|

321

|

Bitcoin / Bitcoin Discussion / Re: HODL bitcoins, you can do it! Look at HODL camp map to build up strong hands

|

on: February 05, 2024, 03:51:19 AM

|

Speaking of hodling, if I may emphasize, especially to those who are still thinking twice until now, time isn't on our side, folks. I may sound as if I'm inciting FOMO, but that's the reality. The train will leave at some point. To those who are putting off buying every time, you might indeed miss out the opportunity. Yeah, we can buy anytime. Yeah, we can buy small portions. But hodling is nothing else but about price appreciation.

Gone are the days when hodlers are easily rewarded x1000, x2000, x5000, and even higher growths. Gone are days when hodlers are rewarded with x100, x200 growths. Gone even are the days when x10, x20, x50 growths are within arm's reach to hodlers. Time will come even x3 and x5 will take many years.

I don't disagree with your overall point about the higher levels of BTC price appreciation are likely going to be much more difficult to achieve, but they still are not impossible...especially since bitcoin is about 1/20th of the market cap of gold, but bitcoin is about 1,000x better than gold, so bitcoin does likely have another 20,000x of price appreciation before reaching all of its likely addressable market and it could take 50-200 years for bitcoin to reach its total addressable market.. and it is not even guaranteed to make gold parity, eve though many folks do recognize bitcoin being in the ballpark of 1,000x better than gold. So whenever we invest into anything we can look at downside versus upside and also consider that even though bitcoin does not have as much upside potential, its investment thesis is likely stronger today than it has ever been, yet there are still a lot of folks who are barely even learning about bitcoin and barely even getting to the point of considering investing into it, whether it is through some kind of ETF or buying it directly.. and surely the ETF is the inferior product, yet many folks (besides already established bitcoiners) realize that direct ownership of bitcoin is the superior product. Indeed, Bitcoin is better than gold in many aspects, but I don't see it overtaking gold anytime soon. As a matter of fact, I don't think Bitcoin's market cap will come close to gold's in the next decade. The huge potential is there, of course, but it will certainly take a much longer term for a new hodler to gain what could be reached in a mere blink of an eye in the past. For now, 4 years is more or less enough for a Bitcoin investor to be of profit. To those who will come late, however, those who will finally do the buying at $100,000, $120,000, or $150,000, a price they deserve, 4 years might not be enough for their investment to even double. In which case, a simple business venture might fare better. |

|

|

|

|

322

|

Other / Beginners & Help / Re: Am I actually doing it right?

|

on: February 05, 2024, 02:55:35 AM

|

|

I guess you can very well answer your own question. You only need to take a look at those merited posts. Hundreds and hundreds of posts here earned merits. There must be something in them. And I guess you're capable enough of knowing it.

And while there's more than one reason for a post to deserve a merit, you must have noticed what's common among those users who have earned the most merits. BPIP.org has a list of the top merit earners on the forum. You can take a look at these users' profiles and their posts to have an idea of what it takes to earn merits.

|

|

|

|

|

323

|

Bitcoin / Bitcoin Discussion / Re: HODL bitcoins, you can do it! Look at HODL camp map to build up strong hands

|

on: February 04, 2024, 04:27:12 AM

|

|

Speaking of hodling, if I may emphasize, especially to those who are still thinking twice until now, time isn't on our side, folks. I may sound as if I'm inciting FOMO, but that's the reality. The train will leave at some point. To those who are putting off buying every time, you might indeed miss out the opportunity. Yeah, we can buy anytime. Yeah, we can buy small portions. But hodling is nothing else but about price appreciation.

