ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

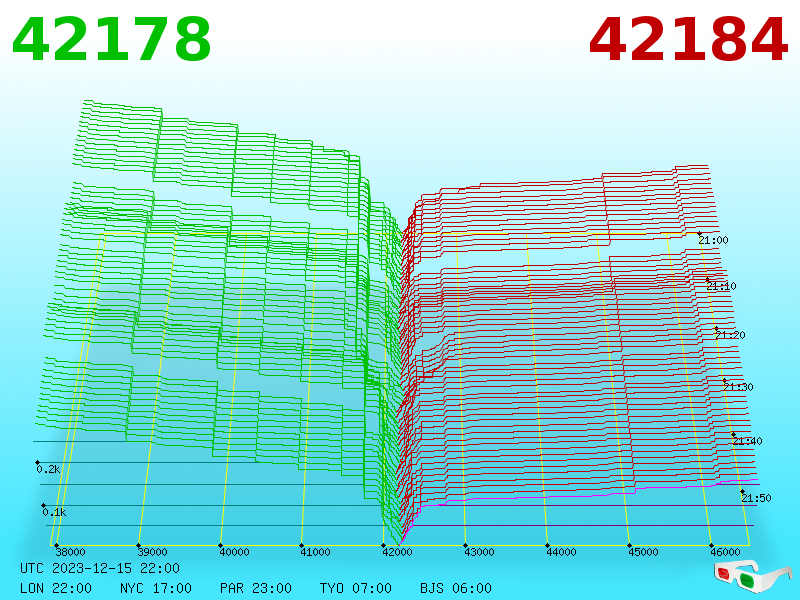

December 15, 2023, 09:03:25 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, which will follow the rules of the network no matter what miners do. Even if every miner decided to create 1000 bitcoins per block, full nodes would stick to the rules and reject those blocks.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 15, 2023, 10:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Greyhats

