Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

August 27, 2021, 07:55:06 AM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

In other words, 6 digits would hardly be any kind of crazy rise, whether we are measuring from our $30ks correction zone (a bit more than 3x) or measuring from our current prices $48,300-ish (a bit more than 2x). But what I said was, “What is crazy is, Bitcoin at “6 digits” is might not actually be the moon”.  Yes, people likely currently think that 6 digits looks BIG, just like they thought 4 digits looked BIG in 2015 when we were stuck in the $200s for most of the year, and just like 5 digits also was seeming big in just recent times.

But think of it as how high Bitcoin has reached in current market value. An experimental protocol that started its development in someone’s “basement”. It’s INSANE that the “PONZI SCHEME” lasted this long, and will last for the next generation. Of course, many of us longer term BTC HODLers are recognizing and appreciating that likely the BTC investment thesis is stronger in current times than it had been a few years back, so even if the UPside BTC price performance potential has been reduced by already happened bitcoin price movements, there remains some additional assurances regarding the downside potential (safety) too. And, buy the dip also might be questions about how much of a dip is sufficient this time around, and so far we have had a dip of about 7% from $50,562 to $47,100 - is the dip over? did anyone buy this particular dip? YES, because every seller always has a buyer in the open market, and I believe those buyers might be the billionaires taking more Bitcoins out of the plebs’ hands, and into their cold-storage again. Which could become a problem. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

|

|

The Bitcoin network protocol was designed to be extremely flexible. It can be used to create timed transactions, escrow transactions, multi-signature transactions, etc. The current features of the client only hint at what will be possible in the future.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 27, 2021, 01:12:30 PM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

In other words, 6 digits would hardly be any kind of crazy rise, whether we are measuring from our $30ks correction zone (a bit more than 3x) or measuring from our current prices $48,300-ish (a bit more than 2x). But what I said was, “What is crazy is, Bitcoin at “6 digits” is might not actually be the moon”.  Yes, people likely currently think that 6 digits looks BIG, just like they thought 4 digits looked BIG in 2015 when we were stuck in the $200s for most of the year, and just like 5 digits also was seeming big in just recent times.

But think of it as how high Bitcoin has reached in current market value. An experimental protocol that started its development in someone’s “basement”. It’s INSANE that the “PONZI SCHEME” lasted this long, and will last for the next generation. Of course, many of us longer term BTC HODLers are recognizing and appreciating that likely the BTC investment thesis is stronger in current times than it had been a few years back, so even if the UPside BTC price performance potential has been reduced by already happened bitcoin price movements, there remains some additional assurances regarding the downside potential (safety) too. And, buy the dip also might be questions about how much of a dip is sufficient this time around, and so far we have had a dip of about 7% from $50,562 to $47,100 - is the dip over? did anyone buy this particular dip? YES, because every seller always has a buyer in the open market, and I believe those buyers might be the billionaires taking more Bitcoins out of the plebs’ hands, and into their cold-storage again. Which could become a problem. Of course there is a bit of a riddle nonsense in your statement, but sure I get the point that there may well be very rich peeps taking money from the normies, but it still seems to me to largely be a myth in the sense that each of us, as individuals have a lot of power in this particular asset class, relatively speaking. Probably Wallstreet and some of the traditional status quo rich are a bit irritated by the fact that no matter what they do, they are not going to be able to garner large portions of the bitcoin wealth, so yeah sure a lot of newbies are turning over their coins, but there are a lot of coins that are not moving and only 900 new coins are being mined per day..and the status quo rich can ONLY get those coins by paying market rate and the more they pay, the higher the BTC price goes. Yes, of course they have their tricks to try to get coins from HODLers, but still plebs/newbies have a lot of advantages in this market both historically and even currently to continue to front run wall street and the traditional status quo. In spite of the rumors, the status quo rich are still not coming to bitcoin in droves, even though there are some of the status quo rich (perhaps the smarter ones?) who are attempting to gobble up as many BTC as they can, and they are not selling.. they are just buying and accumulating BTC. Yes, I know that there are a lot of dumby plebs who do not realize their power in respect to this asset class, and they get confused in terms of recognizing and appreciating the difference between bitcoin and the various shitcoin products out there that are referred to in terms such as crypto.. what the fuck is that? Well you see people using the term all the time, and if you get tricked away from stacking sats and building your bitcoin portfolio, you only have yourself to blame. So again, whether you bought on this particular dip (which now had gone down to as low as $46,309 within the past 24 hours) then surely you are doing what you can in terms of getting some of your own stash that is going to likely continue to be harder and harder to build for normies in terms of high levels of BTC.. but even if it is hard to do, it still seems to be an aspiration that remains worth pursuing on a regular and ongoing basis... until you reach your BTC accumulation goals. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

ILuckyGuyI

|

|

August 27, 2021, 06:20:29 PM |

|

It is really not easy to catch the dip levels and not to miss those chances. Because we don't know what price the dip is for a coin. We just want to make use of the chance when the coin price decreases at a high rate. For example, I guess many people bought Bitcoin when the price was at $30k. It was a good opportunity to accumulate after a big dump. Some people wanted to wait more and expected a bigger drop. But that didn't happen and they missed it.

|

| Peach

BTC bitcoin | │ | Buy and Sell

Bitcoin P2P | │ | .

