OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

March 21, 2024, 03:24:32 PM |

|

The ETFs in and out flows appear to be controlling the price quite a bit at the moment from what I can see. We are dipping again, now that GBTC has sold another 3000 BTC via Coinbase.

The rest of the ETFs would be pleased to wait until Sellbert drops his coins for them to buy at a cheaper price. IF ETFs are dominating the price right now, regardless the outflow of GS, the volume would be sucked up to about re-establish the pre-GBTC-sell price shortly later on. I am thinking in ETF net flow, makes more sense, imo. |

|

|

|

|

|

|

|

|

|

TalkImg was created especially for hosting images on bitcointalk.org: try it next time you want to post an image

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

March 21, 2024, 03:57:49 PM |

|

Anyone else thinks this is a fake relief rally? I’m

About to make the decision I talked here before to sell 10% of my Bitcoin at certain stages. 69k was the first stage to sell 1%. But I’m ok with 67k right now. I have the feeling we will dump further and stabilize until few months after halving. Would be nice to have some powder to buy back deeper. As I am 100% into bitcoin and have nothing else on the side lol

Yes, but you can take my opinion with a dose of salt as I've been sceptical about this rally since $48K  According to Pi Cycle Top, as discussed elsewhere, $70K is either the mid-cycle top (like in 2019, 2016 and 2012), prior to a correction and consolidation, or this is the late-stage top, ie start of full blown bull market, like in 2020, 2017 and 2013. Based on time, I see this as a mid-stage not a late-stage top, especially given this indicator has "factored in" a new ATH being at this mid-stage top, and has previously been the most accurate at identifying these types of tops. This would otherwise be the first time there has been no "mid-stage correction" in Bitcoin's history, so while possible, the argument is that "this time it's different" - which is a fair argument given the introduction of ETFs and new ATH already. But only time will tell whether this is actually true or not, with the recent break of ATH not being enough to justify that speculative opinion as of yet. More than anything I think ETFs are following the price, not leading it. There has been net inflows on the way up and net outflows on the way down generally speaking, even if they are helping to drive the price in both directions. All it will take is for GBTC to offload the rest of their coins, which may only take a couple of months from here, but until then and seeing net outflows, there remains selling pressure. Based on price alone, either $69K breaks to the upside and price rallies further, or otherwise $60K breaks to the downside, leaving a pretty sizeable volume gap down to $52K at best, but more realistically $42K to $44K (which would still be a macro higher low). Also within a couple of months the 50 Week MA will be around these prices too, so bullish continuation could start from there quite easily. Based on 200 WMA projection, it should be around $37K by August (that was also a consolidation level) and would be a full -50% haircut, which is about as low as I see price going for now, if the correction lasted 4 months. I'm otherwise overlooking the shorter-term TA on 4hr, as while price is currently confirming resistance around $68K (bearish trending 50 MA and ichimoku cloud at volume point of control), this could all still be broken with ease after another re-test of the 200 MA that previously supported the price perfectly (as expected in strong uptrends) and is currently around $62K. Too early to tell comes to mind here. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 04:03:21 PM |

