Mayor of ogba

Full Member

Offline Offline

Activity: 280

Merit: 159

★Bitvest.io★ Play Plinko or Invest!

|

|

March 10, 2024, 02:57:15 AM |

|

You seem to be describing someone who had overinvested into bitcoin, and another problem is that the kind of person that you describe sounds like a gambler, because the smart thing to do if you have concluded that that you might have over invested would be to take some value off the table, and then to resume with a more prudent approach in which you can stay more focused on your goal of continuing to accumulate in a way that does not cause you to get overly excited (or emotional) about your investment. Sure, it is difficult to set our positions so that we don't get emotional because sometimes it takes a while to build up your position in bitcoin enough in order that you can begin to feel less and less emotional about it. It takes practice to build your portfolio in a way to at least attempt to minimize the amount of emotion, even though we are likely not going to completely get rid of the emotion, especially if we might happen to be normal people rather than bots.

What you say is quite true, especially us beginners need encouragement to fight our emotions of lust when things are like this. I mean we don't have to take a stupid attitude when market conditions are bullish. Yes, we have to be able to resist the temptation of profit because we have done quite well building a portfolio from the past 1 year by buying and holding. But the most difficult period is fighting our desires and perhaps it will ruin an investment journey if we are consumed by the desire for short-term profits. Of course every increase always gives rise to one reason for every decision where it comes doubt to buy because some of them are afraid of the decision they made. Maybe the important point here is not to check Bitcoin prices every day because that can trigger uncontrollable emotions. When we have succeeded in collecting as many Bitcoins as we can, of course we have to be able to restrain ourselves because if we cannot restrain our desires, it will very likely take what we have invested so that we will lose the opportunity to be able to profit from what we have collect. That's why it's good to have extra source of income before investing in bitcoin. That you are investing in bitcoin doesn't mean that you should deprive yourself of the good things of life and the comfort you deserves. If you have money to run your life, you don't need to restrain yourself from enjoying things of this life. You don't even need to consider taking from your investment. As your investing make sure that no aspect of your life suffers or lack anything. Investment should be done without stress. Having income that exceeds your needs or having additional income because it is not enough is a choice that must be made in any form of investment, including Bitcoin. It is not mandatory to have an income that exceeds our needs before we can start our bitcoin investment. Since bitcoin is a long-term investment, we need a good source of income. We will be using 10% of our salary to accumulate bitcoin every week or month, depending on when we receive our salary. We can also keep 20% of our salary as a reserve fund to be used to settle any unforeseen problems that may arise unexpectedly, so that we will not depend on our bitcoin investment to settle them. |

|

|

|

|

|

|

|

|

|

|

|

|

"This isn't the kind of software where we can leave so many unresolved bugs that we need a tracker for them." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

FinePoine0

Full Member

Offline Offline

Activity: 378

Merit: 113

★Bitvest.io★ Play Plinko or Invest!

|

|

March 10, 2024, 04:39:23 AM |

|

You seem to be describing someone who had overinvested into bitcoin, and another problem is that the kind of person that you describe sounds like a gambler, because the smart thing to do if you have concluded that that you might have over invested would be to take some value off the table, and then to resume with a more prudent approach in which you can stay more focused on your goal of continuing to accumulate in a way that does not cause you to get overly excited (or emotional) about your investment. Sure, it is difficult to set our positions so that we don't get emotional because sometimes it takes a while to build up your position in bitcoin enough in order that you can begin to feel less and less emotional about it. It takes practice to build your portfolio in a way to at least attempt to minimize the amount of emotion, even though we are likely not going to completely get rid of the emotion, especially if we might happen to be normal people rather than bots.

What you say is quite true, especially us beginners need encouragement to fight our emotions of lust when things are like this. I mean we don't have to take a stupid attitude when market conditions are bullish. Yes, we have to be able to resist the temptation of profit because we have done quite well building a portfolio from the past 1 year by buying and holding. But the most difficult period is fighting our desires and perhaps it will ruin an investment journey if we are consumed by the desire for short-term profits. Of course every increase always gives rise to one reason for every decision where it comes doubt to buy because some of them are afraid of the decision they made. Maybe the important point here is not to check Bitcoin prices every day because that can trigger uncontrollable emotions. When we have succeeded in collecting as many Bitcoins as we can, of course we have to be able to restrain ourselves because if we cannot restrain our desires, it will very likely take what we have invested so that we will lose the opportunity to be able to profit from what we have collect. That's why it's good to have extra source of income before investing in bitcoin. That you are investing in bitcoin doesn't mean that you should deprive yourself of the good things of life and the comfort you deserves. If you have money to run your life, you don't need to restrain yourself from enjoying things of this life. You don't even need to consider taking from your investment. As your investing make sure that no aspect of your life suffers or lack anything. Investment should be done without stress. Having income that exceeds your needs or having additional income because it is not enough is a choice that must be made in any form of investment, including Bitcoin. It is not mandatory to have an income that exceeds our needs before we can start our bitcoin investment. Since bitcoin is a long-term investment, we need a good source of income. We will be using 10% of our salary to accumulate bitcoin every week or month, depending on when we receive our salary. We can also keep 20% of our salary as a reserve fund to be used to settle any unforeseen problems that may arise unexpectedly, so that we will not depend on our bitcoin investment to settle them. Basically what do you think applies to people who don't earn bitcoins, specifically I mean you can accumulate bitcoins by deducting extra expenses from your income and household expenses. Because now is the best time to deposit bitcoins, the longer you deposit bitcoins the more your wealth will grow. So if you deposit 20% to 25% percent money in Bitcoin for long term then your future will bring much success. The proof is that I myself have been holding Bitcoin hold for 13 months and my wallet has grown, my portfolio has gained huge benefits. So I won't reveal my share of benefits because my inner greed might wake up. So you should never think about the benefits and sell your investment due to greed. So the longer term the investment is the more benefit will be earned. |

|

|

|

|

Justbillywitt

|

|

March 10, 2024, 08:04:05 AM |

|

When making an investment, what we should first consider is our income level, what percentage of money do we earn on a basis and how much are we willing to begin the investment with, what strategy is best suitable for us in making this investment and how we are going to overcome the aftermath on this investment in balancing through the economy challenge and the needs that may arises, how all these are not going to affect the investment and how wea re going to be sustainable in making same investment without any thing left undone or being affected, proper and adequate planning is very important to be in place before the start of an investment and choosing the right asset is also an important thing never to left behind.

