BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

December 17, 2023, 12:20:12 AM

Last edit: December 17, 2023, 12:59:55 AM by BitcoinBunny Merited by Torque (8), El duderino_ (7), AlcoHoDL (1) |

|

There is now no more money left to write woke propaganda in support of terrible woke movies such as Indiana Jones and The British Arsehole Woman. Hollywood has pretty much died on its ass this year. If it hadn't been for Barbie and Oppenheimer literally almost all Hollywood movies over $100 million can be considered failures this year (Super Mario Bros is a French/Japanese made movie distributed by Universal). There's been some decent stuff I thought this year, but people just don't have the cinema attention span anymore and I think Disney's woke agenda ridden movies over the last several years, burned so many people out of a fun few hours for an evening out, it most likely had a massive effect on other stuff, even if it was good. Gran Turismo, The Creator, Talk To Me, Mission Impossible 7. They were all decent movies. But why go to the cinema, when you can watch these at home on streaming in 4K so soon these days? As for what's out now: Wonka is pretty decent, -if you like the original- but realistically; it probably didn't need to be made. Saw Godzilla Minus One again this evening in Imax, phenomenal, such a great experience. Stellar sound, effects and soundtrack. It's a very heartfelt bit of entertainment with not a minute wasted. My favourite movie of the year and probably my favourite foreign movie. Somehow it felt to me like it's possibly cinema's last hurrah, after Top Gun Maverick, which I thought was a great love letter to cinema also -bringing out all the fun from the 80s nostalgia but even better than before. Godzilla Minus One feels like you are watching Jaws, Jurassic Park and Saving Private Ryan rolled into one. I'm not sure where you can go from there. It feels like it's perhaps the last stop somehow. The cinema experience, as good as it can be in Imax, does feel outdated. The last several showings I've been to (I checked my watch) - they LITERALLY started the movie 30 (!) minutes after the advertised showing time. Too many fucking adverts and repeated trailers, that have been stretched from 20-25 minutes in previous years, an advert for the advertising company itself, Digital Cinema Media, played twice with utterly horrendous music that hasn't changed for years, Pepsi, Audi, adverts for the cinema itself - I get it, I'm already a member, do I really have to sit through that? Cinema came back after Covid but it's now falling off a cliff. I've never seen the cinema busy after Oppenheimer, except for a few £5 showings of classics. I can sit in the middle of the Imax screen on Saturday 8pm during every blockbuster's first weekend, buy my ticket at the cinema and have no people around me. That never used to be possible before. Like I said, Oppenheimer was the exception this year. Young people are not going to sit through 30 minutes of claptrap anymore when there are much easier ways to get entertainment. Mainstream cinema is thus I think mostly dead, I can't see how it can come back. I think many multiplexes will close. Those in need of refurbishment won't survive. People can pay less to block out all adverts on YouTube on all their devices for just 10 bucks a month or get savvy with an adblocker if needed. Endless entertainment. Or 10 bucks for Netflix. Sure some of it, like Zack Snyder's new venture also suck ass, but many original series are pretty good. Disney definitely buried cinema sooner than it needed to with its ridiculous injected woke propaganda after it gained massive power over cinema-chains at the height of the Marvel and Pixar successes, transforming Star Wars and Marvel into women only franchises, and like you said, its brown envelope critics that kept their pretend shite going for some years. The strike was an opportunity to cancel many projects even though writers and actors thought a better deal was possible. There simply won't be the amount of work any more, impossible with the failures we've seen. Studios are (nearly) broke. Streaming isn't anywhere near as profitable unless you are Netflix, or an Amazon or Apple with boat load of other revenue streams. Deadpool 3 will fail, the Star Wars Rey movie will fail. It's pretty much over for $200-$300 million dollar Disney blockbusters I think. Toy Story 5 - really? 4 was already unnecessary! The next failure will be Aquaman 2 I reckon. Warner Brothers will probably have to make a deal with Netflix for its DC stuff to help them. The old paid for critics and many woke movie makers better learn programming... --sorry for the long rant.  |

|

|

|

|

|

|

|

|

|

|

|

|

|

Once a transaction has 6 confirmations, it is extremely unlikely that an attacker without at least 50% of the network's computation power would be able to reverse it.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

December 17, 2023, 01:01:49 AM |

|

yeah sat nite 8pm 6 people and we were four of the 6 weird having a next to empty theater on a sat nite.

but everyone in UK or USA has a flat screen and thats what I am doing right now typing to you looking at a 65 inch sc4k screen.

