If yes, then I would still be paranoid of seed bruteforcing. There's something about Electrum that wouldn't allow me to sleep at night with any relevant amount of money in there.

The seed is just another way of representing a random 128-bit number. You'll have about as much luck bruteforcing that as a private key. You think he really sodl all his Bitcoins for Bcash? I hope he didn't and he is just living a wealthy life somewhere.

Keyword: a key. It would only take getting lucky once to get all of your money. With a wallet.dat you would need to go address by address. Who knows what those fuckers have in store when it comes to quantum computers within a couple of decades. Plus any mistakes on your part leading to key derivation exploits... yeah no thanks. Electrum seems like a bad idea for serious cold storaging. |

|

|

|

Ok, shit is getting serious. And I have to prepare for the next real run. Want to cash out 50% @$50k. My Bitcoins are on a paper wallet. And I yet did not redeemed my Bcash and other forks. I need advice what wallet is recommended these days for Bitcoin, Bcash, BSV, BGold and all the other forks I get after redeem my Bitcoins.

You do realise that you ABSOLUTELY MUST move your bitcoinís to another wallet before you claim the forks, right? Iím sure you do but please do not try & claim BCH when your bitcoinís are still in said address. Regarding claiming - BCH - Electrum Cash BTG - I think I used Coinimi Edit - Just import your private keys into the above wallets, simple. BSV, I didnít have any as I spent all my BCH. There are a load of other shit forks you can claim on Coinimi too. Import your priv keys into electrum and always move your coins to a different private key before you claim anything.

I believe bcash has its own electrum version. You can try it.

No idea about BSV and bGold. Did bgold long time ago.

+1 Merit to mindrust & LFC for trustworthy, good advice to Underdog. Somebody help me out, I have 0 sendables. Thanks! But you sure its a good idea to leave this stuff on your laptop? I use a Macbook Pro. What if it gets broken, got stolen or something else? I thought you guys would recommend me Ledger or so. You can always extract your private keys from electrum, write them down (paper wallet style), delete your wallet files/format your PC. I use electrum just like this. No HW wallet here. For cold storaging big amounts there's something terribly wrong about putting your money in a seed which can spawn your current and all future ever bitcoin addresses. Key derivation is a thing. Good ol wallet.dat dodges that, however you have the annoyance of having to store it, losing it, forgetting passwords... but that is a thing everywhere else. IMO Electrum is just for temporal stuff, not perma cold storage. You can generate your Keys from Bitcoin Core wallet. You can't get more secure than this if you are not OK with electrum's key generating algo. You don't even have to sync it. (or be Online) Use exportprivkey command and again store it. Same logic applies. IMO you can't get anything safer than a onffline generated Priv key by Bitcoin Core software. From that point It is all about how you store that piece of paper. Shouldn't be that hard. Im not familiar with Electrum, I just remember reading something about key derivation. So if you export a private key generated within a full bitcoin client (let's say Core) and you import it within Electrum, and you use the Electrum seed to spawn your wallet, this imported private key from the wallet.dat will not show up? If yes, then I would still be paranoid of seed bruteforcing. There's something about Electrum that wouldn't allow me to sleep at night with any relevant amount of money in there. |

|

|

|

Ok, shit is getting serious. And I have to prepare for the next real run. Want to cash out 50% @$50k. My Bitcoins are on a paper wallet. And I yet did not redeemed my Bcash and other forks. I need advice what wallet is recommended these days for Bitcoin, Bcash, BSV, BGold and all the other forks I get after redeem my Bitcoins.

You do realise that you ABSOLUTELY MUST move your bitcoinís to another wallet before you claim the forks, right? Iím sure you do but please do not try & claim BCH when your bitcoinís are still in said address. Regarding claiming - BCH - Electrum Cash BTG - I think I used Coinimi Edit - Just import your private keys into the above wallets, simple. BSV, I didnít have any as I spent all my BCH. There are a load of other shit forks you can claim on Coinimi too. Import your priv keys into electrum and always move your coins to a different private key before you claim anything.

I believe bcash has its own electrum version. You can try it.