Yes, all what you said is correct. We do not need jump into investing without making good calculations of our cost of living, our savings/emergency funds and other minor expenses, if we don't then there is certainty of becoming affected after making the investment which may result to the urge of tampering one's portfolio. It has been drawn to the best of our knowledge to adhere to the rule of investing not aggressively but passively, this way we don't get to regret. In the investment and personal finance world, the term "passive" has a specific meaning that revolves around getting and/or receiving income without working - in other words an investment can earn a passive income because either it bears interest or it grows in value faster than the rate that value is withdrawn from it. It seems wrong and/or misleading to use the term "passive" as a way of describing how we are investing into something like bitcoin.. Sure there can be ways that we set up automated buys or we could follow a system in which we invest every week no matter what from our discretionary/disposable income, yet I still would not describe that as passive, even if there might be some automation involved in it. Also, we could use income that comes from a passive source in order to invest into another asset such as investing into bitcoin from the proceeds of your property rent (presuming that you don't have to do any work for that property rent income)... Sure, I might be quibbling about semantics, yet it seems to be frequent that guys are misusing the term "passive," and it can become quite confusing to either try to figure out what they are saying or what they mean, especially if they are most likely talking about income that they are receiving from working and maybe it does not even really matter so much from where they are getting their income because in the end, the amount of income that is coming in needs to be greater than the expenses in order to be able to invest with what is remaining and the remaining portion is described as disposable/discretionary income and so if they have $600 per month in disposable/discretionary income, they could be aggressive and invest at or near 100% of that into bitcoin or they could be more whimpy and invest only 10% or 20% of that into bitcoin.. so maybe you are suggesting a more whimpy approach is the same as passive, and I think that it is misleading to use the word passive when you might be talking about being less aggressive in the BTC accumulation approach. For sure we think about going to past where everything is cheap that's why people should not make the same mistake again since there's still plenty of time for them to accumulate and they should not about they came late since on bitcoin there's nothing like that exist since price of bitcoin continuous to grow.

Even though there are no guarantees in bitcoin, it seems quite likely that people who are thinking that BTC is at a current top and vulnerable to crashing, and so therefore they hesitate to buy BTC, and if they continue to hesitate to buy based on that kind of thinking which also relates to their thoughts of "being too late," then in 3-4 years if they still had not been buying BTC, they are likely going to see that bitcoin had landed in a place in which 5 digit bitcoin was not even available anymore and so those who had gotten in at current prices are looking like geniuses. Again, surely not guaranteed, yet it is way better to get some kind of position size into bitcoin rather than presuming from the mere fact that we are hitting ATHs that there needs to be any kind of correction from here or even that BTC prices need to return to these price levels once (or if) they decide to go up... and even this year, we well could be experiencing a BTC price range that is bouncing around $120k to $180k (with $60k price moves to the upside and downside over a few months).. .again, no guarantees of these kinds of scenarios, yet the ONLY way to benefit from those kinds of possibilities is to buy some bitcoin and/or buy exposure to bitcoin (if for some reason you are not ready, willing and/or able to buy bitcoin directly, which would be the preferred way to hold your cornz). You are right because lately I have noticed so many persons with different assumptions of the possibility of Bitcoin price making some correctional moves, so with that information most people feel that is something that would happen and instead of them to keep buying they are still waiting for the correction to happen so that they would have an opportunity to take advantage without knowing that those information are based on assumption and there is a possibility it may likely not happen, so perhaps @JAY I think your advice on this situation is actually the best way because with the current price movement of Bitcoin nothing is for sure now so one of the preferable way is to take a position size on Bitcoin so that if the price movement keep increasing they will never be left out because there position will still be running for them. However one of things I realized about investment is that an investor shouldn't always rely on assumptions of people or even if they should give a listening ear but there should be a back up plan that if should incase it doesn't work the way they had assumed, then there investment back of plan will cover for it. I think it will be foolishness for someone to completely rely on information which is just a speculation and decide to pause his intention of buy bitcoin. What happens to dividing your money and buying at all market conditions. Bitcoin investment is about being proactive and utilizing every opportunity that comes your way. Sitting back and doing nothing simply means that you will get nothing. One thing I like about bitcoin investment is, you get what you deserve. You take action you benefit from it, you sit back without taking action you get nothing. But you will celebrate those that took action while you are in regrets. |

