|

1021

|

Economy / Trading Discussion / Re: For newbies and plebs who want to self-study to become "traders"

|

on: August 02, 2023, 10:16:41 PM

|

I don't know. The person has to judge his own trading performance himself/herself. Because even though a person has a stable source of income but he/she consistently loses a part of his/her salary in "the passion for trading", then what would be the difference between that and losing money regularly in the casino playing Craps?

There are only two ways to judge our trading performance which go hand in hand, the first one is the money in our pockets, if at the end of our trading session we have more money than when we begun then this is a good sign, as people should trade for only one reason and that is to make money. The second criteria we need to use is the process which allowed to get those profits, after all if those profits come from a fortunate movement of the markets that saved us from losing money then we did something wrong and as such those results are not repeatable, however if those profits came from a deep analysis of the markets and we have backtested our strategy many times and those results fit what we can expect out of it, then we are doing things the right way and can expect more sessions like that on the future. I don't know how each and one of you judge your "trading performance", but I'm very confident that if your data is merely one year or two years or even also 3 years, it might not be large enough to "judge" how profitable you are in trading. There's a reason why professional traders back-test their trading strategy to 10 years. Plus my post was for plebs like me who might be doing under-capitalized trading and believing that they could out-trade the market consistently. It's like gambling in my opinion. When it comes on trying out to assess your trading capability then 1 year should really be enough or even on 6 months on doing trading. I'm a mere pleb, and I'm also just learning but I'm sorry, ser. I'm very VERY confident that isn't true. If you don't believe it, you can ask those traders and investors who have been in it long enough for their thoughts and opinions to matter. It's also just common-sense. Having just one year of good performance is not indicative of that person having a consistent winning career as an investor or a trader. There might be exceptions, but it isn't the usual. |

|

|

|

|

1022

|

Bitcoin / Bitcoin Discussion / Re: 51% attack

|

on: August 02, 2023, 11:50:24 AM

|

it still can't make invalid transactions into valid transactions. It can JUST censor transactions.

Can't they make a valid transaction invalid? Isn't it double spending? If anyone can censor transactions, the network won't be any more decentralized. My bad if I have written something wrong, that's what I know. I'm not saying that's going to happen though. Well, it doesn't make sense. Why would someone bother to attempt to do so by spending this huge amount in achieving this huge hash rate? No, because the full nodes validate ALL blocks and ALL transactions, and enforce the rules. If there's a mining pool that announces an invalid block, the full nodes in the network will know and not send it out, disallowing it from propagating around the network. |

|

|

|

|

1023

|

Economy / Economics / Re: The precondition for knowing when the Federal Reserve stops raising rates

|

on: August 02, 2023, 07:10:57 AM

|

As inflation has fallen to 3%, the period of rate hikes should end very soon. Yes, a 0.25% rate hike is now possible, but the Fed could make a surprise move by announcing a pause. In fact, they're talking about 2% - but it's not really 2%, right? So expect some surprises in the near future

Look at the blue line in the charts in OP. There never truly was a fall in inflation until a phase of high unemployment has already happened. Unemployment has currently remained very low, then that means demand is still right their in the U.S. economy, which could mean re-inflation if the Federal Reserve starts pausing rate hikes. Plus to those people who believe that the U.S. will escape a recession, read Fitch's downgrade, https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023That's a symptom of financial deterioration, and the effect of the U.S. government's debt burden. |

|

|

|

|

1024

|

Bitcoin / Bitcoin Discussion / Re: 51% attack

|

on: August 01, 2023, 03:11:12 PM

|

But was there any such attack on Bitcoin around that time?

As far as we know, no. Plus if there was, let's get the facts clear. There's a misstatement that's commonly accepted that if an entity "controls 51% or more of the total hashing power, that entity has total control over the Bitcoin network". That's actually wrong. An entity can have 100% of the total hashing power, but it still can't change the consensus rules and it still can't make invalid transactions into valid transactions. It can JUST censor transactions. |

|

|

|

|

1025

|

Economy / Economics / Re: Can CBDC users lose control of their money?

|

on: August 01, 2023, 02:42:56 PM

|

Maybe you can also learn more about why is the needs for decentralized digital currency and what government stand to achieve with their CBDC decision at last:

The US Congressman alerted for the need to place a ban over the use of the centralized bank digital currency (CBDC), Warren Davidson noted that CBDC is government new strategy to control finances and abuse the fairness in money distribution and utilization for their own benefits in other to have control over other people's financial asset.

