|

Looks like the 'player' has moved out for now, Stamp order book back to a normal spread -- now we see what the market sentiment is really like.

|

|

|

|

And up goes the wall...

But no-one dumping 1K of coins into the bid-side, as we have come to expect in the last six months. So, perhaps the wall at 420 is a good thing, calming the market and allowing some consolidation before further gains? +1 It´s a guardian whale. He wants a controllable rise. We think as one Fonzie  I know its a bit passe to invoke Loaded at these times but IIRC he did say he had fiat arriving at Stamp in the days after the 300wall fell. He would have the resources and the intelligence to push the market up slowly. |

|

|

|

And up goes the wall...

But no-one dumping 1K of coins into the bid-side, as we have come to expect in the last six months. So, perhaps the wall at 420 is a good thing, calming the market and allowing some consolidation before further gains? |

|

|

|

|

The lag between placing orders on Stamp and what you see on Wisdom is close to a minute at present; if there is some insider trading going on I suspect they are making an absolute killing.

|

|

|

|

What sort of uptrend do you guys think would cause shroomsy to stop complaining about goddamn traders and dumpers? You think anything less than a perfectly linear rise would do it (straight line)?  A suppository tranquilizer, trending right up his gaping ass. At least he is consistent, I appreciate his reliability.  |

|

|

|

Well I wasn't expecting this with no volume in the middle of the night...

er...it's the middle of the day for the most populous part of the planet. |

|

|

|

|

Looks like a lot of panic buying to me.

Big red falling knives incoming.

|

|

|

|

Nice find Wally (you bet welcher  ) A pity about the cringe-worthy last line. What a confused lil' bunch of Antipodeans we are: our scientists make news worthy breakthroughs yet our politicians are becoming the embodiment of flat-earthers. Today, Abbott claimed coal is good for the world, Lambie said Putin is a force for world peace, we have business leaders running our environmental policies and trying to prepare us for "global cooling" and our finance minister claims "poor people don't drive cars". A summary of our political lunacy is here... http://www.theguardian.com/commentisfree/2014/oct/13/an-apology-from-australia-to-the-rest-of-the-world-is-now-warranted |

|

|

|

This thread could be a collection of missed calls

With so many many many pages on speculation

I wonder how many times it was right lol.

Great question! Now that would be a time consuming study. I'd have to unblock a whole heap of users to do that, not that I will  Being right or wrong isn't really an issue for me: it's acting like a pompous twat and calling people names at the first sight of a price change (before skulking off when it proves illusory) which is rather tragic. Some of the most interesting and educated posters (TERA, Jorge, Mat) have been hounded from these pages by certain "loud voices", while others like MMi get regularly abused for being 'bearish' in the midst of a massive bear market. Anyway, in an attempt to stay positive: if anyone has not seen it, TimWest has contributed another good analysis https://www.tradingview.com/v/YDhHqWUc/And below the line someone is spruiking a new service http://www.cryptoalerts.net/I checked it out and it seems pretty standard stuff...not sure I'd be paying $60 a quarter for someone to tell me the MACD is crossing. |

|

|

|

Hilarious catching up on this thread, so much angst and bad predictions. If there is any consolation in this protracted bear-market, it is seeing JimboToronto being persistently proved wrong...  |

|

|

|

Press the uniform. Check the battle plans. Call up the reservists. Arm the bombers and refuel the tanks. Field Marshal George Osborne is going on manoeuvres.

On Monday in Washington, the chancellor of the exchequer will see if Britain is ready for war. A financial war that is. Along with his allies from the United States, he will play out a war game designed to show whether lessons have been learned from the last show, the slump of 2008.

Like all commanding officers, Osborne thinks he is ready. He will have general Mark Carney at his side. He has studied the terrain. He has a plan that he insists will work.

Let’s hope so. Because the evidence from last week’s meeting of the International Monetary Fund in Washington was that it won’t be long before the real shooting starts. The Fund’s annual meeting was like a gathering of international diplomats at the League of Nations in the 1930s. Those attending were desperate to avoid another war but were unsure how to do so. They can see dark forces gathering but lack the weapons or the will to tackle them effectively. There is an uneasy, brooding peace as the world waits to see whether lessons really have been learnt or whether the central bankers, the finance ministers and the international bureaucrats are fighting the last war.