|

|

|

|

JoyMarsha

|

|

March 10, 2024, 09:32:47 AM |

|

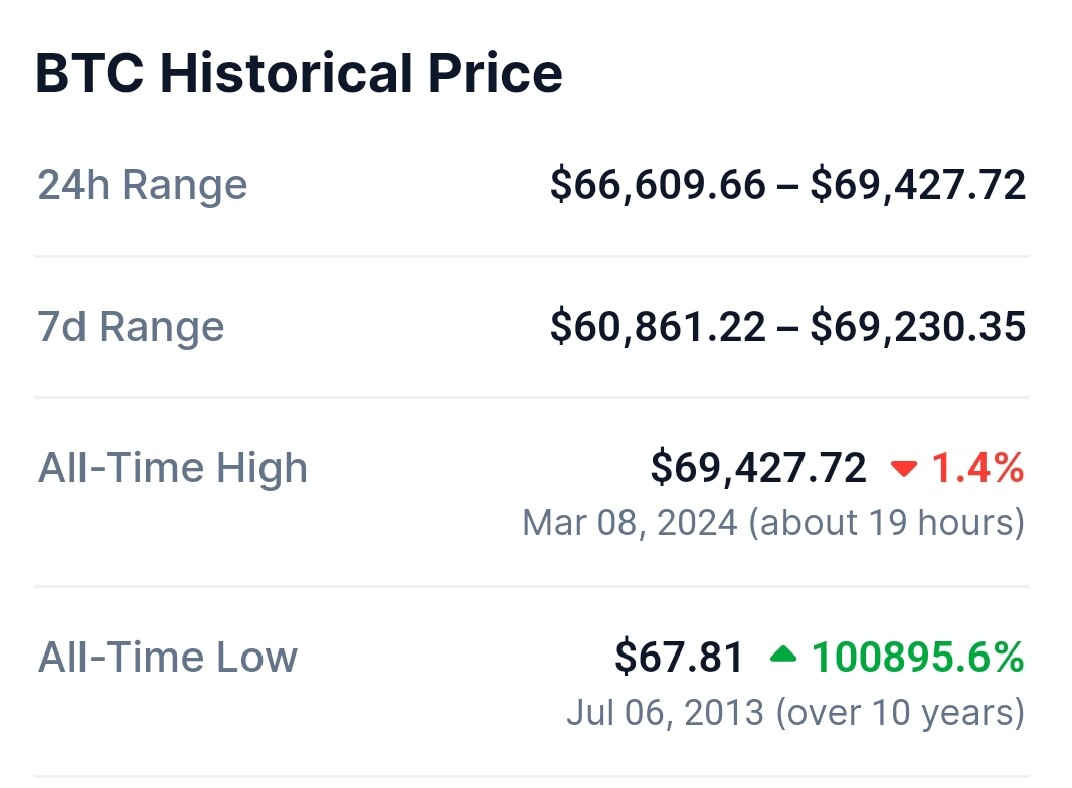

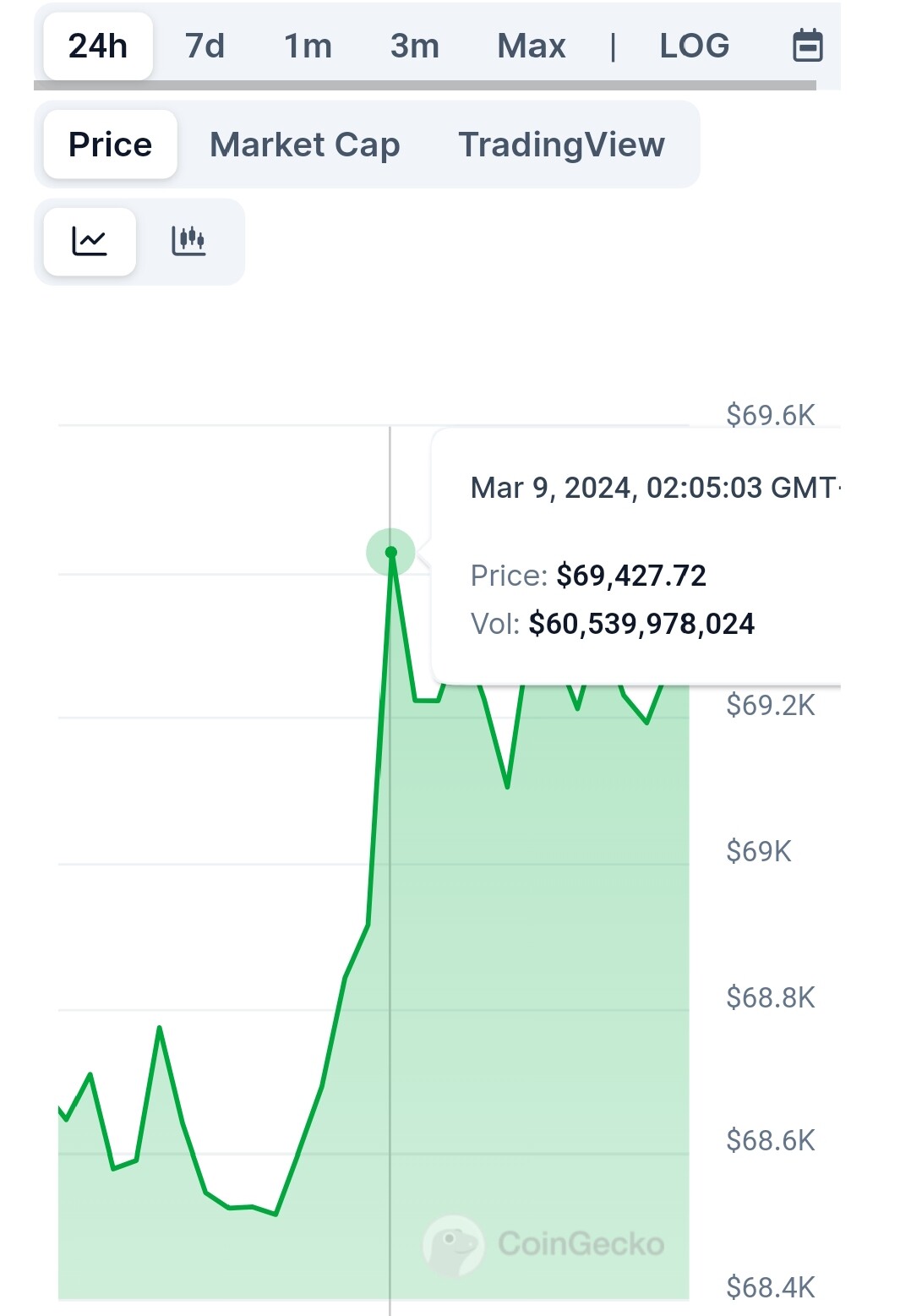

Bitcoin broke its previous ATH. I haven't been able to check the market today due to a lot of busyness, so when I check the market now, I see that Bitcoin broke its previous ATH almost 19 hours ago, That price of Bitcoin is $69,427. But this ATH did not increase much from the previous ATH. But still I am very happy and glad that Bitcoin broke its previous ATH. I am a big believer in Bitcoin and it's a lot of faith that the price of Bitcoin will definitely rise above 100k and it will happen very soon. This is just ice on the cube for bitcoin to be breaking its all-time high from time to time. Expect more of its price increment to keep happening now and then because bitcoin is just at the start of giving us a new ATH from now till next year. What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings. |