|

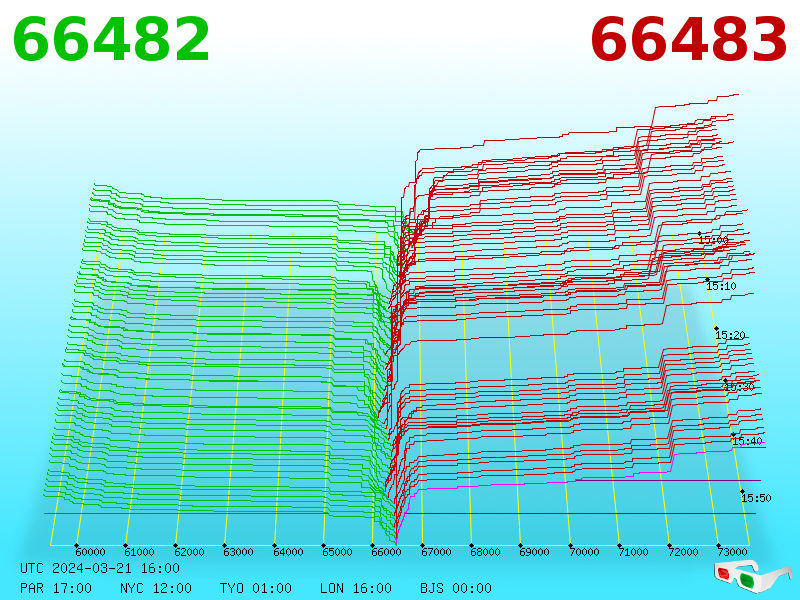

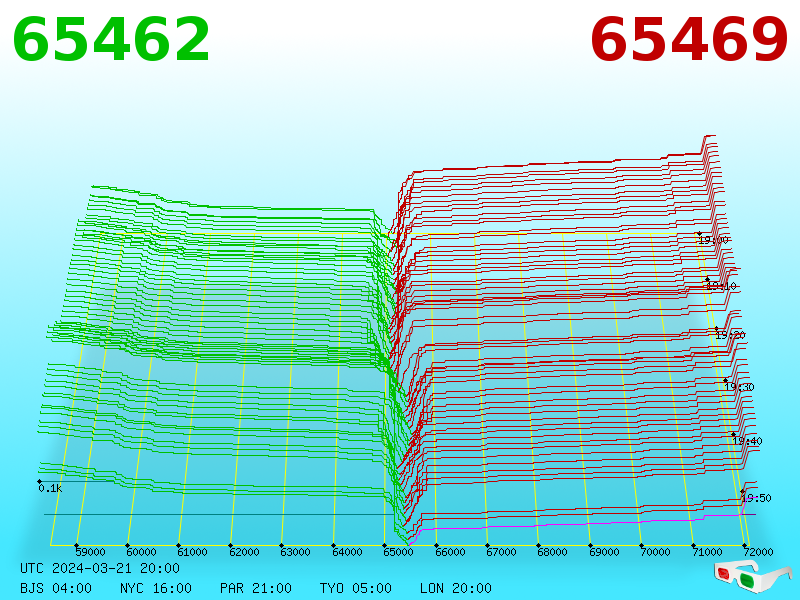

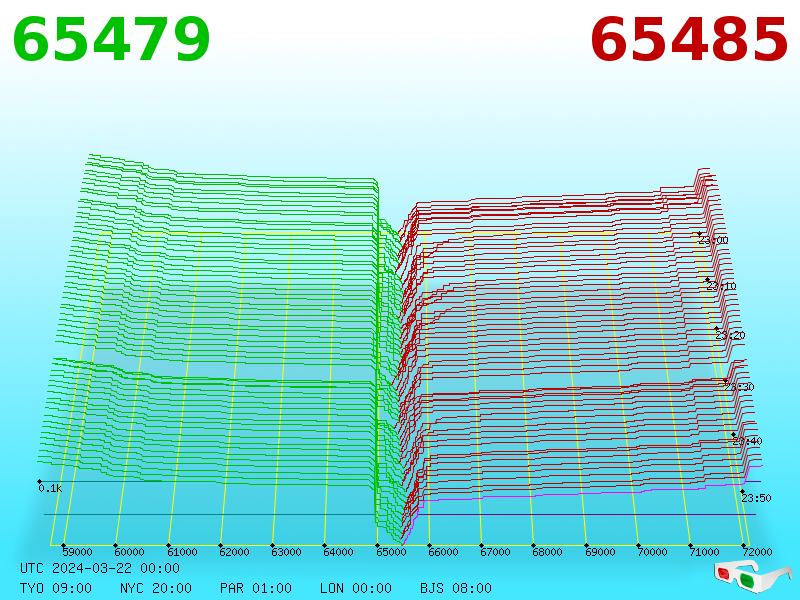

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3234

Merit: 5634

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

March 21, 2024, 04:09:27 PM |

|

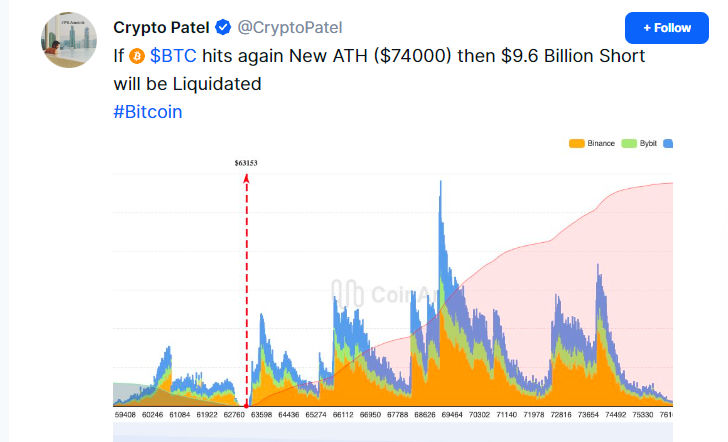

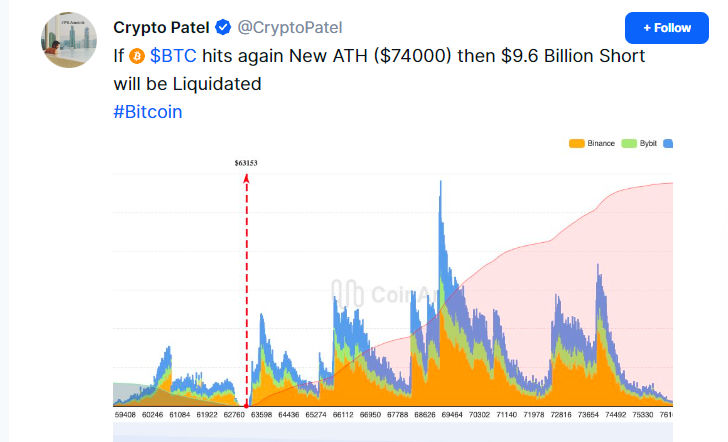

Are we back?  $68K in one hour We are definitely back and this time is with enough energy that can possibly put us far above the previous ATH. As usual, there will be minor turbulence if the below holds water:  Source: https://coinmarketcap.com/community/post/334841115It may be a stupid question, but considering what happened with the liquidation of long positions and futures options a few days ago (about $1.5 billion), what impact will the liquidation of almost $10 billion have on the price? Can we assume that another correction is inevitable, especially if ETFs inflows are at the levels we have had in the last few days? |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9525

#1 VIP Crypto Casino

|

|

March 21, 2024, 04:46:43 PM |

|

@MDBitcoinAt least $1 trillion USD will enter #Bitcoin through the ETFs. This is a reasonable estimation that will occur over time. The Bitcoin ETFs are still not priced in. Let's say it enters in $100 billion increments. And after each $100 billion, the price will need to adjust accordingly to sellers and new supply, Let's assume it stabilizes at a price of $80k after this first 100b increment, Starting Price: $80k After 1st Increment: $119k After 2nd Increment: $154k After 3rd Increment: $191k After 4th Increment: $228k After 5th Increment: $265k After 6th Increment: $302k After 7th Increment: $339k After 8th Increment: $376k After 9th Increment: $413k After 10th Increment: $450k This is only through ETFs, not counting market dynamics, just a simple thought experiment of the potential of a single 1T entering the ETFs, which is extremely conservative. https://x.com/mdbitcoin/status/1770751958548156688