No idea about BSV and bGold. Did bgold long time ago.

+1 Merit to mindrust & LFC for trustworthy, good advice to Underdog. Somebody help me out, I have 0 sendables. Thanks! But you sure its a good idea to leave this stuff on your laptop? I use a Macbook Pro. What if it gets broken, got stolen or something else? I thought you guys would recommend me Ledger or so. You can always extract your private keys from electrum, write them down (paper wallet style), delete your wallet files/format your PC. I use electrum just like this. No HW wallet here. For cold storaging big amounts there's something terribly wrong about putting your money in a seed which can spawn your current and all future ever bitcoin addresses. Key derivation is a thing. Good ol wallet.dat dodges that, however you have the annoyance of having to store it, losing it, forgetting passwords... but that is a thing everywhere else. IMO Electrum is just for temporal stuff, not perma cold storage. Weekly close looks very ugly and points to a trend reversal.

We might revisit 6k range in the coming weeks/months.

We might and we might not, lol. Im more on the bearish side right now. 65% going to 6k vs 35% going to 9k. Im looking for a short entry here. Could be. Your odds seem in the ballpark of reasonable, even though I continue towards 50/50 thinking because I hate to make any bets in the way that I approach my BTC holdings (which I prefer to assure that I am adding to my reserves, rather than gambling that I may or may not add to my reserves). Anyhow, I merely buy if the BTC price goes down and sell if the price goes up. Seems safe, no? In this case, I have already sold all the way up to $9k, so in recent times I have been put into buying mode, so my buy orders have been executing as the BTC price has been going down. Seems to work a lot better than trying to guess, and even if I were to have more confidence - such as something above 60%, which you seem to have, and even if you are guessing in a kind of reasonable way, to me, it seems as if you are betting too... because one thing is to close a long by selling a little bit of BTC, but another extra risk is to add leverage onto the situation by entering into a short position (which is what you said that you are doing)... too scary for me, and too much gambling for my risk tolerance temperament in terms of my preference to preserve what BTCs I have worked so hard to accumulate over the past 5.5 years. That slow buying is easy, however slow selling is more problematic, especially since some coins you bought 5.5 years ago, although it depends on whether you use FIFO or LIFO accounting (the latter is simpler, but maybe less common). FIFO would guarantee at least long term cap gains status, which is much lower in US vs short term gains that are taxed by your tax bracket. In addition, in a case of an old coin sell, properly splitting off at least 3, maybe 4 meaningful forks is also an annoying task. I can't imagine how much of an exercise in insanity it must be trying to explain some normie boomer accountant/gov officer how you had this thing called bitcoin, which some fucktard decided to explit in something bitcoin cash of which you received an 1:1 amount, which some fucktard decided to split in something called bitcoin satoshivision which you received an 1:1 amount... and so on for all other forks. The nightmare of taxes is a great motivator in basically never selling a single sat. |

|

|

|

So I'm thinking this libra nonsense will get heavily regulated, the states would be insane not to. And that will then be used as an excuse to regulate crypto in general, and bitcoin especially. It might be a good time to get around to moving elsewhere for those planning to do so.

Zuckerberg is not going to compete against the Federal Reserve.. only collaborate with the NSA. There isn't going to be competition against it all of a sudden. Only Bitcoin can survive in the wild doing it's own thing. A private centralized company like Facebook cannot ever issue their own money, they will use whatever US government allows. This is another digital USD "stablecoin" thing. Nobody cares. It is either neutral or bullish for Bitcoin as it once again gives it free publicity and makes its case even more obvious for the idiots that still don't get it. Just wait for their Libra wallets to shrink every time they make the wrong political opinion on social media. If Zuckerberg doesn't want to cooperate with the US, they will get shut down or they will try to move to other jurisdiction and release Libra ZV (Zuckerberg Vision) or whatever the fuck. |

|

|

|

We should have gone to 60-80K last time.

Futures killed the run prematurely.

Maybe, to 'compensate', we will go 600-800X this time instead of even lower multiple (32X).