I saw something on amazon prime had good sound and half way decent movie plot for a price of $0

Silver and the book of dreams

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 01:03:24 AM |

|

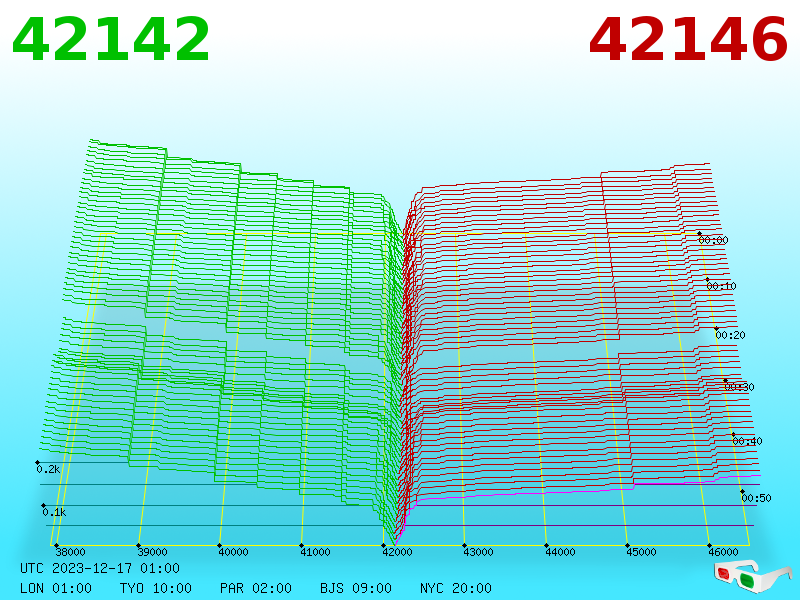

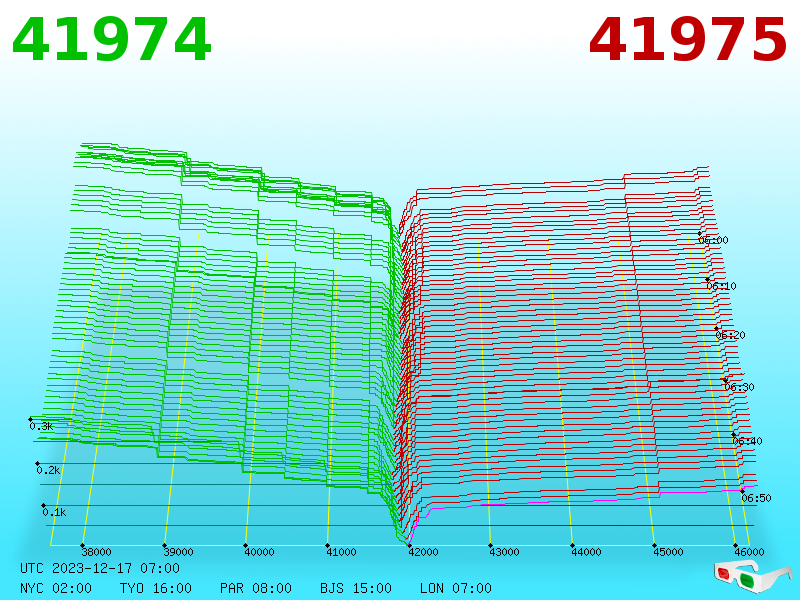

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

December 17, 2023, 01:14:08 AM |

|

yeah sat nite 8pm 6 people and we were four of the 6 weird having a next to empty theater on a sat nite.

but everyone in UK or USA has a flat screen and thats what I am doing right now typing to you looking at a 65 inch sc4k screen.