.

▄▄███████▄▄

▄██████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀

▀▀▀▀███████▀▀▀▀ | | Available in

EUROPE | AFRICA

LATIN AMERICA | | | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

███████▄█

███████▀

██▄▄▄▄▄░▄▄▄▄▄

█████████████▀

▐███████████▌

▐███████████▌

█████████████▄

██████████████

███▀███▀▀███▀ | .

Download on the

App Store | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

▄██▄

██████▄

█████████▄

████████████▄

███████████████

████████████▀

█████████▀

██████▀

▀██▀ | .

GET IT ON

Google Play | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

August 28, 2021, 11:12:13 AM Merited by JayJuanGee (1) |

|

It is really not easy to catch the dip levels and not to miss those chances. Because we don't know what price the dip is for a coin. We just want to make use of the chance when the coin price decreases at a high rate. For example, I guess many people bought Bitcoin when the price was at $30k. It was a good opportunity to accumulate after a big dump. Some people wanted to wait more and expected a bigger drop. But that didn't happen and they missed it.

Those “dip levels” are there during bear markets, but many people don’t take those golden opportunities to buy. Open a Bitcoin chart and zoom out to the maximum. Do you see it? We are given two years in every cycle to buy the lowest or near-lowest dip for that cycle. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

stadus

Legendary

Offline Offline

Activity: 3080

Merit: 1292

Hhampuz for Campaign management

|

|

August 29, 2021, 11:46:59 AM |

|

It is really not easy to catch the dip levels and not to miss those chances. Because we don't know what price the dip is for a coin. We just want to make use of the chance when the coin price decreases at a high rate. For example, I guess many people bought Bitcoin when the price was at $30k. It was a good opportunity to accumulate after a big dump. Some people wanted to wait more and expected a bigger drop. But that didn't happen and they missed it.

Those “dip levels” are there during bear markets, but many people don’t take those golden opportunities to buy. Open a Bitcoin chart and zoom out to the maximum. Do you see it? We are given two years in every cycle to buy the lowest or near-lowest dip for that cycle.I wish it's easy for everyone of us to spot the lowest price. Since that's the cycle, would this mean that we will soon see a long bear period since the market is still bullish until now? We saw bitcoin dip at $28k, but that was not brought by a long bear market, it's just a short correction that resulted in an easy bounce-back of price. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 29, 2021, 12:03:04 PM |

|

It is really not easy to catch the dip levels and not to miss those chances. Because we don't know what price the dip is for a coin. We just want to make use of the chance when the coin price decreases at a high rate. For example, I guess many people bought Bitcoin when the price was at $30k. It was a good opportunity to accumulate after a big dump. Some people wanted to wait more and expected a bigger drop. But that didn't happen and they missed it.

Those “dip levels” are there during bear markets, but many people don’t take those golden opportunities to buy. Open a Bitcoin chart and zoom out to the maximum. Do you see it? We are given two years in every cycle to buy the lowest or near-lowest dip for that cycle.I wish it's easy for everyone of us to spot the lowest price. Since that's the cycle, would this mean that we will soon see a long bear period since the market is still bullish until now? We saw bitcoin dip at $28k, but that was not brought by a long bear market, it's just a short correction that resulted in an easy bounce-back of price. I personally believe that it is nearly impossible to really time the dip in any kind of maximum or close to maximum way, so the best that you can do is to just buy at various dip intervals that are comfortable for you. Another risk of trying to buy only on BIG dips is that there might be an inadequate practice of preparing for UP, so someone planning to buy only on dips of certain magnitudes (let's say greater than 15% or something like that), he may well miss out on profits from UP. Of course, each of us should be attempting to find our own comfort levels in terms of our BTC accumulation strategies both in terms of how much BTC that we want to accumulate and what methods that we want to use to accumulate those BTC, including considering what time period that we would like to accumulate such BTC. The three main accumulation strategies are lump sum investing, DCA, and buying on dips. If we are in a bear market, then there would likely be less of a rush to accumulate BTC, but we cannot always know if we are in a bear market as well.... |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

August 30, 2021, 09:25:57 AM |

|

It is really not easy to catch the dip levels and not to miss those chances. Because we don't know what price the dip is for a coin. We just want to make use of the chance when the coin price decreases at a high rate. For example, I guess many people bought Bitcoin when the price was at $30k. It was a good opportunity to accumulate after a big dump. Some people wanted to wait more and expected a bigger drop. But that didn't happen and they missed it.