Autism overload. It's not possible for the price of Bitcoin to go to the moon and not have mining massively expand to match. Nobody would ever buy an $80k Bitcoin if they can just mine one for $3k cost of production. But it's not really possible for mining to increase by something like an order of magnitude or it would probably use more power than the entire United States. In other words, the Bitcoin pump and dump scam is now butting up against the limits of the natural world for how high it can be artificially rigged with Tethers. The price of Bitcoin will go as high as the next speculator wants to pay for it; hashrate will follow. Zerohedge demographics, at least on the comment section, is middle aged to 60+ year olds... those with descendancy will eventually leave their gold to their kids, kids which will eventually diversify into Bitcoin.

You can lie to yourself and everyone else all you want, it won't help. Bitcoin has zero fundamentals due to transaction validators being designed to centralize, so it's a non-fungible, permissioned ledger, govt tracking system that abolishes the 5th amendment. Then the Lightning Network is another scam recreation of the already existing banking system, but even while being a scam to bait and switch everyone into the same banking system as before where every single transaction is routed through a bank, inherits the base layer scaling problems and doesn't even scale enough to onboard people dumb enough to sign up for it. There is nothing whatsoever 'inevitable' about the entire planet tripping over their own feet to sign up for such garbage. Even if it had good fundamentals - it doesn't - the world could still completely ignore or boycott it anyway. You're just another garbage millenial who was spamming bullshit like "HURR ETHEREUM WORLD COMPUTER" a few months ago until the bottom fell out of that scam and now you've moved to a new scam. In the end, the only thing that actually matters is fundamentals, and metals have them all while imaginary, valueless, centralized, permissioned ledger shitcoins have zero. I have been calling Ethereum a scam for years. As far as Bitcoin mining centralization, contrary to popular belief, we are going towards decentralization. Every day Bitcoin survives with 0 censored transactions is another day you are wrong, thus poorer. Imagine being deluded enough to trust gold accumulation charts given out by governments as truth. Meanwhile you can objectively know how much a Bitcoin address holds. |

|

|

|

|

The ultimate irony is that Libra is facing all the problems of a decentralized currency (having basically all governments as potential enemies) with none of the benefits (being unconfiscable, having no CEO accountable..etc). They are claiming to be decentralized (which they are not) and now the US government is already saying they must halt all development on the thing since a private company cannot create their own currency. I think this a peak moment in the absolute clown clusterfuck that the altcoin space is.

|

|

|

|

Just like 21 million coin limit is also an arbitrary limit of human imposition. The idea behind it being a simulation of gold's supply is irrelevant, what matters for all intended purposes is that it became an immutable trait of Bitcoin due the game theory involved, just like 1 MB blocksize has become an immutable trait of Bitcoin due the game theory involved, this is called protocol solidification.

At it's inception, any values would have cut it, since satoshi was calling all the shoots. Once the creature was alive, he disappeared, and im sure he was smart enough to know (either planned or in retrospect) that those values would never change. It couldn't go any other way if the project is indeed decentralized. This is the fact only for Bitcoin, no altcoin meets the criteria, which is why all altcoins are overpriced and Bitcoin is undervalued, at any rate.

I'm don't think satoshi planned for the 1mb size to be immutable. When Garzik suggested a patch to increase block size, satoshi stated this can be phased in later. I'm not certain the segwit work around was quite what satoshi had in mind. https://bitcointalk.org/index.php?topic=1347.0What satoshi said doesn't mean what satoshi knew. He may or not have known that 1 MB blocksize would eventually become yet another value which becomes immutable due protocol maturation, what matters is the results, and the situation is clear: Reaching wide consensus to raise the blocksize at this point is basically as controversial as raising the max cap. You can find arguments on both sides, which as a result, the status quo prevails. satoshi did at least predict there would be an opposition to raising the blocksize way before the blocksize crisis happened: Piling every proof-of-work quorum system in the world into one dataset doesn't scale.

Bitcoin and BitDNS can be used separately. Users shouldn't have to download all of both to use one or the other. BitDNS users may not want to download everything the next several unrelated networks decide to pile in either.

The networks need to have separate fates. BitDNS users might be completely liberal about adding any large data features since relatively few domain registrars are needed, while Bitcoin users might get increasingly tyrannical about limiting the size of the chain so it's easy for lots of users and small devices.

He knew. And so, he disappeared when Bitcoin took a life of it's own (impossibility to reach consensus to change it). Contrary to the idiots that think Bitcoin is doomed because you cannot buy coffee on-chain, that realization was the fact that Bitcoin was a success. |

|

|

|

The Zerohedge comment section is filled with computer illiterates which probably are posting from a Volkswagen Camper

Zerohedge far more represents the mainstream than this forum, and Zerohedge was roughly 70% anti-(((digital shitcoins))) in the last poll that was held there. The synopsis of this forum is nothing more than scammers scamming scammers. Zerohedge demographics, at least on the comment section, is middle aged to 60+ year olds... those with descendancy will eventually leave their gold to their kids, kids which will eventually diversify into Bitcoin. There's no stopping to this, r0ach, you can scream and shout all day if you want, but metal (and other assets) diversification into Bitcoin is coming and is coming in waves. |

|

|

|

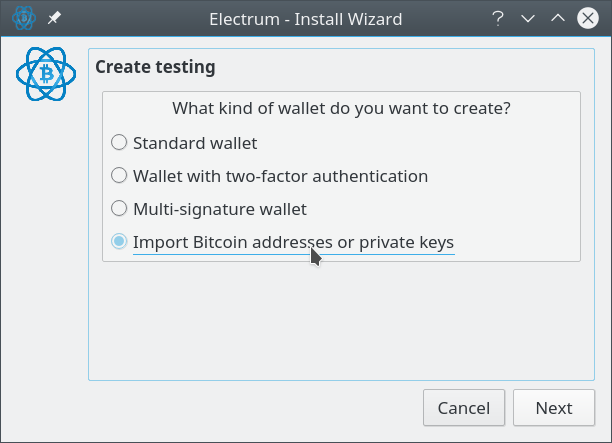

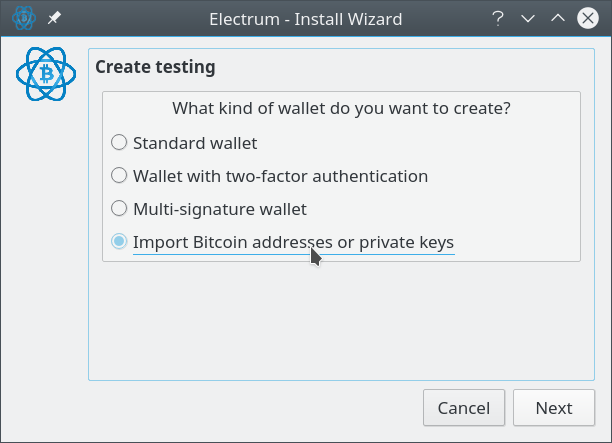

You should be able to use Litecoin Core or Electrum-LTC to import the private key Electrum-LTC also has the advantage of not requiring that you sync the entire blockchain. but how to import the private key with the prefix "3"? in "info" I have only these instructions: WIF keys are typed in Electrum, based on script type.

A few examples:

p2pkh:T4PsyoR5gC8B... -> LXqi2tzER...

p2wpkh-p2sh:T4PsyoR5gC8B... -> MUuWxSpVC...

p2wpkh:T4PsyoR5gC8B... -> ltc1q3fjf... Im more familiar with Core but the way Electrum works, it basically forces you to create a brand new wallet in order to import keys. So backup your current wallet, and simply follow the GUI... click on "Import Bitcoin addresses or private keys" and enter the addresses during the wizard:  |

|

|

|

If yes, where do I get the reference doc?

Eclair besides a nice GUI has an API with JSON-RPC features. Documentation is here: https://acinq.github.io/eclair/#introductionRun core with these settings on .conf file: server=1

rpcuser=foo

rpcpassword=bar

txindex=1

zmqpubrawblock=tcp://127.0.0.1:29000

zmqpubrawtx=tcp://127.0.0.1:29000 To install: with GUI: java -jar eclair-node-gui-<version>-<commit_id>.jar without GUI: java -jar eclair-node-<version>-<commit_id>.jar Note that the node must be segwit ready, so enable segwit addresses (some people only accept Legacy addresses) |

|

|

|

When boomers on twitter start celebrating how Bitcoin is dead

Another bullshit pereira4 post. The vast majority of Zerohedge is anti-(((digital shitcoin))). I'd estimate 70% against, 30% for. It's not "HURR only stupid boomers don't like digital shitcoin scams because they can't understand it!". The Jewish occupied western governments dumped metals on the market to try and suppress the price make believing they have god-like power over the planet and can force everyone into digital slavery coins, so they wouldn't need to keep any around as reserve. Countries like Canada have literally ZERO gold reserves. ZERO. The US claims they have 8000 tons, but from my estimates, the number is somewhere between 0 to 2000 tons max. They did rig the silver market and acquire 1/3rd the silver on the entire planet as an emergency backup plan, though. Anyway, the point is that allowing the Jewish occupied governments run by criminal bankers to foist digital currency scams on top of you IN LIEU of physical metals is just letting them off the hook when they should not be. The plan is full rejection of digital shitcoin scams and all these IMF/BIS/and other Jew scum to be executed for their crimes. The Zerohedge comment section is filled with computer illiterates which probably are posting from a Volkswagen Camper Westfalia in which they hoard their metals. They aren't qualified to talk about Bitcoin. When you get your gold confiscated on every border you try to cross you will understand the benefits of digitalness. |

|

|

|

actually 32mb was a technical based limit of networking related to packets. but 1mb is a arbitrary limit of human imposition

fee war is a wild west zero control human decided imposition that solves nothing but used to avoid real solutions.

Just like 21 million coin limit is also an arbitrary limit of human imposition. The idea behind it being a simulation of gold's supply is irrelevant, what matters for all intended purposes is that it became an immutable trait of Bitcoin due the game theory involved, just like 1 MB blocksize has become an immutable trait of Bitcoin due the game theory involved, this is called protocol solidification. At it's inception, any values would have cut it, since satoshi was calling all the shoots. Once the creature was alive, he disappeared, and im sure he was smart enough to know (either planned or in retrospect) that those values would never change. It couldn't go any other way if the project is indeed decentralized. This is the fact only for Bitcoin, no altcoin meets the criteria, which is why all altcoins are overpriced and Bitcoin is undervalued, at any rate. |

|

|

|

The Boomer Panic (tm) Indicator is my favorite one.  When boomers on twitter start celebrating how Bitcoin is dead = the bottom's in and it's time to accumulate. When they start panicking = the next bull run towards ATH begins. The question is, at what point do those guys admit that they are wrong? How many ATHs does it take specifically? Or do they perpetually stick around like our resident Peter Schiff realr0ach? |

|

|

|

You can't send physical metals from Africa to Australia in 10 minutes.

Just like you can't send a house, car, boat, or drumstick over a phone line. You can't send ANYTHING of value over a phone line. If something can be sent over a phone line, it doesn't mean it's worth something, it means it's WORTHLESS. Well, your messages on this forum are sent over the same medium as Bitcoins are sent... by this same train of thought aren't your forum posts then worthless? Now that we've crossed the $9,000 barrier, why not take a look at the McAfee model again:  Assuming another %600-ish parabolic increase, it would put us around $65,000, which would mean McAfee may not have to heat his own dick as the model would be back on track. Consider that we went above %245 of the mean prediction line at the $20k peak, so there's a big margin of error. If moon and stars align (or ETF and halving) who knows. We'll have to find out in the next episode of McAfee Balls Z. Edit: Actually funny how we just broke the nonlinear regression curve and given past precedents, the potential for a bullrun is around $60k  Maybe McAfee can keep his manhood after all. Hang on tight. In addition to this, I want to add that Shelby is lately considering McAfee's model as a potential good candidate for 2020's price prediction, and it would look like this:  I can't imagine how this thread would look like if McAfee ends up being anywhere near right. Bitcointalk would probably collapse due too much traffic. Awesome. Where can I find the source for the first pic? This very nice website: https://bircoin.top/Very handy, you can add in your own values and create your own curves. Considering the original McAfee model was $500k, we would need to be around $32k. Still a long way to go until Dec 31 2020. |

|

|

|

My parents had a 300ZX Z32 as well, awesome cars, horrible to work on under the hood however. I think their history of Z ownership (from the 240 all the way to 350) inspired my love of Jap cars too and lead to me owning an R33 GTR.