Member

Offline Offline

Activity: 167

Merit: 99

|

|

December 15, 2023, 10:45:40 PM |

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

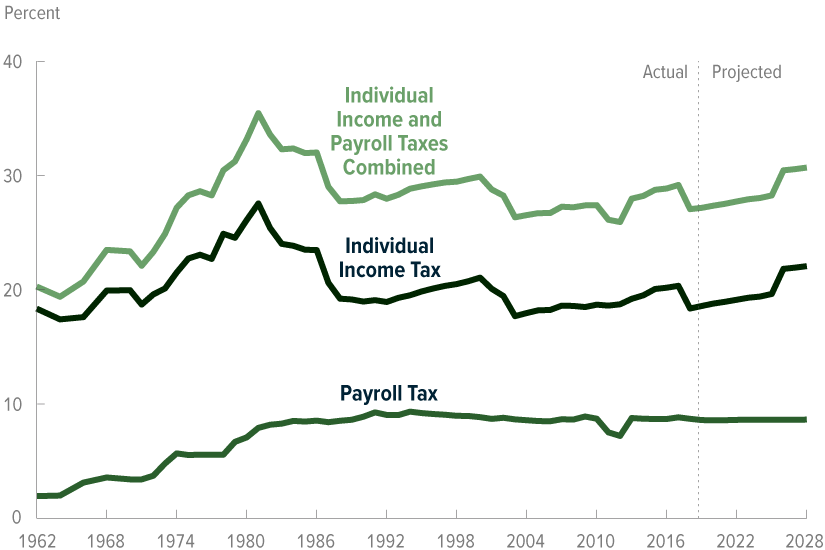

Thanks for sharing this I’m fairly aligned to most of what you have here. BTC enables early retirement imho, If you live under US tax regime, you pay cg tax on gains but only depends on your income if you earn less than ~45k cap gains tax is 0%. Selling btc doesn’t count as income, but when your retirement accounts kick in that’s going to skew your income bracket and the cg tax you pay on asset sales. Most of us don’t have massive stashes but I see Btc as a way to bridge the time between early retirement start and official retirement start. I probably will have more spending power in early retirement than official retirement.one could also posit that your btc stash can set the date of what early retirement is, and using a withdrawal plan you could somewhat forecast this out. The bit I’m trying to work out now is when I come to this liquidation stage is it better to dca sell in year of halving for the next 4yrs of needed inc or to use something like the 200wma for monthly draw downs over a 4 yr period. Good point on the tax. If early retirement is funded on BTC only... then income would be under the $47,025 cap. That is something I had not factored before. However, tax laws are finicky and always changing. It is hard to say what tax laws may be in 2 years, 5 years, 10 years. Another factor to take into account is the taxable rates that are constantly changing:  Source: https://www.cbo.gov/publication/54911The above graph can also explain why when you talk to people who worked from the 1970s through 2000 they tout 401k or other pretax or tax deferred savings methods. They were working during a time where taxable rates were at an all time high. The less tax they could get away with paying or deferring the better! Looking at the graph we are currently working in a near all time low tax rate era while they are projecting tax rates to increase. Meaning those same retirement methods could actually result in you paying a higher taxable rate after deferring that tax. But, in all honesty who the fuck knows what tax laws will be or what rates will be in the future. Could it go down, up, sideways? Perhaps... perhaps... perhaps? An example in tax law changes is when the Trump tax laws went into affect. Some of the law changes did away with unreimbursed working expenses. People who used to claim car mileage or other similar items on their returns were now unable to do so. However, at the same time the standard deduction was also increased in an attempt to "make taxes more simple". As I said, hard to say what tax laws will be or how they may change year to year. WithdrawingMany posts I see and folks I have talked to about this prefer the 200wma as a more stable way to project value of their holdings. I am not quite sold on that method just yet but, I am still maybe 8-10 years away from wanting to do this. The other method that I am looking at is withdrawing approximately 500 days after a halving. Below is a chart I have posted that I will continue to watch in the coming years.  The chart shows an obvious ideal sell period of approximately 500 days after a halving. However, then we come to the obstacle in the road of "past performance does not guarantee future results". Since I am still in the accumulating phase, I have some years left to see if this cycle continues. I've seen others hypothesize that future halvings may not have the same impact as past halvings. There are obviously many factors that go into valuing BTC vs the the US Dollar and it is impossible to project how the future may play out. If BTC did not continue to follow the 4 year cycle I currently see and become more stable then that may even be a better scenario in being able to withdraw on a yearly basis only the amount needed to continue to the next year. I’m working on a move excel sheet examples to show what I mean using forecast 200 wma(borrowed from jjg fu post). I get it tho to me using this is ultra conservative but would prefer to be in a position of doing better than worse and I think using this there is higher probability of being better off. Yes tax law changes but my opinion is my stash is small so honestly saving 15% is a lot of me in comparison to my stack. If I was 10x my stack I wouldn’t care so much tbh. It’s all about being realistic too I have some hopium projections too but I just can’t even fathom these being realistic. Should have something up Monday or Tuesday night even create my first thread on this topic. Want feedback on it help make it better  maybe it helps someone who knows |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

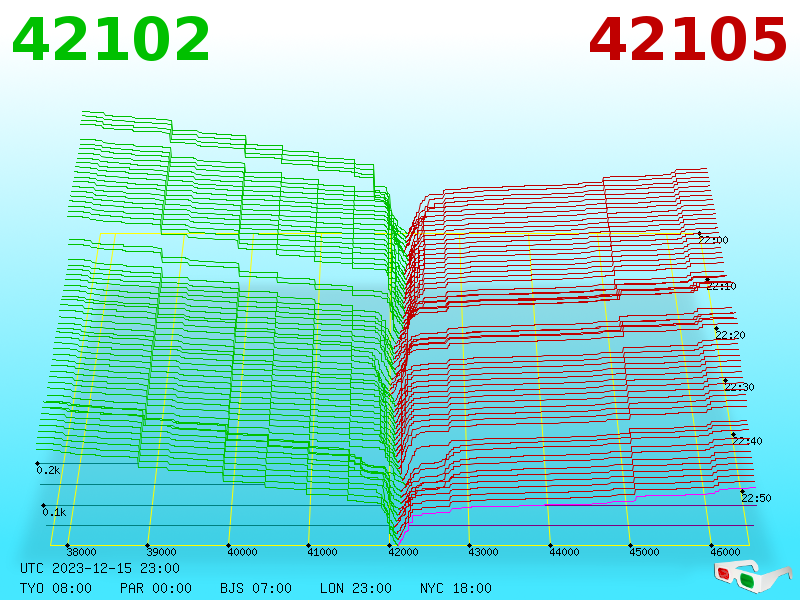

December 15, 2023, 11:03:24 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

kurious

Legendary

Offline Offline

Activity: 2590

Merit: 1643

|

|

December 15, 2023, 11:27:32 PM |

|

No-one ever swapped the firmware on my paper wallet.

