Silver at 9$? Party time  |

|

|

|

Bitfinex 6500 coins to $280, 20,000+ coins to $230

Greece, do what you got to do!

Don't get your hopes up with a Greek rebellion or something. Bitcoin's value is definitely >250 but that isn't necessarily related to what Greece may or may not do. IMO it's bad pump material. |

|

|

|

Bitcoin is backed by the same thing that backs gold: A group of people willing to buy it at various price points and another group willing to sell it. Also known as supply and demand.

Plus mining expenses / energy expenses. (fiat currency has near zero "mining" expenses) As a side note Indeed it doesn't take much for banks to create new money, but you shouldn't forget that bitcoin mining expenses are the same expenses that are required to keep the network going while to keep the fiat flowing you need a lot more than just that... Yes, actually you need to suppress gold, silver and bitcoin, manipulate the stock markets, interest rates, FOREX and wage wars against those that want to doubt fiat money  |

|

|

|

Bitcoin is backed by the same thing that backs gold: A group of people willing to buy it at various price points and another group willing to sell it. Also known as supply and demand.

Plus mining expenses / energy expenses. (fiat currency has near zero "mining" expenses) |

|

|

|

Gold is a deprecating asset in an increasingly electronic and worldwide world. Gold doesn't make much sense in a reality where everything important is done through internet communications. Bitcoin is the natural upgrade.

It depends on whether you trust the (centralized) "electronic" world, where all your "assets" are in 1's and 0's, waiting to be confiscated with a click of a button. Bitcoin is a decentralized alternative, but it's more like in experimental stages at this point of time. |

|

|

|

bitcoin and gold is just the same. highly volatile. a lot of pump and dump no matter how much we try to deny this.

FOREX (fiat currencies) also has too much pump & dumping for tens of countries that do not have strong currencies like USD, EUR, GBP, etc... |

|

|

|

i now mining dash with gpu, and i want to know if old x11 miner can be used to mine dash ?

edit : is x11 asic miner exist ?

Of course...I'm also mining. I think x11 asic miner is still no present. But maybe I'm wrong. A fair point to bring up occasionally but.. the question is rather, is it economically viable to design and build an asic machine for X11? I designed some very tiny micro controllers and FPGA's in University for projects and we built a fast chip that could multiple two 4 bit numbers together. You might think that its easy and can be done in 5 minutes, but it took days of involved boolean algebra, testing, errors, checking the faulty logic for latency overlap problems etc. Basically you can make any (speedy) function only from Nand gates and flip flops but you will need very many of them and they are time consuming to setup. So how long do you think it would take to design a logic circuit to do 11 hashing algorithms from scratch ?! The Sha256 maths on paper takes 16 minutes, and this is way more complicated. https://youtu.be/y3dqhixzGVoThe months of development is not the killer issue though, This is going to require a lot of logic in series and some of the hash functions will be quicker than others so you will have most of the circuit not doing anything for most of the time hence it will be costly to have relatively unused circuitry(more than common GPU's most likely) You could optimize it of course in order to use some of the redundant circuit but this will bring in a new round of testing and errors (using the same part of an algorithm twice is risky as they may over lap-must be thoroughly tested) So months down the line and 50k-100k later (investors getting nervous) drawing closer to an official release, you find that AMD have just released a new graphics card that is twice as quick as the last and Wolf0 has optimized the .bin again (TIA), thus quadrupling the hash rate so your promised pay back time has now gone up by 4, not such a hot seller on ebay any more. And even if you get past all that, it has already been said that if there was an X11 asic machine developed, a fork could be taken immediately and now we have x12 instead and all that hard expensive work at the R&D labs for months was a complete waste of time (for this X11 coin anyway). Would any company take such a risk, with that in mind ? (feathercoin done this already) So do you take the first option, or do you go out and simply buy a few cheap Nvidia 750 ti's and wait for the next upgrades? https://dashtalk.org/threads/x11-mining-optimisation-project.2584/page-6Very interesting Sub-Ether. I've always known that an X11 asic was unlikely given the development costs and likely risk of ROI expectations being thwarted by ever faster GPUs hitting the market, but I've never seen the specifics spelt out like that. Thanks. I think it's more than likely to be developed by "parties" who have a large budget to spend on cryptographic equipment, like governments, and who don't necessarily factor the costs in the same way. At that point you have the world mining with GPUs and governments/secret agencies being able to "outrun" the general public. |

