I guess the only thing I want to reply to is point 2 about centralization. Yes, megagigaterapetablocks will likely result in fewer fully-validating, non-mining entities. It will also likely result in fewer full-stack mining entities. So what?

People keep talking about decentralization as if it is an end in itself. Why? AFAIC, as long as there are no structural barriers to entry by new participants, the network is as decentralized as it need be. If there is no discernible marginal benefit from adding one more participant to the network, then by definition further decentralization is of no benefit.

And quite frankly, all public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already.

Not to mention the fact that non-mining nodes provide zero benefit to the network anyhow. If you have sufficient economic interest to be a first-class tx creator, then fine. Pony up for a validating client. But don't delude yourself that your participation brings any benefit to anyone but yourself.

By having megagigaterapetablocks you are giving full control of blockchain audit to the "operators". I guess the only way some people would understand why centralization is bad is when forces collude to censor certain transactions, such as donating to Wikileaks or anything else that wouldn't comply with what they consider a morally correct transaction. All public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already. A blockchain is not public if it cannot be audited, and that is the dead end of BSV if it ever go to be used at scale. Just because you can see the transactions on some website, it doesn't mean anything in terms of how valid the data being shown is and thus it's private. Anyone who cares to invest the requisite time, talent, and treasure is free to audit the blockchain. In SV as it is in BTC. Auditing means running a full node, validating the entire blockchain and confirming that everything checks in within the rest of the network, something you can't do on centralized, running-at-scale-on-chain approaches like SV or any other altcoin for that matter, since the entry point to do so is basically be an NSA datacenter. |

|

|

|

Now that we've crossed the $9,000 barrier, why not take a look at the McAfee model again:  Assuming another %600-ish parabolic increase, it would put us around $65,000, which would mean McAfee may not have to heat his own dick as the model would be back on track. Consider that we went above %245 of the mean prediction line at the $20k peak, so there's a big margin of error. If moon and stars align (or ETF and halving) who knows. We'll have to find out in the next episode of McAfee Balls Z. Edit: Actually funny how we just broke the nonlinear regression curve and given past precedents, the potential for a bullrun is around $60k  Maybe McAfee can keep his manhood after all. Hang on tight. |

|

|

|

I guess the only thing I want to reply to is point 2 about centralization. Yes, megagigaterapetablocks will likely result in fewer fully-validating, non-mining entities. It will also likely result in fewer full-stack mining entities. So what?

People keep talking about decentralization as if it is an end in itself. Why? AFAIC, as long as there are no structural barriers to entry by new participants, the network is as decentralized as it need be. If there is no discernible marginal benefit from adding one more participant to the network, then by definition further decentralization is of no benefit.

And quite frankly, all public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already.

Not to mention the fact that non-mining nodes provide zero benefit to the network anyhow. If you have sufficient economic interest to be a first-class tx creator, then fine. Pony up for a validating client. But don't delude yourself that your participation brings any benefit to anyone but yourself.

By having megagigaterapetablocks you are giving full control of blockchain audit to the "operators". I guess the only way some people would understand why centralization is bad is when forces collude to censor certain transactions, such as donating to Wikileaks or anything else that wouldn't comply with what they consider a morally correct transaction. All public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already. A blockchain is not public if it cannot be audited, and that is the dead end of BSV if it ever go to be used at scale. Just because you can see the transactions on some website, it doesn't mean anything in terms of how valid the data being shown is and thus it's private. There's no incentive for miners to screw up Bitcoin as they have the most skin in the game along with the mega-whales. |