There are concerns that the lack of necessary legislation could lead to a wave of CBDCs that banks or financial institutions could be free to launch. The state alone cannot work on developing and launching this type of currency without entering into formulas and agreements with other financial institutions and defining the powers of each party. In all analyzes and opinions, everyone raises the issue from the point of view of governments and legislators, due to the tacit conviction that users do not have the freedom of choice and therefore do not have the freedom to control their balances of those currencies since they are subject to the supervision of government control agencies. These currencies are the new face of fiat money and have nothing to do with the privacy or decentralization that characterizes cryptocurrencies. What's bad for the people's freedom to transact actually increases the need for financial assets that are built with censorship-resistance and permissionlessness in mind to help the individual become more ungovernable and self-sovereign. We can't just accept tyranny to rule over the world, no? If only there was such an asset invented.  |

|

|

|

|

1026

|

Economy / Speculation / Re: Buy the DIP, and HODL!

|

on: August 01, 2023, 02:27:24 PM

|

price-based strategy. That won't work if you truly want to HODL. You should have a time-based strategy.

Well despite having long-term perspectives in mind while buying Bitcoin, we must still put in mind that our entry price matters a lot because the buy price is what determines the level and time of profits, this is so because those that bought their first Bitcoin at all-time high price above $55,000-60k+ are going to wait longer before the records profits compared to those that bought bitcoin at a discounted price below $16,000-20k if bitcoin make any all-time high above the last ATH. Try to get the point of the post and what's being said. I'm not telling you to buy blindly at ANY price like a DCA-type of strategy. My own personal belief has always been wait for a DIP, and always bid LOW where you can find a discount. The debate for a time-based strategy is to continue HODLing despite making a mistake and having -50% in paper-losses in your investment. Some price-based investment strategies would have already sold at a loss because "price dictates" that such a strategy should keep losses small. I think for Bitcoin that might be the wrong approach. The devil is still in the details Wind_FURY.... because each of us likely have time-based considerations, but also just buying on the dip in itself is a price-based consideration. So, even though it does not hurt to throw out those ideas, each of us are likely attempting to weigh both types of considerations and to employ those into our overall approach to BTC whether it is in regards to the way that we accumulate BTC or in regards to the extent that we might consider various points that we might sell.. and sometimes we are going to have to consider both time and price at the same time, because if the BTC price shot up to $1 million within this calendar year, it might cause some folks to take some value off the table because the BTC price seems to be unsustainable to be shooting up so rapidly, but if the BTC price slowly goes up for the next 4-10 years and maybe it reaches $1 million in that time frame, and maybe it does not, but the mere passage of time, could well contribute to changes in our own personal ways of thinking about how we might want to manage our BTC portfolio, even if the BTC price reaches the same amount of $1 million, and we are not being irrational or panicking merely because we change our strategy based on the differences in the timeline that ends up playing out in those two different scenarios that I suggested that either of which could end up happening... But the whole point being how to avoid selling at the wrong time because every decision is price-based. IE some people would buy at $30,000 and decide to sell at $32,000 because there's "price resistance", then buying again at some price point and sell at another shortly after "because reasons". The other point for a time-based strategy is that, during bear markets = time-based, there are more opportunities in buying actual DIPs that might not DIP much further, giving the buyer a discount than buying blindly at any price point. |

|

|

|

|

1027

|

Economy / Trading Discussion / Re: For newbies and plebs who want to self-study to become "traders"

|

on: August 01, 2023, 07:28:21 AM

|

I don't know. The person has to judge his own trading performance himself/herself. Because even though a person has a stable source of income but he/she consistently loses a part of his/her salary in "the passion for trading", then what would be the difference between that and losing money regularly in the casino playing Craps?