Here’s the situation. The years leading up to the start of the financial crisis in August 2007 were like the Edwardian summer in advance of the first world war. All seemed serene, but only because of an unsustainable build-up in debt. There was a structural shift in power and income share from labour to capital. Rising asset prices compensated for real income growth.

Then came the crisis, which was long and costly. Once it was over, there was a strong urge to return to the world as it was. Countries wanted to return to balanced budgets and normal levels of interest rates, just as they had once hankered after going back on the Gold Standard.

But that proved impossible. Six years after the global banking system had its near-death experience, interest rates are still at emergency levels. Even attaining the mediocre levels of activity expected by the IMF in the developed countries requires central banks to continue providing large amounts of stimulus. The hope has been that copious amounts of dirt-cheap money will find its way into productive uses, with private investment leading to stronger and better balanced growth.

It hasn’t happened like that. Instead, as the IMF rightly pointed out, the money has not gone into economic risk-taking but into financial risk-taking. Animal spirits of entrepreneurs have remained weak but asset prices have been strong. Tighter controls on banks have been accompanied by the emergence of a powerful and largely unchecked shadow banking system. Investors have been piling into all sorts of dodgy-looking schemes, just as they did pre-2007. Recovery, such as it is, is once again reliant on rising debt levels. Central bankers know this but also know that jacking up interest rates to would push their economies back into recession. They cross their fingers and hope for the best.

Meanwhile, the legacy of the slump has been high levels of unemployment and growing inequality. In those economies where jobs have been created, such as the UK, they have tended to be of the low pay, low skill and low productivity variety. Profits have recovered; real incomes have not.

Christine Lagarde, the IMF’s managing director, says inequality must be tackled. The Fund has produced papers showing that a more even distribution of income and wealth would be good for growth. The words “shared prosperity” were on everybody’s lips in Washington last week.

But as some sceptics pointed out, so far the fight against inequality is currently a phoney war. Lagarde talks a good game, but the advice her organisation dispenses to individual countries has not really changed. There were four things that ensured shared prosperity in the 1950s and 1960s: strong trade unions; redistribution through the tax system; higher public spending; and curbs on the financial system. Apart from suggesting that some countries, such as Germany, might care to spend a bit more on infrastructure, the Fund is not really in favour of any of them. The message, therefore, is clear enough. Lagarde et al are worried about inequality. But they are not yet worried enough to do much about it.

This is where the comparison with the 1920s and 1930s gets scary. The problems created by the first world war were never properly dealt with, and it was only after the Great Depression and a second conflict that policies changed and global institutions were made fit for purpose. There is a real danger of history repeating itself.

The Fund, for example, knows that something is going badly wrong in Europe but is powerless to do anything about it. In the rest of the world, IMF policy is normally governed by what the US Treasury wants. In the euro zone, it is governed by what Germany wants. And what Germany wants is to turn the euro into the modern equivalent of the Gold Standard, with every country running balanced budgets. What Germany is getting is a eurozone in semi-permanent recession. There are alternatives to the status quo: full political union; break-up; a German Marshall Plan for Europe; dumps of helicopter money. Eventually one of them will be tried.

Similarly, the IMF is alert to the threat of another financial crisis. It knows that much of the cash created by central banks has found its way, via the shadow banking system, into emerging markets and developing countries. It knows that investors are complacent about the risks. It knows that in a rush for the exit, many of these investors would be badly burned.

There is, though, no mechanism for regulating these financial flows, just as there is no mechanism for dealing with countries when they go bust. The vulture fund case against Argentina should be the trigger for a sovereign debt bankruptcy system. Instead, the global community is sleepwalking its way towards a developing country debt crisis.

But for the time being, it is easier to avoid doing anything. The rich can enjoy their Great Gatsby lifestyles. Multinational corporations can strip poor countries of their commodities and pay their taxes elsewhere, if at all. Living standards can continue to be squeezed. Debt levels can continue to rise.

Only a real scare, as with Ebola, will lead to meaningful action. Until then, though, the Fund can sit behind its Maginot Line and Field Marshal Osborne can play his war games. But be in no doubt: our chancellor is less Monty in the desert than Neville Chamberlain declaring peace in our time. http://www.theguardian.com/business/2014/oct/12/world-leaders-war-games-financial-crisis?commentpage=1 |

|

|

|

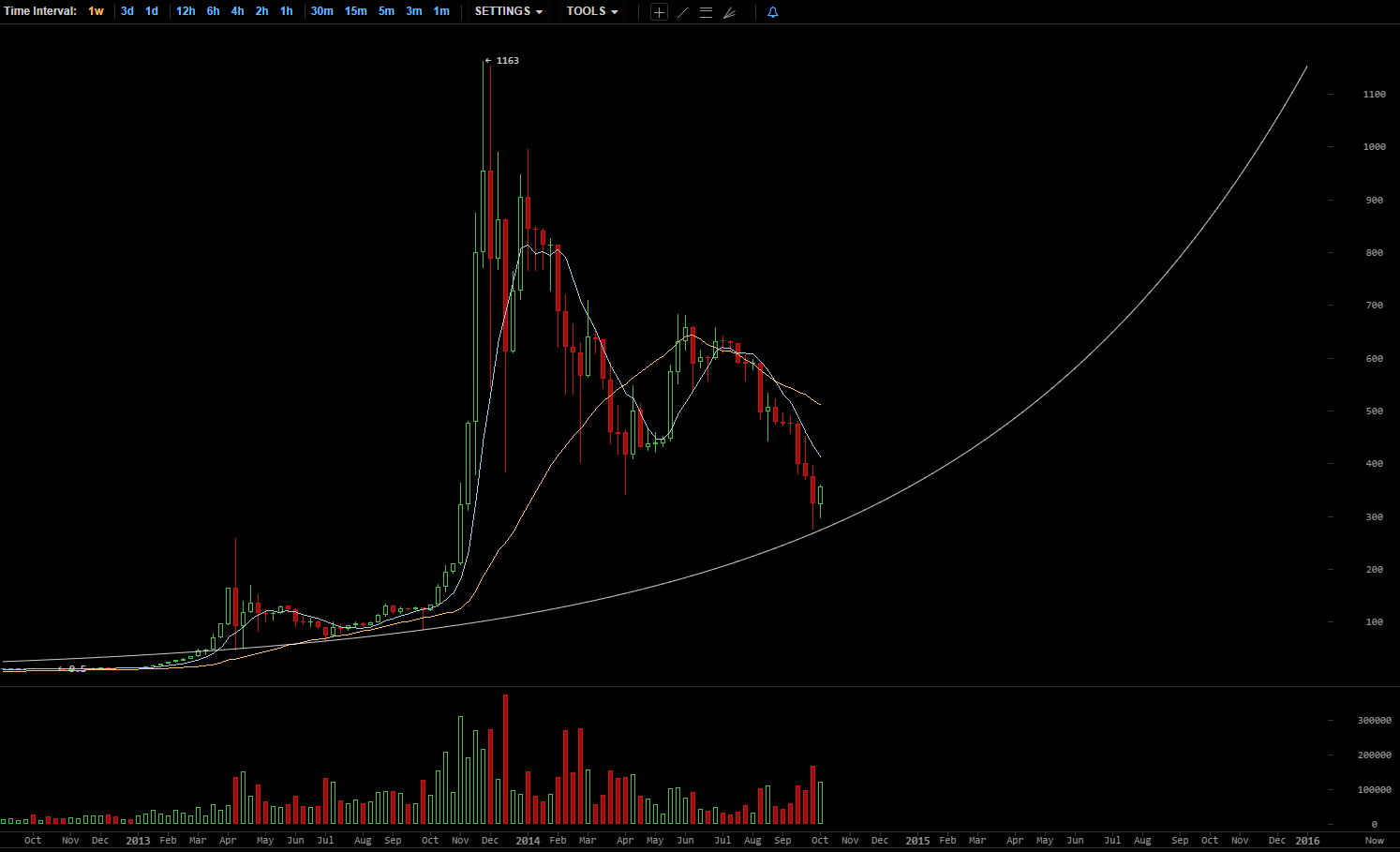

I have been shorting since $387. I wasn't 100% sure it was time to short at the time, but I am fairly certain now. It looks like we are turning the corner in the wrong way. Perhaps the $350 range will hold, but I am expecting us to, at minimum, retest $300.