Gone are the days when hodlers are easily rewarded x1000, x2000, x5000, and even higher growths. Gone are days when hodlers are rewarded with x100, x200 growths. Gone even are the days when x10, x20, x50 growths are within arm's reach to hodlers. Time will come even x3 and x5 will take many years.

|

|

|

|

|

324

|

Economy / Economics / Re: Another war in the Middle East could be dire for the economy

|

on: February 04, 2024, 03:31:26 AM

|

~snip~

I do not think that the peoples of that region are anarchists or love war by nature. I do not expect that anyone would like to bring war, devastation, and destruction to his country, and even if there were, they are few and it is not possible to generalize to all peoples. The peoples of that region are victims of the ambitions of the United States and the West on the one hand, and of Russia and Iran on the other hand, because of their competition for world sovereignty. The fact that that region is rich in oil and underground resources and has a distinctive strategic location in the heart of the world has made it a center for conflicts between world powers thirsty for wealth and influence. ~snip~

They lived in peace for hundreds of years before the imperialist thieves created puppet leaders in those regions to steal the riches of the region. I don't know if violence is part of them, but the theft is part of someone, and please don't insist, I won't tell you who is part of the theft... I'm not implying that the people in that region love war or are anarchists. All I'm saying is that the region has always struggled to achieve stability and peace. Conflict has always characterized its existence. There must be several factors in play including culture and ethnicity, religion, resources, and so on. Modern history might point to the greedy imperialists that sowed trouble for the sake of its rich resources. But even before America is born, even before there's The United Kingdom, even before Islam become popular, the region has already undergone terrible conflicts. Chaos in that part of the world didn't just happen during the past decades. It has been on and off for the past centuries or even millennia. Perhaps it's a factor that civilization started there and while other people in other parts of the world were busy hunting wild boars, Middle Eastern kingdoms and armies were already sophisticated and were already into conquests. |

|

|

|

|

325

|

Bitcoin / Bitcoin Discussion / Re: Can bitcoin be stolen?

|

on: February 03, 2024, 03:52:22 AM

|

As long as you own the keys and only you have access to them, it is impossible for your bitcoins to be "stolen" or "seized".

I disagree here: Bitcoin is basicly a specific type of electronic data, you need a computer to interact with Bitcoin. So if your computer is infected with some malware that sends your Bitcoin details to a thief your Bitcoins are gone. Just an example: Some Hacker buy rights for popular software from developers with a very good reputation, then make an updated version and include some malware that is able to access your bitcoin information, maybe from the clipboard, and Bye Bye your bitcoins..... So everytime you update any software you have this risk.... So forget "impossible" it is more or less easy to steal your Bitcoin.... There might always be risks, so impossible may be too much of a description but "more or less easy to steal your Bitcoin"? I guess that's as absurd as impossible. That's the other extreme. Although there is probably a way to steal Bitcoin even from air-gapped wallets-- researchers from Ben Gurion University finds it possible to steal data from air-gapped wallets through many ways like electromagnetic, ultrasonic waves, light, heat, and so on-- if it is "more or less easy to steal your Bitcoin", we would all have been stealing each other's Bitcoin today. Impossible and "more or less easy" are both exaggerations. |

|

|

|

|

326

|

Economy / Exchanges / Re: Beware of Crypto.com (difficulties cancelling debit card)

|

on: February 03, 2024, 02:48:30 AM

|

Anyway, if this is how hard it is to cancel your card, is it not a more practical option to just unstake and withdraw everything from your account and forget about your card? I'm not a user of Crypto.com's debit card but it seems this is the easier way out. And possibly a way to avoid cancelling fees, dormancy fees, and whatnot.

I can't unstake. I have over 4000 CRO staked, but the platform doesn't let me sell more than 20 CRO. I guess it's because they are attached to the debit card feature. Also, if I don't use the card during a year time period, there is an inactivity fee to be paid, so I don't know if they would use the staked CRO to charge this fee from. There would be a 50 euros fee as well to cancel the card, but that would be only in case I desired to recover the left balance to some address else, although it's not the case here. That's a significant amount. But has it already matured or surpassed the 6-month or 180-day lock-up period? That's basically one of the conditions of staked CRO to be withdrawn, right? Anyway, I think you better follow their advice and drain your card of everything, as in zero. In that way, you can avoid both inactivity fee and cancellation or closing fee. [1] If not, these sneaky scumbags might indeed dip into your staked CRO. That's almost $5 per month just for inactivity. I'm not sure of its complete terms and conditions, though.

