thinkdifferent

Full Member

Offline Offline

Activity: 212

Merit: 100

ASK ME FOR LOANS

|

|

November 10, 2017, 06:39:57 AM |

|

Is it safe to lend money on this site?

I never lend money without taking collateral so asking your feedbacks.

|

ASK ME FOR LOANS

|

|

|

|

|

|

|

|

|

|

Once a transaction has 6 confirmations, it is extremely unlikely that an attacker without at least 50% of the network's computation power would be able to reverse it.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

illyiller

|

|

November 10, 2017, 09:19:45 AM |

|

Is it safe to lend money on this site?

I never lend money without taking collateral so asking your feedbacks.

It's "safe" if you consider that they got hacked last year and can't explain how it happened. Personally, I don't think the lending rates there justify the exchange risk. It's "easy money" if you think about it like parking money in a bank account and letting the interest stack, but it's much more risky than that. Given all the volatility and money flowing into the cryptocurrency markets, I think there's much more money to be made trading altcoins/tokens. Or otherwise BTC on leverage. I would only keep money on Bitfinex if I were actively holding a trade. Otherwise I would get my coins the hell outta there. I can't wait until DEXs change all this and put the centralized exchanges out of business... |

|

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

November 10, 2017, 10:35:25 AM |

|

Is it safe to lend money on this site?

I never lend money without taking collateral so asking your feedbacks.

It's "safe" if you consider that they got hacked last year and can't explain how it happened. Personally, I don't think the lending rates there justify the exchange risk. It's "easy money" if you think about it like parking money in a bank account and letting the interest stack, but it's much more risky than that. Given all the volatility and money flowing into the cryptocurrency markets, I think there's much more money to be made trading altcoins/tokens. Or otherwise BTC on leverage. I would only keep money on Bitfinex if I were actively holding a trade. Otherwise I would get my coins the hell outta there. I can't wait until DEXs change all this and put the centralized exchanges out of business... We may have to wait longer than you expect When Bitfinex got hacked last year, I raised a question whether 70 million dollars (that were stolen from the exchange, if I'm not mistaken) would suffice for developing a fully functional decentralized exchange based on the Bitcoin blockchain (read integrated right into Bitcoin). Most people replied that it would be more than enough. Over a year has passed since then, but we still don't see any DEX's in Bitcoin. Wtf, it took almost a year and a half to get SegWit finally activated in this coin, and it will likely take as much to active LN (a necessary step to decentralized exchanges in Bitcoin), if not longer |

|

|

|

Timetwister

Legendary

Offline Offline

Activity: 1199

Merit: 1047

|

|

November 10, 2017, 12:35:36 PM |

|

Is it safe to lend money on this site?

I never lend money without taking collateral so asking your feedbacks.

It's "safe" if you consider that they got hacked last year and can't explain how it happened. Personally, I don't think the lending rates there justify the exchange risk. It's "easy money" if you think about it like parking money in a bank account and letting the interest stack, but it's much more risky than that. Given all the volatility and money flowing into the cryptocurrency markets, I think there's much more money to be made trading altcoins/tokens. Or otherwise BTC on leverage. I would only keep money on Bitfinex if I were actively holding a trade. Otherwise I would get my coins the hell outta there. I can't wait until DEXs change all this and put the centralized exchanges out of business... It's not worth lending BTC in general, but interest rates for USD are quite good. |

|

|

|

|

|

Samarkand

|

|

November 10, 2017, 02:26:49 PM |

|

...

I believe they have created additional corporate entities to receive money through so they have been able to receive (and send) USD via the banking system. I understand they are primarily catering to institutional customers so they may not be willing to deal in USD via the banking system for smaller amounts.