| Ladies.de | | | | ███████████████

████▄▄▄▄███████▄▄▄▄▄

▄█████████████████████▄

███████████████████████

███████████████████████

▐█████████████████████▌

░█████████████████████

░█████████████████████

▐█████████████████████▌

░█████████████████████

██▀█████████████████▀

███████████████████

██████████████████ | ▬▬▬▬▬▬▬▬▬▬▬▬ ♥

LadiesStars

▬▬▬▬▬▬▬▬ ♥ | ♥

♥ | | | ♥

♥ | ██████▀█████████

███████▀███████▌

████████▐███████▄

██████████████████▄

█████████▐██████████

████████████████████▌

███████▄████████████

███████████████████

████▄█████████████

█████████████████▌

████████▀░███████

░█████▀█████████

████▀██████████ |

|

|

|

Kwarkam

Jr. Member

Offline Offline

Activity: 70

Merit: 3

|

|

March 10, 2024, 10:05:21 AM |

|

Basically what do you think applies to people who don't earn bitcoins, specifically I mean you can accumulate bitcoins by deducting extra expenses from your income and household expenses. Because now is the best time to deposit bitcoins, the longer you deposit bitcoins the more your wealth will grow. So if you deposit 20% to 25% percent money in Bitcoin for long term then your future will bring much success. The proof is that I myself have been holding Bitcoin hold for 13 months and my wallet has grown, my portfolio has gained huge benefits. So I won't reveal my share of benefits because my inner greed might wake up. So you should never think about the benefits and sell your investment due to greed. So the longer term the investment is the more benefit will be earned.

If only traders could understand this. The thing is, not everybody comes to make decisions based on a long termed scale, and not everybody will be able to keep composure at the dips, infact majority tend to panic. I know a lot of people who panicked and sold their coins ( a great deal of) just before Bitcoin hit ATH in 2021. During the dip before, they panicked, but I grabbed more coins back then. Been HODLing since then. Just buy the DIP and HODL. Best way to thrive in Bitcoin. |

|

|

|

|

|

NewRanger

|

|

March 10, 2024, 11:09:58 AM |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. |

|

|

|

|

arjunmujay

Full Member

Offline Offline

Activity: 672

Merit: 161

Cashback 15%

|

|

March 10, 2024, 11:21:09 AM |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. |

|

|

|

|

Taskford

|

|

March 10, 2024, 11:37:30 AM Merited by JayJuanGee (1) |

|

For sure we think about going to past where everything is cheap that's why people should not make the same mistake again since there's still plenty of time for them to accumulate and they should not about they came late since on bitcoin there's nothing like that exist since price of bitcoin continuous to grow.

Even though there are no guarantees in bitcoin, it seems quite likely that people who are thinking that BTC is at a current top and vulnerable to crashing, and so therefore they hesitate to buy BTC, and if they continue to hesitate to buy based on that kind of thinking which also relates to their thoughts of "being too late," then in 3-4 years if they still had not been buying BTC, they are likely going to see that bitcoin had landed in a place in which 5 digit bitcoin was not even available anymore and so those who had gotten in at current prices are looking like geniuses. Again, surely not guaranteed, yet it is way better to get some kind of position size into bitcoin rather than presuming from the mere fact that we are hitting ATHs that there needs to be any kind of correction from here or even that BTC prices need to return to these price levels once (or if) they decide to go up... and even this year, we well could be experiencing a BTC price range that is bouncing around $120k to $180k (with $60k price moves to the upside and downside over a few months).. .again, no guarantees of these kinds of scenarios, yet the ONLY way to benefit from those kinds of possibilities is to buy some bitcoin and/or buy exposure to bitcoin (if for some reason you are not ready, willing and/or able to buy bitcoin directly, which would be the preferred way to hold your cornz). This is what happen if they don't have enough knowledge and always listen to those negative people which doesn't really have long experience on dealing with bitcoins. They feel crazy when people saying that a crash is coming that's why it affect there decision and decide not to buy since as said they are hesitant due to that reason. If they could just able to grab some knowledge by doing some deep research and try to figure out that everything has a basis including those doubts of people then for sure they can decide for theirselves about a good time to accumulate and they will not wait or get affected with the opinion of other people since their research and knowledge is much stronger so they can accumulate and will not left behind once there's good price pump to happen. Although its doesn't have any guarantee but if they hold on strong possibility for sure there will be a good result for them to gain with bitcoins in future. Although we don't have any guaranteed result but it showing us great possibilities for a big pumps. If we continue to doubt and didn't try to take good reaction because we are worried about those correction for sure those people will regret to miss those opportunity that they possibly take if they just accumulate while there's a chance for them before to accumulate some bitcoins. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

Roseline492

|

|

March 10, 2024, 12:55:32 PM |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. In as much as diversification is very important as investors but choosing altcoins for the diversification is not ideal because let's not be moved because of the possible profit you feel you could easily get from diversifying into altcoins but you should also consider the risk of diversifying to altcoins because we have heard about so many altcoins that people invested and at the end they lost there money, so the only investment I trust and believe is only Bitcoin, so perhaps you could as well diversify some of your funds to some other method of accumulating Bitcoin if you have enough funds, @JayJuanGee has explained so many method to use in terms of accumulating Bitcoin, perhaps you could go through the previous post were is being explained. |

|

|

|

|

Sim_card

|

|

March 10, 2024, 01:17:45 PM Merited by JayJuanGee (1) |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. You are not giving out a good advice on investing in bitcoin. When a newbie is investing in bitcoin, he should only stay focus on bitcoin and forget about altcoins. This is because investing in altcoins is a waste of time, and will make you lose focus on your bitcoin investment journey, since they are used for pump and dump. They don't have the potential to give profit in long term but losses. I don't see altcoins as an investment, rather I see it as gambling. You are talking about diversification, when you don't understand what it means. Any bitcoin investor that want to diversify can do that when he feels that he has acquired enough bitcoin or 70% of his bitcoin that, because he feels that he has invested so much on bitcoin and want to invest in other asset. When you are diversifying, you don't diversify into similar investment, like altcoins, because bitcoin price controls all other cryptocurrency. You should diversify into a different asset, like properties, stock, bond, real estate. So that if one of your assets is not doing weel as expected, the other one can balance up. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