I saw something on amazon prime had good sound and half way decent movie plot for a price of $0

Silver and the book of dreams

As a movie buff I have a projector at home but indeed the screens are getting so large now, 100 inch 4-8K screens are starting to become affordable. There is a 98 (!) inch Samsung 4K tv now at £4,499. Considering inflation that isn't much more than the last top of the line TV I bought in 2012. (half the size 50 inch was big in those days) Much easier to use as you don't need a light controlled room. Luckily Imax this evening was mega loud but I could still hear there were 2 cunts about 10 seats and 2 rows away, talking throughout the movie. I don't get why they go. Another reason to enjoy entertainment at home. |

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

December 17, 2023, 01:32:00 AM Merited by vapourminer (10), El duderino_ (10), BobLawblaw (10), JayJuanGee (2), xhomerx10 (1), Hueristic (1), sirazimuth (1), jojo69 (1), d_eddie (1), AlcoHoDL (1), bitebits (1), machasm (1), DirtyKeyboard (1) |

|

It's been a while since I posted a "Saturday Long Read", so allow me to hit you with this little one... Bank... bank? Did Someone say Bank? In hindsight, it was inevitable.We are all hyped up over the ETFs. As usual we are fixated on something important while we miss the thing that really is the MOST important. Remember Baakt? Or is it Bakkt? Does anyone even know? That was going to launch us into HYPERBITCOINIZATION! And here we are again... this cycle's hype is ETFs! Wait... ummm didn't we also try this one before? It's like the China bans. We will gladly lap up the same narratives over and over. Well ETFs ARE coming. Someday. Eventually. But Blackrock, and the others are not the only ones playing. The powerful people had to figure out Bitcoin eventually, and now the race is on to define who controls the most of it. That is assuming Blackrock, and the Fed are not mounting a fantastic FUD campaign against Bitcoin. And I'd estimate there is a 20% chance that is exactly what they are doing. The reason I say 20 instead of zero is they hate bitcoin at least enough to try this. The reason I say 20 instead of 100 is these people are not generally dumb. You do not get to where they are being dumb. They are in control of the Earth, and they have seen what Bitcoin is. I think they are smart enough to know they can't stop it. So the objective from this point is to CONTROL it. And to do that, in the style they are most accustomed to they must own so much of it that it is easier to buy their product than the real thing. Make no mistake. People buying into the Blackrock product (or Fidelity, or ...) are putting 100% trust and control into the hands of the owners of those funds. And they will issue "shares" or "coins" or whatever they want to call it that represent a certain amount of the bitcoin they hold, and thus they can get right back to printing as they always have. I can try to give them the benefit of the doubt that they will not try their old tricks. But I am never able to see it as remotely possible. So that is what we are cheering for. And look! I am not saying that it is all bad. Nor am I saying that it won't set off the rocket of price appreciation. At least for a while. The fact of the matter is MOST Earthlings are going to need help. AND Layer 1, on-chain transactions are going to be expensive as fuck. The average Joe needs help. Frankly, even the above average Lisa needs help. Seriously... LUKE DASHJR has his coins stolen. So, it turns out Hal was right again. We are going to need Bitcoin Banks. And that is exactly what we are seeing the formation of. And by the way... I have never thought exchanges were really "bitcoin banks". Maybe the proto-banks. But if you are paying attention you can see the tip of the real spear making it's way into the spotlight. Old dogs... new tricks.The big exchanges are all conveniently being dragged into the litigation they TOTALLY set themselves up for with all the shitcoin nonsense they did over the last 8+ years. Or they are busy announcing their next NFT series or some other pablum designed to fleece the tiny audience they have been able to gain worldwide. At the same time other big legacy players in the "bitcoin space" are busy having their databases stolen, or floating a way to get your private keys. But at least Ledger is pointed in the right direction macro-strategy wise. They have entered the race to control the money. And though their tradeoff is terribly un-nuanced, they are at least realizing where things are going. Hopefully they improve their strategy. New Kid on the BLOCK.If you thought Jack Dorsey was just a lucky nerd to invent "mico-blogging" then what he did with the Cash App should make you reconsider. But what Block is currently doing tells me that he can see the future. And don't get me wrong. I am not fan-boying @jack. He is also throwing his digital hat into the ring of being the best way to hold your Bitcoin. The Bitkey hardware signer is more than a simple signer. It is also an attempt at creating something your mom or dad could use to hold bitcoin, with SOME sovereignty and a LOT of security. One interesting thing they have done is set up various forms of redundancy so that it makes it extremely difficult