There are only two ways to judge our trading performance which go hand in hand, the first one is the money in our pockets, if at the end of our trading session we have more money than when we begun then this is a good sign, as people should trade for only one reason and that is to make money. The second criteria we need to use is the process which allowed to get those profits, after all if those profits come from a fortunate movement of the markets that saved us from losing money then we did something wrong and as such those results are not repeatable, however if those profits came from a deep analysis of the markets and we have backtested our strategy many times and those results fit what we can expect out of it, then we are doing things the right way and can expect more sessions like that on the future. I don't know how each and one of you judge your "trading performance", but I'm very confident that if your data is merely one year or two years or even also 3 years, it might not be large enough to "judge" how profitable you are in trading. There's a reason why professional traders back-test their trading strategy to 10 years. Plus my post was for plebs like me who might be doing under-capitalized trading and believing that they could out-trade the market consistently. It's like gambling in my opinion. |

|

|

|

|

1028

|

Bitcoin / Development & Technical Discussion / Re: Proposal to Address Dormant Bitcoin:Recycling Lost Coins into the Mining Process

|

on: August 01, 2023, 07:12:36 AM

|

Could you provide example of sabotage?

Let's imagine a situation. The year is 2140. No one is using the first layer for transactions anymore. All transactions are conducted on something like Ark protocol. There are 100 Ark service providers collectively generating 100 transactions in each block. They set a fee of 1.20 satoshis per vByte in their transactions. Miners go out of business and stop producing blocks. Network difficulty drops dramatically, and Bitcoin ceases to be a reliable store of value. Wouldn't it be better to take unused coins and use them to incentivize miners to continue their business? I noticed many posters are trying to go around the hypothetical situation and question. Let's make internetional happy and give it a hypothetical answer.  For me the answer is definitely NO because it breaks blockchain immutability, one of Bitcoin's important social contracts. I believe once given a hard choice of "change or die", the community could come behind the consensus of removing the supply limit and choose to see the currency become inflationary to keep incentivizing the miners than break the concept of not your keys not your coins. I'm not judging OP, and what I'm going to say is nothing against him nor am I trying to offend him. BUT, I'm starting to believe that laughable topics such this are mere 4D Chess moves made to start a debate and see if it catches many people's attention. Perhaps "some people" hope to see some gaslighting in the discussions to happen? Haha.  What recycling of "dormant coins" actually does is KILL Bitcoin's immutability. Moderators should probably lock the topic and stop the naivety of the proposal. No, it's not that laughable at all. If we keep in mind that people don't take care of their wallets and use service like Ledger Recover, then we can say that number of lost bitcoins will grow in near future. At the same time, if demand on bitcoin tremendously rises, that will also mean that a lot of new people won't be able to keep wallet/coins safe and they'll lose them too. Imagine, Binance loses its reserves, which is about half a million bitcoins or hackers steal thousands of bitcoins multiple times but burn every proof, including wallet key/seed before their arrest? Everything can happen. OK, and do you think breaking Bitcoin's immutability is the answer? |

|

|

|

|

1029

|

Bitcoin / Bitcoin Discussion / Re: Lightning Network Observer

|

on: July 31, 2023, 10:51:31 PM

|

I'm sorry to disappoint you, frankandbeans. Growth and adoption might be slow, but it definitely hasn't "failed the test of time". Lightning Network Capacity has actually been growing year on year since 2018.

funny observation that you link a chart that IGNORED this last current month.. because.. capacity dropped in the last month by alot (so that just debunks YOUR "year on year" growth, becasue if you include all months of the year, you will see a drop)  Newbies and my fellow plebs, do you see how frankandbeans plays 4D Chess? It would sort of look like he's right, but the reason why the current month hasn't been recorded in the chart yet is because the month wasn't over the day I posted the link. July's data will be included when the month ends. PLUS it might be true, Lightning Capacity might have gone down by some percentage, but how can that disprove the growth of Lightning year on year since 2018? frankandbeans, I'll give you a hint = It doesn't. |

|

|

|

|

1030

|

Bitcoin / Bitcoin Discussion / Re: The blocksize war

|

on: July 31, 2023, 11:33:38 AM

|

even you just admitted they didnt even change the network magic..

because they didnt want or cause the split..