[1] https://www.reddit.com/r/Crypto_com/comments/vrxtof/if_u_plan_to_not_use_cdc_card_think_of_inactivity/ |

|

|

|

|

327

|

Other / Beginners & Help / Re: Honeypot websites are dangerous for our privacy - BEWARE

|

on: February 03, 2024, 01:57:36 AM

|

That's indeed a big problem. And you're indeed raising a good warning. But what's the way forward then? I guess that should be the more interesting part. Otherwise, we end up just talking about a problem we don't have a solution to. How can everybody then beware of such sites? It's not possible to spot as a normal person, even experts might not know it because it's a sophisticated honeypot.

Because for most sites, it's not possible for normal people to spot if it's a known honeypot website or not. Isn't it troubling? So, should we just avoid the internet as much as possible? Or should we use VPN all the time? Or should we all shift to the use of TOR browsers? What would your advice be to minimize or perhaps to completely avoid exposure to these dangerous websites? |

|

|

|

|

328

|

Other / Beginners & Help / Re: Make reading a habit

|

on: February 03, 2024, 01:18:58 AM

|

|

Of course. It's 1+1=2. This is a forum. This isn't YouTube. This isn't Instagram. This isn't Spotify. Nobody signs up here to take a look at pictures or to watch videos or to listen to songs. People sign up here primarily to read. I assume nobody came here just to post. And it's impossible to make a reply without reading either.

Anyway, I've watched a number of interviews on the richest persons here in my country. They're very busy. Their days are all about traveling, meetings, and so on. But one thing that's common among them is that they all take time to read. Reading can't be underestimated. The most knowledgeable members here couldn't have been who they are if they despised reading.

|

|

|

|

|

329

|

Bitcoin / Bitcoin Discussion / Re: 📢 ₿ Bitcoin will replace Dollar? Even celeb venture capitalists are saying this

|

on: February 03, 2024, 12:52:16 AM

|

|

If I am to be realistic, I'd say that such a day is not in the horizon. It might take decades if not a century for the dollar to lose relevance. It takes no less than a whole paradigm shift for the dollar to end. For as long as money is based on fiat, the dollar will remain in existence. For as long as money is tied with the government, dollar is here to stay. Besides, dollar and fiat in general can transform into different forms to keep up with technological advances and to pursue inclusion.

|

|

|

|

|

330

|

Economy / Economics / Re: Business/Entrepreneurship.

|

on: February 02, 2024, 04:30:47 AM

|

|

They're generally the same. Entrepreneurs are basically businessmen. And many of those who call themselves entrepreneurs haven't actually started a new business idea. Many of them aren't doing business based on original innovations. They're doing something that's already done by others. But, yes, perhaps some of them add some personal touch.

I'd open whatever it is that seems perfect to make money based on whatever available resources I have. Investment has always been there. It's probably the way for me to make the right amount of capital to be able to start a business. As much as possible, I'd avoid risk.

|

|

|

|

|

331

|

Economy / Gambling discussion / Re: Rigging in sports:My Personal Perspective and discussion finding sus. sports

|

on: February 02, 2024, 02:22:23 AM

|

|

There's probably a lot more. What I've heard lately are ones that involved local teams. One is an Esport team in DOTA II which was banned by no less than Valve for being involved in game fixing. This was way back in 2021 during the Southeast Asian Tour. The team was Omega Esports. They were replaced by BOOM Esports as a result of the subsequent investigation. The other was in a basketball match in a local league here. In both, it was apparent that something was wrong.