Attack surfaces: 1. Flood (that one we had and more than once) 2. Nosy gf/wife that likes to "tidy" things up...can't happen  3. Fire 4. Something falling on the house, like a tree (impossible, right?), causing rain to wash away or soak the paper. 6. Forgetting where you put it..or if BIP 38, forgetting the password. That said, I might have agreed a bit more if you delineated how you are circumventing the above...yes, it is doable, but require some trust in those who would hold potential copies, maybe. A "paper" wallet isn't necessarily paper nor a wallet in the sense of funds going in and out of it on an ongoing basis. It is just an address. It is simply two alphanumeric strings, one public key and one private key. The only security consideration is how these addresses are created and stored. Strings can be split into sections and stored in different locations or media. They can additionally be encrypted or passworded/phrased.. They should only be created offline on a computer which cannot be connected to the internet. Protecting those private keys is paramount. Private keys should only be used once and then new addresses created. So simple, so secure. Hi Jimbo, I have always used paper wallets, created offline, laminated and intended for single use. I make 2 copies which are each stored in 2 separate fireproof safes placed in two locations not in my home. When I want to access them, I can. If one location is destroyed, I can still access the funds. If I die, trusted members of my family have key access to the safes to recover funds. Simple and secure enough for me. |

|

|

|

|

|

danadc

|

|

December 15, 2023, 11:35:49 PM |

|

Hello guys, how are you doing? Do you know that it's almost Christmas, and what better gift than a good bullish rally at around $50k? It wouldn't be bad at all, because I think it couldHello guys, how are you doing? Do you know that it's almost Christmas, and what better gift than a good bullish rally at around $50k? It wouldn't be bad at all, because I think it could be very possible, here this analyst is very optimistic: be very possible, here this analyst is very optimistic: “The current trajectory of NUPL suggests an uplift in market optimism, which is a typical precursor to a bull market.”  “A gradual increase in this multiple from its lower levels can be interpreted as a reduction in selling pressure and increased profitability for miners, aligning with the potential onset of a bull cycle.”  Source: https://ambcrypto.com/is-another-bitcoin-bull-run-underway-this-analyst-thinks-so/I'm not a big believer, but I'm very optimistic about Bitcoin, because I want it to go up, it would be great. And even AI is present: BlackRock previews AI co-pilot; attends high-level SEC meeting on spot Bitcoin ETFBlackRock attended three other meetings starting on Nov. 20, 2023. The current meeting had a relatively small attendance: whereas the earlier meetings involved seven to 11 members from BlackRock and NASDAQ, the most recent meeting involved just three members from BlackRock.

Two previous meetings contained attachments indicating that BlackRock and the SEC met to compare in-kind and cash redemption models, which could affect whether certain parties can transact in cryptocurrency.

If the SEC approves a spot Bitcoin ETF, it will be the first available in the U.S. Bloomberg ETF analysts have estimated that there is a 90% chance of approval by Jan. 10, 2024. The SEC has not commented on the likelihood of an approval. Source: https://cryptoslate.com/blackrock-previews-ai-co-pilot-attends-high-level-sec-meeting-on-spot-bitcoin-etf/I wanted to put those paragraphs , because it is possibly the approval of Bitcoin ETFs , that Excites me , now more than Ever you have to buy Bitcoin. |

|

|

|

|

|

True Myth

|

|

December 16, 2023, 12:00:21 AM |

|

I’m working on a move excel sheet examples to show what I mean using forecast 200 wma(borrowed from jjg fu post). I get it tho to me using this is ultra conservative but would prefer to be in a position of doing better than worse and I think using this there is higher probability of being better off. Yes tax law changes but my opinion is my stash is small so honestly saving 15% is a lot of me in comparison to my stack. If I was 10x my stack I wouldn’t care so much tbh. It’s all about being realistic too I have some hopium projections too but I just can’t even fathom these being realistic. Should have something up Monday or Tuesday night even create my first thread on this topic. Want feedback on it help make it better  maybe it helps someone who knows Being conservative is responsible and a good play. If you're planning to continue to accumulate then your stash will grow with time. Looking forward to your post. Shoot me a link to the post if you don't mind. I'd like to check it out but, I honestly don't make it out of the WO thread too often. They keep me chained to the wall up down here. Send help |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