So your argument is BCH announced a hardork, officially stated the day it would go ahead and wrote the code to make it happen, because THEY DIDN'T WANT TO SPLIT? Is that the level of fuckwittery we're going with now? ill make it simple.. the segwit supporting groups changed code.. the non segwit supporting group did not change code.. so you cant say the segwit abstainers caused a fork

*facepalm* If Core devs hadn't been able to look at BCH's code repository, which they could see forked from their own repository, then they wouldn't have been able to see what network magic BCH was using. If you try to apply some logic for the first time in your life, you might comprehend that this means the BCH code existed before Core decided to take action to protect BTC users. Do I have to provide a link to the developer discussion about it again? Here you go: https://github.com/bitcoin/bitcoin/pull/10982BCH code clearly existed first. They caused it. There's no need to debate any further because frankandbeans is merely gaslighting. The big blockers narrative = they didn't want to split from the network but the Core Developers forced "the community", whoever that is -probably Roger Ver and his sockpuppets, to make that decision. THEN he makes the claim that BCash is the real Bitcoin because it's according to Satoshi's vision of a peer to peer electronic cash system.  What a drama queen. |

|

|

|

|

1031

|

Bitcoin / Bitcoin Discussion / Re: Lightning Network Observer

|

on: July 30, 2023, 04:45:29 PM

|

just get a drip of yourself and understand that lightning has failed the test of time, its time to move on, ask for something better. ask your gods to do something. (no 'ask' isnt an acronym for ass kiss)

not just kiss their ass, flatter them with compliments while they do other things sponsored by banking institutions, rather than the decentralised bitcoin community they should be taking care of

I'm sorry to disappoint you, frankandbeans. Growth and adoption might be slow, but it definitely hasn't "failed the test of time". Lightning Network Capacity has actually been growing year on year since 2018. https://bitcoinvisuals.com/ln-capacityIt's still early days, and I personally prefer slow but organic growth than the fast growth we see in many shitcoin networks that crash and burn in one year. |

|

|

|

|

1032

|

Bitcoin / Bitcoin Discussion / Re: The blocksize war - franky1 is an absolute piece of shit

|

on: July 30, 2023, 04:19:27 PM

|

But it's worth noting that blockchain data alone leaves out a significant detail. Intent. A hard fork proposal was announced by Bitmain prior to the activation of SegWit. This is all very well documented, but certain disinfomation agents like franky1 continue to sweep it under the rug because it doesn't fit their agenda or their attempts to distort history. The declaration was always there that a hardfork would take place if SegWit were likely to activate. And thus, BCH happened. Bitmain wanted nothing to do with SegWit because it was a threat to their business model. They were always going to pursue the existence of a blockchain where SegWit was not activated. See the ASICboost controversy for further detail. It's clearly a lie for franky1 to insinuate that the hardfork was anything to do with the method by which SegWit was activated. Whether it had been NYA, UASF or Core's original proposal, Bitmain would have been pushing for a hardfork regardless. But since franky1 is a sociopath, he will now proceed to come up with some more ridiculous technobabble about how his delusional version of history is somehow accurate (it isn't). I hope everyone enjoys the rest of this topic getting thoroughly derailed because franky1 is an obnoxious piece of shit who won't accept reality. He knows the facts, and he doesn't truly deny it. It's not about "accepting it or not", it's about playing 4D Chess and gaslighting people into questioning what the actual facts of actual reality is. It's really wicked. To a newbie, the wall of text full of techno-babble will look like, "Oh he probably is very smart", without verifying if all that he has been saying is true. To the newbies who are too lazy to DYOR, you should just look at franky1's trust-rating and read what gmaxwell and Achow said about him. |

|

|

|

|

1033

|

Economy / Speculation / Re: Buy the DIP, and HODL!

|

on: July 30, 2023, 09:48:50 AM

|

price-based strategy. That won't work if you truly want to HODL. You should have a time-based strategy.