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 05:03:28 PM |

|

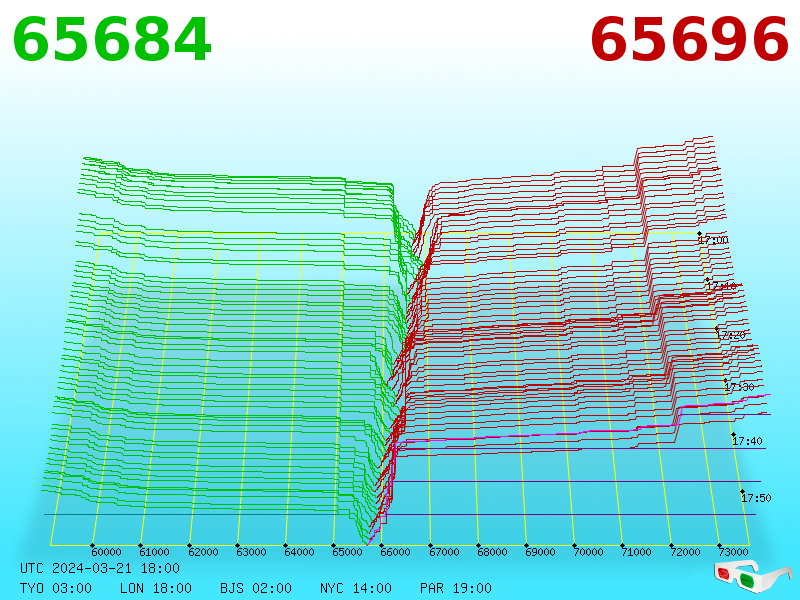

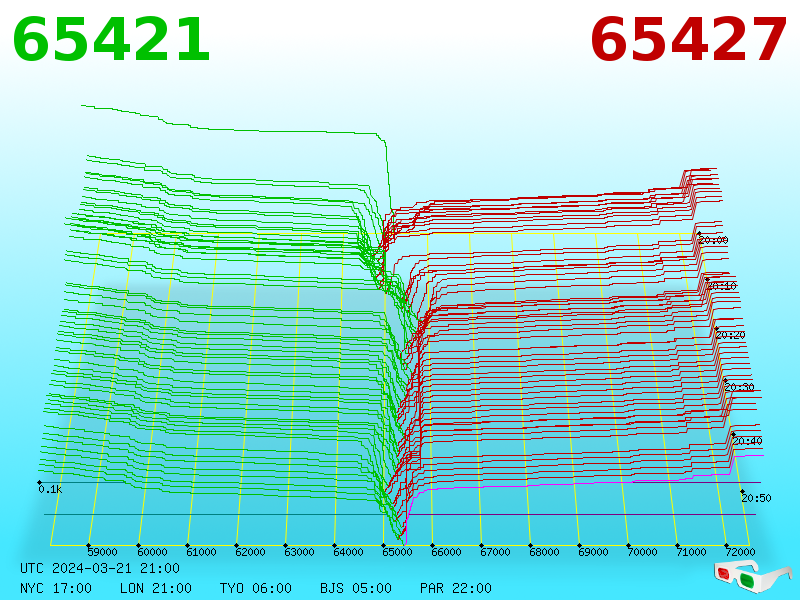

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

WatChe

|

|

March 21, 2024, 05:20:54 PM Merited by JayJuanGee (1) |

|

JP Morgan has concern about the way MSTR is buying Bitcoin but Saylor is very loud and clear about his bitcoin buying strategy: - It's the best investment asset. So the endgame is to acquire more Bitcoin

- Whoever gets the most Bitcoin wins. There is no other endgame

eh..not exactly... BUY bitcoin for cash, don't buy it on a 2.2X perpetual margin. Margin literally kills accounts. I agree with @JJG...there is something odd with the guy rn...like, why you want to buy 500mil a week after you bought 800 mil worth. Between Mar 11 to 18, 2014 Microstrategy has bought 9200 bitcoin for 620 million USD and with that purchase they now have 1% of all bitcoins. 600 Million USD capital was raised via a private offering of 0.875% convertible senior notes due in 2031. Microstrategy now have 214,246 bitcoins with average price of $35,160 - still very much in profit [1]. Look at stock price of Microstrategy for last one month. It has gone up from 687 USD to 1690 USD in less then a month. A straight gain of 1000 USD. The point is Saylor strategy about Bitcoin is working.  Image Source Image Source[1] https://bitcoinmagazine.com/business/michael-saylors-microstrategy-9245-btc-620-million |

|

|

|

|

Alphakilo

Full Member

Offline Offline

Activity: 309

Merit: 132

Cashback 15%

|

The point is Saylor strategy about Bitcoin is working.