I agree with your statement. However, it is probably a legal grey area if you create a new corporate entity for the sole purpose of being able to receive money after you lost banking relationships with your main business. Since my post yesterday an additional 30M of Tether have been released. I somehow doubt that institutional investors are buying all these Tether when they could simply buy Bitcoin directly using a more reputable service like Gemini. Let´s assume that you are an institutional investor willing to buy Bitcoin. Why would you wire 10M (or more) to Tether just in order to trade on Bitfinex when you could also skip this step and buy Bitcoin at Gemini or a comparable site without the intermediary buy of Tethers? |

|

|

|

|

Quickseller

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 2298

|

|

November 10, 2017, 03:41:32 PM |

|

...

I believe they have created additional corporate entities to receive money through so they have been able to receive (and send) USD via the banking system. I understand they are primarily catering to institutional customers so they may not be willing to deal in USD via the banking system for smaller amounts.

I agree with your statement. However, it is probably a legal grey area if you create a new corporate entity for the sole purpose of being able to receive money after you lost banking relationships with your main business. Since my post yesterday an additional 30M of Tether have been released. I somehow doubt that institutional investors are buying all these Tether when they could simply buy Bitcoin directly using a more reputable service like Gemini. Let´s assume that you are an institutional investor willing to buy Bitcoin. Why would you wire 10M (or more) to Tether just in order to trade on Bitfinex when you could also skip this step and buy Bitcoin at Gemini or a comparable site without the intermediary buy of Tethers? If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book. |

|

|

|

|

|

Samarkand

|

|

November 10, 2017, 04:07:28 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