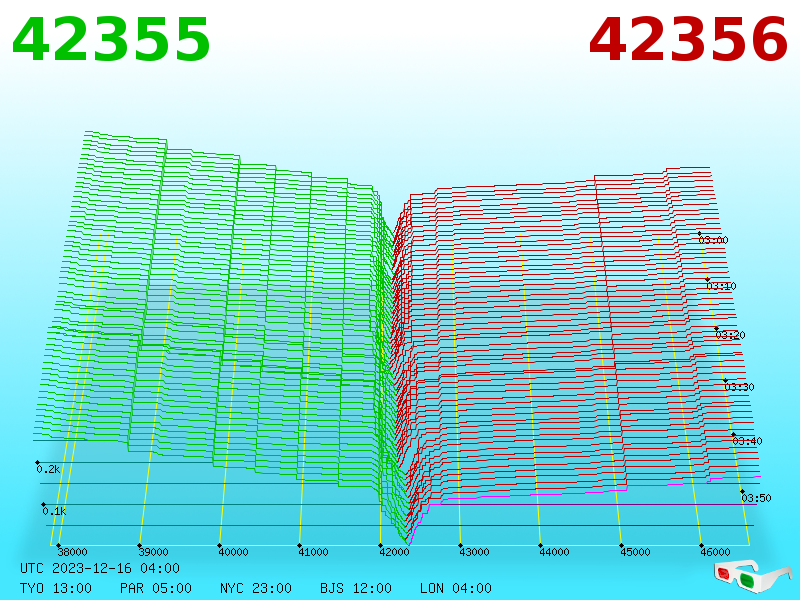

December 16, 2023, 12:03:25 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4732

Merit: 4239

Leading Crypto Sports Betting & Casino Platform

|

|

December 16, 2023, 12:24:26 AM |

|

Corporations will now be able to report btc gains on their asset if they hold it, pumping their overall stock price value for EOY reporting. Funny how a major barrier to corporate bitcoin holding adoption is changed right before the coming Bitcoin ETF approvals? What amazing timing! I'm shocked, shocked I tells ya! /s   https://twitter.com/davidmarcus/status/1734974716505649531 https://twitter.com/davidmarcus/status/1734974716505649531This is indeed a big deal but it’ll be another year before it goes into effect so the timing of it being announced right before the ETF approval doesn’t mean much. What it does mean is that a perfect storm is once again brewing for the 4 year ATH to get set in mid/late 2025. Exciting for people who are already happy with the $40K price. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7824

'The right to privacy matters'

|

|

December 16, 2023, 12:36:10 AM |

|

Corporations will now be able to report btc gains on their asset if they hold it, pumping their overall stock price value for EOY reporting. Funny how a major barrier to corporate bitcoin holding adoption is changed right before the coming Bitcoin ETF approvals? What amazing timing! I'm shocked, shocked I tells ya! /s   https://twitter.com/davidmarcus/status/1734974716505649531 https://twitter.com/davidmarcus/status/1734974716505649531This is indeed a big deal but it’ll be another year before it goes into effect so the timing of it being announced right before the ETF approval doesn’t mean much. What it does mean is that a perfect storm is once again brewing for the 4 year ATH to get set in mid/late 2025. Exciting for people who are already happy with the $40K price. Well it could mean we break the ath before the 1/2ing happens. There are multiple "new" factors that unfold in 2024 we may have am early bull top. |

|

|

|

|

|

True Myth

|

|

December 16, 2023, 12:41:38 AM |

|

Corporations will now be able to report btc gains on their asset if they hold it, pumping their overall stock price value for EOY reporting. Funny how a major barrier to corporate bitcoin holding adoption is changed right before the coming Bitcoin ETF approvals? What amazing timing! I'm shocked, shocked I tells ya! /s   https://twitter.com/davidmarcus/status/1734974716505649531 https://twitter.com/davidmarcus/status/1734974716505649531This is indeed a big deal but it’ll be another year before it goes into effect so the timing of it being announced right before the ETF approval doesn’t mean much. What it does mean is that a perfect storm is once again brewing for the 4 year ATH to get set in mid/late 2025. Exciting for people who are already happy with the $40K price. Well it could mean we break the ath before the 1/2ing happens. There are multiple "new" factors that unfold in 2024 we may have am early bull top. I keep thinking an early bull run is a possibility too. Just seems like there is so much positive momentum and great things in the near term. I keep wondering when the slandering and bad news will drop. Never fails there is always something that gets cooked up. |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 16, 2023, 01:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 16, 2023, 01:55:35 AM Merited by fillippone (3) |

|

[edited out]