|

|

|

|

|

332

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin Numerology +WTF

|

on: February 02, 2024, 01:38:11 AM

|

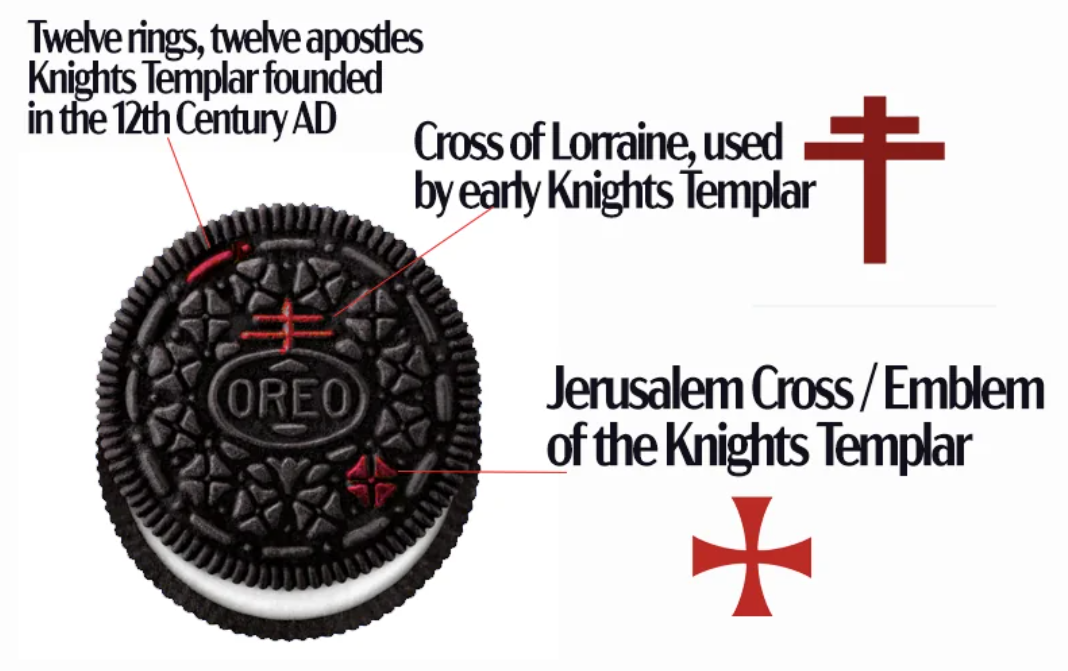

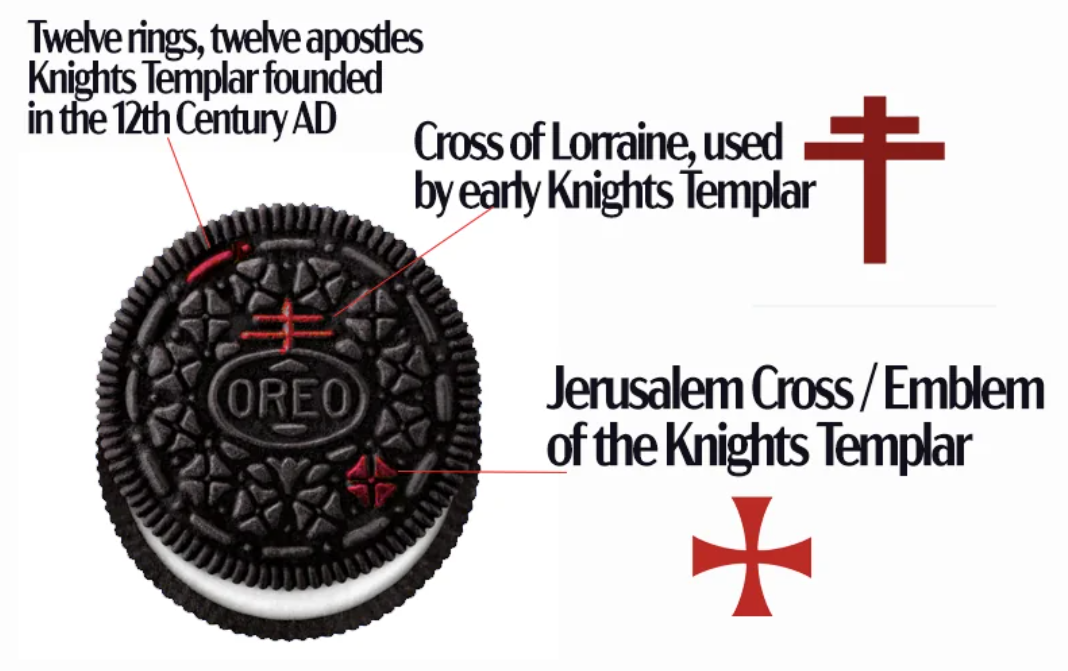

Crazy rather than interesting. What's interesting is the amount of time and effort that some people devote for this kind of thing. These people must have the luxury of time. I hope they will one day discover something that's truly worth it. In the meantime, those who are immersed and obsessed with numerology, astrology, feng shui, esoteric knowledge, alchemy, illuminati, and other WTF, can any of you check if the analysis of this one is correct? If it is, I won't eat it ever again.  https://www.reddit.com/r/insanepeoplefacebook/comments/knj3iu/oreos_are_just_a_false_flag_so_you_dont_discover/ https://www.reddit.com/r/insanepeoplefacebook/comments/knj3iu/oreos_are_just_a_false_flag_so_you_dont_discover/ https://br.ifunny.co/picture/freemason-satanic-cross-zodiac-wheel-oreo-cookie-double-choss-wht-T6PKzQz99 https://br.ifunny.co/picture/freemason-satanic-cross-zodiac-wheel-oreo-cookie-double-choss-wht-T6PKzQz99 |

|

|

|

|

333

|

Economy / Exchanges / Re: Beware of Crypto.com (difficulties cancelling debit card)

|

on: February 02, 2024, 12:57:22 AM

|

|

This is when you want to yell at whoever is at the other end of the line out of frustration, but you'd find it frustrating too because you realized you're dealing with a bot.

Anyway, if this is how hard it is to cancel your card, is it not a more practical option to just unstake and withdraw everything from your account and forget about your card? I'm not a user of Crypto.com's debit card but it seems this is the easier way out. And possibly a way to avoid cancelling fees, dormancy fees, and whatnot.

|

|

|

|

|

334

|

Bitcoin / Bitcoin Discussion / Re: The Psychology of Investing in Bitcoin

|

on: February 02, 2024, 12:16:07 AM

|

|

The feelings were strong when I was a newbie. I was easily swayed by Bitcoin's volatility. It was perhaps the reason why I wanted to try trading. The price was constantly changing all the time, and significantly at that. It was as if I had to react every time I check on the charts. And I had to do the checking almost every minute of the day. And then there were the worst of the bear seasons and the best of the bull runs where you only want to sell what you have, either due to panic or the fear that the price might fall the next day.

Fast forward several years later and there seems to be no sensation left. When you've been through all it all, whatever comes isn't that surprising anymore. You just look forward to the future.

|

|