His strategy about bitcoin is working because he is a strong believer in investing in assets with scarcity and high demand. Bitcoin stands out as one of such assets due to its capped supply of 21 million coins, making it highly scarce. Saylor has already predicted the continued growth, projecting a 200% annual increase over the next decade and he is putting his money where his mouth is. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 06:01:17 PM |

|

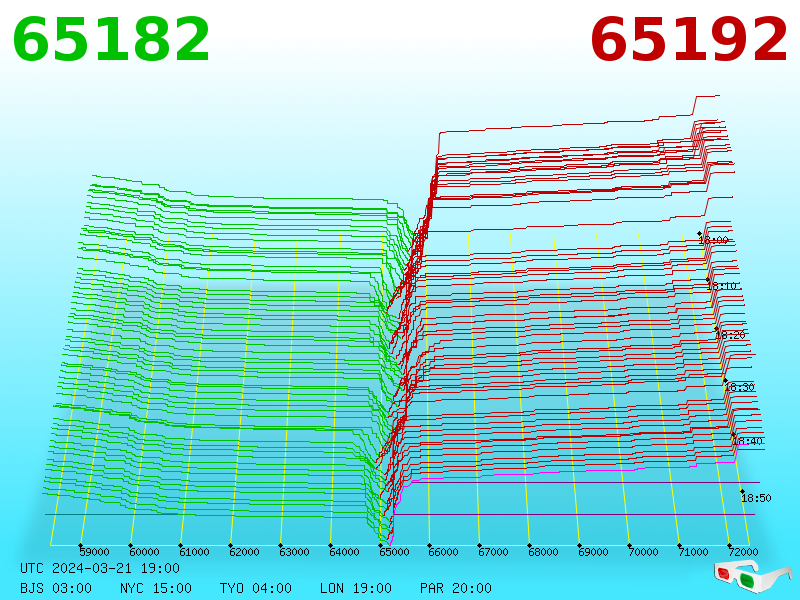

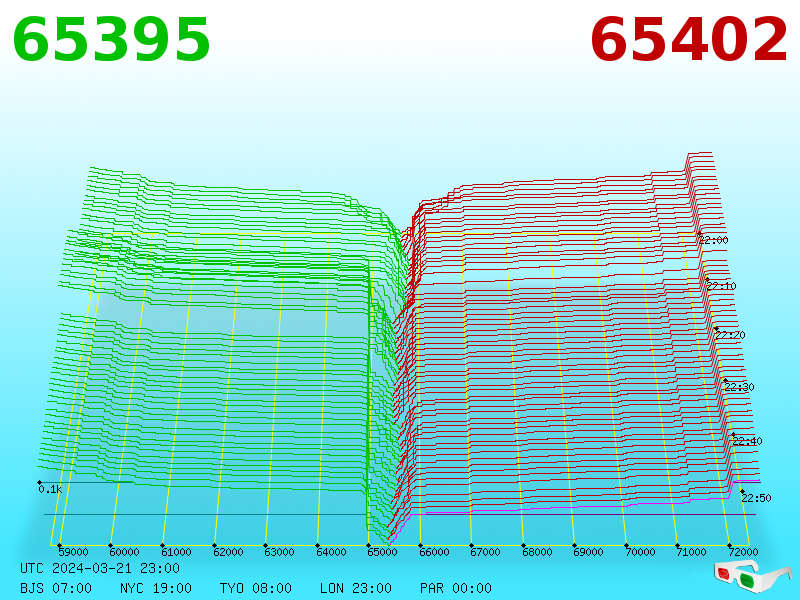

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

UnDerDoG81

Legendary

Offline Offline

Activity: 2179

Merit: 1201

|

|

March 21, 2024, 06:36:24 PM |

|

Anyone else thinks this is a fake relief rally? I’m

About to make the decision I talked here before to sell 10% of my Bitcoin at certain stages. 69k was the first stage to sell 1%. But I’m ok with 67k right now. I have the feeling we will dump further and stabilize until few months after halving. Would be nice to have some powder to buy back deeper. As I am 100% into bitcoin and have nothing else on the side lol