I’m working on a move excel sheet examples to show what I mean using forecast 200 wma(borrowed from jjg fu post). I get it tho to me using this is ultra conservative but would prefer to be in a position of doing better than worse and I think using this there is higher probability of being better off. I look forward to seeing what you come up with, and my 200-WMA had gotten increasingly more conservative. Of course, conservative in terms of where the bottom might be is different from trying to figure out where the top might be, even though some folks have tried to use the concept of how many multiples we are above the 200-week moving average in order to try to figure out if the BTC spot price is getting toppie or not. Regarding the two tops of 2021, we can see that the first BTC spot price top that was nearly $65k got to nearly 6x of the then 200-week moving average that was merely at $11k-ish at the time.. and then the second $69k top was a bit over 4x from the then 200-week moving average which was at $17k at the time. Of course, if we look even further back we will see that the 2017 top of $19,666 would have been close to 16x higher than the then 200-week moving average of $1,240... .. so it can really be difficult to figure out if we are toppie yet or not because 4x to 6x might not seem sufficiently toppie as compared to 16x, but still they end up being tops for that particular cycle. Yes tax law changes but my opinion is my stash is small so honestly saving 15% is a lot of me in comparison to my stack. If I was 10x my stack I wouldn’t care so much tbh. It’s all about being realistic too I have some hopium projections too but I just can’t even fathom these being realistic.

There is a bit of irony how some of us might start to become quite flippant about throwing money around when our BTC stash goes up so many multitudes and even magnitudes. .. It could be something like.. I want to do x (related to some bitcoin transaction or transfer - do I sound like a shitcoiner transferring NFTs?), and we find out that it is going to cost a few thousand because we are in a really busy time, but then we will just throw money at it because we may well realize that we are already in 20x or 40x profits or whatever we are doing is going to end up paying for itself in a fairly short period of time.. or maybe our portfolio went up a by more than $50 thousand in the past 3 hours. Should have something up Monday or Tuesday night even create my first thread on this topic. Want feedback on it help make it better  maybe it helps someone who knows Hopefully you can provide a link here.. or where ever else you believe that you might get people to link to your thread (or your post). No-one ever swapped the firmware on my paper wallet.

Attack surfaces: 1. Flood (that one we had and more than once) 2. Nosy gf/wife that likes to "tidy" things up...can't happen  3. Fire 4. Something falling on the house, like a tree (impossible, right?), causing rain to wash away or soak the paper. 6. Forgetting where you put it..or if BIP 38, forgetting the password. That said, I might have agreed a bit more if you delineated how you are circumventing the above...yes, it is doable, but require some trust in those who would hold potential copies, maybe. A "paper" wallet isn't necessarily paper nor a wallet in the sense of funds going in and out of it on an ongoing basis. It is just an address. It is simply two alphanumeric strings, one public key and one private key. The only security consideration is how these addresses are created and stored. Strings can be split into sections and stored in different locations or media. They can additionally be encrypted or passworded/phrased.. They should only be created offline on a computer which cannot be connected to the internet. Protecting those private keys is paramount. Private keys should only be used once and then new addresses created. So simple, so secure. Hi Jimbo, I have always used paper wallets, created offline, laminated and intended for single use. I make 2 copies which are each stored in 2 separate fireproof safes placed in two locations not in my home. When I want to access them, I can. If one location is destroyed, I can still access the funds. If I die, trusted members of my family have key access to the safes to recover funds. Simple and secure enough for me. I like the idea of 2 copies, but I also like the additional step of dividing the keys into at least a couple of parts and they would not necessarily need to be in a fire proof safe because one part is not sufficient to access the wallet.. I actually personally like three parts since I think that any one part of three is more difficult to figure out as compared with one part of two, and surely if you know about your two locations in which your various key parts are kept, then you would be able to know if they have been damaged or destroyed, but of course, you still might need to check on them once a year or maybe more frequently. Surely one of the problems of having the whole key in a safe is your security is ONLY as good as the safe, and maybe that might be o.k. (acceptable) for $100k or less, but if you start getting into higher numbers, then you might wonder.. and surely some security set up might be o.k. for $60-$80k, but then like in 2017, the BTC price went up around 78x, and even in 2021, we got around 16x price appreciation, which even with a 10x price appreciation, $60-$80k then becomes worth $600k to $800k, so the security level needs to feel comfortable for that new higher level of value. [edited out]