|

|

|

335

|

Economy / Gambling discussion / Re: What's your multi-bet (paroli) strategy?

|

on: February 01, 2024, 04:09:35 AM

|

Usually, I group my bets when the odds are very low. I use very because even if the odds is 1.50-- and that's already low enough-- I still think grouping them together in a parlay remains highly risky. If the odds are like 1.20 or around that, that's probably best to group together in a multi-bet. Also, I think a 5-leg parlay should be the highest. That's more realistic than having so many legs. Less risk, although less return as well. Of course, if you already won 4 and the cash-out offer is already good enough, you might want to take that option. Sometimes you need to weigh the guaranteed prize versus risking it all for a bigger money. In the end, don't take my word for it. I'm not a profitable gambler.  You have a beautiful strategy that is focused on making money but your admittance of not being a profitable gambler makes me wonder what could be the problem. Could it be with the event selection or fate? I know that odds of 1.2 - 1.5 is easy to come by and even if the win rate is low, surely it will happen once in a while and the multiplier effect of the accumulator could have put you in profits. Maybe you could review your event selection, that could be the little fine tuning you need to give you edge in the business. A strategy can only achieve so much. Just like how some friends would have it in a game where their choice is the underdog: the game will still be played. The ball is round, in other words. I have parlay bets in the past in which the lowest odds was the one that failed, meaning the most favorite to win was the one that's lost. It can happen all the time. Underdogs can win, too. In a 5-leg parlay composed of huge favorites, one could result in an upset. It won't be surprising if it happens. That's why it's an option to cash-out especially if you've already won 4 out of 5. |

|

|

|

|

336

|

Economy / Economics / Re: richdad poordad has no more guide after achieving freedom

|

on: February 01, 2024, 02:59:30 AM

|

That book was a hit. It must have offered something to a lot of people, but if you ponder on the author's life, you would wonder whether he used that book as a guide in real life or he was simply a failure. Having said this, I don't think financially successful people are living their lives according to a handbook or some written guide. I doubt Elon and Jeff and Warren are doing things according to cash flow 101 by this person and cash flow 202 by that person.

It's actually weird to hear somebody looking for a guide like this. Surely, you must know what freedom is for you.