|

|

|

The one thing around which the majority agrees is that BTC ETF will cause significant price increase, and some very often referred to gold as an example. But for me personally this is not a good example, gold is something completely different, and the only thing gold and BTC have in common is that they can both be store of value. However recently I read what theymos is write about ETF, and I realized that few people actually wonder what will be a long lasting consequence of ETF. But perhaps it's best to read what our admin thinks about all this and some other important things. Andreas Antonopolous: ETF's are NOT good for bitcoin as the centralized custodian can decide what to do with the bitcoin they're holding. Agreed, an ETF will almost certainly turn into a disaster at some point. The coins will be stolen, forks will be handled controversially, there will be issues with fungibility (eg. someone will "trace stolen coins" to the ETF's stash), the world will freak out when a bunch of retirees lose their life savings after doing the equivalent of buying BTC at $20k, etc. etc. It'll also get the sort of people who love regulation more into BTC, which is never good. But investors want it, so it'll probably happen eventually. In particular, I totally condemn trying to get regulators to interfere in the free market more than they already do by blocking any ETF. (When the SEC was last looking into this, I had actually written a long document that I was going to send to them in order to comment on many technical issues with their proposed Bitcoin ETF regulation, but I decided not to send it because I don't want to have even the slightest hand in regulations.) An ETF probably will increase the price a lot (until the ETF suffers its near-inevitable catastrophe), which has some pros and cons. Note that an ETF can't affect Bitcoin itself, just the ETF investors and the market. There is no voting of any sort in Bitcoin, so it's not as if holding a lot of BTC gives you any power over Bitcoin, for example. I do agree with Andreas that the creation of a "corpo-Bitcoin" seems probable, perhaps after the ETF loses a ton of BTC and wants to undo it. Thanks to bitmover who post this and some other good post from theymos reddit account : https://bitcointalk.org/index.php?topic=5153962.0There's nothing new that we haven't seen before in previous Goxings, in relation to what theymos said. Noobs gonna noob, they will lose coins. What can one do? There's just going to be more coins in the prize pot, a bigger ETF sized booty. The price will go up extremely high and a correction will eventually happen when ETFgox happens, and then so the new cycle towards a new ATH begins because ETF doesn't raise the total supply. BTFD. |

|

|

|

Time to attack $9k again?  soon TMbut need to wait, though when we do $10k is not so far behind as 8 was from 7 and closer than 9 will be to 8.  The japanese vegeta, as well as other international vegetas, are already celebrating: https://www.youtube.com/watch?v=SQYakKz3i6E |

|

|

|

If the chinese colluded to do such a change, they would end up with an useless token and those smart would see the opportunity to mine Bitcoin at a discount while the scammers burn money on their pretend Bitcoin, before the difficulty picks up traction again.

No, that is not how the world works such as how people like Bitcoin core erroneously state that only "nodes" or "users" matter and not miners. Miners determine the fate of Bitcoin because without miners you have no chain security. Yes, you can choose to boycott the majority fork...and then be attacked by them. Then you get to open the can of worms of being forced to change algo. Regardless, since Bitcoin has no Nash equilibrium, no Schelling point, and mining and transaction validators are all designed to centralize, it's nothing more than a corrupt political power vacuum like you would see in a senate. Miners need transactions to happen in order to stay solvent, and nobody would use inflationcoin. Also, literally all whales (except miners that are part of the attack, assuming they don't back-peddle) would dump their share on the attackers chain, collapsing the price, thus collapsing the hashrate, and forcing miners to come back to the original chain or go out of business. Nobody said anything about inflation. You erroneously claimed "21 million coins" constitutes a Schelling point for Bitcoin. You're making shit up on the fly. You can have infinite different forks all with a 21 million coin count. There is no Schelling point in shitcoins. Stop constantly lying. It's also 100% guaranteed for Bitcoin to be co-opted by the state since transaction validators are designed to centralize, not that the state wasn't involved in it's creation in the first place. Increasing the supply of X does definitely not increase the supply of Y. The schelling point in altcoins vs Bitcoin is to stay in Bitcoin since it's the safest, most time-tested one, remaining altcoins will just be like penny stocks which you get to sell to increase Bitcoin stack (that's all that they are now basically). This thread is a complete joke now. In the earlier days of Bitcoin, just about everyone in it was pro-metals. The only people who are anti-metals are these little fly by night, shithead millenial scammers like Micgoossens and this pereira4 guy. The only reason they're anti-metals is because they know metals have far better fundamentals and it's an extreme danger to their imaginary, valueless, digital token Ponzi scheme.

Im not anti metals. Being anti metals is just as dumb as being anti Bitcoin. There are reasons to own both. |

|

|

|

If the chinese colluded to do such a change, they would end up with an useless token and those smart would see the opportunity to mine Bitcoin at a discount while the scammers burn money on their pretend Bitcoin, before the difficulty picks up traction again.

No, that is not how the world works such as how people like Bitcoin core erroneously state that only "nodes" or "users" matter and not miners. Miners determine the fate of Bitcoin because without miners you have no chain security. Yes, you can choose to boycott the majority fork...and then be attacked by them. Then you get to open the can of worms of being forced to change algo. Regardless, since Bitcoin has no Nash equilibrium, no Schelling point, and mining and transaction validators are all designed to centralize, it's nothing more than a corrupt political power vacuum like you would see in a senate. Miners need transactions to happen in order to stay solvent, and nobody would use inflationcoin. Also, literally all whales (except miners that are part of the attack, assuming they don't back-peddle) would dump their share on the attackers chain, collapsing the price, thus collapsing the hashrate, and forcing miners to come back to the original chain or go out of business. |

|

|

|

You definitely cannot create the accumulated Proof Of Work of Bitcoin within your basement, nobody can, which is why Bitcoin has value.

Fine example of the dipshit scammer slogans you see plastered over Reddit all day. The kind of bumper sticker slogan lies Andreas Antonopolous pushes. Proof of work DOES NOT CREATE value. It's sunk cost fallacy. Jesus Christ, reading this continuous stream of mindless shit from you is too much. This accumulated sunk cost fallacy also has ZERO bearing on future security. It preserves value. You are getting annoying. It's not like you don't know how it works. Sunk cost fallacy does not "preserve" value. Sunk cost fallacy by definition has NO BEARING on future value. For example, if the Chicom miners band together and collude with their 70% hash power or whatever they have (I know it's at least 60% but probably higher), if you're on the minority fork with 30% or less, how has the current or past hash power "preserved" your value? It hasn't. You're now on a minority fork that might wither away and die off. Yea, you still have your Jihan Wu tokens on the majority fork, but maybe the tokens on that fork don't even have anything to do with the Bitcoin of yesterday at all and are instead Chinese social credit score tokens with built-in chain anchor. Where is this so called "immutable" bullshit ledger again? It doesn't exist. Your chain can just be nullified by becoming an unsupported minority fork that dies. There is no Nash equilibrium in bitcoin. Arguably, no change would ever take place in the software if there was since there's no such thing as inherently 'good' code that can't have some hidden repurposed motives to it. The schelling point is in the fact that nobody is going to support an increase on 21 million coin supply for instance, things that matter. If the chinese colluded to do such a change, they would end up with an useless token and those smart would see the opportunity to mine Bitcoin at a discount while the scammers burn money on their pretend Bitcoin, before the difficulty picks up traction again. |

|

|

|

You're not even capable of DESCRIBING how your mining in space scheme is supposed to work, let alone place a dollar value on the astronomical cost of production. Are you claiming you're going to process the metals IN SPACE? I hope you have a nuclear reactor in orbit and a space station 10x bigger than the one that's currently there. Or do you claim you're going to send out probes and deflect asteroids into earth collision courses where one tiny screwup might result in a planet destroying, dinosaur extinction catastrophe? You millenial children scammers get the fuck outta here.

Still failing to explain why you are allowed to use far fetched scenarios to pump your metals, but whenever someone uses the mining in space argument (self admittedly far fetched, but definitely more realistic than such as you owning the entire silver supply) suddenly you demand all the explanations in the world when it's you who started with making such bizarre scenarios. Im just exposing the metalhead anti Bitcoin routine and you seem too thick to even realize the fact. |

|

|

|

How would you deal with the fact that it's only a matter of time we are able to mine gold in aesteroids/other planets and the supply will end up becoming huge with so much gold that it will become worthless?

Way to go making it ridiculously obvious that you're a lying scammer by continuously bringing up this stupid space mining meme. The cost of production for anything in space is astronomical and that is never going to change. It's also FAR LESS viable to mine silver in space than gold due to needing to process and transport far more materials. If this lie is the best thing you have to try and trick people into using digital, government tracking and slavery system tokens instead of metals, then your cause is as good as dead. Seriously, you need to be an absolute fucking dumbass to even bring up this topic. You may as well be a flat earther posting this shit. The price of metals would also have to go to the moon BEFOREHAND for anyone to even attempt it. You can tell you're full of shit because you brought ZERO actual numbers to the table. What's the cost of production for mining gold or silver in space? A million dollars an ounce? Oh, that's right, you have no number because you're full of shit. So you are allowed to make your hypothetical absurd scenarios including: "if I owned the entire silver supply..." or the classic "if the electricity went down...", but im not allowed to paint a picture of space mining to make a point. Is this how it works for metalheads? No, you are not allowed to lie and pretend that you live in the movie Star Trek and that mining shit in space wouldn't have a cost of production of a million dollars an ounce. So why are you allowed to make far fetched scenarios such as you having the entire silver supply under your control, or waiting for a mad max scenario in which there is no electricity, in order for you to pump your metals again? |

|

|

|

How would you deal with the fact that it's only a matter of time we are able to mine gold in aesteroids/other planets and the supply will end up becoming huge with so much gold that it will become worthless?

Way to go making it ridiculously obvious that you're a lying scammer by continuously bringing up this stupid space mining meme. The cost of production for anything in space is astronomical and that is never going to change. It's also FAR LESS viable to mine silver in space than gold due to needing to process and transport far more materials. If this lie is the best thing you have to try and trick people into using digital, government tracking and slavery system tokens instead of metals, then your cause is as good as dead. Seriously, you need to be an absolute fucking dumbass to even bring up this topic. You may as well be a flat earther posting this shit. The price of metals would also have to go to the moon BEFOREHAND for anyone to even attempt it. You can tell you're full of shit because you brought ZERO actual numbers to the table. What's the cost of production for mining gold or silver in space? A million dollars an ounce? Oh, that's right, you have no number because you're full of shit. So you are allowed to make your hypothetical absurd scenarios including: "if I owned the entire silver supply..." or the classic "if the electricity went down...", but im not allowed to paint a picture of space mining to make a point. Is this how it works for metalheads? You definitely cannot create the accumulated Proof Of Work of Bitcoin within your basement, nobody can, which is why Bitcoin has value.

Fine example of the dipshit scammer slogans you see plastered over Reddit all day. The kind of bumper sticker slogan lies Andreas Antonopolous pushes. Proof of work DOES NOT CREATE value. It's sunk cost fallacy. Jesus Christ, reading this continuous stream of mindless shit from you is too much. This accumulated sunk cost fallacy also has ZERO bearing on future security. Value is created as you would need to spend increasingly more money to modify existing transactions, and in general accumulated PoW is the scorecount count going up for certainty, the #1 indicator for an investor to put money into something long term. Keep waiting for the death of Bitcoin, anytime now. |

|

|

|

See zack_bitcoin commentary on potential downsides (keywords: retirement attacks): https://twitter.com/zack_bitcoin/status/1135934900605980672This is the same capability as lighting + probabilistic payments. Except it has a lower level of security and is vulnerable to retirement attacks. In any case competing layer 2 protocols are always good, the only problem I see is when they may require controversial updates like segwit. |

|

|

|

as for security. PoW has a great security where it becomes more difficult to hash/solve a block the more popular the block creation gets. some other algos dont change their security level if higher thresholds are met. which leaves those coins weak

Not only PoW is the most secure and the only way in which "a coin" can run in a way that isn't just unadulterated insanity, but it has to be spawned without no expectatives. As in, it has to be spawned when cryptocurrencies weren't a thing, by someone anonymous, and it has to have the longest PoW of any competitors. In other words, all altcoins are by default inferior by definition, and the conditions for "another Bitcoin" cannot be replicated. |

|

|

|

Stock to flow models simply don't work for LTC. PlanB has some evidence on this fact:

"Stock to flow" doesn't work on ANYTHING that's not a real commodity or resource. You can hoard all 21 million Bitcoins and the rest of the world can completely ignore you like you don't exist because NOBODY actually needs Bitcoins for anything. It's a fake, imaginary commodity aka a Keynesian scam. If I hoard all the physical silver in the world, people actually need it for things, the stock to flow metrics actually do function, and I get to charge whatever the market will bear. A real commodity money grants you power, a fake commodity grants you zero. In the absurd scenario in which a guy called r0ach were to hoard the entire silver supply, people would simply search for silver alternatives for whatever industrial usages, and said alternatives would be more affordable when a single guy is hoarding the entire supply of silver. There's nothing that unique about metals, there's always alternatives. Also notice how metalheads always have to stretch their arguments to the point of maximum absurdity to make a point of how they defeat Bitcoin, in such scenarios which will never happen (r0ach owning all of the metal supply, madmax scenario in which there is no electricity left in the world, and so on) Looks like he's trying to help reduce the drama that has been the pissing match of the trust system

You mean how Lauda & Last of the V8s started abusing the trust system that's supposed to be for things like trades and instead made up random nonsense and left negative scores on people who they disagree with but have never actually traded with? I especially loved the negative trust score for Jbreher for simply owning Bcash HAHA. What a fucking effeminate, jackass female move that is. Digital shitcoins are not money, or commodities, or resources. They're simply Keynesian scams based on artificial scarcity with no valid Schelling point. You cannot force people to buy the scam token you created out of thin air instead of them just doing the same thing and creating another one out of thin air that benefits themselves instead. But nobody can create a new silver or gold in their basement like you can with shitcoins, which is why metals are money and shitcoins aren't. You definitely cannot create the accumulated Proof Of Work of Bitcoin within your basement, nobody can, which is why Bitcoin has value. |

|

|

|

The world needs good money. It NEEDS it. Fiat is not it. Fiat is awful in every way. Gold and silver are pretty good in some situations but just plain worthless when it comes to digital commerce...

..So what if we could solve that problem with a collective delusion. A collective delusion not dissimilar to what gives fiat money value. What if we could all just agree that bitcoin is special because we need it to be special.

It's not a negative that physical metals as money are NOT CONDUCIVE to globalization, it's A FEATURE - a positive one. Globalization creates overspecialization and lack of local redundancy, which then results in complete system collapse with the side effect of 90% of civilization having no reason to exist. See Joseph Tantor et al. Oh, you want to be able to buy everything on the planet from Amazon while every other store on earth goes out of business? Too bad. Local economies have to exist with redundant systems to the next state or country over. If you're not doing things redundantly to the country next to you, you're not a country in the first place and are just a defacto, global, feudalist govt cog. No, we do not need a "collective delusion". Delusion is just a synonym for scam. The further you abstract from barter, the bigger a scam you have. The closest thing to barter without actually using barter is trading non-perishable physical commodities or resources. Anything that's not a resource or commodity is just an artificial scarcity Keynesian scam. Yes, digital shitcoin scammers are Keynesians while pretending not to be. Whether you believe the universe was created by some sort of God or it created itself, the only way you're getting out of Keynesian scams is by using the tools the universe gave you for economics instead of pretending to play God yourself. I have zero interest in participating in some moron's attempt to play God when the universe itself has created far superior systems. How would you deal with the fact that it's only a matter of time we are able to mine gold in aesteroids/other planets and the supply will end up becoming huge with so much gold that it will become worthless? God could have placed massive amounts of gold somewhere and we'll end up finding it. With Bitcoin you don't have to worry about such things. Sorry but you cannot go back in time. Global value settlement is where it's at and Bitcoin defeats gold in every department. If you want to keep things within your local Amish community then good luck with your financial goals in 2020. I have zero interest in participating in some moron's attempt to play God when the universe itself has created far superior systems.

Which one are you going to prefer for traveling? 1. Donkey ride (so natural and a ride created by the universe itself) 2. Lamborghini ride (which is some moron's attempt)  1) Metals are superior to imaginary, valueless, digital shitcoins as a settlement system. 2) A donkey is not a superior form of transportation. 3) A Lamborghini is not an artificial, Keynesian construct; it's made of metal, so part of the natural world and not even a valid comparison. Keynesian systems are entirely arbitrary and based on magic numbers. A shitcoin can be made of 21 or 21 million units. A lambo cannot have 21 million wheels or be made out of bread. Bitcoin is not some sort of voodoo magic, it's still physical, atoms are there moving. Proof of Work needed to generate certain combinations of atoms, which cannot be generated out of thin air as you need said PoW. Metalheads have a hard time grasping this. |

|

|

|

Speaking of mystery blobs; I assume everyone in here is aware of the fact that every computer after 2006 for Intel and 2013 for AMD contains proprietary binary blobs which are basically "features" in which your favorite triple letter friends steal all of your coins on your sleep. Just a reminder.

Which setup are you running again? Yeah, we have been warning about this since the late 90's so no big surprise. The funny thing is back then they called us tin foil crackpots and now that there is proof its all "we knew all along and its just fine". They want you to run open source software which has been approved by "them". Imagine.

Are they trying to make it illegal to run FOSS? Thats pretty much impossible and why would that have to do with perverts? Tie in with the Andy Kaufman post maybe? Idunno that one went over my head.  They are perverting the concept of FOSS by running a police over what is and isn't acceptable code. What's not to get? |

|

|

|

|

Fundamental value investing is all that matters and were people get rich. Get in on something you consider to be undervalued after research, and have patience, lots of it.

Never saw anyone getting rich off a bunch of continuous trades in a row. Those people usually lie and sell their premium trading courses and other online content which is where they make the actual money.

|

|

|

|

There is no real competition between banks. There is a monopoly. If there was a real competition going on and users choosing whatever fits their needs best it wouldn't be such a clusterfuck. Hal Finney talked about this back in the day with his "bitcoin banks" idea: Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases.

Bitcoin backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.

George Selgin has worked out the theory of competitive free banking in detail, and he argues that such a system would be stable, inflation resistant and self-regulating.

I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers. Bitcoin transactions by private individuals will be as rare as... well, as Bitcoin based purchases are today.

|

|

|

|

Moon news: https://www.nationalgeographic.com/science/2019/06/massive-blob-discovered-moon-surface/Huge mystery blob found under the moon's far side

Researchers have discovered something massive lurking underneath the far side of the moon: a mysterious blob with the mass akin to a pile of metal five times the size of the Big Island of Hawaii.

The structure, described in a recent study published in Geophysical Research Letters, sits at least 180 miles beneath the South Pole-Aitken basin—a colossal crater punched into the lunar landscape billions of years ago, when the moon's initially molten surface had cooled just enough for impacts to leave a lasting mark.

The blob is likely related to the crater's formation, and it may be the remnants of an ancient impactor's metal core, says study coauthor Peter James of Baylor University. Aliens left a gift for us to celebrate discovering spaceflight! Speaking of mystery blobs; I assume everyone in here is aware of the fact that every computer after 2006 for Intel and 2013 for AMD contains proprietary binary blobs which are basically "features" in which your favorite triple letter friends steal all of your coins on your sleep. Just a reminder. Which setup are you running again? In other vacuous perverts news, the British Government. The government would welcome views on whether the publication of open-source software should be subject to CDD [Customer Due Diligence] requirements. If so, under which circumstances should these activities be subject to these requirements? If so, in what circumstances should the legislation deem software users be deemed a customer, or to be entering into a business relationship, with the publisher? Your going to have to explain this one? They want you to run open source software which has been approved by "them". Imagine. |

|

|

|

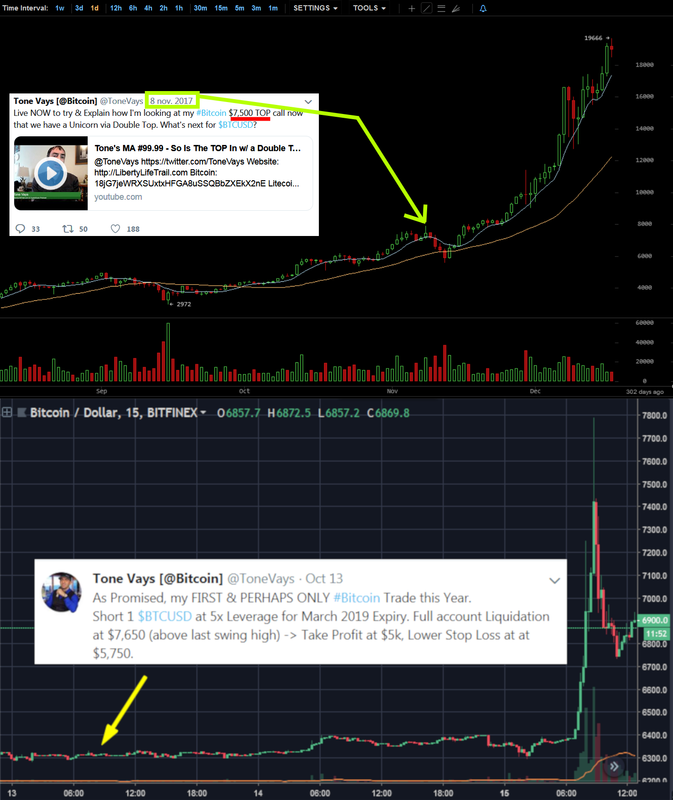

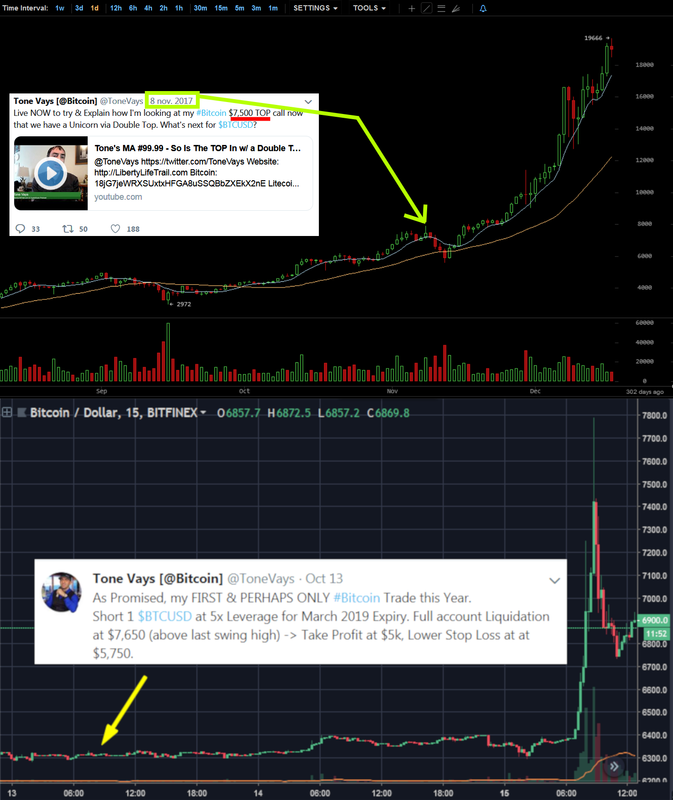

All the technical analysts that were expecting sub $3000 prices by now are increasingly nervous. Every new Tone Vays upload is him trying to push the price down so his prediction comes true. He predicted $7500 as the highest point for 2017, so he would screw up again this time being overly pessimistic. Tyler Jenks was expecting a sub $1000 bottom.  Being a technical analyst for a living must suck, specially in Bitcoin. I don't know how those guys take the risk of making public predictions and charging for classes when it's obvious Bitcoin is going to do whatever the fuck it wants to do. |

|

|

|

|