|

|

|

This could really boost adoption...   |

|

|

|

Today is May 20, 2015. The price of Bitcoin is around $233 US Dollars.

Q: What does it take for Bitcoin to go 100X? (10 000% price increase)

A: It takes 1% of the most obvious target markets.

The halving won't hurt either. |

|

|

|

I'm not a big fan of the anonymity coins. Anonymity can be achieved in bitcoin, maybe not as efficiently as with cryptonote-based coins, but probably efficiently enough. The fact that nobody knows who Satoshi is, nobody can prove what happened to mt gox coins, ect is evidence of this. Transparency should be the default and the user can use anonymity if he or she so chooses.

Nobody among common people with common resources. Governments might know who he is though. |

|

|

|

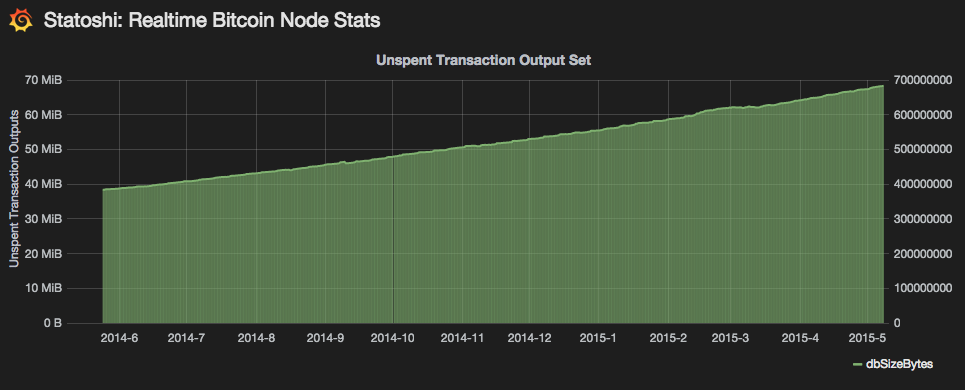

Sub-Ether's chart of the day. http://statoshi.info/#/dashboard/file/default.json?panelId=5&fullscreen&edit&from=1399556468856&to=1431092468872Moore's law is not keeping up with the memory usage as the unspent transaction memory requirement has doubled in 1 year and the cost of memory has only gone down by 20% so once again the scaling problems of bitcoin are showing themselves.  Read more from the man himself ... http://gavinandresen.ninja/utxo-uhohToday, the UTXO database is about 650MiB on disk, 4GB when decompressed into memory. DRAM costs about $10 per GB, so you need to spend about $40 on memory if you want absolute fastest access to the UTXO. Not a big deal.... 'Assuming the UTXO set continues to double and RAM prices continue to drop 20% per year, next year you’ll have to spend about $64. Ten years from now, over $4,000…'RAM compression (software solution) might be useful to alleviate the issue. In linux I've setted up z-ram and it can compress data from 2 to 3x on the fly, meaning 1gb ram can fit 2 or 3gb worth of ram data with some CPU tradeoff (time wasted to compress/decompress data, which is still much faster than swapping data out to a hard disk). |

|

|

|

Yesterday, while searching some other stuff, I bumped into zram for linux: http://en.wikipedia.org/wiki/ZramThis can be handy for Monero if some older linux boxes have limited RAM. In general purpose use I'm seeing compression ratios of 2-3x, meaning that a single gb of ram is turned into 2-3gb. It has a tradeoff with cpu power (as it requires cpu to compress/decompress the data on the fly) but the cpu will be much faster than swapping data to the hard disk. It's a no brainer. |

|

|

|

0.012 is holding so far, but the monster support is at 0.01, that one is HUGE! Of course there is no guarantees that 0.01 will hold, but the chances are high that a lot of people will be executing orders there and the market will have a reaction.