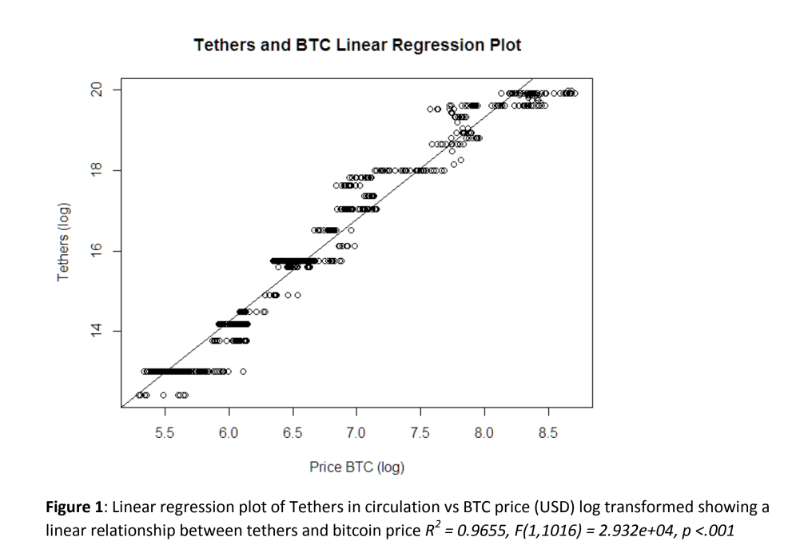

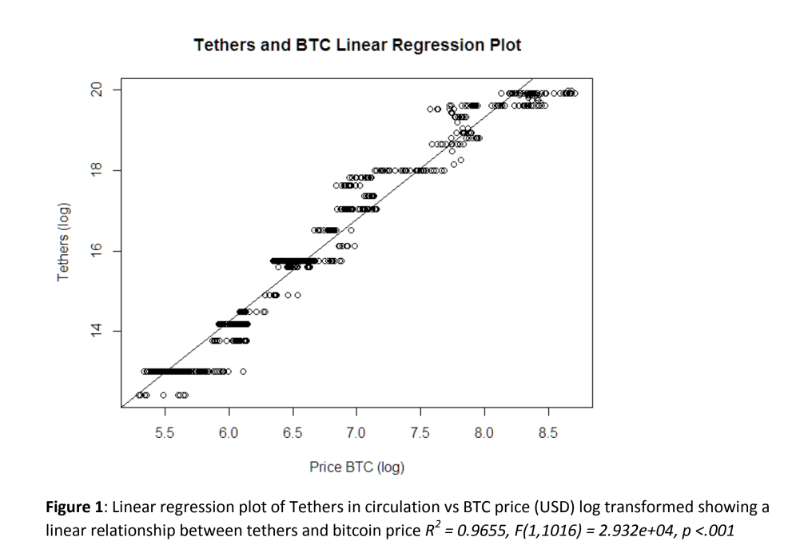

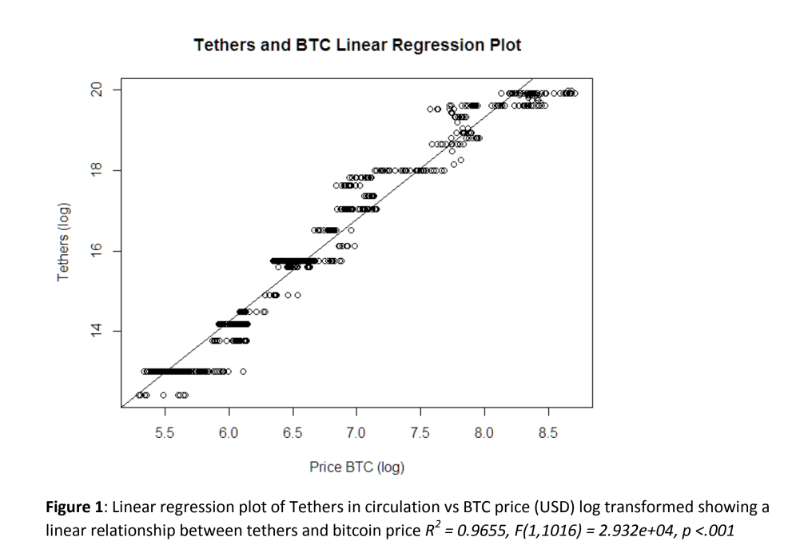

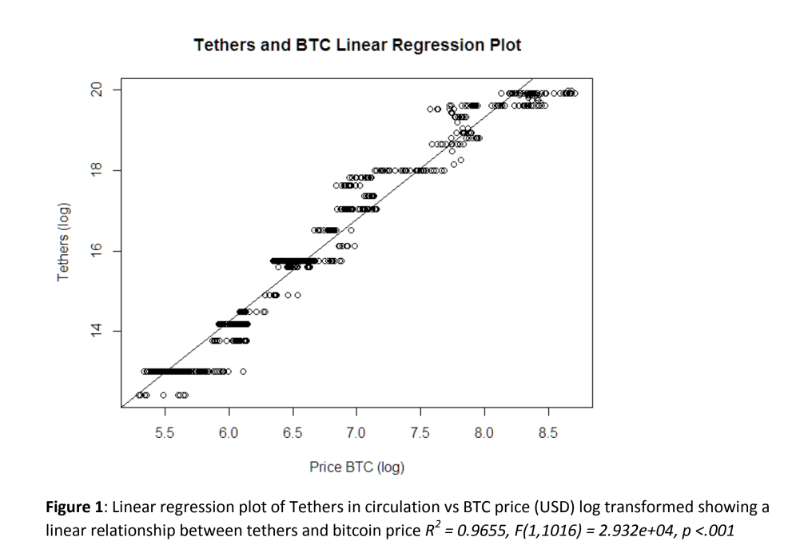

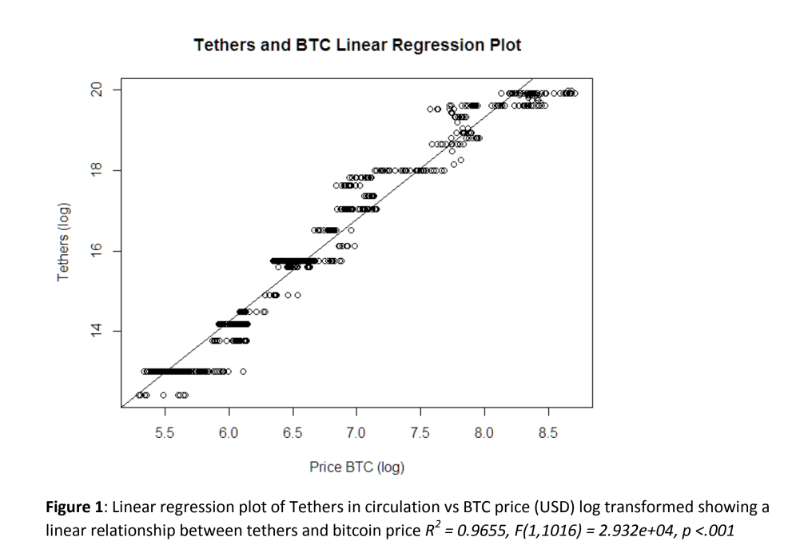

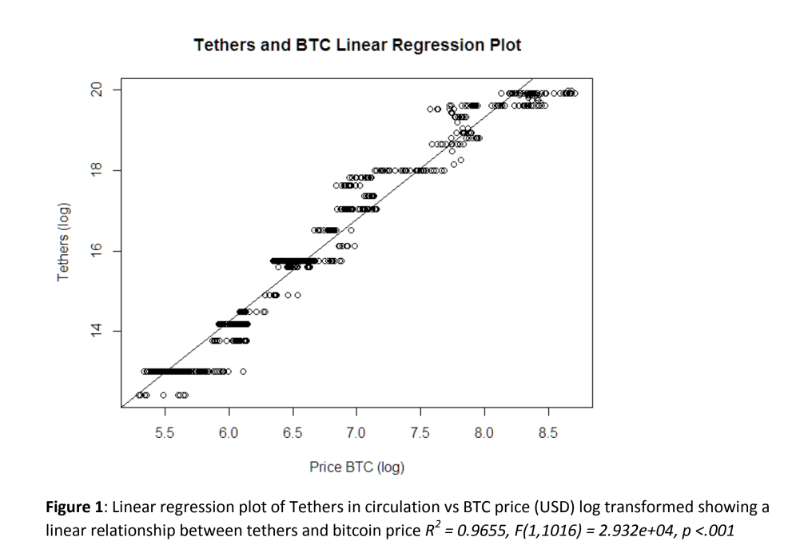

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. |

|

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

November 10, 2017, 04:20:27 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. Correlation doesn't mean causation Obviously, these two things seem to be closely related to each other, but we can't say with certainty that the recent price rise was due to "printing" Tether tokens and people buying real bitcoins with them, thereby pushing the price up. It could very well be the other way round. Anyway, it is something new, and I'm as concerned as you are and likely anyone else if it is not a sort of FRB at best or a Ponzi at worst. We should definitely seek for further information, and it would be nice if someone from Bitfinex came to us and explained all these things in a simple and comprehensible language |

|

|

|

|

Samarkand

|

|

November 10, 2017, 04:33:17 PM |

|

...

Correlation doesn't mean causation

Obviously, these two things seem to be closely related to each other, but we can't say with certainty that the recent price rise was due to "printing" Tether tokens and people buying real bitcoins with them, thereby pushing the price up. It could very well be the other way round. Anyway, it is something new, and I'm as concerned as you are and likely anyone else if it is not a sort of FRB at best or a Ponzi at worst. We should definitely seek for further information, and it would be nice if someone from Bitfinex came to us and explained all these things in a simple and comprehensible language

Yes, the causal connection could definitely be the other way around, too. However, I think my interpretation is more likely, because newly issued Tethers often ended up in margin positions a few hours after the issuance. This is just too much of a coincidence. If it looks like a duck... Regarding my earlier post I probably need to clarify that I don´t think that all of the 2017 rally can be attributed to Tether issuance. Nonetheless, I think that Tether contributed to the price increase, which then lead to increased media coverage, which caused inflows of genuine money. Push the price up a few hundred dollars using margin positions powered by Tether and watch real money flow in by people, who buy in due to the (artificial) price rise. |

|

|

|

|

Timetwister

Legendary

Offline Offline

Activity: 1199

Merit: 1047

|

|

November 10, 2017, 04:44:04 PM |

|

...