I_Anime

Full Member

Offline Offline

Activity: 364

Merit: 153

Cashback 15%

|

|

March 10, 2024, 01:37:44 PM |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. at first try as possible to accumulate some good quantity of bitcoin or hit your accumulation goal before having the thought of diversificating , because you diversificating now would reduce your accumulation of bitcoin , due to the process of sharing your funds in different investment in the name of diversificating. And you thinking diversificating in altcoins (shit coins) ain't a smart move at all because the risk attached is just too much , because most shitcoins are just pump and dump project and your funds may endup dumping with it. So after reaching your fuck you status (your bitcoin accumulation goal) as sir JJG normally refers to it . You can think of diversifying but not in altcoins but some good investment outside this space that you know the risk ain't that high and can still yield some good ROI. |

|

|

|

|

Rabata

|

|

March 10, 2024, 01:54:14 PM Merited by JayJuanGee (1) |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. We can say altcoins are gambling coins and bitcoin is a fixed asset. It is entirely up to the investor which direction to take. Although some altcoins have the potential to gain money due to major pumping events, some altcoins can lose at any time. Investors who have lost investing in altcoins will understand the value of Bitcoin. There are many coins other than Bitcoin in the coin market cap, how can an investor be risk free about his investment? Investing in Bitcoin is also risky but long-term investment based on potential can certainly keep a holder relatively risk-free. When it comes to investing, an investor must make the best investment as possible. If we look at the Bitcoin price in 2017, it was unbelievable that Bitcoin would reach $70,000 after 4 years. Again, if Bitcoin is predicted to reach 1 million in the next few years, it will not be believable. But Bitcoin will eventually reach that position slowly. Those who have purchased train tickets may be able to board the train and those who haven't may never reach their destination. |

|

|

|

Miles2006

Full Member

Offline Offline

Activity: 224

Merit: 149

Cashback 15%

|

|

March 10, 2024, 03:31:17 PM

Last edit: April 09, 2024, 06:03:54 AM by Miles2006 |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. This idea is wrong from my perspective, I don't know for other members but I personally can't go for diversification cause I have not accumulated much and from what I learnt here from JJG, before thinking of diversification of an asset you should build your bitcoin portfolio first and secondly why going for an uncertain investment choice (shitcoins) if thinking about altcoins I will advice you investment in bitcoin only and build gradually in terms of knowledge and accumulation rather than diversification, learning about altcoins although no one can fully go into bitcoin investment but rather there's an average percentage when it comes to our accumulation choice. secondly this thread is meant for bitcoin accumulation only, let's not make the thread look like a combination of altcoins and bitcoin discussion cause I have seen several members coming here to discuss about altcoins. |

|

|

|

|

Frankolala

|

|

March 10, 2024, 04:40:03 PM |

|

Basically what do you think applies to people who don't earn bitcoins, specifically I mean you can accumulate bitcoins by deducting extra expenses from your income and household expenses. Because now is the best time to deposit bitcoins, the longer you deposit bitcoins the more your wealth will grow. So if you deposit 20% to 25% percent money in Bitcoin for long term then your future will bring much success. The proof is that I myself have been holding Bitcoin hold for 13 months and my wallet has grown, my portfolio has gained huge benefits. So I won't reveal my share of benefits because my inner greed might wake up. So you should never think about the benefits and sell your investment due to greed. So the longer term the investment is the more benefit will be earned.

If only traders could understand this. The thing is, not everybody comes to make decisions based on a long termed scale, and not everybody will be able to keep composure at the dips, infact majority tend to panic. I know a lot of people who panicked and sold their coins ( a great deal of) just before Bitcoin hit ATH in 2021. During the dip before, they panicked, but I grabbed more coins back then. Been HODLing since then. Just buy the DIP and HODL. Best way to thrive in Bitcoin. I don't think this is the best time to use this term BUY THE DIP AND HODL!. This is because we are not in the dip, and we are in the bull market, because bitcoin has passed the previous ATH. What should be said now is DCA AND HODL!, because at the current bitcoin price, it is only DCA that is the best strategy in which some accumulating bitcoin can use to increase his bitcoin portfolio due to the high price of bitcoin. I would not even lump sum if I have the money to do that, because bitcoin price go into correction, so DCA regularly either weekly or monthly and hodli for a very long time, and when the bear market appears again, you can buy dip and hodli. However, this is my personal thoughts that I am sharing, and we all have the right to do whatever we think is best for us, but you will be responsible for your own actions. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

laijsica

Jr. Member

Offline Offline

Activity: 70

Merit: 8

|

You seem to be describing someone who had overinvested into bitcoin, and another problem is that the kind of person that you describe sounds like a gambler, because the smart thing to do if you have concluded that that you might have over invested would be to take some value off the table, and then to resume with a more prudent approach in which you can stay more focused on your goal of continuing to accumulate in a way that does not cause you to get overly excited (or emotional) about your investment. Sure, it is difficult to set our positions so that we don't get emotional because sometimes it takes a while to build up your position in bitcoin enough in order that you can begin to feel less and less emotional about it. It takes practice to build your portfolio in a way to at least attempt to minimize the amount of emotion, even though we are likely not going to completely get rid of the emotion, especially if we might happen to be normal people rather than bots.

What you say is quite true, especially us beginners need encouragement to fight our emotions of lust when things are like this. I mean we don't have to take a stupid attitude when market conditions are bullish. Yes, we have to be able to resist the temptation of profit because we have done quite well building a portfolio from the past 1 year by buying and holding. But the most difficult period is fighting our desires and perhaps it will ruin an investment journey if we are consumed by the desire for short-term profits. Of course every increase always gives rise to one reason for every decision where it comes doubt to buy because some of them are afraid of the decision they made. Maybe the important point here is not to check Bitcoin prices every day because that can trigger uncontrollable emotions. When we have succeeded in collecting as many Bitcoins as we can, of course we have to be able to restrain ourselves because if we cannot restrain our desires, it will very likely take what we have invested so that we will lose the opportunity to be able to profit from what we have collect. That's why it's good to have extra source of income before investing in bitcoin. That you are investing in bitcoin doesn't mean that you should deprive yourself of the good things of life and the comfort you deserves. If you have money to run your life, you don't need to restrain yourself from enjoying things of this life. You don't even need to consider taking from your investment. As your investing make sure that no aspect of your life suffers or lack anything. Investment should be done without stress. Having income that exceeds your needs or having additional income because it is not enough is a choice that must be made in any form of investment, including Bitcoin. It is not mandatory to have an income that exceeds our needs before we can start our bitcoin investment. Since bitcoin is a long-term investment, we need a good source of income. We will be using 10% of our salary to accumulate bitcoin every week or month, depending on when we receive our salary. We can also keep 20% of our salary as a reserve fund to be used to settle any unforeseen problems that may arise unexpectedly, so that we will not depend on our bitcoin investment to settle them. The income should be more than the demand, and if the income is not high, how can you think about DCA? If the income is not more than the demand, how will you meet the basic of the family... First of all you have to keep our family well and then something else. At the end of the month you can invest your extra money invest in DCA you want but you have to keep the needs of the family in mind first, in this case you can reduce some extra expenses. you have to stick to a atlest DCA target amount that is 10% or more, it's depend on your income. |