to lose your funds because of a single mistake. I am guessing it will also integrate L2 networks as the software grows. At least lightning which Block/Square/CashApp have already done. But this sort of "Bank" introduces a HUGE amount of trust in Block. I have not deeply studied the model yet, but at a glance you have to TRUST Block just like you trust JP Morgan. And although they are dividing the power in a way that you have the majority, they are still able to act as a "safety net" which means they have a lot of control over your UTXOs (or HTLCs). Still... This is a good step. And it might just find the niche that a lot of new Bitcoinners will be attracted to, and frankly better off with than trying to "be their own bank". Cypherpunks gonna cypherpunk.I am admittedly a bit of a fanboy of Adam Back. And I think Blockstream is certainly one of the more important companies in Bitcoin. Blockstream folks have contributed to Bitcoin Core, as well as producing the 2nd most used lightning implementation. They manufacture my favorite hardware wallet (tied with Seedsigner)And they have developed Elements, the engine for their layer 2 creation: Liquid. And though Liquid is a ghosttown still, and has been rightly criticized by people who do not matter very much anymore, it is a very compelling structure into which Bitcoin transactions can move as the fee market makes all of us tremble. It is interoperable with lightning, and has very interesting security trade offs. Would I use it for cold storage? Not yet. But I do have a non-trivial amount of value in it in anticipation of it being more important as we move forward. Well Blockstream too has entered the Bitcoin Bank game. Their Green wallet recently announced the ability to use lightning. It's still experimental, and I am testing it now. And I think it can be used both on the Bitcoin lightning network as well as Liquid lightning. Blockstream is building one of the most compelling sets of tradeoffs. Trust is introduced, but is distributed unlike most other horses in this race. And what they have left to do is to make their wallet Green transparently transact on the network that makes the most sense for the end user, whether it be the base layer, Lightning or Liquid. If they can do that then they will have a very strong business model. Since they own the Liquid network then they can charge small fees for transactions and make their money that way. As well as profiting from the exchange of on chain BTC with L-BTC and Lightning. And their model leaves you ultimately sovereign and distributes risk better than others. The best of the best for self-sovereignty.What I really want to see has yet to emerge. Perhaps I should try to create it... oh wait. Is that a taco over there? I think of it as a FOSS Firefox unlike a captured Chromium. An implementation of an easy to use wallet that employs multiple forms of redundancy and integrates multiple layer two networks seamlessly. Yet it is fully FOSS, fully un-owned, and run by the users. It could integrate base layer transactions as well as lightning, and maybe even introduce some of the leading edge strategies like Chaumian Mints (Fedimint, Cashu) or even an Elements based liquid-like implementation. The latter could be interoperable with other Elements implementations, including Liquid itself. Pardon me as I daydream. But are you seeing it? The future? It's out there waiting for us to seize it, direct it, and make it the best it can be. Even as "just" end users we have a lot of power. We choose what works best for us and can help others use those tools as well. No, Neo. What I am telling you is when you are ready... you won't have to!So this is where the competition in Bitcoin software is right now. Becoming the strongest Bitcoin Bank is the prize. And we need to help steer as many as possible to sovereign systems as we can. The old guard, such as the old hardware signers, as well as the big exchanges etc., should be paying attention. They can be left in the dust in a matter of a few years. Or sidelined to a single function, or niche use. While they are still living in the last halving, visionaries are quietly building the rails for the machines that will run on top of Bitcoin. In the end, we as the users... the seasoned users, need to be vigilant to guide the machines in the right direction by supporting the things that are built with the best tradeoffs. And we must help the clueless noobs already here, as well as the hoards on the way, UNDERSTAND why every precious bit of sovereignty you trade for every promise of security and convenience must be CAREFULLY weighed. In the end we, the users, get to OWN our money for the first time in our lifetimes. #CCMF |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 02:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Negotiation

|

|

December 17, 2023, 02:35:38 AM |

|

This year is ending with a bitcoin price $60k?

Doubt. Same with you but expected. Same. I don’t see us even hitting $50K this month/year. It would require breaking through some pretty long lasting resistance levels. $45K or maybe even $47K I would see as possible, but it would take a great deal of buying to get us to even $49K, let alone breaking the psychological barrier of $50K in such a short time.