So that's my book and I don't wish to hide that I have a very obvious interest in it. But, apart from that, be careful. It looks like that was a dead cat bounce... and if not dead... critically ill cat.

Newbies...can't tell the difference between a cat and a honey badger. Looks like the newb has better eyesight than you. |

|

|

|

she's a fuckin lawyer, of course you can't get a straight answer out of her.

also, she's a woman. since when do women know how long anything takes. my wifes 5 mins can be several minutes to an hour

I bet she knows how long you take!  Absolutely, and I bet 5mins in the company of such a charming man like 'Piggles' would feel like an hour for most women. Oh look at that I made a sarcastic generalisation about women and someone got butthurt. Calm down dear Don't worry. She just hates men. Not sure which version of Shroomskit I'm talking to but I think you know that's untrue; I hate the lazy, casual sexism that pervades this thread and the fact that as soon as there is any resistance to it, it prompts comments that you are either sensitive or 'hate men'. I'm not going to get into this (mainly because I'm hopelessly outnumbered and have done it, fruitlessly, before nearly a year ago) but I do wonder if Piggles et al actually behave like this with their wives, partners and daughters in the 'real' world. I imagine not. Back on topic: I'm not going to change my view supporting the theory that we'll back in the high 200's in the next 9 days. |

|

|

|

LOL, so you're saying we need to "prevent this disaster"?   |

|

|

|

Well, I stuck my neck out yesterday and foolishly made a prediction that was completely incorrect (revisiting the 330s yesterday). However, I still think we are over-heated on enthusiasm and will be retesting 300 at least before we truly reverse market sentiment. Its' heartening to see a few more people here are beginning to step out from the red mist and actually look at things a bit more objectively. Adam reposting scenes from Armageddon does not a trading strategy make. I'd be more inclined to think this may play out https://www.tradingview.com/v/uWy5zTmF/ |

|

|

|

she's a fuckin lawyer, of course you can't get a straight answer out of her.

also, she's a woman. since when do women know how long anything takes. my wifes 5 mins can be several minutes to an hour

I bet she knows how long you take!  Absolutely, and I bet 5mins in the company of such a charming man like 'Piggles' would feel like an hour for most women. |

|

|

|

|

Wow, just some incredible posts the last few pages; I'm seriously wondering if I've taken a wrong turn with crypto. Some of this conspiracy stuff about "the manipulator" is just plain ludicrous, I'm going to stop myself because I don't won't get into either a discussion/argument nor offend anyone.

I seriously believe a lot of you need to take a break from monitors and charts and analysis; take a walk in the woods, dance, talk to people face to face, visit another country. Find some balance.

|

|

|

|

This place gets weirder by the day. Personally, I hear the wall was skewered by a unicorn controlled by the CIA. |

|

|

|

BTC breakout short term atm... Time to share... MY ULTIMATE BEARISH CASE:

MY ULTIMATE BULLISH CASE: MY ULTIMATE BULLISH CASE:

currently, the bears are winning, but it is still possible to return to the bullish case and stay between those 2 trendlines  edit: I call that we will never touch 275 USD again and probably will never dip below 300 USDYou have the right to ridicule me if this doesn't happen  Here we go again, another never post, I love these posts  Edit: Edit: and yes, I still didn't buy and wont buy, my chart is not showing any kind of reversal, it could be just a dead cat bounce.... if we go to $500 and maintain it for days or continue going up, I will buy back, but for for now it is business as usual, waiting for more downtrend. I agree with you, and most of the TA I've been reading today suggests the same, maybe upto 500 or even 550 but we will keep travelling downwards in the next couple of months. It's incredible how much (irrational) exuberance there has been since Monday. A great deal seems to be based on Adam whipping people into a frenzy with talk of rockets, trains etc. I'm beginning to find it all a bit tragic that you can't offer an rational opinion without being called a "bear troll" or similar. But I do notice that we've gone back to posting random pictures of breasts, which is normally a good indicator that the collective IQ/attention span of the thread is dipping. |

|

|

|

|