|

|

|

|

promise444c5

Full Member

Offline Offline

Activity: 266

Merit: 128

Keep Promises !

|

|

March 10, 2024, 09:24:06 PM |

|

[The income should be more than the demand, and if the income is not high, how can you think about DCA?

If the income is not more than the demand, how will you meet the basic of the family... First of all you have to keep our family well and then something else.

At the end of the month you can invest your extra money invest in DCA you want but you have to keep the needs of the family in mind first, in this case you can reduce some extra expenses. you have to stick to a atlest DCA target amount that is 10% or more, it's depend on your income.

Yeah! It's true that your income must overflow your your expenses and budgets. If this is not achieved then some measures could be taken like Reduce your outflowsAvoid spending extravagantlySetting up scale of preference as some can be forgone(or brought down to a new budget list )to come up with a DCA target Avoiding deficit bugetWith these, there should be something for ones DCA |

|

|

|

|

ginsan

|

|

March 10, 2024, 09:55:19 PM Merited by JayJuanGee (1) |

|

I don't think this is the best time to use this term BUY THE DIP AND HODL!. This is because we are not in the dip, and we are in the bull market, because bitcoin has passed the previous ATH. What should be said now is DCA AND HODL!, because at the current bitcoin price, it is only DCA that is the best strategy in which some accumulating bitcoin can use to increase his bitcoin portfolio due to the high price of bitcoin.

I would not even lump sum if I have the money to do that, because bitcoin price go into correction, so DCA regularly either weekly or monthly and hodli for a very long time, and when the bear market appears again, you can buy dip and hodli. However, this is my personal thoughts that I am sharing, and we all have the right to do whatever we think is best for us, but you will be responsible for your own actions.

I use the DCA method to accumulate Bitcoin every two weeks, so in this case I want to tell you that we really don't think about the price when we buy Bitcoin. Why, because we buy regularly so we will find an average entry price when we are satisfied with our BTC holdings. Yes, it's up to them to interpret whatever they want in this bullish condition, but in my opinion we still prioritize the term Buy and Hold in our investment journey. For this reason, continue to stick to our respective concepts, where if you think that this bullsih condition is disturbing your concerns about buying Bitcoin, then you can wait for the price to fall to be able to accumulate Bitcoin. |

| .

.Duelbits. | │ | | │ | ▄▄█▄▄░░▄▄█▄▄░░▄▄█▄▄

███░░░░███░░░░███

▀░░░▀░░▀░░░▀░░▀░░░▀

▄░░░░░░░░░░░░

▀██████████

░░░░░███░░░░▀

░░█░░░███▄█░░░█

░░██▌░░███░▀░░██▌

░█░██░░███░░░█░██

░█▀▀▀█▌░███░░█▀▀▀█▌

▄█▄░░░██▄███▄█▄░░▄██▄

▄███▄

░░░░▀██▄▀ | .

REGIONAL

SPONSOR | | ███▀██▀███▀█▀▀▀▀██▀▀▀██

██░▀░██░█░███░▀██░███▄█

█▄███▄██▄████▄████▄▄▄██

██▀ ▀███▀▀░▀██▀▀▀██████

███▄███░▄▀██████▀█▀█▀▀█

████▀▀██▄▀█████▄█▀███▄█

███▄▄▄████████▄█▄▀█████

███▀▀▀████████████▄▀███

███▄░▄█▀▀▀██████▀▀▀▄███

███████▄██▄▌████▀▀█████

▀██▄███▀██▄█▄▄▄██▄████▀

▀▀██████████▄▄███▀▀

▀▀▀▀█▀▀▀▀ | .

EUROPEAN

BETTING

PARTNER | |

|

|

|

|

adultcrypto

|

|

March 10, 2024, 10:06:55 PM Merited by JayJuanGee (1) |

|

It is not mandatory to have an income that exceeds our needs before we can start our bitcoin investment. Since bitcoin is a long-term investment, we need a good source of income.

There is difference between needs and basic needs. Needs is a general term that covers both the basic needs and nonbasic needs. Basic needs are those things that you must have, they are mandatory to have and if you don't have them, your mind cannot be at rest and there is no way you can hold bitcoin under that situation. For example, food is a basic need, while driving luxury cars is not a basic need. You cannot hold a bitcoin portfolio when you are battling with hunger, the safety of that investment is not guaranteed because it can be sold anytime the hunger hits the right spots in the stomach. Before investing in bitcoin, it is mandatory that the basic needs must be met and some funds even set aside as reserve incase of any emergency. Not that you cannot buy bitcoin when basic needs have not been met but calling yourself a long term holder of bitcoin when you have not sorted your basic needs is like self deceit because it will not work. We are advocating for ways people can better invest and hold bitcoin and the suggestion of basic needs and emergency funds is just one of them We will be using 10% of our salary to accumulate bitcoin every week or month, depending on when we receive our salary. We can also keep 20% of our salary as a reserve fund to be used to settle any unforeseen problems that may arise unexpectedly, so that we will not depend on our bitcoin investment to settle them.

The percentage of salary to allocate to bitcoin investment will vary per individual and will also depend if one is well paid or underpaid. For most jobs in my neighborhood where the salary is not even enough for basic needs, investing in bitcoin will be very difficult. |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

March 10, 2024, 10:25:11 PM |

|

This part is true... it can take several years to start to get into profits, yet even the mere fact that you are in profits would not even necessarily start to mean that you need to sell any coins. .