Those “dip levels” are there during bear markets, but many people don’t take those golden opportunities to buy. Open a Bitcoin chart and zoom out to the maximum. Do you see it? We are given two years in every cycle to buy the lowest or near-lowest dip for that cycle.. Since that's the cycle, would this mean that we will soon see a long bear period since the market is still bullish until now? We saw bitcoin dip at $28k, but that was not brought by a long bear market, it's just a short correction that resulted in an easy bounce-back of price. Who said we should spot the “lowest price”? We only need to know that it’s a bear market, and that it’s within a “radius” of prices. Remember the people who always annoyed everyone in the forum to buy Bitcoin with everything they possibly can under $10,000? Then $15,000? Then under 2017’s ATH? |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

September 02, 2021, 11:03:48 AM |

|

Bitcoin ready to surge to a new ATH. Did you sell the dip, or buy the dip, or did you DCA? Listen to your Uncle JJG. Many many years from now, you will either regret that you didn’t listen, or you can proudly tell your grandchildren how you had fun becoming rich by HODLing and shitposting.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

September 06, 2021, 07:25:08 AM |

|

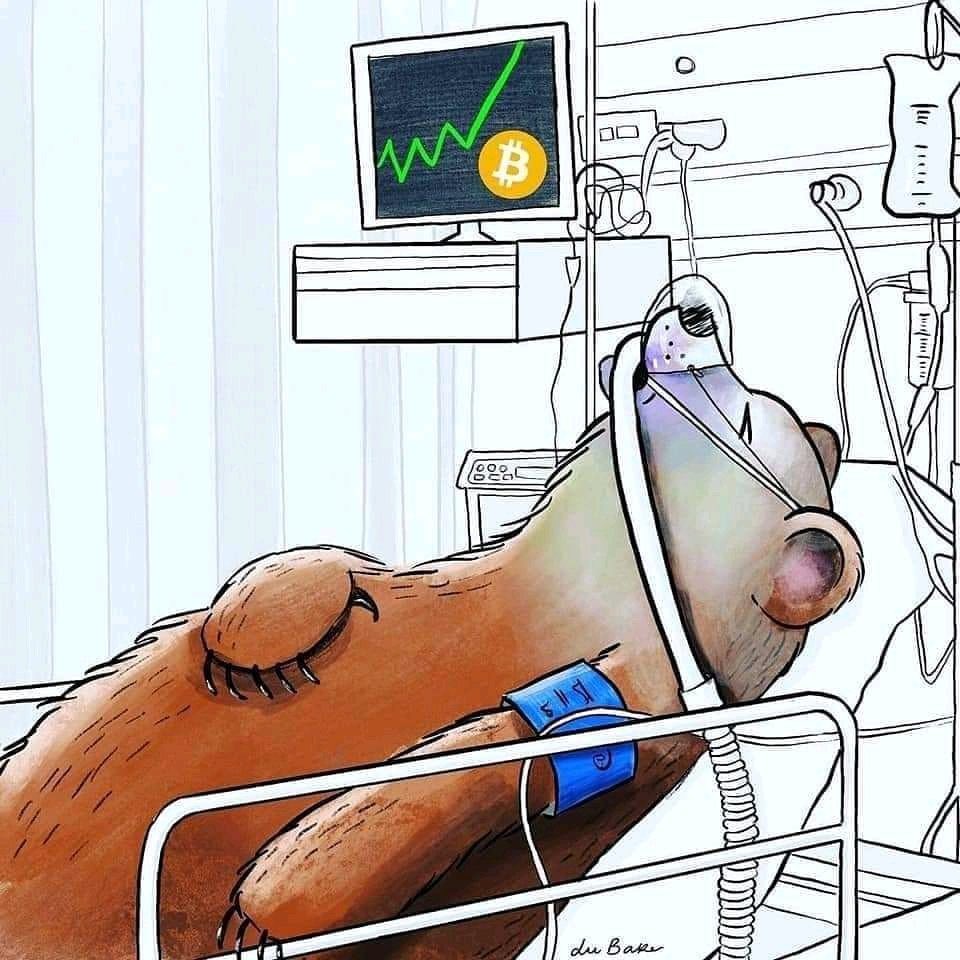

The doctors around the world are confused. The cases caused by COVID-19 are going down, but there is an increasing number of cases of people going to the hospitals because of stress, and anxiety caused by an unknown disease.  Bear disease?  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

ranaprime

Jr. Member

Offline Offline

Activity: 1380

Merit: 1

|

|

September 06, 2021, 05:29:38 PM |

|

I believe that holding is the best strategy. Most of my assets are also in bloody red but it doesn’t affect me too much, its a normal cycle and just temporary so why you fell worry? We really need a lot of patience to keep holding. Just remember that if you can be good holder then will definitely gain.