I agree with the points, people are now buying so it is not impossible. 1) Did you forget what thread your in?

No man... 2) Do you always plagiarize or did you just forget to apply attributions?[/b][/size]

If you can say quote with the source link so I hope it was my mistake, but I can provide source link for details and part by part...it's helpful for easy the discussion. I know that plagiarize is a crime. I can provide sources in different parts. Now Edited... More immediately, if we look at this week's candle, we would have to get above $43,786 for it to close in the green, so I am not sure how great the odds are, because we ONLY have right around 24 hours before this week's candle closes, so the price would need to rise by more than $1,500 as I type this post.

Well, I am also confused but others think is, If for some reason the market rises above $45k and remains stable for a while, everything has to be rearranged. But I hope we're going to see something range good. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 03:03:26 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

_Hiloveua_

|

|

December 17, 2023, 03:56:09 AM |

|

come on satoshi 50k  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 04:03:22 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 17, 2023, 04:31:51 AM |

|

@JJG - you crack me up sometimes but, also amaze me at the amount of thought and analyzing you perform.

No problem... I cannot really help myself, anyhow, and as you might realize, I have been just chomping at the bit to revisit my HypoPhil model, while at the same time potentially adding to it by showing some buy back ideas. Here's a couple of charts that summarizes the HypoPhil matter. ** Hey JJG. I tried to reconstruct your spreadsheet and encountered some difficulties matching it. HypoMyth's BTC sell ladder PlanIn particular I saw the raking formula (column D) is not accurate, and also it changes somehow on the hypothesis of the reinvestments...But it's not specified how. Upon receiving more direction, I can provide you with the usual spreadsheet to share. Oh Thanks. You are right that I had a twist in my formula, and I had not remembered that I had put an additional 0.2% deduction in the amounts for the rakes and also into the reinvestment amounts in order to roughly account for exchange fees.. yet ultimately that part of the formula is likely not necessary in order to attempt to focus on the overall ideas rather than getting caught up in the weeds...so once i remove my the additional 0.2% from mine, then our base numbers match up.... even though I see that you had not yet placed the projected reinvestment success of 41.67% in your Column A numbers. I'm wondering also if you want to keep all this in the WO or if you want to move it to your specific thread.

That is probably a good idea, because it does kind of relate to the sustainable withdrawal idea.. but more of a price-based angle, as compared to my motivation of that that other thread was a monthly withdrawal limit.. which kind of becomes a time-based system that also just withdraws every month but also takes into account of the location of the spot price in relation to the 200-week moving average.. whereas this one is more of a pure price based approach... maybe I can put this chart into that thread since it is kind of related, and maye it wouldn't confuse people too much if I provide a bit of a descriptor regarding how it relates and how it differs.. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 05:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 17, 2023, 05:29:41 AM |

|

More immediately, if we look at this week's candle, we would have to get above $43,786 for it to close in the green, so I am not sure how great the odds are, because we ONLY have right around 24 hours before this week's candle closes, so the price would need to rise by more than $1,500 as I type this post.

Well, I am also confused but others think is, If for some reason the market rises above $45k and remains stable for a while, everything has to be rearranged. But I hope we're going to see something range good. I doubt that "we" are in "ranging" territory. Bitcoin does not work like that... We don't just go to the top of the price point and start to "range," so either we go up further and then correct back down to here and then we range, or we correct back down from here. and then range somewhere down in the $30ks.. it seems that we are set up for more UPplity.. prior to ranging .. but who knows when the UPpity is going to stop.. and sure if we go down from here and end up ranging somewhere in the $30ks that might be possible too.. yet, in any event, I am not personally going to get into any of those kinds of attempts at short-term predictions and just suggest that it seems that we are currently in a don't wake me up zone that is about $35k to $55k, and, so yeah, it is still pretty large, so I am not really going to get too excited within that range, but I still am not going to proclaim that we are actually "ranging" because that does not seem like the correct way of describing what seems to be our current status. It does sound good, though, even though it does not seem to have very high odds if suggesting that the exponential would go up 20x in a short period.. such as 6-9 months as he suggested to be possible (but then he also said that the price could go up 20x in days to week seems a bit much). It was a decent interview, and ONLY 11 minutes long. By the way, the Cointelegraph interviewer (was it Marco Castrovilli?) was trying to see if he could get Samson to agree to equate ethereum to bitcoin in some kinds of ways, but Samson was not having any of that.. so gotta respect Samson for not getting trapped in either the shitcoiner nonsense and also Samson did not really back off of his prediction since Castrovilli seemed to be trying to suggest that Samson was a bit delerious with the exponential angle that he was taking in regards to bitcoin's UPpity potential. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 06:03:25 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 07:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