There's something about mid 90's to mid 00's Jap cars that hold a special place in my heart

I had a R32 GTR. Without a shadow of a doubt the most hateful vehicle I have ever possessed. Everything went wrong, it handled and braked like shit. The engine was incredible so some day I will place one in a Morris Minor and enjoy the sole bright spot that car had to offer. Ideally I'd like to buy back that specific car so I can slowly cut it to pieces with tin snips but I think it got scrapped which made me smirk. When I was a kid playing Gran Turismo I always remember dreaming about owning an Skyline.  Fastforward to 2019 and I wouldn't even bother. I expect it would be a PITA to maintain. How do you rate the 370 over the 350 for a proper, affordable ricer with easy to find spare parts? Much better imo. Sure it's not as "cool" as the mightly Skyline but let's be realistic. Also sorry for the purists but I can't drive on the right. What else is there? The new Supra sucks, the old ones are overpriced and you would feel like wasting an investment everytime you use it. The new GTR is awesome, but BTC would need to bottom at $100k to even bother spending that much on a car. |

|

|

|

I understand your case for gold, but why not find a middle term and own both? Both gold and Bitcoin have a point. You have become our resident Peter Schiff at this point.

Bitcoin is not a resource or commodity. It's an imaginary, valueless, designed to centralize, government tracking system token. The goal of all Keynesian scams is to give someone something of zero value while stealing their resources, goods, or labor that actually does have value. Only a moron accepts a Keynesian scam for their goods or labor. There is always going to be a need for something with the properties of Bitcoin for someone out there, just like there's always going to be a need for something with the properties of gold for someone out there. Case in point, none of them is going to 0. There are no real reasons to not own some of both unless you've become a goldbug only drone/bitcoin only drone which rejects the good use cases of both. |

|

|

|

You can always give Roach this cube  Nice red herring cube that doesn't even include the main problems at all like having zero fundamentals from transaction validators being designed to centralize, or the completely illogical scaling issues where even if Lightning Network was a valid scaling solution (it's not), most of the coin supply would probably be stranded as dust with the cost of opening a channel higher than the value of the dust. But that's an inherent terminal error of any of these high overhead, low performance, slavechain tracking system tokens. I understand your case for gold, but why not find a middle term and own both? Both gold and Bitcoin have a point. So far everyone that has been a stuck up goldbug has end up paying the price of missing on massive boats. Why not own some of both again? How high must it go for you to accept selling was a bad idea? You have become our resident Peter Schiff at this point. I don't expect any closure since we've been debating this since the release of gold 1.0 itself. |

|

|

|

In a market perspective, the consequences of such stealing of Segwit outputs would be like what happened to the ethereum blockchain. Ethereum forked after the DAO hack, rolling back and thus, having the shortest blockchain at that point. The original one (that is, the one retaining the original chain after the DAO hack) was hence called "ethereum classic". However, both investors and miners flocked to the forked chain, and it gained more hashrate, surpassing the classic chain both in value and power. It also retained its original name.

So, what would happen, in a market perspective, is that both chains would start with the same value, but the one forked by Core (technically, Core would have to rollback, to reverse the stealing of Segwit outputs, thus forking like ethereum did) would receive more value, even if dont go straight to a PoS model at first.

We need to weigh down human behaviour on this event. Investors dont have a clue about immutability in the protocol, they dont even know how the protocol works, so they would mistrust the miners, and in such a way that it would put the PoW model into question. It could even affect the altcoin market, with several coins switching to a PoS model. Notice that, right now, ethereum is going to a hybrid between PoS and PoW, and this give a clue of what would happen to bitcoin in case of this attack.