This is indeed a big deal but it’ll be another year before it goes into effect so the timing of it being announced right before the ETF approval doesn’t mean much. What it does mean is that a perfect storm is once again brewing for the 4 year ATH to get set in mid/late 2025. Exciting for people who are already happy with the $40K price. I already responded to the ideas of this post, and it appears that the accounting requirements are mandatory to follow after December 15, 2024, yet they are already optional to follow, which there does not seem to be too many reasons that public companies would not start following the new rules prior to December 15, 2024... including starting to follow them right away. Corporations will now be able to report btc gains on their asset if they hold it, pumping their overall stock price value for EOY reporting. Funny how a major barrier to corporate bitcoin holding adoption is changed right before the coming Bitcoin ETF approvals? What amazing timing! I'm shocked, shocked I tells ya! /s   https://twitter.com/davidmarcus/status/1734974716505649531 https://twitter.com/davidmarcus/status/1734974716505649531I think that part of my response (shown/linked below) in fillippone's "Micheal Salyor decalogue for a 10x Bitcoin Appreciation" thread also highlights an important part that public companies are allowed to implement the rule earlier than the December 15, 2024 mandate in which they have to use the new preferrable accounting rule. Finally, as the news was much anticipated, the FASB amended the accounting rules companies must follow when adding Digital assets on their balance sheets. Standards Board Approves Long-Sought Change in Crypto Accounting RulesUnder current rules, companies have to record cryptocurrency holdings at their original cost and then write them down as an "impairment charge" if the value drops below cost—but cannot mark them up if the price rises. This method has drawn criticism for only reflecting one side of value changes.

The new FASB rules will require companies to account for digital assets at fair market value, capturing frequent price fluctuations. Gains and losses will flow through the income statement.

Having a mark to market pricing approach means the price discovery of the asset is efficient, meaning that the asset class is investable. Current standards actually tried to prevent swings in balance sheets trough a very cautious approach, that on the other hands potentially could lead to swings upon investment unwind. This new rules is much more informative of the true value of the investment in the balance sheet, making it more transparent to the investor. New rules will come in effect from 2025, but companies can anticipate the rule in 2024. I think that the below statement from the article more clearly states what you might have been wanting to say in your last sentence. All public companies and private companies will need to apply the new rules, with an effective date for fiscal years beginning after December 15, 2024. Earlier adoption is permitted. Essentially public companies have to apply the new rules after December 15, 2024, but they are allowed to adopt and apply the new rules earlier.. which likely means that any public company that holds significant amounts of bitcoin may well already be wanting to apply the new rules to any reports that they make about their companies finances from here on out (because they can and because the new rule is better and more accurate in terms of showing actual value as compared with the old rule). |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 16, 2023, 02:03:23 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 16, 2023, 03:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 16, 2023, 04:03:23 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3853

|

Everybody expects the imminent ETF bull run, but then it would be a first bull run I am aware of that was predicted, discussed and "implemented'.

Personally, I see a more complex trajectory:

Whatever the price is at ETF approval, I see a flat to 10% reduction during the first 4-6 mo "post ETF" with a possibility of a short duration 20-30% run up just before the halving, most likely followed by an equivalent "Bart" down with btc price at $40-50K (maybe it be would smack in the middle of that range at $45K) by May-June 2024 followed by an increasingly strong bull for the next 6-16 mo, with a possibility of at least a first wave (if it would have two humps) peaking in Dec 2024 and the second one in September-November of 2025.

Of course, no need to sell during any of those presumed flat or slight down periods.

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10196

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 16, 2023, 04:49:22 AM |

|

Everybody expects the imminent ETF bull run, but then it would be a first bull run I am aware of that was predicted, discussed and "implemented'.

Personally, I see a more complex trajectory:

Whatever the price is at ETF approval, I see a flat to 10% reduction during the first 4-6 mo "post ETF" with a possibility of a short duration 20-30% run up just before the halving, most likely followed by an equivalent "Bart" down with btc price at $40-50K (maybe it be would smack in the middle of that range at $45K) by May-June 2024 followed by an increasingly strong bull for the next 6-16 mo, with a possibility of at least a first wave (if it would have two humps) peaking in Dec 2024 and the second one in September-November of 2025.

Of course, no need to sell during any of those presumed flat or slight down periods.

Sure there has likely been some pre-event (pre-ETF announcement) pumpening of the BTC price, but what if the announcement does end up actually putting additional UPpity pressures on BTC prices. Of course, it is always good to prepare for either BTC price direction, and I am not even sure why I am wanting to quibble with you, except that you are pretty specific in terms of your expectations of what "might happen." |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 16, 2023, 05:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3836

Merit: 7977

|

|

December 16, 2023, 05:50:57 AM |

|

|

|

|

|

|

|

Poll

Poll