I recently came across a video of Grant Cardone where he talked about Robert Kiyosakiís book. He made some interesting comments, according to him Robert Kiyosaki didnít write the book. He also suggested that the key characters in the book; the Rich Dad and Poor Dad didnít exist and were concepts Kiyosaki came up with for the book. This is odd since the story was told as if it was a true life story of the author and I believe that was the reason why people were interested in the ideas of the book. I haven't read the book as I don't like such books. But reading Kiyosaki's small statements every now and then, it seems he has this inclination to speak before he thinks. I don't know if Cordone's accusation is true, but it could be, albeit purely based on Kiyosaki's impression on me and probably the paradox of his life. A self-proclaimed financial guru speaking about financial education, creating wealth, economics, and so on, but a number of his companies have gone bankrupt. Even his support of Bitcoin is questionable to me. |

|

|

|

|

337

|

Economy / Economics / Re: Why does a country borrow money from the world bank even when they can afford it

|

on: February 01, 2024, 02:15:49 AM

|

|

For one, there's always a room for improvement. A rich and beautiful country can still improve in many ways. In this sense, sky is the limit in terms of improvement, so in a way there's always not enough. Needs and wants are always ahead of the available resources. But there may be certain territories, small ones in particular, that don't have debts in the World Bank or other countries. Liechtenstein, I believe, is an example.

The reality with most countries, however, is that they're poorly run, and not with brilliant leaders but dumb yet popular ones. And since the leaders will come and go and the government isn't their personal business, they don't care about it. What's important is that they've accumulated so much wealth while they're in power.

|

|

|

|

|

338

|

Economy / Exchanges / Re: 🟦BitChanger - The best place to exchange Crypto

|

on: February 01, 2024, 01:44:43 AM

|

As a leading non-custodial exchanger... How is it that you're already leading in this kind of service when you've just introduced your platform? And how is your platform non-custodial when you ask users to deposit their money to your address? And please let us not prostitute this "no-KYC" marketing line just to attract users. It is a big lie. You even have a separate tab in your home page dedicated to "AML and KYC Policy". We utilize the latest encryption technology to protect your funds and personal information. I thought you're non-custodial and don't ask for personal information? Why, then, are you so proud that you have the latest technology to protect funds and personal information? What's there to protect when you neither custody funds nor gather personal information? Also, what's the difference between fixed and floating? And why can't I opt for a fixed exchange rate? It seems your platform is still under construction. You might want to finish it first before launching it. |

|

|

|

|

339

|

Economy / Gambling discussion / Re: What's your multi-bet (paroli) strategy?

|

on: February 01, 2024, 01:05:05 AM

|

Usually, I group my bets when the odds are very low. I use very because even if the odds is 1.50-- and that's already low enough-- I still think grouping them together in a parlay remains highly risky. If the odds are like 1.20 or around that, that's probably best to group together in a multi-bet. Also, I think a 5-leg parlay should be the highest. That's more realistic than having so many legs. Less risk, although less return as well. Of course, if you already won 4 and the cash-out offer is already good enough, you might want to take that option. Sometimes you need to weigh the guaranteed prize versus risking it all for a bigger money. In the end, don't take my word for it. I'm not a profitable gambler.  |

|

|

|

|

340

|

Bitcoin / Bitcoin Discussion / Re: At a range of 2years, can a Bitcoin literate invest with a borrowed fund in BTC?

|

on: February 01, 2024, 12:45:07 AM

|

|

I sometimes do what I won't advise other people to do. But borrowing money for investment purposes is something I would never do. However, it seems in the case of your friend, he has a lot of leeway in paying it. Did you say payment could be made anytime within 2 years? Or is it like the banks and other financial institutions which require regular small payments with a term of 2 years?

Provided the loan amount isn't big enough that paying it would require him to work day and night and cut on his basic needs, I guess this one's tolerable. Certainly, within 2 years, the price of Bitcoin will surpass $42,000.

But your friend can't be greedy. It's borrowed money. He has to be practical and realistic. If Bitcoin hits $60,000 in just 3 months, he may consider taking profit and paying the loan, forget about the 2 years and forget about a high target like $100,000.

|

|

|

|

|