The PoS model would also attract institutional money. Banks gained power through stacking in the debt-based fiat system. They dont like bitcoin because they dont have more power than the miners over it. The miners would lose their power if they steal the Segwit outputs, and ultimately, the theft would be reversed, like it happened with ethereum. So, I believe this wont happen at all, unless the miners want to consciously end their business. If the electrical companies benefit from mining, I dont see why this should happen.

But in case it happens, it would be better to have most of your output in legacy addresses, as this would maximize the airdrop. People who only hold in Segwit adresses would not receive coins from the miners chain, as their coins would be the ones stolen on that chain.

You just have described the Schelling point case for legacy addresses as the be-all-end-all place to be when it comes to perma-hodling relevant amounts of money. Why would one not be exposed to giveaway forkcoins when you can be sitting on legacy addresses and receive them at no cost? (well, cost being, moving the coins properly to get the forkcoins which is a massive pain in the ass in itself but you would get nothing sitting on non-legacy addresses. |

|

|

|

I guess the only thing I want to reply to is point 2 about centralization. Yes, megagigaterapetablocks will likely result in fewer fully-validating, non-mining entities. It will also likely result in fewer full-stack mining entities. So what?

People keep talking about decentralization as if it is an end in itself. Why? AFAIC, as long as there are no structural barriers to entry by new participants, the network is as decentralized as it need be. If there is no discernible marginal benefit from adding one more participant to the network, then by definition further decentralization is of no benefit.

And quite frankly, all public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already.

Not to mention the fact that non-mining nodes provide zero benefit to the network anyhow. If you have sufficient economic interest to be a first-class tx creator, then fine. Pony up for a validating client. But don't delude yourself that your participation brings any benefit to anyone but yourself.

By having megagigaterapetablocks you are giving full control of blockchain audit to the "operators". I guess the only way some people would understand why centralization is bad is when forces collude to censor certain transactions, such as donating to Wikileaks or anything else that wouldn't comply with what they consider a morally correct transaction. All public blockchains -- to the extent that said blockchain is economically significant -- will centralize thusly - at least with respect to mining. How many parties make up 51% of BTC hashpower? Four. Already. A blockchain is not public if it cannot be audited, and that is the dead end of BSV if it ever go to be used at scale. Just because you can see the transactions on some website, it doesn't mean anything in terms of how valid the data being shown is and thus it's private. Anyone who cares to invest the requisite time, talent, and treasure is free to audit the blockchain. In SV as it is in BTC. Auditing means running a full node, Okaaayy.... validating the entire blockchain and confirming that everything checks in within the rest of the network, something you can't do on centralized, running-at-scale-on-chain approaches

Ok, so what's your point? like SV

Oh I see - you're deluded. Carry on. My point is that you are bagholding an altcoin (BSV) from the look of your posts, and you are not understand the game theory at play when it comes to what makes Bitcoin valuable on the first place. A Bitcoin which is ran on datacenters on both the auditing and mining part is basically fiat. At that point if there were no alternatives, you could just keep using fiat (which is already digital) and use gold as store of value. |

|

|

|

Now that we've crossed the $9,000 barrier, why not take a look at the McAfee model again:  Assuming another %600-ish parabolic increase, it would put us around $65,000, which would mean McAfee may not have to heat his own dick as the model would be back on track. Consider that we went above %245 of the mean prediction line at the $20k peak, so there's a big margin of error. If moon and stars align (or ETF and halving) who knows. We'll have to find out in the next episode of McAfee Balls Z. Edit: Actually funny how we just broke the nonlinear regression curve and given past precedents, the potential for a bullrun is around $60k  Maybe McAfee can keep his manhood after all. Hang on tight. In addition to this, I want to add that Shelby is lately considering McAfee's model as a potential good candidate for 2020's price prediction, and it would look like this:  I can't imagine how this thread would look like if McAfee ends up being anywhere near right. Bitcointalk would probably collapse due too much traffic. |

|

|

|

|