DirtyKeyboard

Sr. Member

Online Online

Activity: 252

Merit: 445

Fly free sweet Mango.

|

|

December 17, 2023, 07:23:59 AM |

|

ChartBuddy's 24 hour Wall Observation recap . . . |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 08:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Tuco Benedicto Pacifico

Jr. Member

Offline Offline

Activity: 45

Merit: 28

|

|

December 17, 2023, 08:39:03 AM |

|

It's been a while since I posted a "Saturday Long Read", so allow me to hit you with this little one... Bank... bank? Did Someone say Bank? In hindsight, it was inevitable.We are all hyped up over the ETFs. As usual we are fixated on something important while we miss the thing that really is the MOST important. Remember Baakt? Or is it Bakkt? Does anyone even know? That was going to launch us into HYPERBITCOINIZATION! And here we are again... this cycle's hype is ETFs! Wait... ummm didn't we also try this one before? It's like the China bans. We will gladly lap up the same narratives over and over. Well ETFs ARE coming. Someday. Eventually. But Blackrock, and the others are not the only ones playing. The powerful people had to figure out Bitcoin eventually, and now the race is on to define who controls the most of it. That is assuming Blackrock, and the Fed are not mounting a fantastic FUD campaign against Bitcoin. And I'd estimate there is a 20% chance that is exactly what they are doing. The reason I say 20 instead of zero is they hate bitcoin at least enough to try this. The reason I say 20 instead of 100 is these people are not generally dumb. You do not get to where they are being dumb. They are in control of the Earth, and they have seen what Bitcoin is. I think they are smart enough to know they can't stop it. So the objective from this point is to CONTROL it. And to do that, in the style they are most accustomed to they must own so much of it that it is easier to buy their product than the real thing. Make no mistake. People buying into the Blackrock product (or Fidelity, or ...) are putting 100% trust and control into the hands of the owners of those funds. And they will issue "shares" or "coins" or whatever they want to call it that represent a certain amount of the bitcoin they hold, and thus they can get right back to printing as they always have. I can try to give them the benefit of the doubt that they will not try their old tricks. But I am never able to see it as remotely possible. So that is what we are cheering for. And look! I am not saying that it is all bad. Nor am I saying that it won't set off the rocket of price appreciation. At least for a while. The fact of the matter is MOST Earthlings are going to need help. AND Layer 1, on-chain transactions are going to be expensive as fuck. The average Joe needs help. Frankly, even the above average Lisa needs help. Seriously... LUKE DASHJR has his coins stolen. So, it turns out Hal was right again. We are going to need Bitcoin Banks. And that is exactly what we are seeing the formation of. And by the way... I have never thought exchanges were really "bitcoin banks". Maybe the proto-banks. But if you are paying attention you can see the tip of the real spear making it's way into the spotlight. Old dogs... new tricks.The big exchanges are all conveniently being dragged into the litigation they TOTALLY set themselves up for with all the shitcoin nonsense they did over the last 8+ years. Or they are busy announcing their next NFT series or some other pablum designed to fleece the tiny audience they have been able to gain worldwide. At the same time other big legacy players in the "bitcoin space" are busy having their databases stolen, or floating a way to get your private keys. But at least Ledger is pointed in the right direction macro-strategy wise. They have entered the race to control the money. And though their tradeoff is terribly un-nuanced, they are at least realizing where things are going. Hopefully they improve their strategy. New Kid on the BLOCK.If you thought Jack Dorsey was just a lucky nerd to invent "mico-blogging" then what he did with the Cash App should make you reconsider. But what Block is currently doing tells me that he can see the future. And don't get me wrong. I am not fan-boying @jack. He is also throwing his digital hat into the ring of being the best way to hold your Bitcoin. The Bitkey hardware signer is more than a simple signer. It is also an attempt at creating something your mom or dad could use to hold bitcoin, with SOME sovereignty and a LOT of security. One interesting thing they have done is set up various forms of redundancy so that it makes it extremely difficult to lose your funds because of a single mistake. I am guessing it will also integrate L2 networks as the software grows. At least lightning which Block/Square/CashApp