I believe they have created additional corporate entities to receive money through so they have been able to receive (and send) USD via the banking system. I understand they are primarily catering to institutional customers so they may not be willing to deal in USD via the banking system for smaller amounts.

I agree with your statement. However, it is probably a legal grey area if you create a new corporate entity for the sole purpose of being able to receive money after you lost banking relationships with your main business. Since my post yesterday an additional 30M of Tether have been released. I somehow doubt that institutional investors are buying all these Tether when they could simply buy Bitcoin directly using a more reputable service like Gemini. Let´s assume that you are an institutional investor willing to buy Bitcoin. Why would you wire 10M (or more) to Tether just in order to trade on Bitfinex when you could also skip this step and buy Bitcoin at Gemini or a comparable site without the intermediary buy of Tethers? I lend some USD there. I just simply used fiat to buy BTC, deposited them on Bitfinex, sold them and lent the money. What's the point Tether? |

|

|

|

|

Quickseller

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 2298

|

|

November 10, 2017, 08:10:50 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. One could see this as evidence that bitfinex is a market leader and that many large customers are using their platform. If the USDT was fake, then it’s price would fall below $1 when arbitrators cannot sell their USDT for USD to tether, which has not happened. |

|

|

|

|

mayax

Legendary

Offline Offline

Activity: 1456

Merit: 1004

|

|

November 10, 2017, 08:47:20 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. One could see this as evidence that bitfinex is a market leader and that many large customers are using their platform. If the USDT was fake, then it’s price would fall below $1 when arbitrators cannot sell their USDT for USD to tether, which has not happened. one can see that you are a shill  Bitfinex is creating a ponzi. you must be blind not seeing that. What genuine company would not have a bank since 7 months ago or a listed(on website) bank account? A "market leader" without a bank account, fake volumes,Tether shit and so on... What kind or "leader" is that? If this shit company is a leader then the majority of the BTC users are scammers, fraudsters, money launderers ...like them. Also, there are many other questions you can put yourself about this fraudulent company. I warned about BTC-e since years ago like I warn about Bitfinex "now"... This bubble will burst soon and many will cry. |

|

|

|

|

Quickseller

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 2298

|

|

November 10, 2017, 08:59:31 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. One could see this as evidence that bitfinex is a market leader and that many large customers are using their platform. If the USDT was fake, then it’s price would fall below $1 when arbitrators cannot sell their USDT for USD to tether, which has not happened. one can see that you are a shill  Bitfinex is creating a ponzi. you must be blind not seeing that. What genuine company would not have a bank since 7 months ago or a listed(on website) bank account? A "market leader" without a bank account, fake volumes,Tether shit and so on... What kind or "leader" is that? If this shit company is a leader then the majority of the BTC users are scammers, fraudsters, money launderers ...like them. Also, there are many other questions you can put yourself about this fraudulent company. I warned about BTC-e since years ago like I warn about Bitfinex "now"... This bubble will burst soon and many will cry. Why don’t you point out where other exchanges have posted their bank details on their websites? Please and thank you. |

|

|

|

|

mayax

Legendary

Offline Offline

Activity: 1456

Merit: 1004

|

|

November 10, 2017, 09:48:16 PM |

|

...If I had to guess, I would say someone with $10mm doesn’t use Gemini because you cannot realistically buy that much bitcoin on Gemini (doing so would effectively clear the order book). If you wanted to buy $2mm worth of bitcoin on Gemini you would lose about 2.5% via slippage based on Gemini’s order book. Buying $2mm on bitfinex would result in less than $50 in slippage (<1%) based on their current order book.