Yes, but you can take my opinion with a dose of salt as I've been sceptical about this rally since $48K  According to Pi Cycle Top, as discussed elsewhere, $70K is either the mid-cycle top (like in 2019, 2016 and 2012), prior to a correction and consolidation, or this is the late-stage top, ie start of full blown bull market, like in 2020, 2017 and 2013. Based on time, I see this as a mid-stage not a late-stage top, especially given this indicator has "factored in" a new ATH being at this mid-stage top, and has previously been the most accurate at identifying these types of tops. This would otherwise be the first time there has been no "mid-stage correction" in Bitcoin's history, so while possible, the argument is that "this time it's different" - which is a fair argument given the introduction of ETFs and new ATH already. But only time will tell whether this is actually true or not, with the recent break of ATH not being enough to justify that speculative opinion as of yet. More than anything I think ETFs are following the price, not leading it. There has been net inflows on the way up and net outflows on the way down generally speaking, even if they are helping to drive the price in both directions. All it will take is for GBTC to offload the rest of their coins, which may only take a couple of months from here, but until then and seeing net outflows, there remains selling pressure. Based on price alone, either $69K breaks to the upside and price rallies further, or otherwise $60K breaks to the downside, leaving a pretty sizeable volume gap down to $52K at best, but more realistically $42K to $44K (which would still be a macro higher low). Also within a couple of months the 50 Week MA will be around these prices too, so bullish continuation could start from there quite easily. Based on 200 WMA projection, it should be around $37K by August (that was also a consolidation level) and would be a full -50% haircut, which is about as low as I see price going for now, if the correction lasted 4 months. I'm otherwise overlooking the shorter-term TA on 4hr, as while price is currently confirming resistance around $68K (bearish trending 50 MA and ichimoku cloud at volume point of control), this could all still be broken with ease after another re-test of the 200 MA that previously supported the price perfectly (as expected in strong uptrends) and is currently around $62K. Too early to tell comes to mind here. Thanks! Since I have no clue about trading and reading charts, this is helpful. What I have a clue about (or experience in) are the fake rallies after some “good news” whales use to create fomo. And that Jerome Powell news from yesterday was the perfect reason for whales to create another fake pump just do dump very hard later. They did this so many times that I’m so sick of this strategy. But of course there is always the chance that “this time it’s different”. Well I missed to sell at 67-68k. Now I won’t sell at 65-66k. Either I wait for another small pump or I take my coins off Binance and go into hodl mode again. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3850

|

|

March 21, 2024, 06:44:43 PM |

|

Anyone else thinks this is a fake relief rally? I’m

About to make the decision I talked here before to sell 10% of my Bitcoin at certain stages. 69k was the first stage to sell 1%. But I’m ok with 67k right now. I have the feeling we will dump further and stabilize until few months after halving. Would be nice to have some powder to buy back deeper. As I am 100% into bitcoin and have nothing else on the side lol