have already done. But this sort of "Bank" introduces a HUGE amount of trust in Block. I have not deeply studied the model yet, but at a glance you have to TRUST Block just like you trust JP Morgan. And although they are dividing the power in a way that you have the majority, they are still able to act as a "safety net" which means they have a lot of control over your UTXOs (or HTLCs). Still... This is a good step. And it might just find the niche that a lot of new Bitcoinners will be attracted to, and frankly better off with than trying to "be their own bank". Cypherpunks gonna cypherpunk.I am admittedly a bit of a fanboy of Adam Back. And I think Blockstream is certainly one of the more important companies in Bitcoin. Blockstream folks have contributed to Bitcoin Core, as well as producing the 2nd most used lightning implementation. They manufacture my favorite hardware wallet (tied with Seedsigner)And they have developed Elements, the engine for their layer 2 creation: Liquid. And though Liquid is a ghosttown still, and has been rightly criticized by people who do not matter very much anymore, it is a very compelling structure into which Bitcoin transactions can move as the fee market makes all of us tremble. It is interoperable with lightning, and has very interesting security trade offs. Would I use it for cold storage? Not yet. But I do have a non-trivial amount of value in it in anticipation of it being more important as we move forward. Well Blockstream too has entered the Bitcoin Bank game. Their Green wallet recently announced the ability to use lightning. It's still experimental, and I am testing it now. And I think it can be used both on the Bitcoin lightning network as well as Liquid lightning. Blockstream is building one of the most compelling sets of tradeoffs. Trust is introduced, but is distributed unlike most other horses in this race. And what they have left to do is to make their wallet Green transparently transact on the network that makes the most sense for the end user, whether it be the base layer, Lightning or Liquid. If they can do that then they will have a very strong business model. Since they own the Liquid network then they can charge small fees for transactions and make their money that way. As well as profiting from the exchange of on chain BTC with L-BTC and Lightning. And their model leaves you ultimately sovereign and distributes risk better than others. The best of the best for self-sovereignty.What I really want to see has yet to emerge. Perhaps I should try to create it... oh wait. Is that a taco over there? I think of it as a FOSS Firefox unlike a captured Chromium. An implementation of an easy to use wallet that employs multiple forms of redundancy and integrates multiple layer two networks seamlessly. Yet it is fully FOSS, fully un-owned, and run by the users. It could integrate base layer transactions as well as lightning, and maybe even introduce some of the leading edge strategies like Chaumian Mints (Fedimint, Cashu) or even an Elements based liquid-like implementation. The latter could be interoperable with other Elements implementations, including Liquid itself. Pardon me as I daydream. But are you seeing it? The future? It's out there waiting for us to seize it, direct it, and make it the best it can be. Even as "just" end users we have a lot of power. We choose what works best for us and can help others use those tools as well. No, Neo. What I am telling you is when you are ready... you won't have to!So this is where the competition in Bitcoin software is right now. Becoming the strongest Bitcoin Bank is the prize. And we need to help steer as many as possible to sovereign systems as we can. The old guard, such as the old hardware signers, as well as the big exchanges etc., should be paying attention. They can be left in the dust in a matter of a few years. Or sidelined to a single function, or niche use. While they are still living in the last halving, visionaries are quietly building the rails for the machines that will run on top of Bitcoin. In the end, we as the users... the seasoned users, need to be vigilant to guide the machines in the right direction by supporting the things that are built with the best tradeoffs. And we must help the clueless noobs already here, as well as the hoards on the way, UNDERSTAND why every precious bit of sovereignty you trade for every promise of security and convenience must be CAREFULLY weighed. In the end we, the users, get to OWN our money for the first time in our lifetimes. #CCMF Post of the year, imo. ------------------------- Wrapping up 23, this here sounds about right https://www.youtube.com/watch?v=9wCoXGMxJnk |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 17, 2023, 09:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll