sushil

Newbie

Offline Offline

Activity: 67

Merit: 0

|

|

February 15, 2022, 06:36:26 PM |

|

Thought so... So how can you know when you've reached a low point? Is this the lowest point in our history?

You may think it's impossible that bitcoin will ever return to these prices, but people who waited for a dip at 1400 had the same idea, and the price went down a lot and they waited for it to go down even more, and when it started to go back up they waited for it to go back down, but the price only kept going up and never saw those numbers again.

So, purchasing every dip is a fantastic idea, but it's not something you can easily do yourself without knowing when you're at the dip, implementation is more difficult than the advice. On the surface, I agree with the concept, however, I've had several failures with implementation.

|

|

|

|

|

|

|

|

|

|

"This isn't the kind of software where we can leave so many unresolved bugs that we need a tracker for them." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 15, 2022, 07:20:49 PM |

|

Thought so... So how can you know when you've reached a low point? Is this the lowest point in our history?

You may think it's impossible that bitcoin will ever return to these prices, but people who waited for a dip at 1400 had the same idea, and the price went down a lot and they waited for it to go down even more, and when it started to go back up they waited for it to go back down, but the price only kept going up and never saw those numbers again.

So, purchasing every dip is a fantastic idea, but it's not something you can easily do yourself without knowing when you're at the dip, implementation is more difficult than the advice. On the surface, I agree with the concept, however, I've had several failures with implementation.

What are you doing then, sushil? It's not like any plan or practice is going to be fool proof, and many of us already appreciate that it is almost impossible to predict any exact bottom or to know how long the BTC price is going to stay down when it is down. So if you have a cashflow coming in, you can reserve part of that for buying various dips at various price points, and you can use other portions of your incoming cashflow to buy no matter what the price.. just in case the dip is already in. There is no exact answer, but it seems that one pattern exists for people who have been in BTC for longer periods of time, and those who had continued to buy on a regular basis have tended to do quite well especially after one or two cycles.. so 4 years or longer. Of course, if you timeline is shorter than 4 years or even 10 years, then you might end up in a world of hurt because you are too busy with being preoccupied about the BTC price rather than just accumulating on a regular basis... it can take a while for any investment to really pay off, and BTC seems to be amongst those kinds of investments.. there are no guarantees, either... but bitcoin does seem to be a decently good (maybe the best) of asymmetric bets that are available to normies.. and you can start with small amounts or larger amounts if you have it, but even if you have larger amounts, you might still be cautious in terms of how much to allocate to bitcoin and what approach to take in order to reach whatever BTC accumulation targets you set for yourself and the targets that you might also tweak along the way, too. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

February 16, 2022, 07:36:24 AM |

|

Thought so... So how can you know when you've reached a low point? Is this the lowest point in our history?

You will never know, and no one actually knows. We the plebs, and the poors can “only try” to find the DIP, but it’s important that we try than buying blindly at any price.

You may think it's impossible that bitcoin will ever return to these prices, but people who waited for a dip at 1400 had the same idea, and the price went down a lot and they waited for it to go down even more, and when it started to go back up they waited for it to go back down, but the price only kept going up and never saw those numbers again.

So, purchasing every dip is a fantastic idea, but it's not something you can easily do yourself without knowing when you're at the dip, implementation is more difficult than the advice. On the surface, I agree with the concept, however, I've had several failures with implementation.

My advice, find a job, and save. If you have a job, find a second job, and save more. Use that to buy every Bitcoin DIPs, but it’s your choice. You can buy now, or you can buy during the next bear cycle, which I believe will start either this year or the next year if past cycle patterns are to be followed. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 16, 2022, 06:27:36 PM |

|

Thought so... So how can you know when you've reached a low point? Is this the lowest point in our history?

You will never know, and no one actually knows. We the plebs, and the poors can “only try” to find the DIP, but it’s important that we try than buying blindly at any price. One of your problems Wind_FURY is that you continue to repeat your poor mental framework based on various presumptions that either you or other people (especially newbie normies) have very strong abilities to see BTC's price direction, before it happens. Hopefully, not too many forum members are taking you so serious as to screw up their own preparations for UP because they are spending too much time believing that they are going to be able to buy upon a BTC price dip that may well not happen. I am not saying that I know anything, even though I have been watching and practicing with BTC buying for more than 8 years....and over and over we see that some folks end up panic buying on the way up because they failed/refused to sufficiently/adequately prepare for up because they were so busy believing that they were going to be able to buy on a dip... blah blah blah. In other words, there is some value and need to buy regularly, even if there is also some value in attempting to buy on dips, too. You may think it's impossible that bitcoin will ever return to these prices, but people who waited for a dip at 1400 had the same idea, and the price went down a lot and they waited for it to go down even more, and when it started to go back up they waited for it to go back down, but the price only kept going up and never saw those numbers again.

So, purchasing every dip is a fantastic idea, but it's not something you can easily do yourself without knowing when you're at the dip, implementation is more difficult than the advice. On the surface, I agree with the concept, however, I've had several failures with implementation.

My advice, find a job, and save. If you have a job, find a second job, and save more. Use that to buy every Bitcoin DIPs, but it’s your choice. For sure, it is a good suggestion that people who are still early in the BTC accumulation stage, should be attempting to engage in various ways to increase their cashflow and their abilities to set aside money to invest in BTC. It's likely going to pay off .. especially if there is a 4 year to 10 year or longer investment timeline. You can buy now, or you can buy during the next bear cycle, which I believe will start either this year or the next year if past cycle patterns are to be followed.

Again, Wind_FURY there is a bit of a problematic angle to your ongoing presumption that any bear market is going to allow for either the purchase of BTC at prices lower than our current price or that some newbie BTC accumulator is not going to be better off just getting some BTC now rather than waiting the fuck around for a price dip that may or may not happen. Of course, there are going to be differences between different kinds of BTC newbies... One who might have already accumulated a bit of BTC, one who has some lump sum amount that s/he might be able to invest right away, variations in cashflow amounts whether a person can spare $50 per month to invest in bitcoin or $5k per month.. Those various differences in circumstances are going to affect the approach regarding how much to buy now, how much to prepare for buying on dips, and whether to employ a DCA strategy too.. which is a very powerful tool.. as I have mentioned around a zillion times. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

February 17, 2022, 11:59:19 AM |

|

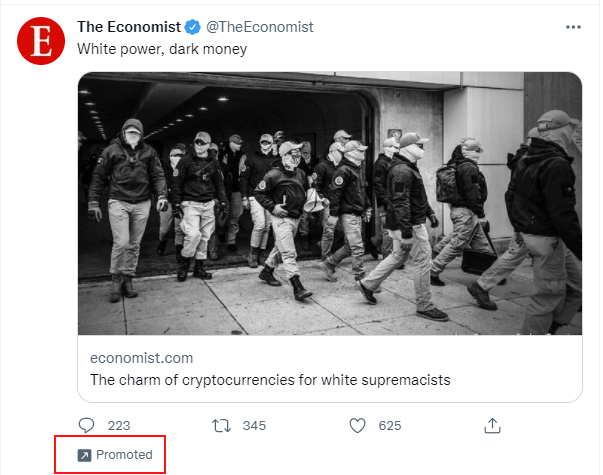

The nocoiners’ narrative of the month. “White Power”. Haha.  It’s true that Bitcoin can be used for nefarious reasons, but that’s because Bitcoin is convenient for entities that can’t use, or who are banned from using the legacy banking system. It is working as designed. That’s bullish. Buy the DIP, and? |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Falconer

Legendary

Offline Offline

Activity: 2492

Merit: 1124

|

|

February 19, 2022, 07:50:44 PM |

|

I prefer to buy when prices are in a positive trend, it will reduce the risk of loss. when prices are falling it is very difficult to determine the lowest point, this is the reason why I prefer buying when market conditions are rising. according to research I have done this method is more effective to reduce the risk of loss.

Now try to test the buy dip and hold until price recovery occurs and compare which one is better with the strategy you have done before. The risk of buying when the trend is positive is actually greater than you are buying when it is dip. Although nothing seems to go wrong but your potential profit is much greater if you buy on a dip. Setting a dip shouldn't be around -2% of the previous price but you may have a good chance when you see -7% of the previous price. |

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | | | BK8? | | | .

..PLAY NOW.. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 19, 2022, 08:12:56 PM |

|

I prefer to buy when prices are in a positive trend, it will reduce the risk of loss. when prices are falling it is very difficult to determine the lowest point, this is the reason why I prefer buying when market conditions are rising. according to research I have done this method is more effective to reduce the risk of loss.

Now try to test the buy dip and hold until price recovery occurs and compare which one is better with the strategy you have done before. The risk of buying when the trend is positive is actually greater than you are buying when it is dip. Although nothing seems to go wrong but your potential profit is much greater if you buy on a dip. Setting a dip shouldn't be around -2% of the previous price but you may have a good chance when you see -7% of the previous price. Ok. Falconer.. I agree with you overall because the ideas presented by olib123 are likely going to fuck you out of a lot of profit areas, but there are some issues when you seem to be suggesting ONLY buying on dips.. because sometimes the BTC price does not dip for an extended period of time. you have been registered on this forum for about the same amount of time as me, so likely you have been through several examples of periods in which the BTC price goes up without really dipping.. so what do you do? just stop everything? Let's take our recent example of September 2020 to April 2021.. The BTC price largely went from $10k to $64,895 with only around one period of significant dip.. For the sake of this example, let's say that you have $1k per month of extra cashflow (that you can dedicate towards buying BTC) coming in between September 2020 and April 2021. What do you do? Do you buy? Do you just hold it? And, you don't know in advance where the BTC price is going.. even though afterwards, you can see where it went.. but while the price is going up between September 2020 and April 2021 you do not really know when the UP is going to stop, right? I chose September 2020 and April 2021, but we have a lot of examples like that in bitcoin. Remember April 2019 to June 2019 going from $4,200 to $13,880 without any meaningful dips? What do you do during those kinds of times? Of course, we could go further back, but some of that could be messy to describe the period. especially if we look at the various price moves in late 2016 or throughout 2017. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

February 23, 2022, 09:19:44 AM |

|

Don’t listen to the advice of these charlatans in YouTube. They just want you to buy blindly anywhere, without any care for your investment and your frustration. A Bitcoin bought lower by buying the DIP is more Bitcoin purchased for every Dollar. Don’t worry about the surge or how high you think you can sell, worry about discounts and HODL.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

lizarder

|

|

February 23, 2022, 11:51:00 AM |

|

every decrease in bitcoin and altcoins is an opportunity to make a purchase, many people are not able to take advantage of the condition of the decline in price as a step to buy, so when the good trend is happening in bitcoin and altcoins we are not able to benefit from both, I think we should be able to follow the good trend against bitcoin after making a purchase in a correction condition, because that's when we will get the maximum profit |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 23, 2022, 07:44:46 PM |

|

every decrease in bitcoin and altcoins is an opportunity to make a purchase, many people are not able to take advantage of the condition of the decline in price as a step to buy, so when the good trend is happening in bitcoin and altcoins we are not able to benefit from both, I think we should be able to follow the good trend against bitcoin after making a purchase in a correction condition, because that's when we will get the maximum profit A common problem is that potential bitcoin investors get scared or worried into doing nothing.. so can we know that the BTC price is going to dip more? I would say that we cannot know.. so it may well be better to buy once a week with extra cashflow than to be waiting for lower prices that might not happen... At the same time, I can understand that sometimes people run out of money too.. so they do not have much if any extra cashflow coming in.. so it is not an easy balance to know how much to buy now, versus waiting for another dip. if another dip might happen or not.. maybe? maybe not. Regarding your mentioning shitcoins.. fuck shitcoins.. who cares about that? That's a topic for some other thread to figure out calculating which if any of them might be of any value at all versus how much risk exists to involve yourself with various forms of crap.. . and need not get into discussions here to figure out which shit coin might be less shitty than some other shitcoin... In other words, this thread is about bitcoin... not some amorphous concept that includes considering how much to allocate to shitcoins. possibly zero would be a good number to make the dilemma less difficult in terms of running out of money to buy bitcoin if you happen to be using some of your cashflow to invest in crap. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

Ararbermas

|

|

February 24, 2022, 04:26:57 AM Merited by JayJuanGee (1) |

|

Don’t listen to the advice of these charlatans in YouTube. They just want you to buy blindly anywhere, without any care for your investment and your frustration. A Bitcoin bought lower by buying the DIP is more Bitcoin purchased for every Dollar. Don’t worry about the surge or how high you think you can sell, worry about discounts and HODL.  Correct! Let's bear in mind that it's always too good to be true when it comes buying and holding. And we need to make our own way when it comes analysing the graph instead of listening to those crap content creators in youtube because most of their information is to gain views only not for the safety of our investments. Let's just be practical as well to prevent risky situation and in order to have a good return after all.. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7823

'The right to privacy matters'

|

|

February 24, 2022, 04:33:44 AM

Last edit: February 24, 2022, 04:48:10 AM by philipma1957 |

|

buy x only if you will buy x at 32k and 30k and 28k

i just got a piece and will ladder down to as low as it goes.

note this is in addition to the 50 a day dca that I have.

Lets hope that the Russian /Ukrainian war ends quickly with few casualties.

God bless those in harms way.

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 24, 2022, 05:48:59 AM |

|

buy x only if you will buy x at 32k and 30k and 28k

i just got a piece and will ladder down to as low as it goes.

note this is in addition to the 50 a day dca that I have.

Lets hope that the Russian /Ukrainian war ends quickly with few casualties.

God bless those in harms way.

Let's say hypothetically the BTC price goes all the way down to $10k. Have you already set a sufficient amount of cash away to ladder buy all the way down to $10k... or do you consider your budget based on how long it might take to get there, if it were to get there. By the way, I believe that the odds of going below something like $23k would be pretty low.. even though it surely is possible to wick below that $23k price point.. .. right now the 200-week moving average is just crossing over $20k, and historically the BTC price has not touched the 200-week moving average very frequently.. and furthermore, usually it would not stay at or near the 200-week moving average for very long and also most of the time we would need to be in a bear market for the 200-week moving average to be even feasible.. and it is not clear that we have entered or that we are likely to enter into a bear market.. yet... though of course, the Russian armed entrance into Ukraine has sure caused concern that such a set of affairs could trigger such a transition into a bear market..(beyond just a severe correction) for a certain amount of time.. yet to be determined... Regarding if we happen to be in a correction of a bull market rather than a bear market, then usually the 100-week moving average would be the bottom, and currently the 100-week moving average is at $32k... .. so surely we are close to touching that now, and breaching it could cause further cascading of confidence in BTC and thus cause greater likelihood to break below and perhaps into the $20ks. For sure, I would not proclaim to know where the bottom might be with any level of certainty.. and surely there can be some value for whales to shake out as many weak hands as possible (especially during times like this).. and our recent moves down seems to show that there well could be more weak hands that are available to be shaken out... The next 3 days (72 hours) are critical tm....  |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

February 24, 2022, 08:46:27 AM |

|

Don’t listen to the advice of these charlatans in YouTube. They just want you to buy blindly anywhere, without any care for your investment and your frustration. A Bitcoin bought lower by buying the DIP is more Bitcoin purchased for every Dollar. Don’t worry about the surge or how high you think you can sell, worry about discounts and HODL.  Correct! Let's bear in mind that it's always too good to be true when it comes buying and holding. And we need to make our own way when it comes analysing the graph instead of listening to those crap content creators in youtube because most of their information is to gain views only not for the safety of our investments. Let's just be practical as well to prevent risky situation and in order to have a good return after all.. It’s hard to be wrong if we plebs always look for a discount, or a “sale”, when we purchase Bitcoin, clothes, shoes, or ANYTHING. Because every Dollar saved, is every Dollar earned. It’s ironic to post that phrase, but it has a point. Hahaha. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

lizarder

|

|

February 24, 2022, 11:02:03 AM |

|

every decrease in bitcoin and altcoins is an opportunity to make a purchase, many people are not able to take advantage of the condition of the decline in price as a step to buy, so when the good trend is happening in bitcoin and altcoins we are not able to benefit from both, I think we should be able to follow the good trend against bitcoin after making a purchase in a correction condition, because that's when we will get the maximum profit A common problem is that potential bitcoin investors get scared or worried into doing nothing.. so can we know that the BTC price is going to dip more? I would say that we cannot know.. so it may well be better to buy once a week with extra cashflow than to be waiting for lower prices that might not happen... At the same time, I can understand that sometimes people run out of money too.. so they do not have much if any extra cashflow coming in.. so it is not an easy balance to know how much to buy now, versus waiting for another dip. if another dip might happen or not.. maybe? maybe not. Regarding your mentioning shitcoins.. fuck shitcoins.. who cares about that? That's a topic for some other thread to figure out calculating which if any of them might be of any value at all versus how much risk exists to involve yourself with various forms of crap.. . and need not get into discussions here to figure out which shit coin might be less shitty than some other shitcoin... In other words, this thread is about bitcoin... not some amorphous concept that includes considering how much to allocate to shitcoins. possibly zero would be a good number to make the dilemma less difficult in terms of running out of money to buy bitcoin if you happen to be using some of your cashflow to invest in crap. Investment patterns contain different ways, sometimes people believe bitcoin in the long term will be better, so they adopt the long term as a strategy, really no one can be sure what bitcoin will be in the long term, but hasn't bitcoin shown a fairly improved development from early appearance. the problem of people investing anywhere is not my business, and it doesn't really matter what they want to do, right now I'm only interested in discussing bitcoin, because this coin has proven to be more stable than others, so try to think wisely to start a discussion with each other. It's true that it's a waste of time investing in bullshit coins, but we should also appreciate the people who do that, because not everyone can afford to invest in bitcoin. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1824

|

|

February 24, 2022, 11:55:02 AM |

|

Investment patterns contain different ways, sometimes people believe bitcoin in the long term will be better, so they adopt the long term as a strategy, really no one can be sure what bitcoin will be in the long term, but hasn't bitcoin shown a fairly improved development from early appearance.

I believe you’re right to say that “no one can be sure what Bitcoin will be”, but in deeply learning what Bitcoin is and what it can truly do, wouldn’t you say that it has an underlyng nature to break and weaken socio-political strongholds? We’ve seen institutions HODL it, let’s wait for nation-states. It cannot be avoided in my opinion. Bitcoin to six digits. Buy the DIP, and HODL.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 24, 2022, 05:20:21 PM |

|

every decrease in bitcoin and altcoins is an opportunity to make a purchase, many people are not able to take advantage of the condition of the decline in price as a step to buy, so when the good trend is happening in bitcoin and altcoins we are not able to benefit from both, I think we should be able to follow the good trend against bitcoin after making a purchase in a correction condition, because that's when we will get the maximum profit A common problem is that potential bitcoin investors get scared or worried into doing nothing.. so can we know that the BTC price is going to dip more? I would say that we cannot know.. so it may well be better to buy once a week with extra cashflow than to be waiting for lower prices that might not happen... At the same time, I can understand that sometimes people run out of money too.. so they do not have much if any extra cashflow coming in.. so it is not an easy balance to know how much to buy now, versus waiting for another dip. if another dip might happen or not.. maybe? maybe not. Regarding your mentioning shitcoins.. fuck shitcoins.. who cares about that? That's a topic for some other thread to figure out calculating which if any of them might be of any value at all versus how much risk exists to involve yourself with various forms of crap.. . and need not get into discussions here to figure out which shit coin might be less shitty than some other shitcoin... In other words, this thread is about bitcoin... not some amorphous concept that includes considering how much to allocate to shitcoins. possibly zero would be a good number to make the dilemma less difficult in terms of running out of money to buy bitcoin if you happen to be using some of your cashflow to invest in crap. Investment patterns contain different ways, sometimes people believe bitcoin in the long term will be better, so they adopt the long term as a strategy, really no one can be sure what bitcoin will be in the long term, but hasn't bitcoin shown a fairly improved development from early appearance. You are free to believe what you want in terms of bitcoin's contribution to the space and the strength of it as a long term investment, and I believe that bitcoin's long term investment thesis is much stronger today than it was in 2013... so even if the upside price potential has been dampened by some already existing price appreciation, bitcoin likely is amongst the strongest of assets that anyone can invest into, if considering both the upside potential and the downside risk..... Since bitcoin remains such a great asymmetric upside, there is likely no need to gamble big on it.. just merely invest somewhat aggressively within your budget and likely your investment will profit stupendously and if you are able to have a longer timeline then you are likely to be even better off.... Short term, it is not always clear about whether you will end up being profitable, but a 4-10 year or longer investment timeline would be a good way of thinking about the matter if you have that much ability to invest for at least that long. the problem of people investing anywhere is not my business, and it doesn't really matter what they want to do, right now I'm only interested in discussing bitcoin, because this coin has proven to be more stable than others, so try to think wisely to start a discussion with each other.

Sure. Each person needs to decide for himself/herself, and sometimes it can take a long time to learn bout something as intricate as bitcoin. You can spend 10, 100, 1000 hours or more studying and investing time into learning about bitcoin, and there are not too many bitcoin naysayers who spent a lot of time studying it.. but there are quite a few naysayers who don't seem to understand what the fuck bitcoin is. It's true that it's a waste of time investing in bullshit coins, but we should also appreciate the people who do that, I don't see why there is any purpose to appreciate people who do dumb shit and gamble... even though there are people who do dumb shit, and they have a right to do dumb shit... no reason to praise them, even if they have rights to do whatever they like. because not everyone can afford to invest in bitcoin.

Don't get distracted with unit bias nonsense.. You can invest $10 per week into bitcoin if you like.. and sure you could measure your progress in satoshis rather than being worried about whether or not you have accumulated a whole bitcoin. In other words, work with your own budget and don't dilute your own budget by buying a bunch of shit.. if you ave a limited budget, then maybe start out with $10 per week and work your way up to $100 per week or more.. and in the end, you do what you can to build your satoshis stash.. and if you keep building, you will likely be quite grateful that you did it.. especially 4-10 years or longer down the road. Don't get distracted into bullshit projects, and surely don't get distracted into some stupid ass project merely because it is cheaper and you buy into all those distracting, deceptive bullshit talking points about getting rich quick or that they are the next bitcoin or that bitcoin is inadequate in various ways.. figure out bitcoin first, and then if you still want to invest part into shitcoin nonsense, then do that after you have already established your bitcoin strategy..... but hey, there have been years and years and years of people getting distracted into various shitcoins and then failing/refusing to adequately establish the bitcoin portion of their investment portfolio.. and if you only have $10 to $100 per week that you can invest, it does not make too much sense to allow your budget to get diluted into gambling nonsense... but if you happen to have $1,000 per week then you have more luxury to maybe shave off some of that to play around with shitcoins.. perhaps? perhaps? Each person has to decide.. how to apportion their investments, and if they are investing long term or if they are gambling with short term plays.. and if they are trying to do both, then they have to decide how much of their budget to allocate to each and if their budget is big enough to divide up or if they would be better off to build up their portfolio first before getting distracted into gambling that may not end up ever building up their portfolio. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7823

'The right to privacy matters'

|

|

February 24, 2022, 07:20:25 PM |

|

buy x only if you will buy x at 32k and 30k and 28k

i just got a piece and will ladder down to as low as it goes.

note this is in addition to the 50 a day dca that I have.

Lets hope that the Russian /Ukrainian war ends quickly with few casualties.

God bless those in harms way.

Let's say hypothetically the BTC price goes all the way down to $10k. Have you already set a sufficient amount of cash away to ladder buy all the way down to $10k... or do you consider your budget based on how long it might take to get there, if it were to get there. By the way, I believe that the odds of going below something like $23k would be pretty low.. even though it surely is possible to wick below that $23k price point.. .. right now the 200-week moving average is just crossing over $20k, and historically the BTC price has not touched the 200-week moving average very frequently.. and furthermore, usually it would not stay at or near the 200-week moving average for very long and also most of the time we would need to be in a bear market for the 200-week moving average to be even feasible.. and it is not clear that we have entered or that we are likely to enter into a bear market.. yet... though of course, the Russian armed entrance into Ukraine has sure caused concern that such a set of affairs could trigger such a transition into a bear market..(beyond just a severe correction) for a certain amount of time.. yet to be determined... Regarding if we happen to be in a correction of a bull market rather than a bear market, then usually the 100-week moving average would be the bottom, and currently the 100-week moving average is at $32k... .. so surely we are close to touching that now, and breaching it could cause further cascading of confidence in BTC and thus cause greater likelihood to break below and perhaps into the $20ks. For sure, I would not proclaim to know where the bottom might be with any level of certainty.. and surely there can be some value for whales to shake out as many weak hands as possible (especially during times like this).. and our recent moves down seems to show that there well could be more weak hands that are available to be shaken out... The next 3 days (72 hours) are critical tm....  I would buy down to 1k if needed. My belief is this is more like the flash crash at the beginning of covid. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10193

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 24, 2022, 07:47:46 PM

Last edit: February 24, 2022, 08:00:53 PM by JayJuanGee Merited by philipma1957 (2) |

|

buy x only if you will buy x at 32k and 30k and 28k

i just got a piece and will ladder down to as low as it goes.

note this is in addition to the 50 a day dca that I have.

Lets hope that the Russian /Ukrainian war ends quickly with few casualties.

God bless those in harms way.

Let's say hypothetically the BTC price goes all the way down to $10k. Have you already set a sufficient amount of cash away to ladder buy all the way down to $10k... or do you consider your budget based on how long it might take to get there, if it were to get there. By the way, I believe that the odds of going below something like $23k would be pretty low.. even though it surely is possible to wick below that $23k price point.. .. right now the 200-week moving average is just crossing over $20k, and historically the BTC price has not touched the 200-week moving average very frequently.. and furthermore, usually it would not stay at or near the 200-week moving average for very long and also most of the time we would need to be in a bear market for the 200-week moving average to be even feasible.. and it is not clear that we have entered or that we are likely to enter into a bear market.. yet... though of course, the Russian armed entrance into Ukraine has sure caused concern that such a set of affairs could trigger such a transition into a bear market..(beyond just a severe correction) for a certain amount of time.. yet to be determined... Regarding if we happen to be in a correction of a bull market rather than a bear market, then usually the 100-week moving average would be the bottom, and currently the 100-week moving average is at $32k... .. so surely we are close to touching that now, and breaching it could cause further cascading of confidence in BTC and thus cause greater likelihood to break below and perhaps into the $20ks. For sure, I would not proclaim to know where the bottom might be with any level of certainty.. and surely there can be some value for whales to shake out as many weak hands as possible (especially during times like this).. and our recent moves down seems to show that there well could be more weak hands that are available to be shaken out... The next 3 days (72 hours) are critical tm....  I would buy down to 1k if needed. My belief is this is more like the flash crash at the beginning of covid. You seem to be avoiding the crux of my question to some extent, philip. I am not really asking you to give up any more OPsec than you have already done to ask if you already have money that is earmarked and dedicated to such or not. I do recognize and appreciate both the time and quantity (of down) element.. so surely the way that any of us might approach a matter such as the potential falling of the price of Bitcoin might have to do with both how fast it goes down and how far. At any given point, we might already have buy orders outstanding or maybe even flagged amounts for various price points..... I have mentioned several times that I have buy orders down to $20k.. so that has not changed recently... but sometimes there could be justification to change the amounts at each point in the ladder.. and then maybe even to change the increments or how far the buys go down. Let's say for example, you have already budgeted that every time that the BTC price goes down $1k, you will buy $300 worth of bitcoin.. but then your buy orders ONLY go down to $20k.. so then new events cause you to speculate that the BTC price could go down lower. .and maybe even that you want to be prepared for the BTC price going down to $1k.. just in case... therefore, either you increase your budget or maybe you do not have any extra cash that you can spare... so maybe you end up having to reduce your buy amounts to $100.. and then maybe once the BTC price goes below $10k for example, instead of buying $100 per each $1k increments, you change that to buying $50 for every $500 increments. Of course, there are all kinds of ways to structure these kinds of matters, and after my own several years of practicing this matter, I have already figured out it is easier for me psychologically (and perhaps financially too) to keep my BTC buy orders outstanding with a kind of presumption that they are there in case the BTC price crashes down quickly.. but if I start to get close to filling all the buy orders because the BTC price moves down lower and longer than I had anticipated, then I may well have to readjust my orders and my strategy.. just in case and just to have insurance for just in case the BTC price goes down lower. There have been a few times that I had gotten close to running out of cash.. and for me, the November/December 2018 correction down to $3,124 was a bit worse for me than the March 2020 correction down to $3,850.. and I am not really sure how to attribute my greater level of financial and psychological strength in the 2020 period as compared with the 2018 period, except probably to just recognize that I had fewer demands on the cash flow that I had dedicated to BTC in March 2020 as compared with the demands that I had on my cashflow in late 2018.. and sure another part could have been that the 2020 correction did end up playing out more like a bouncing/wick down event (like a flash crash, as you referred to) rather than the longer draw down and staying down that ended up playing out in 2018 into early 2019. Another way to think about the hypothetical could be that a person might have already dedicated $100 for every $1k price drop all the way down to the BTC price going down to $1k.. so that money is already dedicated.. but also to acknowledge that the current preparation is for a kind of "flash crash," while realizing if a "crash" down to $1k were to take 6 months or even up to 36 months to play out, then there would still be likely currently unclear amounts of available cashflow coming in during that time, and that at various points in the next 6 months to 36 months, there would likely be opportunities or even necessities to reassess the amount of cash that has been dedicated on the way down and to reformulate such dedicated cash to the extent that subsequent events (or cashflow reconsiderations) have caused some needs to reassess the amounts and the increments of the dedicated buy on the dip cash. Maybe it is worth noting that I already recognize and appreciate that your actual current relationship with BTC is more in an accumulation phase than me.. and I consider myself to be more in a maintenance stage.. so sure maybe any of us could still be striving to take advantage of the dip, we still may well consider our own ways of budgeting our money (and psychology) in different ways depending upon where we perceive ourselves to be in terms of how much emphasis we might be giving to BTC accumulation versus BTC portfolio maintenance versus maybe being involved in ongoing liquidation (which if we were to be in a liquidation stage, we might temper our liquidation amounts during periods that we consider to be significant BTC dipping/correction periods). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7823

'The right to privacy matters'

|

|

February 24, 2022, 10:09:56 PM Merited by JayJuanGee (1) |

|

have a 50 a day DCA for 3 months.

Today I grabbed 100 at 36 k and at 35 k

I would buy down to 1k at 1k drops at 100 a buy

and I will continue my 50 a day dca.

Is this clear enough?

that would be buys at 34k down to 1k = 3400 usd worth

and continue my 50 a day dca

and to repeat myself I think the drop to 34k+ was a reaction to the war really starting.

|

|

|

|

|