|

/// ASAN VERSE /// Building the Future of Digital Art ///

ASAN VERSE NFT MARKETPLACE

METAVERSE FOR ART COMMUNITY |

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 06, 2021, 05:43:05 PM |

|

I believe that holding is the best strategy. Most of my assets are also in bloody red but it doesn’t affect me too much, its a normal cycle and just temporary so why you fell worry? We really need a lot of patience to keep holding. Just remember that if you can be good holder then will definitely gain.

This thread is not about "most of your assets," but instead about how to attempt to strategize in regards to accumulating and holding bitcoin. Of course, deciding about how much to allocate to bitcoin may also depend somewhat regarding the performance of other assets that you may well hold and the extent to which you may want to consider allocating additional value into bitcoin or perhaps also shaving off some of your BTC allocation if you happen to be way too over-allocated into BTC. Personally, I consider that it could take a whole hell of a long time for anyone who is in BTC accumulation stages to transition into either maintenance stages or liquidation stages, but of course, it could even be a dilemma determining when you have reached those later stages.. yet the subject matter of this thread does seem to apply way more to BTC HODLers/accumulators who have not quite yet reached those more advanced stages of their BTC investment.--- and for sure, none of the stages really are absolutes because they are going to overlap somewhat and individual circumstances are quite likely to determine assessments regarding if some kind of maintenance (rather than accumulation and HODL) strategies might be acceptable at various price points along the way in what seem to be largely 4 year bitcoin price cycles (those 4-year price cycles are not guaranteed, either). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

September 10, 2021, 07:48:16 AM |

|

Janet Yellen said that the United States government may not have the money to pay its “financial obligations”, and the government might “default”. The word Bankrupt is more suitable to truly describe the problem. But the solution to this is, raise the debt ceiling. Give the government more capacity to issue more bonds to “borrow” more money from the Federal Reserve. Where does the money of the Federal Reserve come from? BRRRRR.

BUY THE DIP AND HODL.

|

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

September 14, 2021, 12:41:13 PM |

|

Open Bitcoin chart, and install 50-day SMA indicator. Go to 500 days AFTER the halving of 2016. Where is the price and 50-day SMA? THEN go to 500 days after the halving of 2020. Where is the price and 50-day SMA?  Buy the dip and? |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 14, 2021, 04:21:58 PM |

|

Open Bitcoin chart, and install 50-day SMA indicator. Go to 500 days AFTER the halving of 2016. Where is the price and 50-day SMA? THEN go to 500 days after the halving of 2020. Where is the price and 50-day SMA?  Buy the dip and? If you have some kind of important knowledge regarding how those kinds of indicators might be helpful in some kind of way, you may need to explain a wee bit more better. To the extent that anyone is considering philosophies of either buying the dip or dollar cost averaging, the buying the dip philosophy does require some kind of sense about either how much of a dip is enough to trigger BTC buys and also if some fiat should be kept aside in order to anticipate that some further dip could be coming. Personally, I am not much of a fan of completely running out of fiat, even if there is some sense that all of the dip is already in, and so surely each of us are going to have tactics and strategies to attempt to deal with how much we might want to buy now versus having some cash just in case there is more dip. Another dynamic remains that with the longer the passage of time with the BTC price in one place there would be a presumption that cashflows may well end up coming in, so then there might be anticipations about what portion of that to buy BTC right now at the current price versus how much to keep in case there is a further dip. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

September 15, 2021, 09:19:46 AM |

|

Open Bitcoin chart, and install 50-day SMA indicator. Go to 500 days AFTER the halving of 2016. Where is the price and 50-day SMA? THEN go to 500 days after the halving of 2020. Where is the price and 50-day SMA?  Buy the dip and? If you have some kind of important knowledge regarding how those kinds of indicators might be helpful in some kind of way, you may need to explain a wee bit more better. I have no “important knowledge”, I’m only illustrating what can simply be seen, and what’s obviously there. Chart patterns, the same as History, tend to repeat itself, and I believe it’s repeating itself again NOW. Although, many people are in denial. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

DU18

Sr. Member

Offline Offline

Activity: 1694

Merit: 268

Binance #SWGT dan CERTIK Audited

|

|

September 15, 2021, 10:09:17 AM |

|

I believe that holding is the best strategy. Most of my assets are also in bloody red but it doesn’t affect me too much, its a normal cycle and just temporary so why you fell worry? We really need a lot of patience to keep holding. Just remember that if you can be good holder then will definitely gain.