Well despite having long-term perspectives in mind while buying Bitcoin, we must still put in mind that our entry price matters a lot because the buy price is what determines the level and time of profits, this is so because those that bought their first Bitcoin at all-time high price above $55,000-60k+ are going to wait longer before the records profits compared to those that bought bitcoin at a discounted price below $16,000-20k if bitcoin make any all-time high above the last ATH. Try to get the point of the post and what's being said. I'm not telling you to buy blindly at ANY price like a DCA-type of strategy. My own personal belief has always been wait for a DIP, and always bid LOW where you can find a discount. The debate for a time-based strategy is to continue HODLing despite making a mistake and having -50% in paper-losses in your investment. Some price-based investment strategies would have already sold at a loss because "price dictates" that such a strategy should keep losses small. I think for Bitcoin that might be the wrong approach. |

|

|

|

|

1034

|

Bitcoin / Development & Technical Discussion / Re: Proposal to Address Dormant Bitcoin:Recycling Lost Coins into the Mining Process

|

on: July 30, 2023, 07:45:08 AM

|

I'm not judging OP, and what I'm going to say is nothing against him nor am I trying to offend him. BUT, I'm starting to believe that laughable topics such this are mere 4D Chess moves made to start a debate and see if it catches many people's attention. Perhaps "some people" hope to see some gaslighting in the discussions to happen? Haha.  What recycling of "dormant coins" actually does is KILL Bitcoin's immutability. Moderators should probably lock the topic and stop the naivety of the proposal. |

|

|

|

|

1035

|

Economy / Trading Discussion / Re: For newbies and plebs who want to self-study to become "traders"

|

on: July 30, 2023, 07:22:01 AM

|

For under-capitalized plebs like many of us are, you won't have to find quality "trading resources". It would be a waste of our already limited capital. The best use for it is merely to buy the Bitcoin DIP, and HODLing it as a store of value, then DCA any additional capital that you earn. Plus instead of wasting your time in trading, just find a job, a second job, or other ways to earn extra money. you just hit the nail on the head. I appreciate your honest response to my question. I do know that not having a stable source of income while relying 100% on trading profits might not be the way to go for most people and it might mess up trading psychology since a new trader would have to choose between their empty stomach and withdrawing a part of their trading capital every time to survive. This isn't the ideal way to go. I do have some concerns: Plus instead of wasting your time in trading, just find a job, a second job, or other ways to earn extra money.

Someone with a stable source of income might just want a trading career or has a passion for trading and numbers. This wouldn't apply to them? I don't know. The person has to judge his own trading performance himself/herself. Because even though a person has a stable source of income but he/she consistently loses a part of his/her salary in "the passion for trading", then what would be the difference between that and losing money regularly in the casino playing Craps? |

|

|

|

|

1036

|

Bitcoin / Bitcoin Discussion / Re: The blocksize war

|

on: July 29, 2023, 10:37:00 AM

|

Hello. I am interested in learning about "The blocksize war".

I have been in Bitcoin since 2020, and therefore, I don't know the history before 2020. I know that it was a "debate" regarding the block size, but I want to read details about it.

I can google it, but I don't know who to trust. So, knowing that there are many knowledgeable people in this forum, could you tell me more about this period?

Of course, any relevant website, video, article is more than welcome.

Read "The Long Road To Segwit: How Bitcoin's Biggest Protocol Upgrade Became A Reality" by Aaron Van Wirdum. He's definitely the most trustworthy person you can find that wrote about the subject-matter. https://bitcoinmagazine.com/technical/the-long-road-to-segwit-how-bitcoins-biggest-protocol-upgrade-became-realityThat write up will give you the history, what caused the "Scaling Debate", the context why, and why the the Core Developers chose the path where we are today. Thank you. Plus be careful of those trolls and charlatans who will gaslight you and spread disinformation that will sort of look real and would look like they make some sense. When in doubt, you can always reach out to trustworthy people like Aaron Van Wirdum and others through Twitter. https://twitter.com/aaronvanw?lang=enSome of them will reply back, others won't, but it's important not to fall in the mind-trap of the Anti-Bitcoin-Trolls who will pretend to be Bitcoiners but are actually playing 4D Chess. Always reach out and good luck to your Bitcoin journey! |

|

|

|

|

1037

|

Economy / Speculation / Re: Buy the DIP, and HODL!