My point exactly. Most short term investors have a fixed investment duration, and then they sell off their coins, which as you've stated isn't the best. And as it takes several years to start making PROFITS, they mostly do not take heed to that, and their investment duration falls below the 'several' years that they need to get into profits. Bitcoin being as unpredictable as it is, can drop or whatever other reason, they find themselves incurring significant losses. Through more years, there are more possibilities of compounding value, when then can put a person in a place where they are able to either live off their bitcoin or to greatly supplement their income and they are ONLY selling small portions of their bitcoin on a monthly or perhaps some other kind of timeline in which they choose to withdraw some of the value from BTC and convert it into their currency and/or make purchases with it.. So one thing is getting the stash to a large enough level that it starts to have meaning, and the other thing is being in profits and how much in profits, and even if a person might make it through more than a whole cycle, he might be able to consider continuing to mostly accumulate and maybe not having any desperate need to withdraw any value from his holdings until a bit of time has passed, maybe even a couple of cycles or more. There are some guys willing to accept that they may well be into fairly heavy BTC accumulation for 10 years or more and then maybe to reassess their situation after going through that level of BTC accumulation, which also is likely to mean that their average cost per BTC is likely going to continue to go up, especially if the BTC prices are mostly going up and there is no real expectation of being able to buy on dips, if dips may or may not end up happening from any given price point...even though in retrospect we can see that the last couple of years had been a dip, and some folks did not realize that it was a dip, even though the presence of the dip should have had been fairly obvious. Basically what do you think applies to people who don't earn bitcoins, specifically I mean you can accumulate bitcoins by deducting extra expenses from your income and household expenses. Because now is the best time to deposit bitcoins, the longer you deposit bitcoins the more your wealth will grow. So if you deposit 20% to 25% percent money in Bitcoin for long term then your future will bring much success. The proof is that I myself have been holding Bitcoin hold for 13 months and my wallet has grown, my portfolio has gained huge benefits. So I won't reveal my share of benefits because my inner greed might wake up. So you should never think about the benefits and sell your investment due to greed. So the longer term the investment is the more benefit will be earned.

It sounds as if you have stopped accumulating bitcoin FinePoine0. So does that mean that you have enough bitcoin? You are not free from the trading mentality if you believe that buying and just sitting on it is going to be enough, and it sounds like you are just considering the point in which you are going to sell.. which also is not a long term commitment... So yeah if you stopped buying, then you have already likely been losing opportunities because maybe you are either presuming the price is going to come down or you are planning to sell when the BTC price goes up, and then where is that going to put you? Are you going to be better off in the long term or just some short term pleasure that you were able to get from "buying low and selling high?" which is also known as trading. What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. There is no need to diversify into shitcoins. That is nonsense. Now if you build up your BTC holdings, you might start out just by only building your BTC and your cash, and at some point you might want to consider whether it would be better for you to diversify your investment into other kinds of investments besides dollars and cash (perhaps property, stocks, bonds, commodities and/or cash equivalents), but that does not mean that you would need to get involved in shitcoins at all or that it would be helpful (rather than a waste of time, energy and money) to get involved in shitcoins.. What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. at first try as possible to accumulate some good quantity of bitcoin or hit your accumulation goal before having the thought of diversificating , because you diversificating now would reduce your accumulation of bitcoin , due to the process of sharing your funds in different investment in the name of diversificating. And you thinking diversificating in altcoins (shit coins) ain't a smart move at all because the risk attached is just too much , because most shitcoins are just pump and dump project and your funds may endup dumping with it. So after reaching your fuck you status (your bitcoin accumulation goal) as sir JJG normally refers to it . You can think of diversifying but not in altcoins but some good investment outside this space that you know the risk ain't that high and can still yield some good ROI. You don't have to reach fuck you status prior to considering diversification, and so each person needs to try to consider for himself how comfortable he is with ONLY having exposure to bitcoin and cash, and there may be some advantage to having some of that cash that is potentially building up in other kinds of assets... .. so when does that trigger? It will be different for different people. Some people come to bitcoin and they already have other investments, and I am not even necessarily suggesting that any of the other investments into areas such as property, stocks, bonds, commodities and cash equivalents are going to be very helpful, but sometimes the more that any of us builds up our bitcoin holdings, then the more logical it will be to have some off-sets to that which could be cash, but we might feel that we are too vulnerable if we have 5 years of our salary in bitcoin and 1 or 2 years in cash.. And, so yeah if we are thinking about fuck you status as a possible goal, then that generally would be considered 20-30 years worth of income using something like the 200-WMA for valuation of your BTC holdings rather than using BTC's spot price since BTC's spot price tends to be all over the place.. so we would need to be making a reasonable assessment of the value of our BTC based on the bottom price rather than the current price or any potential top prices, even though if we sell any BTC we are going to be selling at spot price and maybe even trying to sell during points in which the spot price is relatively high based on expectations.. but that is once we get there, so we have to get there first in terms of figuring out how much BTC to accumulate and sometimes if we might want to make sure that we don't have all of our value in just one thing, especially once we might get to a point in which we have several years of our income in bitcoin.. and I cannot say exactly what each person might choose before they start to diversify, even though I know diversification is not needed in the beginning, but some level of diversification could even be started before reaching a whole year's accumulation of value in BTC.. and sometimes those diversified assets/currencies could be part of an emergency fund and/or reserves depending on how liquid they might be.. . but they would be things to sell prior to selling BTC since BTC would likely be considered the main thing to be wanting to accumulate the most so not wanting to prematurely selling any of it.. I don't think this is the best time to use this term BUY THE DIP AND HODL!. This is because we are not in the dip, and we are in the bull market, because bitcoin has passed the previous ATH. What should be said now is DCA AND HODL!, because at the current bitcoin price, it is only DCA that is the best strategy in which some accumulating bitcoin can use to increase his bitcoin portfolio due to the high price of bitcoin.