Yes, but you can take my opinion with a dose of salt as I've been sceptical about this rally since $48K  According to Pi Cycle Top, as discussed elsewhere, $70K is either the mid-cycle top (like in 2019, 2016 and 2012), prior to a correction and consolidation, or this is the late-stage top, ie start of full blown bull market, like in 2020, 2017 and 2013. Based on time, I see this as a mid-stage not a late-stage top, especially given this indicator has "factored in" a new ATH being at this mid-stage top, and has previously been the most accurate at identifying these types of tops. This would otherwise be the first time there has been no "mid-stage correction" in Bitcoin's history, so while possible, the argument is that "this time it's different" - which is a fair argument given the introduction of ETFs and new ATH already. But only time will tell whether this is actually true or not, with the recent break of ATH not being enough to justify that speculative opinion as of yet. More than anything I think ETFs are following the price, not leading it. There has been net inflows on the way up and net outflows on the way down generally speaking, even if they are helping to drive the price in both directions. All it will take is for GBTC to offload the rest of their coins, which may only take a couple of months from here, but until then and seeing net outflows, there remains selling pressure. Based on price alone, either $69K breaks to the upside and price rallies further, or otherwise $60K breaks to the downside, leaving a pretty sizeable volume gap down to $52K at best, but more realistically $42K to $44K (which would still be a macro higher low). Also within a couple of months the 50 Week MA will be around these prices too, so bullish continuation could start from there quite easily. Based on 200 WMA projection, it should be around $37K by August (that was also a consolidation level) and would be a full -50% haircut, which is about as low as I see price going for now, if the correction lasted 4 months. I'm otherwise overlooking the shorter-term TA on 4hr, as while price is currently confirming resistance around $68K (bearish trending 50 MA and ichimoku cloud at volume point of control), this could all still be broken with ease after another re-test of the 200 MA that previously supported the price perfectly (as expected in strong uptrends) and is currently around $62K. Too early to tell comes to mind here. ...but what do you REALLY think? Surely, it could go up or down, as always. What's the probabilities, as @JJG likes to post from time to time? If bitcoin is 37K by August, all ETF holders will be out of it and ETF "project" crashes and burns. ETF investors are not accustomed to more than 50% haircuts in a few months. They will be out and stay out. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 07:03:26 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

March 21, 2024, 07:03:29 PM Merited by JayJuanGee (1) |

|

Anyone else thinks this is a fake relief rally? I’m

About to make the decision I talked here before to sell 10% of my Bitcoin at certain stages. 69k was the first stage to sell 1%. But I’m ok with 67k right now. I have the feeling we will dump further and stabilize until few months after halving. Would be nice to have some powder to buy back deeper. As I am 100% into bitcoin and have nothing else on the side lol

Yes, but you can take my opinion with a dose of salt as I've been sceptical about this rally since $48K  According to Pi Cycle Top, as discussed elsewhere, $70K is either the mid-cycle top (like in 2019, 2016 and 2012), prior to a correction and consolidation, or this is the late-stage top, ie start of full blown bull market, like in 2020, 2017 and 2013. Based on time, I see this as a mid-stage not a late-stage top, especially given this indicator has "factored in" a new ATH being at this mid-stage top, and has previously been the most accurate at identifying these types of tops. This would otherwise be the first time there has been no "mid-stage correction" in Bitcoin's history, so while possible, the argument is that "this time it's different" - which is a fair argument given the introduction of ETFs and new ATH already. But only time will tell whether this is actually true or not, with the recent break of ATH not being enough to justify that speculative opinion as of yet. More than anything I think ETFs are following the price, not leading it. There has been net inflows on the way up and net outflows on the way down generally speaking, even if they are helping to drive the price in both directions. All it will take is for GBTC to offload the rest of their coins, which may only take a couple of months from here, but until then and seeing net outflows, there remains selling pressure. Based on price alone, either $69K breaks to the upside and price rallies further, or otherwise $60K breaks to the downside, leaving a pretty sizeable volume gap down to $52K at best, but more realistically $42K to $44K (which would still be a macro higher low). Also within a couple of months the 50 Week MA will be around these prices too, so bullish continuation could start from there quite easily. Based on 200 WMA projection, it should be around $37K by August (that was also a consolidation level) and would be a full -50% haircut, which is about as low as I see price going for now, if the correction lasted 4 months. I'm otherwise overlooking the shorter-term TA on 4hr, as while price is currently confirming resistance around $68K (bearish trending 50 MA and ichimoku cloud at volume point of control), this could all still be broken with ease after another re-test of the 200 MA that previously supported the price perfectly (as expected in strong uptrends) and is currently around $62K. Too early to tell comes to mind here. Thanks! Since I have no clue about trading and reading charts, this is helpful. What I have a clue about (or experience in) are the fake rallies after some “good news” whales use to create fomo. And that Jerome Powell news from yesterday was the perfect reason for whales to create another fake pump just do dump very hard later. They did this so many times that I’m so sick of this strategy. But of course there is always the chance that “this time it’s different”. Well I missed to sell at 67-68k. Now I won’t sell at 65-66k. Either I wait for another small pump or I take my coins off Binance and go into hodl mode again. Just be aware that selling around ATH is historically a very risky strategy. But also, depends on your exposure how much your selling etc. If you're 100% invested, then sure, you could be overexposed here, even if price were to go to the upside, you wouldn't be "losing" much by holding 90%. Especially if you'd feel more comfortable having some dry powder for a potential correction. Often I think it's less about whether price is more likely to go up or down, but what you feel more comfortable with, or which scenario you'd prefer to be. Ie, would you prefer to have 10% capital for a potential correction, or prefer to be 100% in rather than 90% if there were further upside? That's the real question here. To me that'd be a no brainier, as I'm not as greedy as I used to be, but everyone is different. ...but what you REALLY think? Surely, it could up or down, as always.