Interesting! I was under the impression that Gemini had really good liquidity, but apparently you are right and it isn´t really suited for really big purchases of several millions $. I continued digging into the Tether accusations and found this interesting plot:  I´m not really sure who created it, but if the displayed correlation between Tether and BTC price is correct the BTC rally of 2017 has to be approached with a healthy scepticism. One could see this as evidence that bitfinex is a market leader and that many large customers are using their platform. If the USDT was fake, then it’s price would fall below $1 when arbitrators cannot sell their USDT for USD to tether, which has not happened. one can see that you are a shill  Bitfinex is creating a ponzi. you must be blind not seeing that. What genuine company would not have a bank since 7 months ago or a listed(on website) bank account? A "market leader" without a bank account, fake volumes,Tether shit and so on... What kind or "leader" is that? If this shit company is a leader then the majority of the BTC users are scammers, fraudsters, money launderers ...like them. Also, there are many other questions you can put yourself about this fraudulent company. I warned about BTC-e since years ago like I warn about Bitfinex "now"... This bubble will burst soon and many will cry. Why don’t you point out where other exchanges have posted their bank details on their websites? Please and thank you. in their withdrawals/deposit section |

|

|

|

|

|

TheQuin

|

|

November 11, 2017, 07:56:03 AM |

|

I lend some USD there. I just simply used fiat to buy BTC, deposited them on Bitfinex, sold them and lent the money. What's the point Tether?

The only real differences are that you take the currency risk during the time it takes to purchase and transfer the BTC and the additional costs of commissions on buying and selling BTC twice. I have and would do it the same way as you, but I'd guess for someone looking to move millions of dollars the savings are attractive. |

|

|

|

|

Samarkand

|

|

November 11, 2017, 11:30:06 AM |

|

...

I lend some USD there. I just simply used fiat to buy BTC, deposited them on Bitfinex, sold them and lent the money. What's the point Tether?

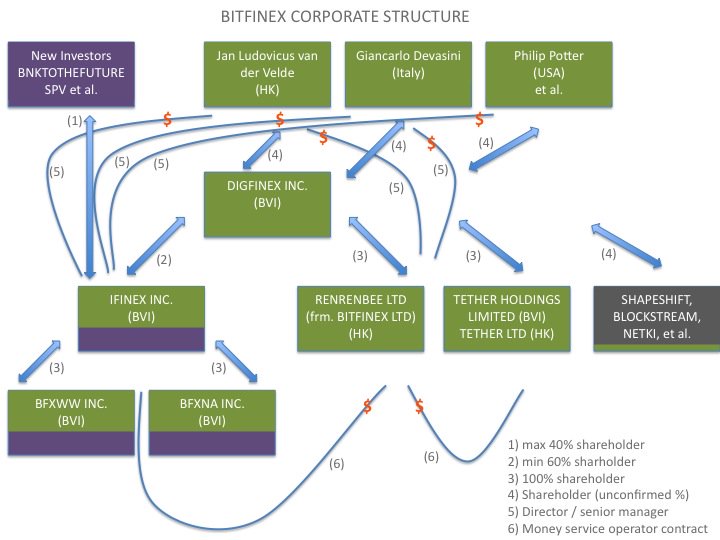

I actually do exactly the same to fund my Bitfinex account in order to lend USD. However, this whole Tether situation has created some doubts that make me question, whether it is smart to use Bitfinex (even for lending purposes and not trading) any more. I´m personally planning on reducing the amount of USD that I have currently lend out there. What exactly is your question regarding Tether? The involvement of Bitfinex in Tether? Take a look at the following chart that analyses the corporate structure of Bitfinex, Tether and the other corporate entities:  Meanwhile Tether has authorized another 30M. Tether issuance in the last 14 days has reached a staggering 150M. http://omniexplorer.info/lookupadd.aspx?address=3MbYQMMmSkC3AgWkj9FMo5LsPTW1zBTwXLOr are you more interested in the general purpose of Tether and why it has been created? In my opinion the main reason is that it enables certain exchanges (e.g. Poloniex) to have fiat or rather quasi-fiat trading pairs without having to rely on formal banking relationships, which obviously are hard to attain for cryptocurrency related businesses. |

|

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

November 11, 2017, 01:58:50 PM

Last edit: November 12, 2017, 12:35:13 PM by deisik |

|

...

I lend some USD there. I just simply used fiat to buy BTC, deposited them on Bitfinex, sold them and lent the money. What's the point Tether?

I actually do exactly the same to fund my Bitfinex account in order to lend USD. However, this whole Tether situation has created some doubts that make me question, whether it is smart to use Bitfinex (even for lending purposes and not trading) any more. I´m personally planning on reducing the amount of USD that I have currently lend out there And what does it mean? For us, simple traders at Bitfinex? What are your doubts more specifically? Do you mean that they create Tethers out of thin air? How are they supposed to be created and on which basis? As far as I understand it, the amount of Tether tokens in circulation should match the amount of dollars injected into the system, right? In other words, the whole purpose of this operation is to create a parallel quasi-banking system which would allow people to buy cryptocurrencies with real dollars bypassing banks (most likely, American banks) |

|

|

|

|

TheQuin

|

|

November 12, 2017, 10:24:50 AM |

|

For us, simple traders at Bitfinex? What are your doubts more specifically? Do you mean that they create Tethers out of thin air? How are they supposed to be created and on which basis? As far as I understand it, the amount of Tether tokens in circulation should match the amount of dollars injected into the system, right? In other words, the whole purpose of this operation is to create a parallel quasi-banking system which would allow people to buy cryptocurrencies with real dollars bypassing banks (most likely, American banks)

The accusation for the conspiracy theories is exactly that, Tethers are created out of thin air. I haven't seen anything that could be remotely conceived of evidence for it. The usual approach is just to point out that the people behind Bitfinex are also involved in Tether and assert therefore it must be a scam. Everyone is free to make up their own mind who they believe: https://wallet.tether.to/transparencyAll tethers are backed 100% by actual assets in our reserve account

Our reserve account is regularly audited

Or you can go with what anonymous accounts post on internet forums. |

|

|

|

deisik

Legendary

Offline Offline

Activity: 3444

Merit: 1280

English ⬄ Russian Translation Services

|

|

November 12, 2017, 10:33:58 AM |

|

https://wallet.tether.to/transparencyAll tethers are backed 100% by actual assets in our reserve account

Our reserve account is regularly audited

Or you can go with what anonymous accounts post on internet forums I'm not very much interested in what dudes like mayax are posting here But as the saying goes, just because you're paranoid, it doesn't mean they aren't after you. It is essentially the same with Tether. If someone slings mud at them (or at Bitfinex, for that matter), it doesn't mean that we shouldn't seek real facts and data for ourselves which would either prove or disprove our suspicions. In this case specifically, Tether claims that they are regularly audited, so where can we find the audit reports? Are they publicly audited since otherwise these audits (or rather claims) are pretty much inconsequential |

|

|

|

mayax

Legendary

Offline Offline

Activity: 1456

Merit: 1004

|

|

November 12, 2017, 10:42:02 AM |

|

For us, simple traders at Bitfinex? What are your doubts more specifically? Do you mean that they create Tethers out of thin air? How are they supposed to be created and on which basis? As far as I understand it, the amount of Tether tokens in circulation should match the amount of dollars injected into the system, right? In other words, the whole purpose of this operation is to create a parallel quasi-banking system which would allow people to buy cryptocurrencies with real dollars bypassing banks (most likely, American banks)

The accusation for the conspiracy theories is exactly that, Tethers are created out of thin air. I haven't seen anything that could be remotely conceived of evidence for it. The usual approach is just to point out that the people behind Bitfinex are also involved in Tether and assert therefore it must be a scam. Everyone is free to make up their own mind who they believe: https://wallet.tether.to/transparencyAll tethers are backed 100% by actual assets in our reserve account

Our reserve account is regularly audited

Or you can go with what anonymous accounts post on internet forums. by whom? I didn't see a genuine audit company (not a shit so called company related to Bitfinex) showing the audit report. Bitfinex is a criminal company and it will end like BTC-e. |

|

|

|

|

|