|

on: July 28, 2023, 02:41:03 PM

|

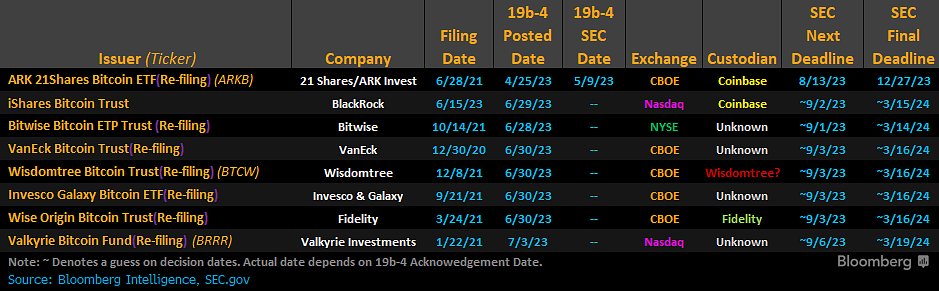

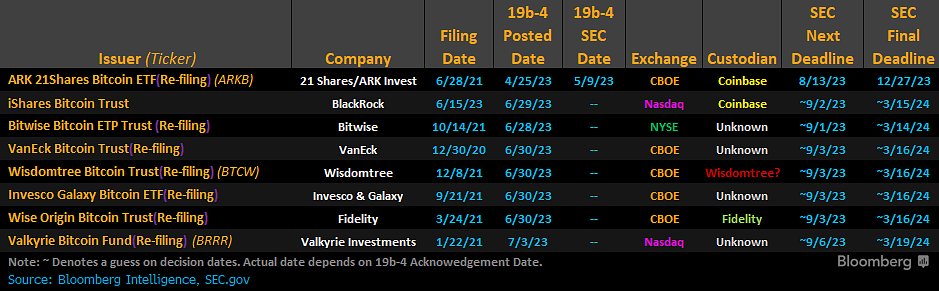

On a lighter topic, Valkyrie's ETF will be listed under the ticker "BRRR". Hahaha.

Haha, An ETF investor be like hey broo did you invested in BRRR.   . the ticker names are funny though, Well the other company ARK shares have a good ticker name (AKRB) which is better, but this BRRR doesn't make any sense. I doubt why would traditionally people about many news outlets are talking about. Saying these are the main targeted audience of these upcoming ETFs. Because when companies will get registered via governments such people will start to invest in it.  post link post linkI hope those traditional and well sophisticated people like this ticker BRRR   I should make some meme on it. I cited your post to show your image - but your image cut off some of the content.. so I reposted the full image from the twitter link that you provided.  This kind of news in regards to so many ETF applications pending should have some kind of upwards pressures on the BTC price, so if we are currently getting BTC price movement in the opposite direction, then it seems like good ideas to buy at various price points - and none of us can really know how much further the BTC price might dip.. or even if it is done dipping. If you do not have much if any BTC at all, then likely you should be erroring in the side of buying regularly rather than waiting for lower BTC prices, but if you have been buying BTC in the sub $35k territories, and even down into the sub-$20k territories for the last 15 months or so, then you might not feel as much urgency to buy BTC on the relatively smaller dips that are currently happening and bringing us down from $32k into the sub-$29k prices, so far... I agree with you. No one can predict for sure where the bottom of BTC will be. In my opinion, you should determine where your buy zone is, when the btc price reaches the target price area you start buying. You can divide into many buy zones with different weights. When you buy BTC at a good price, your psychology will be very stable when the price fluctuates up and down. And you will hold BTC to the target price you expect. Personally, a good indicator is the 200-Weekly Moving Average. If it crashes near it, touches it, or the best = actually crashes below it, our move as plebs is simple. Buy the DIP, and then have the long term conviction to HODL. I believe another problem many people have is they invest using a price-based strategy. That won't work if you truly want to HODL. You should have a time-based strategy. |

|

|

|

|

1038

|

Bitcoin / Bitcoin Discussion / Re: Lightning Network Observer

|

on: July 28, 2023, 02:22:23 PM

|

im not a bitcoin cash fan. i never used it i never even claimed their forked coins of the same key i used on bitcoin ever