I would not even lump sum if I have the money to do that, because bitcoin price go into correction, so DCA regularly either weekly or monthly and hodli for a very long time, and when the bear market appears again, you can buy dip and hodli. However, this is my personal thoughts that I am sharing, and we all have the right to do whatever we think is best for us, but you will be responsible for your own actions.

If you are brand new to bitcoin, you should consider all three options of accumulation: Lump sum , DCA and buy the dip. If you are investing for several years, you might not want to consider some of the options, but even if you have been buying for 1-2 years, and if you all of a sudden have extra money. .Let's say you get a $3k pay out for something. .then all of a sudden you have $3k. So how are you going to treat that extra money? I would think that you would want to consider all three categories, even if you might choose not to employ all three categories.. but the default still might be to put 1/3 into each, but if you think that we are more inclined towards up, then you might want to put more into lump sum in order to better prepare for up, since we cannot know if there is going to be further down.. so maybe you end up deciding to put 60% or 70% into lump sum and then divide the remaining part into buying on dips and DCA. [The income should be more than the demand, and if the income is not high, how can you think about DCA?

If the income is not more than the demand, how will you meet the basic of the family... First of all you have to keep our family well and then something else.

At the end of the month you can invest your extra money invest in DCA you want but you have to keep the needs of the family in mind first, in this case you can reduce some extra expenses. you have to stick to a atlest DCA target amount that is 10% or more, it's depend on your income.

Yeah! It's true that your income must overflow your your expenses and budgets. If this is not achieved then some measures could be taken like Reduce your outflowsAvoid spending extravagantlySetting up scale of preference as some can be forgone(or brought down to a new budget list )to come up with a DCA target Avoiding deficit bugetWith these, there should be something for ones DCA You can also try to figure out ways to increase your income. Yes, it's up to them to interpret whatever they want in this bullish condition, but in my opinion we still prioritize the term Buy and Hold in our investment journey. For this reason, continue to stick to our respective concepts, where if you think that this bullsih condition is disturbing your concerns about buying Bitcoin, then you can wait for the price to fall to be able to accumulate Bitcoin.

Waiting or even lowering your DCA amount may not be a great idea, especially if you already determined that you don't have enough BTC. Yet, for sure, everyone has to make these decisions for themselves, and historically there are a lot of examples of guys reducing the amount of their DCA to wait for dips that never ended up happening, so they end up both screwing up their accumulation but they also screwed up their psychology...so sometimes it is better to just keep buying, even if your average costs per BTC is going up. Also like you seem to suggest, there are ways to keep buying, but ONLY to reserve part of what you would have otherwise used to buy for the possibility for dips. No one can really say and each of us needs to decide how much to allocate to each of these areas, especially if we are trying to figure out if we have enough BTC or not.. and how we think we might be able to get more BTC and is it worth it to wait with some of it.. because sometimes it does help to have some money for those dips that come at various points, and they might come rapidly and other times we end up getting stuck back down in a correction zone.. but the question never really goes away concerning how much to buy and when and whether we should preserve some of that (and how much) for the possibility of buying on dips. It is not mandatory to have an income that exceeds our needs before we can start our bitcoin investment. Since bitcoin is a long-term investment, we need a good source of income.

There is difference between needs and basic needs. Needs is a general term that covers both the basic needs and nonbasic needs. Basic needs are those things that you must have, they are mandatory to have and if you don't have them, your mind cannot be at rest and there is no way you can hold bitcoin under that situation. For example, food is a basic need, while driving luxury cars is not a basic need. You cannot hold a bitcoin portfolio when you are battling with hunger, the safety of that investment is not guaranteed because it can be sold anytime the hunger hits the right spots in the stomach. Before investing in bitcoin, it is mandatory that the basic needs must be met and some funds even set aside as reserve incase of any emergency. Not that you cannot buy bitcoin when basic needs have not been met but calling yourself a long term holder of bitcoin when you have not sorted your basic needs is like self deceit because it will not work. We are advocating for ways people can better invest and hold bitcoin and the suggestion of basic needs and emergency funds is just one of them We will be using 10% of our salary to accumulate bitcoin every week or month, depending on when we receive our salary. We can also keep 20% of our salary as a reserve fund to be used to settle any unforeseen problems that may arise unexpectedly, so that we will not depend on our bitcoin investment to settle them.

The percentage of salary to allocate to bitcoin investment will vary per individual and will also depend if one is well paid or underpaid. For most jobs in my neighborhood where the salary is not even enough for basic needs, investing in bitcoin will be very difficult. Yep, exactly. There are various levels of needs, and some are more basic and some can be deferred until later and some might be considered wants rather than needs, so we surely would need to know which category of the needs we have to satisfy and which ones might be deferred and which ones we might want to balance out in terms of whether to treat ourselves to some of our wants, and those can be personal choices, yet as you suggested, the more basic the need, the more we are going to get ourselves into trouble if we are using our basic needs money to invest and/or to buy bitcoin.. So in that regard, if we do not have enough income (or other resources) to satisfy our basic needs then we are going to have to satisfy those first. By the way, we could also look up Maslow's heirarchy of needs if we want to consider those kinds of ideas about levels of needs. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Ludmilla_rose1995

Full Member

Offline Offline

Activity: 1508

Merit: 157

#SWGT PRE-SALE IS LIVE

|

|

March 10, 2024, 11:10:09 PM |

|

What is expected of us as bitcoin holders is to keep hodling our bitcoin in our portfolio and never to sell until bitcoin reaches our speculated price before we can be able to sell some part of our bitcoin holdings.

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. those who like to move to altcoins when they make a profit from selling bitcoin are not worthy of being called a holder, they only make profits from using bitcoin as a means, some whales actually use this method to pump several altcoins in a structured manner ~

That right, We also have to think rationally when holding BTC coins and don't be quickly influenced by liking other coins when they go up, continue to exchange them for our BTC to hold the damn coin and that at any time can be a disaster for us because we don't know about its future even though it exists which says we will get double the profit when the market recovers. That's right, you can choose another altcoin with a price and capitalization that is still low so you can get extraordinary results in the future. However, you still have to stick to Bitcoin. Diversification is very important to minimize large losses. This is also a good way to get multiple profits in the future, with good accuracy and timeliness, this trick can definitely be carried out well and without making any losses |

|

|

|

|