "every DIP doesn't have a strong reason" would be a mistake. The DIPs currently have a very strong reason behind it. DYOR on Grayscale Bitcoin Trust.  |

|

|

|

OP, we're in that part of the cycle where all DIPs should be welcomed to buy Bitcoin with a discount. It's the pre-halving phase, and your "mission should YOU choose to accept it" is to look for extra liquidity to buy these Bitcoin DIPs, especially if it's the BIG DIP, which I believe there's a high probability of happening. But it will be painful, and it will make everyone panic. But during 2025, the DIP will not be noticed in a Bitcoin chart that shows the price at six digits.  |

|

|

|

Majority of the sites have a similar looking UI and Stake was the one which came first in this aspect, most of the recently launched casinos have followed suit.

They have the same software provider, but the casinos use different skins and have different implementations. I'm not being biased, but IN MOBILE if you go to both sites, and compare Stake and Shuffle, it's obvious that they use one software provider, and although Stake has moderately a better UI, Shuffle has better implementation because you do less taps to use it compared to Stake. Try it. Well, less taps means less features I believe, cus If a casino has a lot of features, then that simply and automatically translate to more taps, which means, you tap more to access all the features or a good number of it. But for a Casino with less features, it's very understandable why it won't take more or alot of taps to navigate around such a casino and get things done, and the clear advantage here is that, things get done faster on a casino with less features, compare to the casino with more features.. Now, don't misunderstood or misquote me, I am not saying that shuffle has less features, I've never used or played on shuffle, so I think it will be inappropriate for me to judge, but what I said above is based on my observations in general terms, not talking about one casino in particular. Did you actually try it? I'm talking about one additional tap, but probably an unnecessary/avoidable action in the UI which could make it an annoying user experience. Use your iPad/tablet sideways for a wider view, then go to Stake. Tap from "Casino" to "Sports", then choose a sport. Next, go to Shuffle then do the same actions. The side panel of Shuffle doesn't go back and forth which makes it one tap lesser. A mere ONE TAP. That simple change made its UX better for me. |

|

|

|

Tesla still holds 9720 Bitcoin, https://bitcointreasuries.net/I believe Elon Musk's "FUD" was done because he owns an electric car company with a vision to use clean sustainable energy. He was probably trying to save the company from a public relations issue. Recent months, Elon Musk was quite silent when he was asked severap times about his opinion on Bitcoin and cryptocurrency market. It is different than his attitude in the past and maybe it is because he is planning to do something with X as a super app includes digital payment. He definitely needs to be silent about Bitcoin because he holds the the third largest wallet among business institutions that's not offering an ETF. Greta might reprimand him for investing in something that's "destryoing the environment".

Weeks ago he told that SpaceX still has big number of bitcoin but that company is not regulated to publicly report on their investment in Bitcoin, different than Tesla.

That's probably where he's hiding the wallet with the larger amount of Bitcoin? |

|

|

|

Grayscale Bitcoin "Trust" is still holding, NOT HODLing, more than 500,000 Bitcoin and they have been selling more aggressively since January 12. https://bitcointreasuries.net/entities/50I believe if the selling contintues, and the market panics, that might cause a pre-halving DIP, no? As plebs what do we do in this kind of situation? I can't tell you what to do with your money, but if you ask me it's = Buy the DIP, and HODL.   However, panic sales are not a new phenomenon in the Bitcoin market, but rather a well-known phenomenon that occurs regularly. Such panic sales before bitcoin halving have been seen many times in the past and we will face such panic sales before halving in the future as well. Grayscale sells 500k bitcoins in the bitcoin market creating a market bloody moment despite the temporary negative impact on the bitcoin market.This is expected to be the biggest dumping in the Bitcoin market before the halving. This may be the best time to invest in Bitcoin for those who are planning to invest in Bitcoin and hold it for the long term. Therefore, those who can use this panic sale and invest and hold Bitcoin at the highest DIP will have a 100% chance of getting potential profit after the halving. Is that chart saying that a DIP lower than $30,000 has higher probability than expected? That's currently impossible if you ask me. But if Grayscale continues selling until next month, and it starts a panic, then probably that could happen? If Gray-scale does not stop selling bitcoins, the panic market of bitcoins will never end, but if they continue to sell bitcoins, the market is expected to decline more in February than this month. After the approval of the Bitcoin Spot ETF, the Bitcoin market fell from $49,000 to below $40,000, which is a 20% drop, according to statistics. However, since the sale of gray-scale Bitcoin, the market has declined by 15 percent, according to statistics. If this selling trend continues in February, the Bitcoin market is expected to fall further below 36,000 and the market is predicted to decline by 7%. That's surely a probability, BUT as plebs what can we actually do while the whales make their moves that move the market either up or down? We can merely try to Buy the DIPs and look for small discounts from the market, OR if we're lucky, a flash-crash happens giving us another Golden Opportunity to buy a very big DIP. No one can predict when it will happen, but there's a higher probability than expected that it might happen. Grayscale Bitcoin Trust selling + "Higher For Longer" interest rates from legacy = ? ¯\_(ツ)_/¯ I'm not saying it absolutely will happen, I'm merely saying that it's an opportunity. |