Crypto markets are way more "irrational" than normal markets due to factors that are inherent in the current ecosystem. You can have a hack in an exchange, a guy running off with a stash of money from a market or an exchange and suddenly the market floods with coins. Technical analysis, charts etc are useless in this regard as they can't predict anomalies like these. The moolah scammer was dumping hundreds of thousands of DRKs down to 0.002x. Can this be predicted? No. Bottoms are difficult to calculate because the market players are not playing rationally. Even the highs can be difficult to predict due to the same irrational reasons. Say someone steals 100.000 BTCs and floods the anon altcoin market with buy orders... You can't see these coming. Instead you must assume that the bottoms and ceilings are always greater than what you can imagine  |

|

|

|

And about MN blinding: - DS Speed Improvements : Darksend should be lightning fast now on mainnet. We're going to delay the implementation of masternode blinding because there's two separate mobile wallets that are in the process of implementing Darksend and the reference implementation needs to be super stable during this period of time. Once we have the mobile wallets done (which should have Darksend and InstantX support) we can move back to improving Darksend.

|

|

|

|

The Trolls just want to pick a fight with the front runners, so their coin gets associated with DASH...

Some times they are quite short-sighted in this regard, as it is in the interest of the anonymous coin market in general for dash to perform well. When drk/dash marketcap rises, so does the marketcap of other anon coins (the more serious ones, not the p&d shitcoins) from money flowing from the dash market to them, either as a hedge, or as investment with more booming potential due to their low marketcaps (sometimes the lower the marketcap the better in terms of speculation). Speaking of other anon alts, CRAVE seems to be pushing I2P integration in the wallet: https://bitcointalk.org/index.php?topic=997356.msg11236382#msg11236382Can we get something similar for DASH? IP obfuscation plans have been on hold (?) for too long it seems. |

|

|

|

Nobody uses Dash to actually do anything.

You can continue living in denial. The gambling site owners and precious metal shop owners have often posted -in this thread- how their volume in DRK is #2 after BTC. But then again you haven't followed this thread except for trolling purposes, so how would you know? |

|

|

|

Game theory tells us how Dash's instamine may destroy its network effect.

A guy, let's name him "John", wants to accept payments or buy stuff privately with DRKs. What John cares about is a) The currency is anonymous b) The currency has adoption / is among the most popular ones so that he can use it among people, shops etc c) The currency is easy to use d) The currency is liquid (plenty of exchange backing where he can convert to fiat, btc, precious metals etc) and has sufficient market depth to absorb larger amounts if necessary without the price getting affected too much How people got their coins is of no concern to John. If John wants to buy something privately, then: BTC/FIAT => DRK => purchase what he wants If John wants to accept payments, then: OTHER PEOPLE WITH DRKs => him => he does whatever he wants with them (keeps them/converts them to FIAT/BTC/PMs/buys stuff with them etc) So, how does that reality fit with your "game theory" assessment, in the real market? It doesn't. Because your view is so narrow that it only focuses on shitcoin speculation instead of real-world adoption (where DRK is already #2, behind BTC, in several sites that deal with PMs, gambling etc). |

|

|

|

Fact is none of these cryptos are likely to succeed long term, hell even btc is going to struggle to make any *real* impact. I'm talking 100's of billions market cap and accepted in most places (bitpay doesn't count) not a few billion.

Not fact. Just your personal assessment. Fact is factual, and the future (and what will happen there) is not yet factual. Just a couple years ago people were buying 10.000 BTC pizzas. Some probably thought that market cap in the billions is most definitely an absurd notion. History proved them wrong. |

|

|

|

|