No? But you merely claimed that Bitcoin "bilaterally split into Bitcoin Core and Bitcoin Cash", right? Therefore making Bitcoin Cash as rightful as having to be considered also Bitcoin? You further said that it's like the "Dollar". There's the U.S. Dollar, the Australian Dollar and the other "Dollars". What was that? Your attempt to make what is considered Bitcoin worth less?

you are the ultimate troll that are again spouting silly rhetoric trained on you by an idiot mentor of yours that makes you think those that dont treat core as god must be a fork coin lover

To be called a troll by you is an honor. That means I'm doing something right. But you, why would trustworthy developers like gmaxwell and Achow give you a negative trust-rating?

Your script is to convert "layer 2" to "subnetwork".

Your script is to convert "offchain" to "other networks".

Your script is to convert an inclusive and eloquent soft fork into "bloat".

He's gaslighting. It's actually to confuse the newbies reading our debates. It's so moronic that the forum vote for him as the "anti-hero", giving him recognition. It probably means that a majority of people in BitcoinTalk don't truly have a grasp of basic concepts about Bitcoin or what's happening around it. |

|

|

|

|

1039

|

Bitcoin / Bitcoin Discussion / Re: Lightning Network Observer

|

on: July 28, 2023, 08:39:48 AM

|

subnetworks have a NICHE but are not the solution. especially not this flawed subnetwork called LN that needs a complete rebuild or be scrapped and a fresh attempt made using different economic model.. rather then waiting another half decade for empty promises and pretend successes, even when the stats do not convey what they pretend

What's that? Haha. I know there are some smart developers who are right to criticize some aspects of the Lightning Network, but from a troll like you saying that it should be "scrapped"?  The developers working on Lightning are doing a better job in REAL scaling if you look and compare it with a coin like BCash. You laugh at the people in this forum because they support Lightning? Look at your community in BCash, believing that the solution to real scaling is by making blocks bigger and bigger forever, without any consideration for the limitations of bandwidth and hardware. |

|

|

|

|

1040

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 28, 2023, 06:13:27 AM

|

I respect your opinion and you have a point, but I can't entirely agree. Bitcoin is a blackhole for fiat currencies. If the Cabal behind the Central Banks print more, Bitcoin will absorb more and add to its market value. It's currently right there happening in front of us, and the ETFs will make the trajectory to six digits steeper and faster. Plus wait for QE when there's more liquidity available in the system. It might be "Oh My God It's Christmas" during March of 2025.

Wait? Would be great right if bitcoin drive its value and more and more people join the crypto industry right or I am missing something here so in my opinion Bitcoin ETF is great but anything also has advantages and disadvantages the big Disadvantage is those companies like BlackRock and other US companies will have the majority of Bitcoin maybe in total would be couple of percent of Bitcoin supply and the ETF buyer dont have real impact to Bitcoin worldI'm tired of wasting time making the same debate like a broken record. Read the hypothesis in OP about Gold's ETF and just connect the effect of an ETF in Bitcoin's own market.  ~snip~

I have no fascination. Simply noticed the large difference in networth between Chad Saylor and BlackRock. Larger networth = Possibly a larger investment into Bitcoin. It probably might be three times Saylor's investment by BlackRock? More if we consider the investments of the other major asset managers?

Of course, the difference in capital that you mention is incredible, because a few billion $ compared to $10 trillion managed by one company together with all other companies/funds make up tens of trillions of $ in value, and all this in a possible combination with investing in Bitcoin definitely tickles the imagination of anyone who thinks about it. The question of all questions is how much interest there is in investing in Bitcoin through such funds - is it 1%, 5% or maybe even 10% - are we talking about tens, hundreds of billions of $ or even trillions of $? I actually don't know, but if BlackRock was correctly and accurately described in this post, https://bitcointalk.org/index.php?topic=5459385.msg62598645#msg62598645Therefore I truly believe BlackRock will make the largest investment by an institution/asset manager in Bitcoin's history. How much is Chad Saylor's Bitcoin investment? 0.05% of Total Supply? |

|

|

|

|