|

|

|

Grayscale Bitcoin "Trust" is still holding, NOT HODLing, more than 500,000 Bitcoin and they have been selling more aggressively since January 12. https://bitcointreasuries.net/entities/50I believe if the selling contintues, and the market panics, that might cause a pre-halving DIP, no? As plebs what do we do in this kind of situation? I can't tell you what to do with your money, but if you ask me it's = Buy the DIP, and HODL.   However, panic sales are not a new phenomenon in the Bitcoin market, but rather a well-known phenomenon that occurs regularly. Such panic sales before bitcoin halving have been seen many times in the past and we will face such panic sales before halving in the future as well. Grayscale sells 500k bitcoins in the bitcoin market creating a market bloody moment despite the temporary negative impact on the bitcoin market.This is expected to be the biggest dumping in the Bitcoin market before the halving. This may be the best time to invest in Bitcoin for those who are planning to invest in Bitcoin and hold it for the long term. Therefore, those who can use this panic sale and invest and hold Bitcoin at the highest DIP will have a 100% chance of getting potential profit after the halving. Is that chart saying that a DIP lower than $30,000 has higher probability than expected? That's currently impossible if you ask me. But if Grayscale continues selling until next month, and it starts a panic, then probably that could happen? |

|

|

|

But does Jamie Dimon hate Bitcoin? YES because the "idea of Bitcoin" is a threat to legacy finance. Is he stupid in anything about Bitcoin? YES, this man is absolutely misinformed.

Fair enough. Regarding this part about such people "hating bitcoin", I'm not so sure. It is a possibility but it may also be that they just see Bitcoin as another tool to fill their pockets. Right now it benefits them to spread FUD about it and it could change in the future. But why FUD it? At the very minimum start a reasonable debate, not a stupid, misinformed statement saying that SATASHI will come back and either increase or erase the supply.

Remember Musk? He did this in reverse. It benefited him to praise Bitcoin while it was going on and he had a stake in it and was making profit but when the profit stopped and he wanted to exit, he started spreading FUD. Then he did the same with a shitcoin called Dogecoin and made some money there too.

I'm almost certain that if JPM were allowed to open bitcoin accounts (like they do bank accounts) for customers and they saw a profit there, Dimon will start praising Bitcoin. After all it is all about making money for this type of people.

Tesla still holds 9720 Bitcoin, https://bitcointreasuries.net/I believe Elon Musk's "FUD" was done because he owns an electric car company with a vision to use clean sustainable energy. He was probably trying to save the company from a public relations issue. |

|

|

|

Grayscale Bitcoin "Trust" is still holding, NOT HODLing, more than 500,000 Bitcoin and they have been selling more aggressively since January 12. https://bitcointreasuries.net/entities/50I believe if the selling contintues, and the market panics, that might cause a pre-halving DIP, no? As plebs what do we do in this kind of situation? I can't tell you what to do with your money, but if you ask me it's = Buy the DIP, and HODL.  |

|

|

|

|