Buy at a low price like now and hold it for the next few years is the right step we are doing now, from year to year the price of bitcoin continues to change and in the end the price of bitcoin will rise again over time, I think experience At the beginning of 2020 can be our benchmark for holding bitcoin for a long time, Bitcoin was at $8K In December 2020, and then the bitcoin price started to soar again and penetrated $20K and in the end for those who are patient to hold bitcoin get quite a profit when bitcoin breaks its highest price so far . So, I think we have nothing to fear to hold bitcoins as long as possible. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 15, 2021, 02:23:15 PM |

|

Open Bitcoin chart, and install 50-day SMA indicator. Go to 500 days AFTER the halving of 2016. Where is the price and 50-day SMA? THEN go to 500 days after the halving of 2020. Where is the price and 50-day SMA?  Buy the dip and? If you have some kind of important knowledge regarding how those kinds of indicators might be helpful in some kind of way, you may need to explain a wee bit more better. I have no “important knowledge”, I’m only illustrating what can simply be seen, and what’s obviously there. Chart patterns, the same as History, tend to repeat itself, and I believe it’s repeating itself again NOW. Although, many people are in denial. Fair enough. I will point out that this people is not in denial, even though each people may well give differing weight to which factors are relevant and how much probability to assign to future events that have not happened yet. Thus a chart can show us the past - and seems to me that the most of convincing BTC price prediction models are 1) stock to flow, 2) four-year fractal and 3) exponential s-curve adoption based on network effects and metcalfe principles - but even those models do not tell us about details or short-term momentum or manipulation, but they still tell us likely what direction bitcoin prices are likely going in the future.. even if far from guaranteed. The use of other various models or indicators or even showing some moving averages will show trends averaged out that are averaged out so if there is a sudden change in BTC's price in the short term, the average will take a while to catch up, especially the more data that it attempts to capture in the average. Also does not guarantee that the averages will continue to go up merely because historically they had been going up. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Pulsar77

|

|

September 15, 2021, 10:00:30 PM Merited by JayJuanGee (1) |

|

It is easy to say that ""Buy the dip" but it is nearly impossible to know what the dip price is. We are just making our predictions and acting according to it. And we hope that we invested in at the right time. But of course, you don't need to care about what dip level could be too. You can just make an investment any time you want and start waiting for a long term.

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10194

Self-Custody is a right. Say no to"Non-custodial"

|

|

September 16, 2021, 04:30:27 AM |

|

It is easy to say that ""Buy the dip" but it is nearly impossible to know what the dip price is. We are just making our predictions and acting according to it. And we hope that we invested in at the right time. But of course, you don't need to care about what dip level could be too. You can just make an investment any time you want and start waiting for a long term.

Several times in this thread, I have asserted that I personally believe that buying the dip is at best a supplemental strategy, and amongst the best of strategies for accumulating bitcoin is Dollar cost averaging (DCA).. and of course, if any of us figure out a DCA strategy, then hopefully we are both analyzing and figuring out our cashflow, and also creating target BTC accumulation goals.. that could well take a long time to reach if we are a young investor and just beginning to build our investment portfolio... so in that regard, both lump sum and buying on dip are methods that supplement DCA strategies that also involve assessment and tailorizing to our own personal circumstances that should include figuring out our cashflow, our other investment, our view of bitcoin compared with other investments, our timeline, risk tolerance and our time, skills and abilities to plan, learn and tweak our strategies along the way. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

poldanmig

|

|

September 16, 2021, 08:22:48 AM |

|

It is easy to say that ""Buy the dip" but it is nearly impossible to know what the dip price is. We are just making our predictions and acting according to it. And we hope that we invested in at the right time. But of course, you don't need to care about what dip level could be too. You can just make an investment any time you want and start waiting for a long term.

usually when the price of bitcoin or altcoin is on a decline, I will try to place an order at several different prices and I think it is quite effective for those of us who don't know how much the price decline is likely to be, and even from some of the altcoin portfolios that I trade on the market , I even got some of them at the lowest prices when ordering prices in spot trading, so obviously this will be profitable and can also cover the losses of some of the altcoins that I bought at a slightly high price before. |

|

|

|

|