What's the probabilities, as @JJG likes to post from time to time?

If bitcoin is 37K by August, all ETF holders will be out of it and ETF "project" crashes and burns.

ETF investors are not accustomed to more than 50% haircuts in a few months.

They will be out and stay out.

Not sure if you were asking me, but at present I'd say 50/50 further upside. With $60K breaking I'd be 60/40 for further downside. With $69K breaking to the upside I'd say 60/40 further upside. Not massively swaying in either direction here and from a trading perspective this is very much in a "no trade zone" when inbetween support and resistance. Hence emphasis on too early tell. But also if you're not willing to sell below $60K (for obvious reasons), then you'd have to make a decision before then. Not gonna lie, some of the best analysts are suggesting that the cycle is over now with ETFs entering the space, which while I generally agree with, I don't believe it will be fully realised until GBTC selling is resolved. Either that, of net inflows returns to positive again, which again above $69K would be quite likely I think. As for the idea that ETF investors will jump ship if price corrected in half, I think the opposite is true. They got in knowing price could correct 50% or further, and are instead much more likely to double down at a considerable discount, after some consolidation and price stability (ie not buying the dip per say), compared to retail who are known for panic selling. I don't think they are naive or going to be quick sellers, but instead they will happily sit back and let prices fall until strength returns to the market, as they have done this week, as is the norm for ETF investing, in order to buy strength not weakness. I think JJG might even agree with me to some degree on this point that ETF investors are more likely to be strong hands, that I'm slowly but surely coming round to, especially given the lack of selling over the recent correction. Even if this doesn't change the situation with GBTC outflows at present. Obviously this is speculation that ETF holders will be strong hands, as is that they will be weak hands, when neither can be proven yet. But that's all we have to go on for now: speculation. |

|

|

|

|

|

adultcrypto

|

|

March 21, 2024, 07:39:58 PM |

|

Are we back?  $68K in one hour We are definitely back and this time is with enough energy that can possibly put us far above the previous ATH. As usual, there will be minor turbulence if the below holds water:  Source: https://coinmarketcap.com/community/post/334841115It may be a stupid question, but considering what happened with the liquidation of long positions and futures options a few days ago (about $1.5 billion), what impact will the liquidation of almost $10 billion have on the price? Can we assume that another correction is inevitable, especially if ETFs inflows are at the levels we have had in the last few days? Like I said in my earlier posts, such liquidation will cause deeper correction(the reason I referred to it as turbulence) than the previous liquidation but it is not the time to panic because bitcoin have got the necessary fundamental that will lead to quick recovery just like we are witnessing now. It does not make sense to see a prolonged dump when bitcoin halving is around the corner. One thing that is certain is that traders will do what they are good at doing, they are loyal to one thing which is the profit. So, often we will experience huge liquidation and that is how the market movement of impulse and correction is maintained. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 08:01:16 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 09:01:22 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 10:03:36 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 21, 2024, 11:03:23 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 22, 2024, 12:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2071

$120000 in 2024 Confirmed

|

|

March 22, 2024, 12:54:50 AM |

|

Dang it

|

|

|

|

|

|

Poll

Poll